IRS 4070 Forms and Instructions for 2024

What Is Form 4070 Series?

The IRS 4070 Forms include the following two documents:

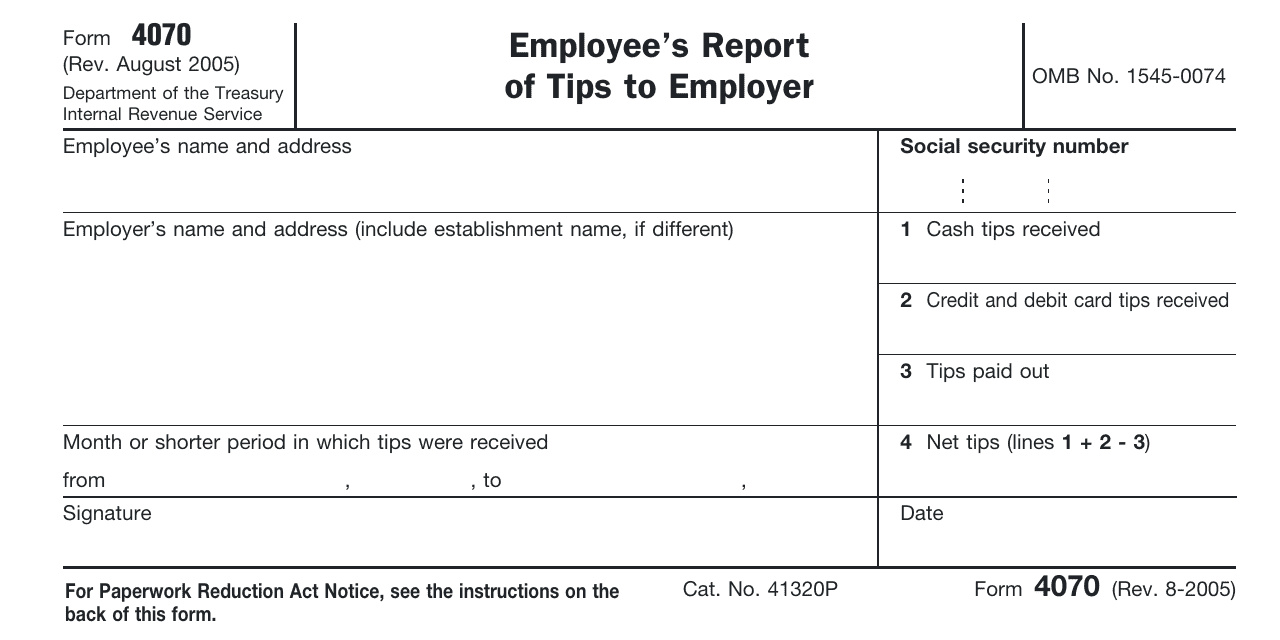

- IRS Form 4070, Employee’s Report of Tips to Employer, is used to report tips to the employer each month or another period of time. This form is usually filed on a monthly basis, but the employer can establish a shorter period of time. Tips reports are due on the 10th day of the month following the reported month. Filing this form is not necessary if the number of tips received in the reported month is less than $20;

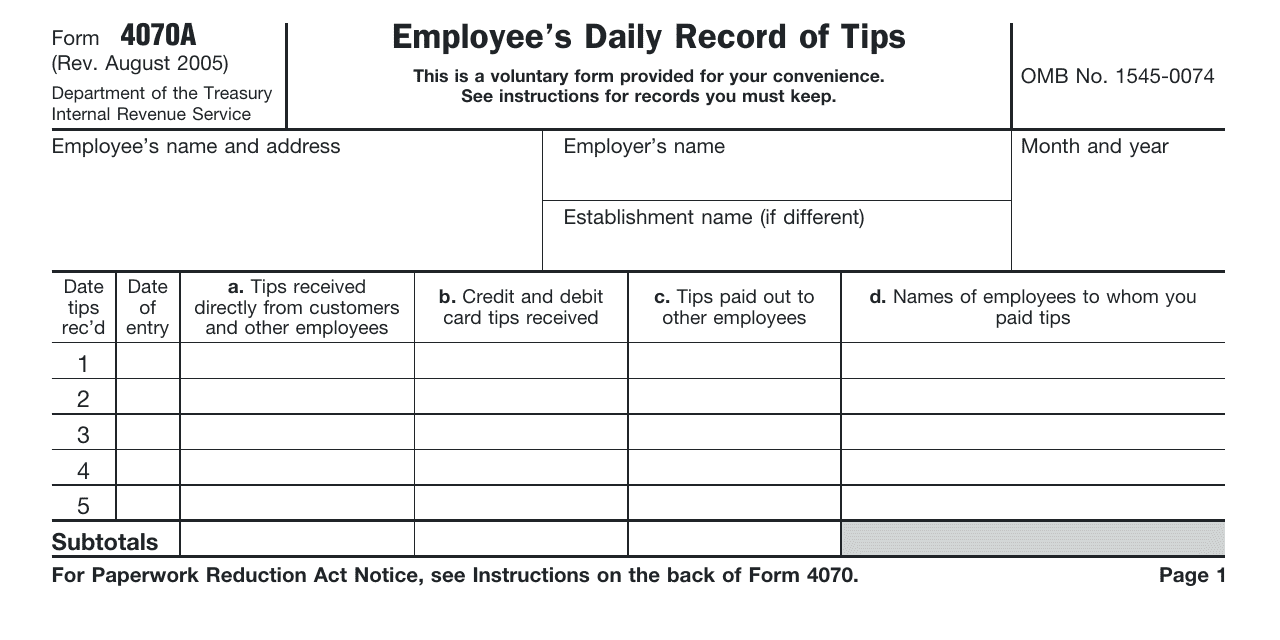

- IRS Form 4070A, Employee’s Daily Record of Tips, is used to keep track of tips received and paid to other employees every day. Unlike the IRS form 4070, using this form is voluntary and it is provided to facilitate the reporting process. This form should contain the record of tips received in cash and from card payments and paid to other employees. The employee should also keep their own record on non-cash tips for tax return in addition to this form. The daily tip record must not contain service charges, added to customers' checks by the employer, as long as they are considered a part of wages.

How to Report Tips?

Tips are considered income and are subject to federal income tax. Tips can be received in cash, added to debit or credit card charges, or in items of value, such as concert tickets or passes to an event.

If the amount of extra payment, the employee receiving it is determined by a customer, it is made free from compulsion and is not dictated by establishment policy, this payment can be considered a tip and should be recorded. If the establishments add service charges, they must not be reported.

Employees must report tips to employers, including cash tips, tips received from card payments, and tips received from other employees from tips sharing to their employer and all received tips on their annual tax return. The employer requires tips reporting for proper tax withholding from the employee's paycheck and report their income correctly to the Social Security Administration (SSA). Proper reporting of tip income will influence the benefits the employee will receive after they retire. Also, the employer's share of Medicare and social security taxes will depend on the employee's earnings.

Using IRS tip-reporting forms is voluntary and the forms are provided to facilitate the process. The employer can use their own tip reports and if the employee desires, they can keep their own record of tips. The record must contain their name and tips, received from customers in cash and from card payment, and paid to other employees must be recorded separately. If the establishments use an electronic form of tips record, the paper record must be used for reporting cash tips anyway.

Failure to report tips to the employer may lead to a penalty of 50% of the social security and Medicare taxes due to unreported income. However, if the employee can provide a reasonable ground for non-reporting their tips, the penalty will not be imposed.

Related Articles

Documents:

2

This form is a formal instrument used by employees to elaborate on the amount of tips they get every month.

Download this form if you are an employee receiving daily tips in order to keep track of tips you received from customers. These tips may include cash tips, as well as tips received from customers' debit or credit cards and items of value, such as tickets or passes.