Fill and Sign Illinois Legal Forms

Documents:

6290

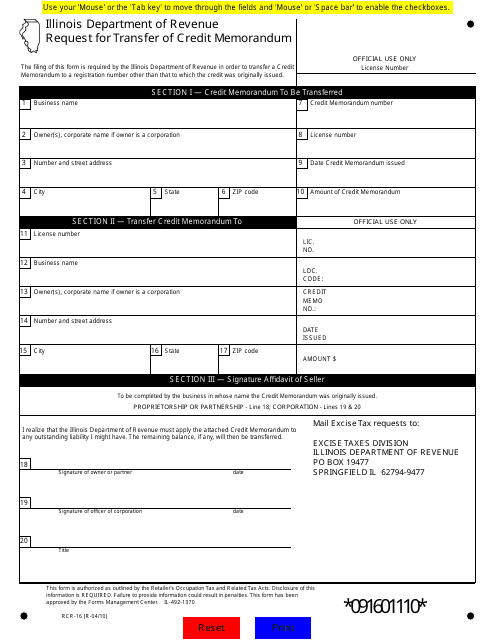

This form is used for making a request to transfer credit memorandums in the state of Illinois.

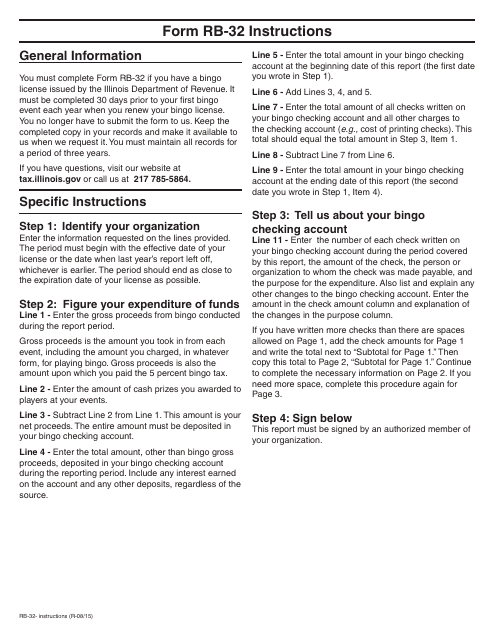

This form is used for reporting the expenditure of funds earned through bingo in the state of Illinois. It provides instructions on how to properly document and allocate the funds.

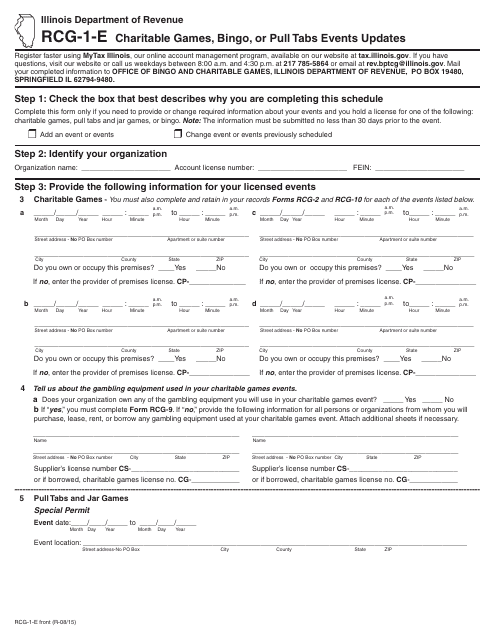

This Form is used for updating information on charitable games, bingo, or pull tabs events in the state of Illinois.

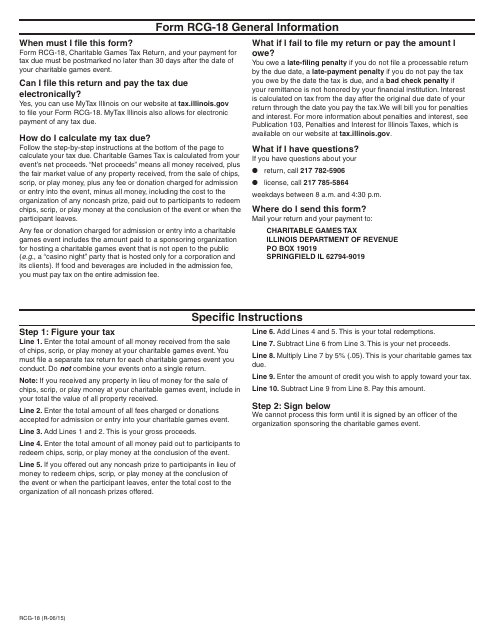

This form is used for reporting and paying taxes on charitable games in the state of Illinois. It provides instructions on how to properly fill out and submit the Form RCG-18.

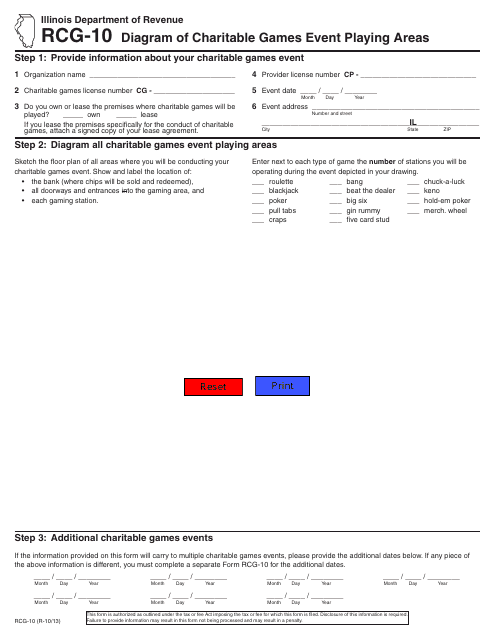

This document is a diagram of the playing areas for charitable games events in Illinois. It provides visual information on the layout and design of the gaming areas.

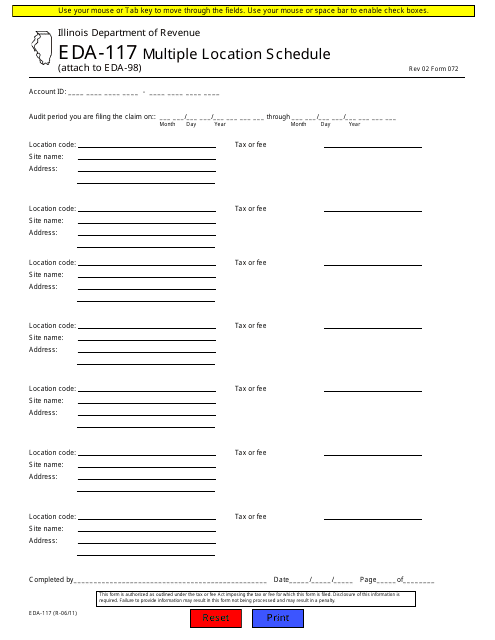

This form is used for creating a schedule for multiple locations in the state of Illinois. It is used to efficiently manage and track activities across various locations.

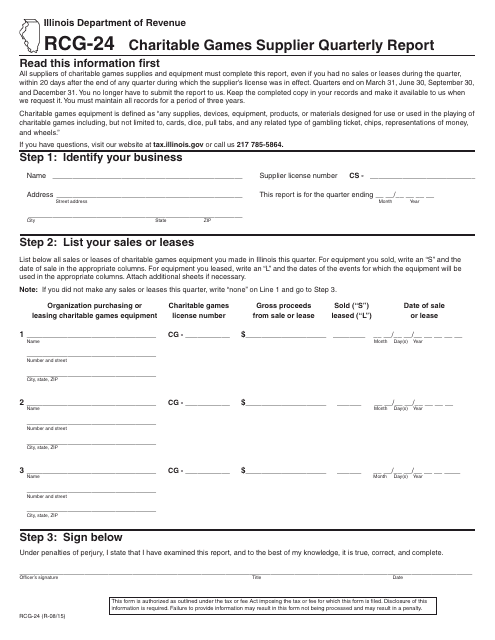

This form is used for submitting a quarterly report by charitable games suppliers in Illinois.

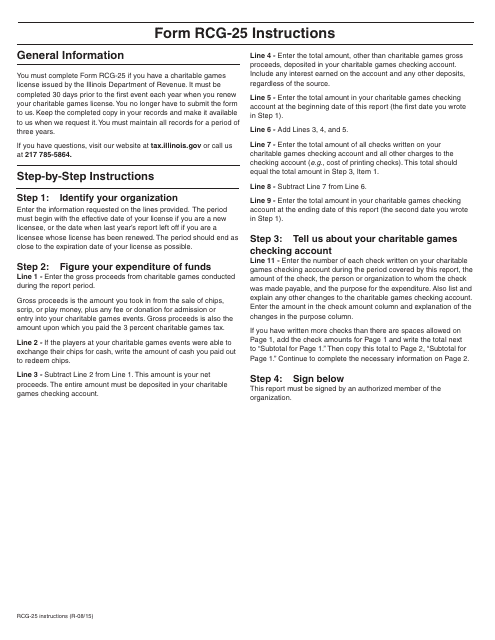

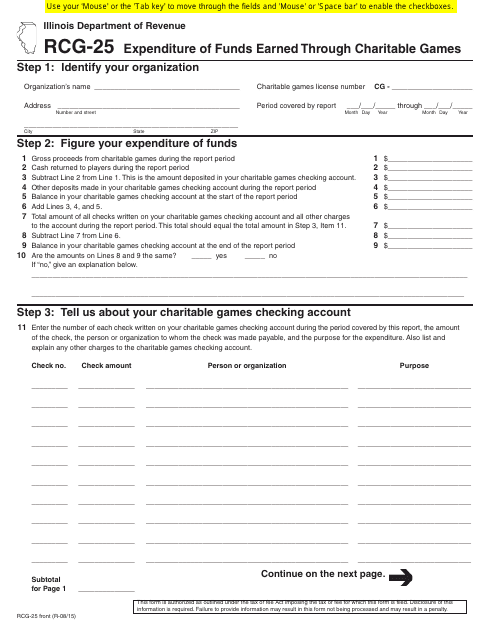

This Form is used for reporting the expenditure of funds earned through charitable games in the state of Illinois.

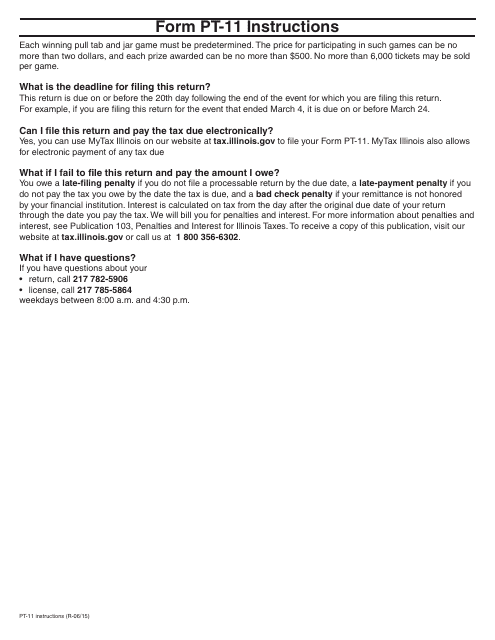

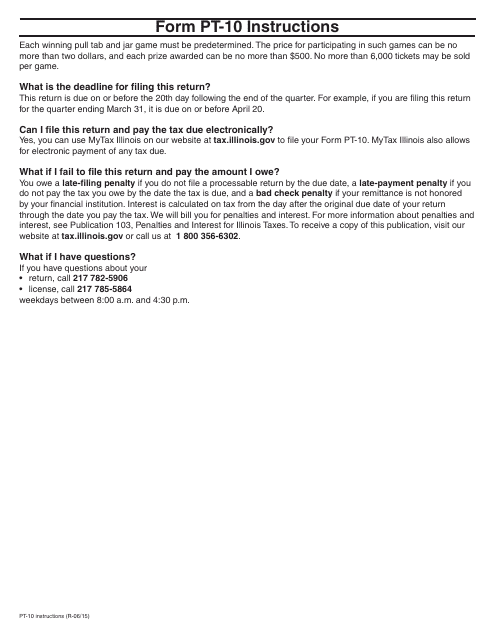

This form is used for filing the Limited Pull Tabs and Jar Games Tax Return in Illinois. It provides instructions and guidelines for properly completing the tax return for these specific gambling activities.

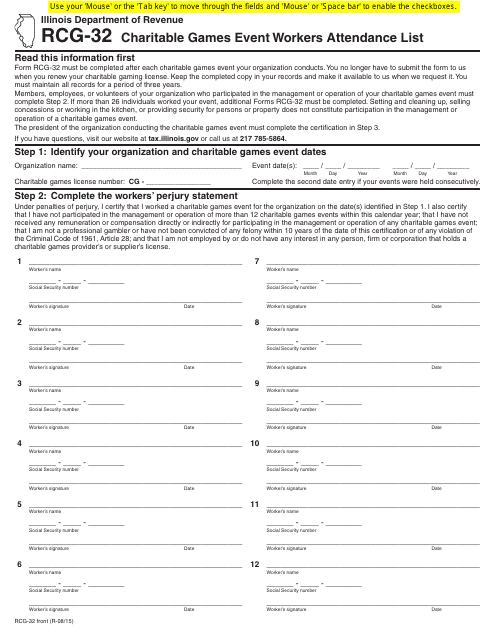

This Form is used for tracking the attendance of workers for charitable games events in Illinois.

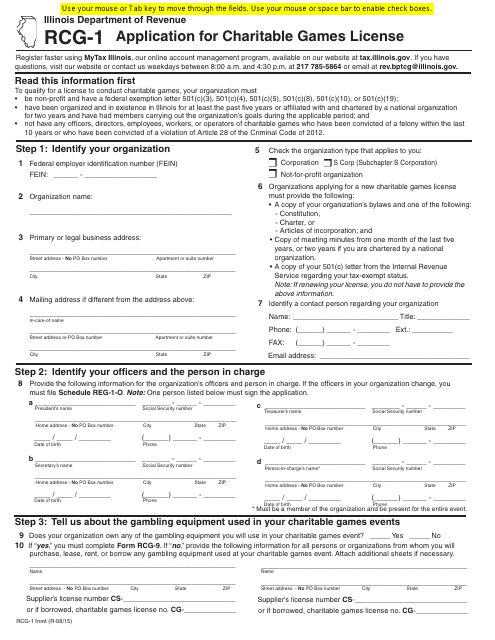

This form is used for applying for a charitable games license in the state of Illinois. It is required for organizations that wish to hold charitable games such as bingo, raffles, and poker tournaments.

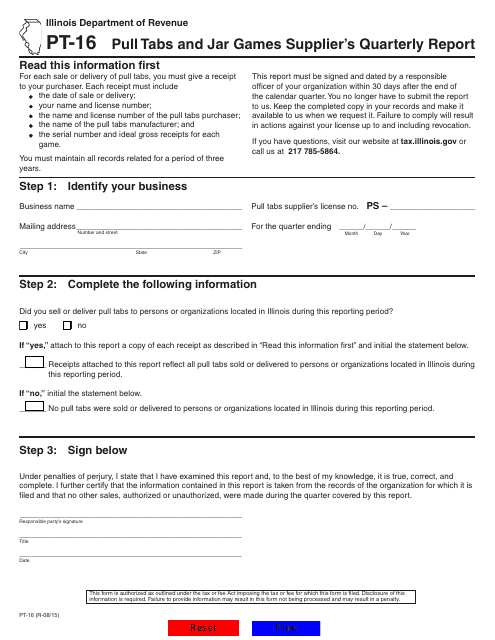

This form is used for suppliers of pull tabs and jar games in Illinois to report quarterly sales and revenue information.

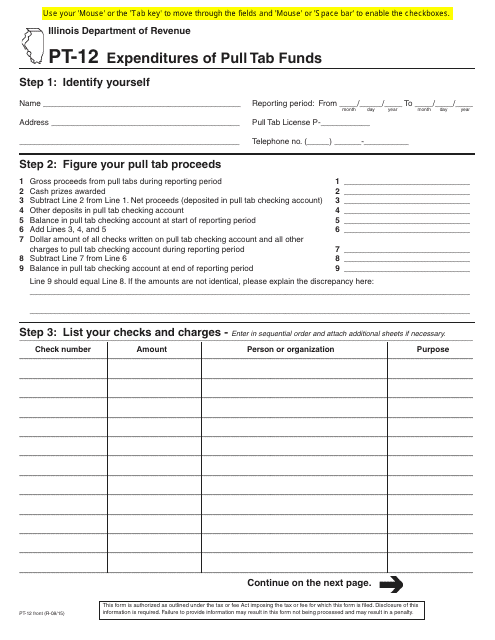

This form is used for reporting the expenditures of pull tab funds in the state of Illinois.

This form is used for reporting and paying quarterly taxes for pull tabs and jar games in the state of Illinois. It provides instructions on how to accurately complete and submit the tax return.

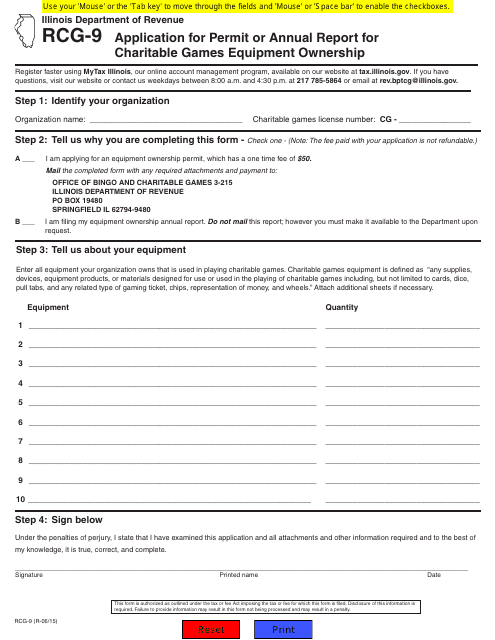

This form is used for applying for a permit or submitting an annual report for owning charitable games equipment in the state of Illinois.

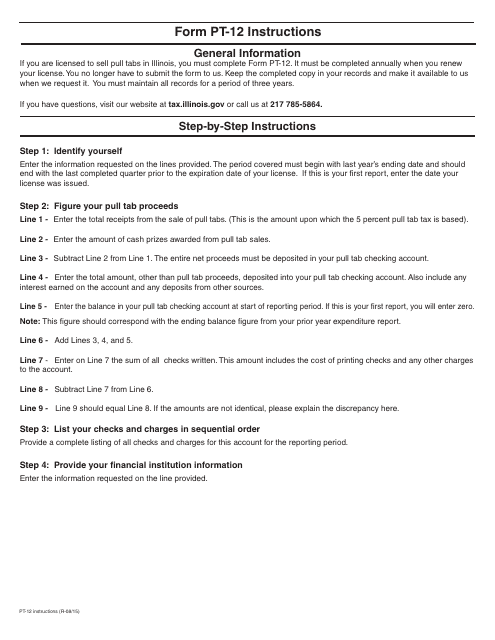

This type of document provides instructions for reporting the expenditures of pull tab funds in the state of Illinois.

This form is used for submitting an amended revenue return for out-of-state cigarette and little cigar sales in Illinois. Follow the instructions provided to correctly fill out and submit the form.

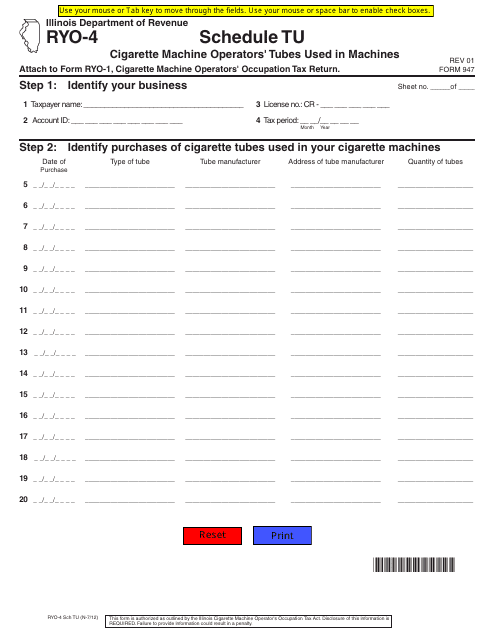

This document is a form used in Illinois to report the number of cigarette machine operators' tubes used in machines.

This form is used for reporting the expenditure of funds earned through charitable games in the state of Illinois. It provides a record of how the funds were utilized for charitable purposes.

This form is used for reporting and remitting cigarette and little cigar revenue generated from sales made outside the state of Illinois.

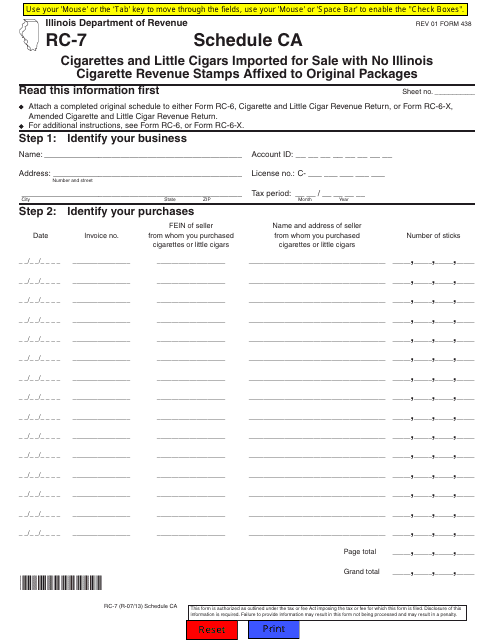

This form is used for reporting the import of cigarettes and little cigars that are being sold in Illinois without the required cigarette revenue stamps attached to the original packages.

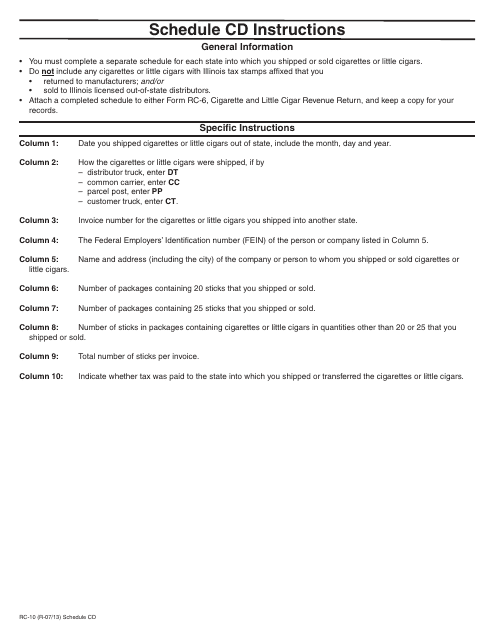

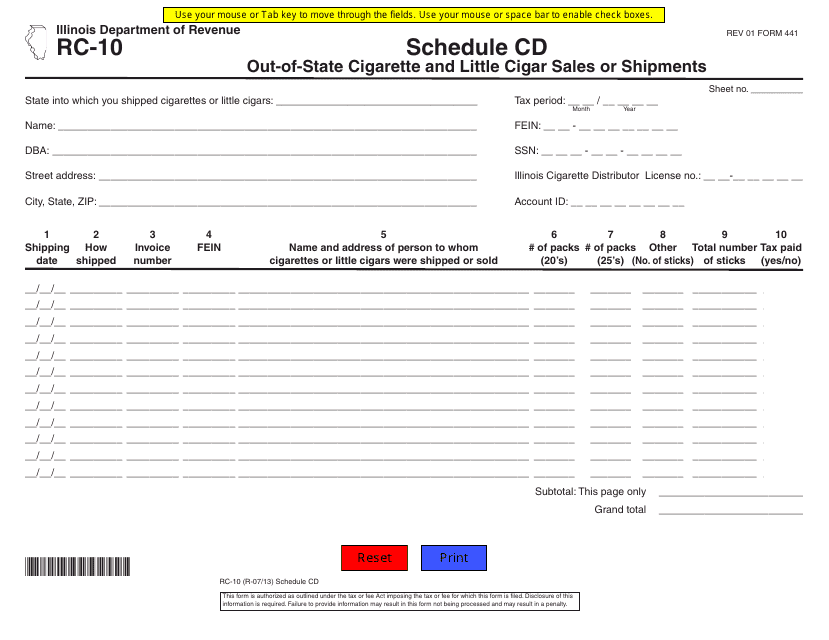

This Form is used for reporting out-of-state cigarette and little cigar sales or shipments in Illinois. It provides instructions for filling out Form RC-10 Schedule CD.

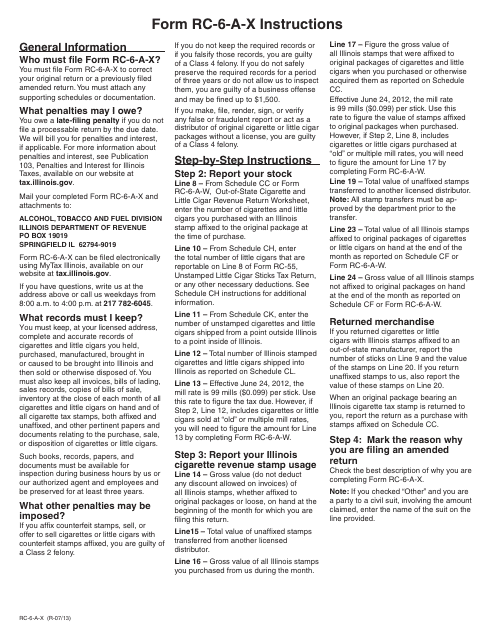

This Form is used for filing an amended cigarette and little cigar revenue return in the state of Illinois. It provides instructions on how to correctly report and correct any errors on the original return.

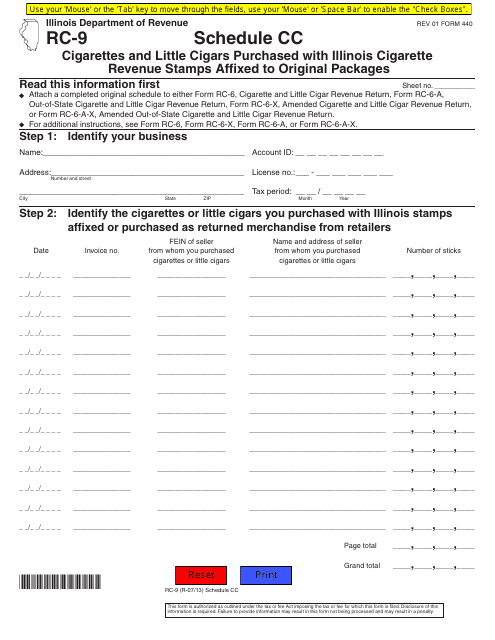

This form is used for reporting the purchase of cigarettes and little cigars in Illinois that have revenue stamps affixed to their original packages.

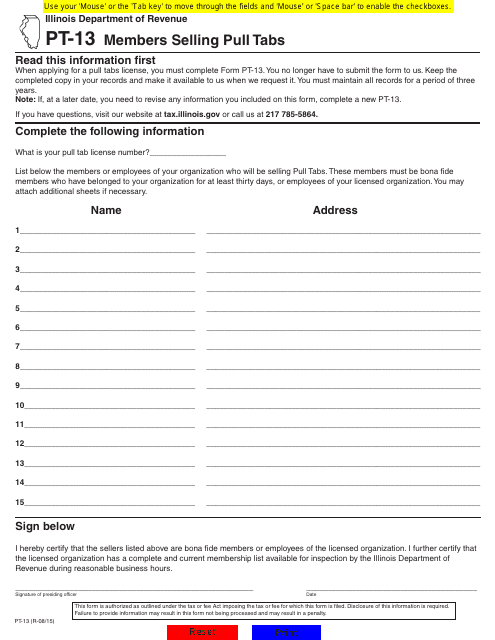

This form is used for reporting the sale of pull tabs by members in Illinois.

This Form is used for reporting out-of-state cigarette and little cigar sales or shipments in Illinois.

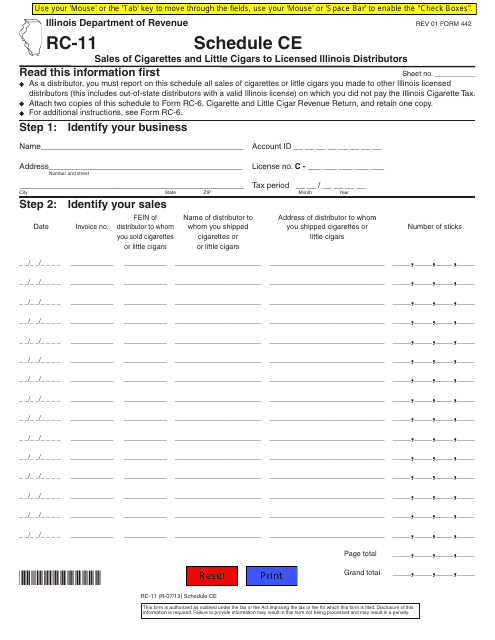

This form is used for reporting sales of cigarettes and little cigars to licensed Illinois distributors in Illinois.

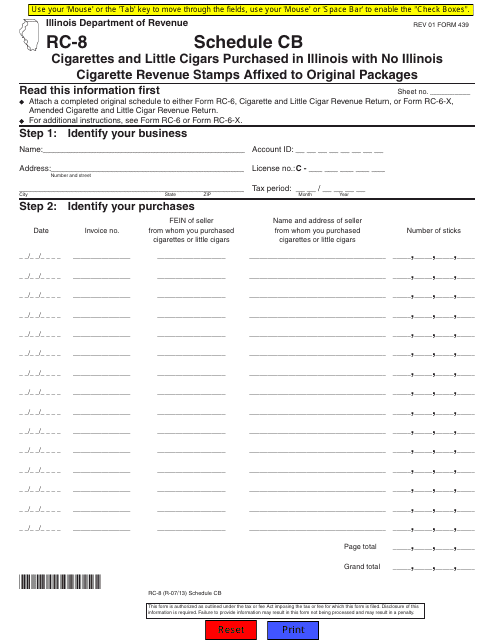

This form is used for reporting the purchase of cigarettes and little cigars in Illinois that do not have Illinois cigarette revenue stamps attached to the original packaging.

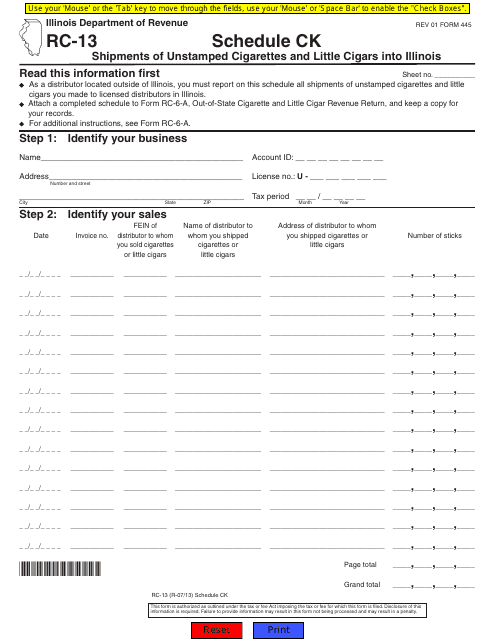

This form is used for reporting shipments of unstamped cigarettes and little cigars into Illinois.

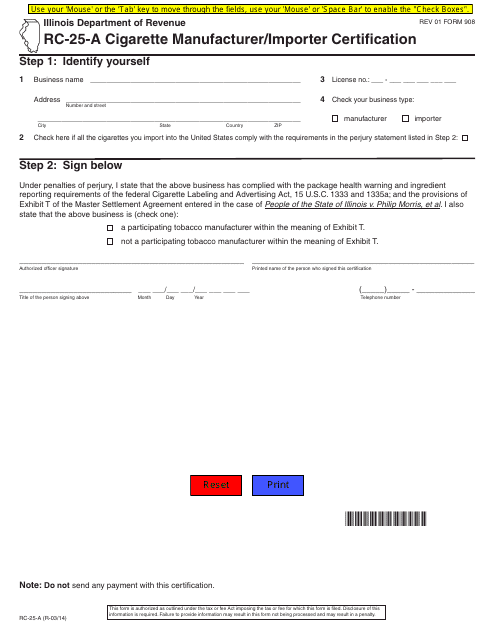

This document is used for cigarette manufacturers or importers in Illinois to certify their compliance with state laws and regulations.

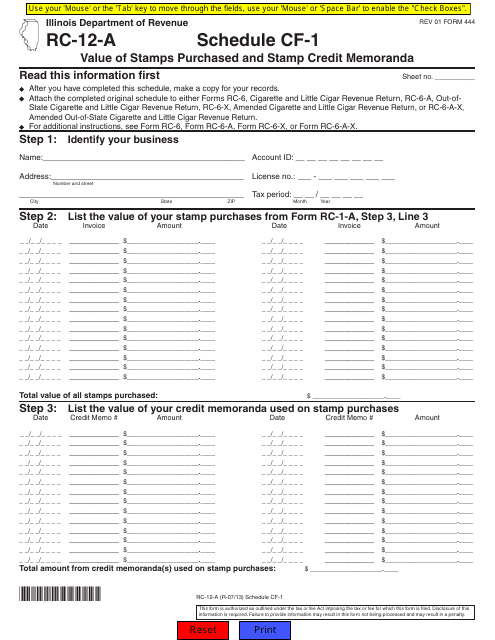

This form is used to report the value of stamps purchased and stamp credit memoranda in the state of Illinois.

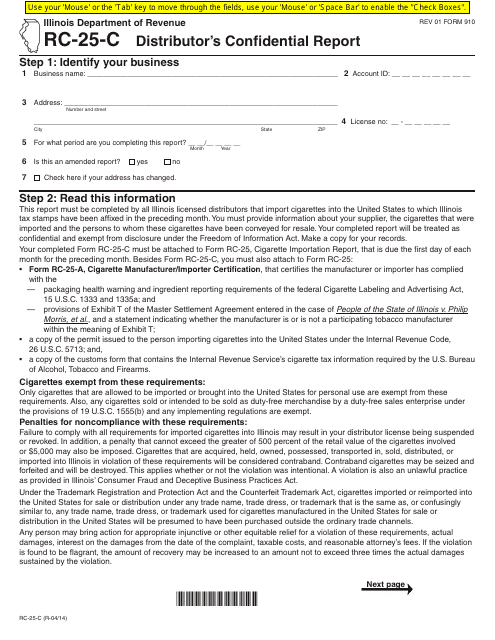

This form is used for distributors to submit a confidential report in Illinois.

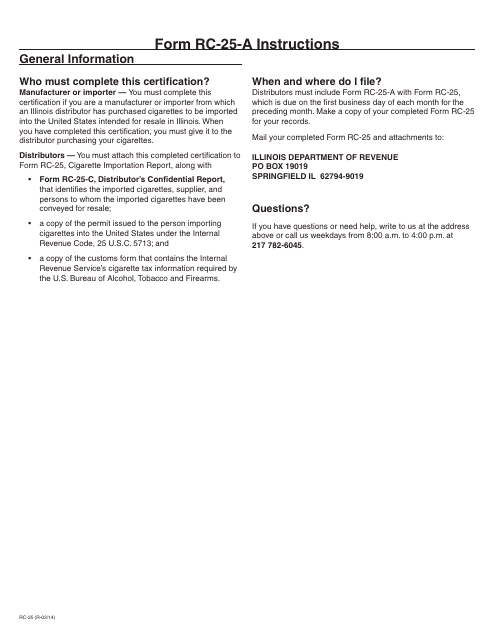

This form is used for cigarette manufacturers and importers in Illinois to certify compliance with state regulations. It provides instructions for completing and submitting Form RC-25-A.

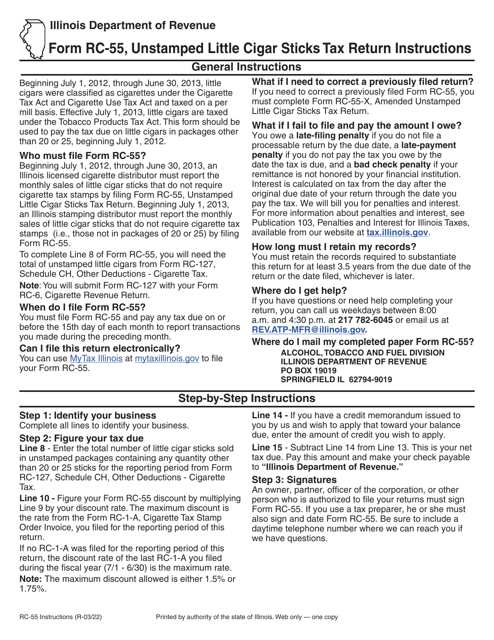

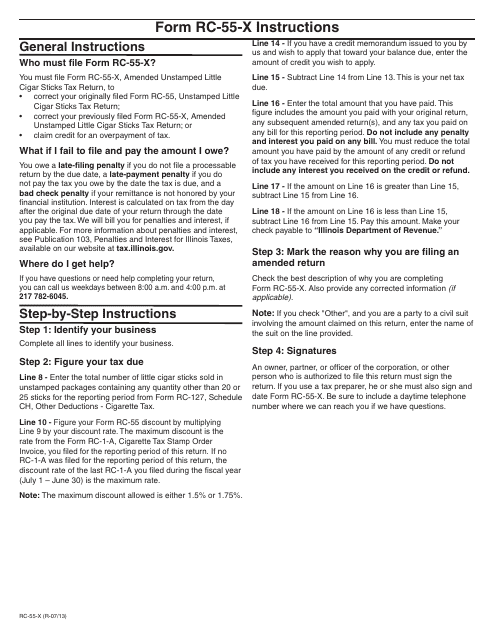

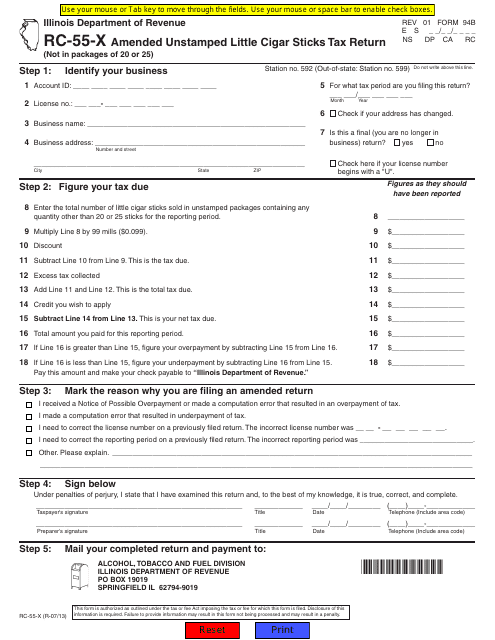

This Form is used for filing an amended tax return for unstamped little cigar sticks in the state of Illinois.

This form is used for filing an amended tax return for unstamped little cigar sticks in Illinois.

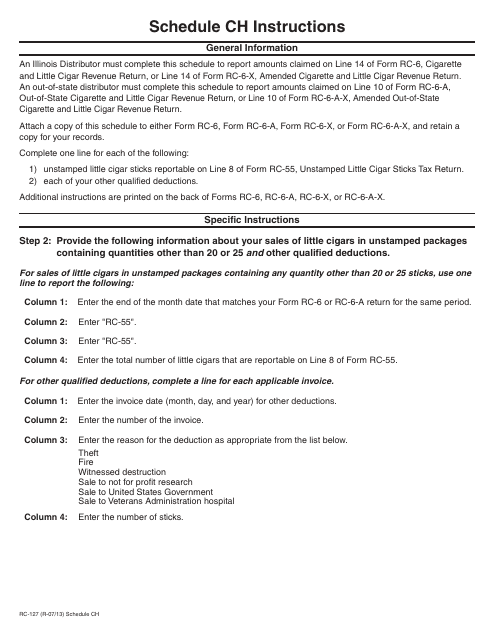

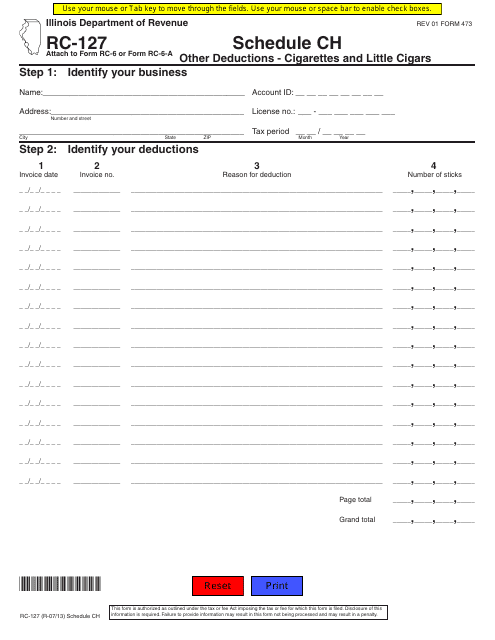

This form is used for reporting other deductions related to cigarettes and little cigars in the state of Illinois.

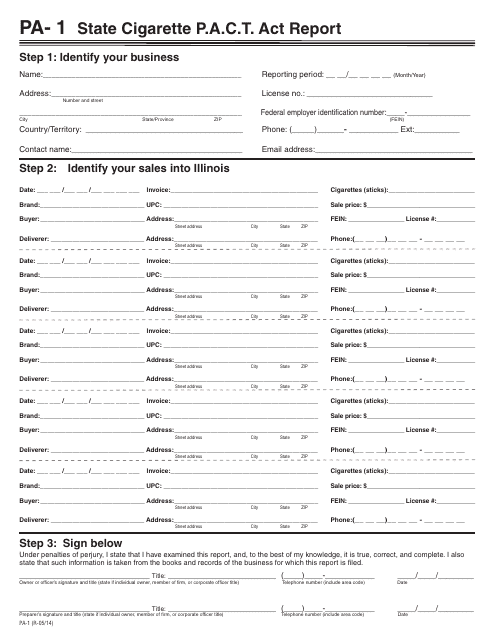

This form is used for reporting information related to the P.A.C.T. Act (Prevent All Cigarette Trafficking Act) for cigarette sales in the state of Illinois.

This form is used for reporting other deductions related to cigarettes and little cigars in the state of Illinois.