Fill and Sign Texas Legal Forms

Documents:

10817

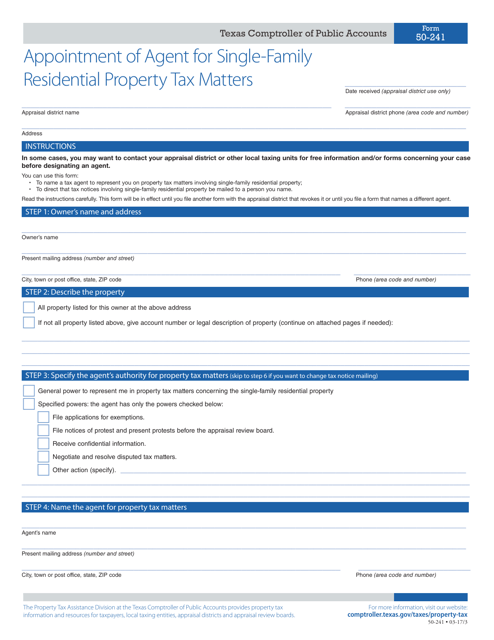

This form is used for appointing an agent to handle property tax matters for single-family residential properties in Texas.

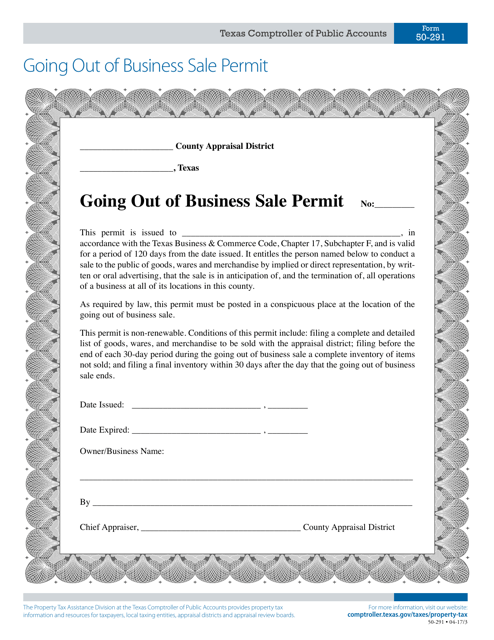

This Form is used for obtaining a Going out of Business Sale Permit in the state of Texas. It allows businesses to legally hold a sale when they are closing or going out of business.

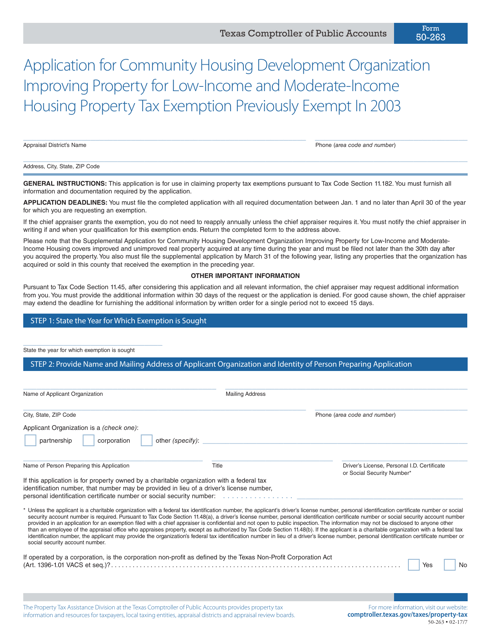

This form is used for applying for a property tax exemption for a Community Housing Development Organization (CHDO) that is improving property for low-income and moderate-income housing in Texas.

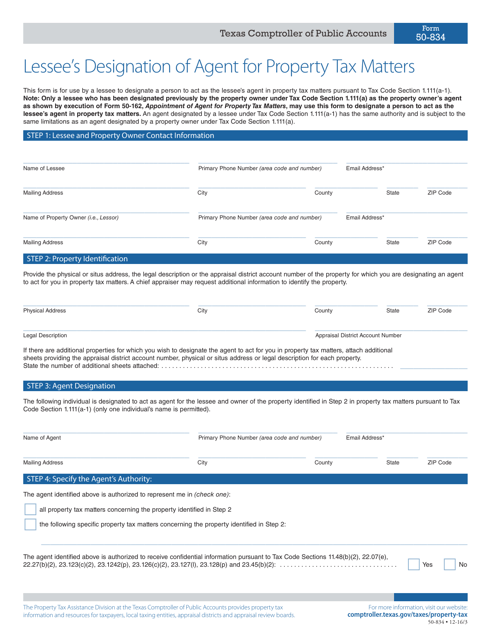

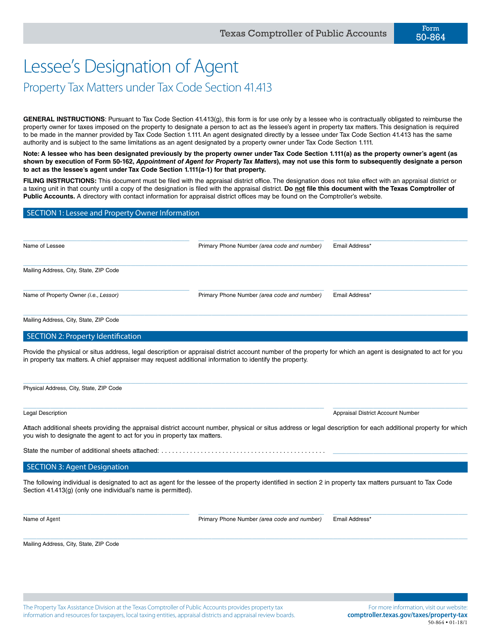

This form is used for a lessee in Texas to designate an agent to handle property tax matters on their behalf.

This form is used for a lessee to designate an agent for property tax matters under Tax Code Section 41.413 in the state of Texas.

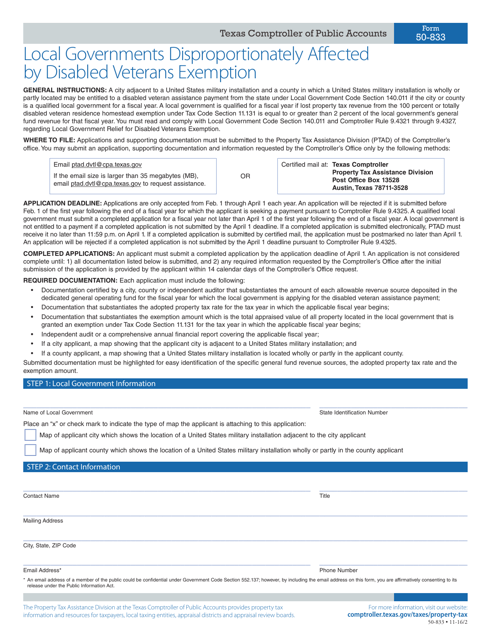

This Form is used for local governments in Texas to report and apply for the Disabled Veterans Exemption. It helps determine the impact of this exemption on local budgets and revenue.

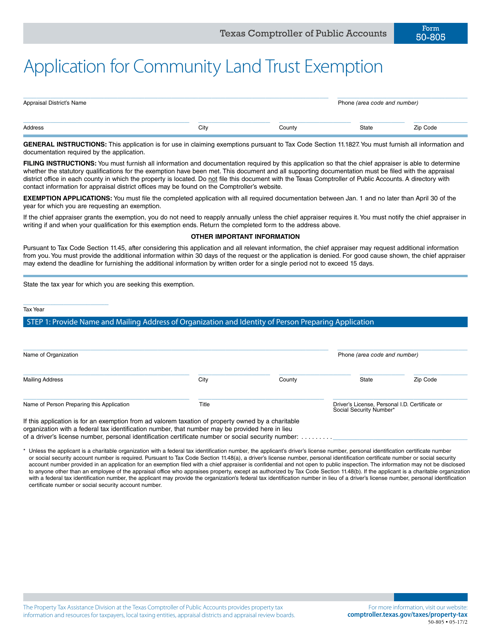

This form is used for applying for a community land trust exemption in the state of Texas. It is a document that enables eligible individuals or organizations to request a tax exemption for property that is owned by a community land trust.

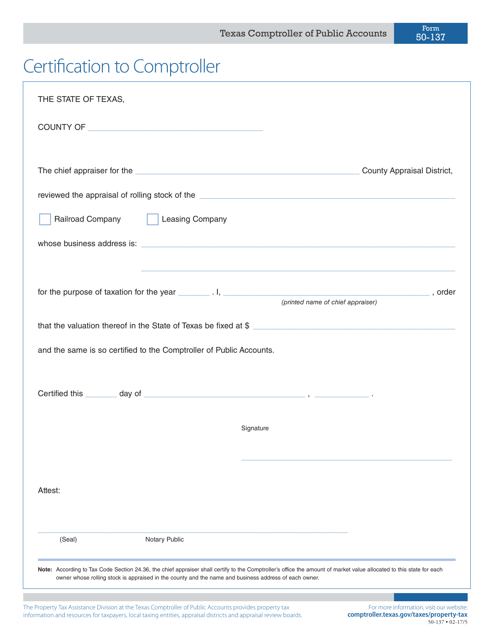

This form is used for certifying financial information to the Comptroller in the state of Texas.

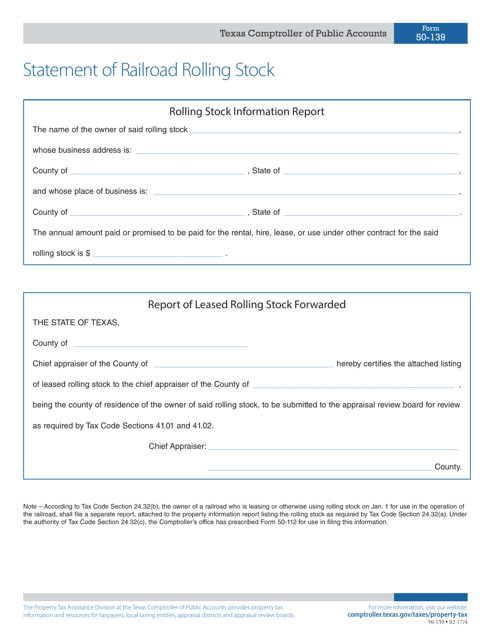

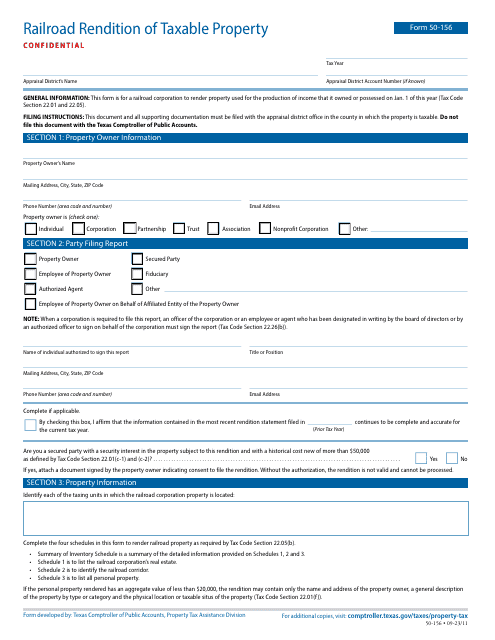

This Form is used for filing a statement of railroad rolling stock in the state of Texas.

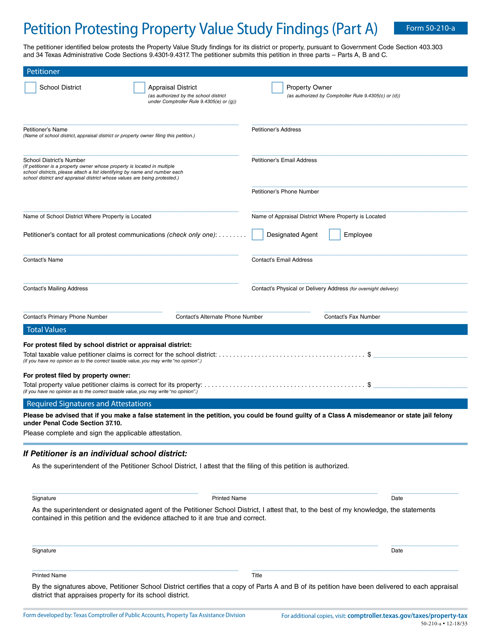

This form is used for filing a petition to protest the findings of a property value study in Texas. It is part A of the petition.

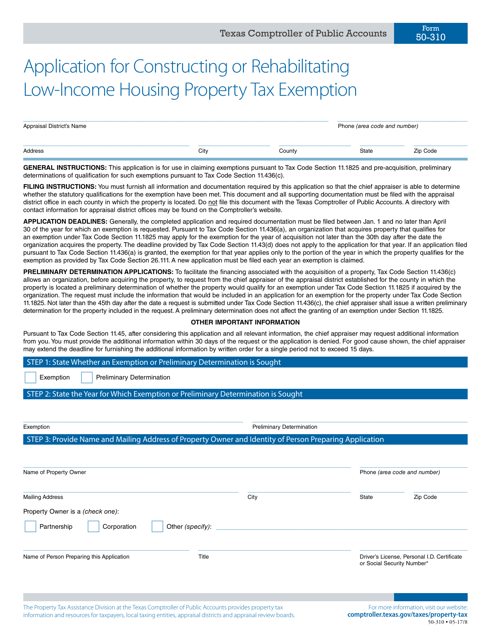

This form is used for applying for a property tax exemption in Texas for constructing or rehabilitating low-income housing.

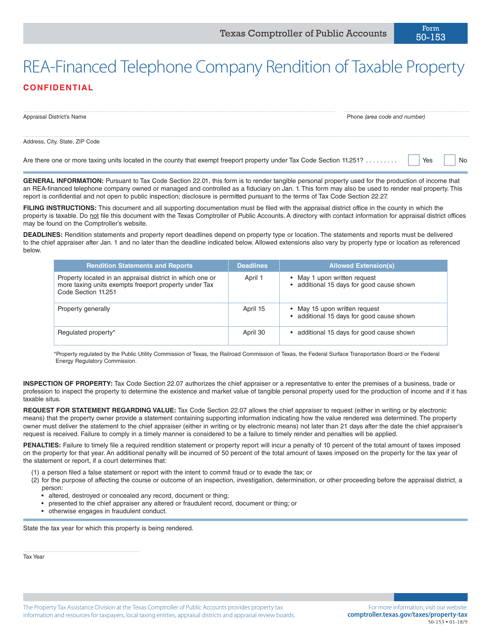

This form is used for a telephone company in Texas to report the taxable property that has been refinanced.

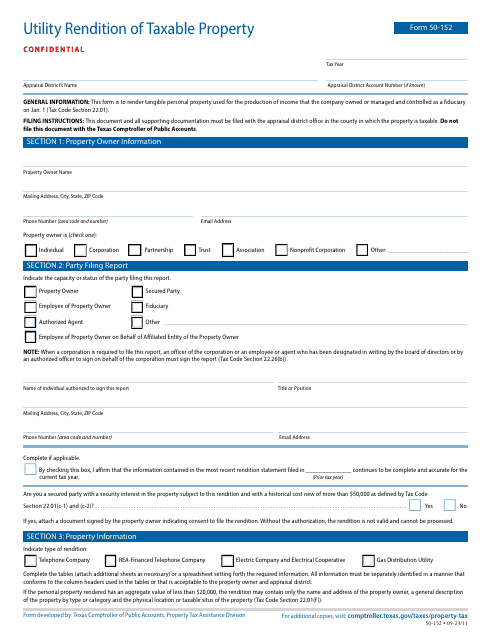

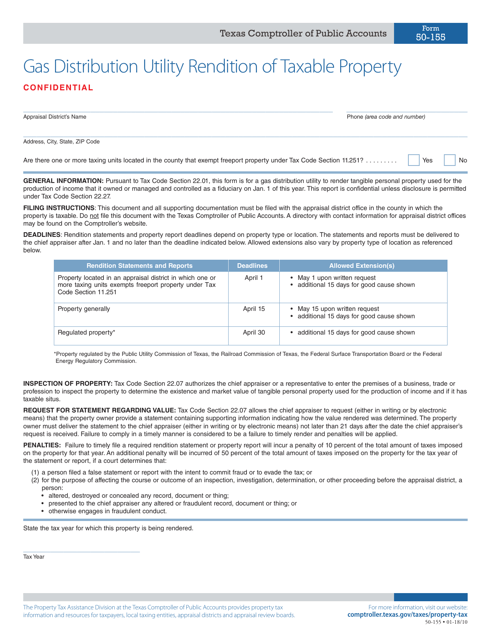

This form is used for gas distribution utilities in Texas to report their taxable property for tax purposes.

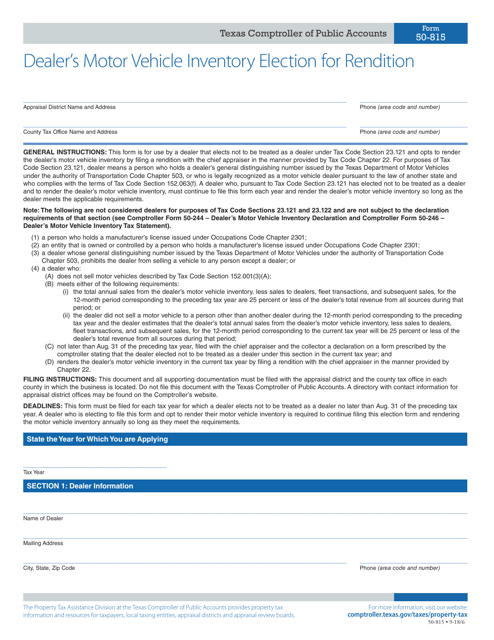

This form is used for dealers in Texas to elect how they want to value their motor vehicle inventory for property tax purposes.

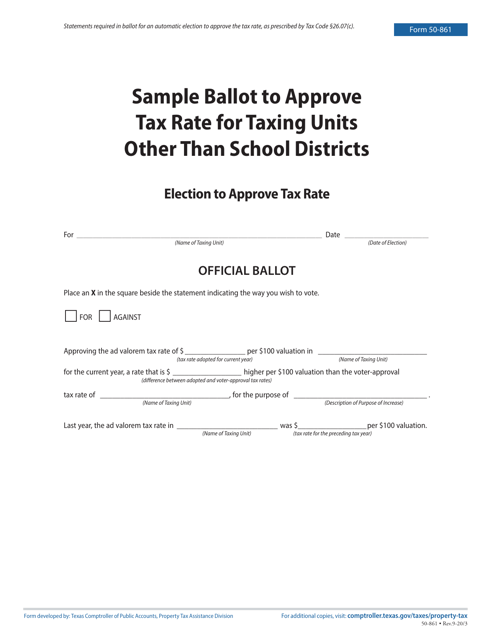

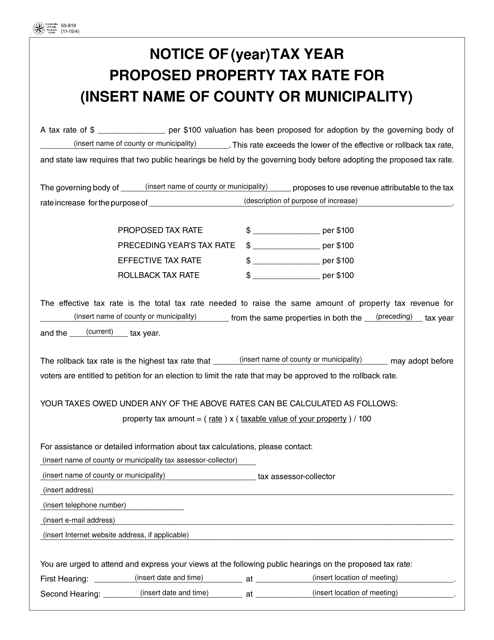

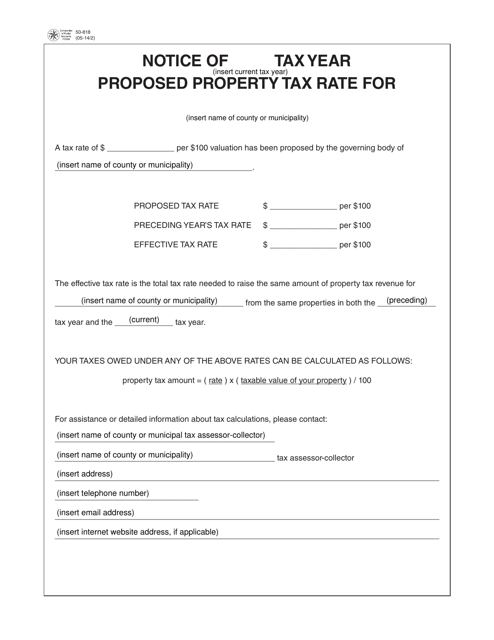

This form is used in Texas to notify residents about the proposed property tax rate for their property.

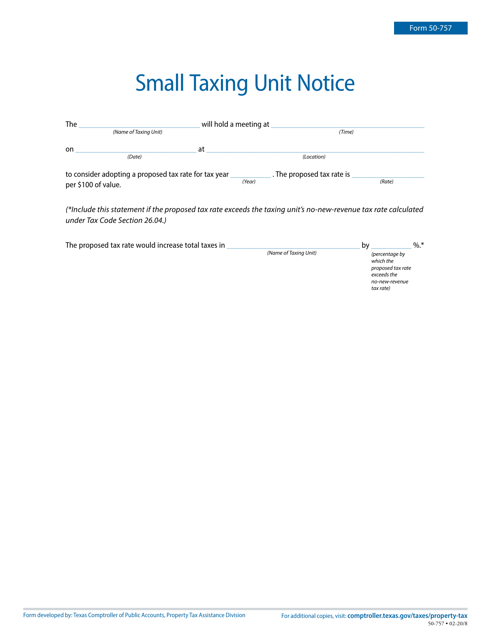

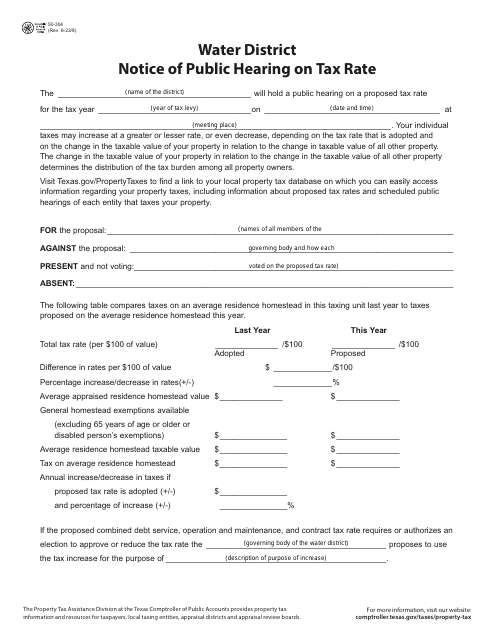

This form is used for notifying taxpayers in Texas about the proposed tax rate that may be applied.

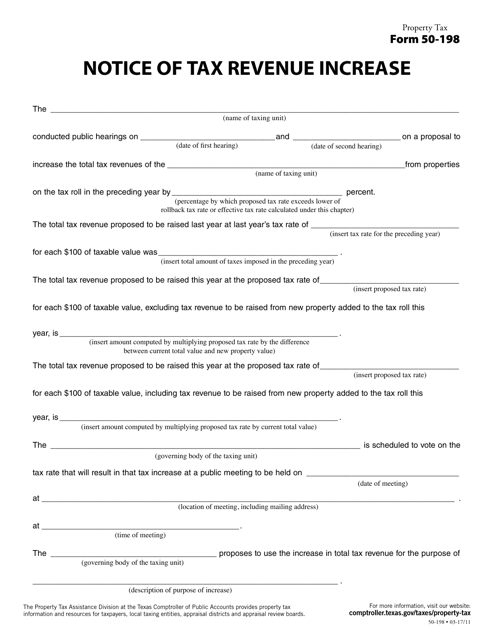

This form is used for notifying Texas taxpayers about an increase in tax revenue.