Fill and Sign Texas Legal Forms

Documents:

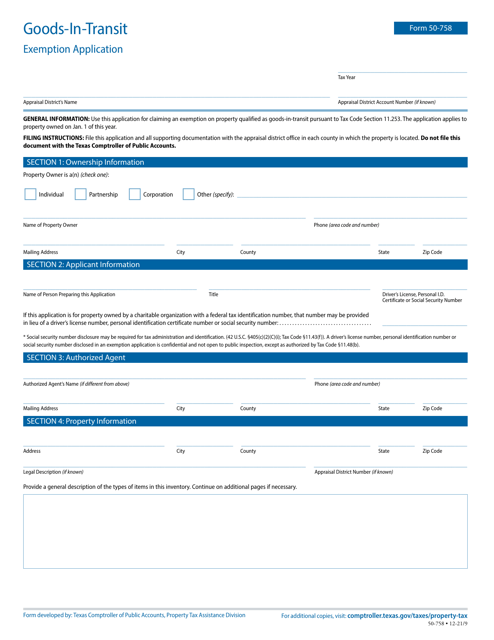

10817

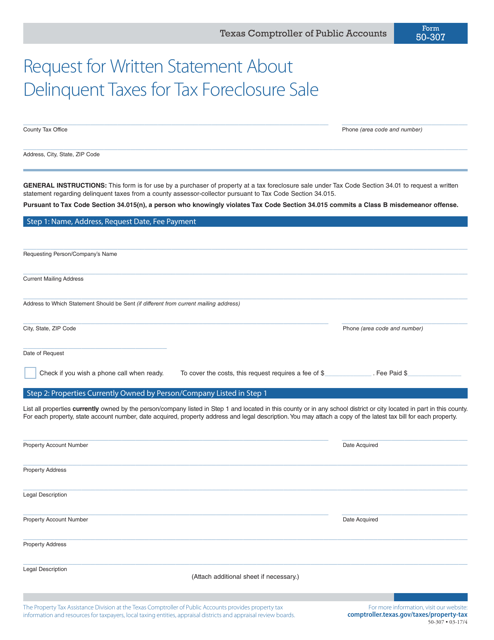

This form is used for requesting a written statement about delinquent taxes for a tax foreclosure sale in Texas.

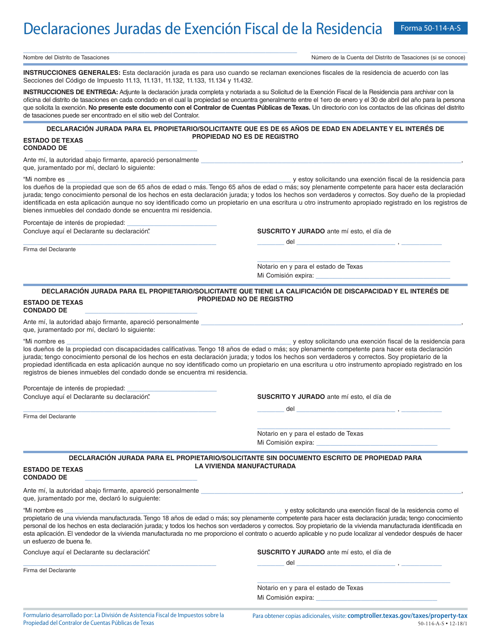

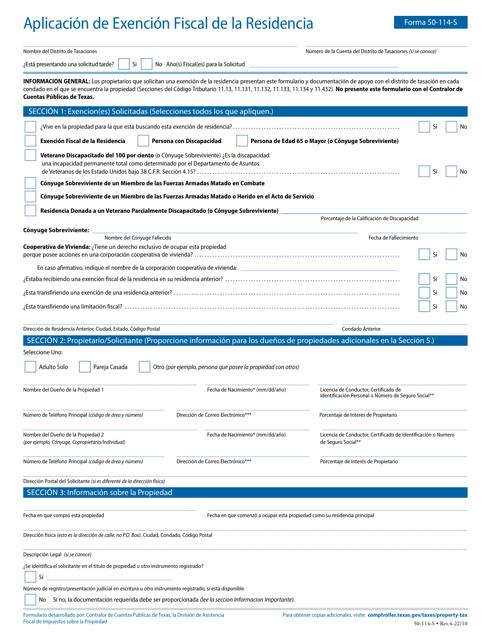

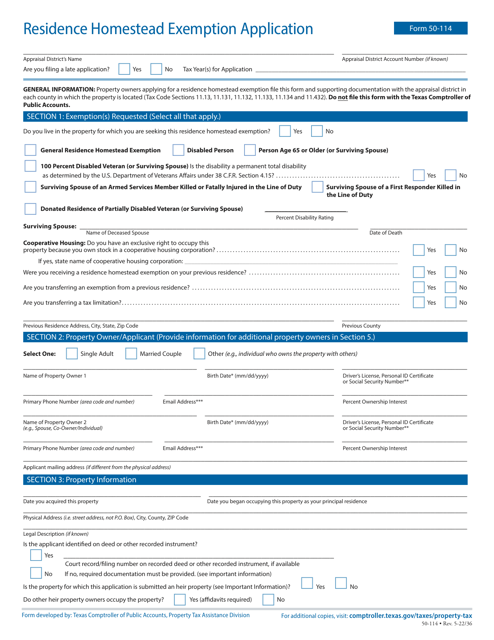

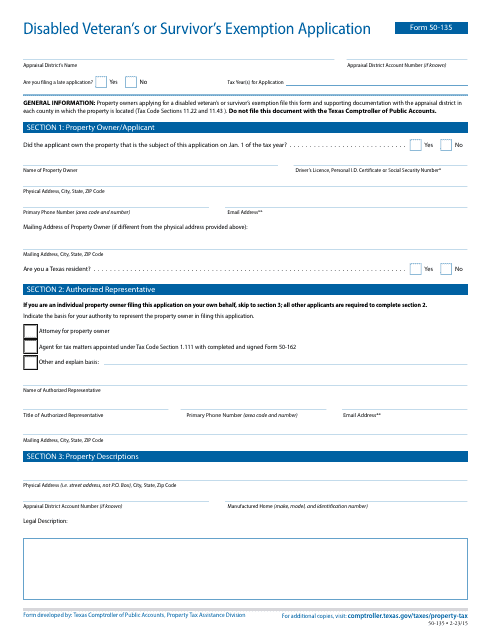

This Form is used for declaring tax exemption for residence in Texas.

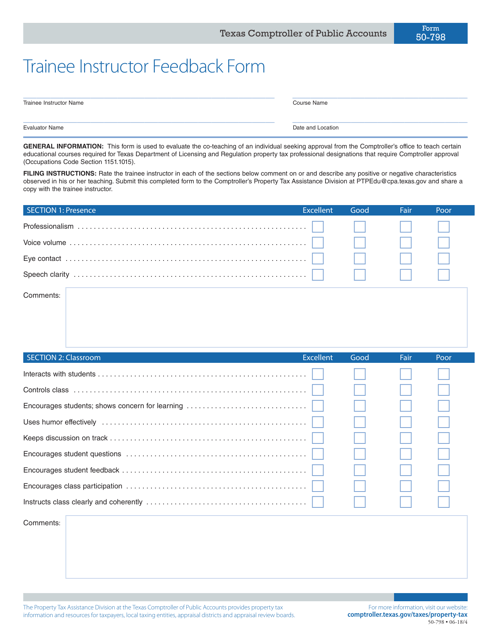

This form is used for gathering feedback from trainees regarding their instructors in Texas.

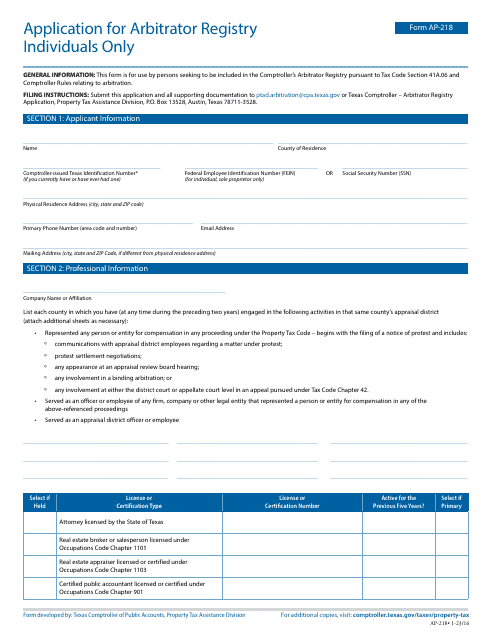

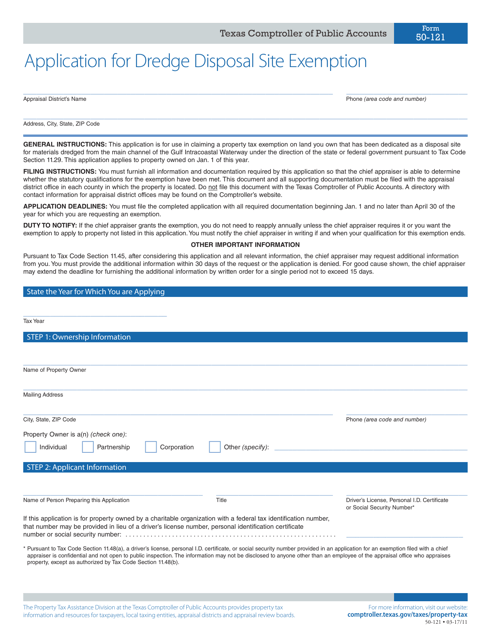

This form is used for applying for an exemption for a dredge disposal site in the state of Texas.

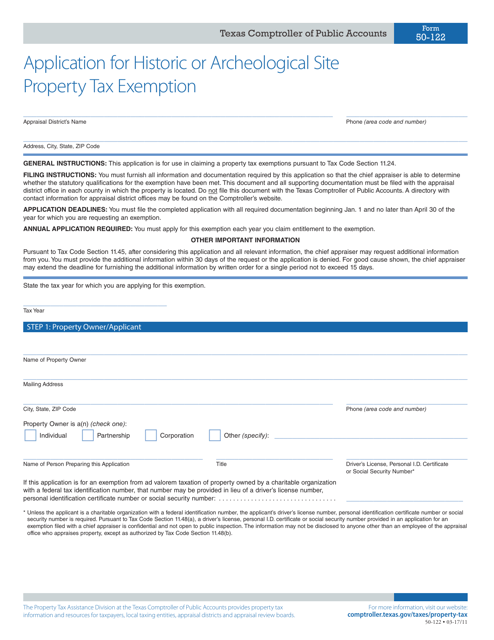

This Form is used for applying for a property tax exemption for historic or archaeological sites in Texas.

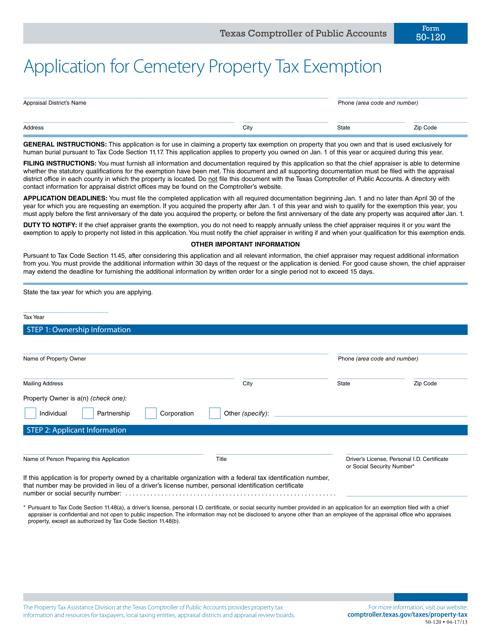

This form is used for applying for a property tax exemption for cemetery property in Texas.

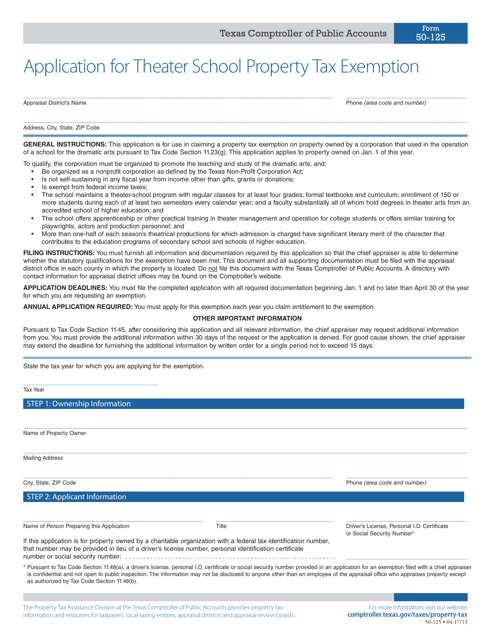

This document is used for applying for a property tax exemption for theater schools in Texas.

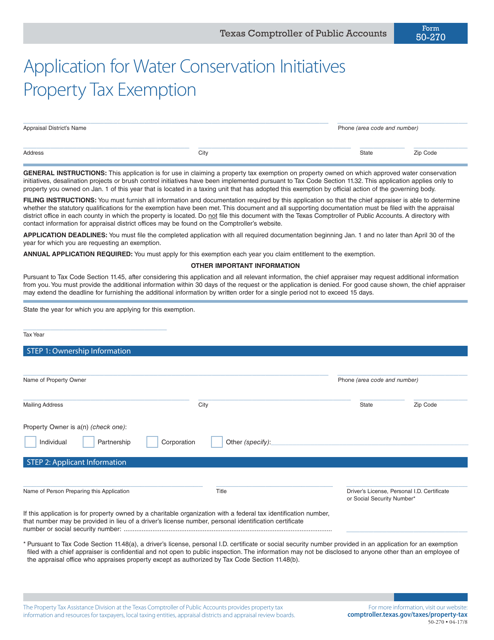

This form is used for applying for a property tax exemption in Texas for water conservation initiatives.

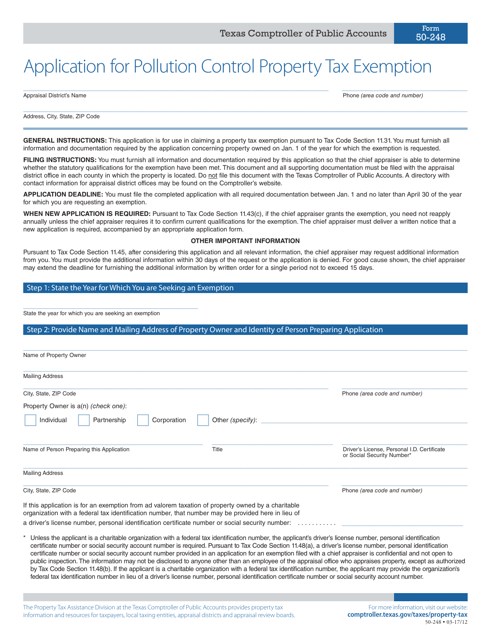

This form is used for applying for a tax exemption on pollution control property in the state of Texas.

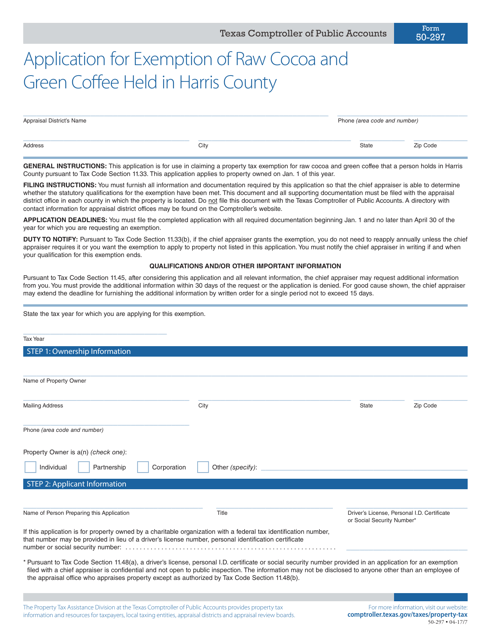

This form is used for applying for an exemption for raw cocoa and green coffee held in Harris County, Texas from certain taxes or regulations.

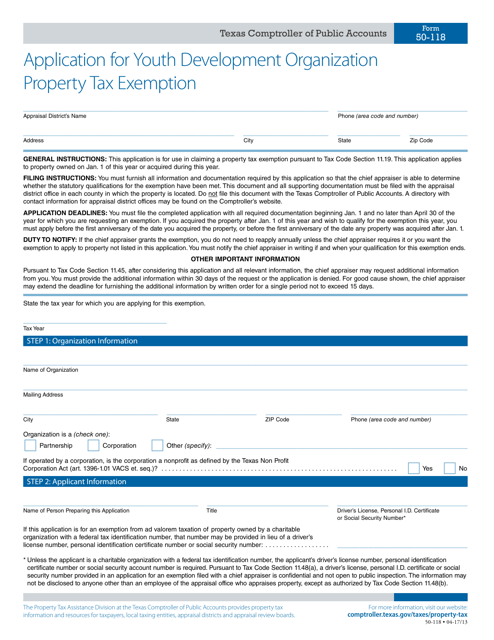

This form is used for applying for a property tax exemption for a youth development organization in Texas.

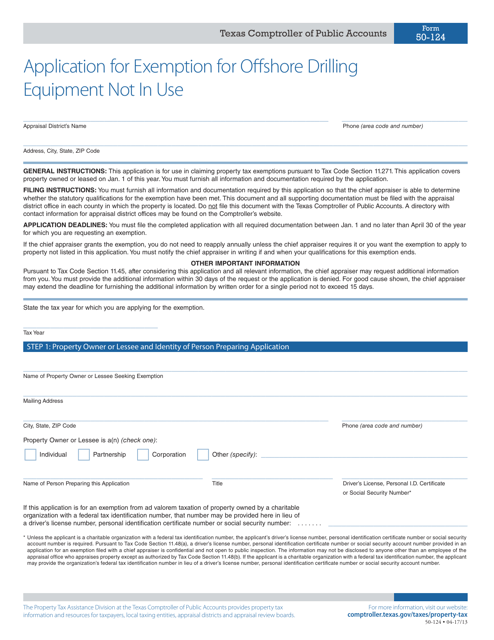

This form is used for applying for an exemption for offshore drilling equipment that is not in use in the state of Texas.

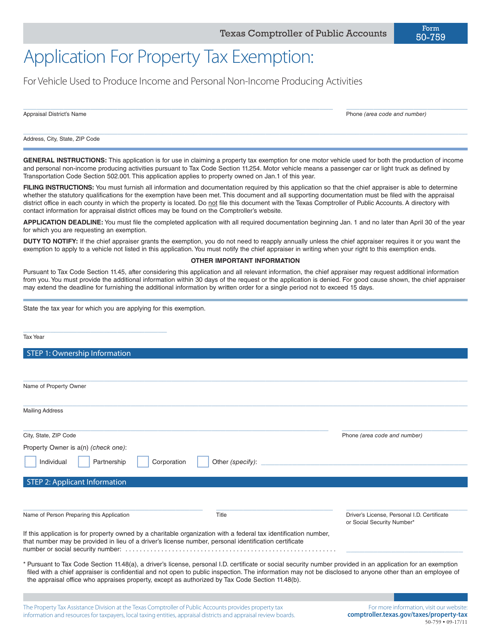

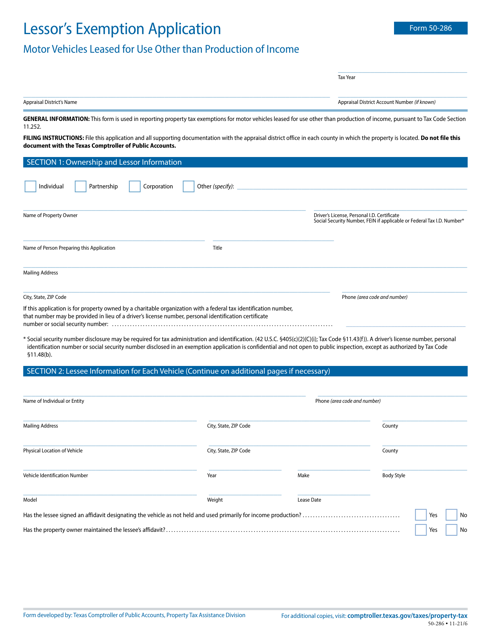

This form is used for applying for a property tax exemption in Texas for vehicles that are used to generate income and for personal activities that do not generate income.

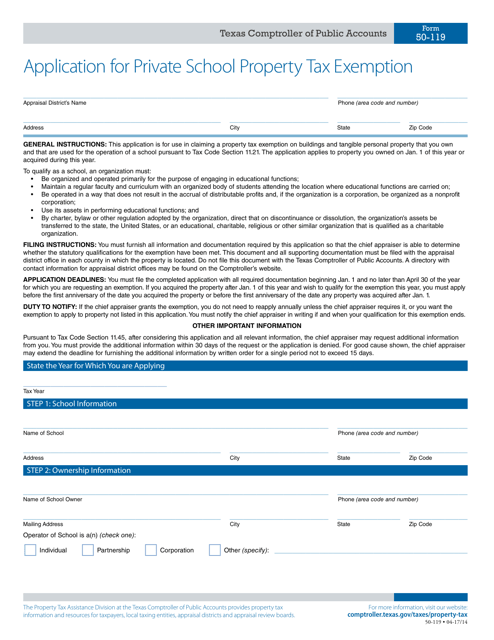

This form is used for applying for a property tax exemption for private schools in Texas.

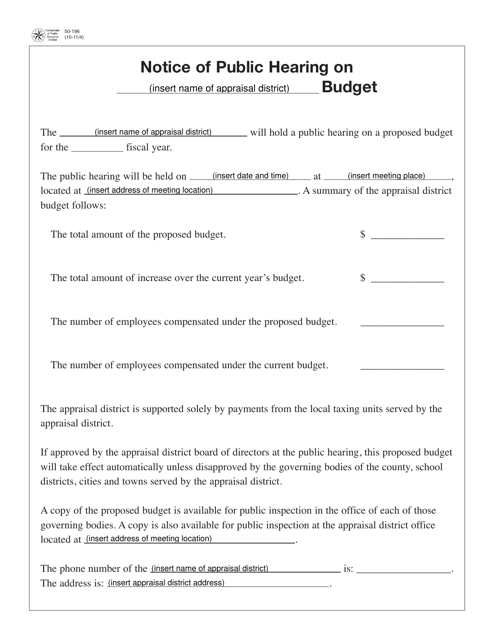

This form is used for notifying the public about a hearing regarding the budget of an appraisal district in Texas.

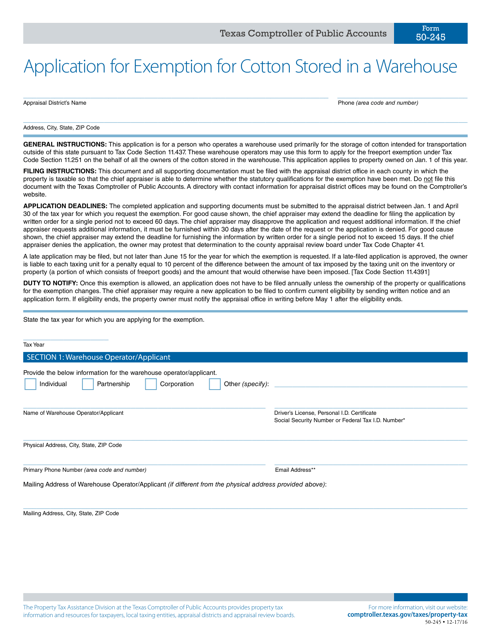

This form is used for applying for an exemption for cotton stored in a warehouse in Texas.

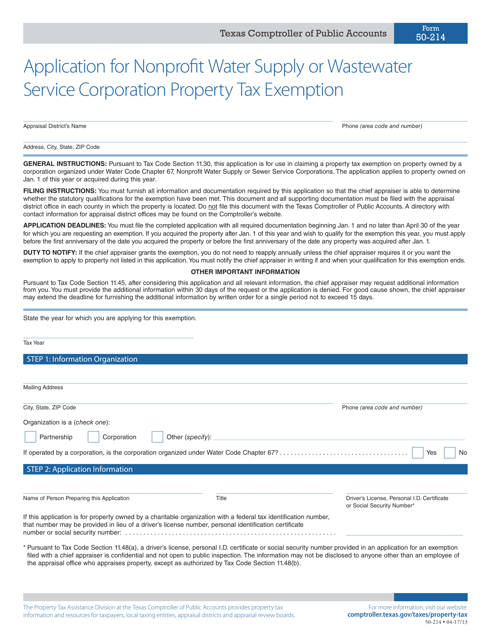

This Form is used for applying for a property tax exemption for nonprofit water supply or wastewater service corporations in Texas.

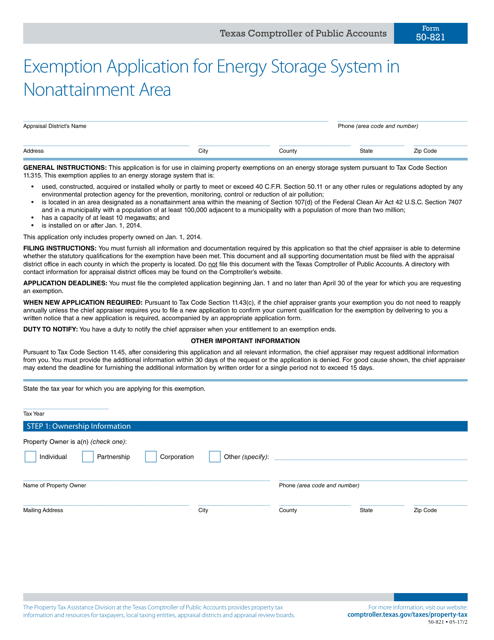

This form is used for applying for an exemption for an energy storage system in a nonattainment area in Texas.

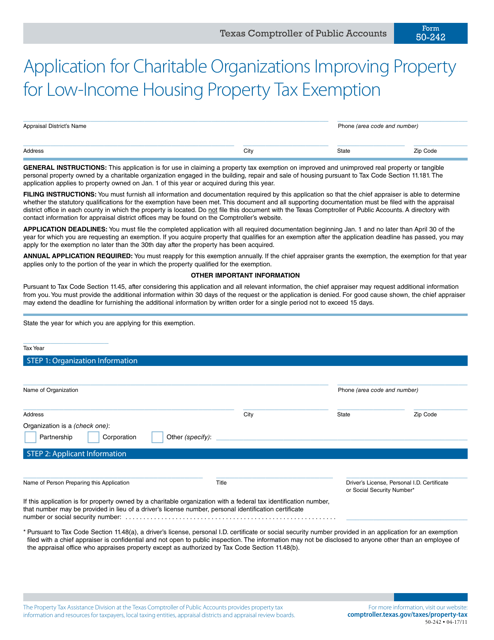

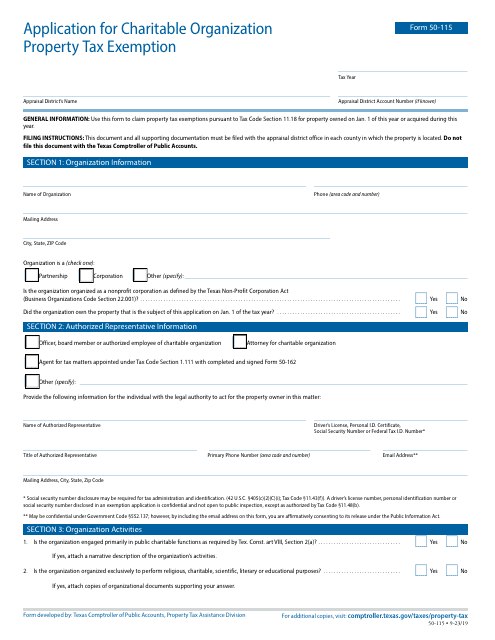

This Form is used for applying for a property tax exemption in Texas for charitable organizations that improve property for low-income housing.

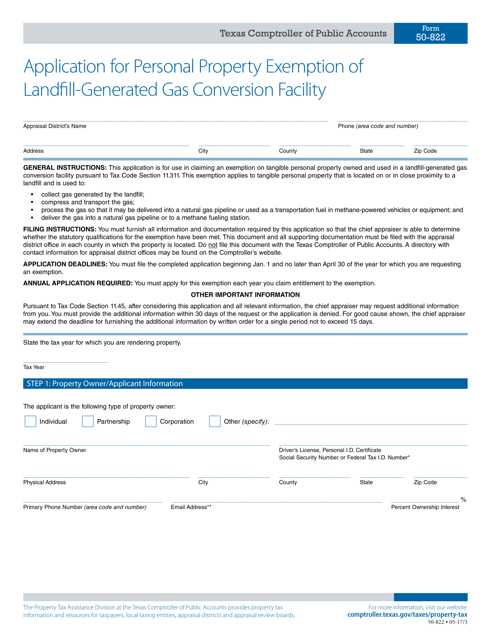

This form is used for applying for a personal property exemption for a landfill-generated gas conversion facility in Texas.

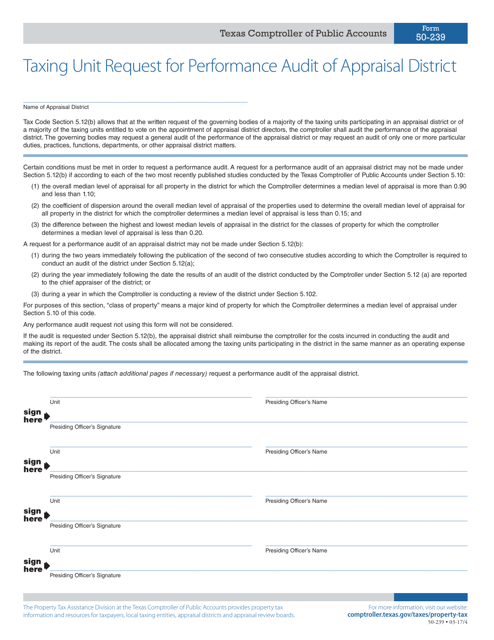

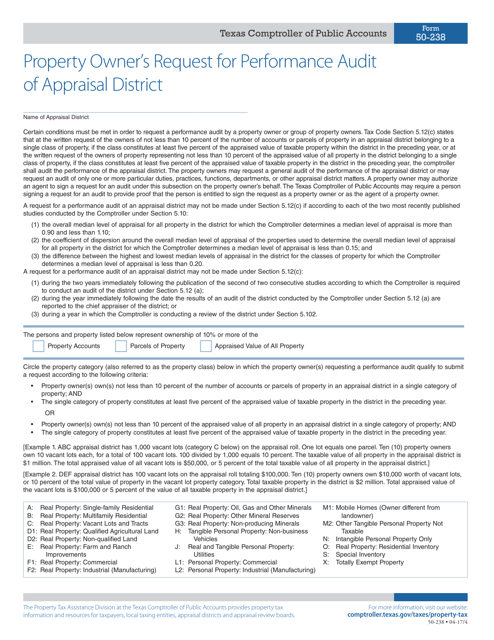

This form is used for requesting a performance audit of an appraisal district in Texas. It allows taxing units to submit a formal request to assess the efficiency and effectiveness of the appraisal district's operations.

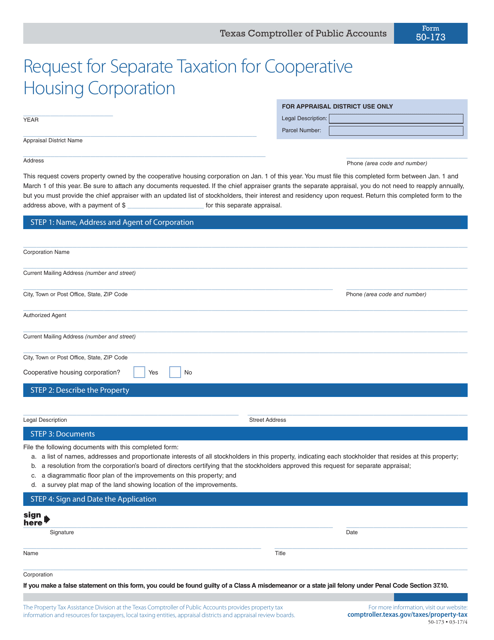

This form is used for requesting separate taxation for a cooperative housing corporation in Texas.

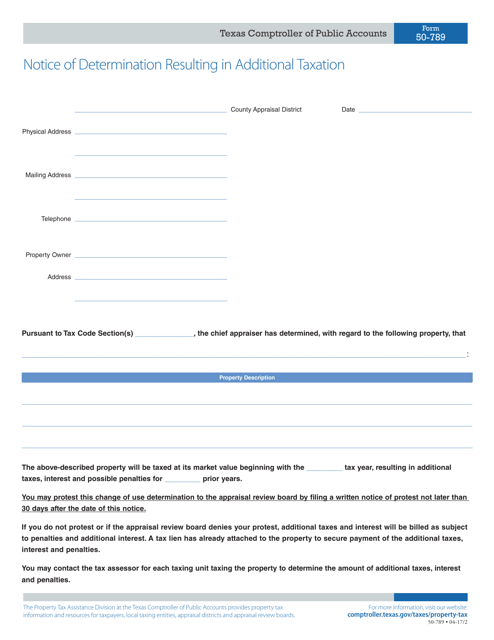

This form is used for notifying taxpayers in Texas of a determination resulting in additional taxation.

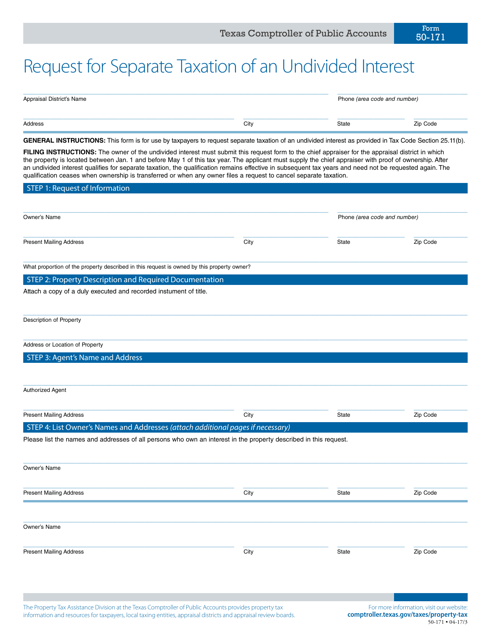

This form is used for requesting separate taxation of an undivided interest in Texas. It allows individuals to specify their share of property for tax purposes.

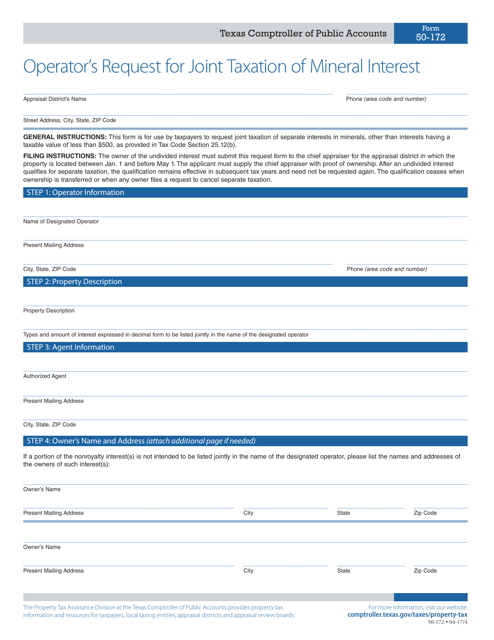

This Form is used for operators in Texas to request joint taxation of mineral interests for tax purposes.

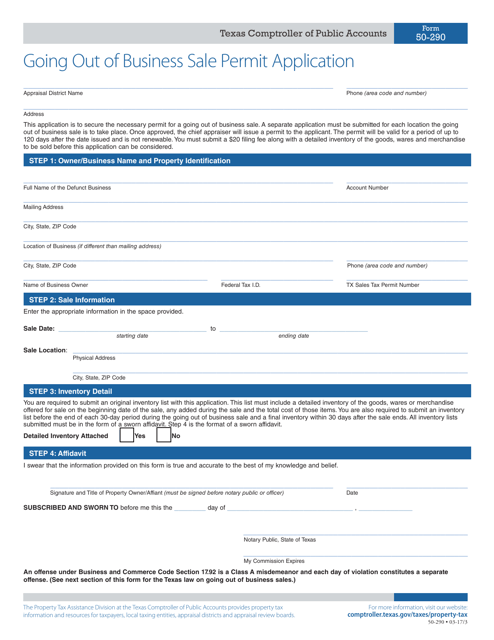

This type of document is used for applying for a permit to hold a going out of business sale in Texas.

This form is used for property owners in Texas to request a performance audit of their local appraisal district. The audit ensures that the appraisal district is accurately valuing their property for tax purposes.

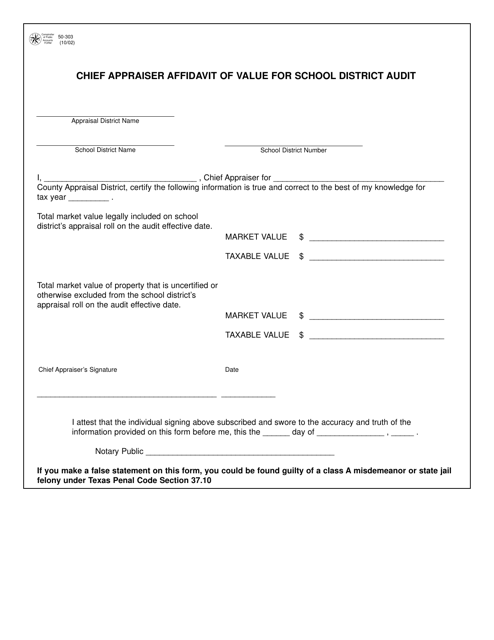

This Form is used for Chief Appraisers in Texas to provide an Affidavit of Value for School District Audits.

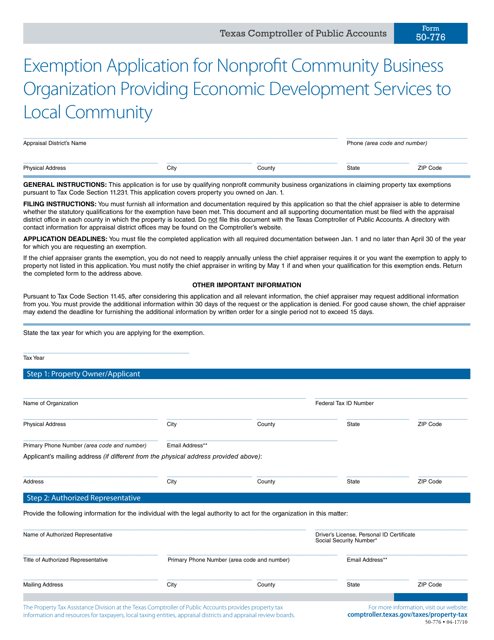

This document is used for applying for a tax exemption for a nonprofit organization that provides economic development services to the local community in Texas.

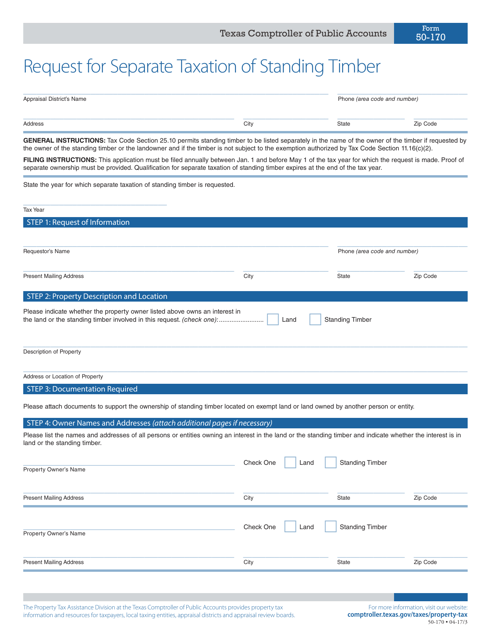

This form is used for requesting separate taxation of standing timber in Texas.