IRS 1099 Forms and Instructions

What Are IRS 1099 Forms?

The IRS Form 1099 series is a set of 20 forms called "information returns" that are filed with the Internal Revenue Service (IRS) . The forms are used for reporting various types of income received throughout the calendar year, other than tips, wages, or salaries paid by an employer.

What Are the Different IRS 1099 Forms Used for?

- IRS Form 1099-A, Acquisition or Abandonment of Secured Property. Use this form to provide information on the acquisition or abandonment of property that is security for a debt where you are the lender. There are no limits as regards to the amount.

- IRS Form 1099-B, Proceeds from Broker and Barter Exchange Transactions. This form is used to report sales or redemptions of securities, commodities, futures transactions, and barter exchange transactions in all amounts.

- IRS Form 1099-C, Cancellation of Debt. This form is filed by the lender and is used to report a $600 minimum in the cancellation of a debt owed to a financial institution, the federal government, a credit union, a military department, the U.S. Postal Service, or any organization having a significant money-lending trade or business. The IRS treats the debt cancellation as income, which may be taxable to the debtor.

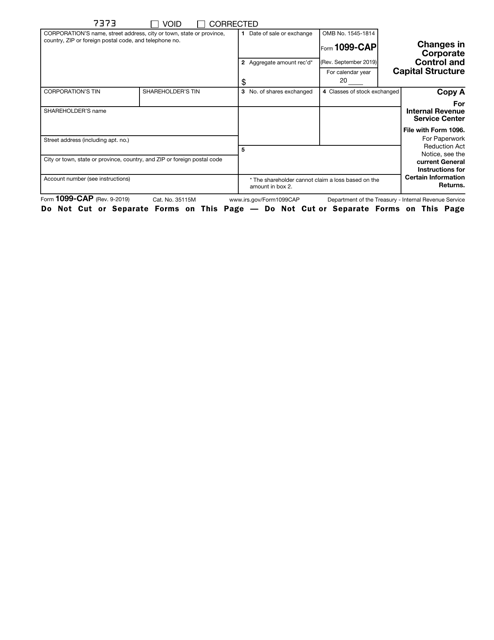

- IRS Form 1099-CAP, Changes in Corporate Control and Capital Structure. This form is filed by a corporation and is used to report information about cash, stock, or any other property obtained through the acquisition of control, or to declare a substantial change in the capital structure of a corporation. Only amounts over $1,000 are to be reported.

- IRS Form 1099-DIV, Dividends and Distributions. An investment fund company uses this form to report their distributions and dividends that were paid on stock and liquidation distributions during the year. These payments are different than the income earned by the company from selling stocks; it is a payment of the corporation’s earnings directly to shareholders. The minimum amount to be reported is $10, and $600 for liquidations.

- IRS Form 1099-G, Certain Government Payments. This form is filed by a government agency and is used to report at least $10 in compensations for unemployment, state and local income tax refunds, taxable grants, and agricultural payments made during the year.

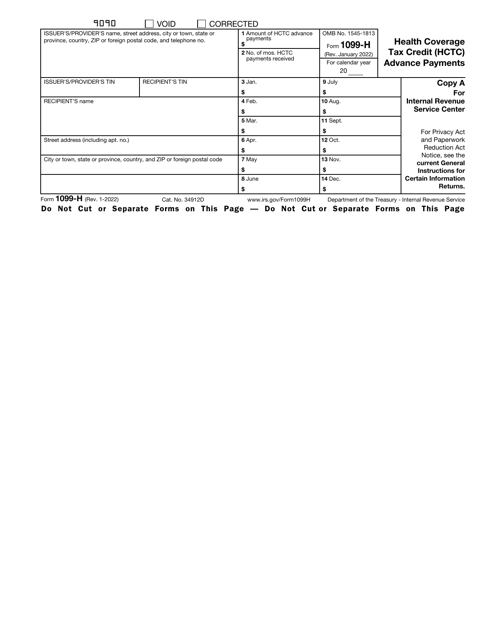

- IRS Form 1099-H, Health Coverage Tax Credit (HCTC) Advance Payments. This form is used to report health insurance premiums that were paid on behalf of certain individuals.

- IRS Form 1099-INT, Interest Income. This form is used to report interest payments. Taxpayers receive this form from the government, financial institutions, or banks where they have interest-bearing accounts. The minimum for paid amounts reported in Boxes 1, 3, and 8 is $10, and $600 is the minimum when reporting interest paid in the course of your trade or business in Box 1;

- IRS Form 1099-K, Payment Card and Third-Party Network Transactions. Banks and other payment processors use this form to report payment card transactions in any amount, and third-party network transactions of at least $20,000 and a minimum of 200 transactions.

- IRS Form 1099-LS, Reportable Life Insurance Sale. This form is used to report amounts paid in a reportable policy sale in any amount.

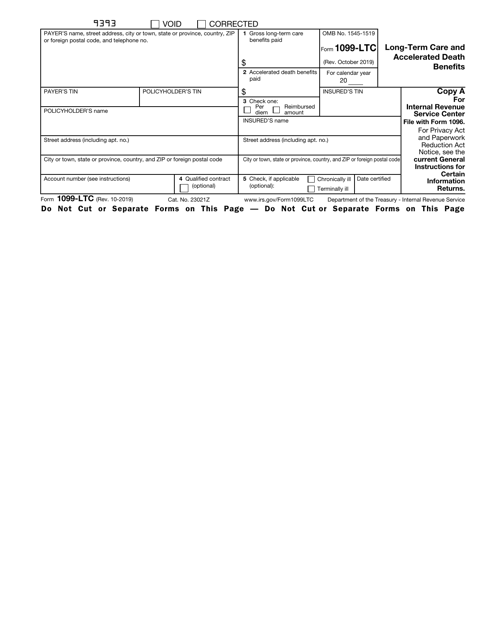

- IRS Form 1099-LTC, Long-Term Care and Accelerated Death Benefits. This form is used to report payments made in compliance with a long-term care insurance contract and accelerated death benefits paid in compliance with a life insurance contract or by a viatical settlement provider, in any amount.

- IRS Form 1099-MISC, Miscellaneous Income. This form is used to report payments of $10 or more in royalties or payments in lieu of dividends and tax-exempt interests reportable by brokers; to report payments of $600 or more for rents; services performed by independent contractors or self-employed individuals; crop insurance proceeds; cash payments for fish purchases from anyone engaged in the trade of catching fish; or fishing boat proceeds, among other payments. This form is also used to report direct sales of at least $5,000 of consumer goods for resale.

- IRS Form 1099-OID, Original Issue Discount. The issuer of the debt instrument or broker uses this form to report a minimum $10 original issue discount.

- IRS Form 1099-PATR, Taxable Distributions Received from Cooperatives. This form is used to report at least $10 in distributions from cooperatives.

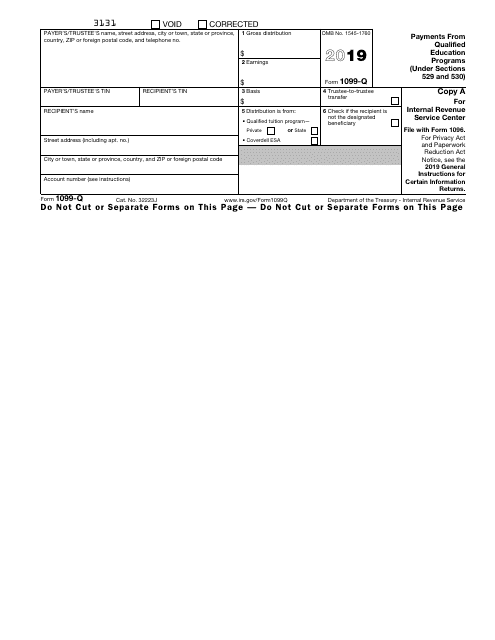

- IRS Form 1099-Q, Payments from Qualified Education Programs. This form is used to report earnings from qualified tuition programs and Coverdell Education Savings Accounts.

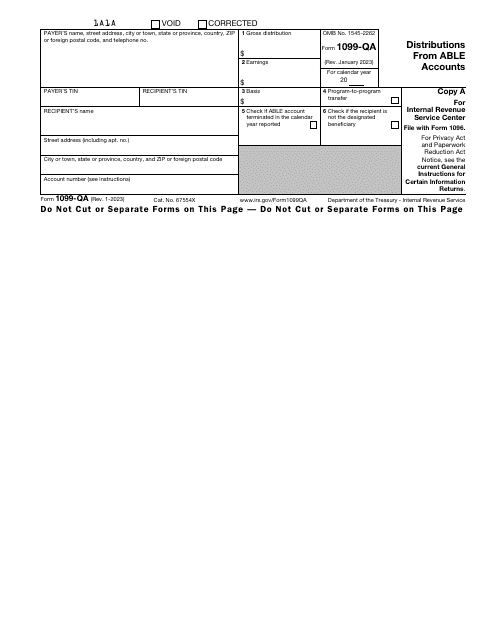

- IRS Form 1099-QA, Distributions from ABLE Accounts. This form is used to report distributions from Achieving a Better Life Experience (ABLE) accounts, in any amount.

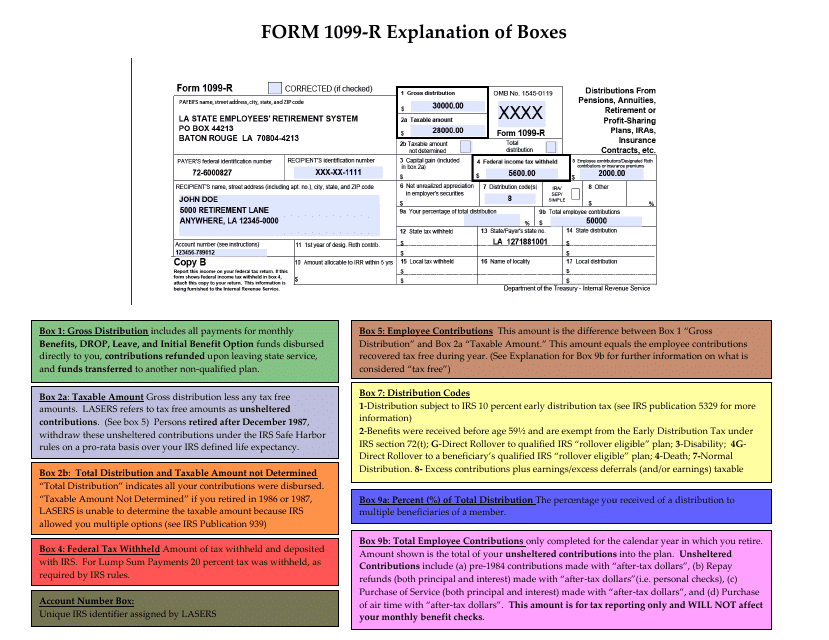

- IRS Form 1099-R, Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. This form is used to report the distributions obtained from retirement or profit-sharing plans, any Individual Retirement Arrangement (IRA), insurance contract, and IRA recharacterization, in the amount of at least $10.

- IRS Form 1099-S, Proceeds From Real Estate Transactions. This form is used to report at least $600 in gross proceeds from sales or exchanges of real estate and certain royalty payments.

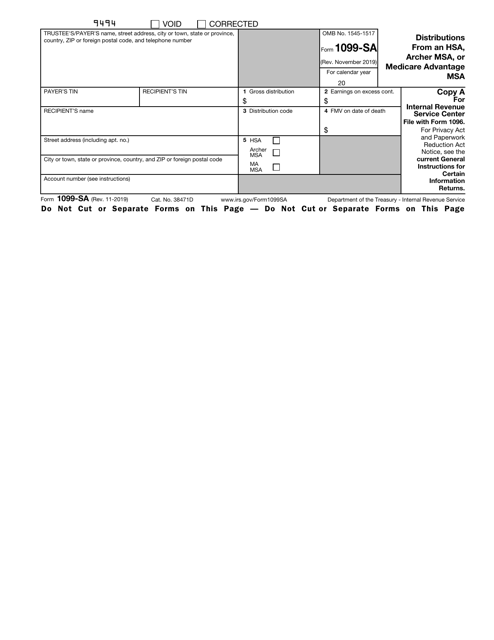

- IRS Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA. This form is used to report any amount of distributions from a Health Savings Account or an Archer or Medicare Advantage Medical Savings Account.

- IRS Form 1099-SB, Seller’s Investment in Life Insurance Contract. The issuer of a life insurance contract uses this to report the seller’s investment in the contract, in any amount.

Related Articles

Documents:

62

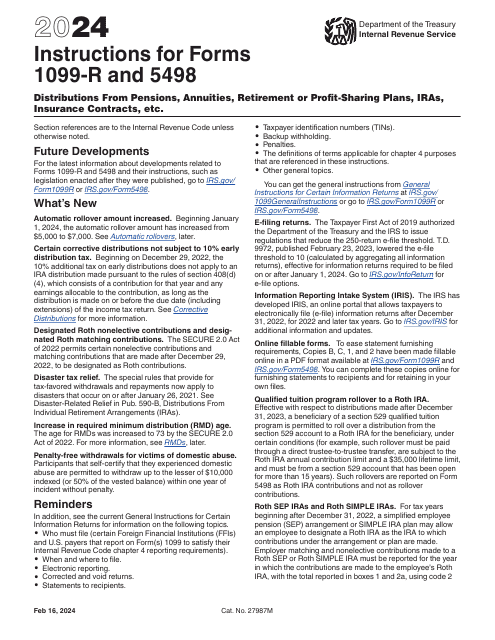

This document provides instructions for IRS Form 1099-R, which is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and other types of retirement accounts. The document explains the different boxes on the form and how to fill them out accurately.

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

This is a fiscal form used by taxpayers that need to inform the tax organs about the financial profit they generated through transactions with real estate.

This is a formal IRS document that outlines the details of a property foreclosure.

This is a formal IRS document used by entities that charge their customers a commission or fee for handling buy and sell orders to report how much capital gain or loss every client has got.

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

This is an IRS document released for those individuals who got payments during the calendar year of qualified health insurance payments for the benefit of eligible trade adjustment assistance.

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.

This is a fiscal document completed by financial entities to specify the amount of supplementary income investors have generated during the year.

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

This is a fiscal IRS form filled out by the cooperative that paid patronage dividends during the tax year.

This is a formal IRS document completed to outline the discount received on particular debt instruments.

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.