Tax Deductions Templates

Documents:

1801

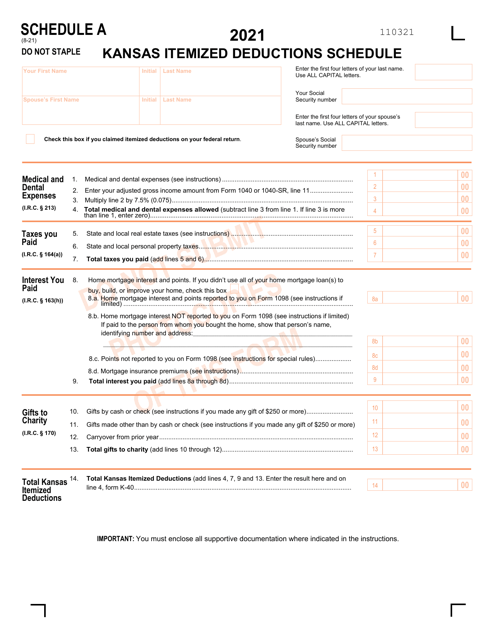

This form is used for reporting itemized deductions specific to the state of Kansas. It is necessary for residents of Kansas who want to claim deductions on their state taxes.

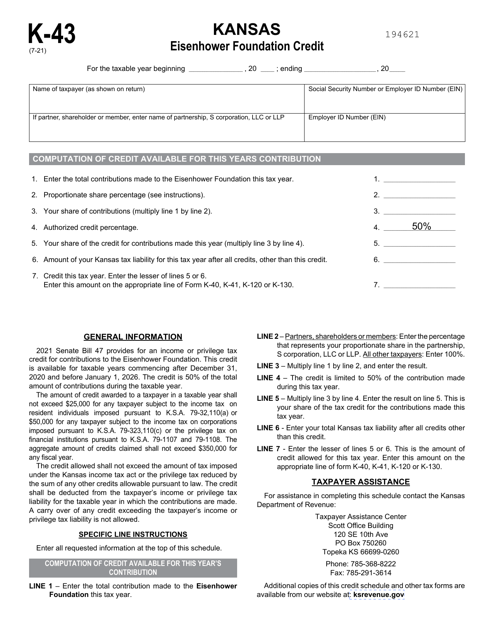

This form is used for claiming the Kansas Eisenhower Foundation Credit in the state of Kansas. Taxpayers can use this credit to offset their state income tax liability.

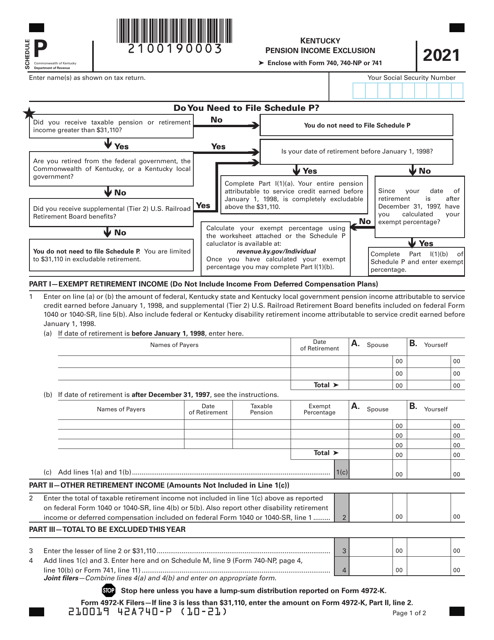

This document is a Schedule P used for the Kentucky Pension Income Exclusion. It is used to exclude pension income from Kentucky state taxes.

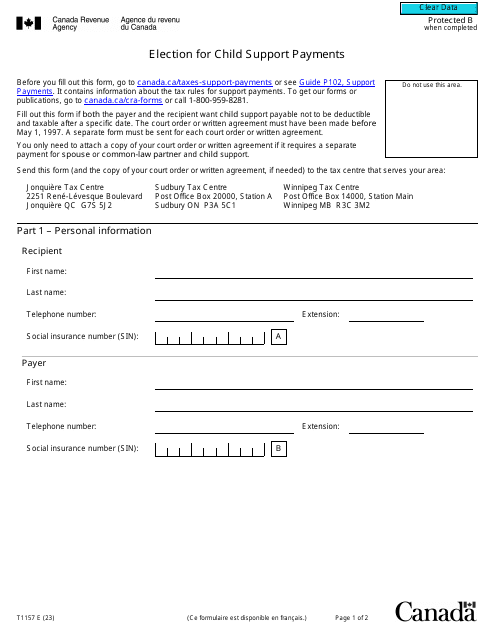

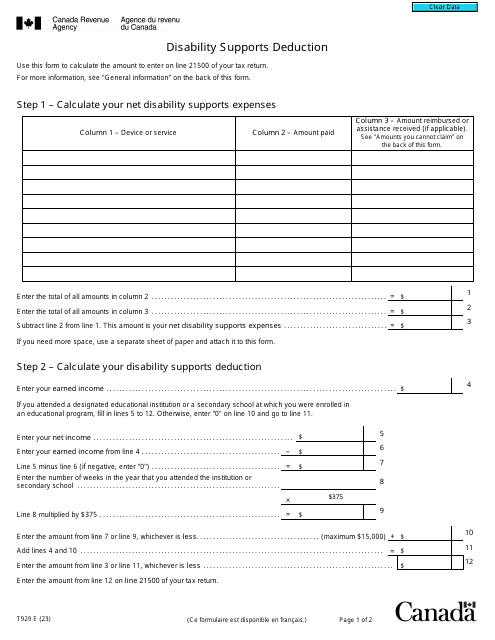

This is a legal document that needs to be completed to register an election for child support payments in Canada.

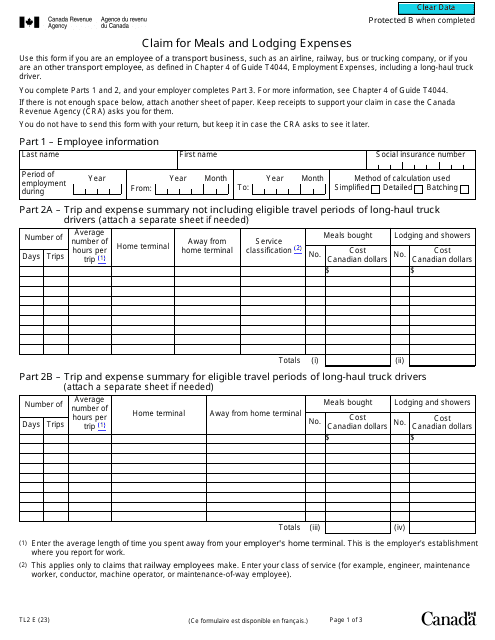

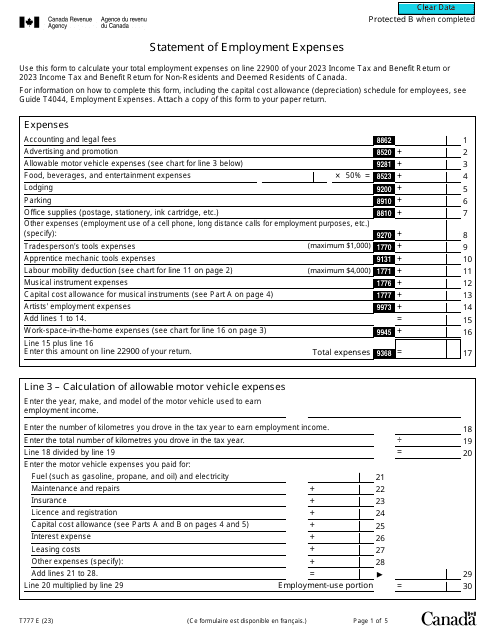

Canadian employees may use this form when they often need to supply themselves with materials necessary to complete their work, but are not reimbursed through their place of work for these expenses.