Fill and Sign Texas Legal Forms

Documents:

10817

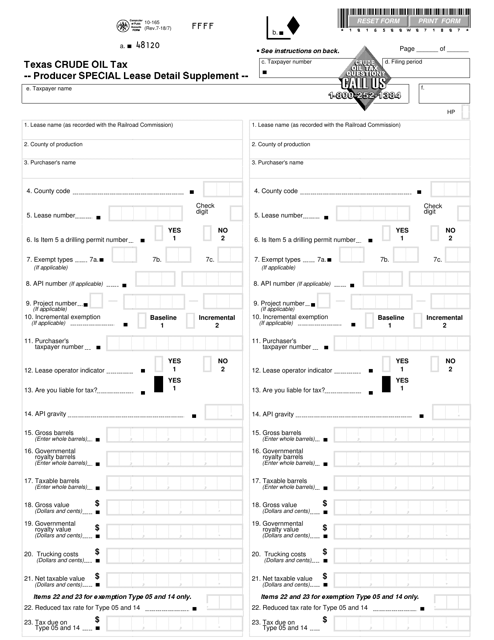

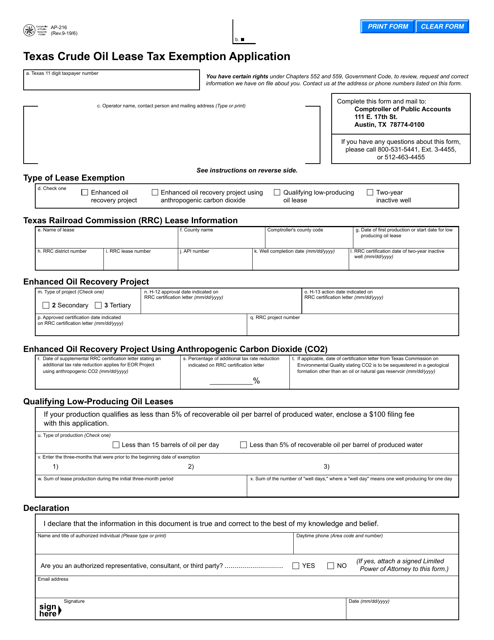

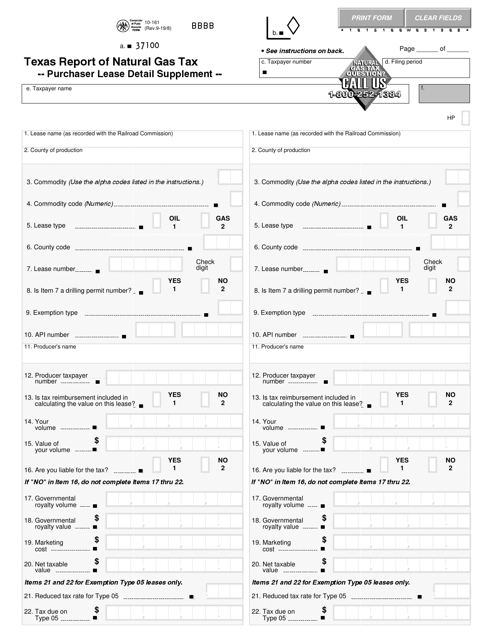

This Form is used for providing additional details about special lease agreements and taxes related to crude oil production in Texas.

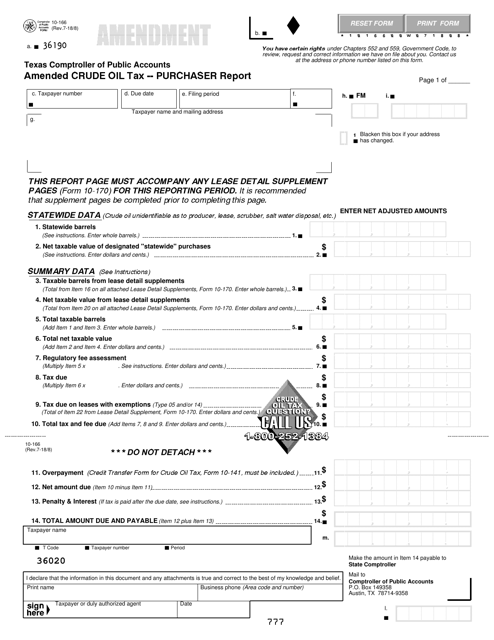

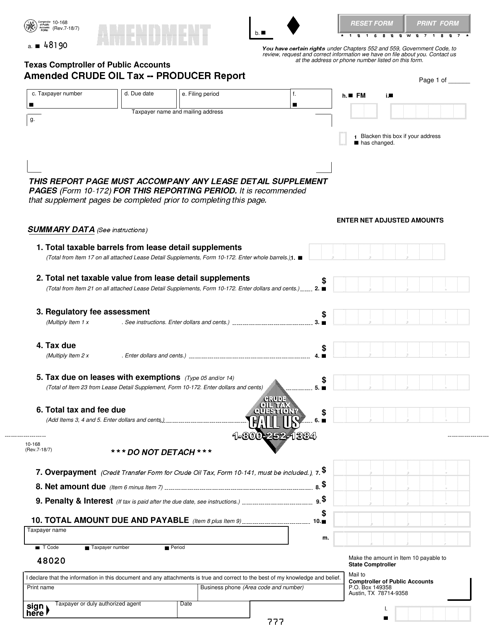

This form is used for reporting amended crude oil tax purchases in Texas.

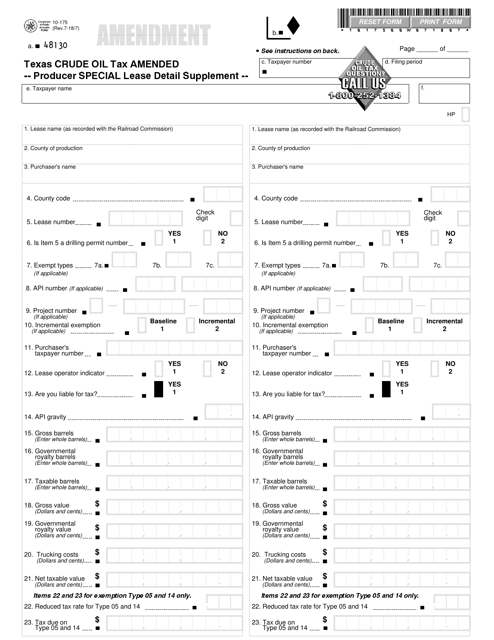

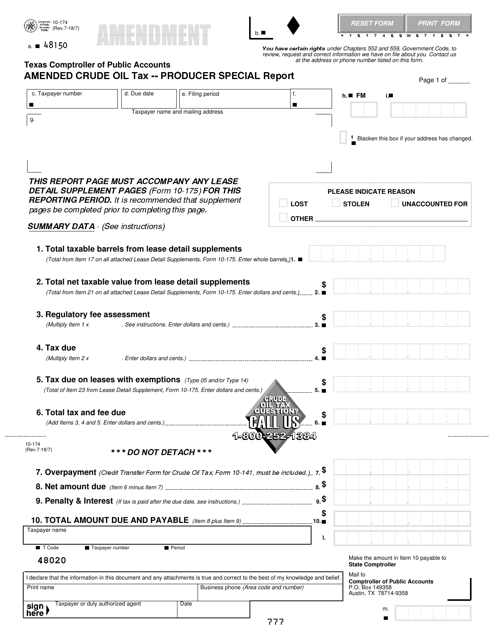

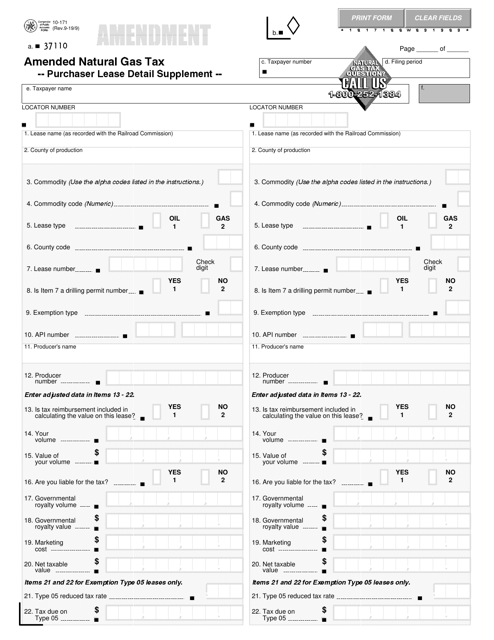

This Form is used for providing additional information regarding special lease details for amending Texas crude oil tax for producers.

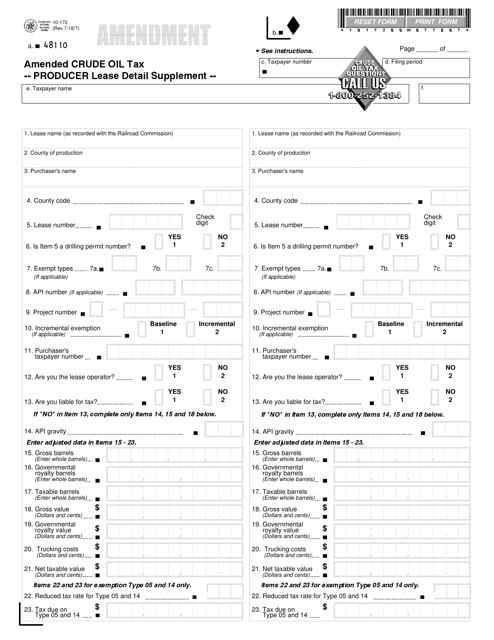

This form is used for providing additional details about the producer lease related to crude oil tax in Texas.

This type of document is used by crude oil producers in Texas to report amended tax information for crude oil production.

This Form is used for reporting amendments to the Crude Oil Tax Producer Special Report in Texas.

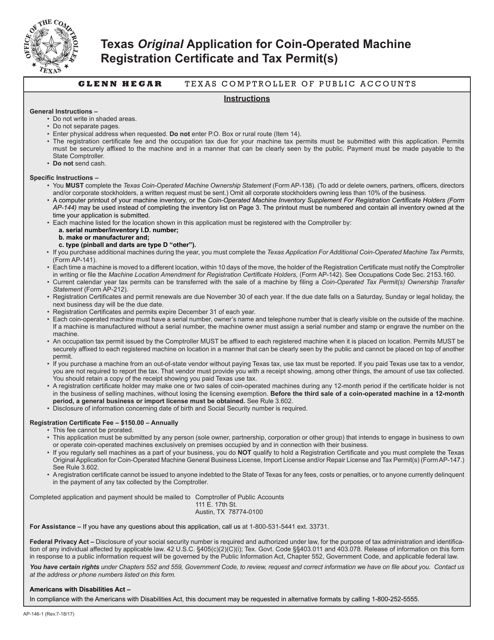

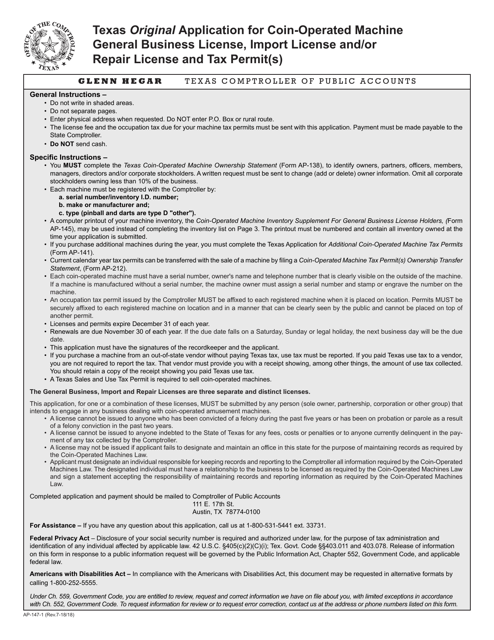

This form is used for applying for a registration certificate and tax permit for coin-operated machines in Texas. It is required for individuals or businesses operating these types of machines within the state.

This form is used for applying for various licenses and tax permits related to coin-operated machines in Texas.

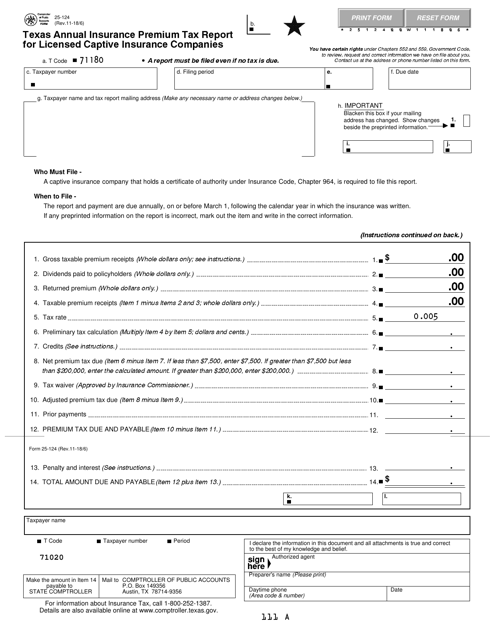

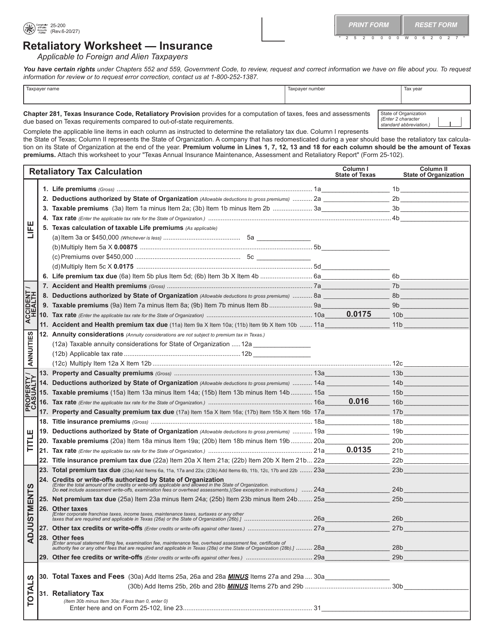

This Form is used for filing the annual insurance premium tax report for licensed captive insurance companies in Texas.

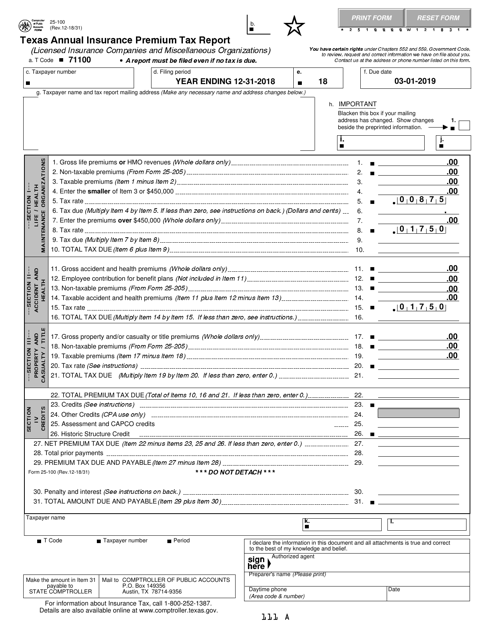

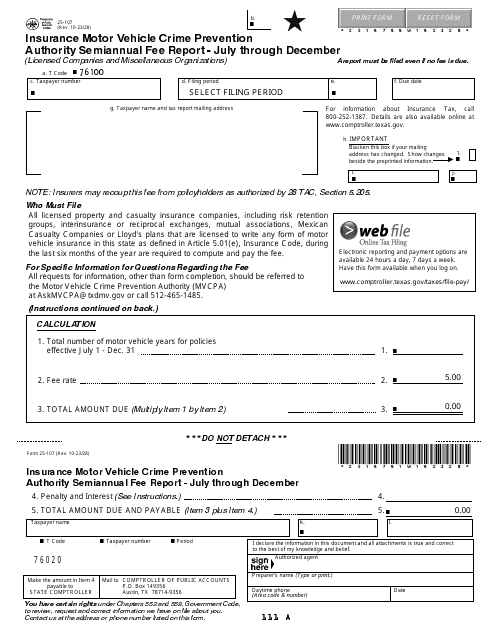

This form is used for reporting the annual insurance premium tax for licensed insurance companies and miscellaneous organizations in Texas.

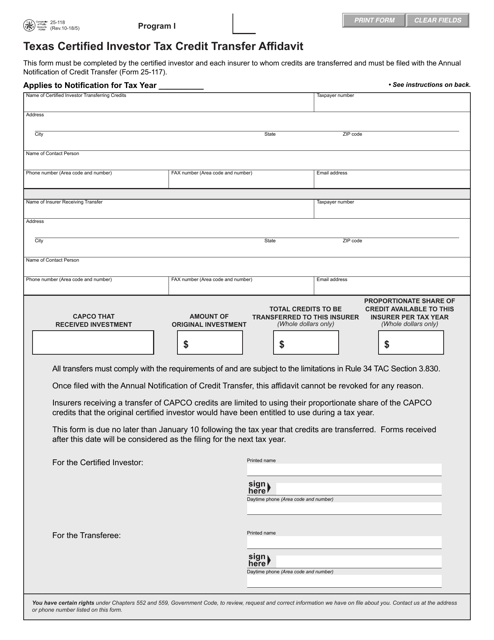

This document is used for transferring tax credits to certified investors in Texas under Program I. The Form 25-118 is a certified investor tax credit transfer affidavit specifically designed for this purpose.

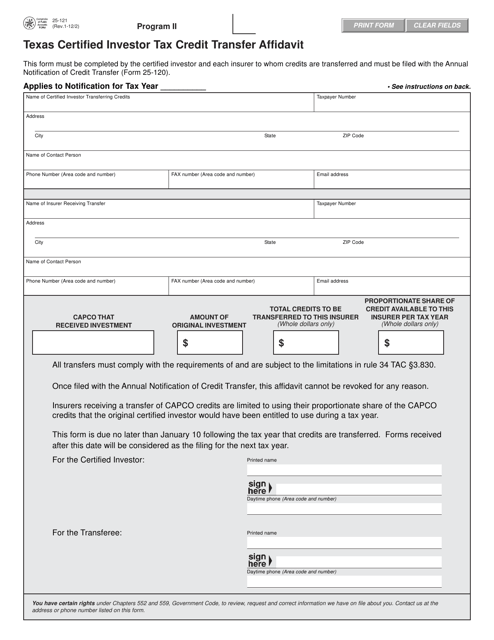

This document is used for transferring tax credits in Texas for certified investors participating in Program II.

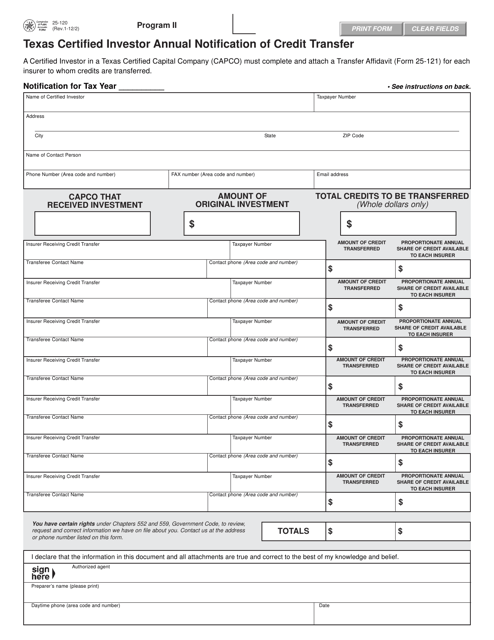

This form is used for Texas certified investors to annually notify of credit transfers in Program II in Texas.

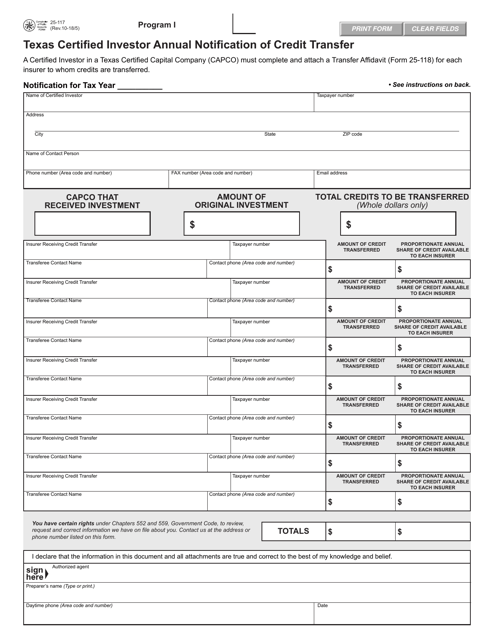

This form is used for Texas certified investors to annually notify the Texas Credit Transfer Program I.

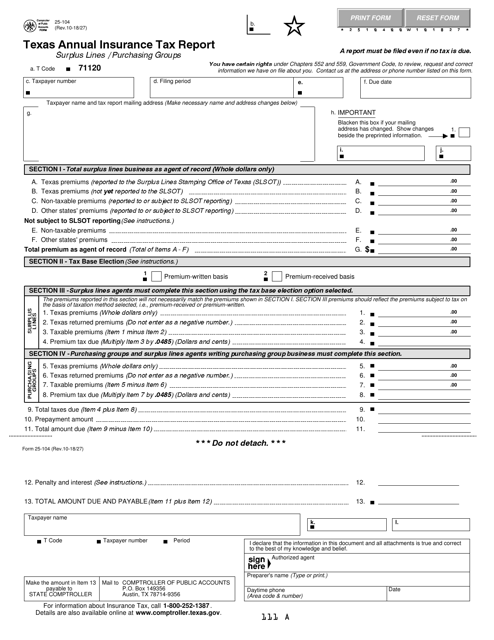

This form is used for reporting annual insurance taxes for surplus lines and purchasing groups in the state of Texas.

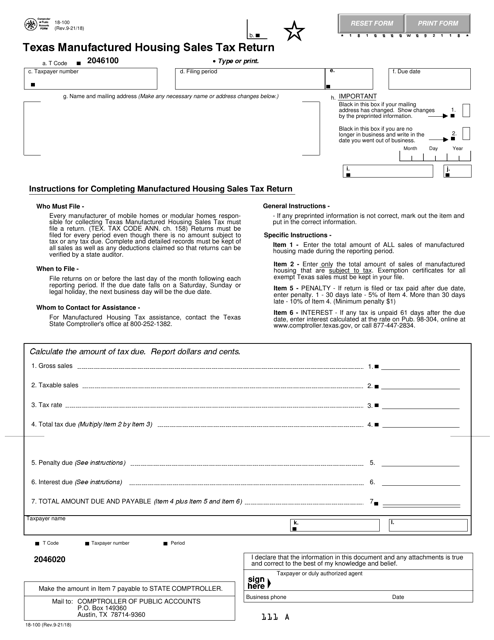

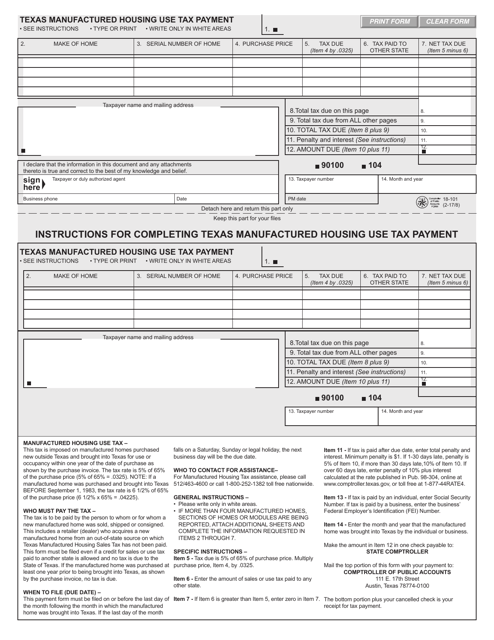

This form is used for making tax payments related to manufactured housing in the state of Texas.

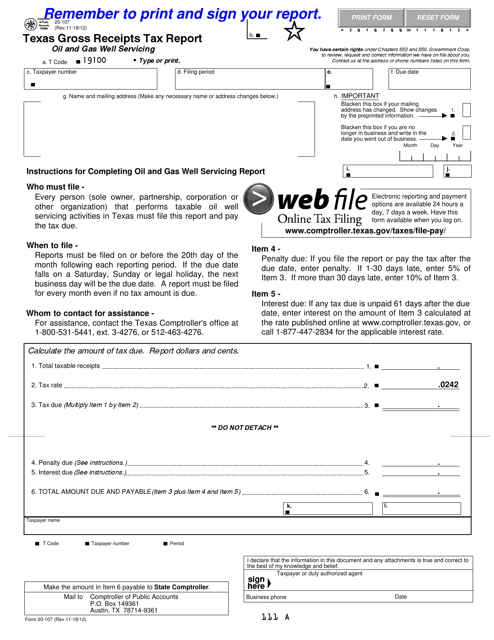

This form is used for reporting the gross receipts tax specifically for oil and gas well servicing businesses in the state of Texas. It helps businesses accurately calculate and report their tax liability to the Texas Comptroller's Office.

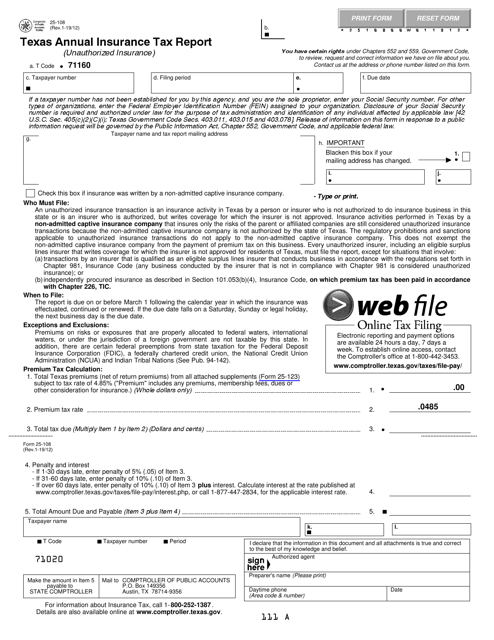

This form is used for filing an annual insurance tax report for unauthorized insurance companies in the state of Texas.

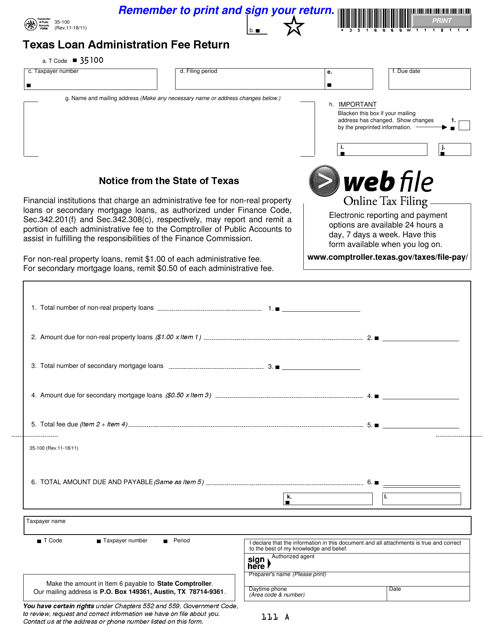

This form is used for submitting the Texas Loan Administration Fee Return in Texas. It is required to report and pay the loan administration fee.

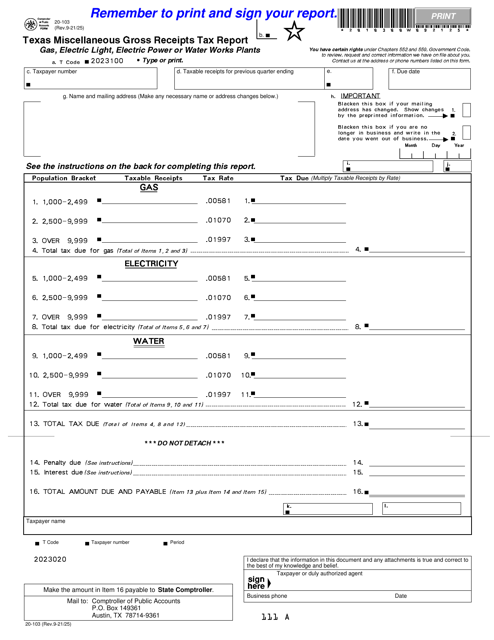

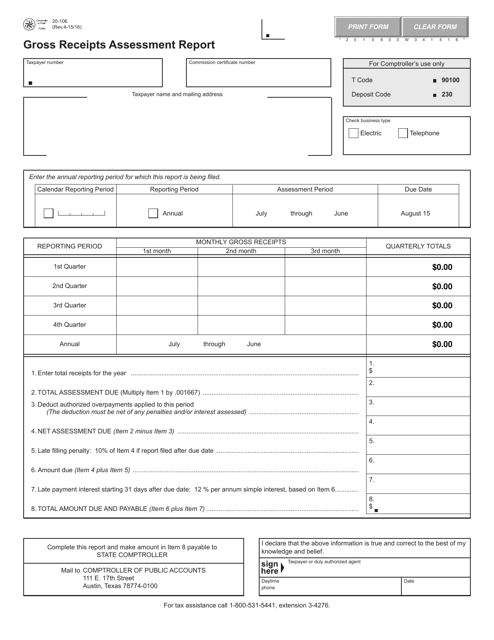

This form is used for reporting and assessing gross receipts in the state of Texas. It helps businesses comply with tax regulations by providing information on their income from sales or services.

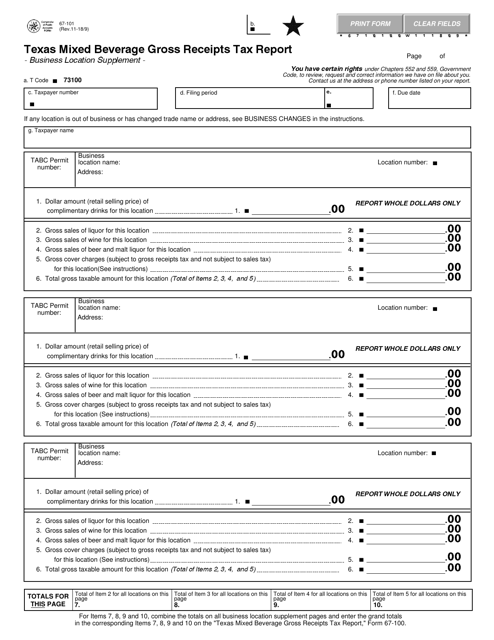

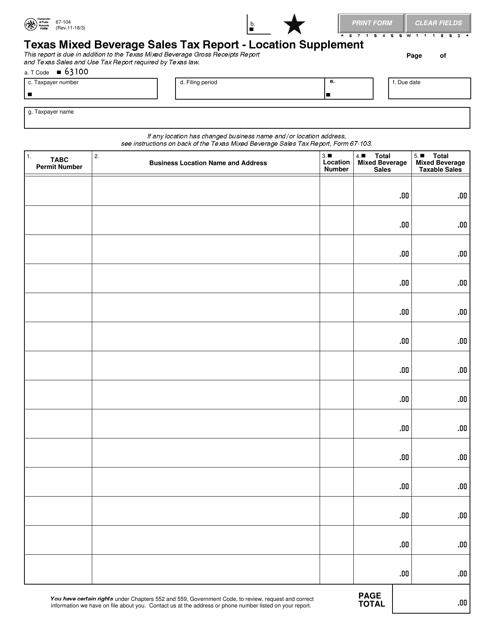

This form is used to report the gross receipts tax for businesses in Texas that sell mixed beverages. It is a supplement form that provides additional information about the business location.

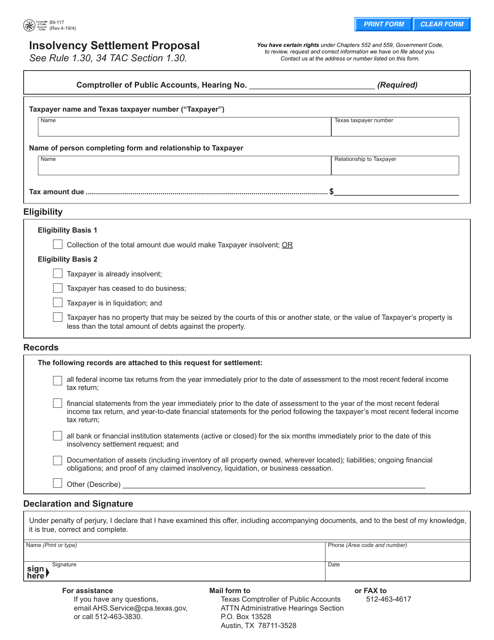

This Form is used for submitting an Insolvency Settlement Proposal in the state of Texas.

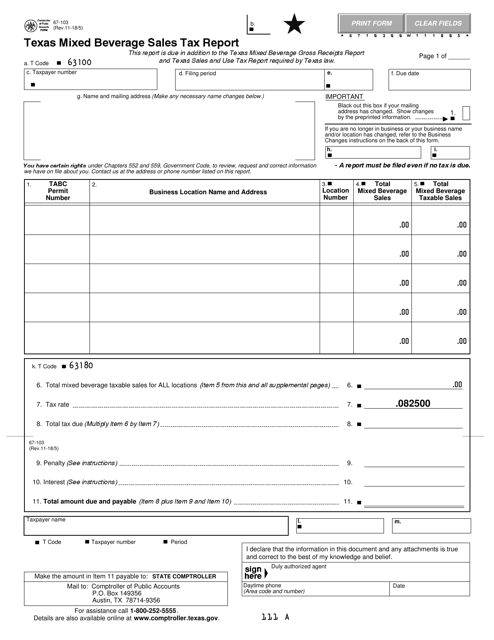

This Form is used for reporting mixed beverage sales tax in Texas and includes supplemental information about the location.

This form is used for reporting sales tax on mixed beverages in Texas. It is required by the Texas Comptroller's Office for businesses that sell mixed alcoholic drinks.

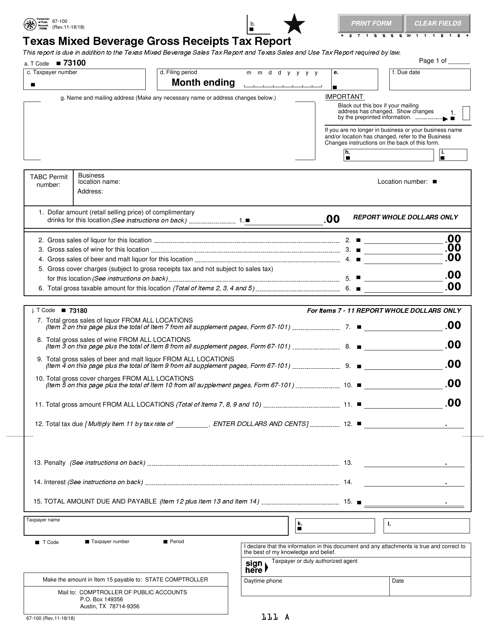

This form is used for reporting the gross receipts tax on mixed beverages in the state of Texas. It is required for businesses that sell mixed drinks.

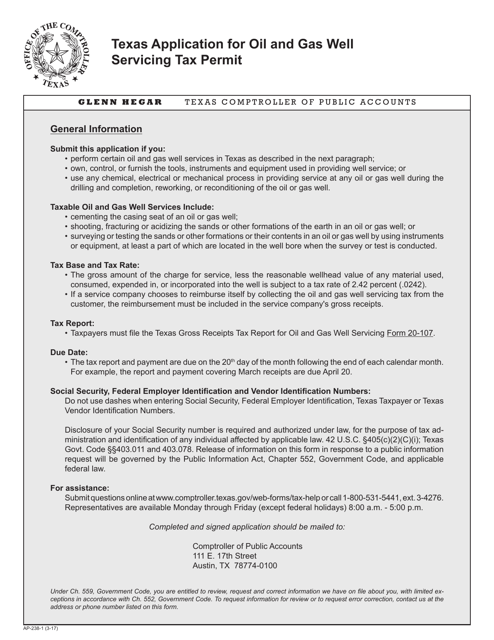

This form is used for applying for an oil and gas well servicing tax permit in the state of Texas.

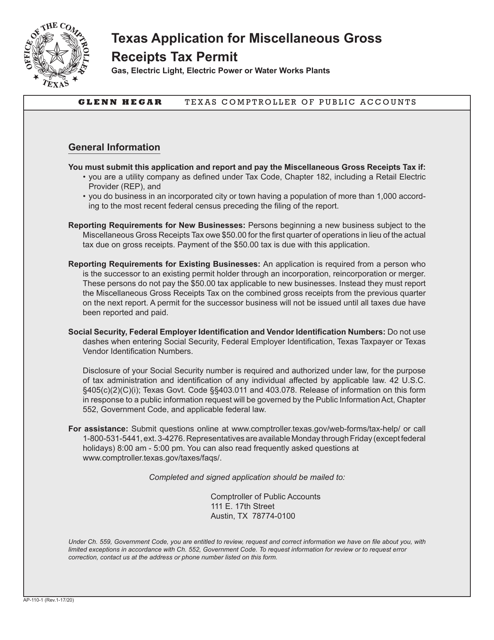

This form is used for applying for a miscellaneous gross receipts tax permit for gas, electric light, electric power, or water works plants in Texas.

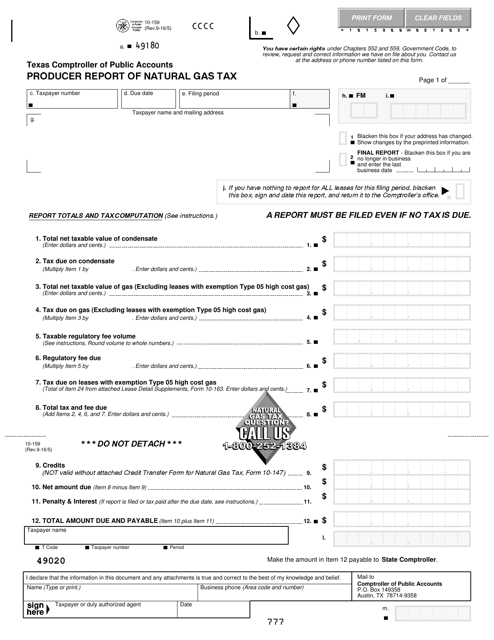

This Form is used for reporting natural gas tax by producers in the state of Texas.