Sales Tax Templates

Documents:

663

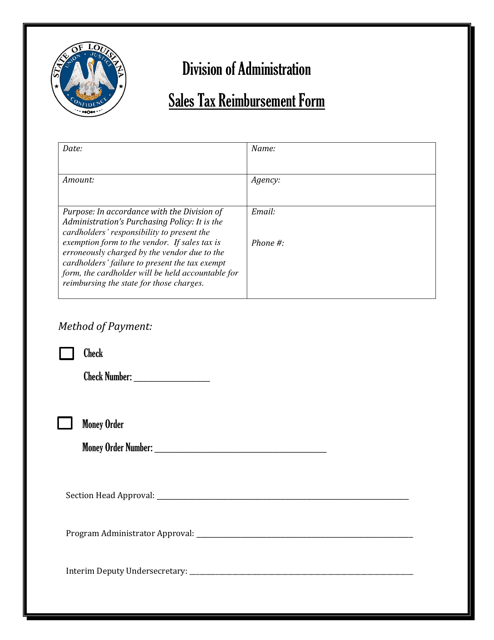

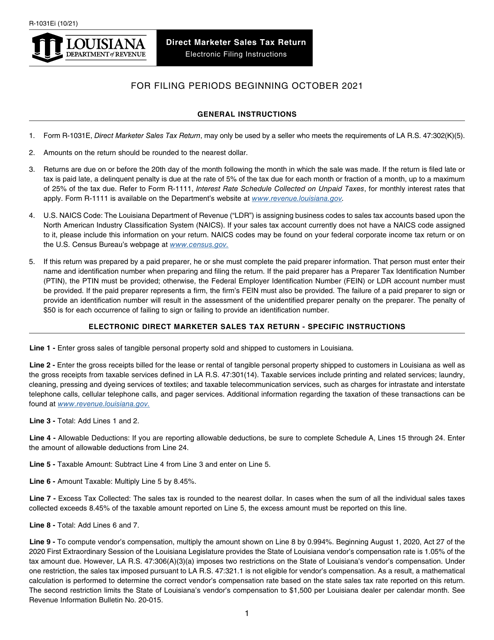

This form is used for requesting a reimbursement of sales tax paid in Louisiana.

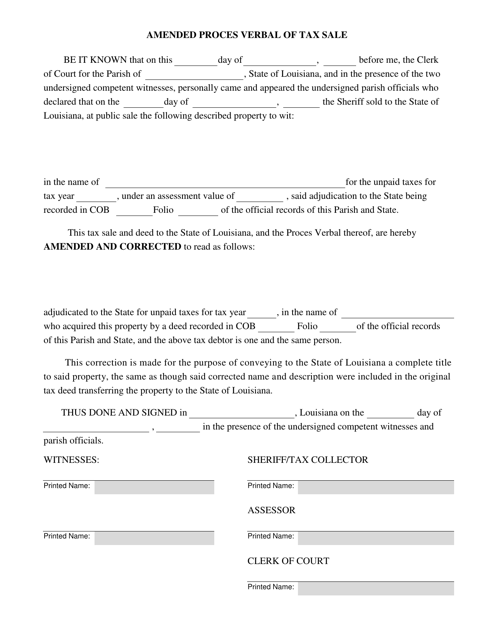

This document is used for making changes or corrections to the official record of a tax sale in Louisiana. It is a legal document that updates the details of the sale.

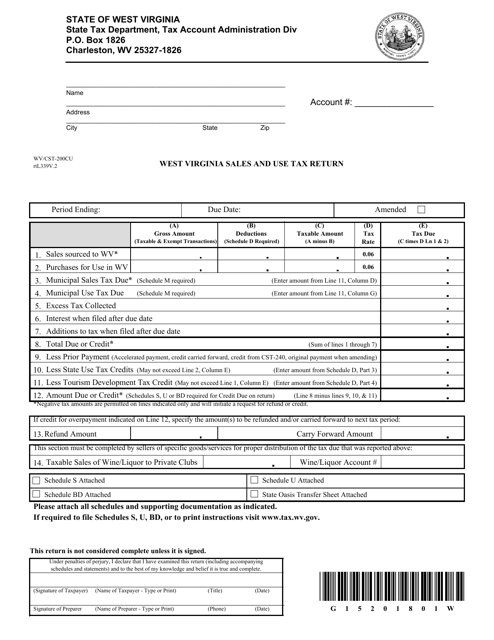

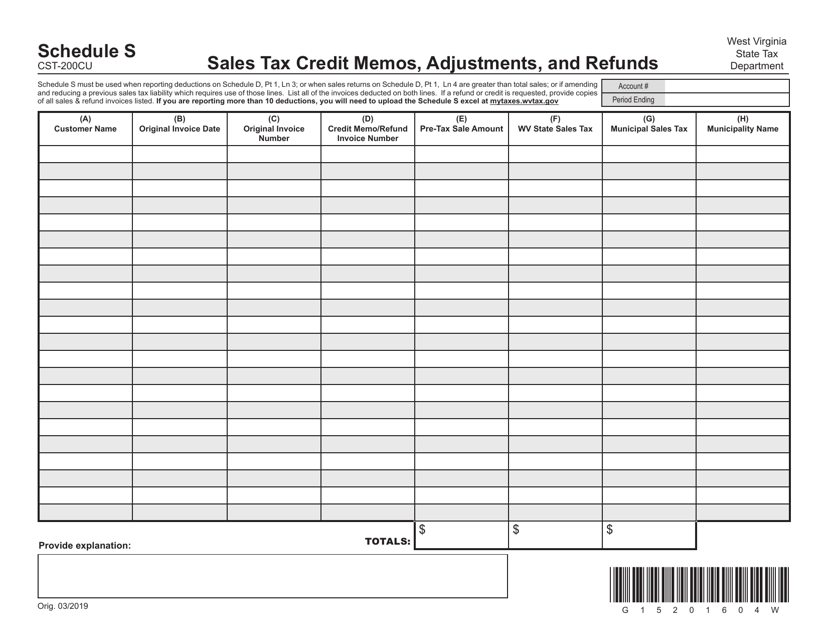

This Form is used for filing the West Virginia Sales and Use Tax Return in the state of West Virginia.

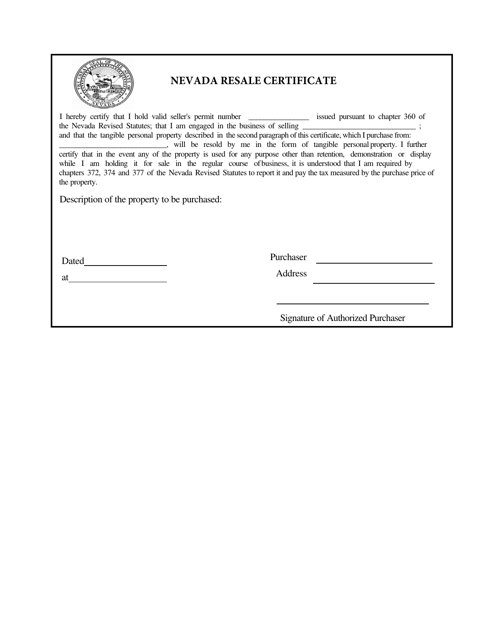

This document is used for obtaining a resale certificate in the state of Nevada. It allows businesses to purchase goods for resale without paying sales tax.

This Form is used for accounting and reporting sales tax in the state of Alabama.

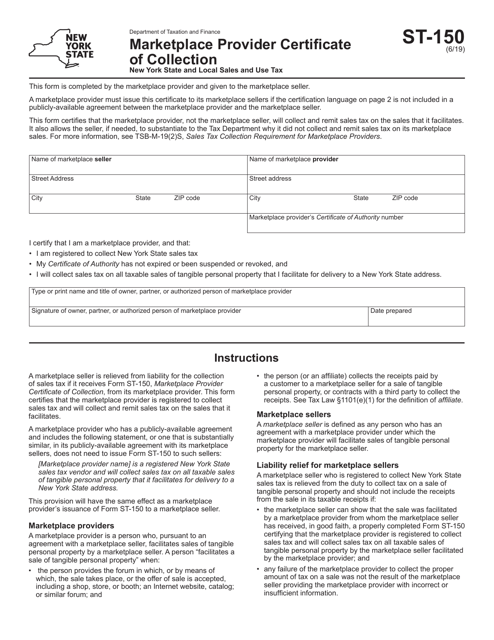

This form is used for marketplace providers in New York to certify their sales tax collection activities.

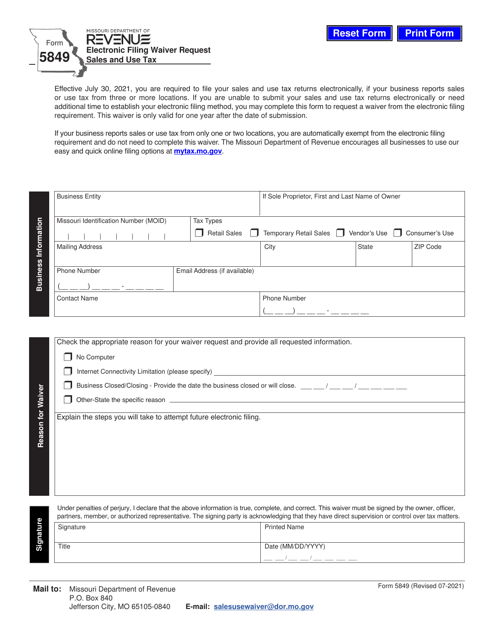

This form is used for requesting a waiver to electronically file sales and use tax returns in Missouri.

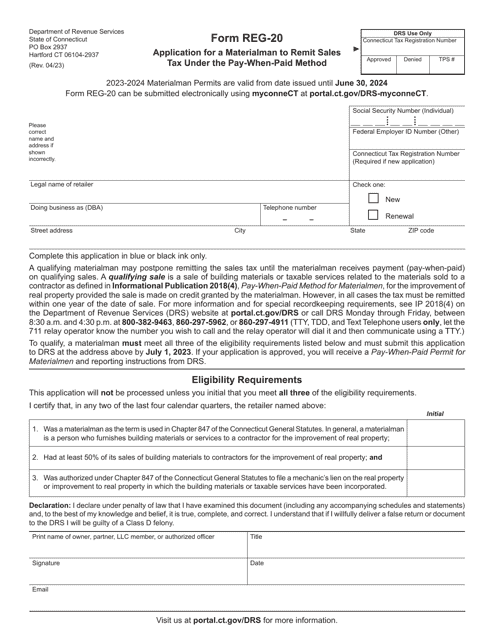

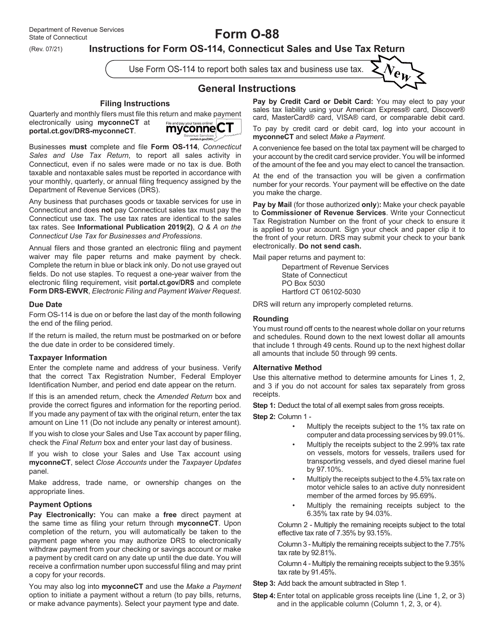

This Form is used for reporting and paying Connecticut sales and use tax. It is required for businesses operating in Connecticut to accurately report their sales and use tax obligations.

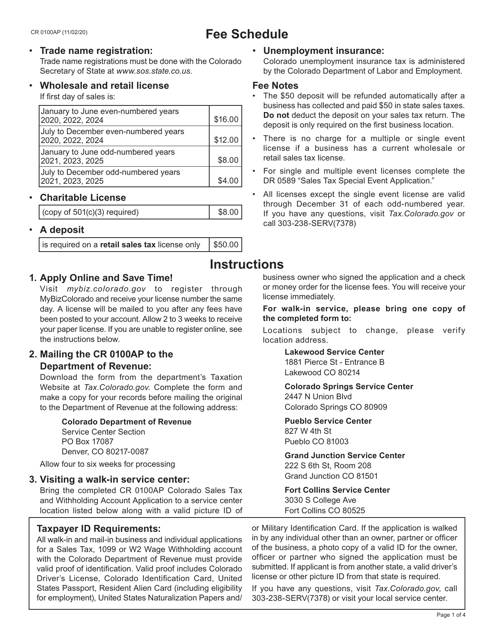

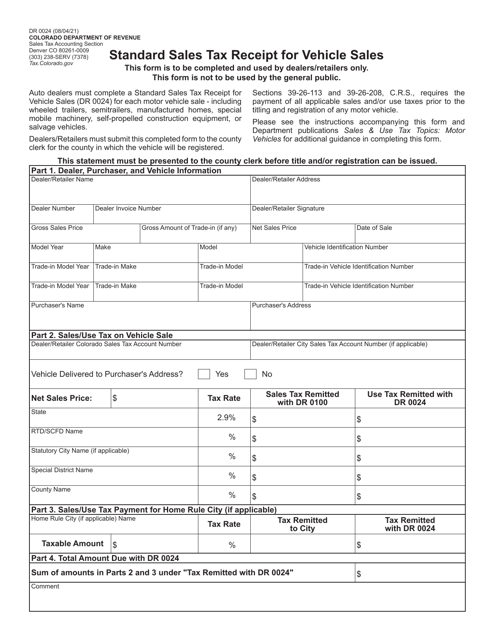

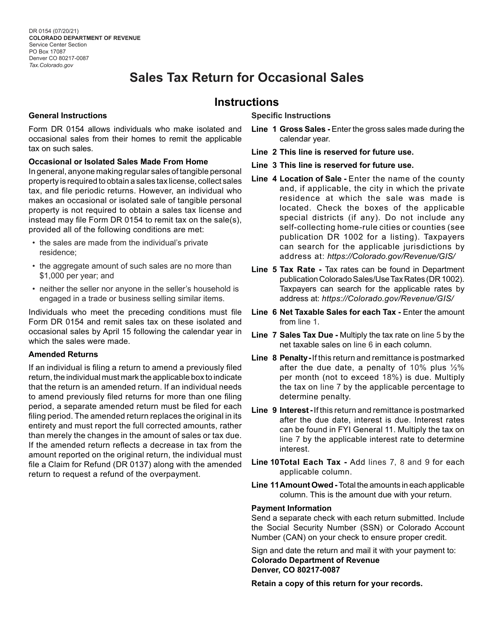

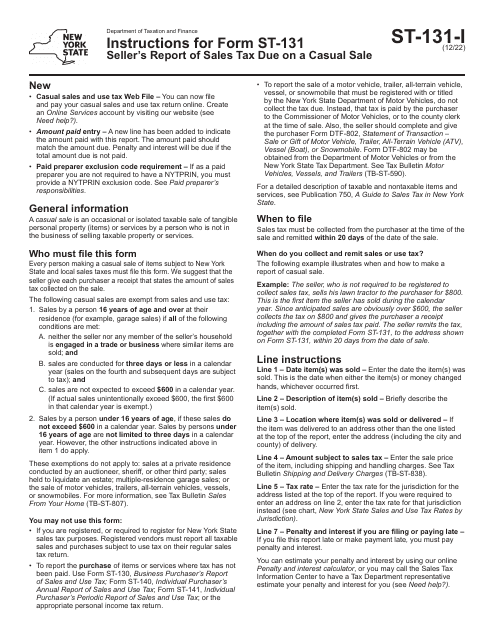

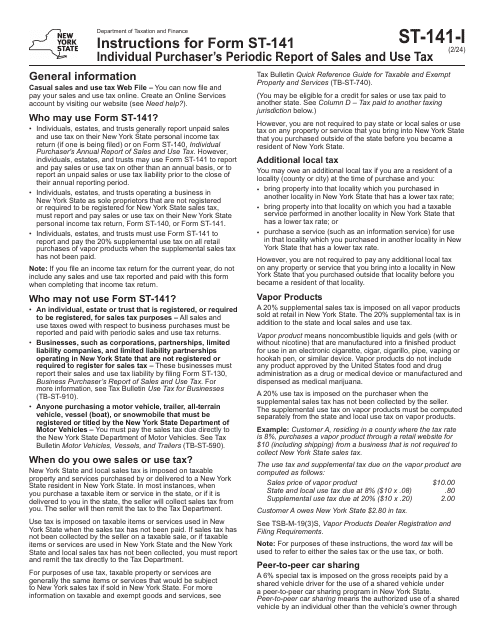

This form is used for reporting occasional sales and remitting sales tax in Colorado.

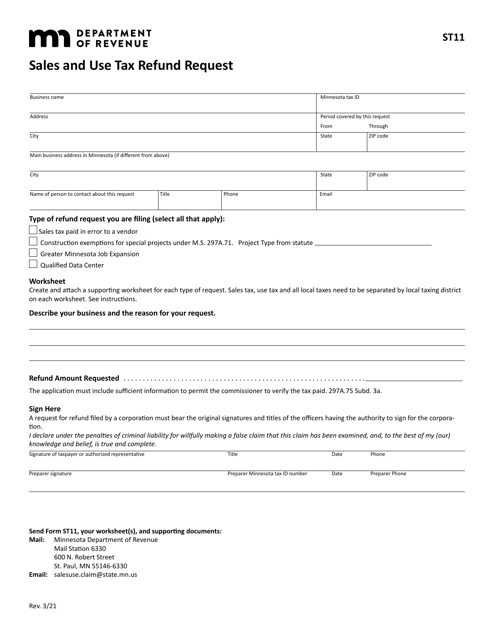

This form is used for requesting a refund of sales and use tax in the state of Minnesota.

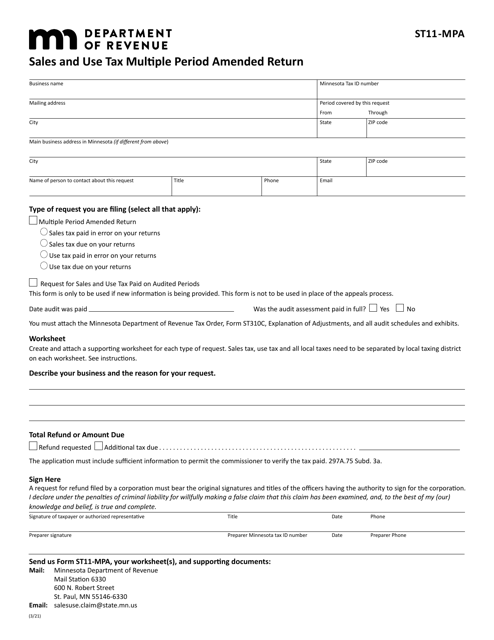

This form is used for filing an amended sales and use tax return for multiple periods in Minnesota.

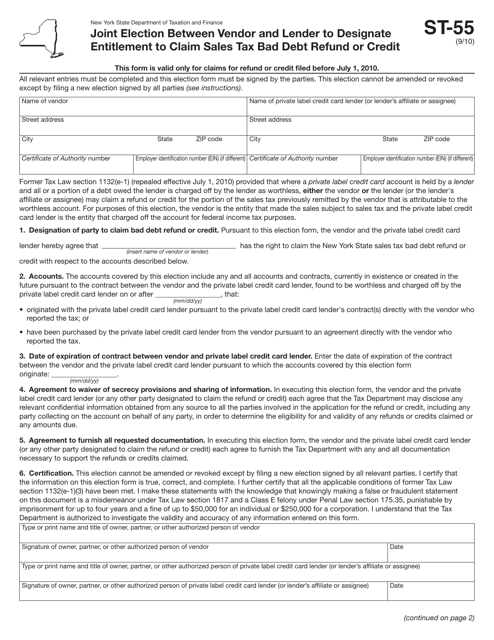

This Form is used for vendors and lenders in New York to jointly designate entitlement to claim sales tax bad debt refund or credit.

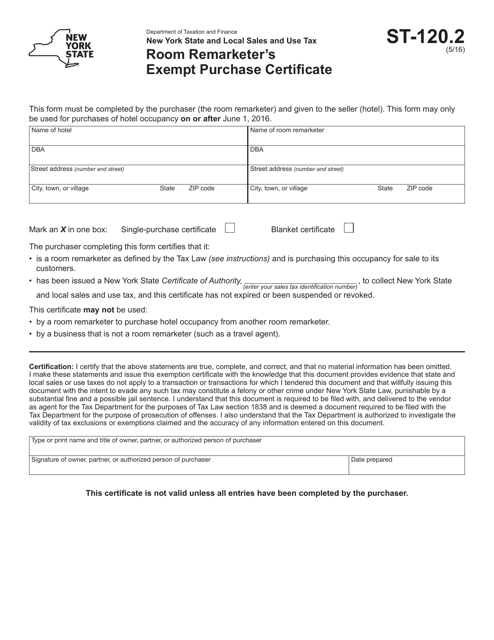

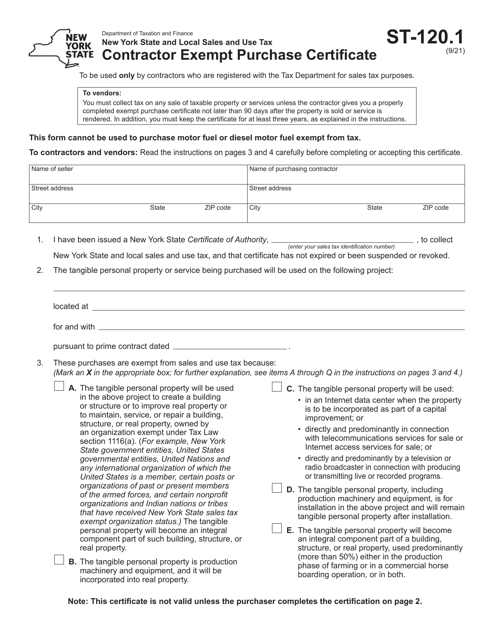

This document is used for exempt purchases made by room remarketers in New York.

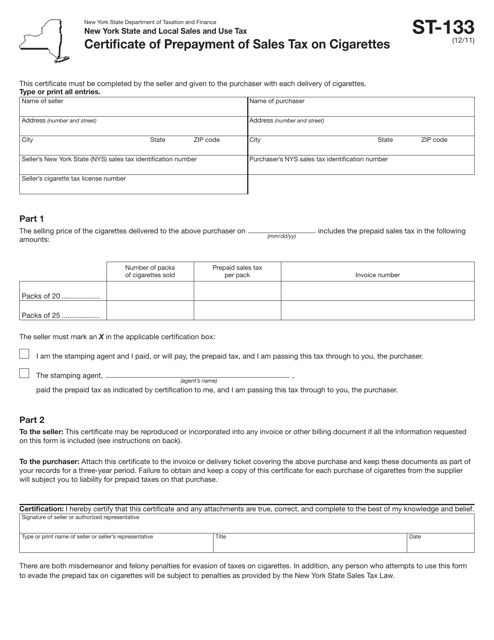

This form is used for certifying the prepayment of sales tax on cigarettes in the state of New York. It serves as proof that the required sales tax on cigarettes has been paid in advance.

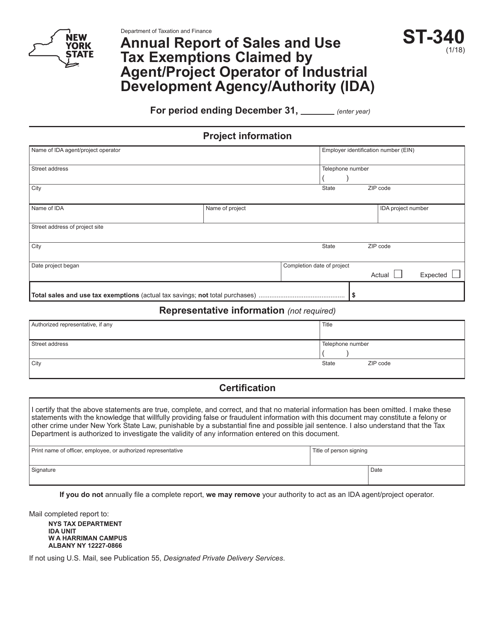

This document is used for reporting sales and use tax exemptions claimed by an agent or project operator of an Industrial Development Agency/Authority (IDA) in New York.

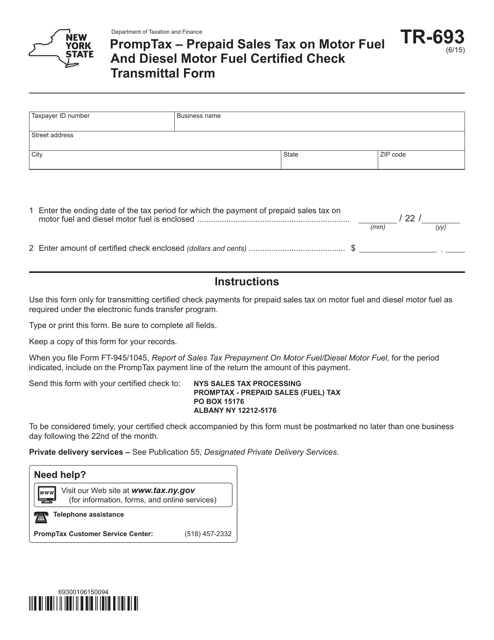

This form is used for transmitting certified checks for prepaid sales tax on motor fuel and diesel motor fuel in New York.