Sales Tax Templates

Documents:

663

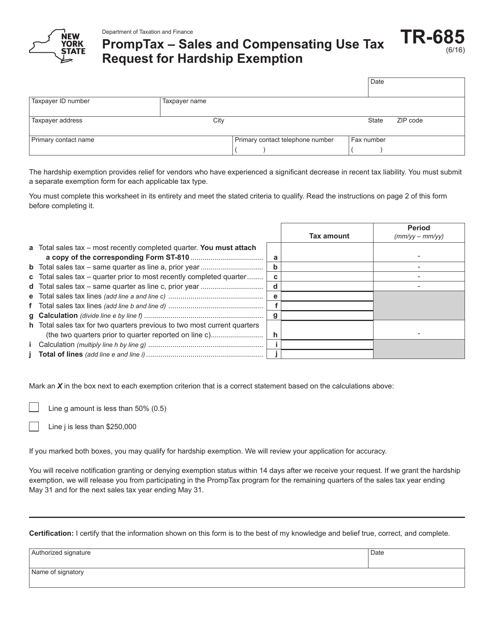

This form is used for requesting a hardship exemption from the sales and compensating use tax in the state of New York. It is specifically designated as Form TR-685 Promptax.

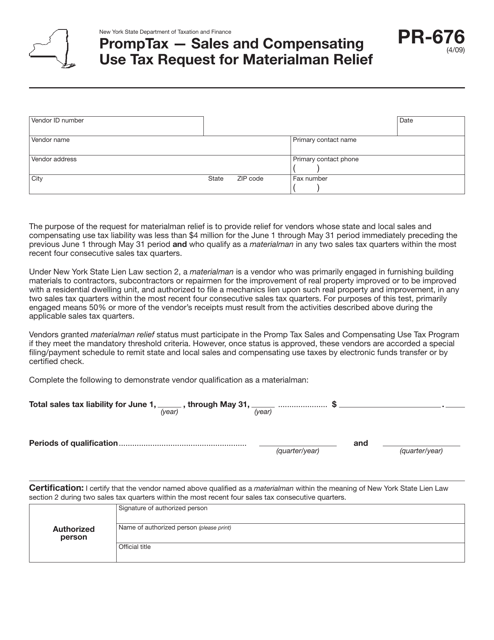

This Form is used for requesting materialman relief from sales and compensating use tax in New York.

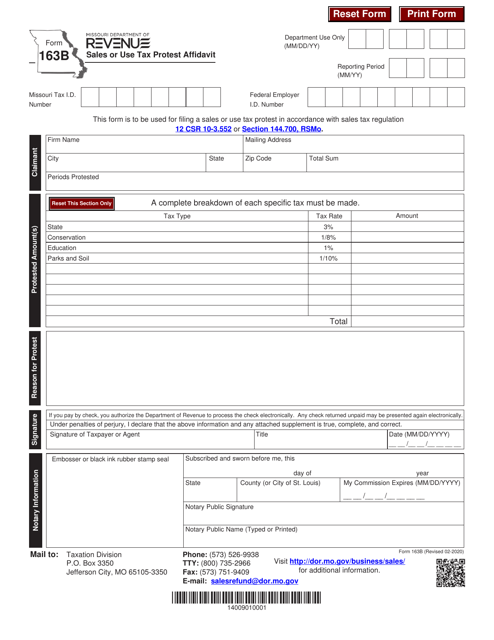

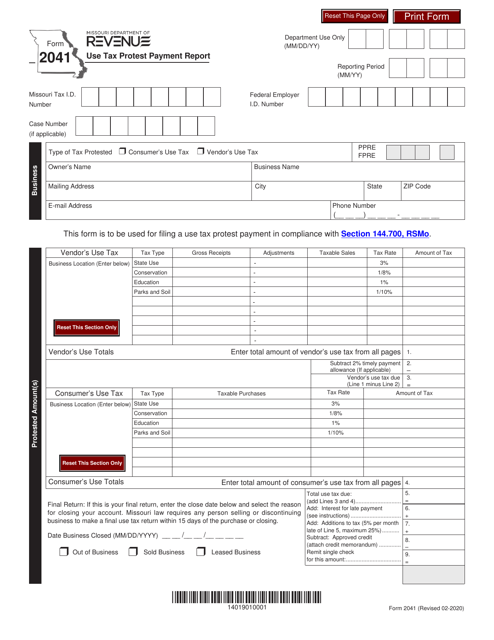

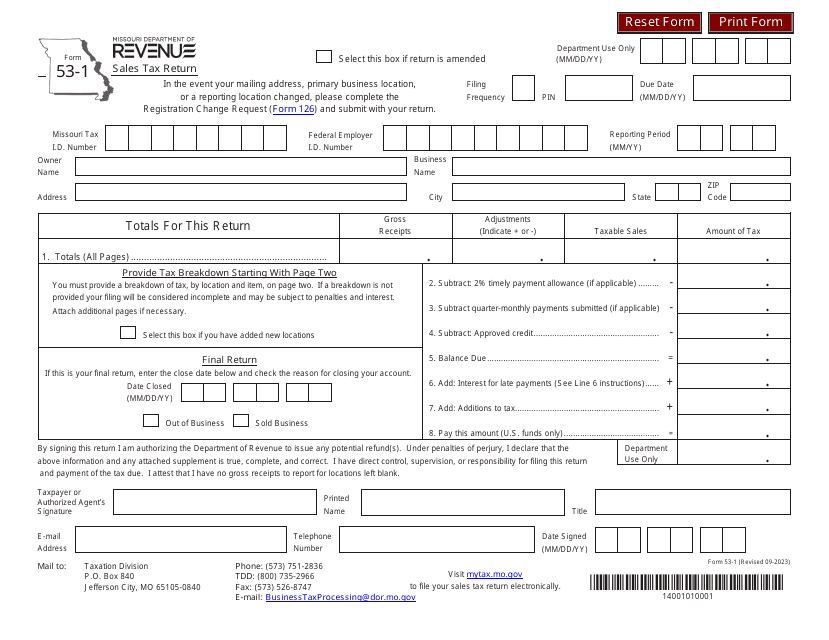

This form is used for protesting sales or use tax in the state of Missouri. It allows individuals to submit a formal affidavit to challenge the amount of tax owed.

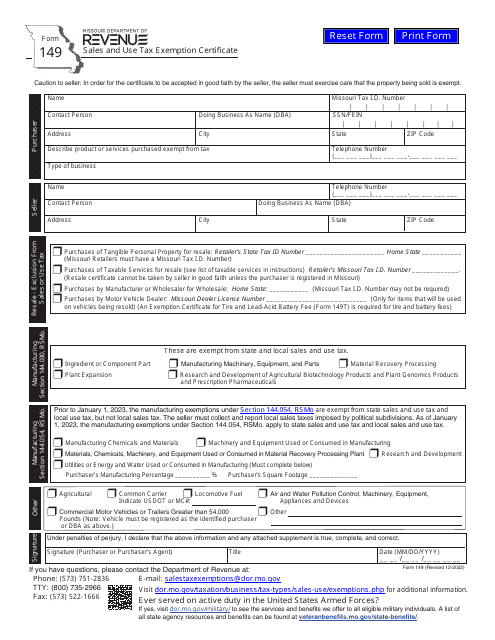

This form is used for reporting and protesting use tax payments in the state of Missouri. It allows individuals and businesses to dispute any taxes they believe were incorrectly imposed on their purchases.

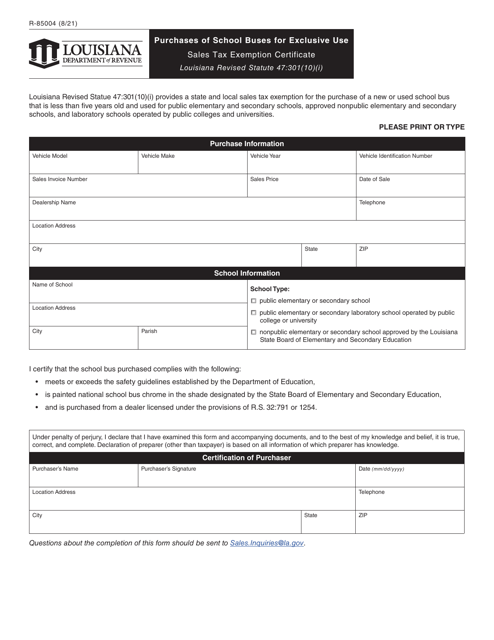

Form R-85004 Purchases of School Buses for Exclusive Use Sales Tax Exemption Certificate - Louisiana

This form is used for claiming a sales tax exemption when purchasing school buses in Louisiana that will be exclusively used for school-related purposes.

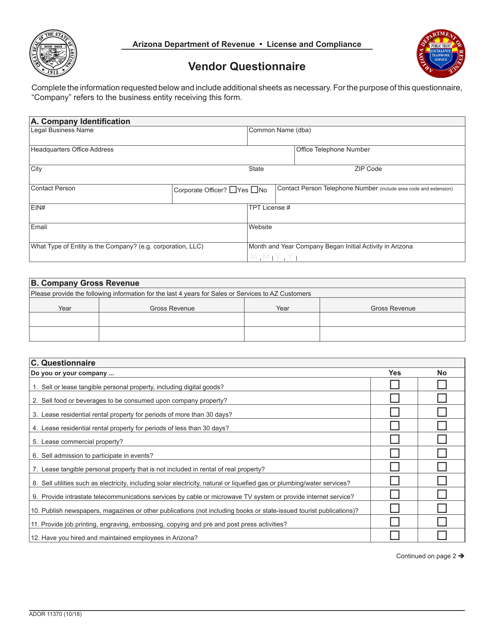

This form is used for vendors to complete a questionnaire in Arizona.

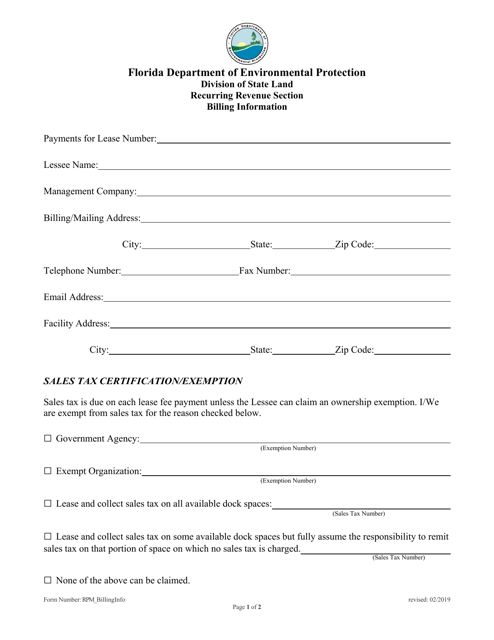

This form is used for requesting sales tax exemption in the state of Florida. It is required for individuals or businesses seeking tax exemption on certain purchases.

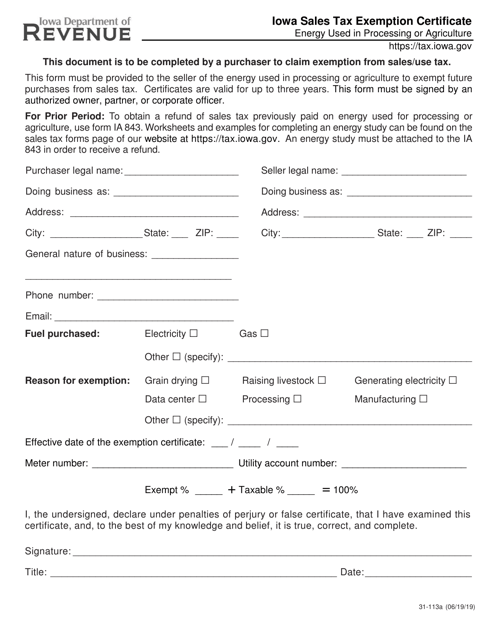

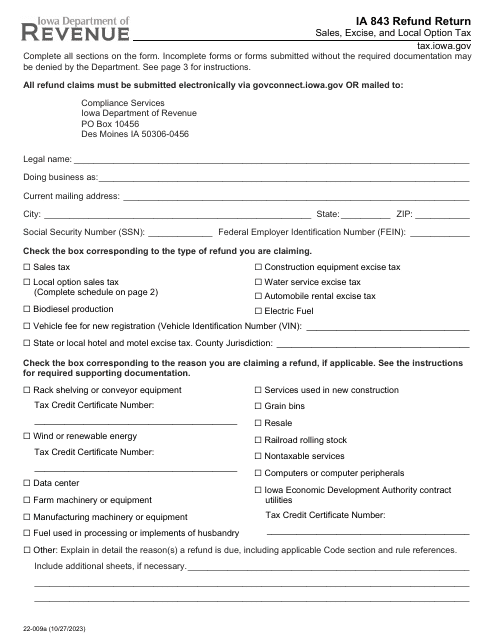

This form is used for Iowa residents to claim sales tax exemption on energy used in processing or agriculture in the state of Iowa.

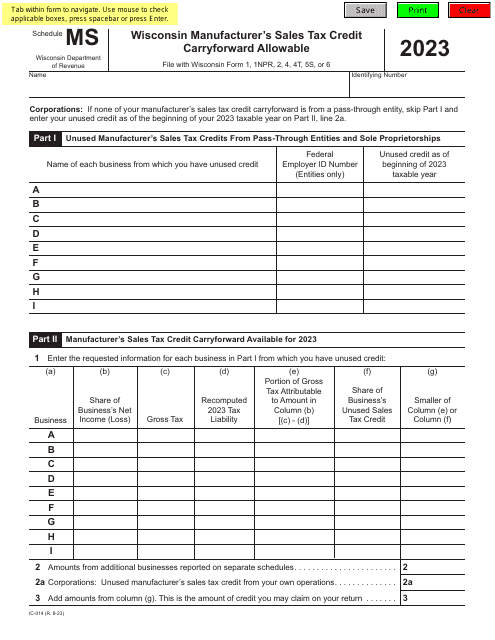

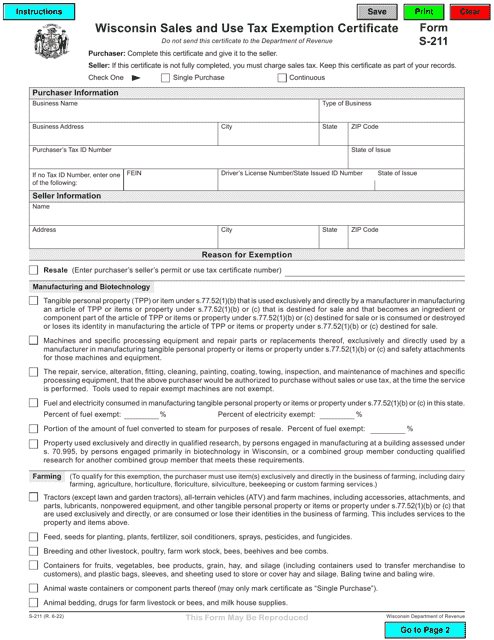

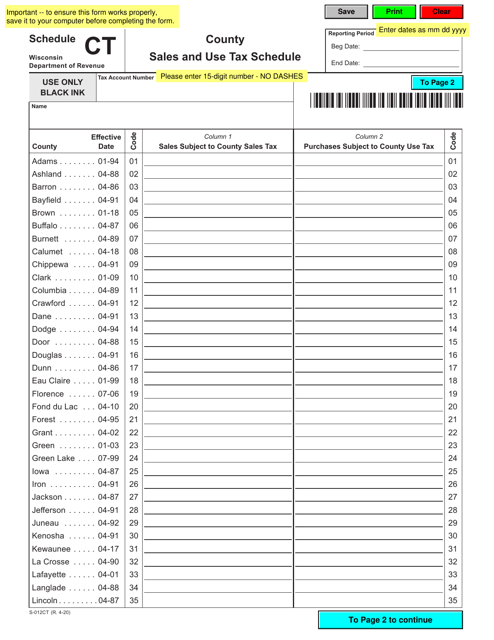

This form is used for reporting county sales and use tax in Wisconsin.

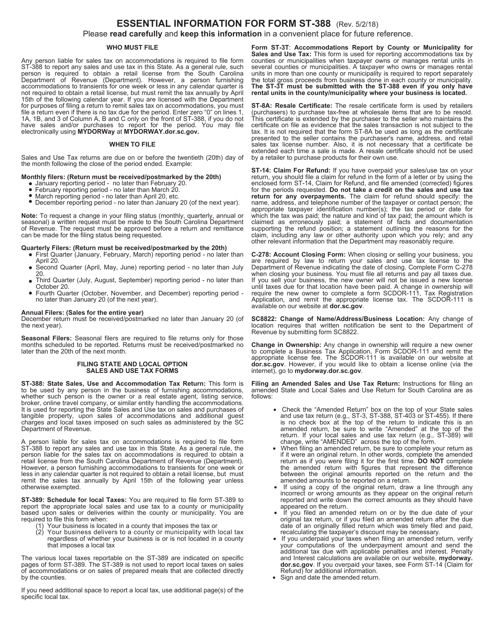

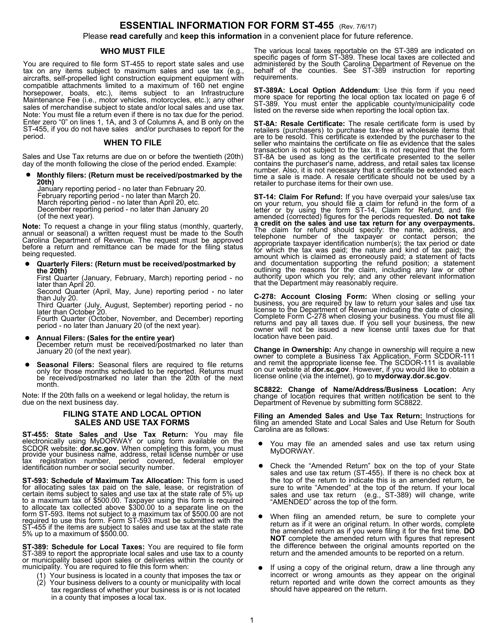

This Form is used for filing the State Sales, Use, and Accommodations Tax Return in South Carolina. It provides instructions on how to report and pay sales, use, and accommodations taxes to the state.

This Form is used for filing state sales, use, and maximum tax return for businesses in South Carolina. It provides instructions on how to report and pay the taxes owed.

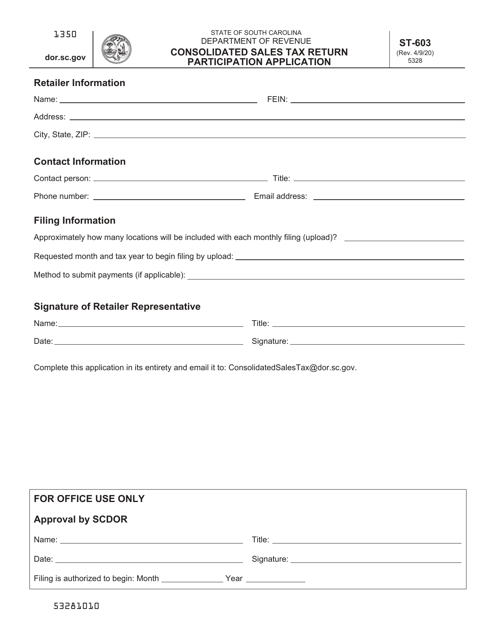

This form is used for applying to participate in the South Carolina Consolidated Sales Tax Return program.

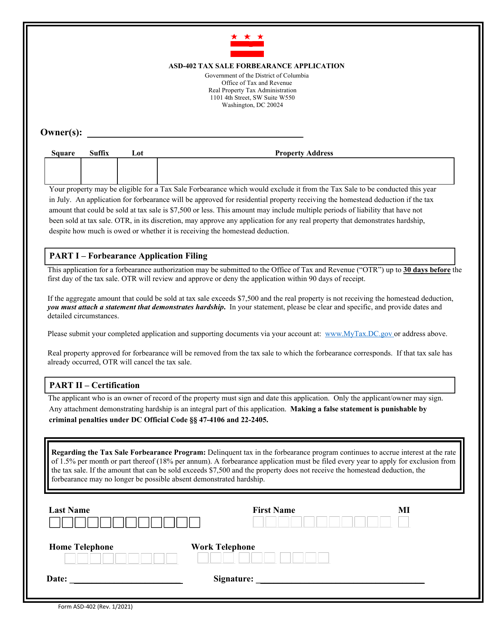

This form is used for applying for tax sale forbearance in Washington, D.C.

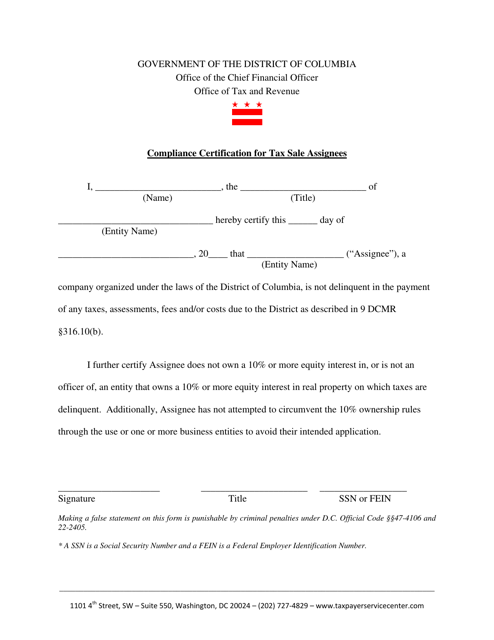

This document certifies compliance for tax sale assignees in Washington, D.C. It ensures that assignees have met all necessary requirements for participating in tax sales.

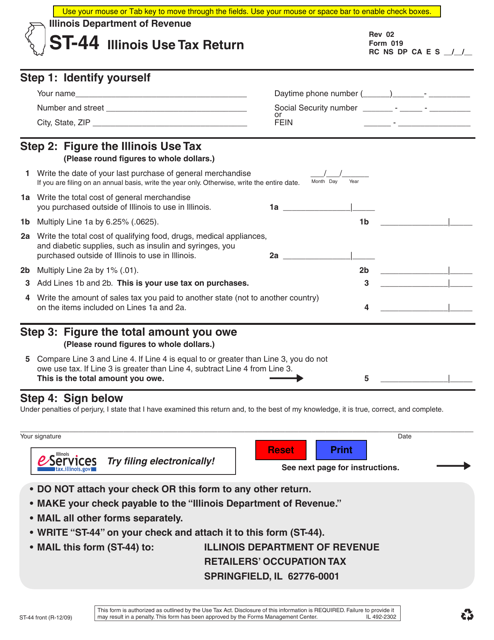

This document is the Use Tax Return Form (ST-44) for the state of Illinois. It is used to report and pay use tax on purchases made from out-of-state retailers when sales tax was not collected.

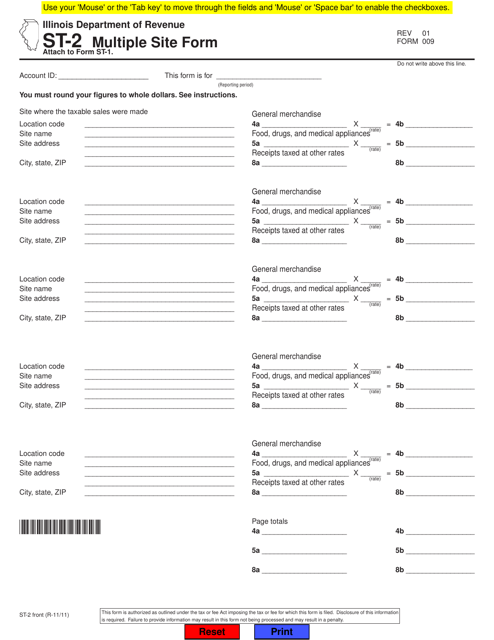

This form is used for reporting sales tax information for multiple sites in the state of Illinois.

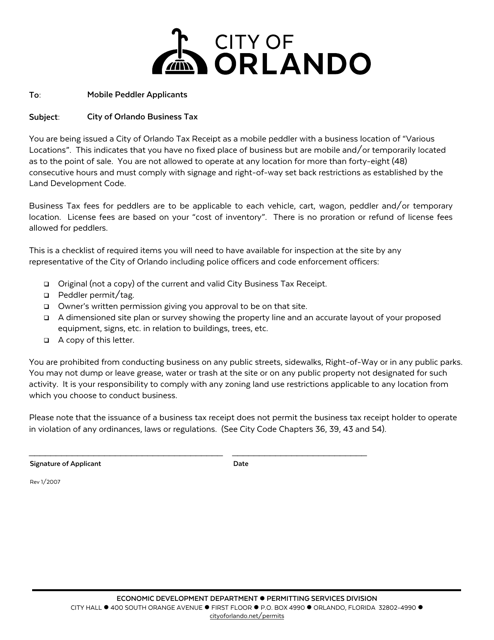

This document is a checklist used by mobile peddlers in the City of Orlando, Florida. It includes the requirements and guidelines that need to be followed by mobile peddlers when operating in the city.

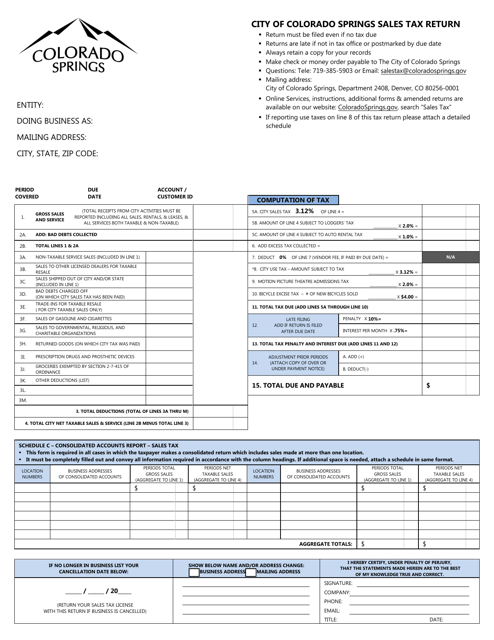

This sales and use tax return form is used by businesses in the City of Colorado Springs, Colorado to report and pay their sales and use tax at a rate of 3.12%.

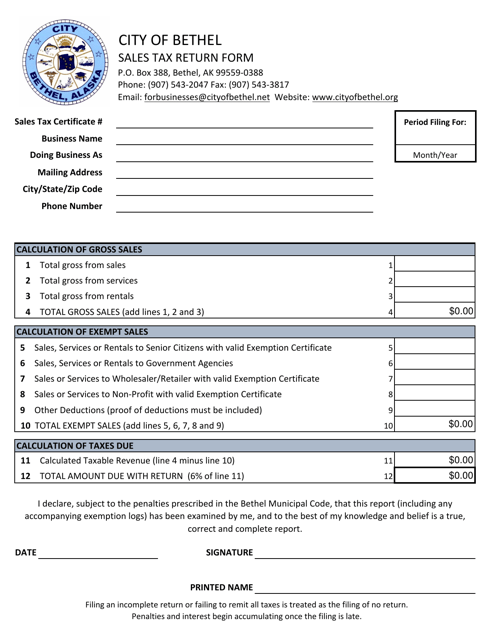

This form is used for reporting and submitting sales tax returns to the City of Bethel, Alaska. It is required for businesses operating within the city limits to collect and remit sales tax on their sales transactions.

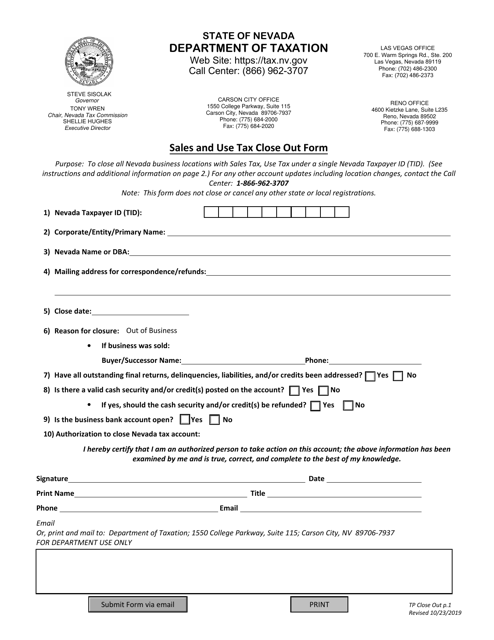

This form is used for closing out sales and use tax accounts in the state of Nevada. It helps businesses ensure that all tax obligations have been met and provides a record of the closure process.

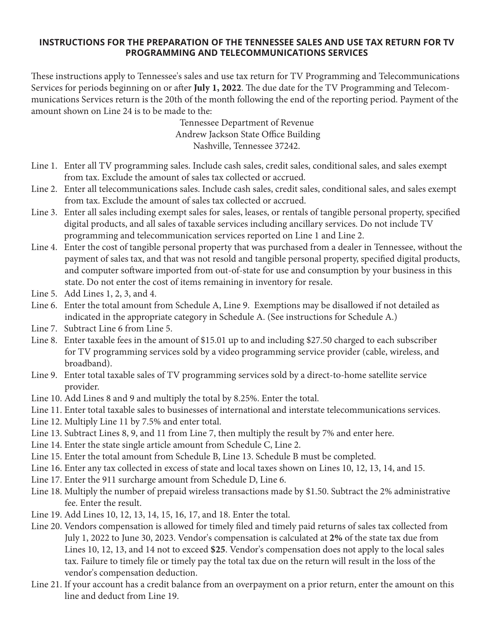

This Form is used for reporting and paying sales and use tax related to TV programming and telecommunications in the state of Tennessee. It provides instructions on how to fill out and submit the form.