Sales Tax Templates

Documents:

663

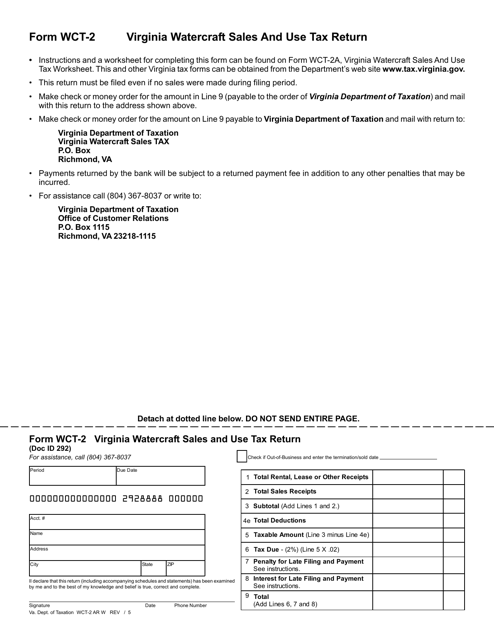

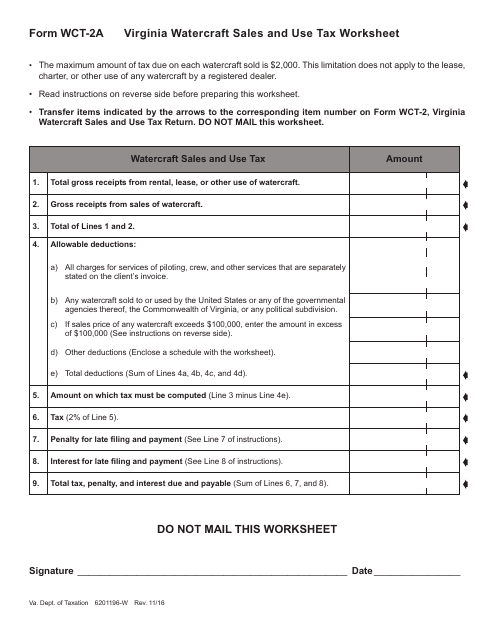

This form is used for reporting and paying sales and use tax on watercraft purchases in Virginia.

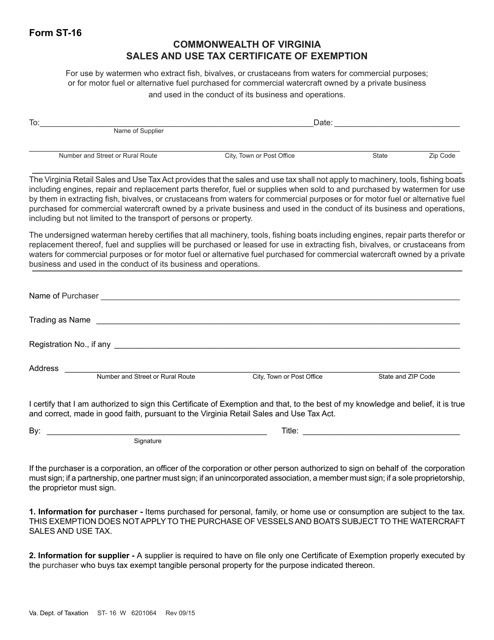

This form is used for the Sales and Use Tax Certificate of Exemption in Virginia.

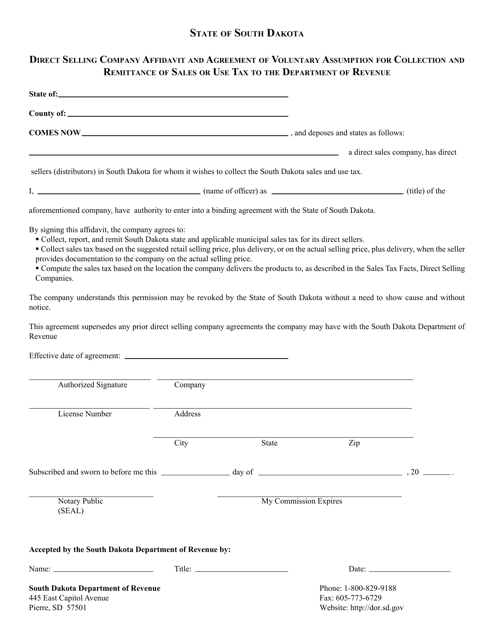

This document is used for a direct selling company to acknowledge and agree to voluntarily assume the responsibility of collecting and remitting sales or use tax to the Department of Revenue in South Dakota.

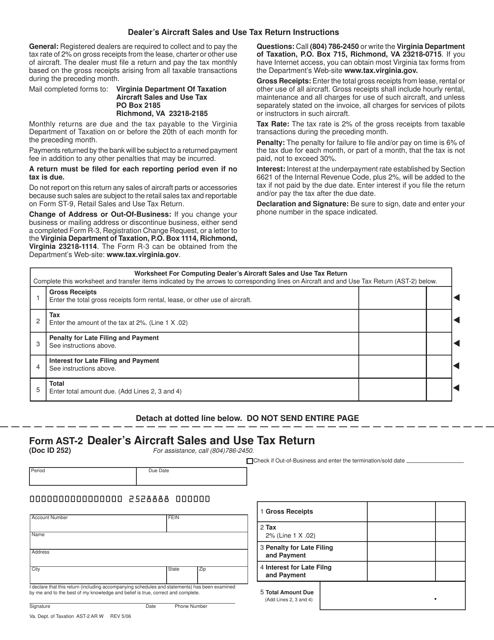

This form is used for reporting aircraft sales and use tax by dealers in Virginia.

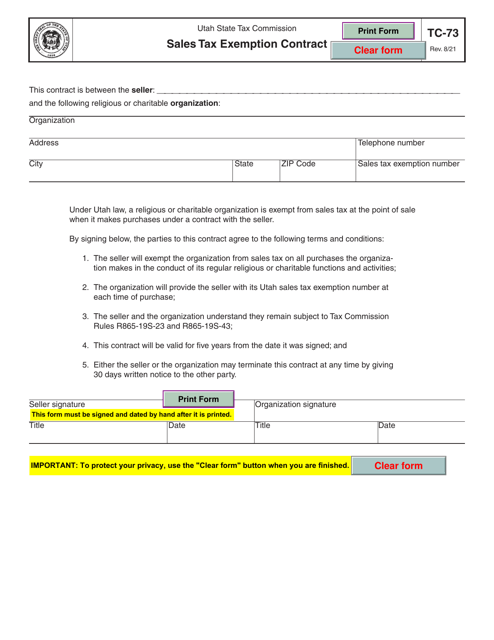

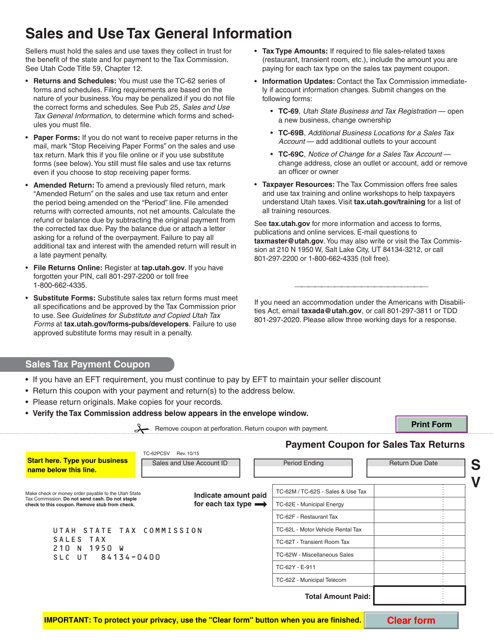

This Form is used for submitting sales tax payments in the state of Utah.

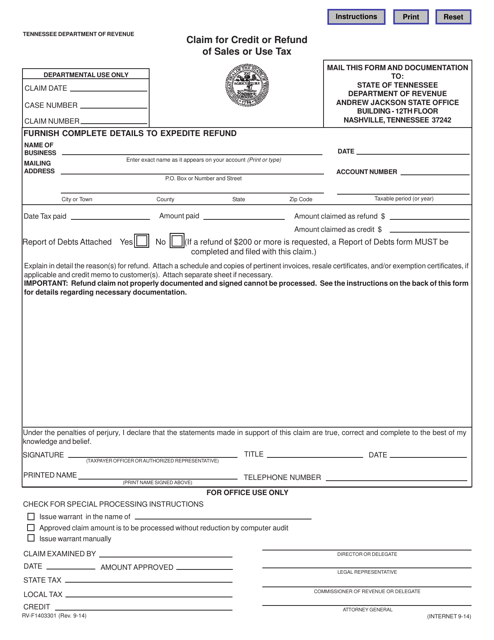

This form is used for claiming a credit or refund for sales or use tax paid in Tennessee.

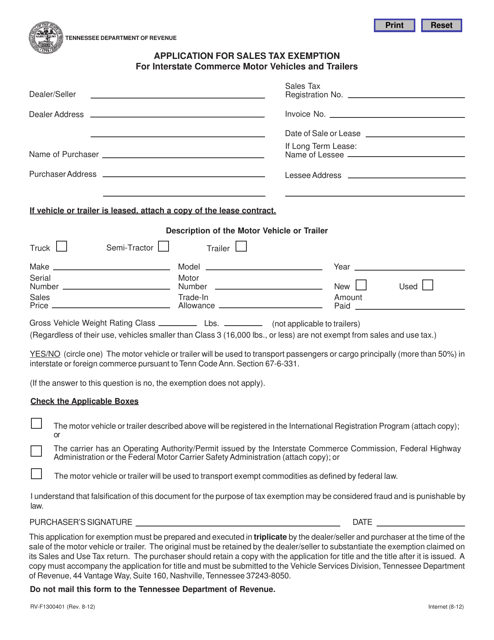

This form is used for applying for a sales tax exemption in Tennessee for motor vehicles and trailers used in interstate commerce.

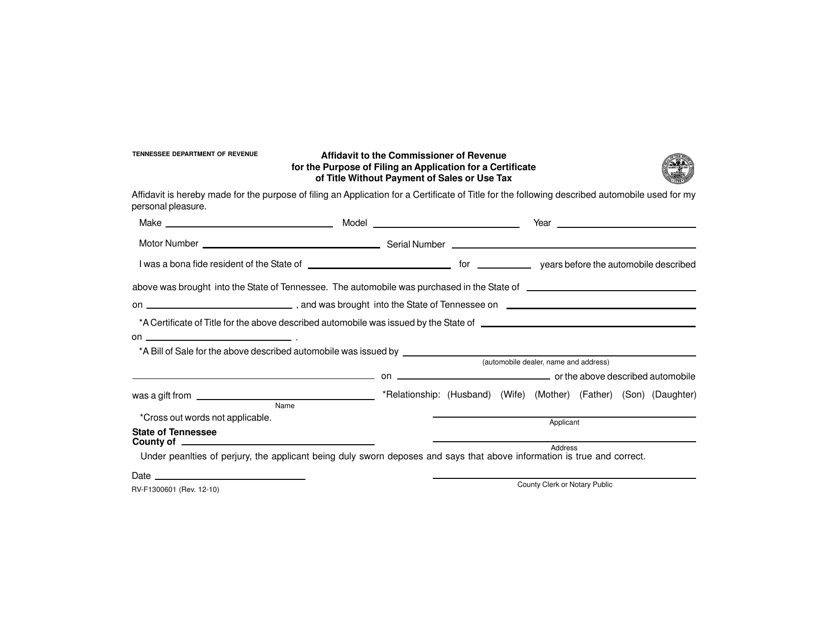

This form is used for filing an affidavit to the Commissioner of Revenue in Tennessee in order to apply for a certificate of title without payment of sales or use tax.

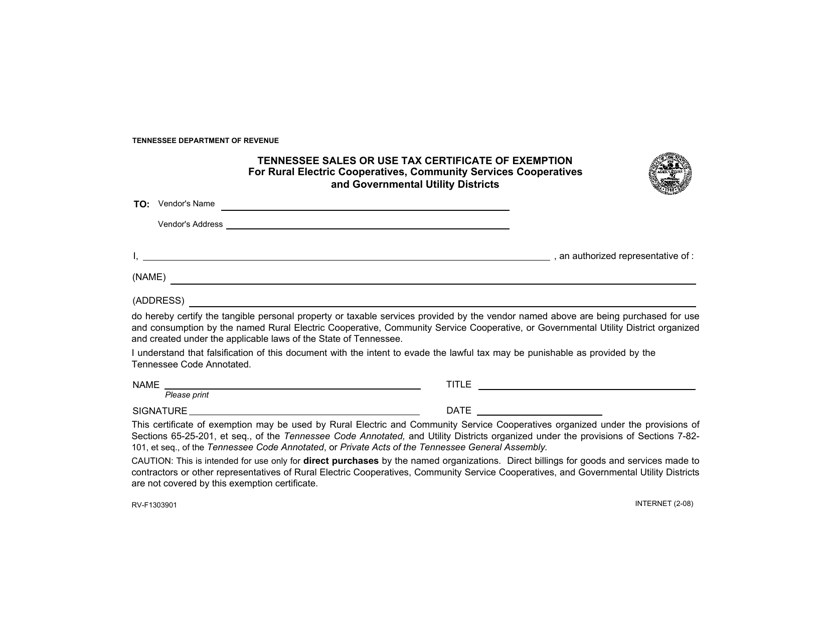

This form is used for rural electric cooperatives, community services cooperatives, and governmental utility districts in Tennessee to apply for a sales or use tax exemption certificate for certain items.

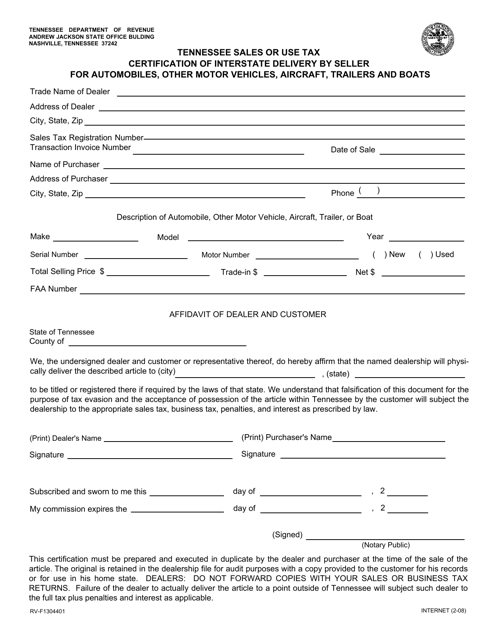

This form is used for sellers in Tennessee to certify the interstate delivery of automobiles, motor vehicles, aircraft, trailers, and boats for sales or use tax purposes. It ensures that the seller is exempt from collecting or remitting sales tax on these types of transactions.

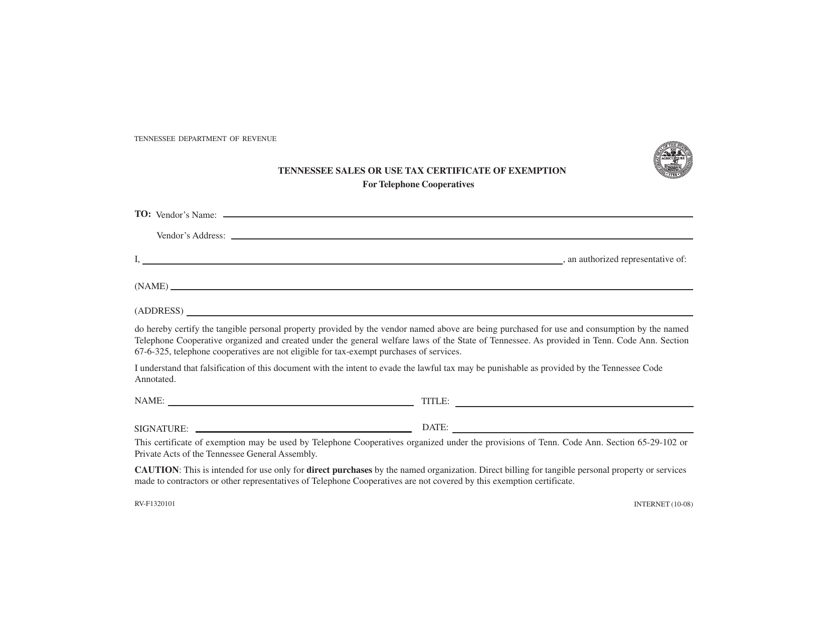

This form is used for Tennessee telephone cooperatives to obtain a sales or use tax exemption certificate.

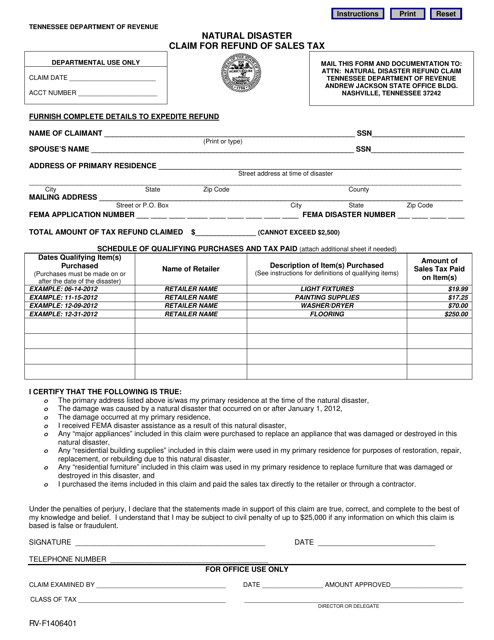

This form is used for filing a claim for refund of sales tax in the state of Tennessee due to a natural disaster.

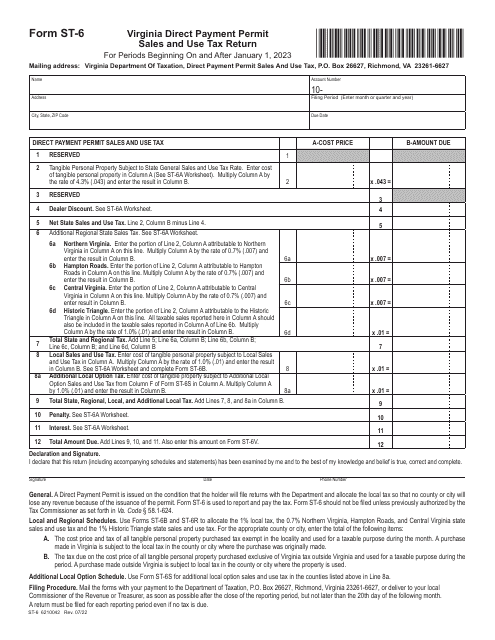

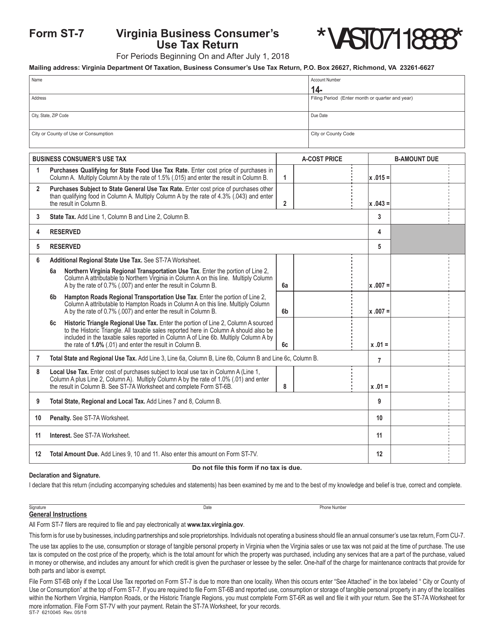

This Form is used for reporting and paying business consumer's use tax in the state of Virginia.

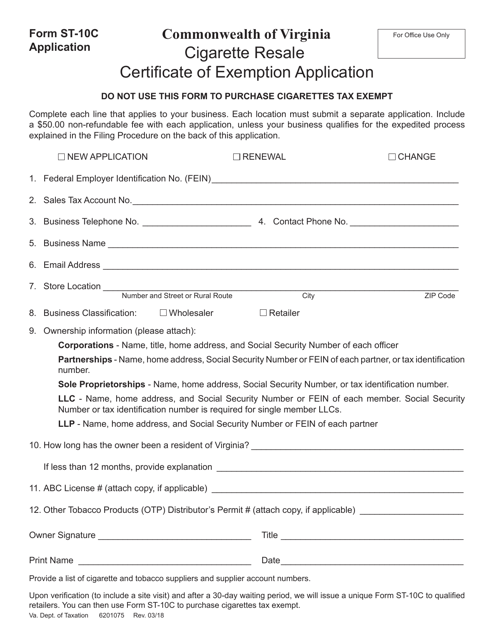

This Form is used for applying for a Cigarette Resale Certificate of Exemption in Virginia. It allows businesses to be exempt from paying sales tax on cigarettes that are intended for resale.

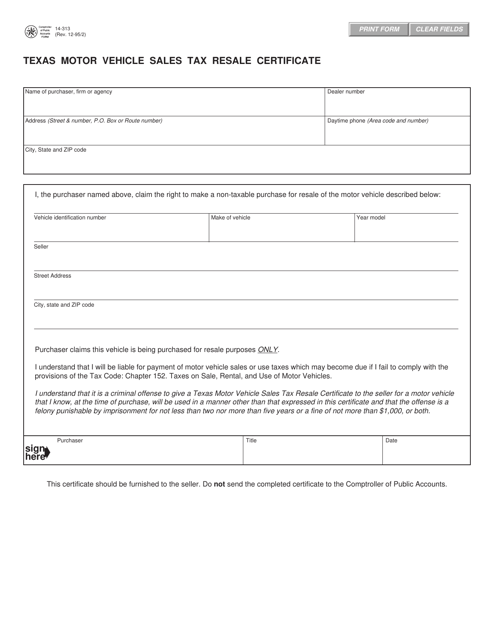

This form is used for obtaining a resale certificate for motor vehicle sales tax in Texas. It is used by businesses to avoid paying sales tax when purchasing vehicles for resale purposes.

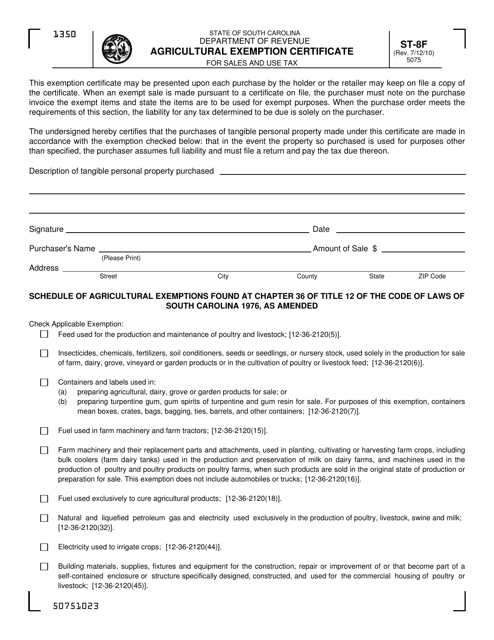

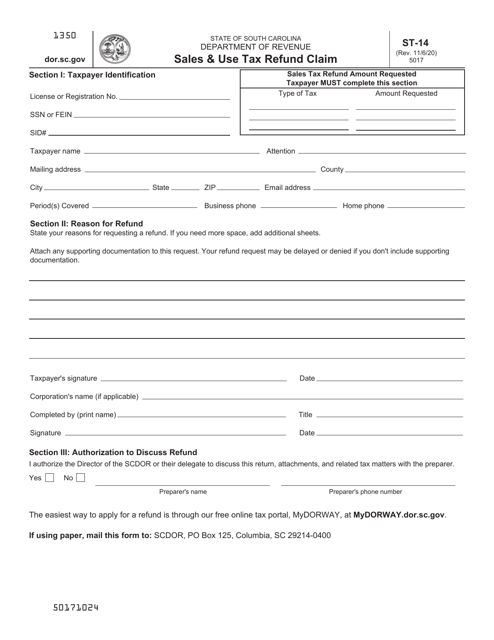

This form is used for claiming an exemption from sales and use tax on agricultural products in South Carolina. It provides instructions on how to properly fill out and submit the Form ST-8F Agricultural Exemption Certificate.

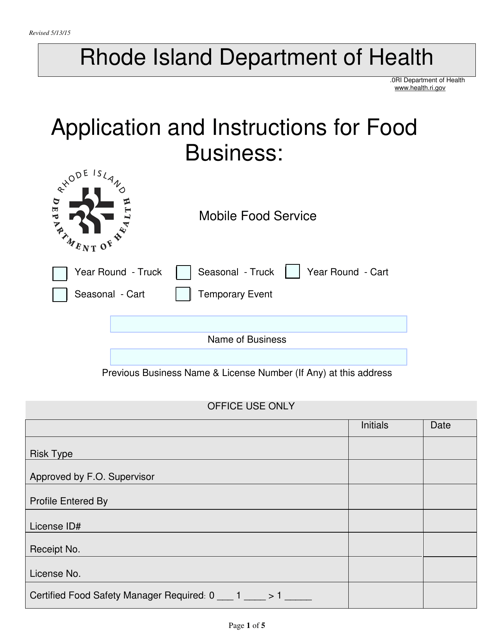

This document is for individuals or businesses who want to operate a mobile food service in Rhode Island. It is used to apply for a license to sell food from a mobile food truck or trailer.

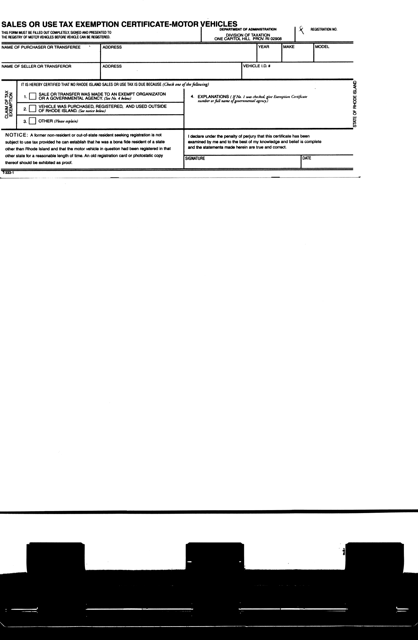

This form is used for claiming exemption from sales or use tax in the state of Rhode Island.

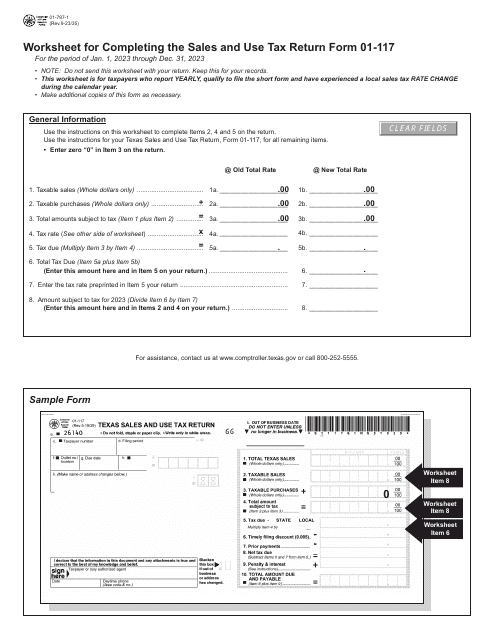

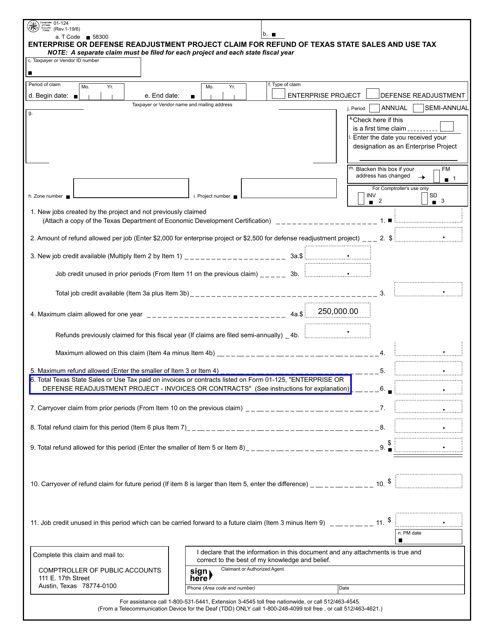

This form is used for claiming a refund of Texas State Sales and Use Tax for enterprise or defense readjustment projects in Texas.

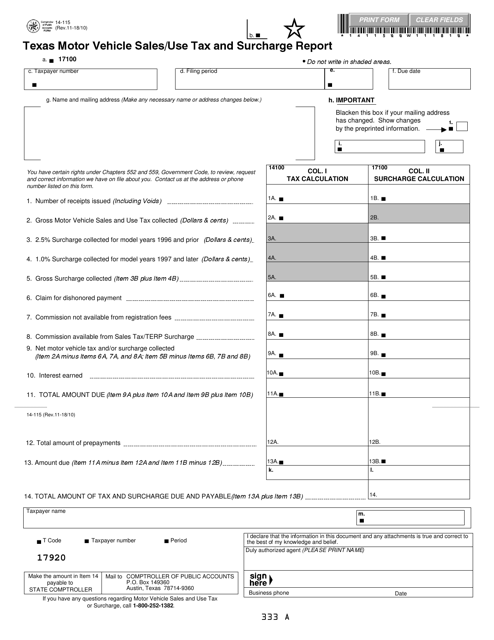

This Form is used for reporting sales and use tax on motor vehicles in Texas. It includes a surcharge report as well.

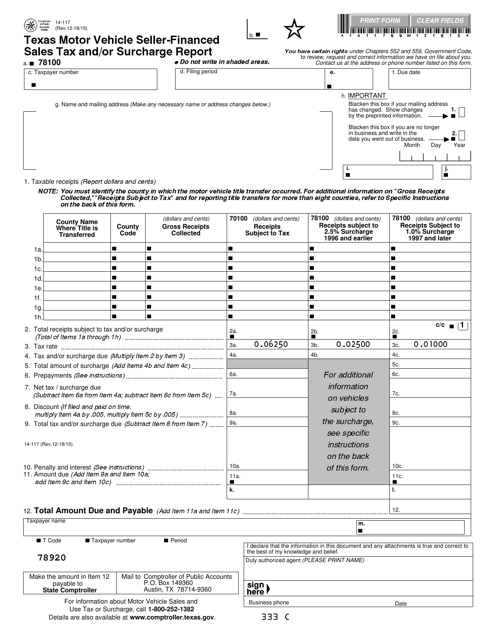

This form is used for reporting motor vehicle seller-financed sales tax and/or surcharge in the state of Texas. It is required for sellers who offer financing options to their customers when selling a motor vehicle.

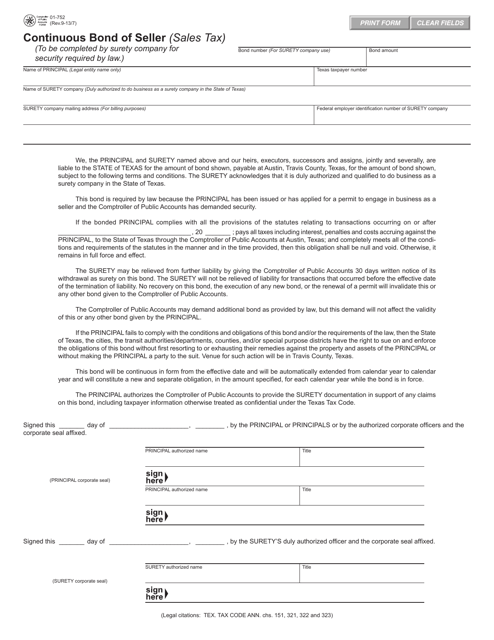

This form is used for submitting a continuous bond of seller for sales tax in the state of Texas.

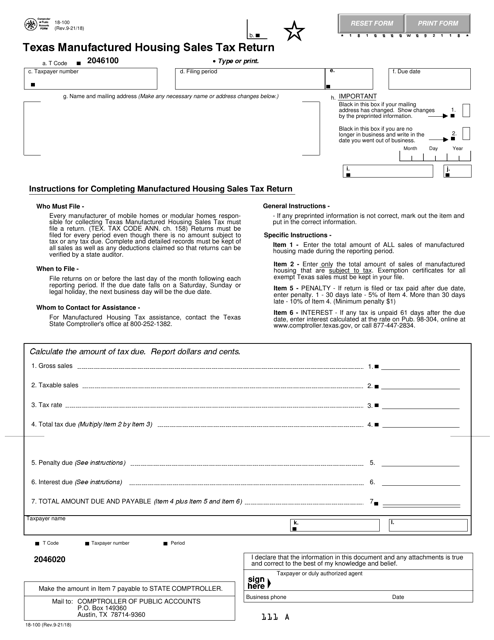

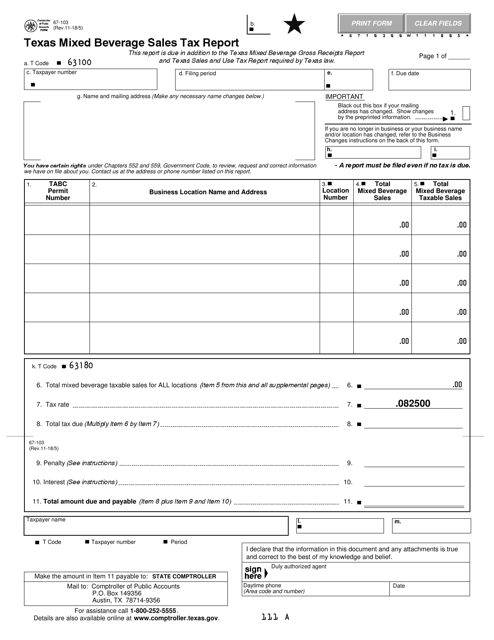

This form is used for reporting sales tax on mixed beverages in Texas. It is required by the Texas Comptroller's Office for businesses that sell mixed alcoholic drinks.

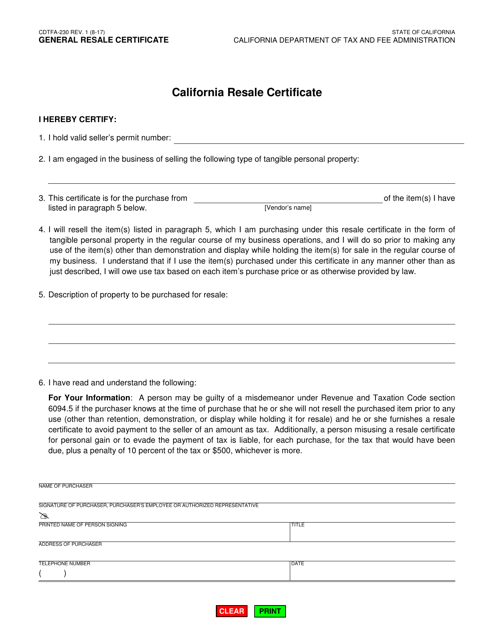

This is a California legal document a buyer presents to a seller from whom the buyer purchases various merchandise with the intent to resell it later in the usual course of business.

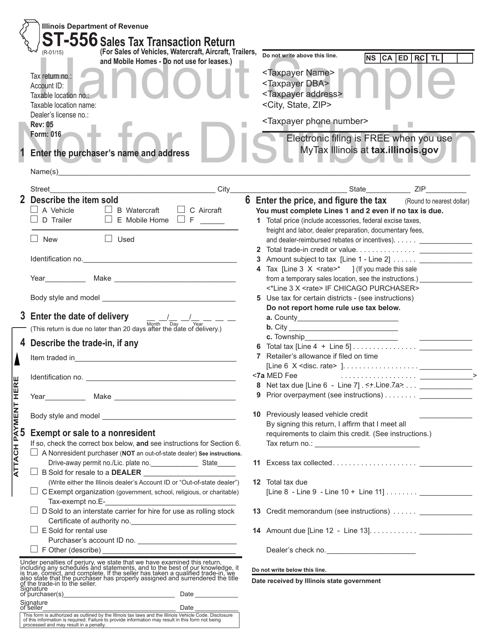

This is a form that is used to register a vehicle title with the State of Illinois government agency.