Fill and Sign Illinois Legal Forms

Documents:

6290

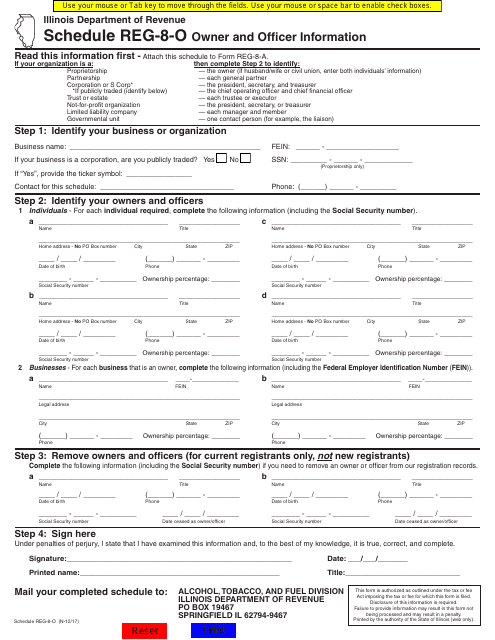

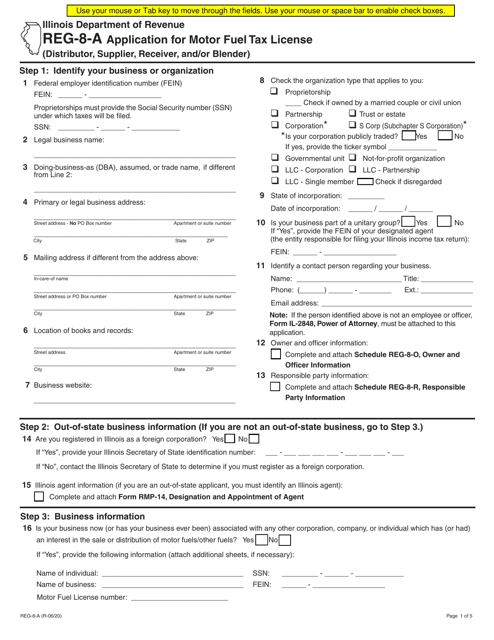

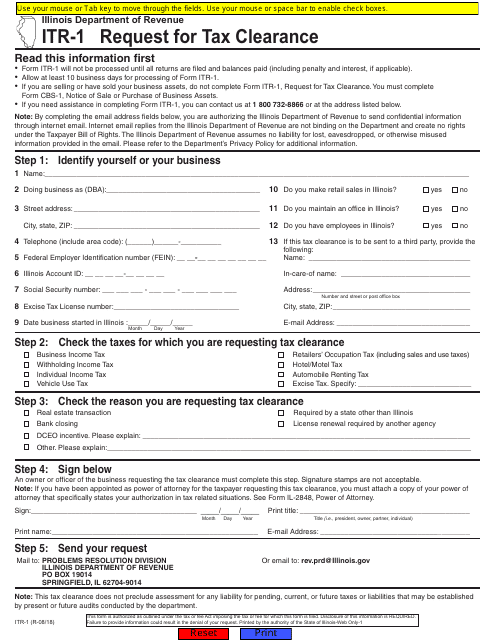

This document is used for providing owner and officer information for a business in the state of Illinois.

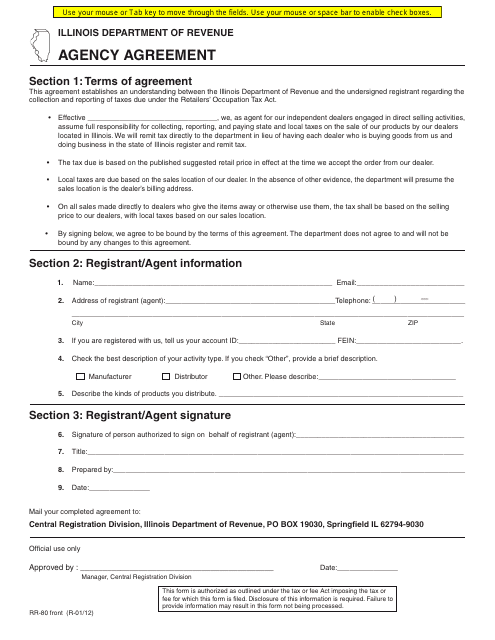

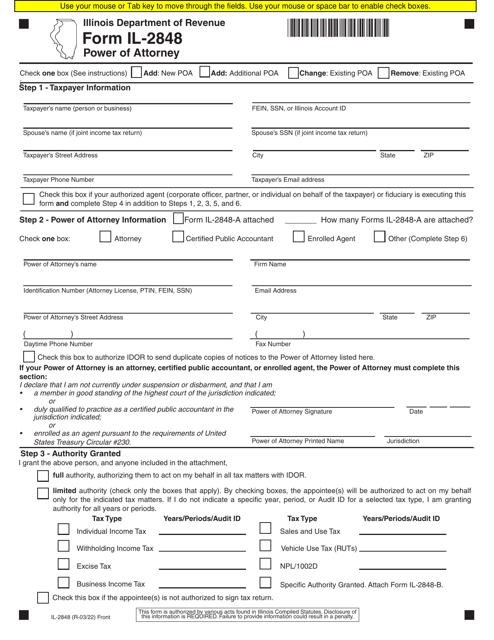

This Form is used for entering into an Agency Agreement in the state of Illinois. An Agency Agreement is a legal document that outlines the relationship between a principal and an agent, and sets forth the terms and conditions under which the agent will act on behalf of the principal.

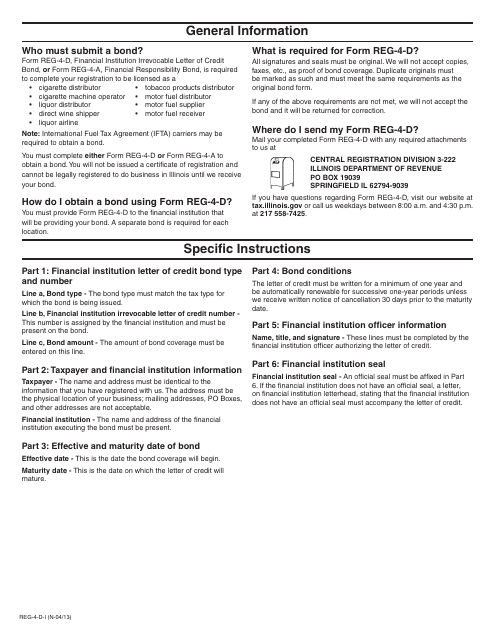

This Form is used for obtaining a Financial Institution Irrevocable Letter of Credit Bond in Illinois. It provides instructions for filling out the form and requirements for financial institutions.

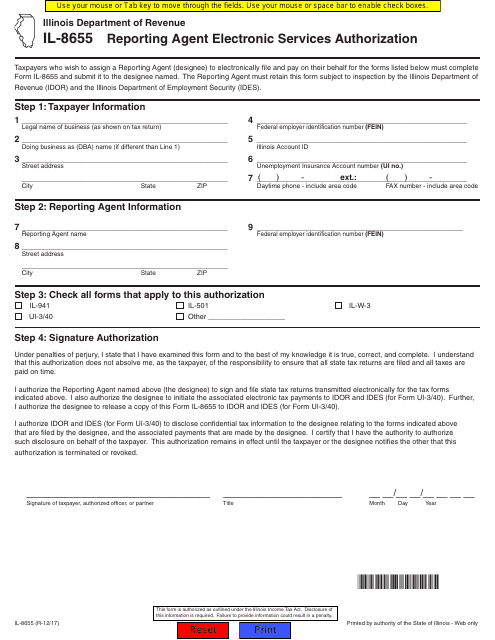

This Form is used for authorizing a reporting agent to electronically file taxes on behalf of a taxpayer in Illinois.

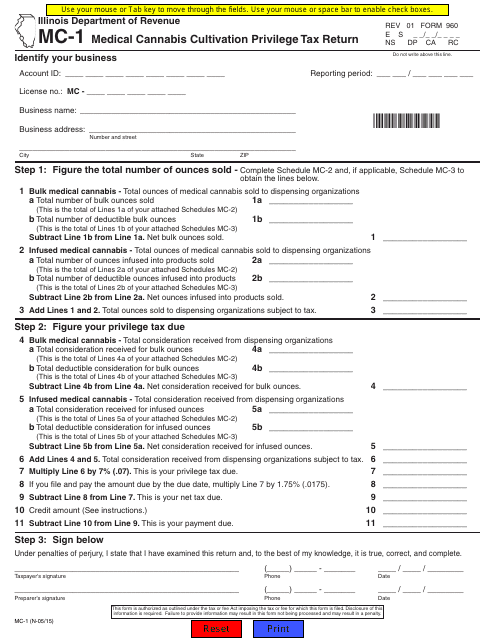

This form is used for filing the Medical Cannabis Cultivation Privilege Tax Return in the state of Illinois.

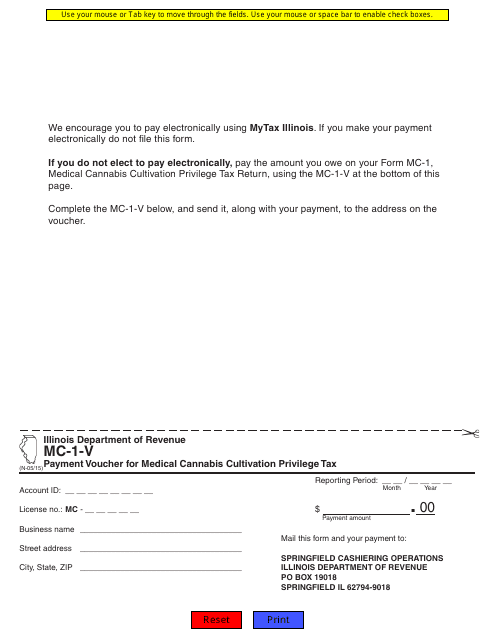

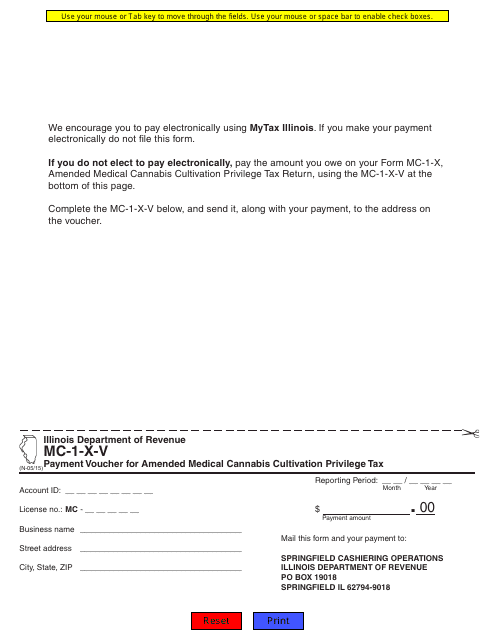

This form is used for submitting payment vouchers for the medical cannabis cultivation privilege tax in Illinois. It is specifically for individuals or businesses involved in the cultivation of medical cannabis and is used to report and remit the tax owed to the state.

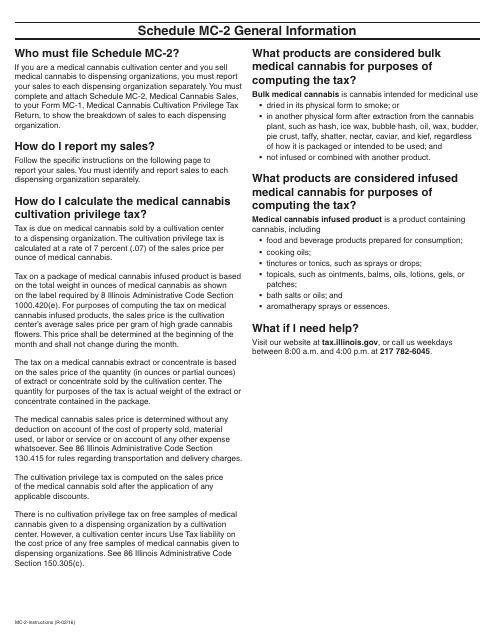

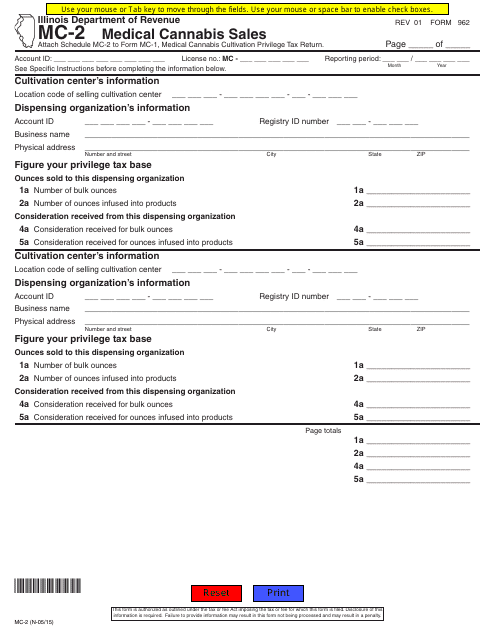

This Form is used for reporting medical cannabis sales in the state of Illinois. It provides instructions for completing Form 962 Schedule MC-2.

This form is used for reporting and documenting medical cannabis sales in the state of Illinois.

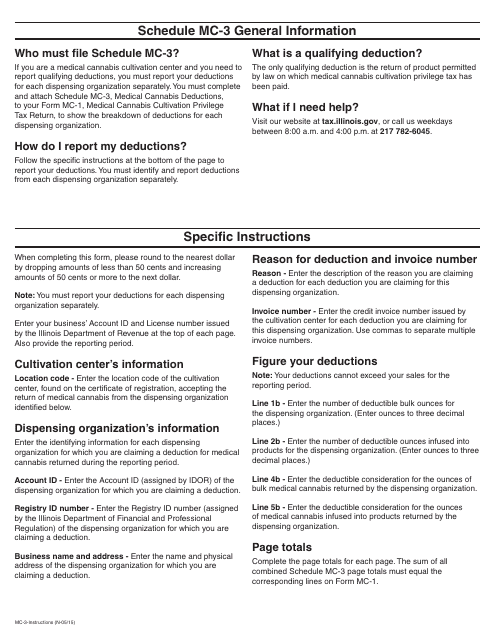

This Form is used for claiming medical cannabis deductions in Illinois on Schedule MC-3. It provides instructions on how to accurately report and calculate deductions related to medical cannabis expenses.

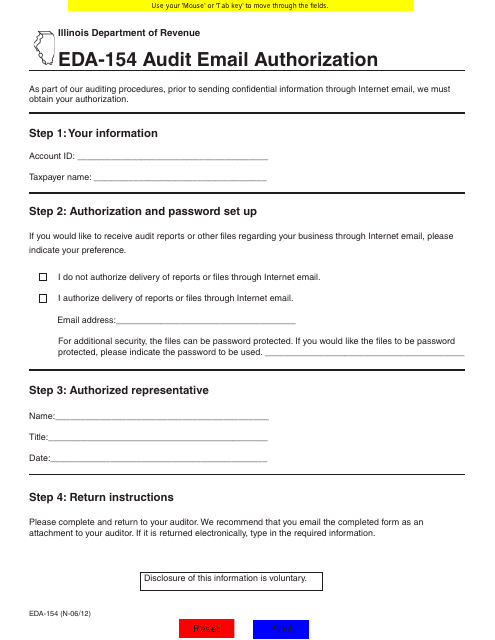

This form is used for authorizing audit emails in the state of Illinois.

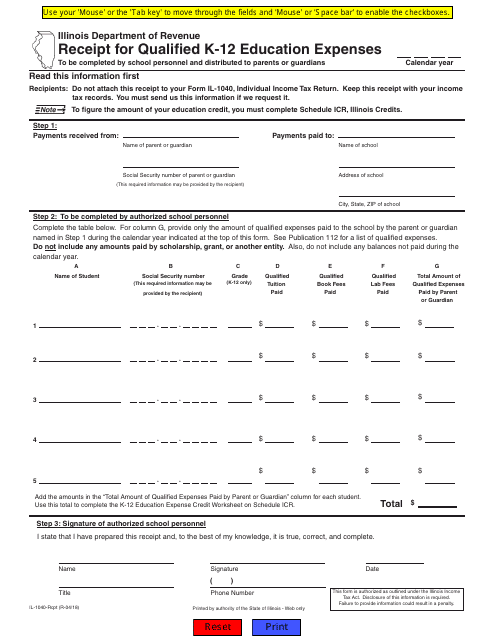

This document is a receipt for qualified K-12 education expenses in Illinois. It is used to track and document expenses related to education for tax purposes.

This Form is used for submitting payment voucher for amended medical cannabis cultivation privilege tax in the state of Illinois.

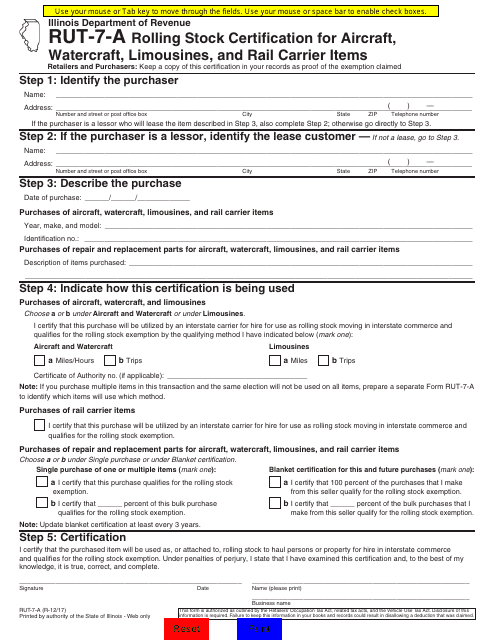

This form is used for the rolling stock certification of aircraft, watercraft, limousines, and rail carrier items in the state of Illinois.

This Form is used for certifying rolling stock items such as aircraft, watercraft, limousines, and rail carrier items in the state of Illinois. It provides instructions for filling out Form RUT-7-A.

This Form is used for filing an amended Automobile Renting Occupation and Use Tax Return in the state of Illinois. It provides instructions on how to make changes to a previously filed return for automobile renting taxes.

This Form is used for submitting an amended multiple site form in the state of Illinois. It provides instructions on how to complete and file the Form ART-2-X.

This form is used for filing the Chicago Soft Drink Tax Return in Illinois. It provides instructions on how to fill out and submit the form.

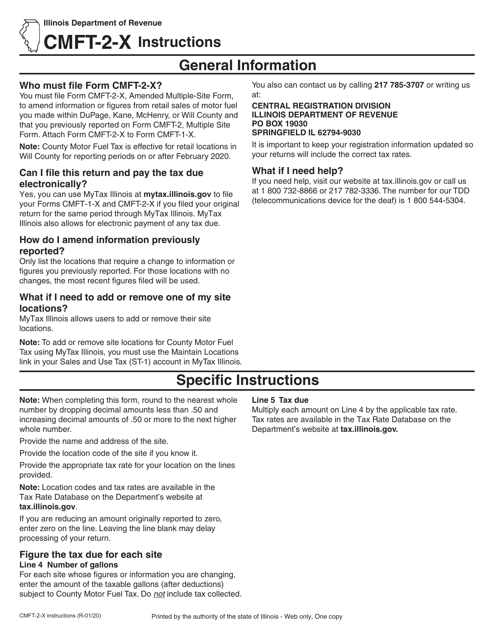

This document provides instructions for completing the CMFT-1 County Motor Fuel Tax Return in Illinois. It guides taxpayers on how to accurately report their motor fuel taxes and provides step-by-step instructions on filling out the form.

This Form is used for submitting the Multiple Site Form in the state of Illinois. It provides instructions on how to complete and submit the form.

This Form is used for filing an amended Chicago Soft Drink Tax Return in Illinois. It provides instructions on how to correct any errors or update information on the original return.

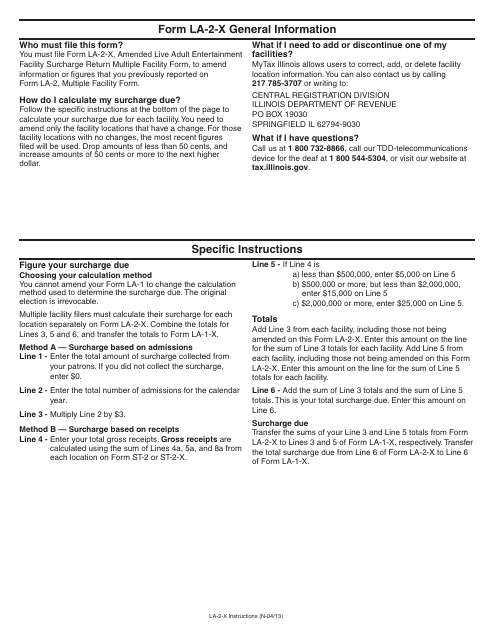

This Form is used for amending the Live Adult Entertainment Facility Surcharge Return for multiple facilities in Illinois. It provides instructions on how to accurately complete and submit the amended return.

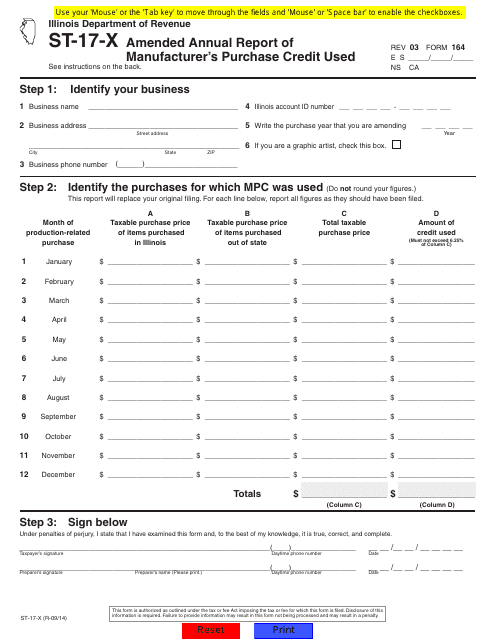

This form is used for filing an amended annual report of a manufacturer's purchase credit used in the state of Illinois.

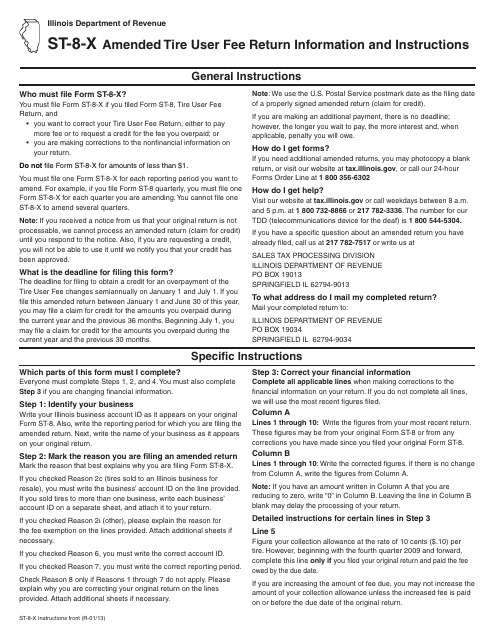

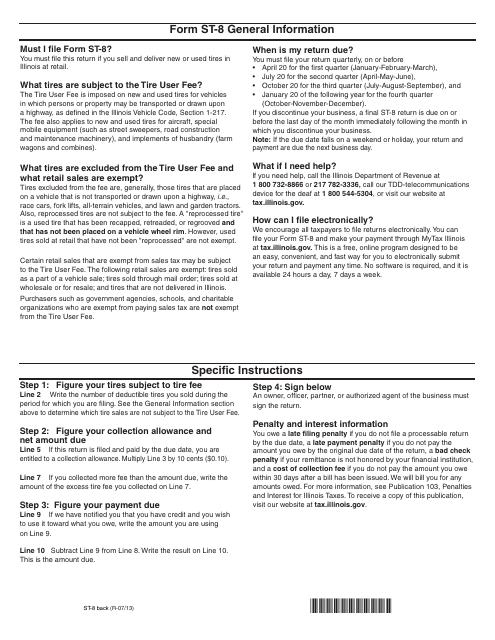

This form is used for filing an amended tire user fee return in the state of Illinois. It provides instructions on how to correctly complete and submit the form.

This Form is used for reporting and paying tire user fees in the state of Illinois. It provides instructions on how to fill out and submit the form correctly.

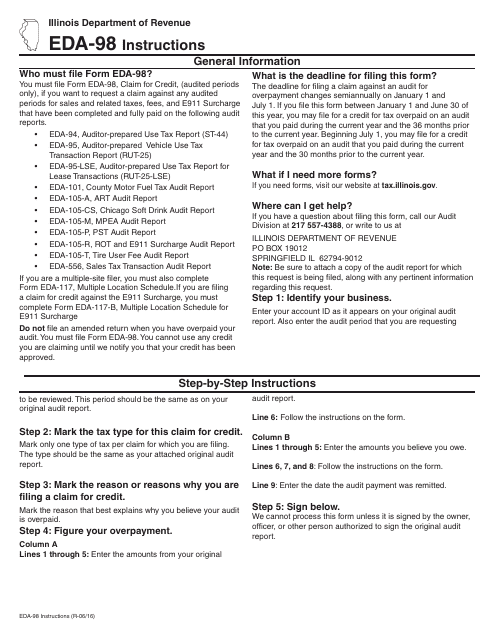

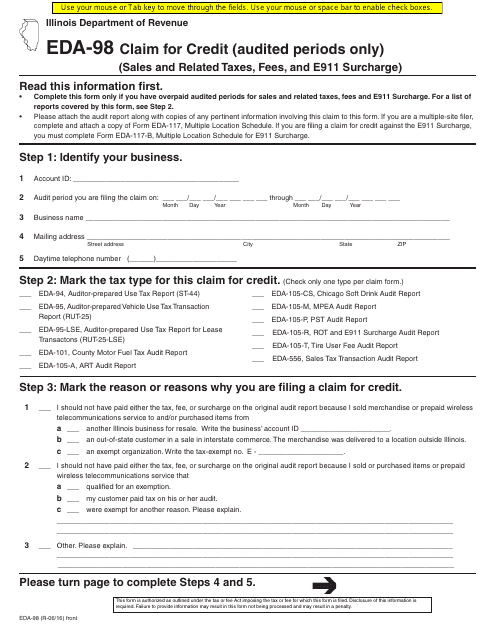

This document is used for claiming credits on audited periods for sales taxes, fees, and E911 surcharges in Illinois. It provides instructions on how to complete and submit Form EDA-98.

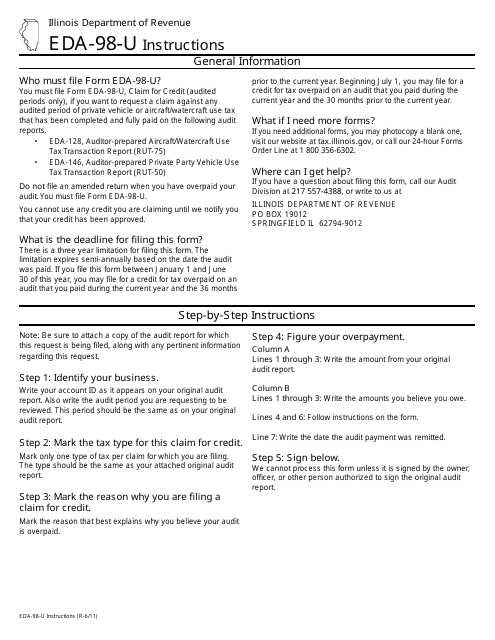

This Form is used for claiming a credit for private vehicle and aircraft/watercraft use tax in Illinois for audit periods. It provides instructions on how to complete the form and submit it to the appropriate authority.

This document is used for claiming a credit for audited sales and related taxes, fees, and E911 surcharge in Illinois.

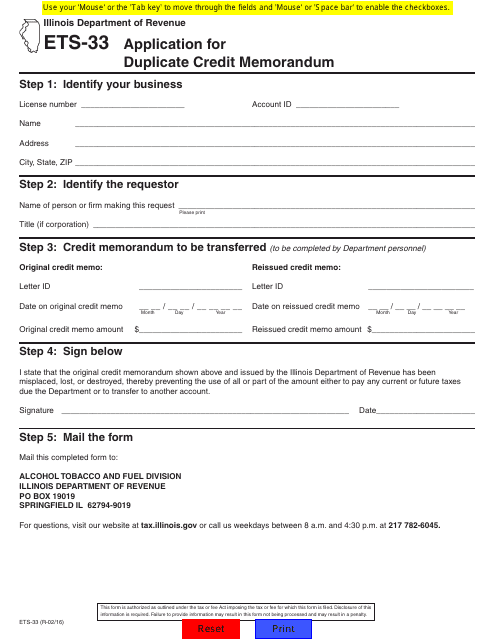

This form is used for applying for a duplicate credit memorandum in the state of Illinois. It is used when you need to obtain a new copy of your credit memorandum.

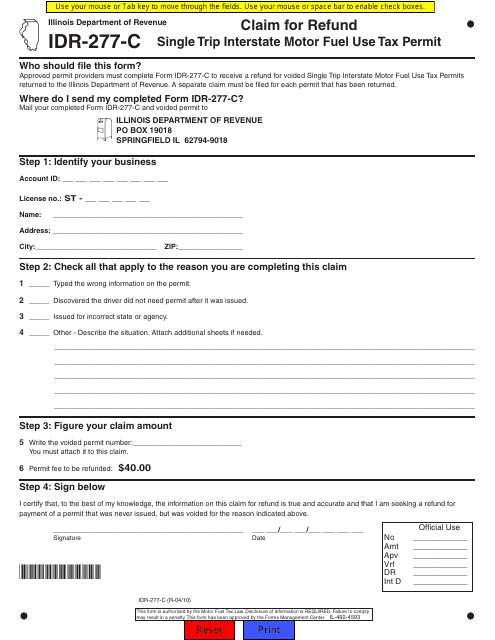

This document is used for claiming a refund for the Single Trip Interstate Motor Fuel Use Tax Permit in Illinois.

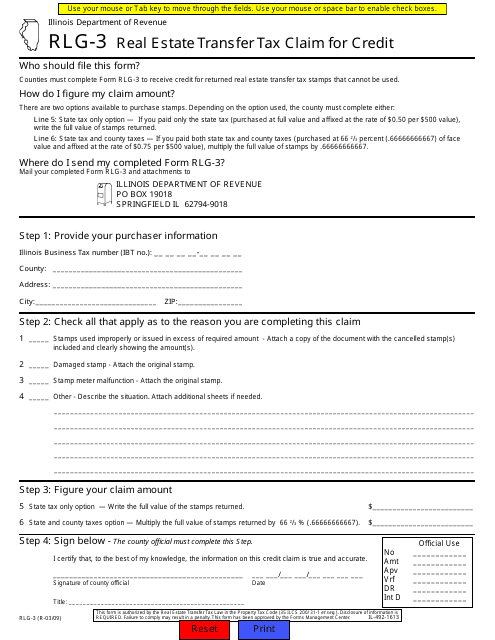

This form is used for claiming credit for real estate transfer tax in Illinois.

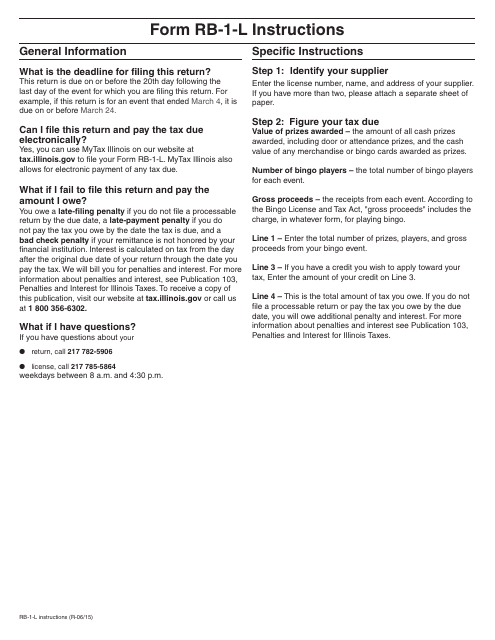

This Form is used for filing the Limited Bingo Tax Return in the state of Illinois. It provides instructions on how to report and pay taxes related to limited bingo activities.