Tax Deductions Templates

Documents:

1801

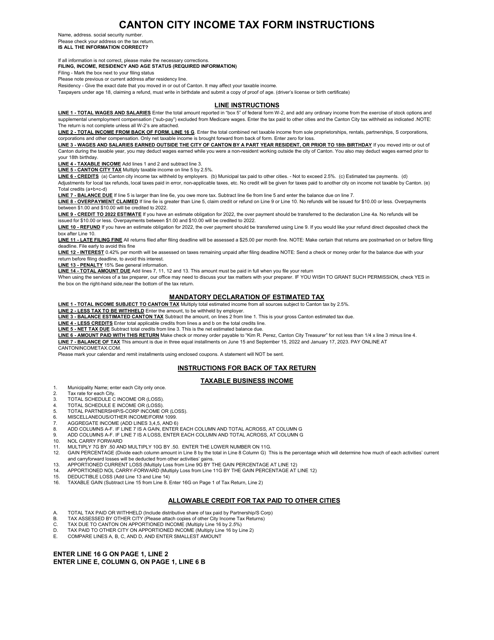

This Form is used for filing your Individual Income Tax Return with the City of Canton, Ohio. It provides step-by-step instructions for completing your tax return and ensures that you accurately report your income and claim any applicable deductions and credits.

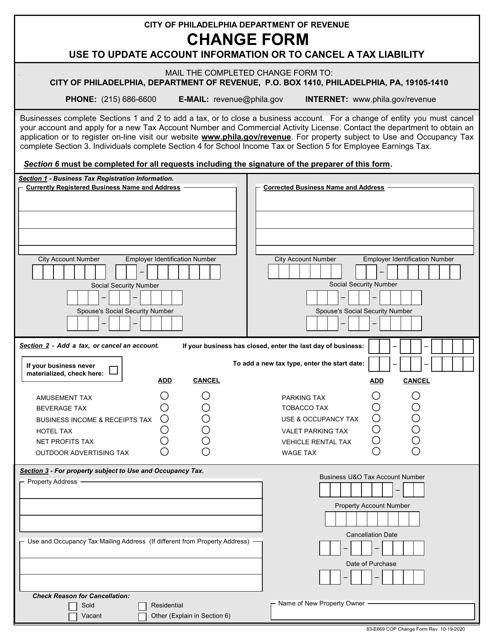

This form is used for changing your tax account information with the City of Philadelphia, Pennsylvania.

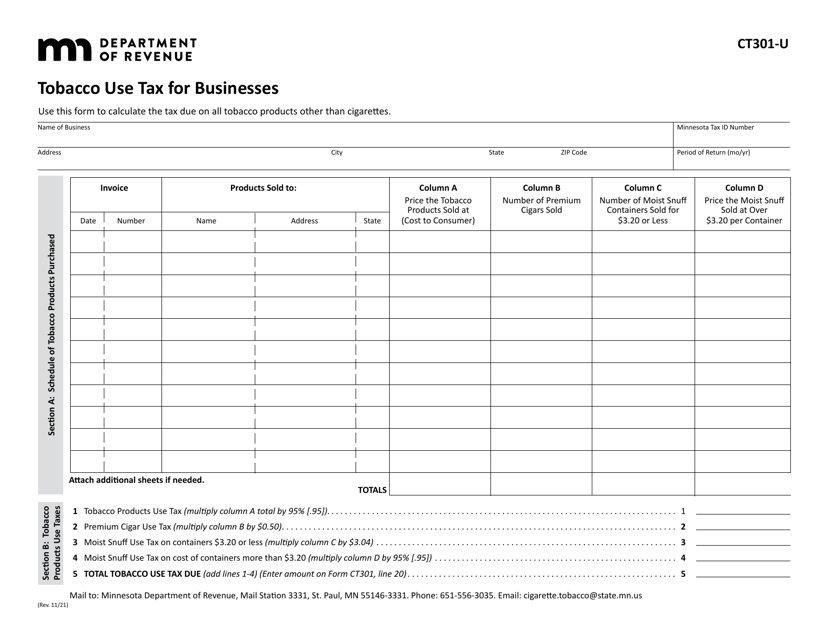

This form is used for businesses in Minnesota to report and pay tobacco use tax.

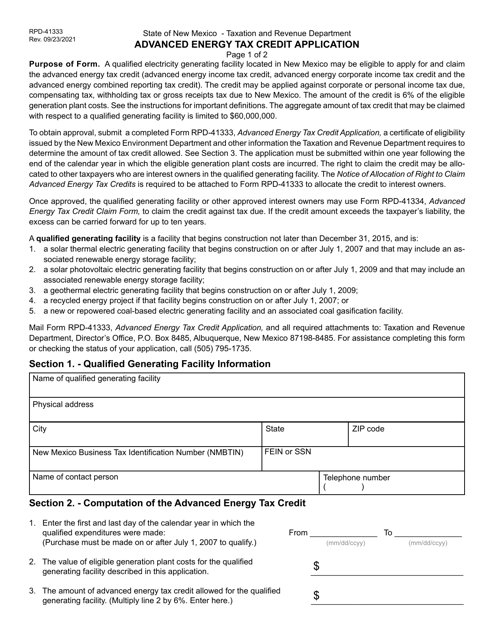

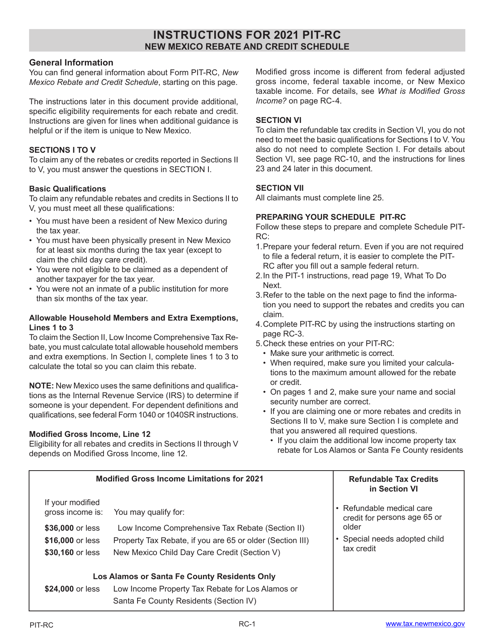

This form is used for applying for the Advanced Energy Tax Credit in the state of New Mexico.

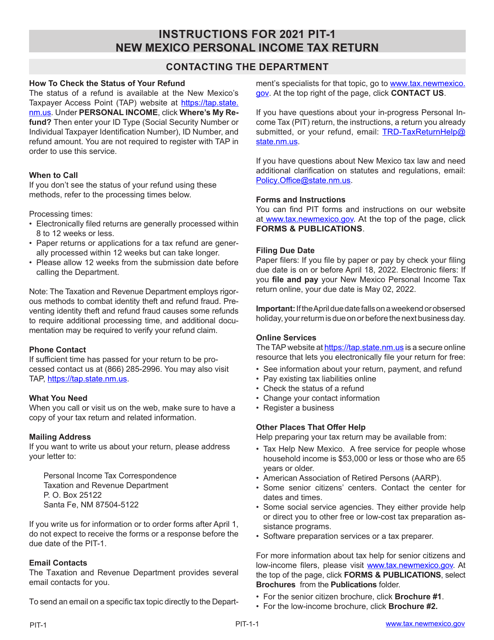

This Form is used for filing the New Mexico Personal Income Tax Return in the state of New Mexico. It provides instructions on how to accurately complete and submit the PIT-1 form for income taxes.

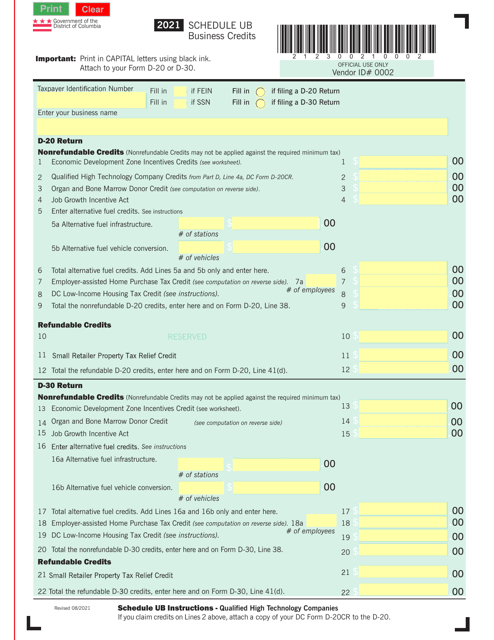

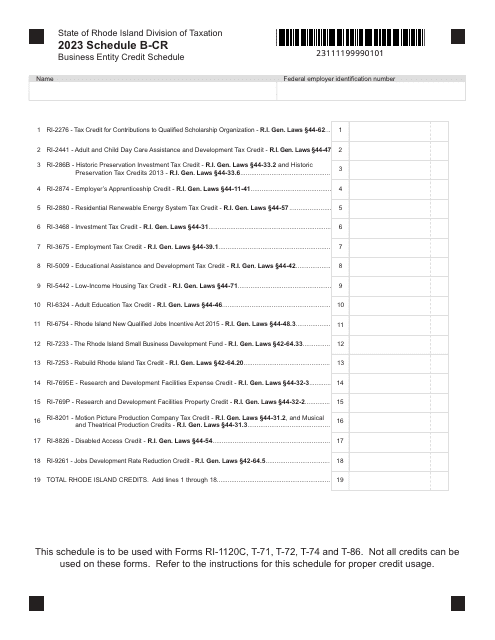

This Form is used for claiming business credits in Washington, D.C. It allows taxpayers to report and potentially reduce their tax liability by taking advantage of various business credits available in the city.

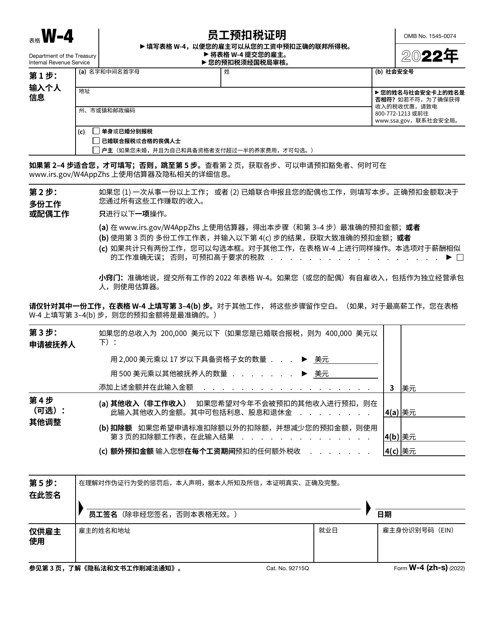

This Form is used for Chinese Simplified version of the IRS Form W-4 Employee's Withholding Certificate. It is used by employees to indicate their tax withholding preferences for income earned in the United States.

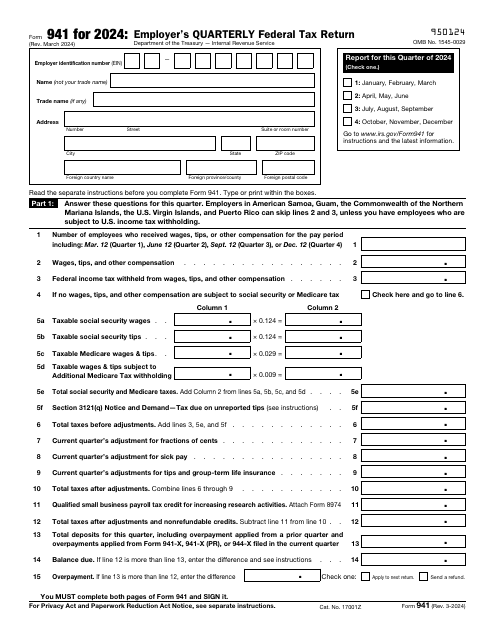

This is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have received over the course of the previous quarter and the tax already subtracted from the workers' salaries.