Sales Tax Templates

Documents:

663

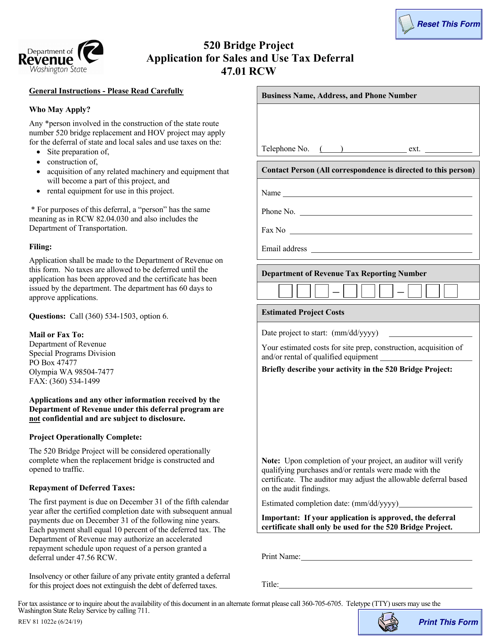

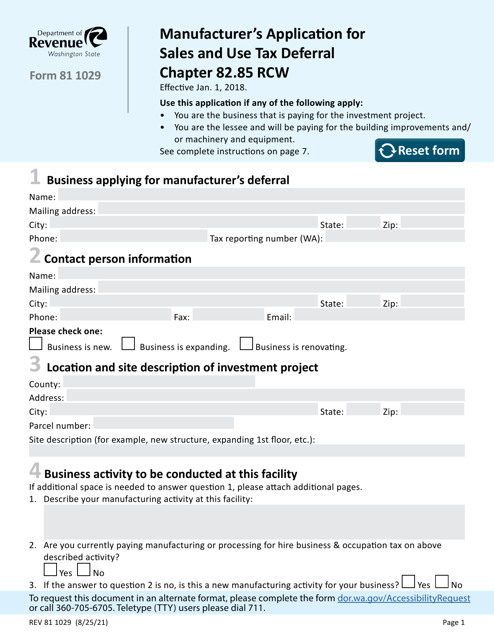

This document is an application form for the Sales and Use Tax Deferral program for the 520 Bridge Project in Washington state. It is used to request a deferral of sales and use tax for eligible construction and improvement projects related to the 520 bridge.

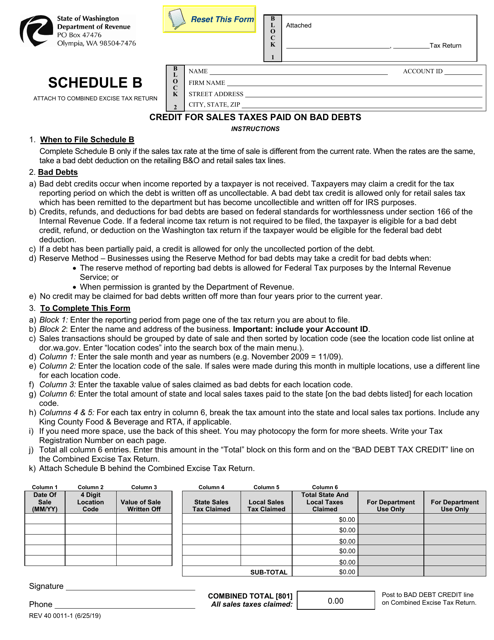

This Form is used for claiming a credit for sales taxes paid on bad debts in Washington.

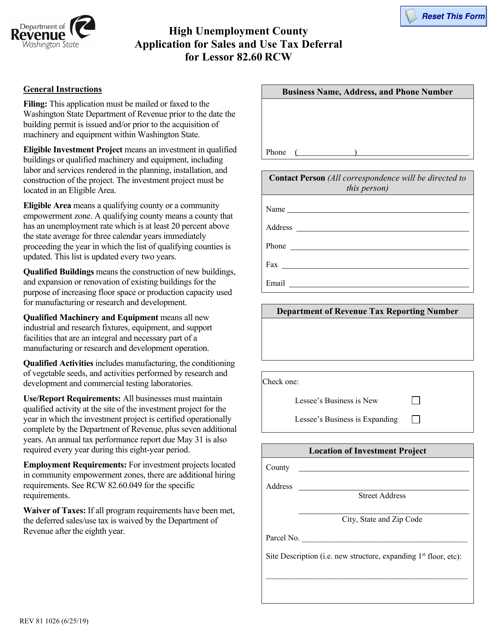

This Form is used for applying for sales and use tax deferral for lessors in Washington counties with high unemployment rates.

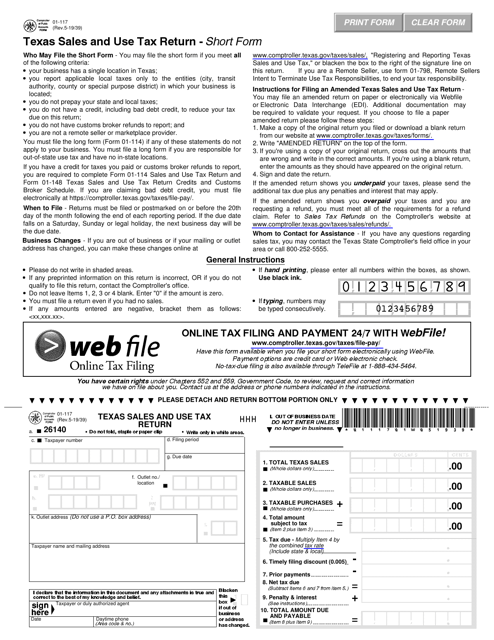

This type of document is used for filing a short form of the Texas Sales and Use Tax Return in the state of Texas.

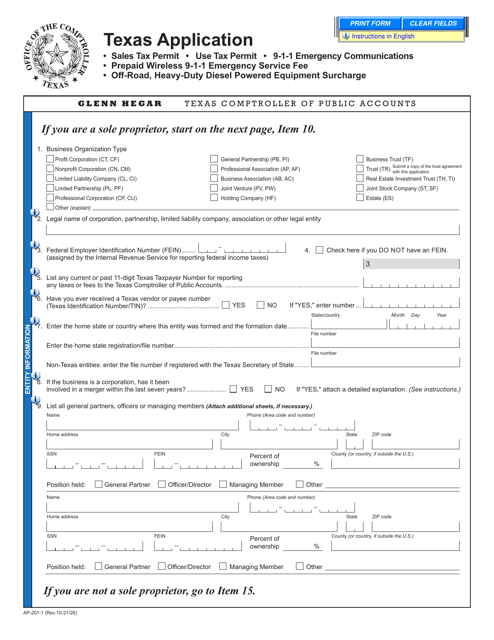

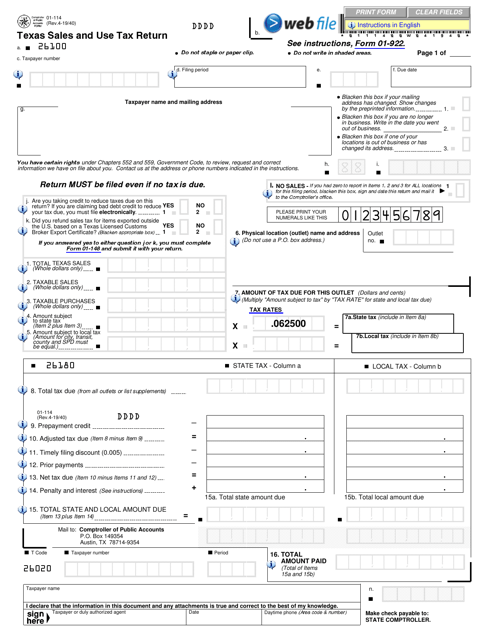

This is a form used in the state of Texas that is used by taxpayers when they want to report information related to the Sales and Use Tax they are supposed to pay.

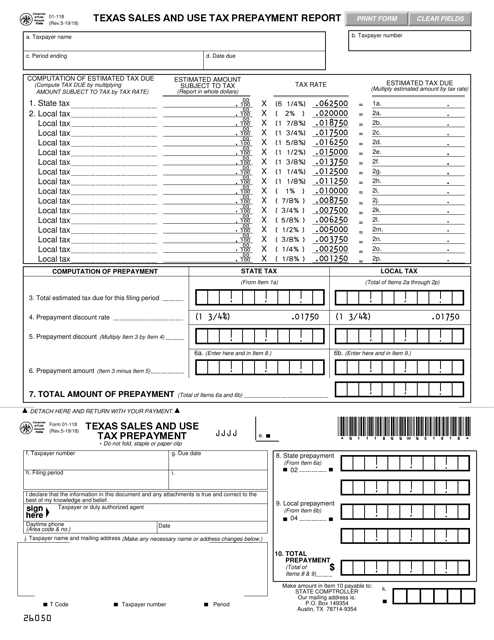

This form is used for reporting and prepaying sales and use taxes in the state of Texas.

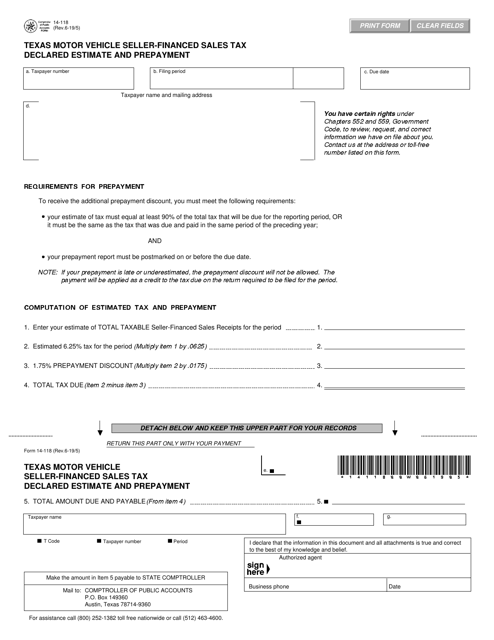

This form is used for declaring and prepaying the sales tax for motor vehicle seller-financed sales in Texas.

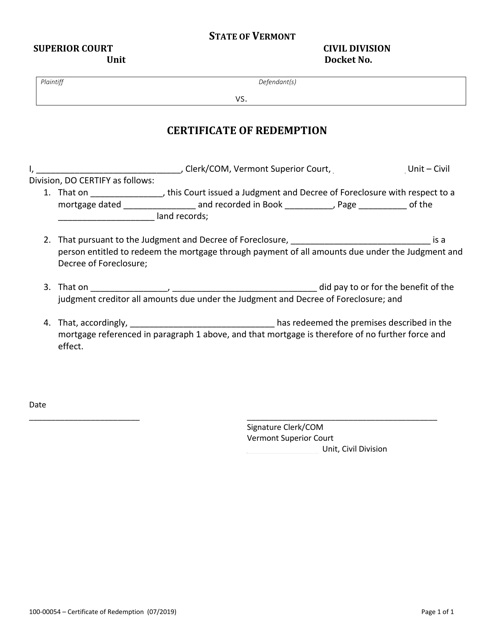

This form is used for the process of redeeming a property in the state of Vermont.

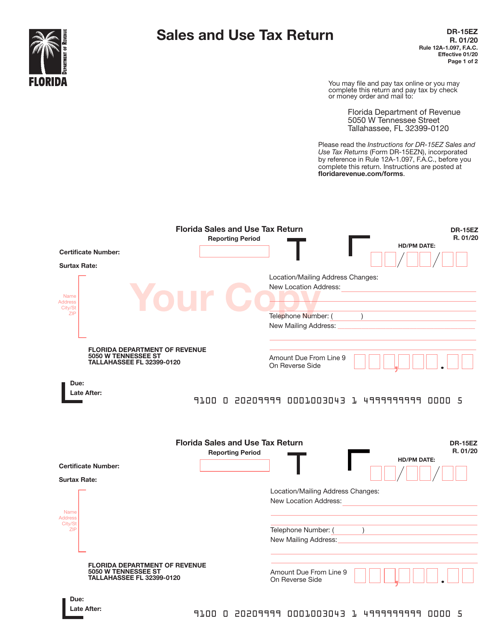

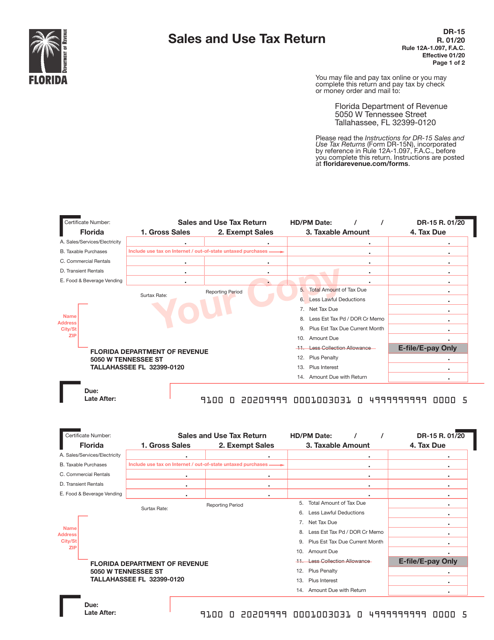

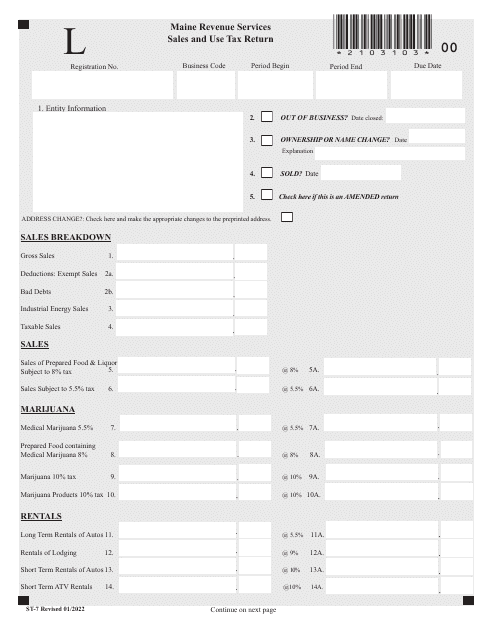

This Form is used for reporting sales and use tax in the state of Florida.

This Form is used for the filing of Sales and Use Tax Return in the state of Florida.

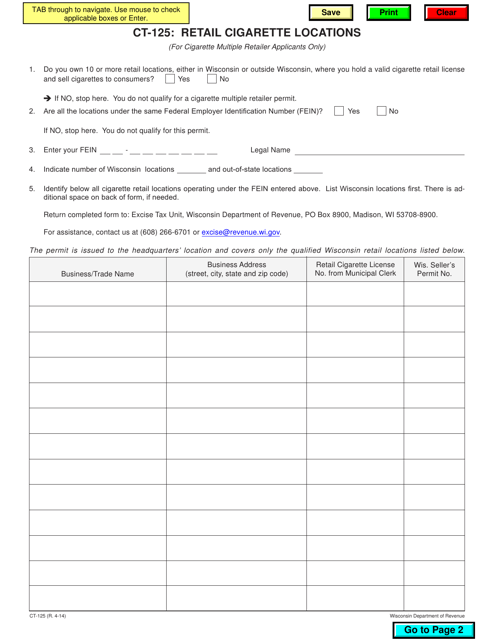

This form is used for registering retail cigarette locations in the state of Wisconsin.

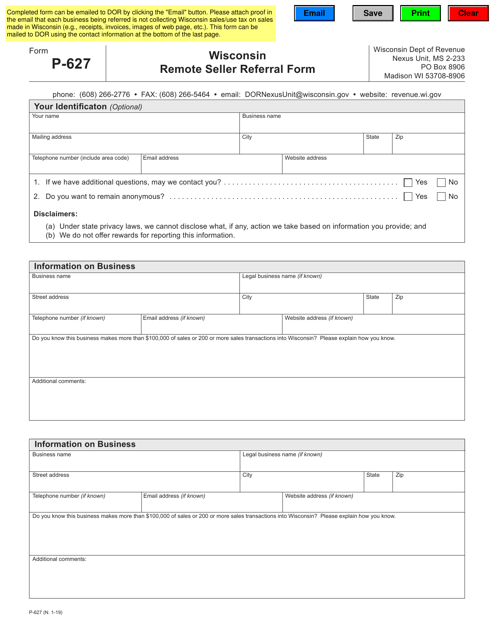

This form is used for remote sellers in Wisconsin to refer potential customers to the Wisconsin Department of Revenue for sales tax collection purposes.

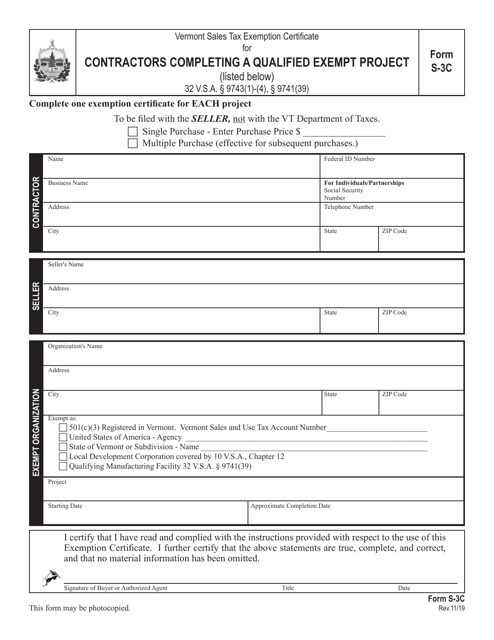

This form is used for contractors working on a qualified exempt project in Vermont to apply for a sales tax exemption.

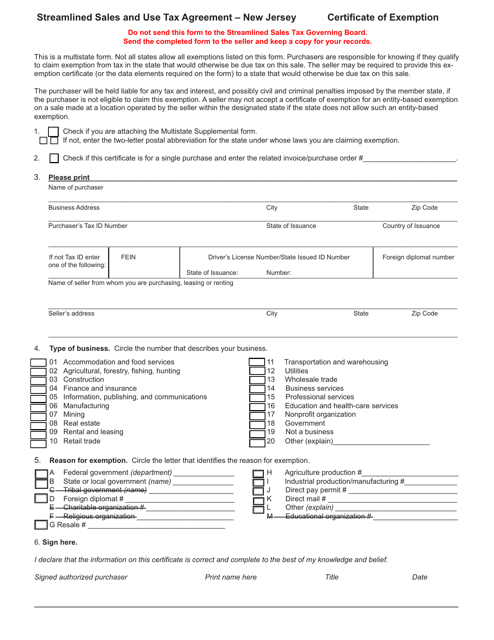

This form is used for applying for a certificate of exemption in New Jersey under the Streamline Sales & Use Tax Agreement.

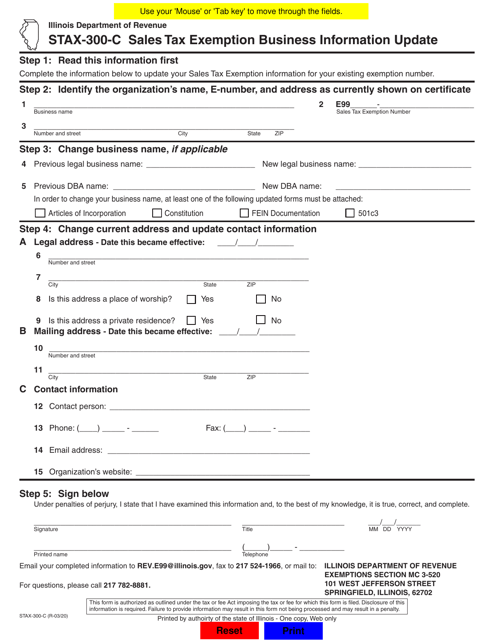

This form is used for updating business information for sales tax exemption in Illinois.

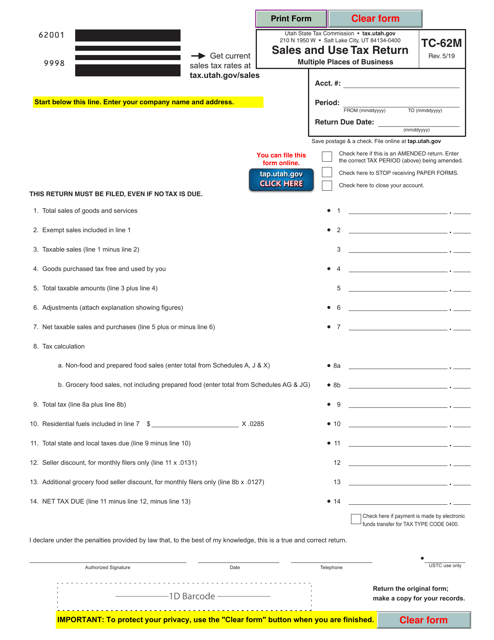

This form is used for filing sales and use tax returns for businesses with multiple locations in Utah.

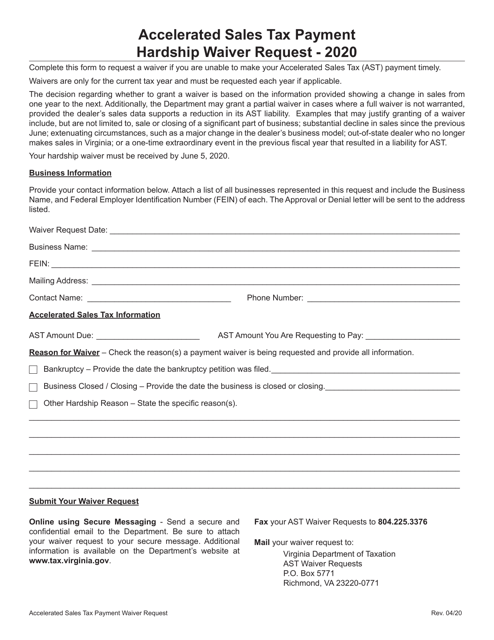

This form is used in Virginia to request a hardship waiver for the accelerated sales tax payment. It is meant for individuals or businesses facing financial difficulties that make it difficult to make the tax payment on time.

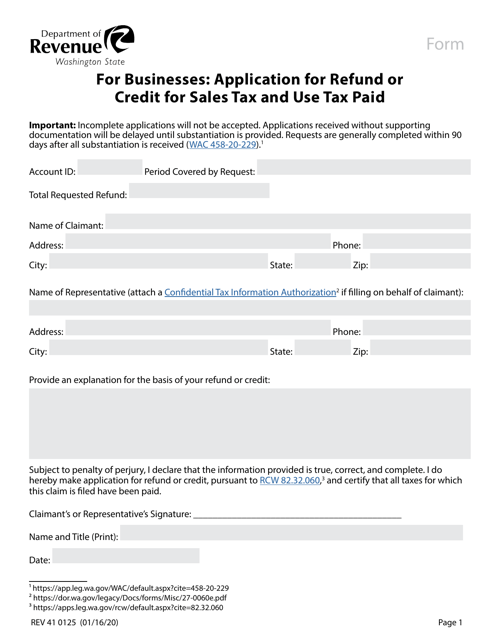

This form is used by businesses in Washington to apply for a refund or credit for sales tax and use tax paid.

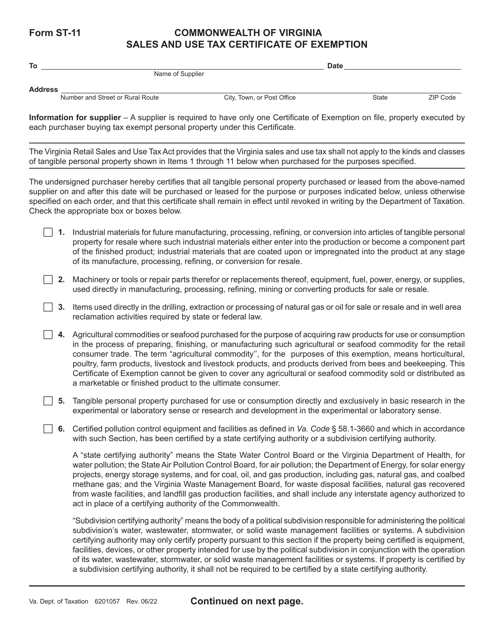

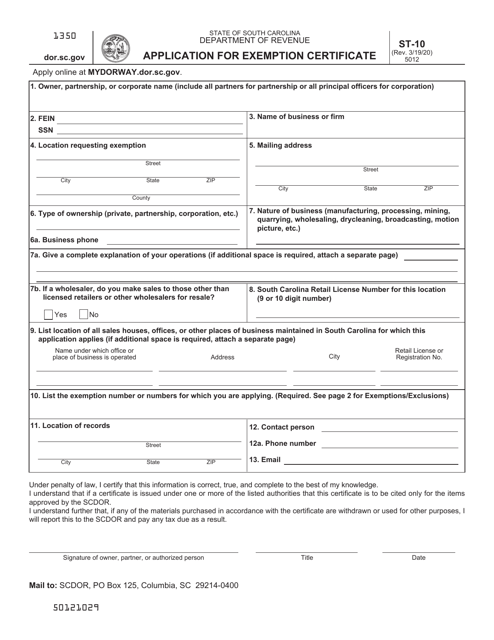

This form is used for applying for an exemption certificate in South Carolina.

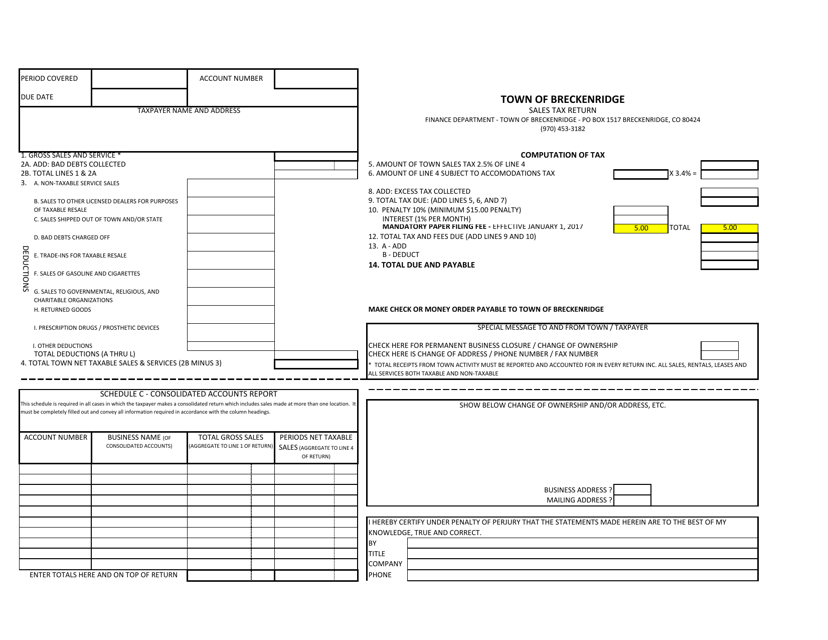

This document is for filing sales tax returns for businesses located in the Town of Breckenridge, Colorado.

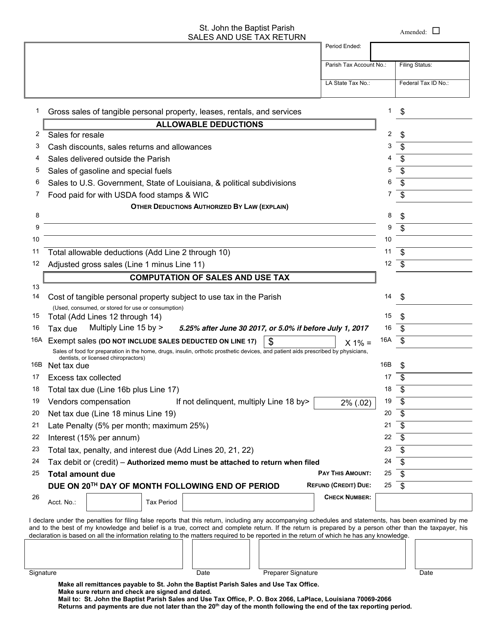

This form is used for submitting sales and use tax returns specifically for St. John the Baptist Parish, Louisiana. It is used to report and remit the taxes collected from sales and use of goods and services within the parish.

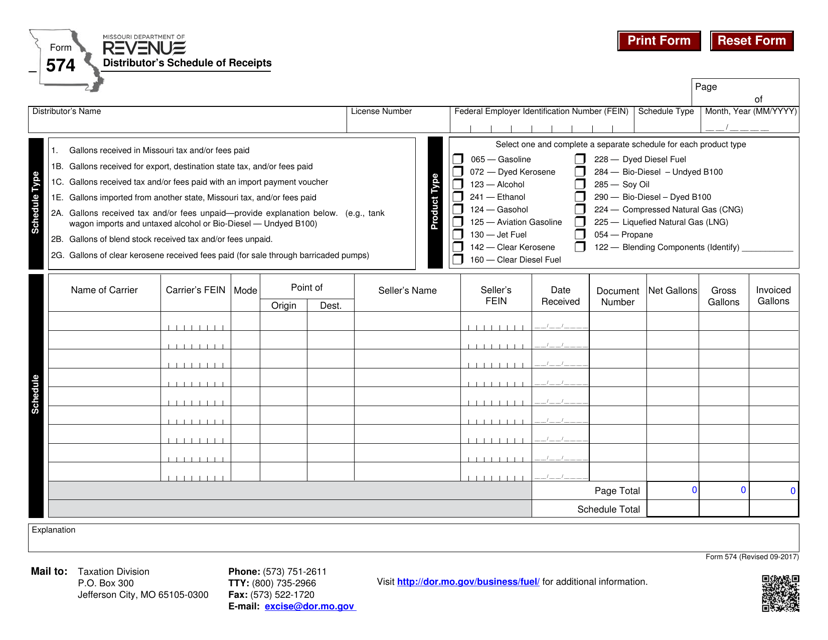

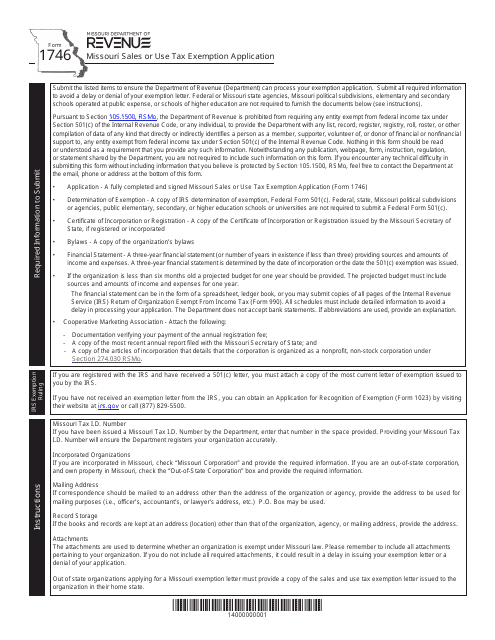

This document is used for reporting the schedule of receipts for distributors in the state of Missouri.

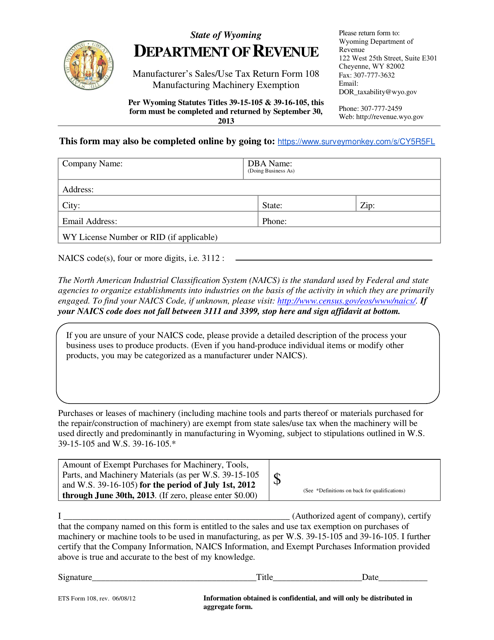

This form is used for reporting and claiming exemption on sales/use tax for manufacturing machinery in the state of Wyoming.

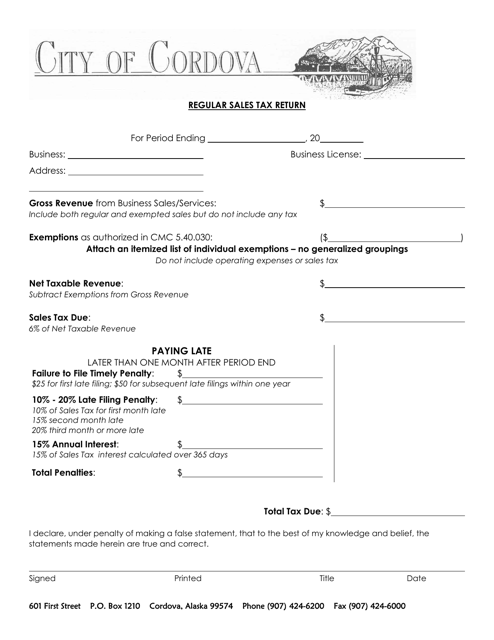

This document is used for filing regular sales tax returns in the City of Cordova, Alaska.

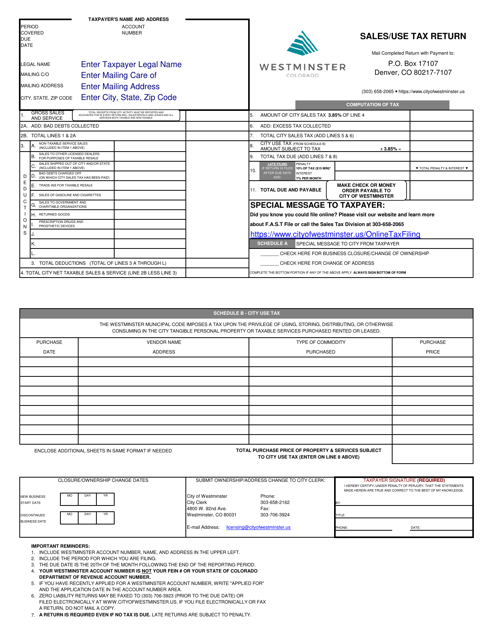

This form is used for reporting and paying sales use tax in the City of Westminster, Colorado.

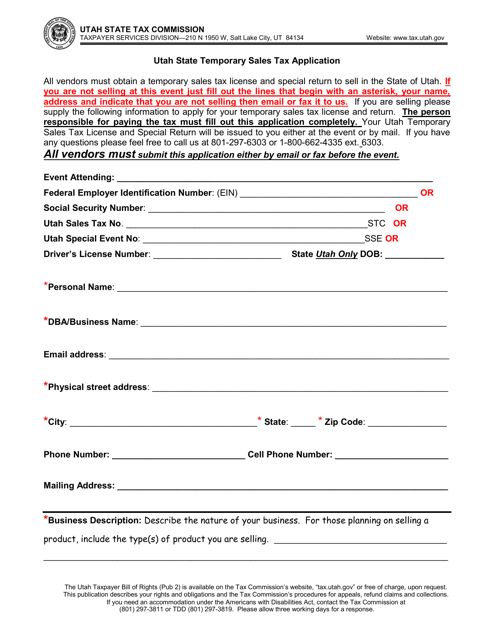

This document is used for applying for a temporary sales tax permit in the state of Utah.

This document provides tax information for motor vehicle dealers in Florida. It covers topics such as sales tax, registration fees, and dealer licensing requirements.