Tax Deductions Templates

Documents:

1801

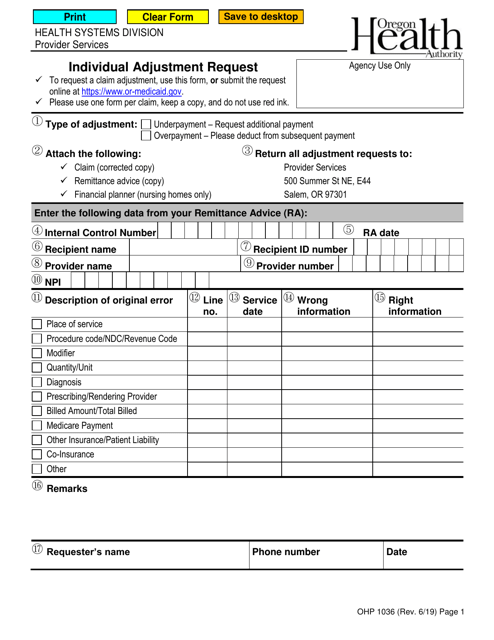

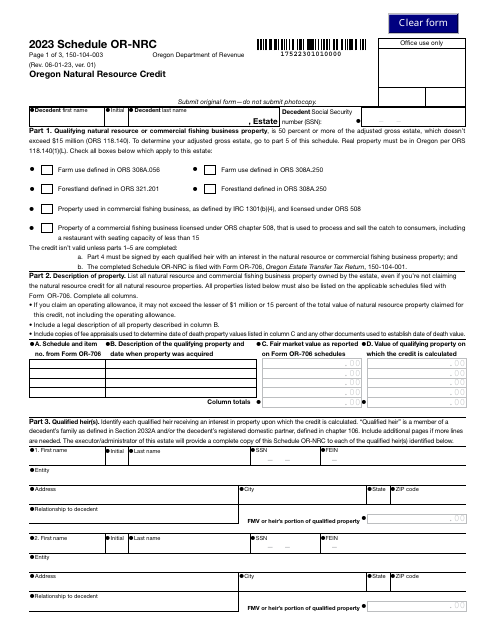

This Form is used for individuals in Oregon to request an adjustment to their taxes or other financial matters. It allows individuals to make changes or corrections to information previously reported to the Oregon Department of Revenue.

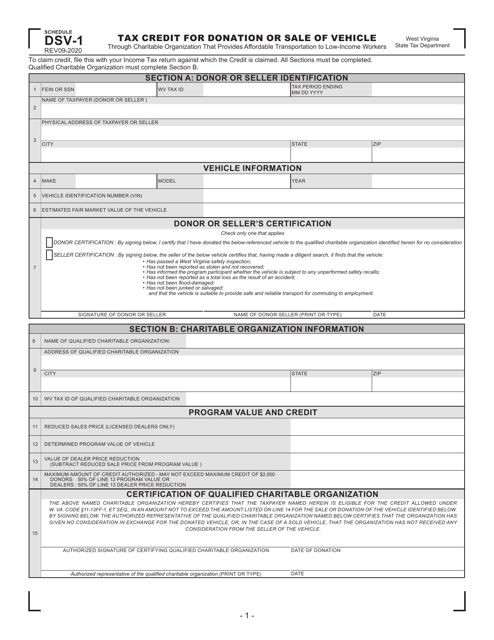

This type of document is used for claiming a tax credit in West Virginia for donating or selling a vehicle to a charitable organization that provides affordable transportation to low-income workers.

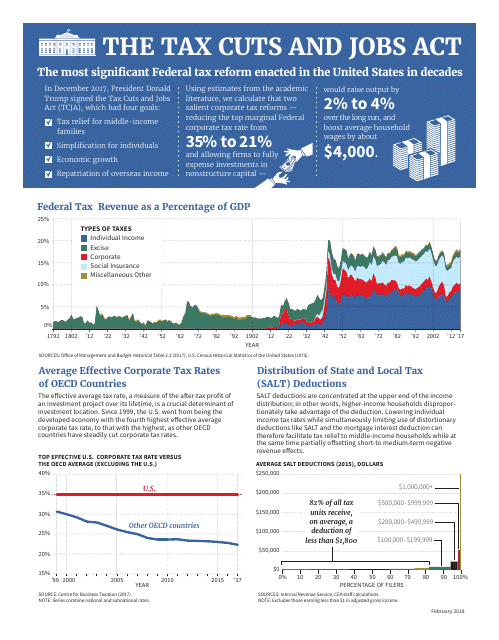

This document explains the Tax Cuts and Jobs Act, a law in the United States that made changes to the tax code with the goal of promoting economic growth and job creation.

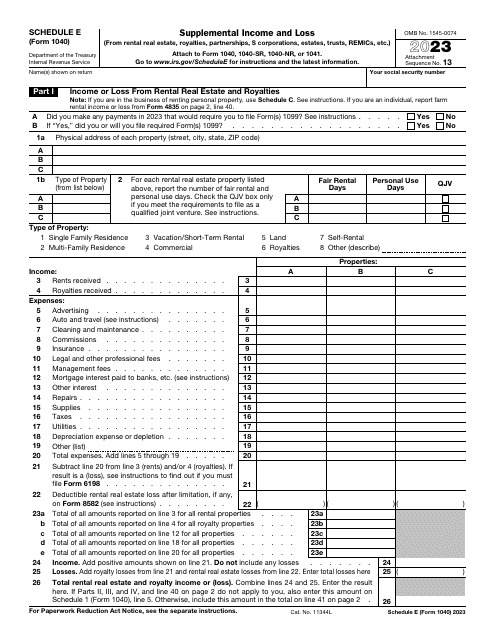

This form is part of the IRS 1040 series, which is used to calculate and submit different types of federal individual income tax returns. File this form to inform the Internal Revenue Service (IRS) about your income and loss from royalties, rental real estate, trusts, and S corporations among others.

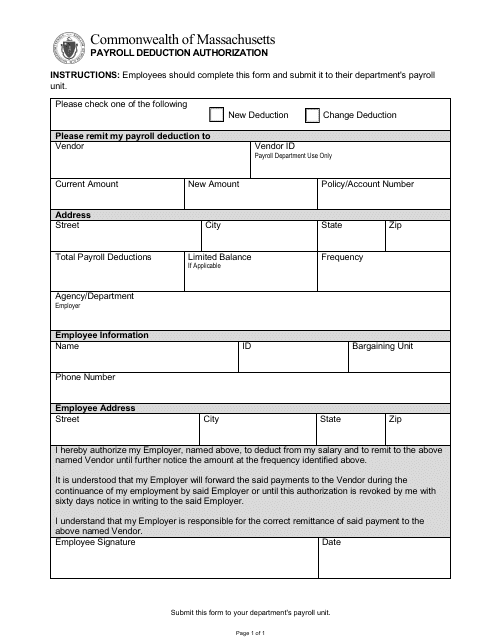

This document allows an employer in Massachusetts to deduct certain expenses from an employee's paycheck.

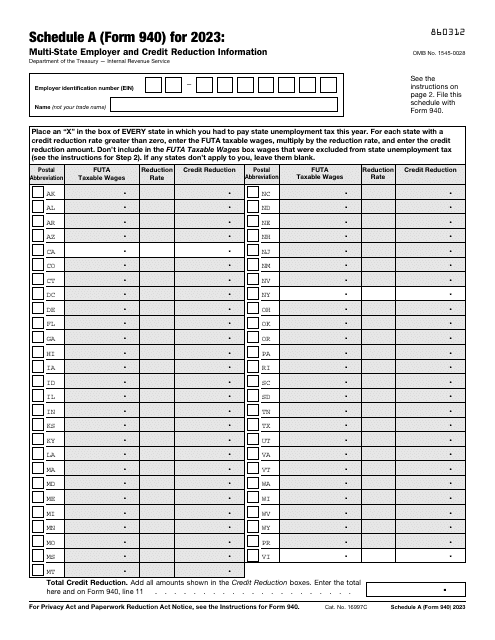

This is a supplementary form used by a taxpayer to figure out their annual federal unemployment tax.

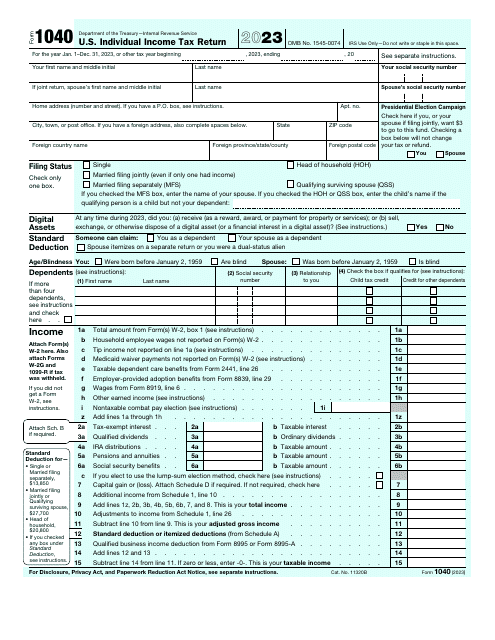

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

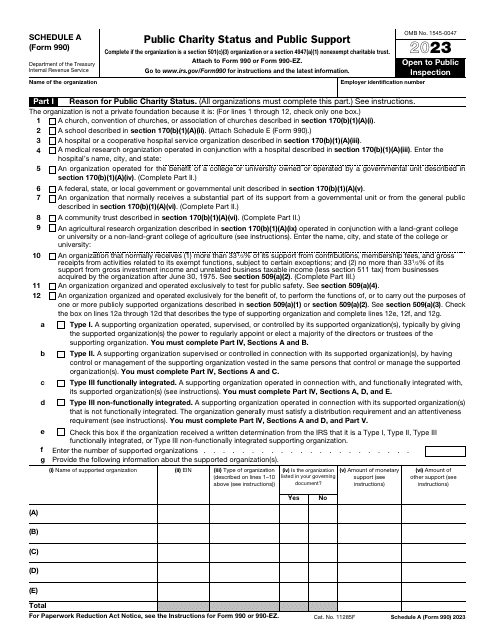

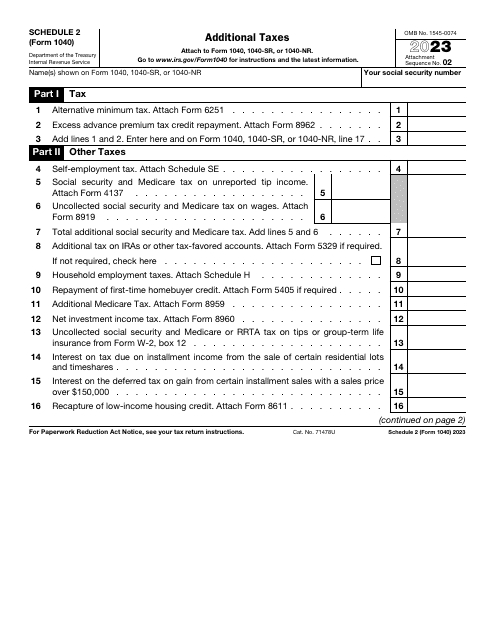

This is a supplementary document designed to allow taxpayers to list taxes they do not outline on the main income statement they are supposed to file annually.

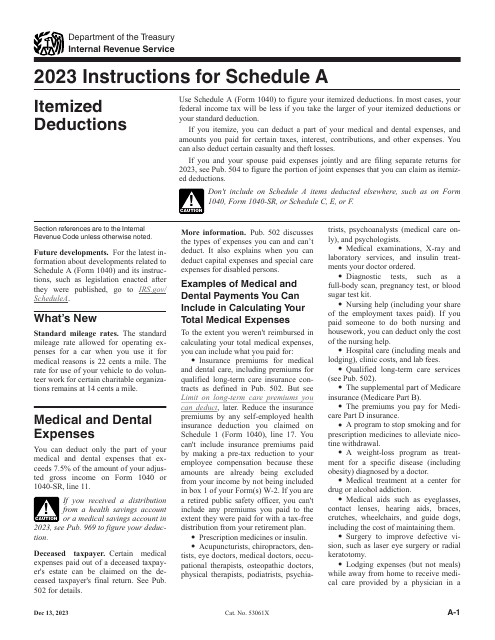

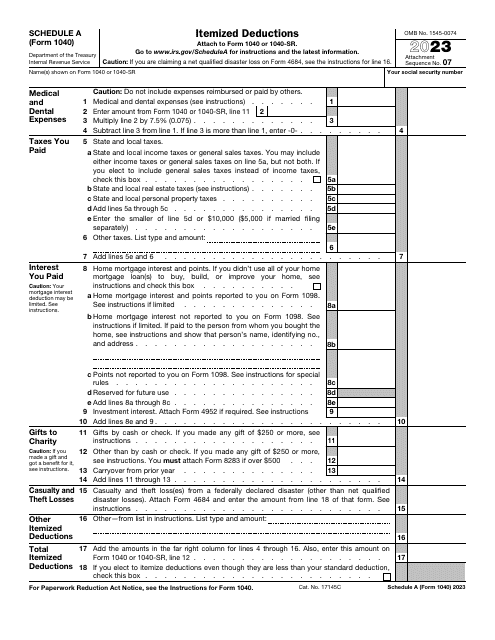

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

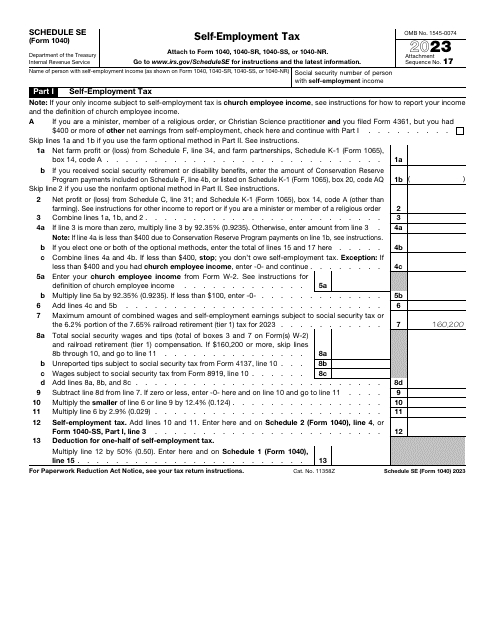

This is an IRS form that contains the breakdown of the self-employment tax the taxpayer figures out after analyzing their net earnings.

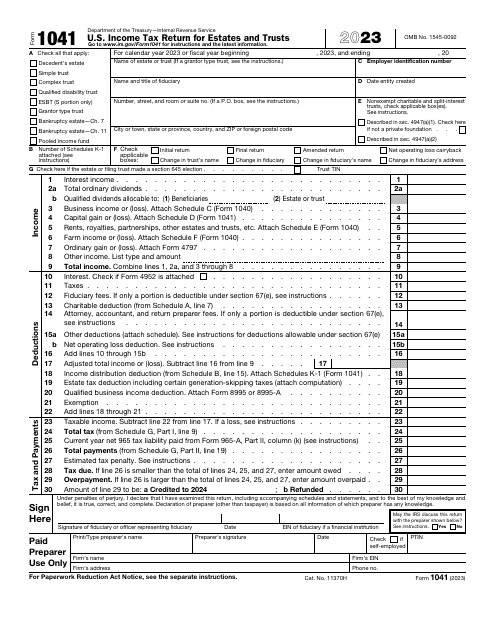

File this document, also known as the Estates and Trusts Tax Return, as an income tax return to the Internal Revenue Service (IRS) if you are a fiduciary of a bankruptcy estate, domestic decedent's estate, or a trust.