Oregon Tax Forms and Templates

Documents:

168

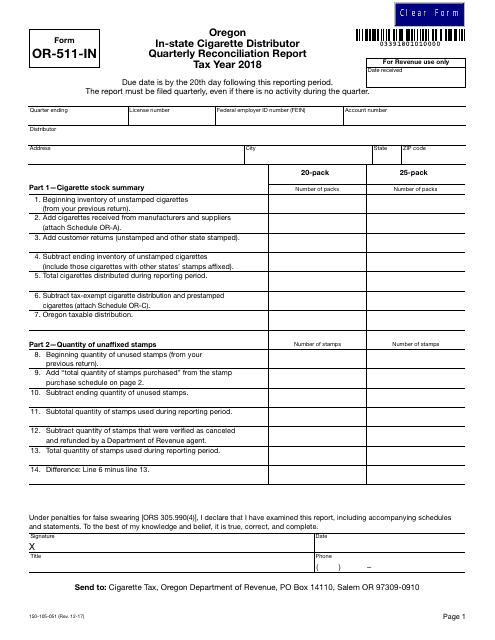

This Form is used for Oregon in-state cigarette distributors to reconcile their quarterly tax report for the tax year 2018.

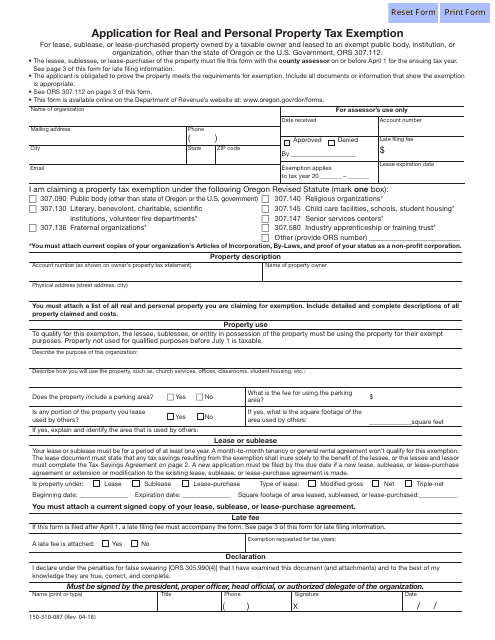

This form is used for applying for a tax exemption on real and personal property in Oregon.

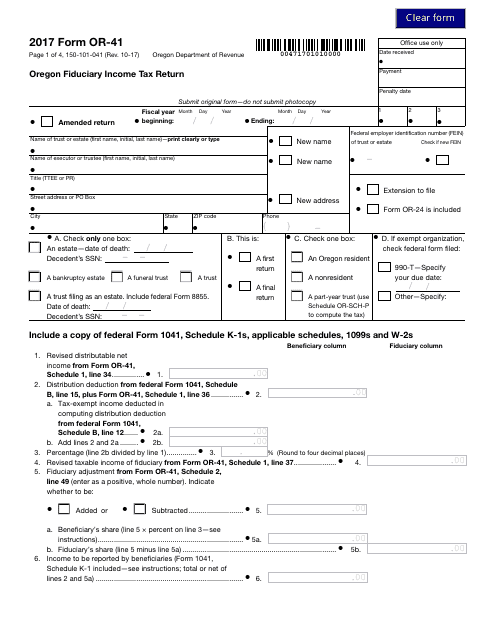

This form is used for filing the Oregon Fiduciary Income Tax Return in the state of Oregon. It is specifically used by fiduciaries to report income earned by an estate or trust.

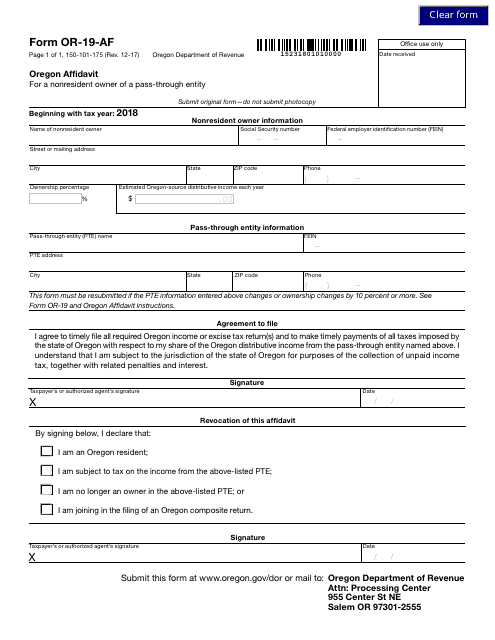

This document is used for filing an affidavit in the state of Oregon. It is known as Form OR-19-AF and is used to provide a sworn statement or declaration under oath.

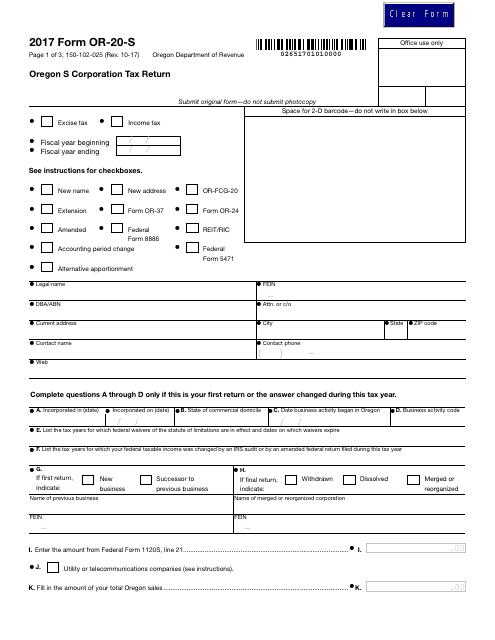

This form is used for Oregon S corporations to file their state tax return.

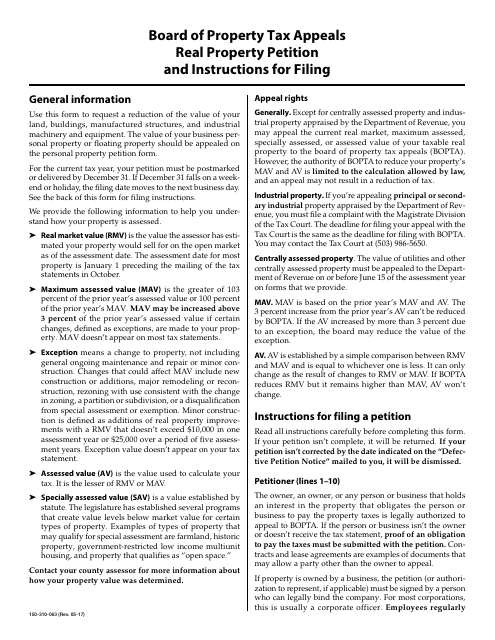

This Form is used for filing a Real Property Petition to the Board of Property Tax Appeals in Oregon.

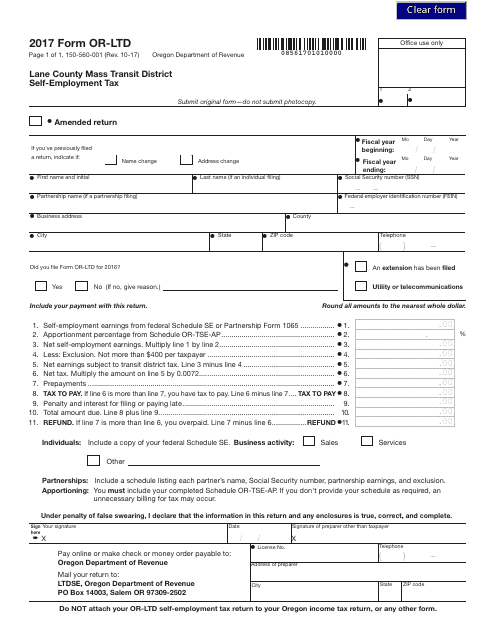

This Form is used for reporting self-employment tax for individuals who work in the Lane County Mass Transit District in Oregon.

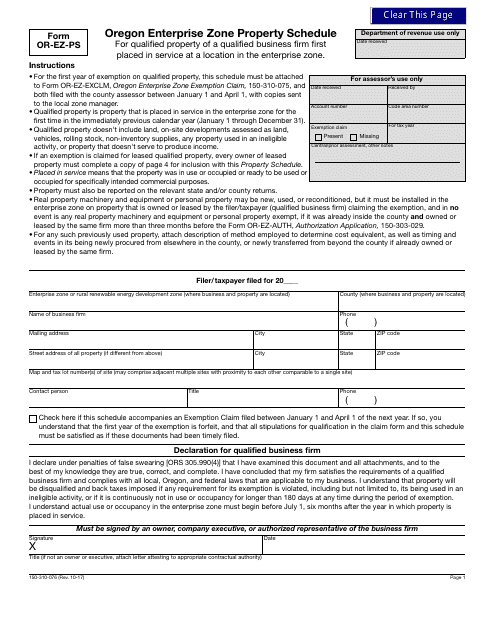

This Form is used for reporting property schedule information for the Oregon enterprise zone program.

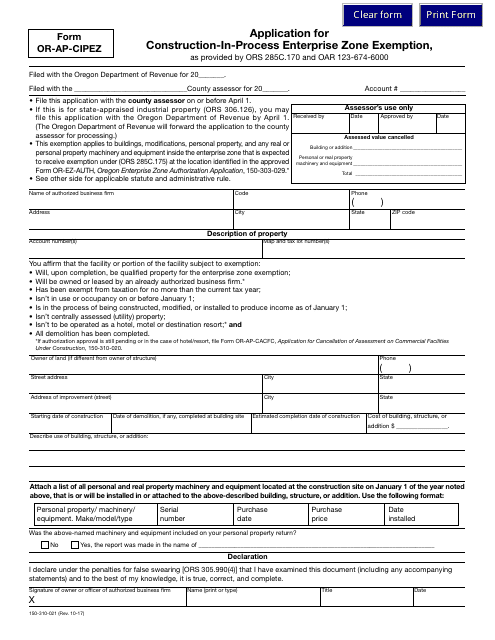

This form is used for applying for the Construction-In-Process Enterprise Zone Exemption in Oregon.

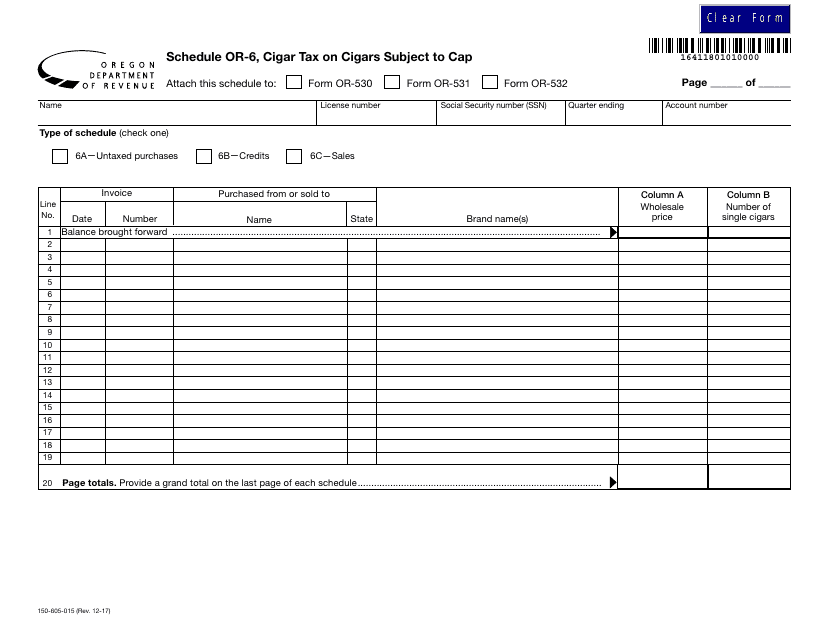

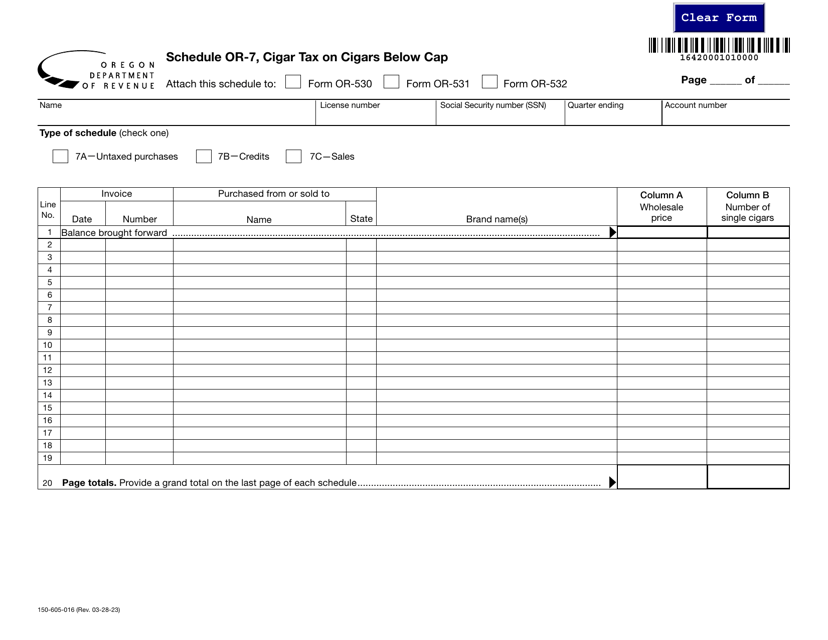

This document is used for calculating and reporting the cigar tax for cigars that are subject to a cap in the state of Oregon.

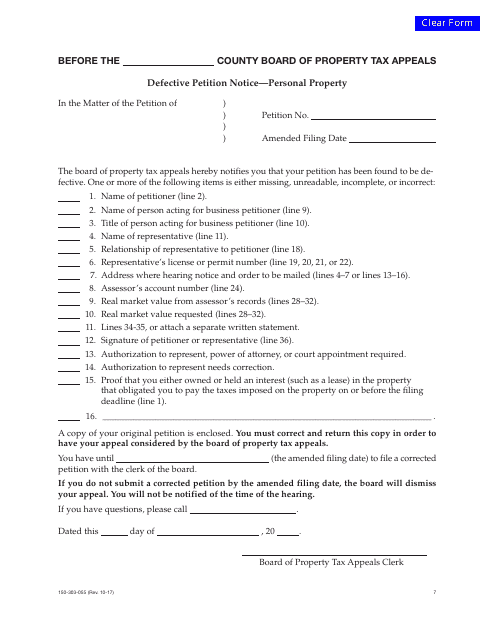

This form is used for notifying a petitioner in Oregon about a defective petition related to personal property.

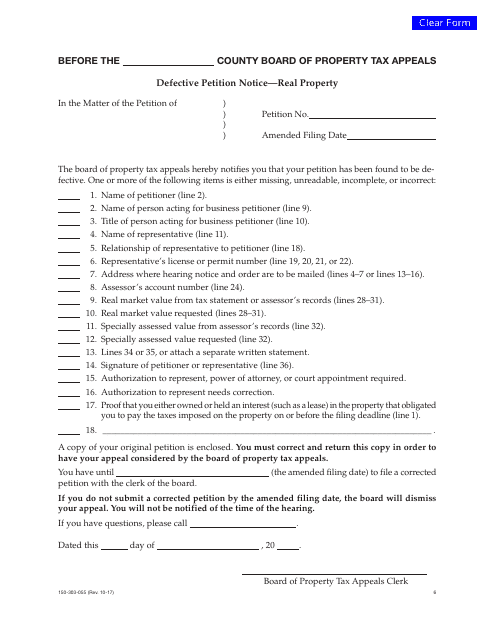

This form is used for notifying a property owner in Oregon about a defective petition related to their real property.

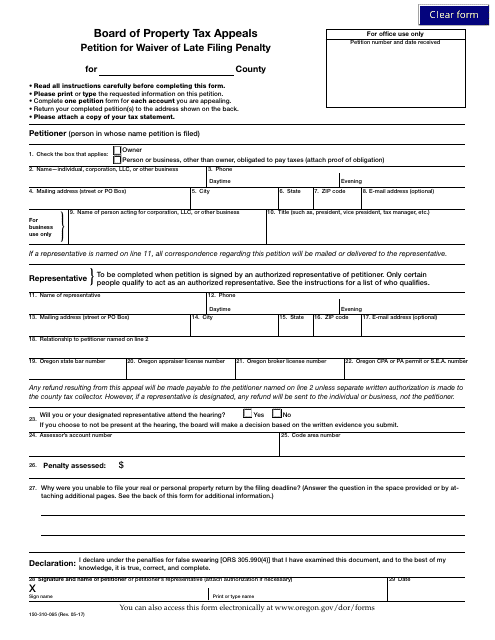

This form is used for requesting a waiver of the late filing penalty for tax returns in the state of Oregon.

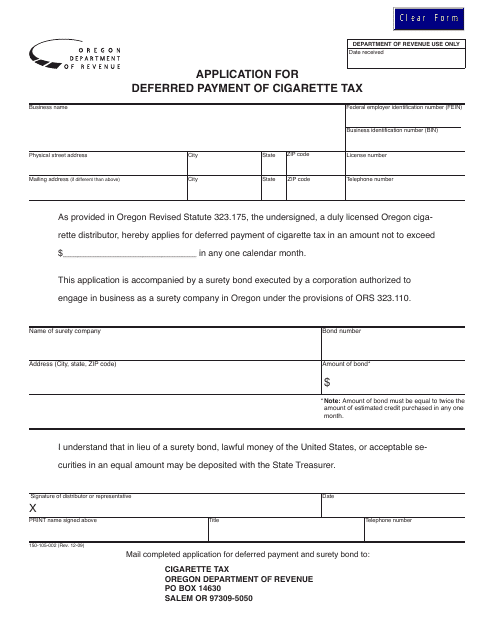

This form is used for applying for deferred payment of cigarette tax in the state of Oregon. It allows businesses to delay payment of their cigarette tax until a later date.

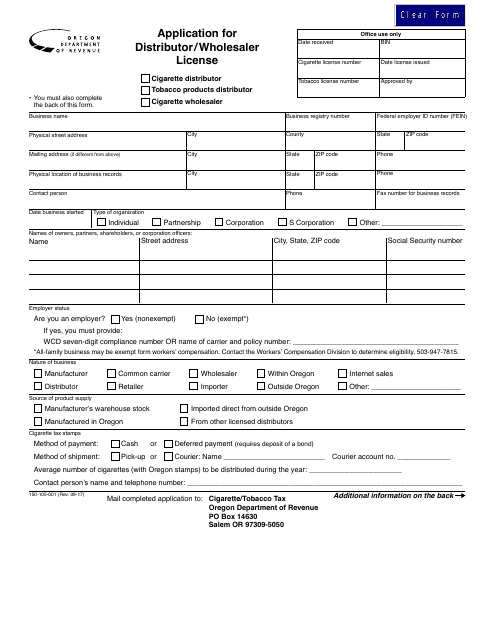

This form is used for applying for a distributor/wholesaler license in the state of Oregon. It is required for businesses that wish to distribute or sell goods on a wholesale basis.

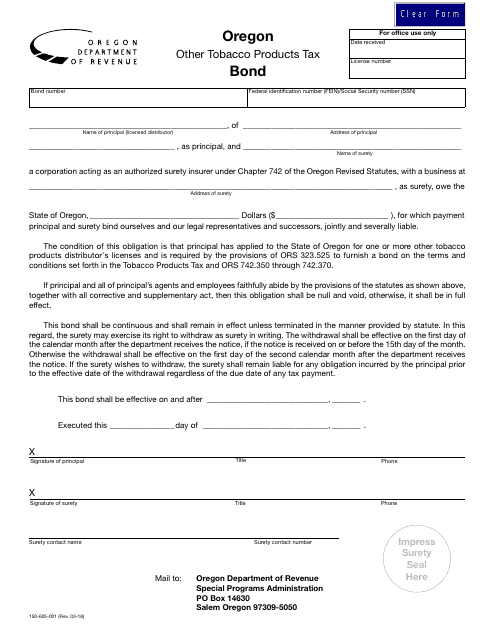

This document is for obtaining a bond for the taxation of other tobacco products in the state of Oregon.

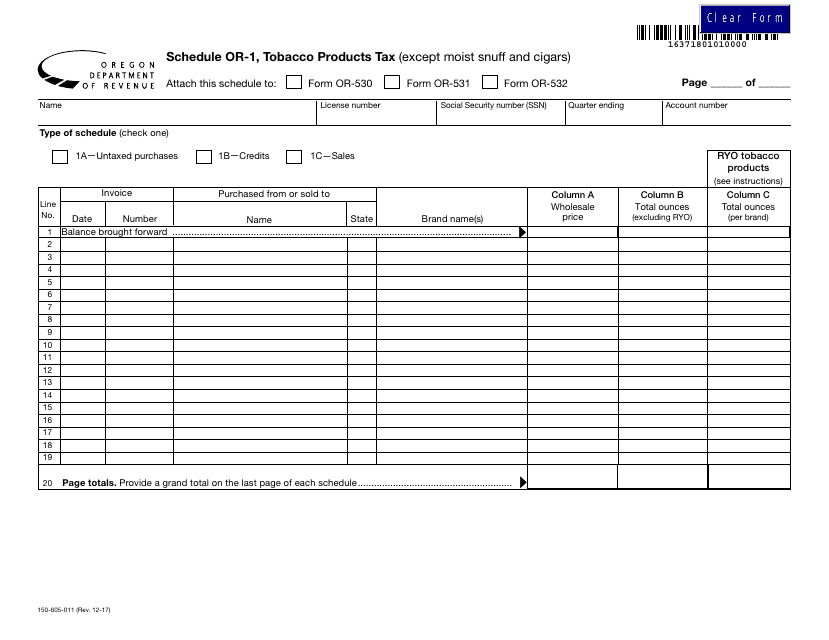

This Form is used for reporting and paying taxes on tobacco products, excluding moist snuff and cigars, in the state of Oregon.

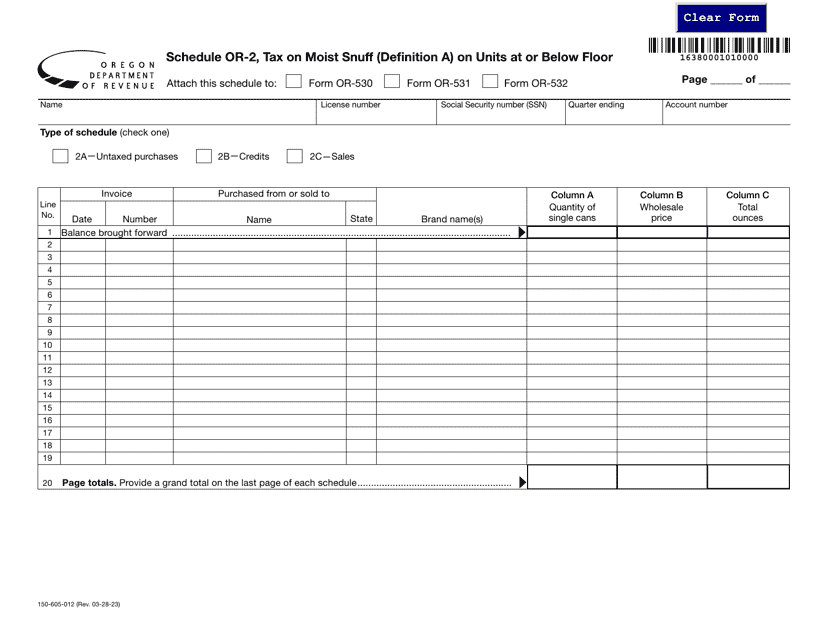

Form 150-605-012 Schedule OR-2 Tax on Moist Snuff (Definition a) on Units at or Below Floor - Oregon

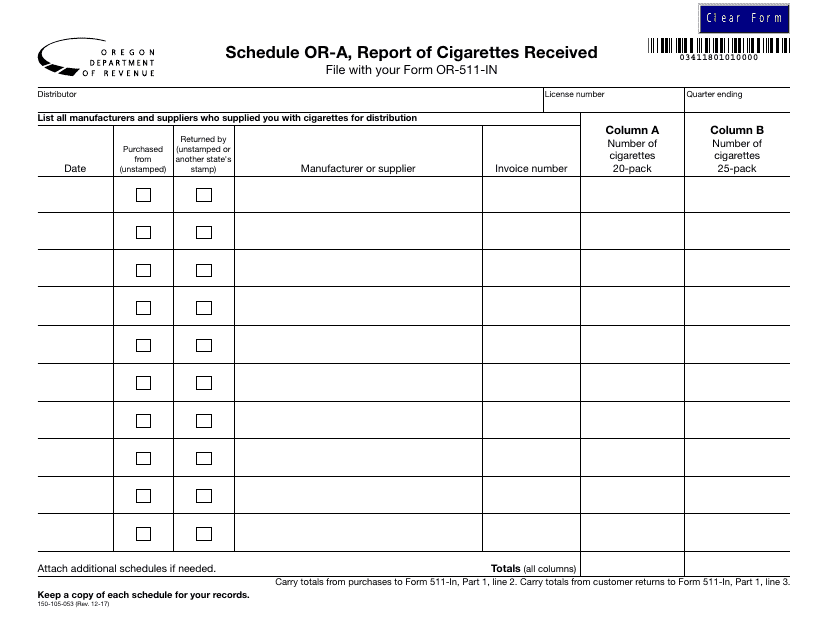

This form is used for reporting cigarettes received in the state of Oregon.

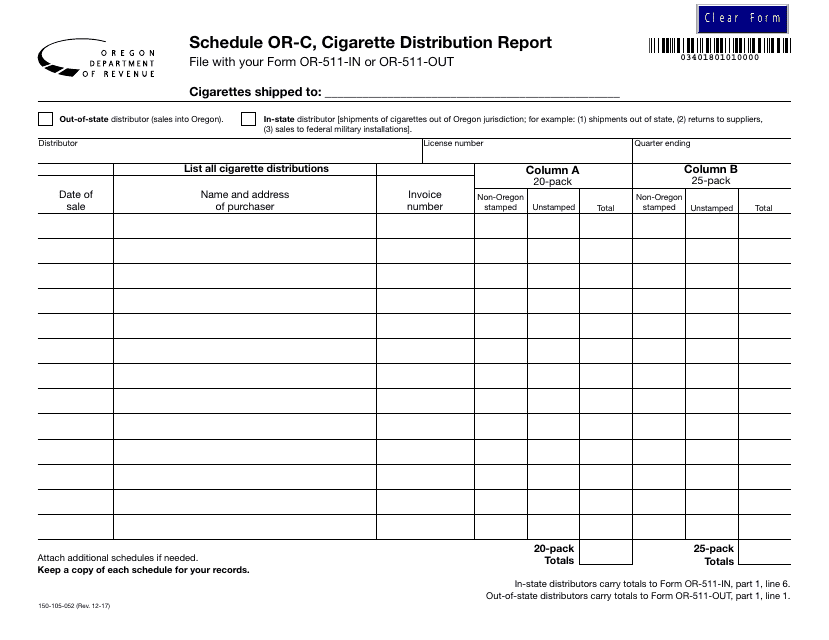

This form is used for reporting cigarette distribution in Oregon.

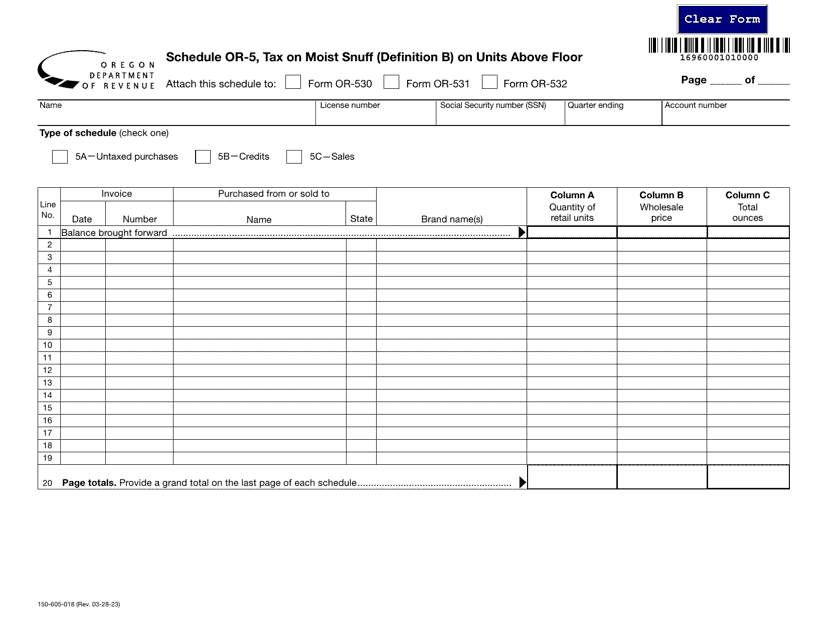

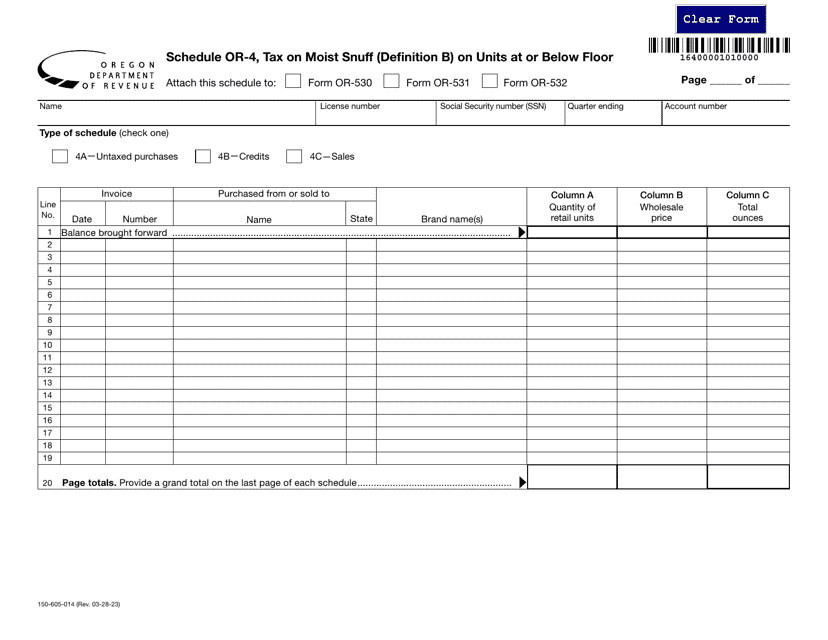

Form 150-605-014 Schedule OR-4 Tax on Moist Snuff (Definition B) on Units at or Below Floor - Oregon

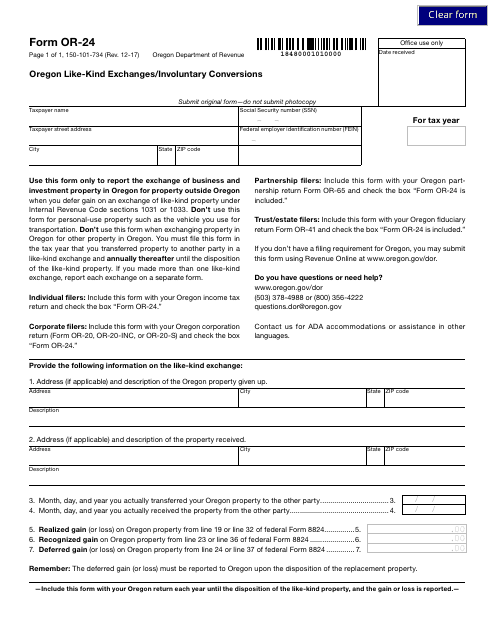

This Form is used for reporting like-kind exchanges and involuntary conversions in the state of Oregon.

This form is used for employers in the sports and entertainment industries in Oregon to guide them on withholding and transit taxes.

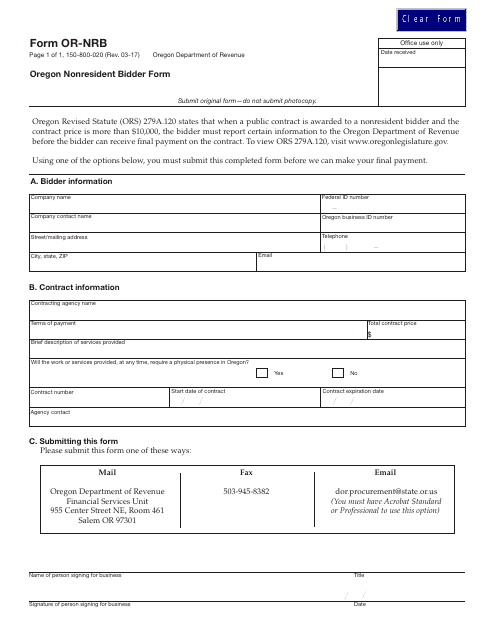

This is a form for nonresidents of Oregon who want to bid on a project in the state.

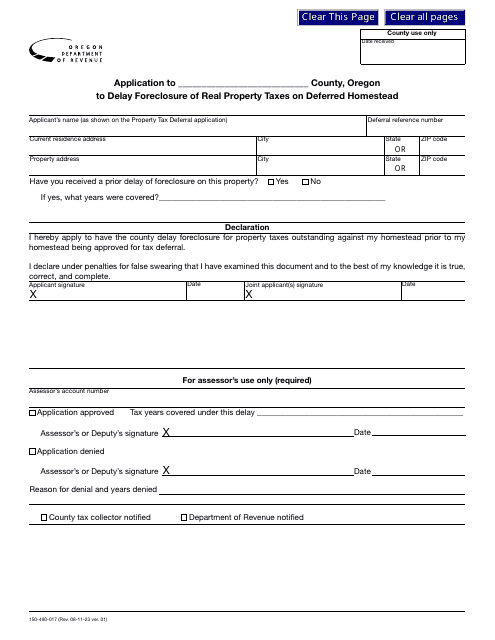

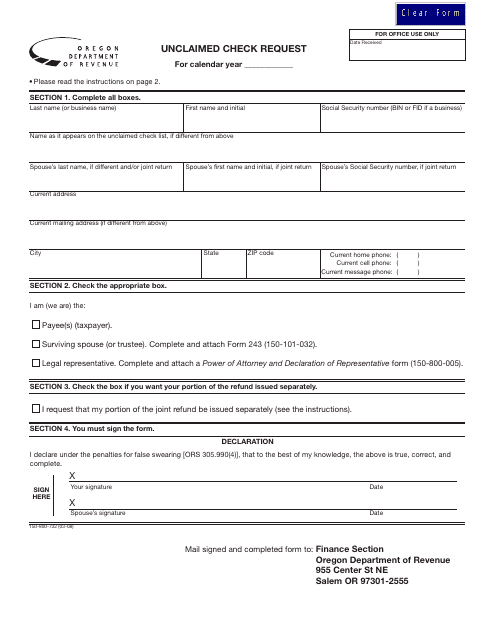

This Form is used for requesting an unclaimed check in the state of Oregon.

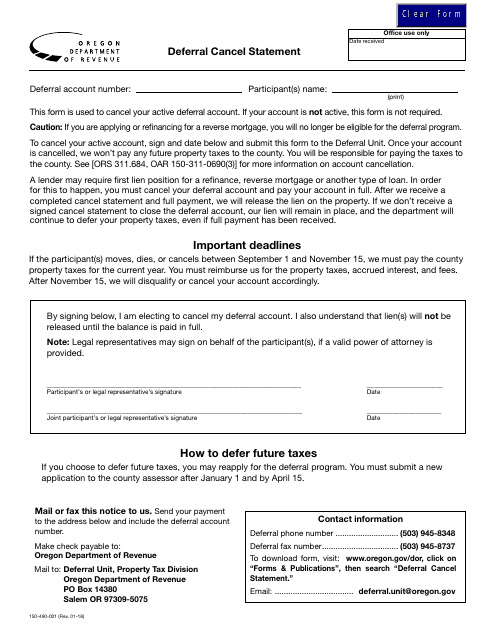

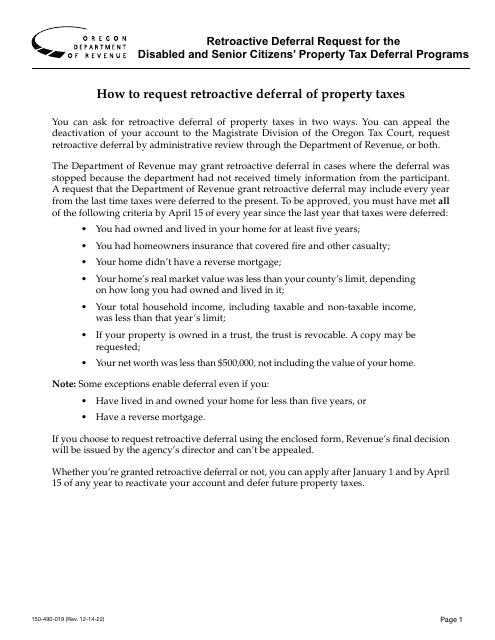

This type of document is used for canceling a deferral statement in the state of Oregon.

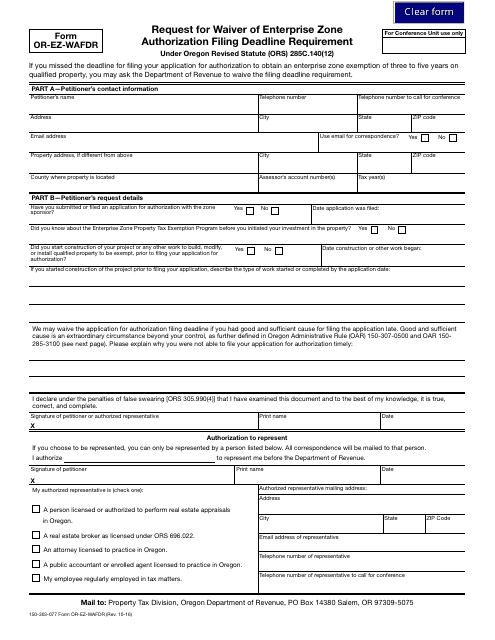

This Form is used for requesting a waiver of the deadline to file an enterprise zone authorization in Oregon.

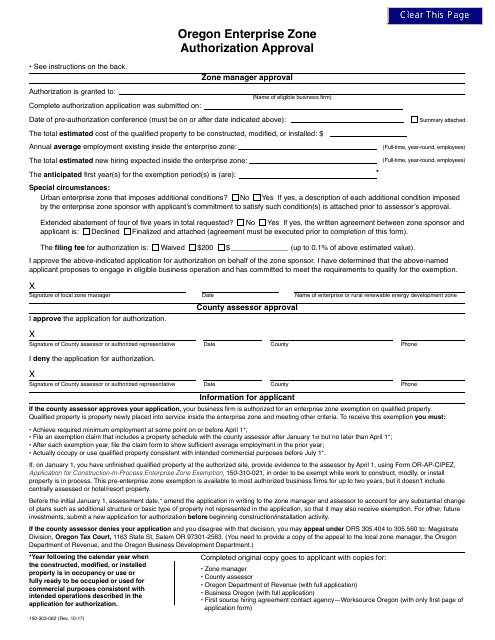

This form is used for obtaining approval for the Oregon Enterprise Zone Authorization in Oregon.

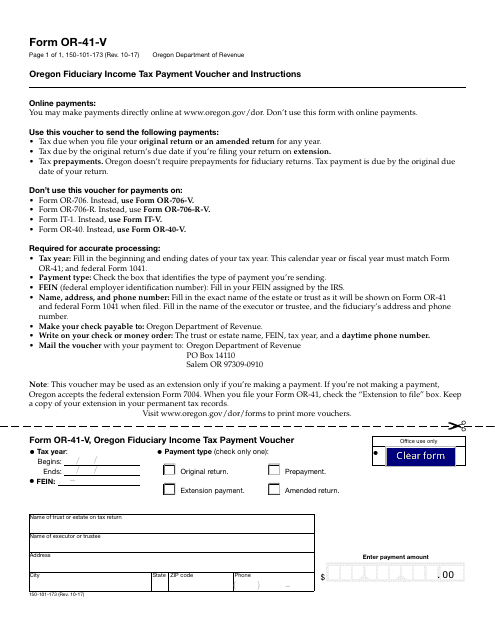

This form is used for making tax payments for fiduciary income in Oregon.