Tax Deductions Templates

Documents:

1801

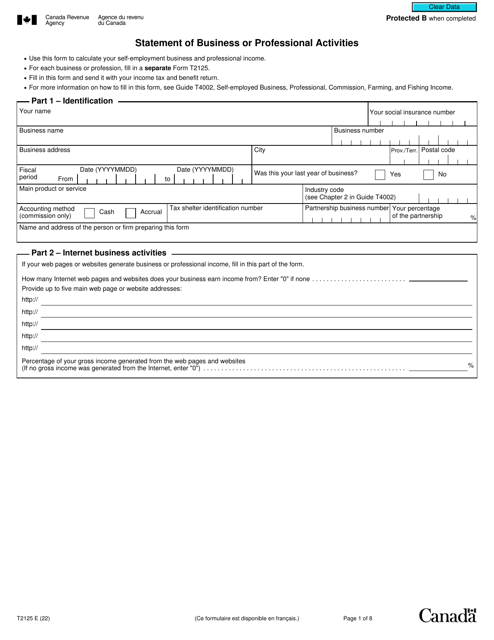

This a legal document that was specifically developed for Canadian taxpayers who receive self-employment business or professional income that they may use when they want to report their income.

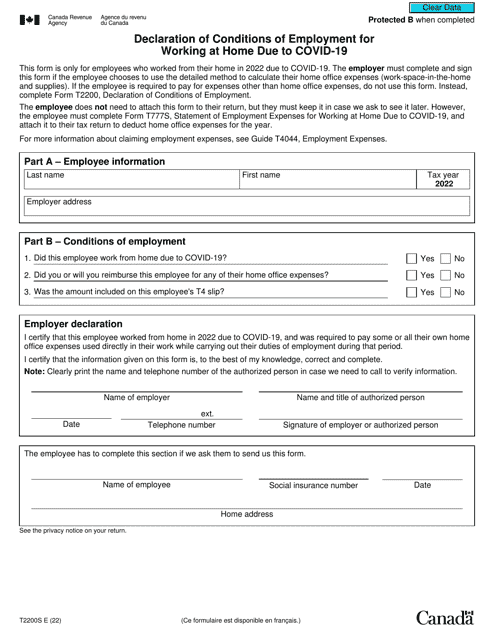

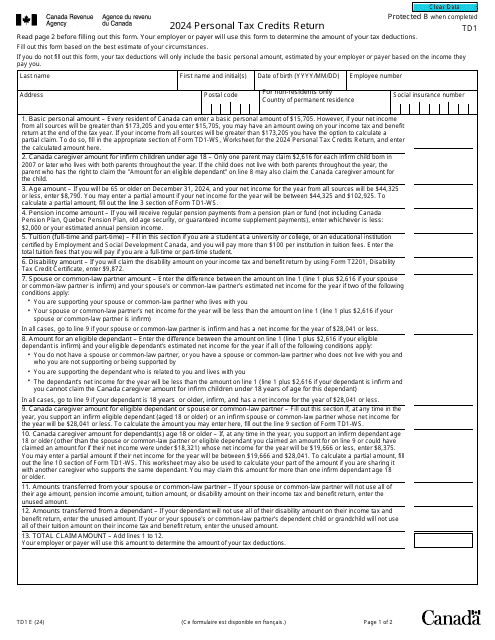

The purpose of this document is to provide a taxpayer's employer with all of the necessary information so that they will be able to determine the number of tax deductions for the Canadian taxpayer.

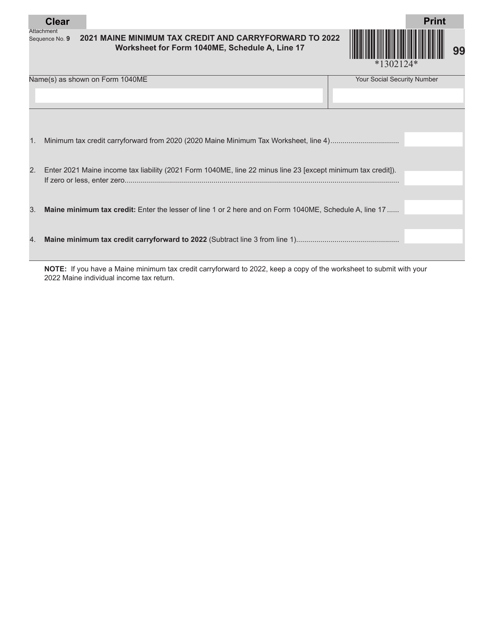

This form is used for calculating and reporting the Maine Minimum Tax Credit and Carryforward for individuals filing taxes in Maine.

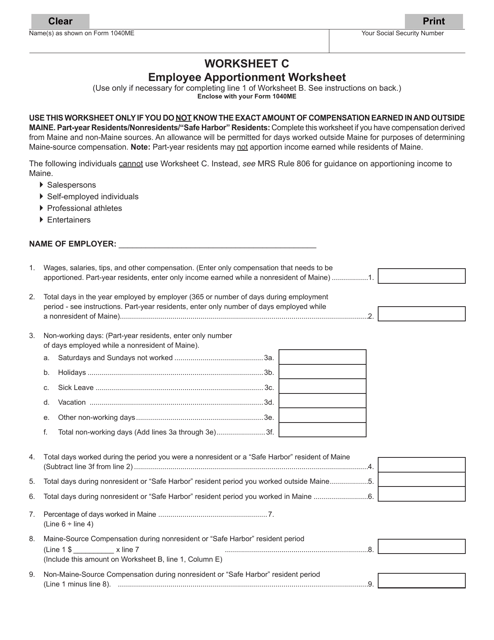

This document is a worksheet used to calculate employee apportionment for state income tax in Maine.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

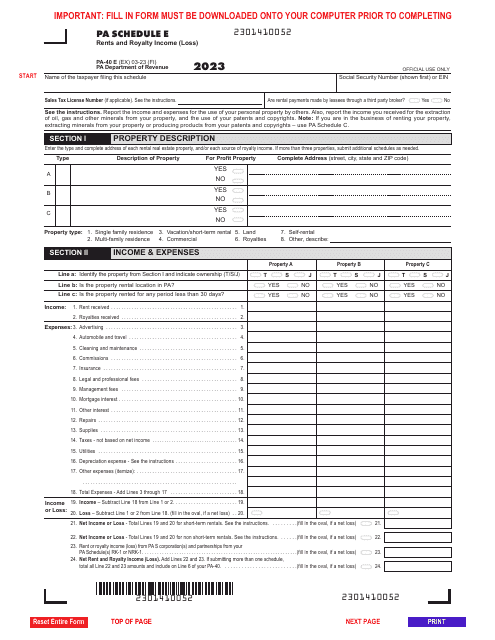

This is a fiscal document completed by financial entities to specify the amount of supplementary income investors have generated during the year.

This form is used to report a mortgage interest paid by an individual or sole proprietor during a tax year to the government, in order to receive a mortgage interest deduction on the borrower's federal income tax return.