Fill and Sign Illinois Legal Forms

Documents:

6290

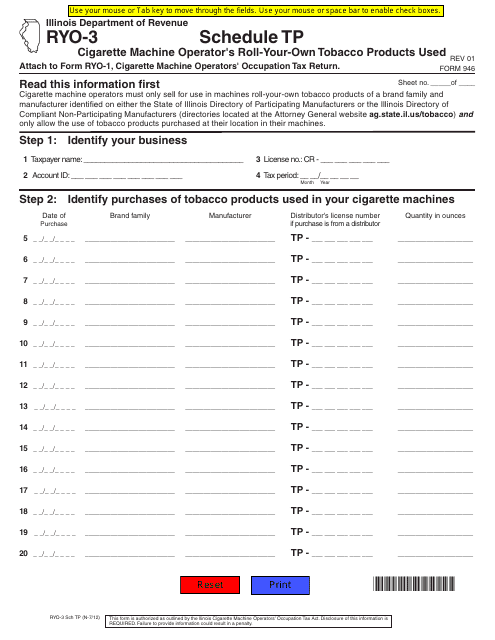

This Form is used for reporting the amount of roll-your-own tobacco products used by cigarette machine operators in Illinois.

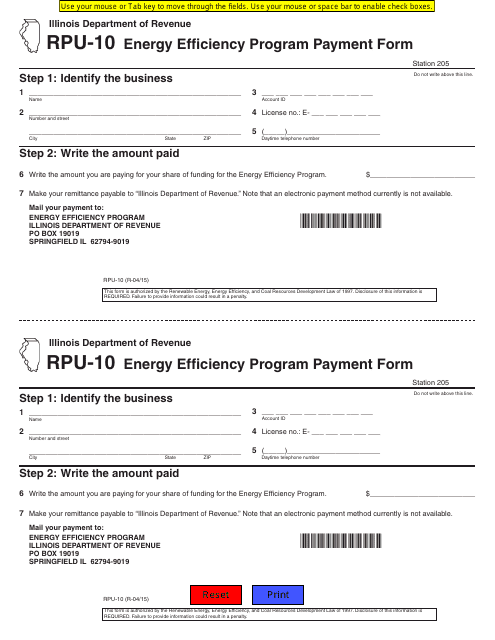

This Form is used for making payments to the Energy Efficiency Program in Illinois.

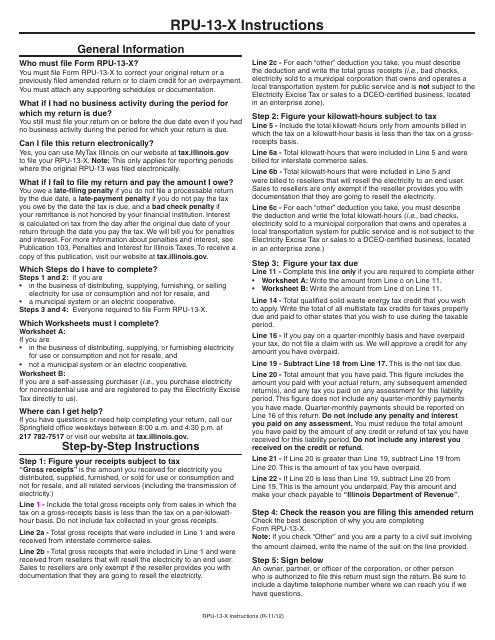

This document provides instructions for completing the Amended Electricity Excise Tax Return (Form RPU-13-X) in the state of Illinois. It outlines the steps to amend a previously filed electricity excise tax return.

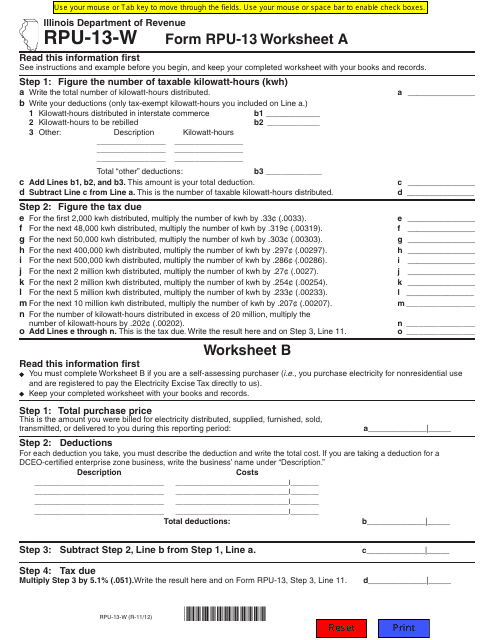

This document is used for filling out Form RPU-13 in Illinois. It includes Worksheet A and Worksheet B to assist with calculations.

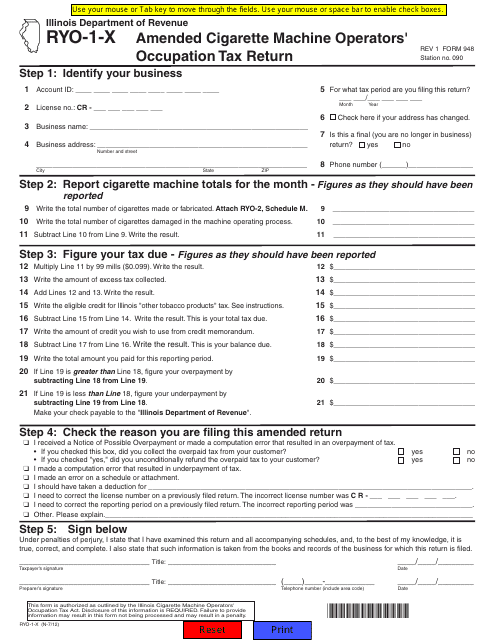

This form is used for filing an amended cigarette machine operators' occupation tax return in the state of Illinois.

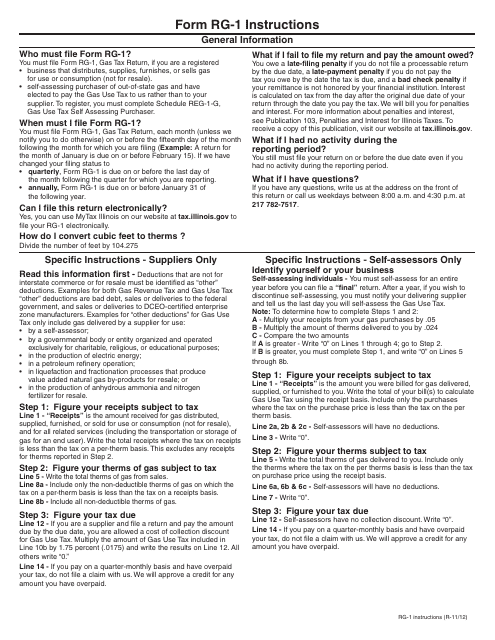

This Form is used for reporting and filing gas tax returns in the state of Illinois.

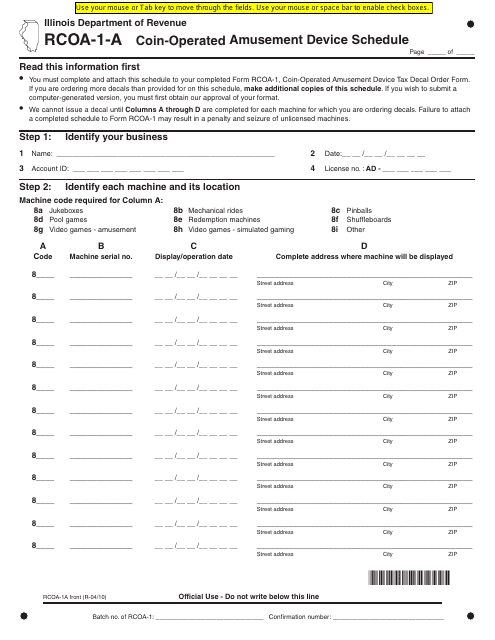

This document is used for reporting coin-operated amusement devices in the state of Illinois. It is a schedule form called RCOA-1-A.

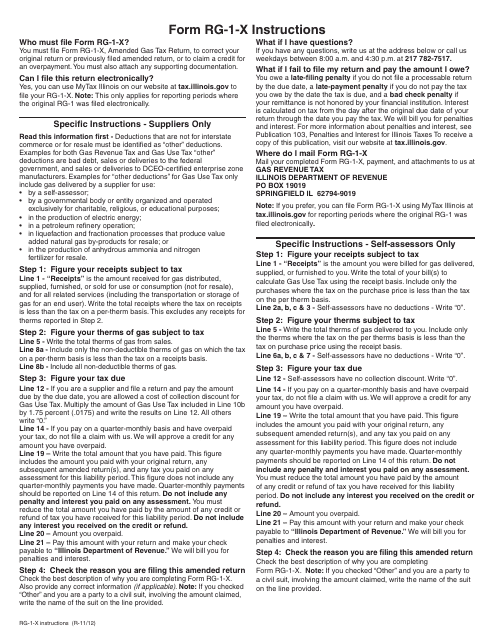

This Form is used for amending a Gas Tax Return in the state of Illinois. It provides instructions on how to correct any errors or make updates to the original return.

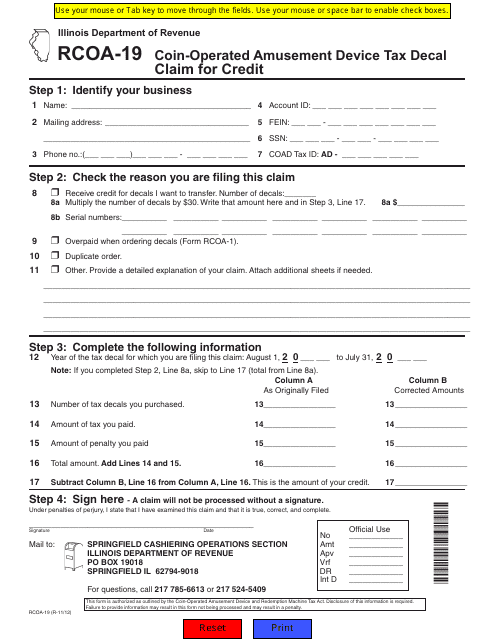

This form is used for claiming a credit for the tax paid on coin-operated amusement devices in Illinois.

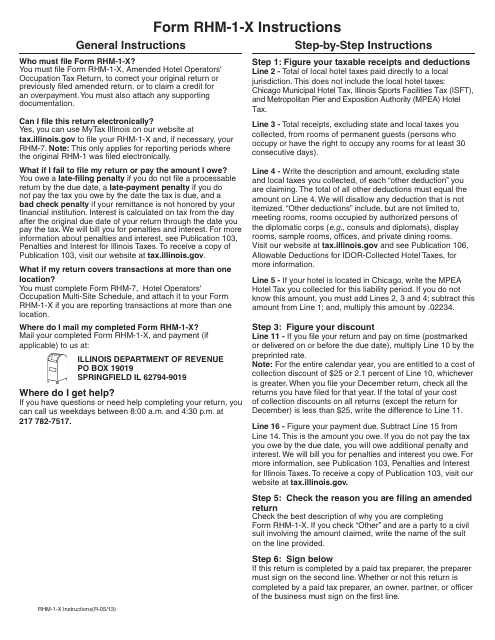

This document provides instructions for hotel operators in Illinois to fill out Form RHM-1-X for the Hotel Operators' Occupation Tax Return. It guides them through the process of reporting and paying the required tax.

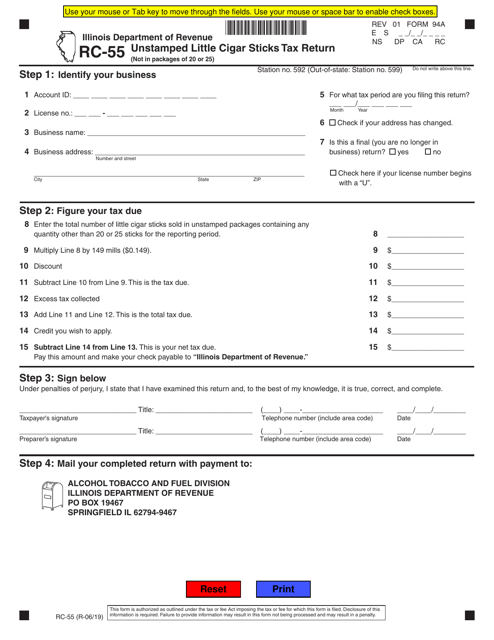

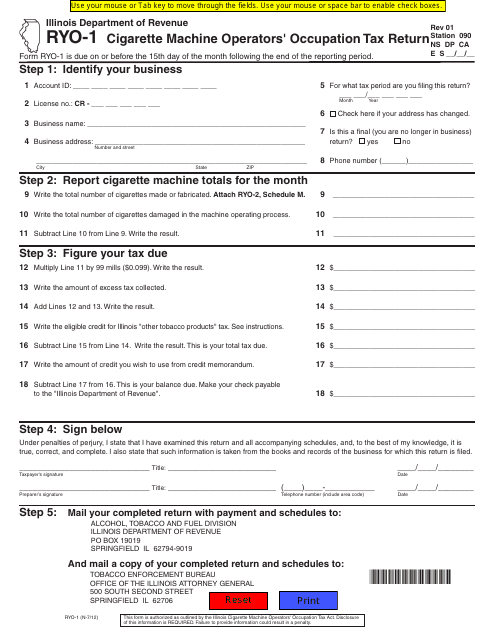

This form is used for filing the Cigarette Machine Operators' Occupation Tax Return in the state of Illinois.

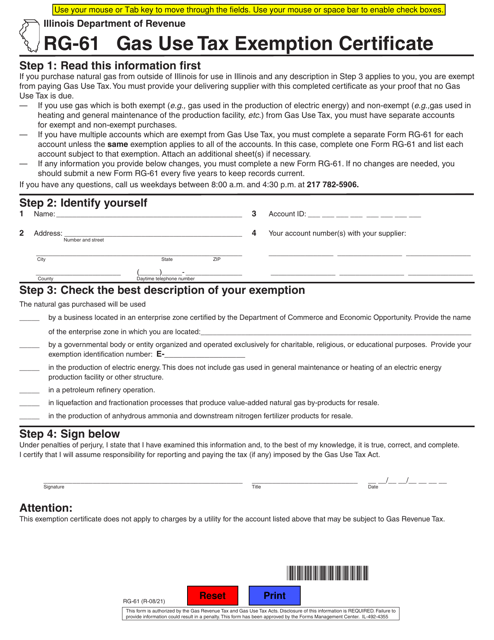

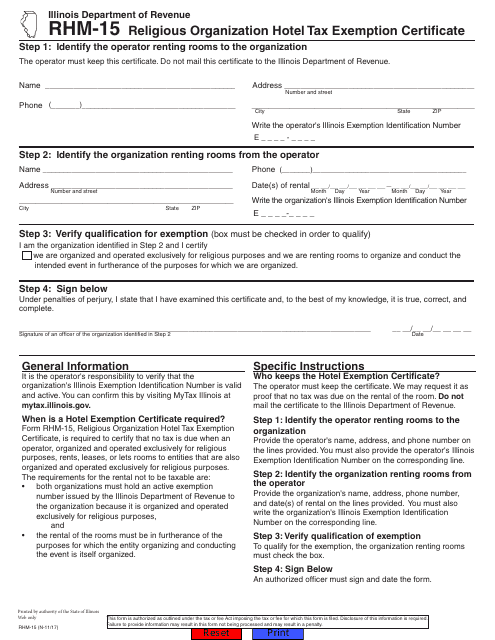

This form is used for religious organizations in Illinois to apply for hotel tax exemption.

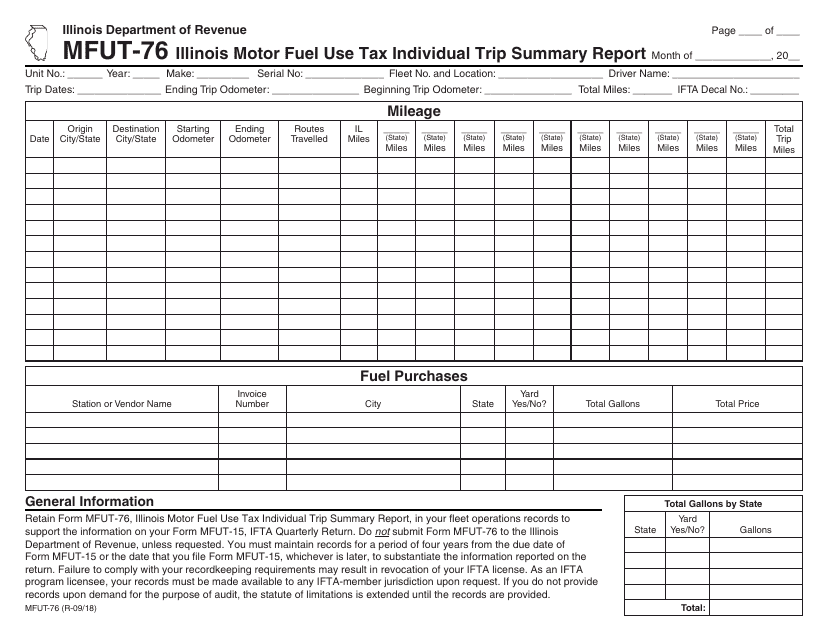

This form allows individuals to report their motor fuel use tax in Illinois for each individual trip.

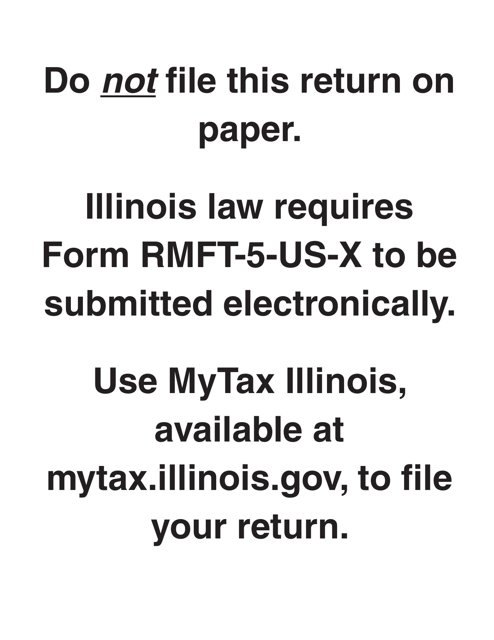

This Form is used for filing motor fuel distributor/supplier tax return in Illinois. It provides instructions on how to complete and submit the RMFT-5 form.

This document provides instructions for completing and filing Form RPU-13, which is used to report and pay electricity excise tax in the state of Illinois.

This form is used for assigning and tracking IFTA decals in the state of Illinois.

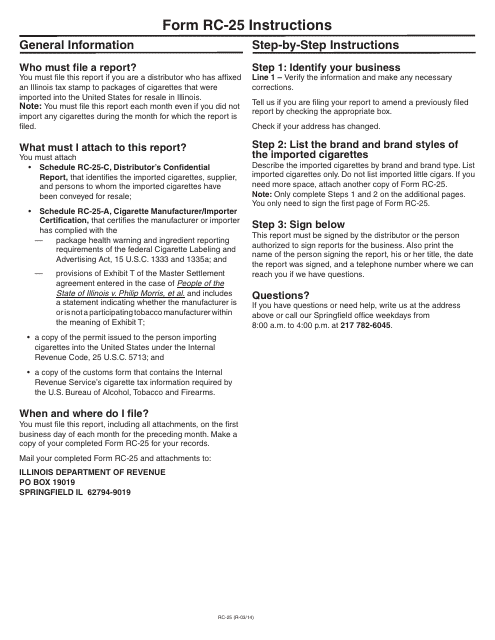

This form is used for reporting the importation of cigarettes in Illinois. It provides instructions on how to complete the RC-25 form accurately.

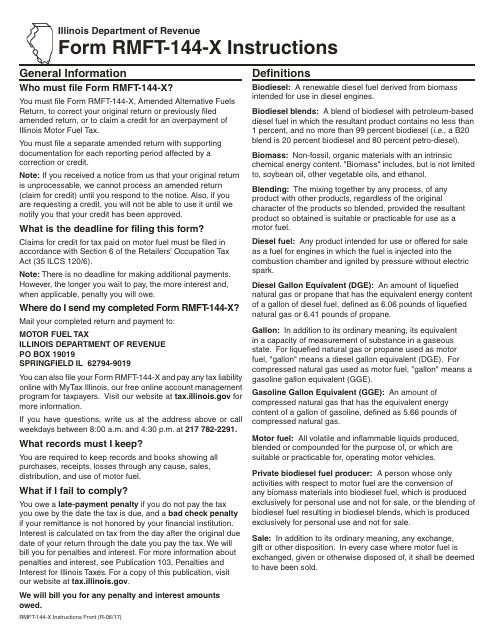

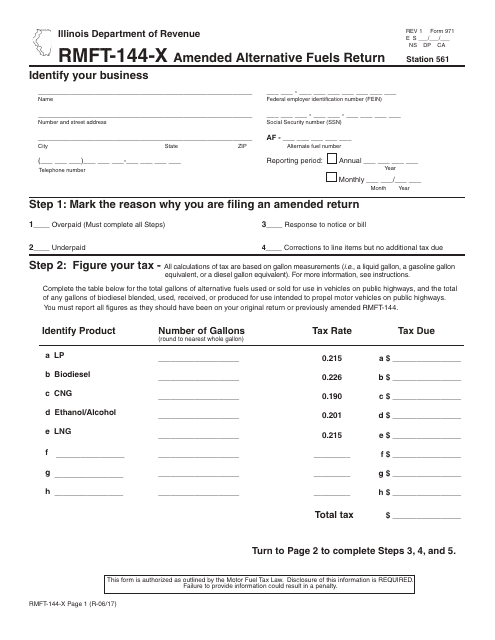

This Form RMFT-144-X is used for filing an Amended Alternative Fuels Return in the state of Illinois. It provides instructions on how to correctly revise and submit your previously filed return for alternative fuels.

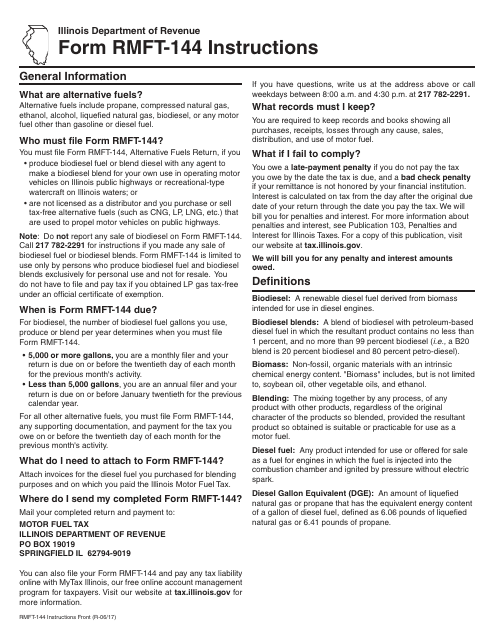

This Form is used for reporting alternative fuels usage in Illinois. It provides instructions on how to complete and submit the RMFT-144 Alternative Fuels Return.

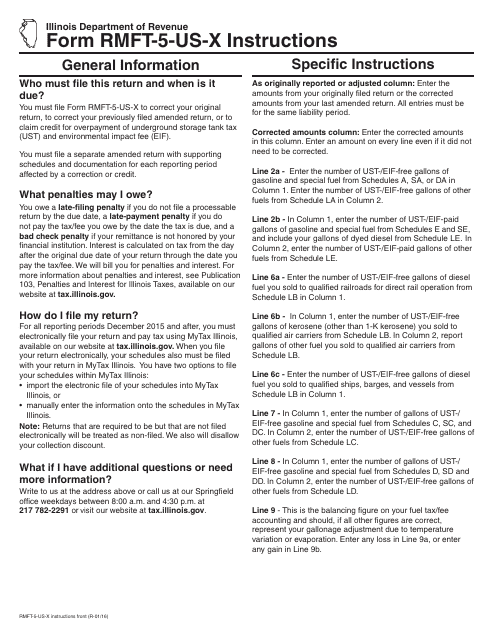

This form is used for filing an amended return or a claim for credit for the Underground Storage Tank Tax and Environmental Impact Fee in the state of Illinois.

This document is used for filing an amended alternative fuels return in the state of Illinois.

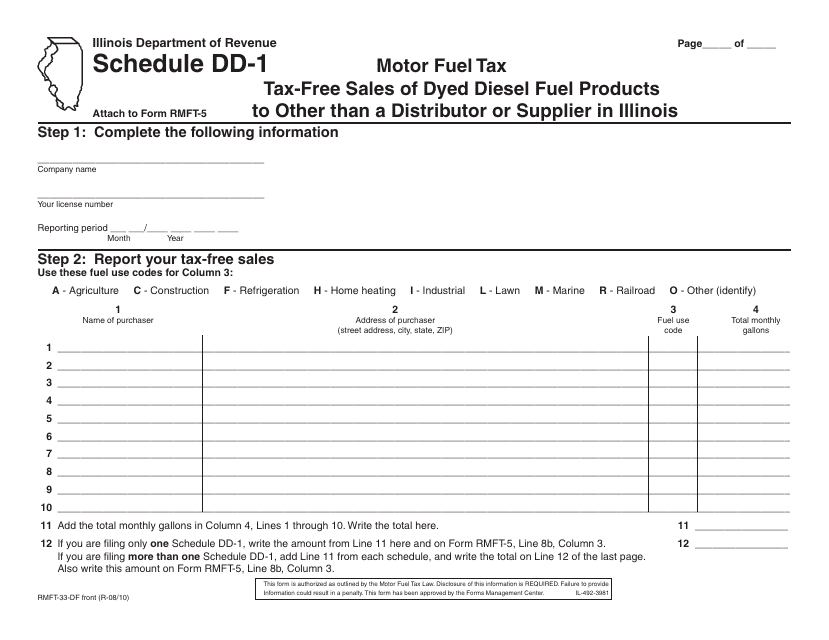

This Form is used for reporting tax-free sales of dyed diesel fuel products to buyers other than distributors or suppliers in Illinois.

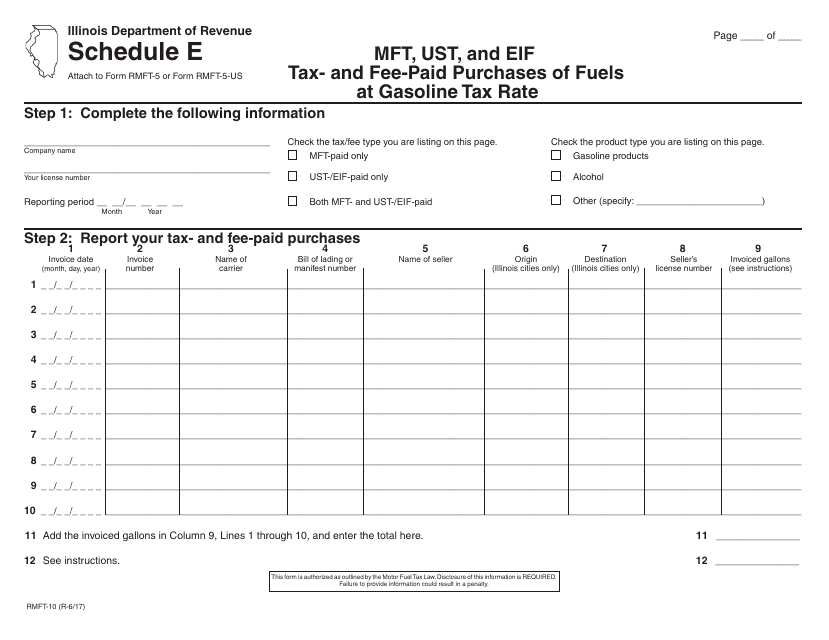

This form is used for reporting tax- and fee-paid purchases of fuels at the gasoline tax rate in Illinois. It is used by MFT, UST, and EIF taxpayers.

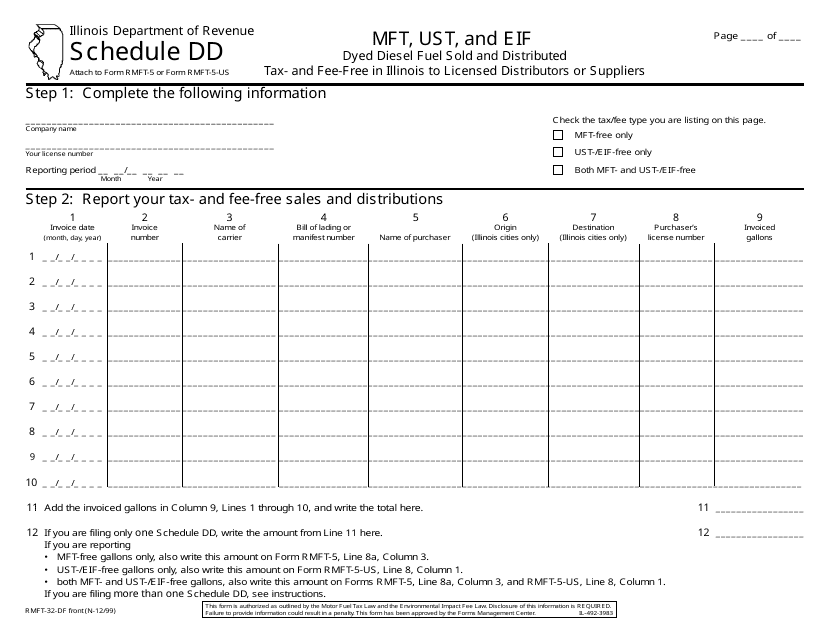

This form is used for reporting the sale and distribution of tax- and fee-free dyed diesel fuel in Illinois to licensed distributors or suppliers.

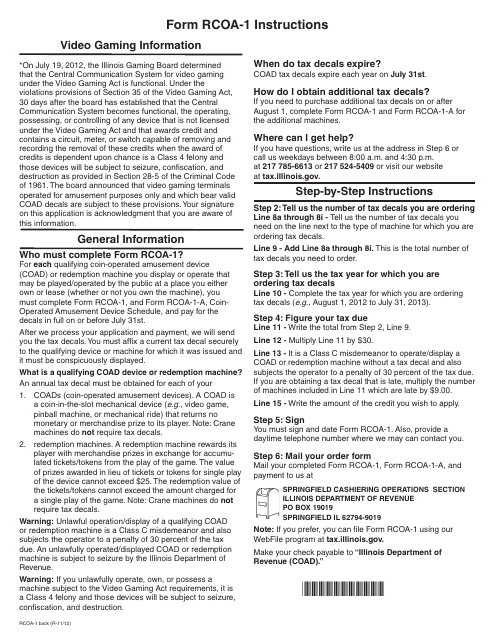

This Form is used for ordering tax decals for coin-operated amusement devices in the state of Illinois.

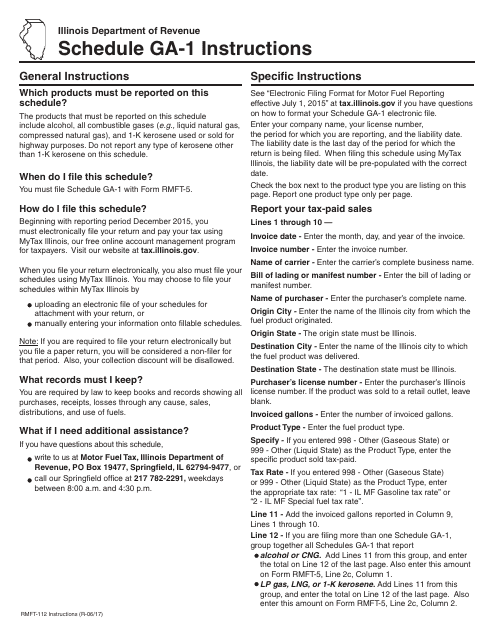

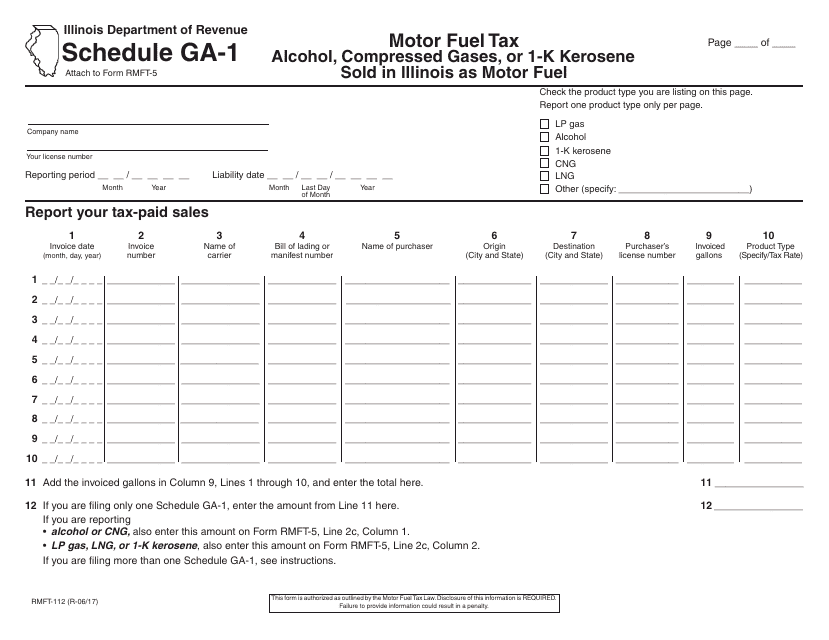

This form is used for reporting the sale of alcohol, compressed gases, or 1-k kerosene as motor fuel in Illinois.

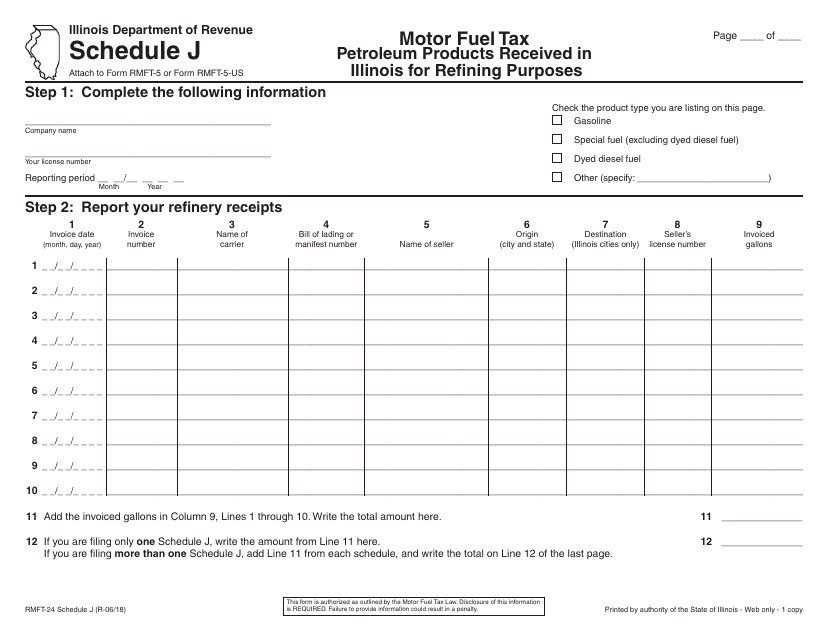

This form is used in Illinois to report the quantity of petroleum products received for refining purposes.

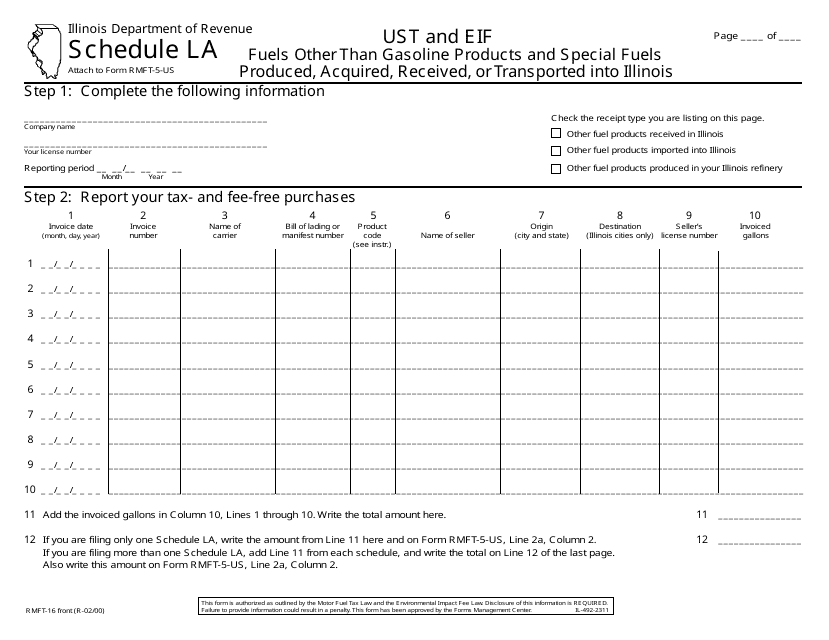

This form is used for reporting fuels other than gasoline products and special fuels that are produced, acquired, received, or transported into Illinois. It is specifically for use in the state of Illinois.

This form is used for reporting the sale of alcohol, compressed gases, or 1-k Kerosene in Illinois as motor fuel.

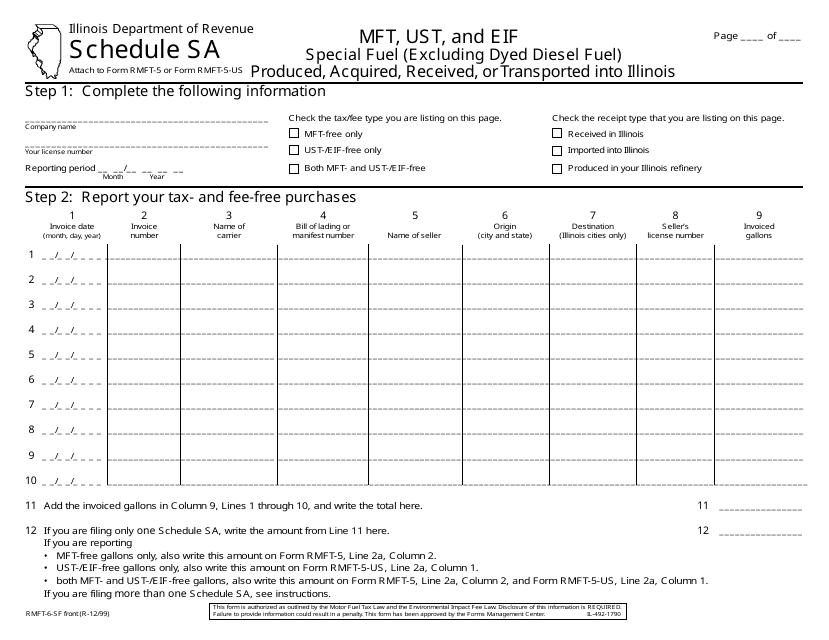

This form is used for reporting the production, acquisition, receipt, or transportation of special fuel (excluding dyed diesel fuel) into Illinois.

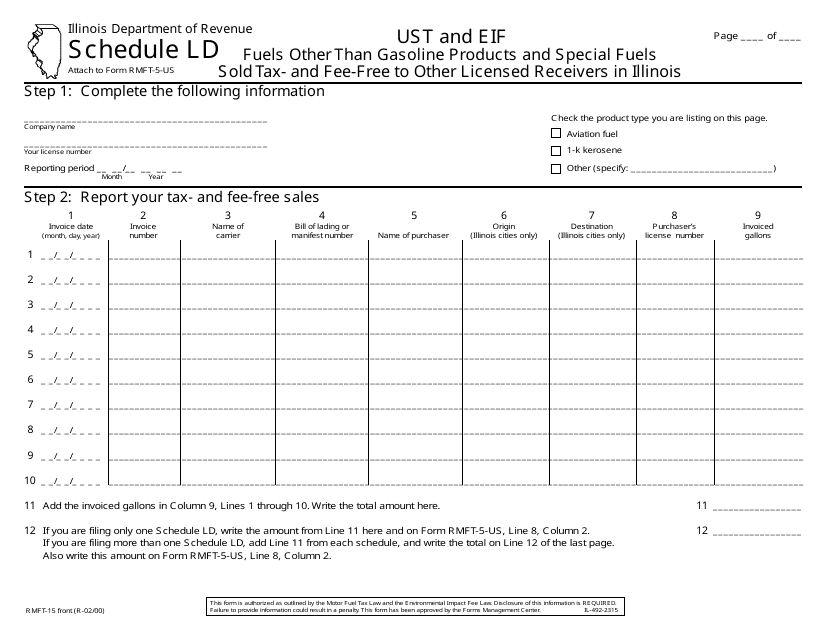

This form is used for reporting and documenting the sales of fuels other than gasoline products and special fuels that are sold tax- and fee-free to other licensed receivers in Illinois.

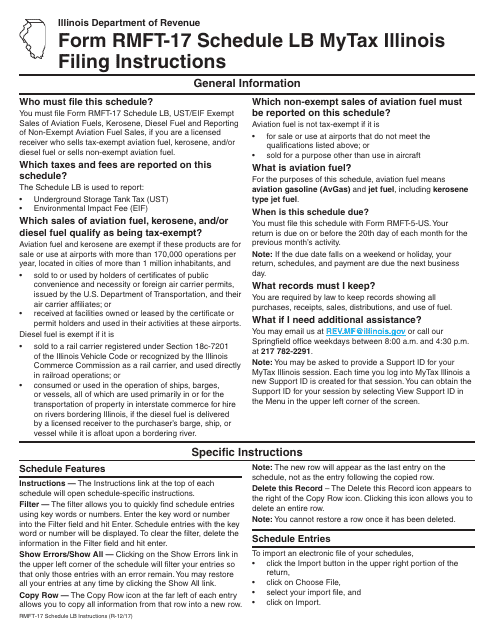

This Form is used for reporting exempt and non-exempt sales of aviation fuels in Illinois. It provides instructions for filling out Schedule LB of Form RMFT-17.

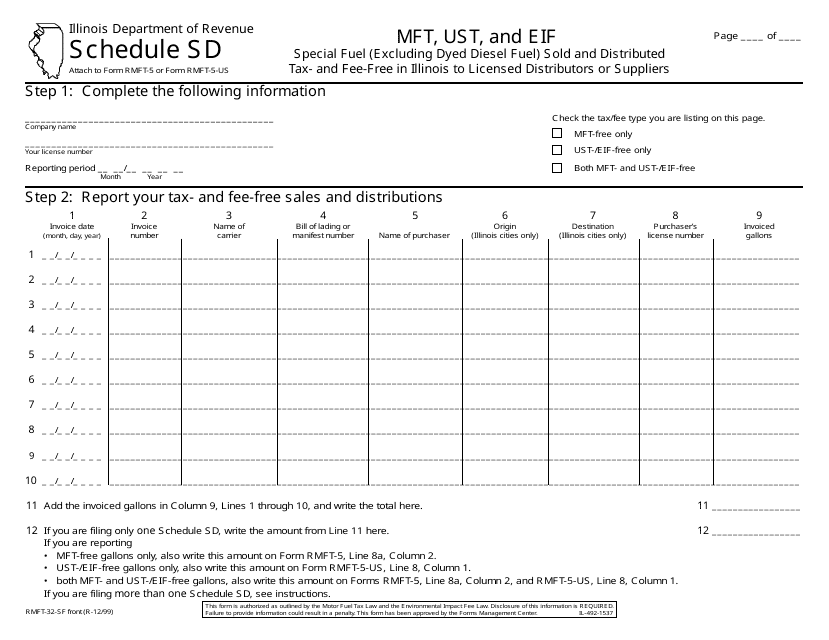

This Form is used for reporting special fuel sales in Illinois that are tax- and fee-free. It is specifically for licensed distributors or suppliers and excludes dyed diesel fuel.