Oregon Tax Forms and Templates

Oregon Tax Forms are used by individuals and businesses in the state of Oregon to report their income, calculate their tax liability, and claim any deductions or credits they may be eligible for. These forms are used to file state income taxes and ensure compliance with Oregon tax laws.

Documents:

168

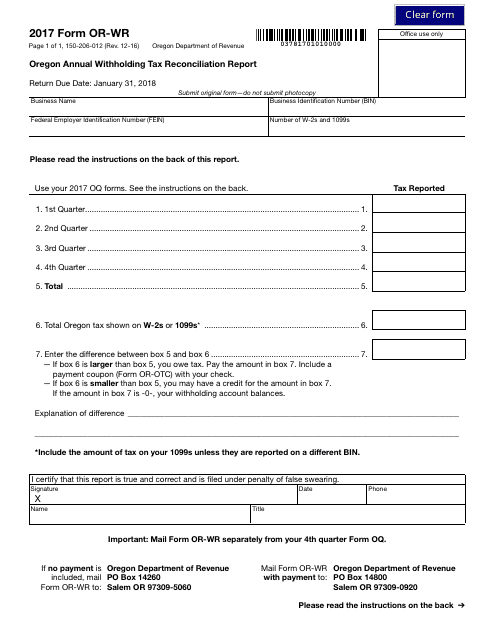

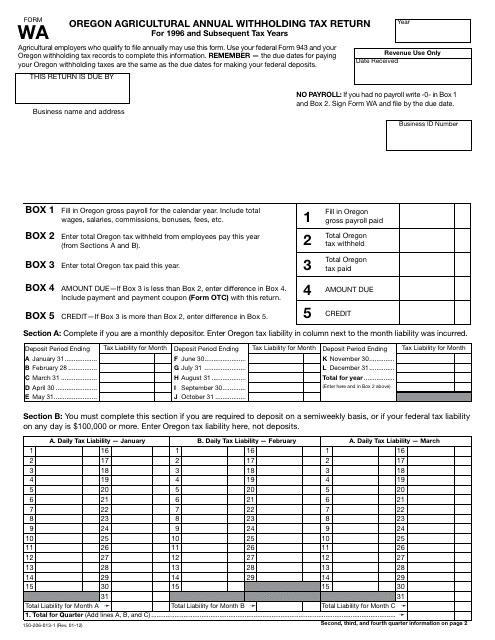

This Form is used for reporting annual withholding tax in Oregon.

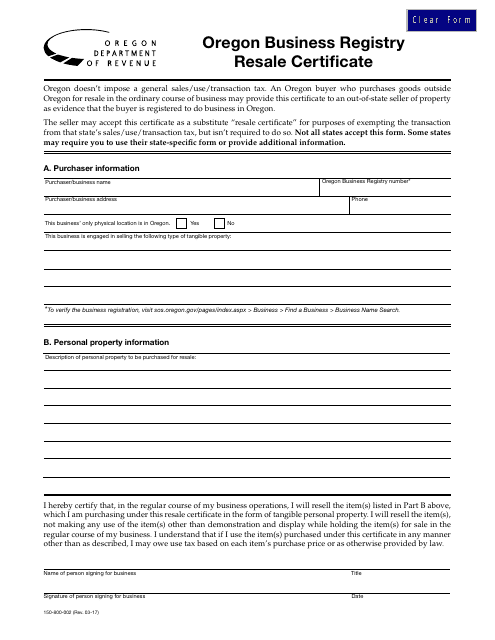

This Form is used for obtaining a Resale Certificate in Oregon for businesses registered in the state. It allows businesses to make purchases for resale without paying sales tax.

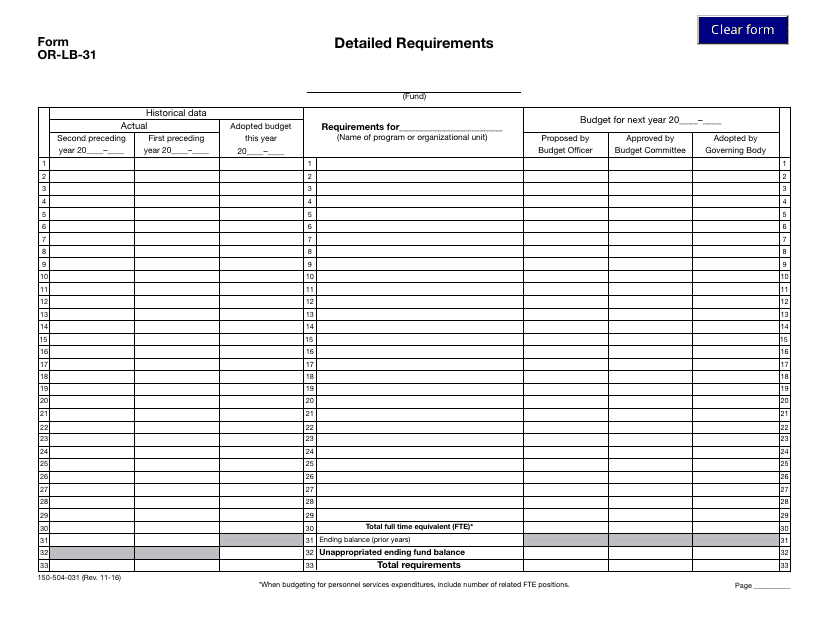

This document provides detailed requirements for Form 150-504-031 (OR-LB-31) in the state of Oregon.

This document is used for reporting and paying the annual withholding tax for agricultural businesses in the state of Oregon.

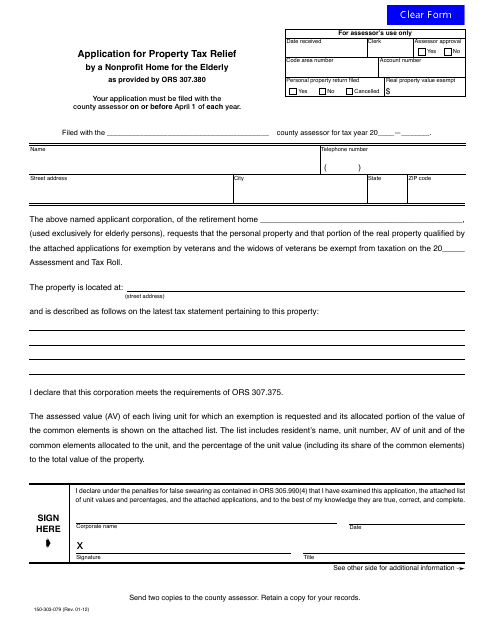

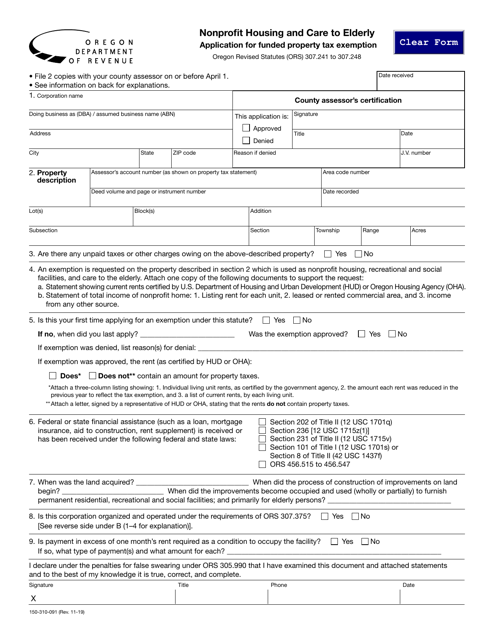

This form is used for nonprofit homes for the elderly in Oregon to apply for property tax relief. It helps them reduce their tax burden and continue providing essential services for the elderly population.

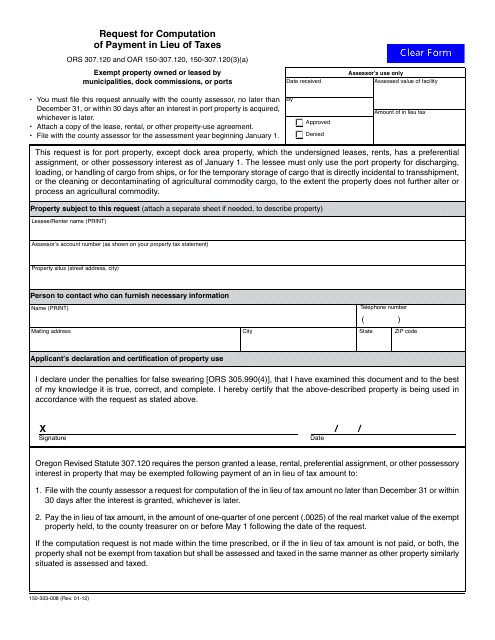

This form is used for requesting the computation of payment in lieu of taxes in the state of Oregon.

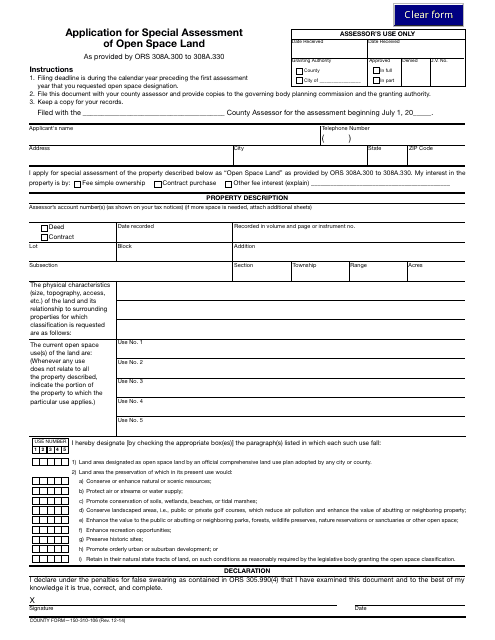

This Form is used for applying for special assessment of open space land in Oregon.

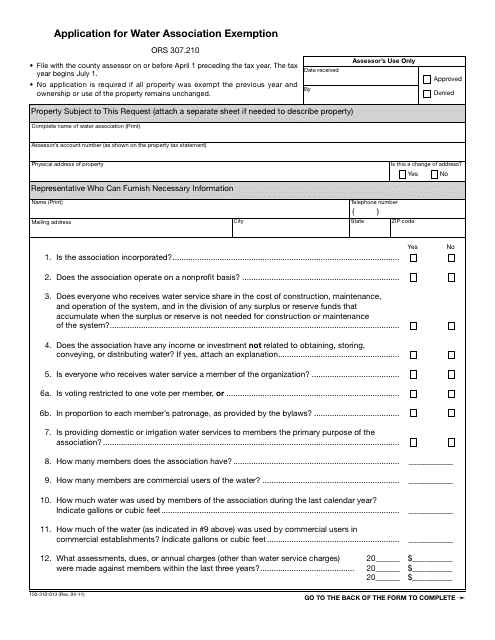

This Form is used for applying for a water association exemption in the state of Oregon.

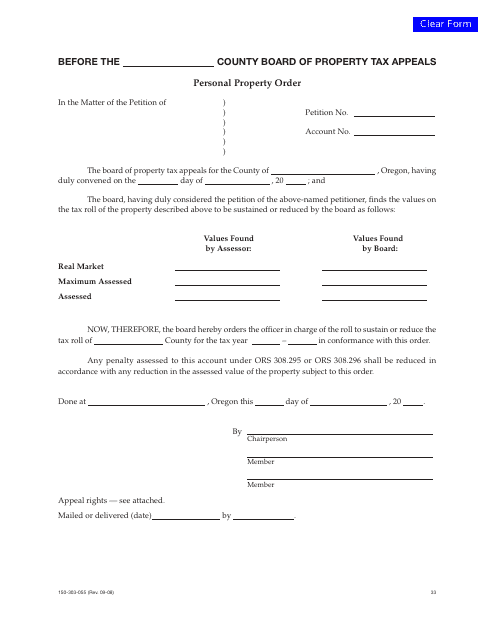

This form is used for placing an order for personal property in the state of Oregon.

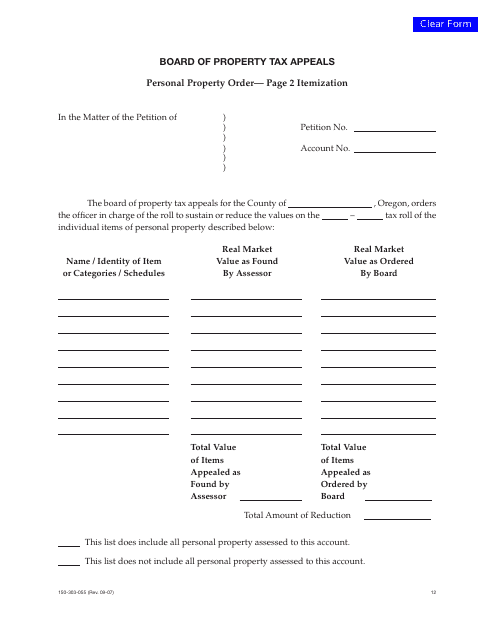

This form is used for itemizing personal property in Oregon.

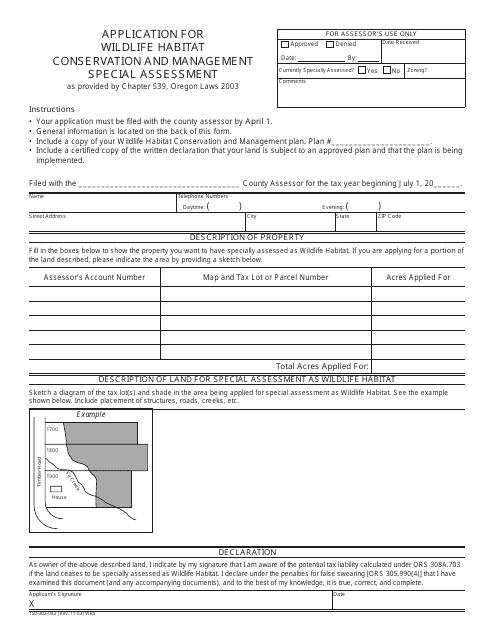

This form is used for applying for the Wildlife Habitat Conservation and Management Special Assessment in Oregon.

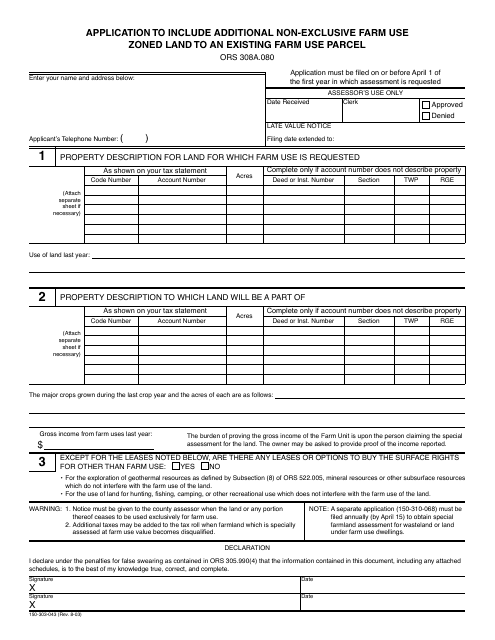

This form is used in Oregon to apply for including additional non-exclusive farm use zoned land to an existing farm use parcel.

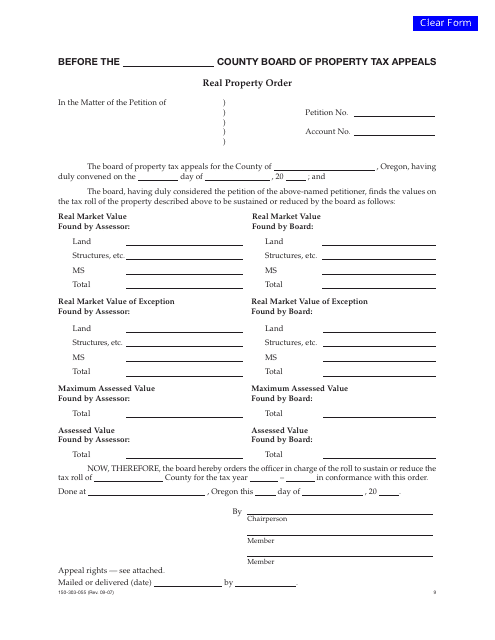

This form is used for creating a real property order in the state of Oregon.

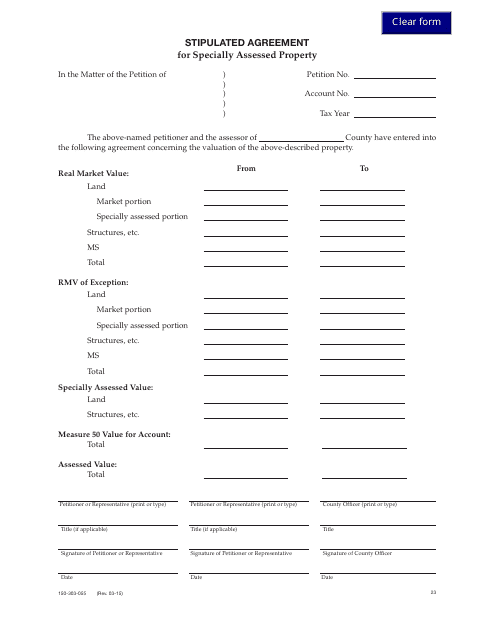

This form is used for entering into a stipulated agreement for specially assessed property in the state of Oregon.

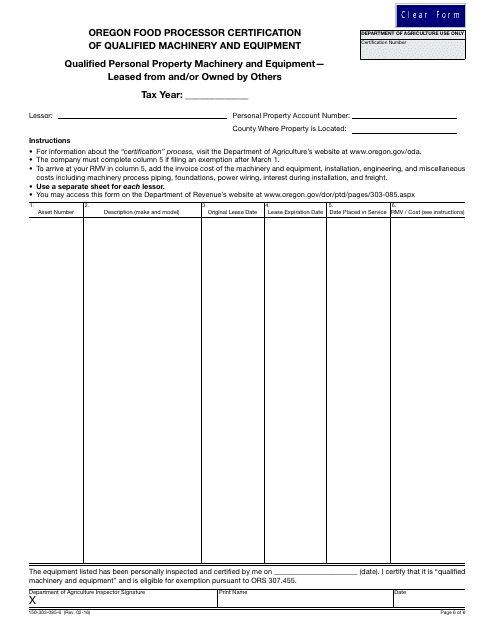

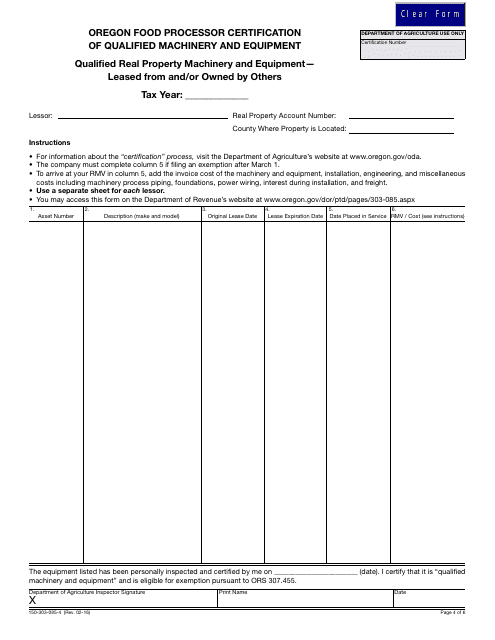

This Form is used for Oregon food processors to certify their qualified machinery and equipment that is leased or owned by others for tax purposes.

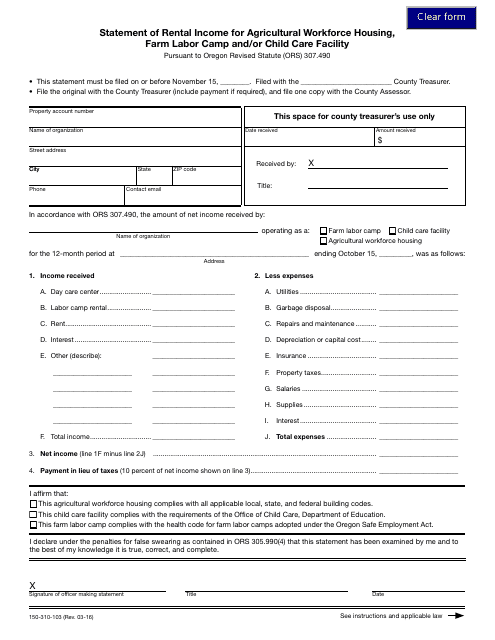

This form is used for reporting rental income for agricultural housing, farm labor camps, and child care facilities in Oregon.

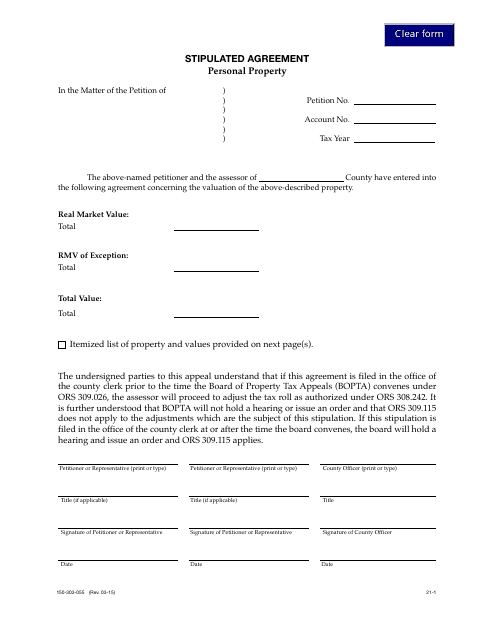

This Form is used for creating a stipulated agreement regarding personal property in the state of Oregon. It outlines the terms and conditions agreed upon by both parties regarding the property in question.

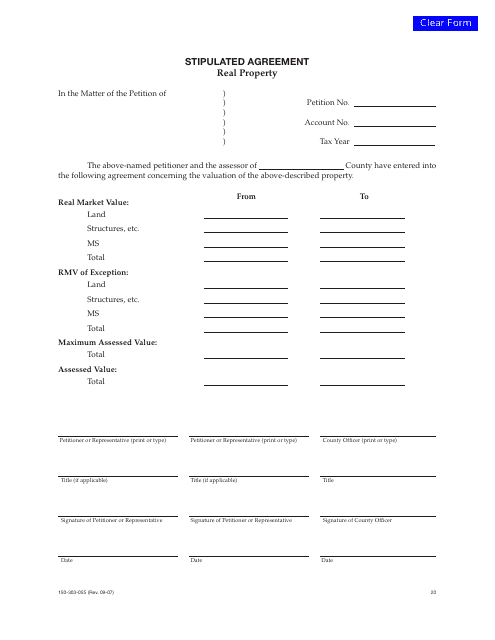

This Form is used for a stipulated agreement regarding real property in Oregon.

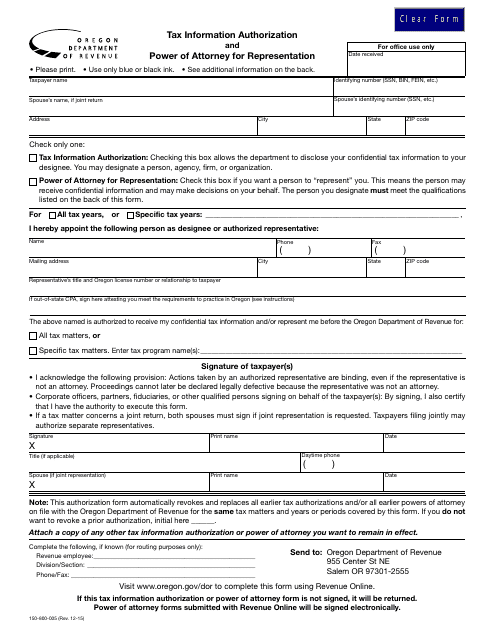

This form is used for authorizing someone to act on your behalf for tax matters in Oregon. It allows them to access your tax information and represent you before the Oregon Department of Revenue.

This Form is used for Oregon food processors to certify their leased or owned machinery and equipment.

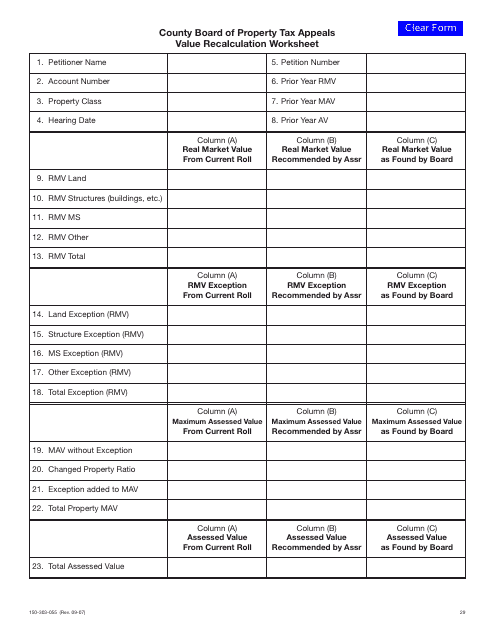

This form is used for property owners in Oregon to request a recalculation of their property's value for tax purposes.

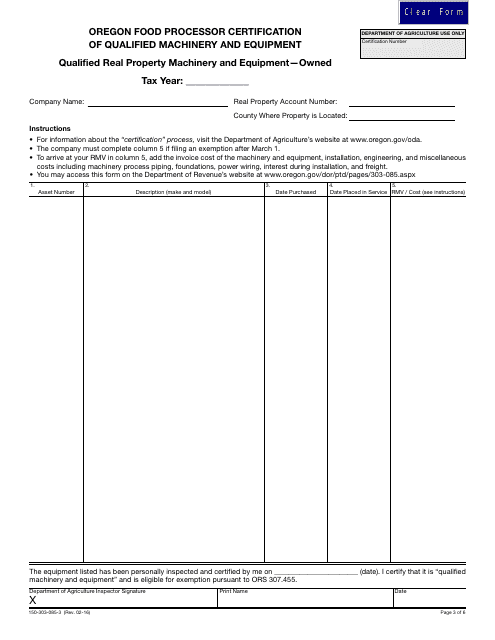

This Form is used for Oregon food processors to certify their qualified machinery and equipment that they own.

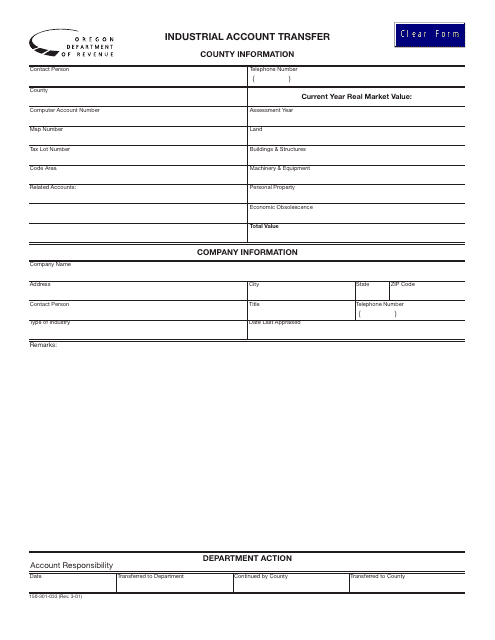

This form is used for transferring an industrial account in Oregon.

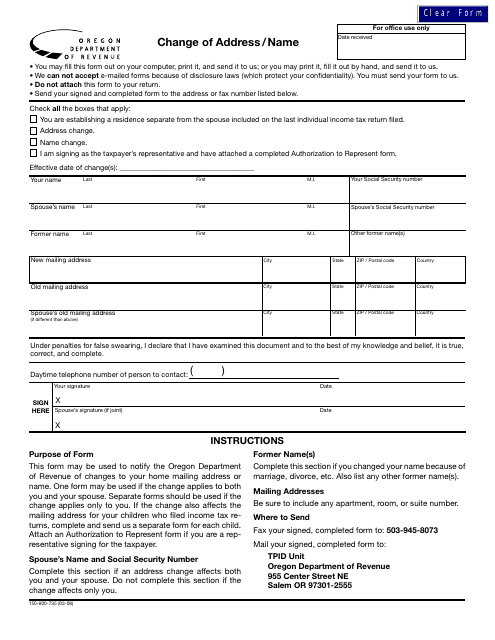

This form is used for changing your address or name in Oregon.

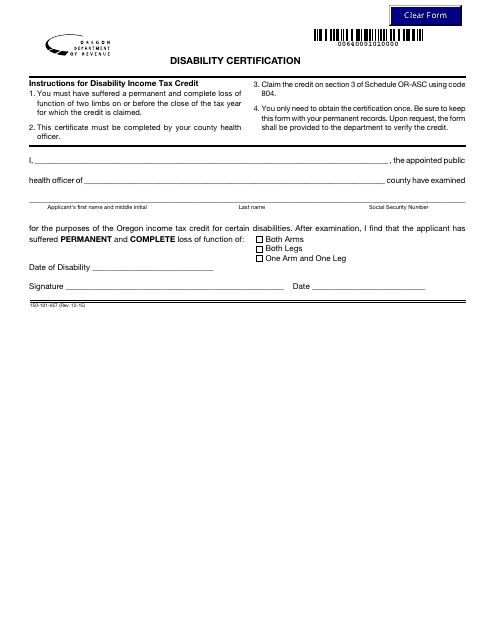

This Form is used for Disability Certification in the state of Oregon. It is used to determine if an individual qualifies for disability benefits in Oregon.

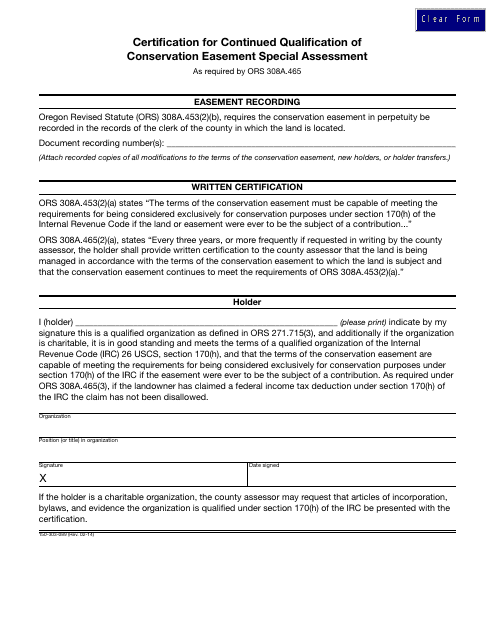

This form is used for the certification of continued qualification for the conservation easement special assessment in Oregon.

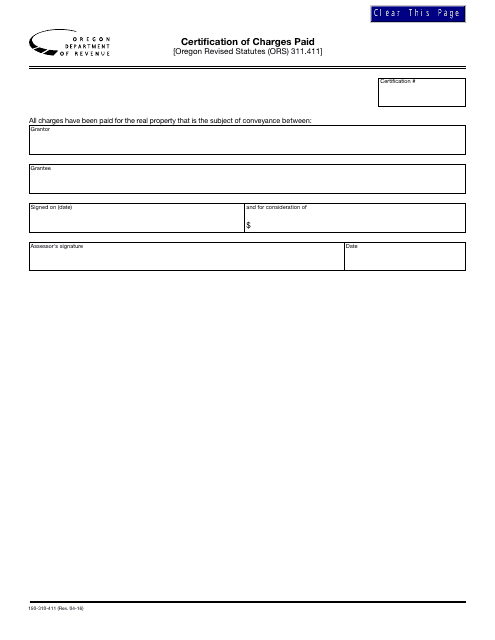

This form is used for certifying charges paid in the state of Oregon.

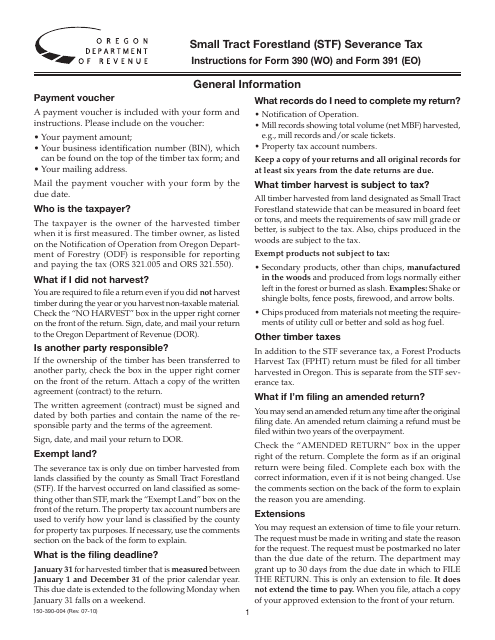

This form is used for reporting and paying the small tract forestland severance tax in Oregon. It provides instructions on how to fill out forms 390 (WO) and 391 (EO) for reporting the tax on forest product removals from small tracts of forestland.

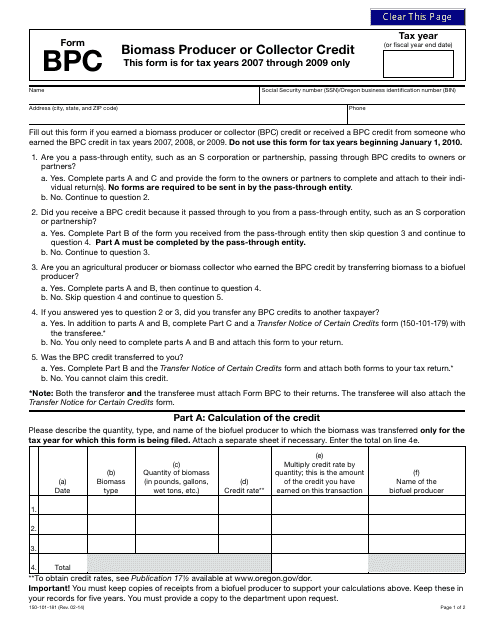

This form is used for claiming the Biomass Producer or Collector Credit in the state of Oregon.

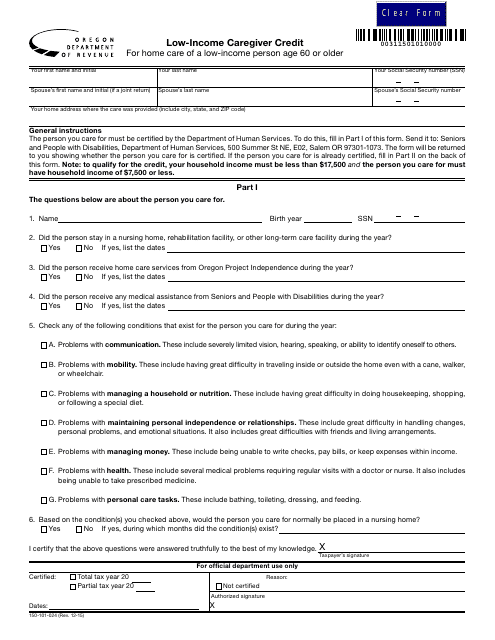

This form is used for claiming the Low-Income Caregiver Credit in the state of Oregon.

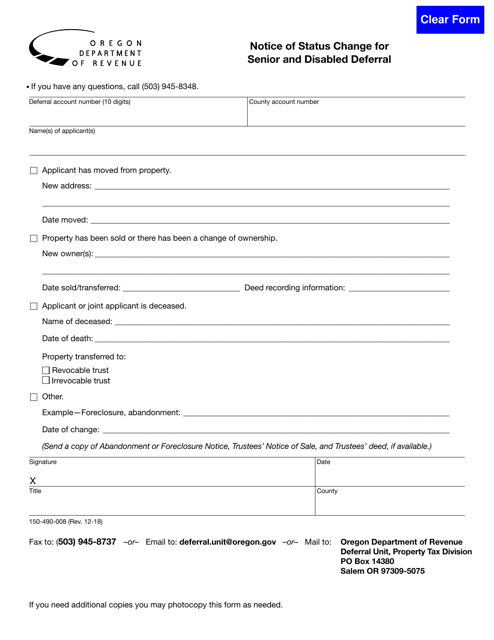

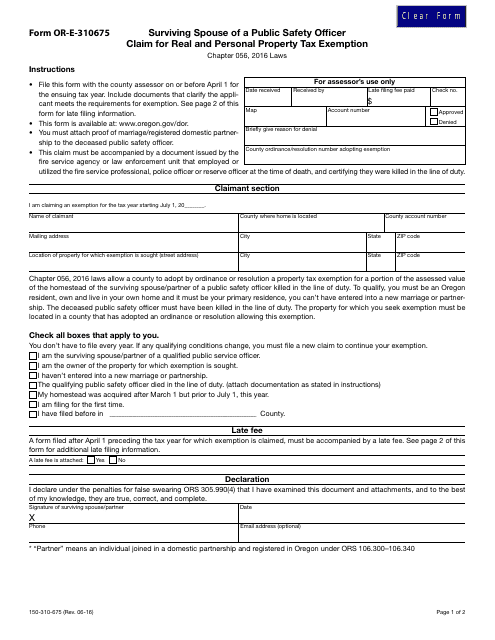

This form is used for a surviving spouse of a public safety officer to claim a real and personal property tax exemption in the state of Oregon.

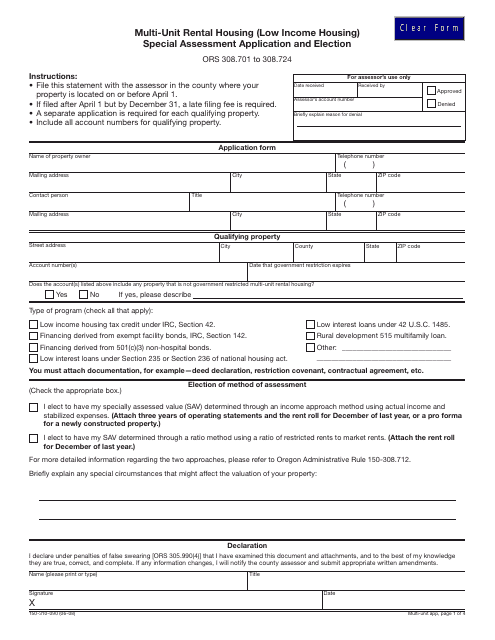

Form 150-310-090 Multi-Unit Rental Housing Special Assessment Application and Election Form - Oregon

This Form is used for applying for special assessment and conducting elections for multi-unit rental housing in Oregon.

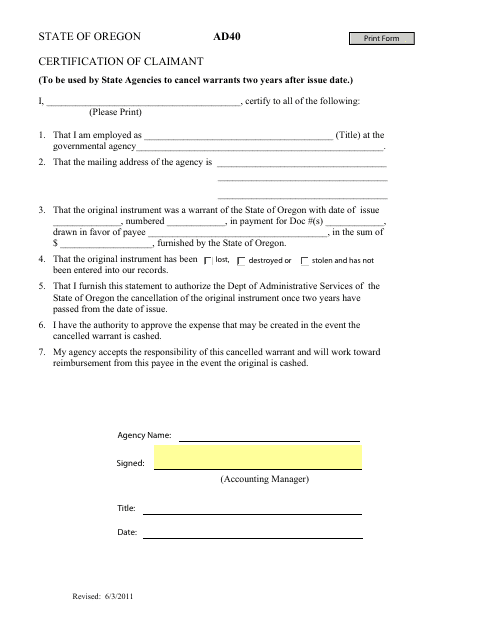

This form is used for certifying the claimant's eligibility to receive benefits in the state of Oregon.

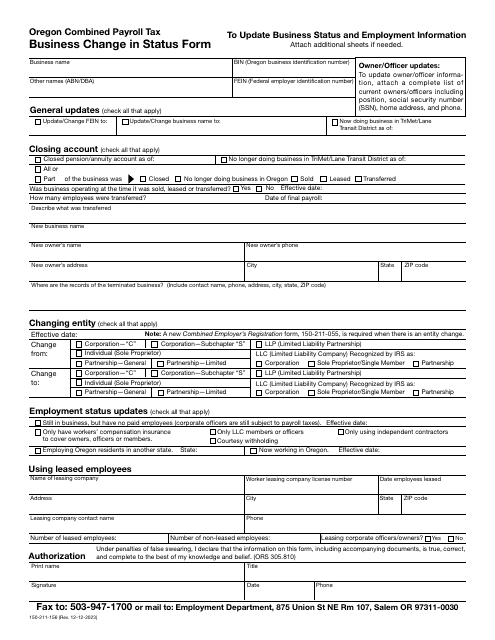

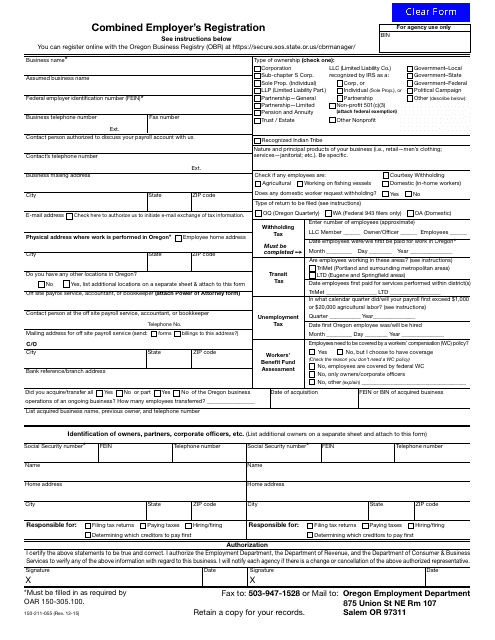

This form is used for combined employer's registration in the state of Oregon.

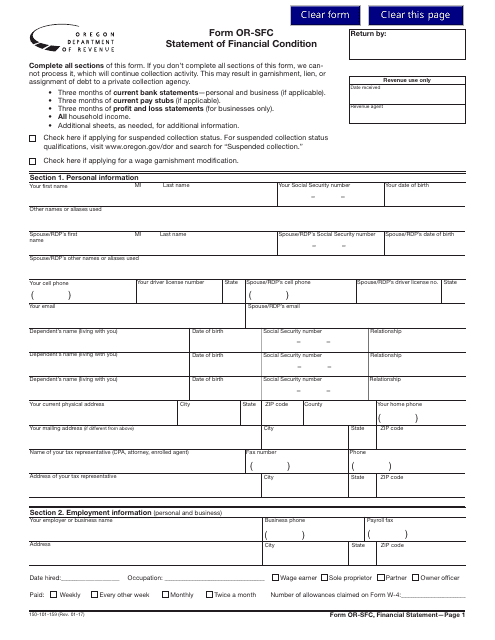

This form is used for reporting the financial condition of individuals or businesses in Oregon.

This form is used for filing a settlement offer application in Oregon. It allows individuals to propose a reduced amount to settle their outstanding tax debt with the state.