Sales Tax Templates

Documents:

663

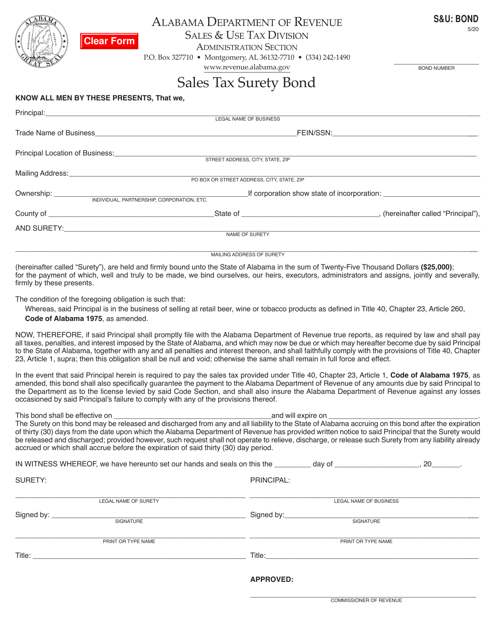

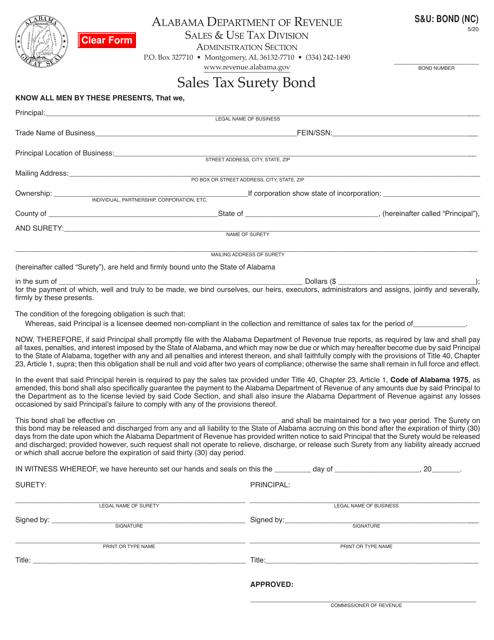

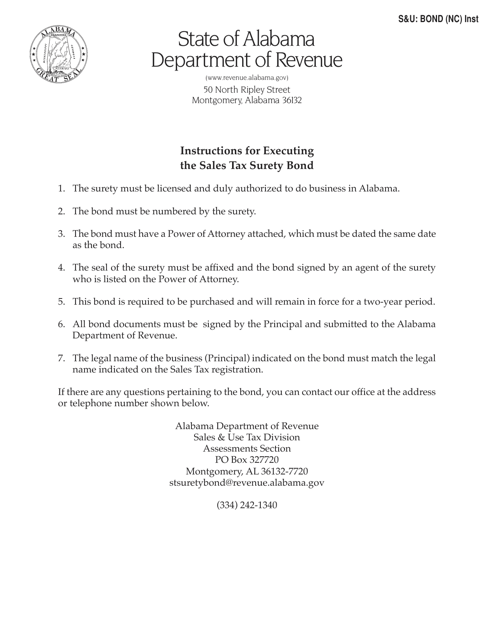

This form is used for obtaining a sales tax surety bond in Alabama.

This form is used for obtaining a Sales Tax Surety Bond for non-compliant taxpayers in Alabama.

This Form is used for obtaining a Sales Tax Surety Bond for non-compliant taxpayers in Alabama. The bond is required to ensure payment of sales tax liabilities by businesses.

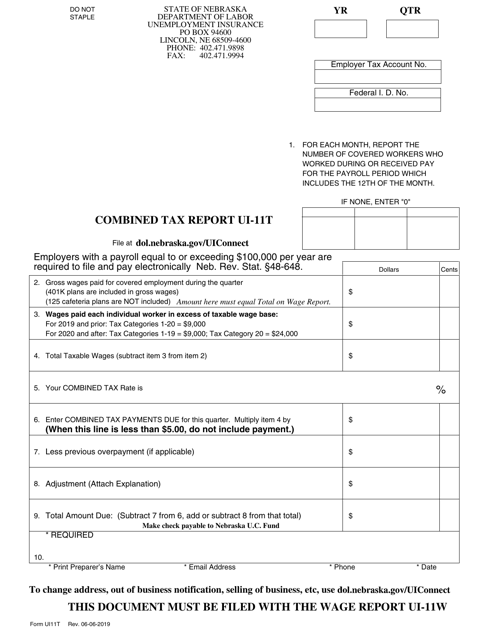

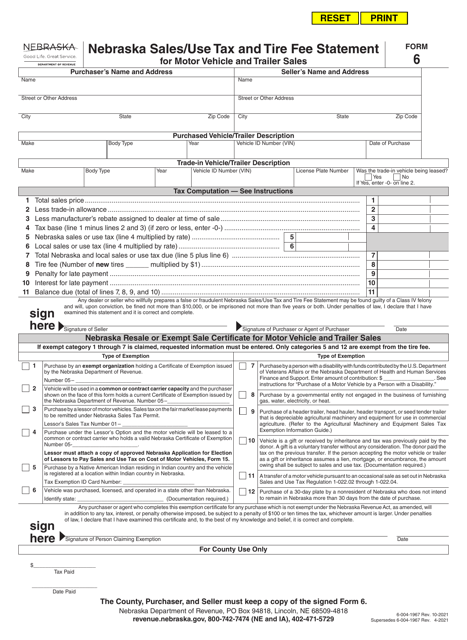

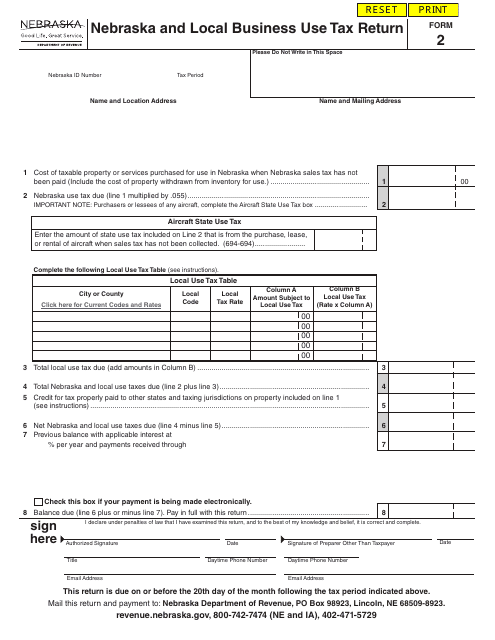

This document is used for filing a combined tax report in Nebraska. It is known as Form UI-11T.

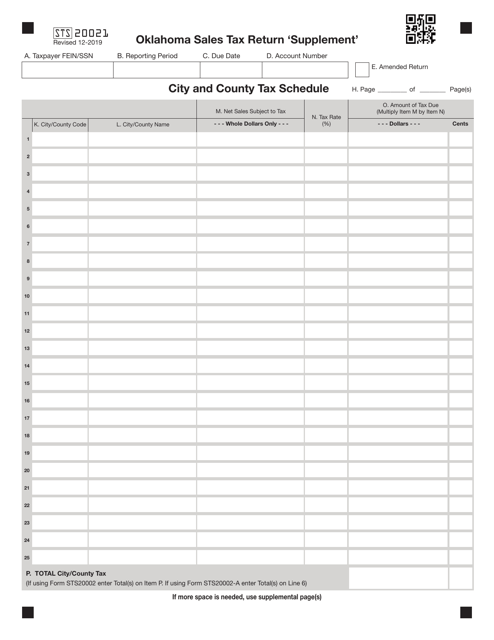

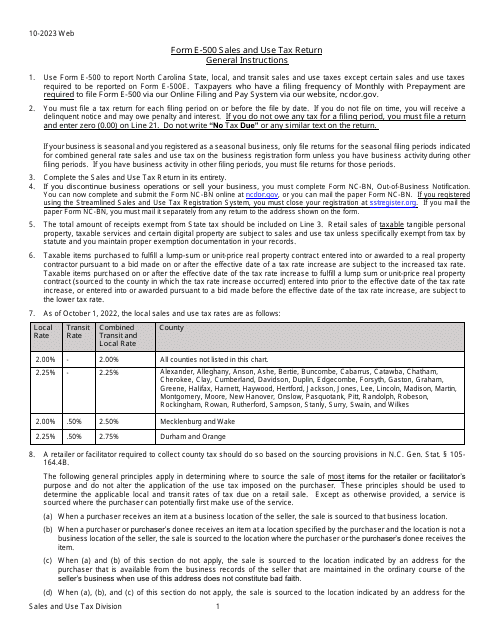

This form is used for filing a sales tax return in the state of Oklahoma. It is a supplemental form that must be filed along with the regular sales tax return.

This form is used for filing sales tax returns in the state of Oklahoma. It is necessary for businesses to report and pay their sales tax liability to the Oklahoma Tax Commission.

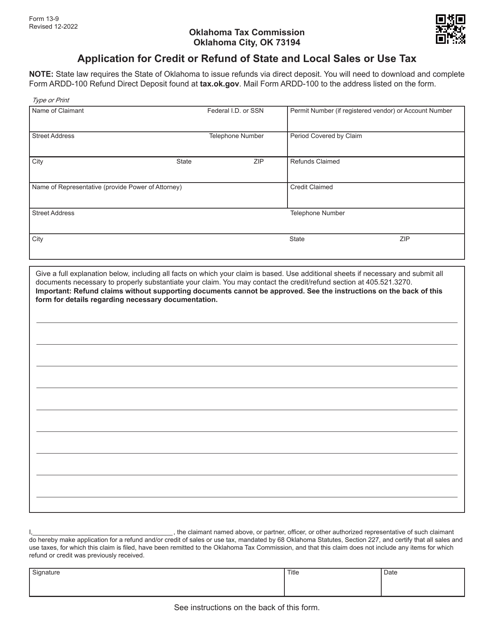

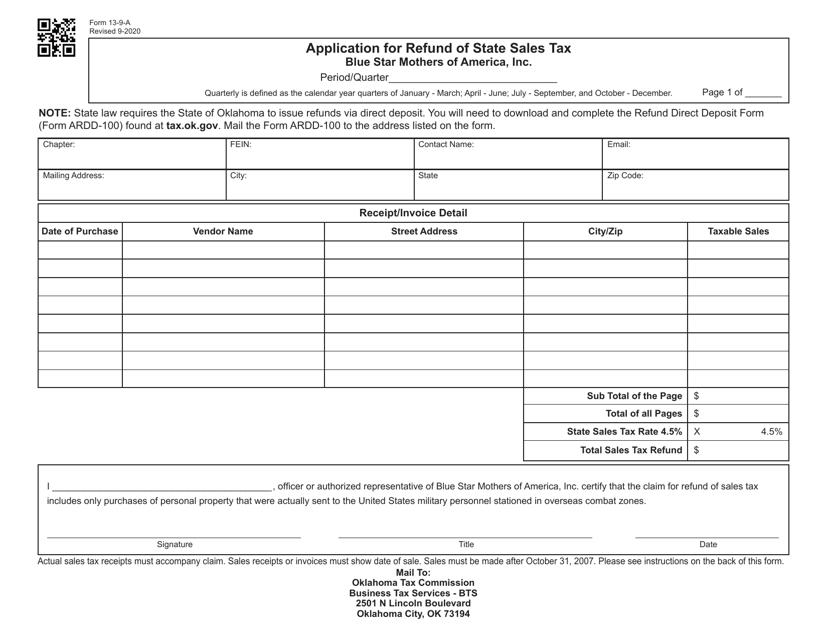

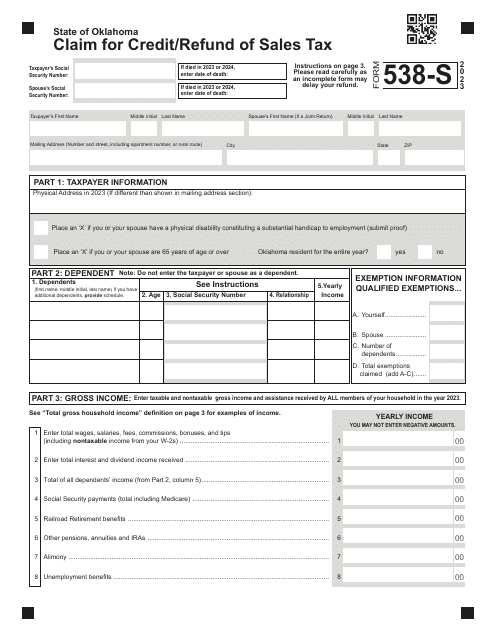

This form is used for applying for a refund of sales tax by the Blue Star Mothers of America in Oklahoma.

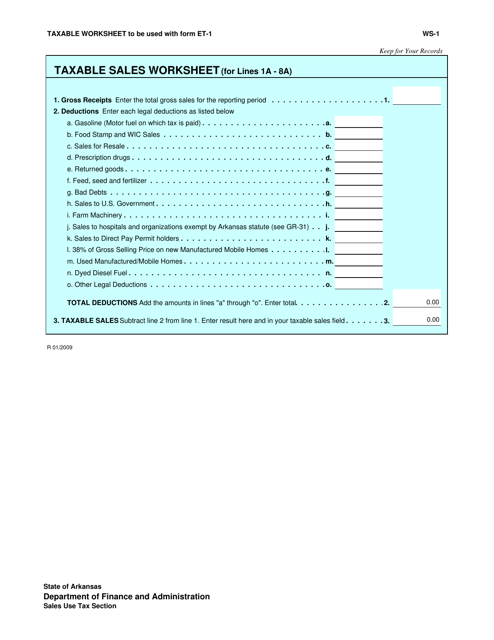

This document is used for calculating taxable sales in the state of Arkansas. It helps businesses determine the amount of sales that are subject to sales tax.

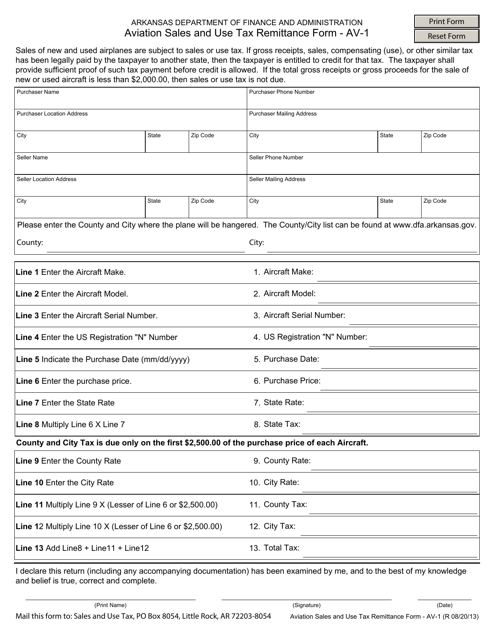

This form is used for remitting aviation sales and use tax in the state of Arkansas.

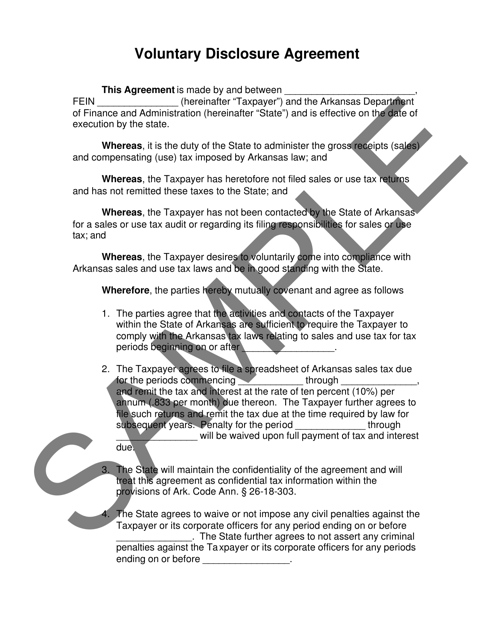

This Form is used for disclosing and resolving any past sales tax liabilities in Arkansas on a voluntary basis.

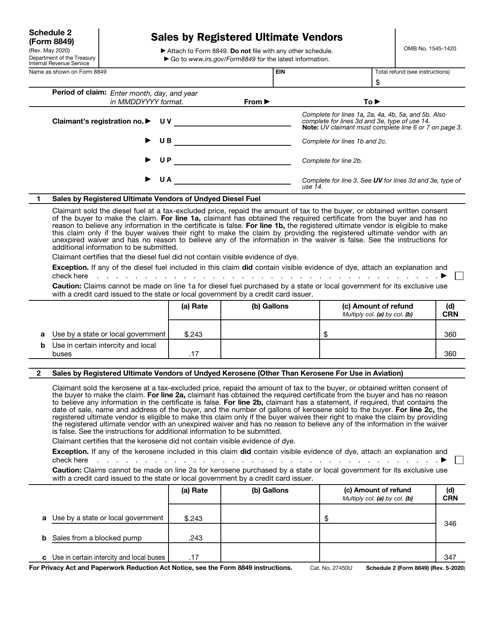

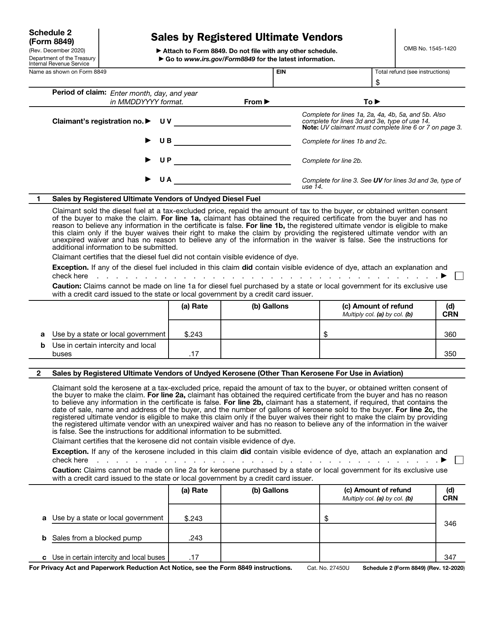

This Form is used for reporting sales made by registered ultimate vendors to claim a credit or refund.

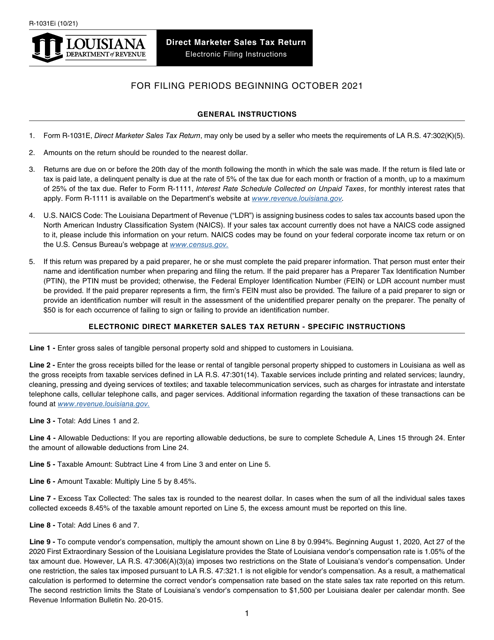

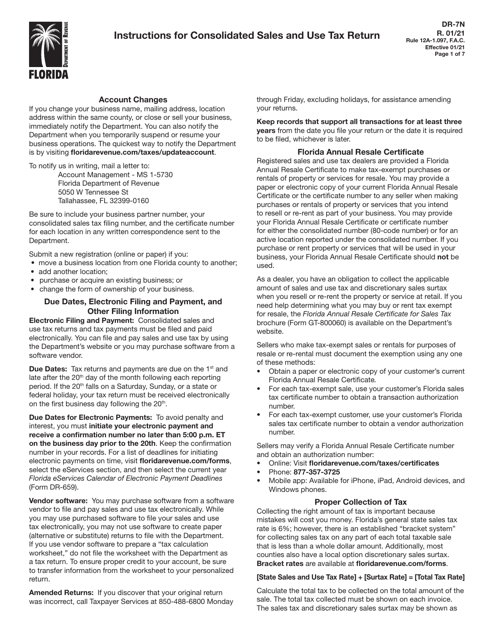

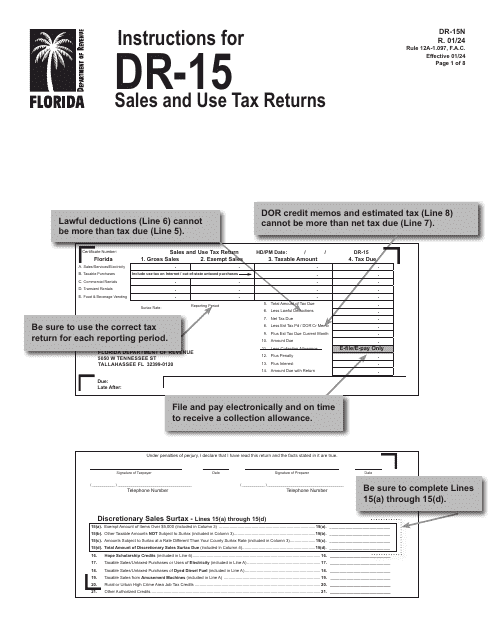

This Form is used for filing a Consolidated Sales and Use Tax Return in the state of Florida. It provides instructions on how to report and pay sales and use taxes for multiple locations or businesses on a single return.