Tax Benefits Templates

Documents:

418

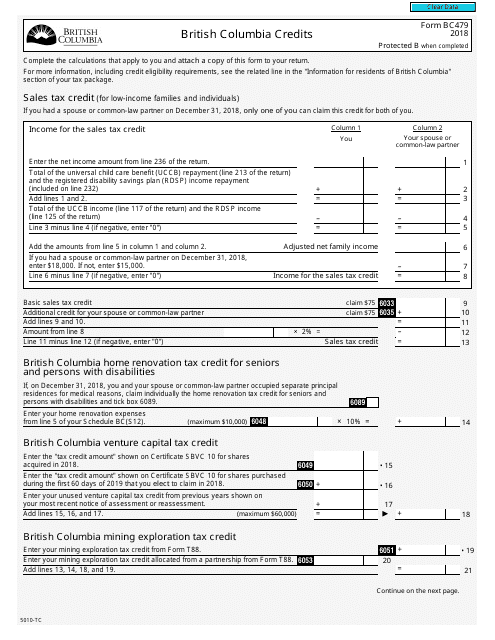

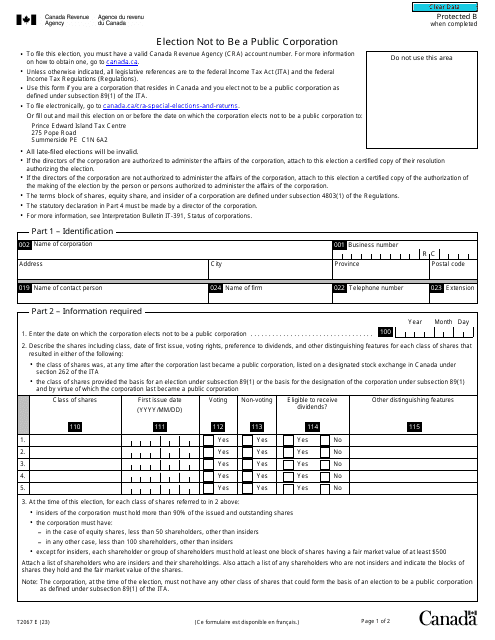

This form is used for claiming British Columbia credits in Canada.

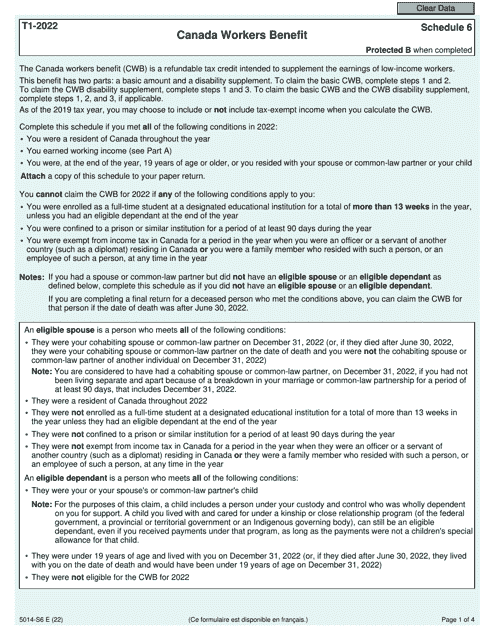

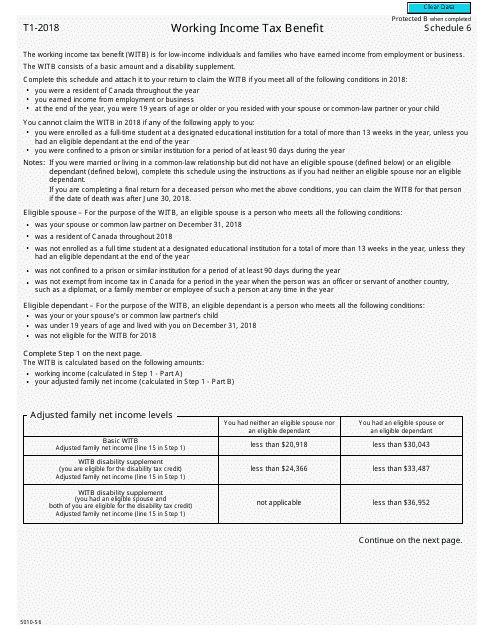

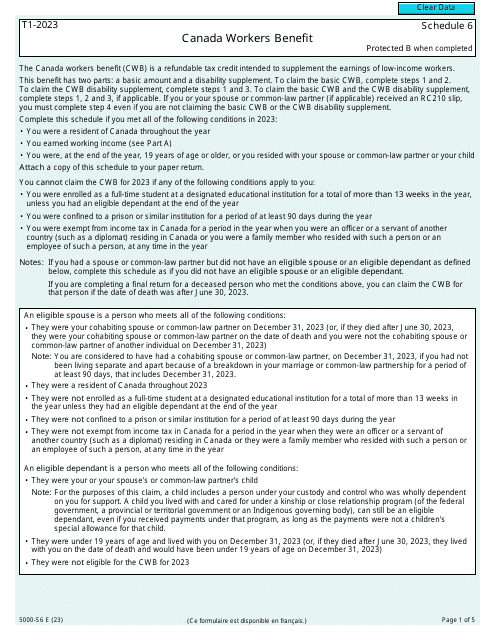

This form is used for reporting the Working Income Tax Benefit in Canada.

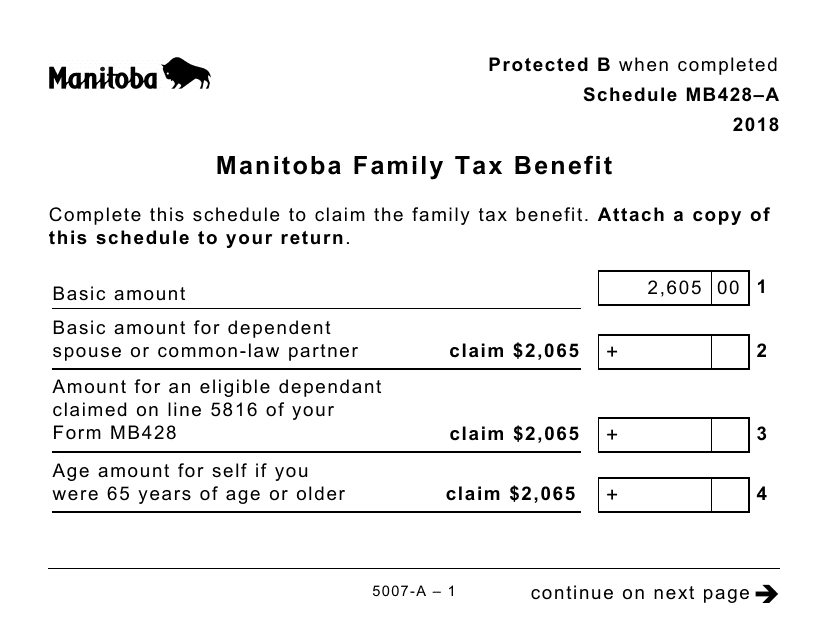

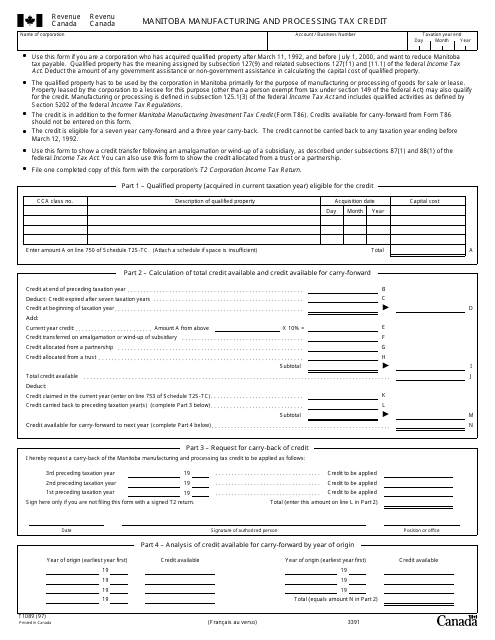

This form is used for claiming the Manitoba Manufacturing and Processing Tax Credit in Canada. It is used by individuals or businesses involved in the manufacturing and processing sector in Manitoba to claim a tax credit based on their eligible expenditures.

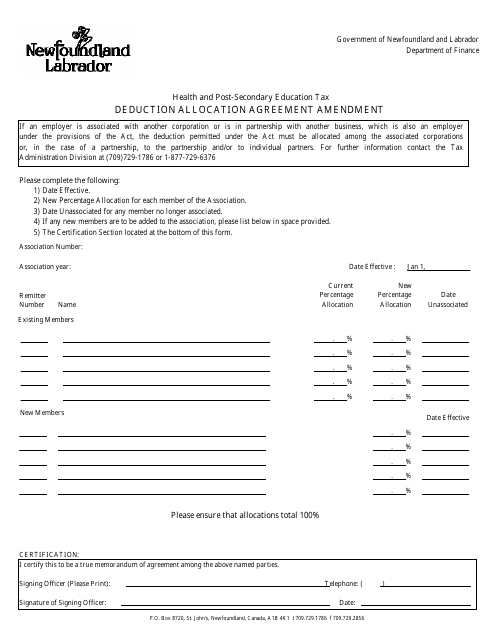

This document is used for amending the Health and Post-secondary Education Tax Deduction Allocation Agreement in Newfoundland and Labrador, Canada.

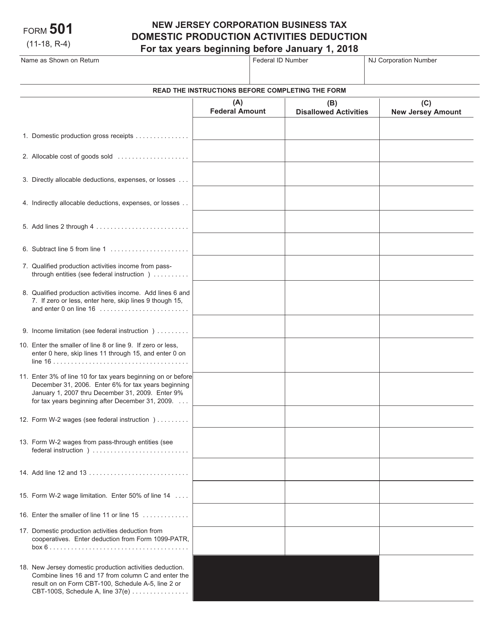

This form is used for claiming the Domestic Production Activities Deduction in the state of New Jersey. The deduction allows businesses to reduce their taxable income based on certain production activities that take place within the state.

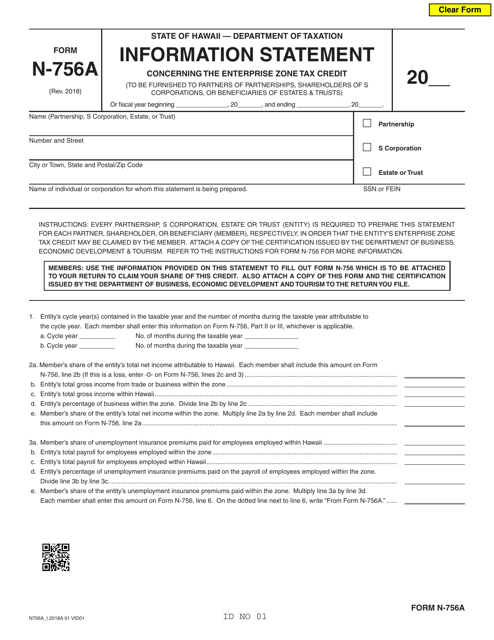

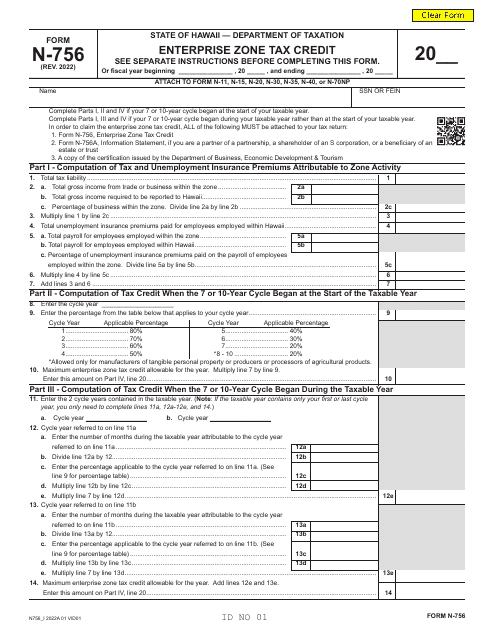

This document provides information about the Enterprise Zone Tax Credit specific to Hawaii. It includes details that individuals and businesses need to complete the Form N-756A.

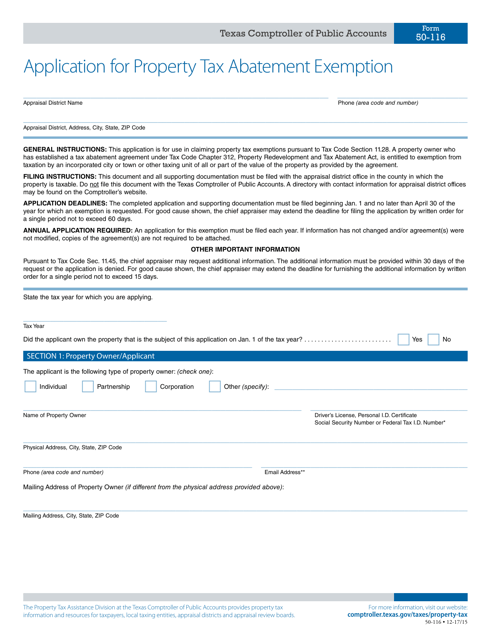

This form is used for applying for a property tax abatement exemption in Texas.

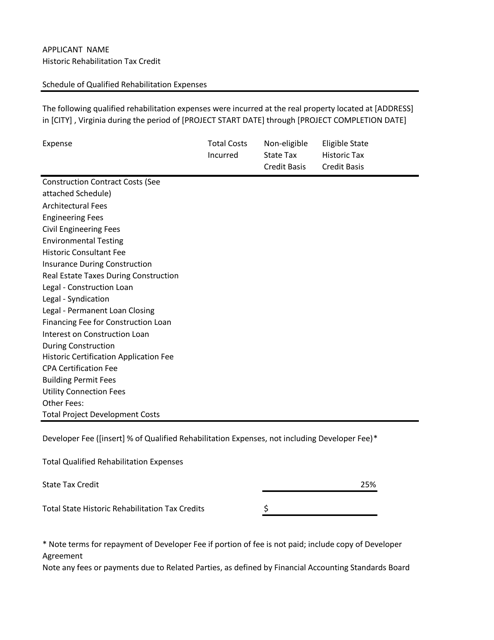

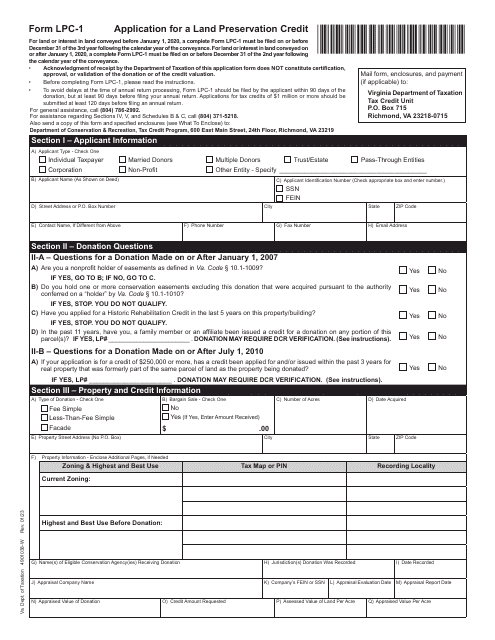

This document provides information about the schedule of qualified rehabilitation expenses in the state of Virginia. It outlines the expenses that qualify for rehabilitation tax credits in the state.

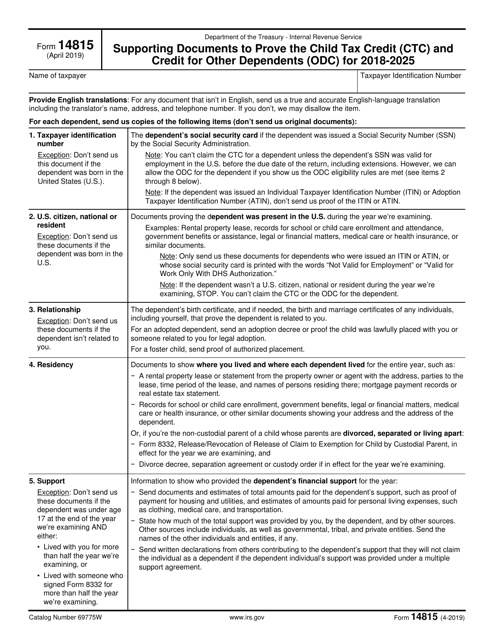

This Form is used for submitting supporting documents to prove eligibility for the Child Tax Credit (CTC) and Credit for Other Dependents (ODC) to the IRS.

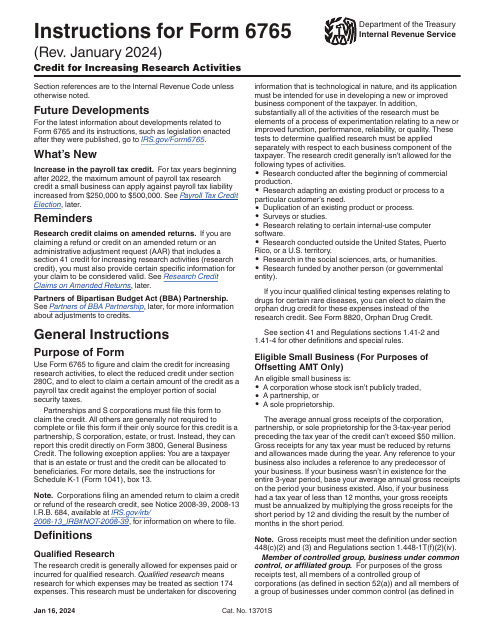

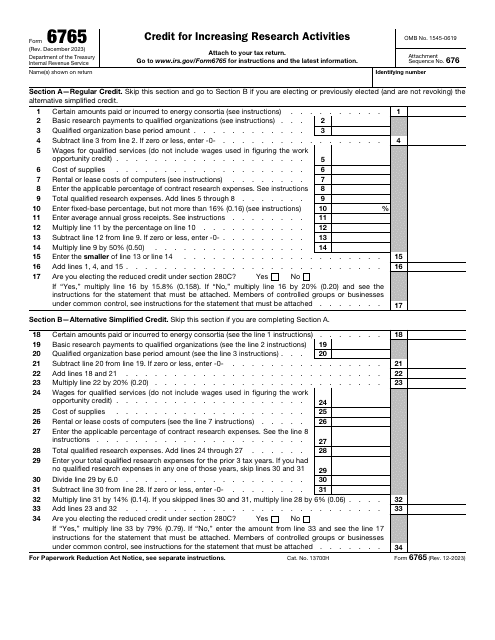

This is a document you may use to figure out how to properly complete IRS Form 6765

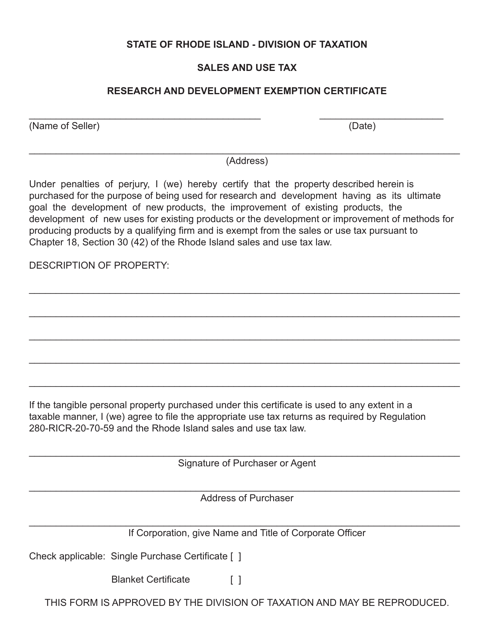

This document is for businesses in Rhode Island to obtain an exemption certificate for research and development activities.

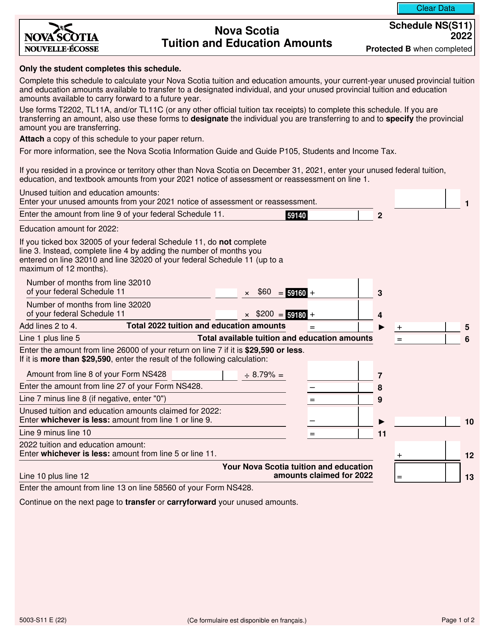

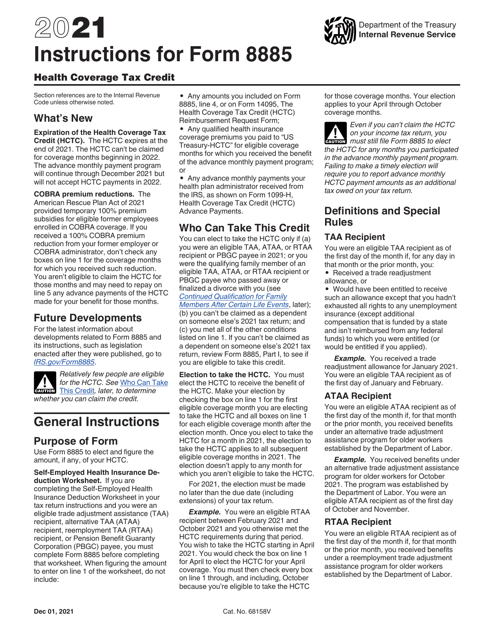

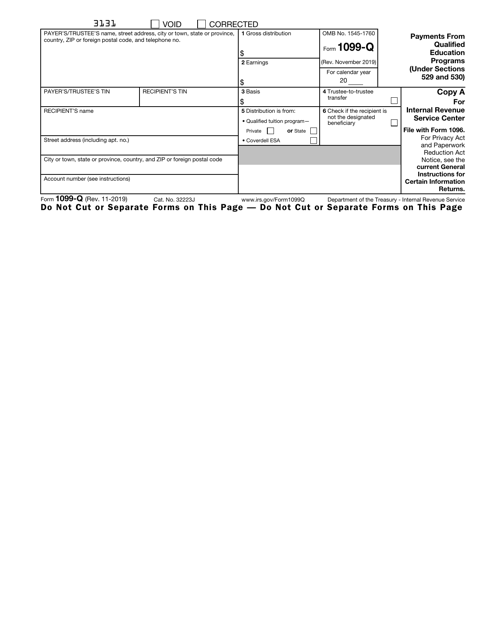

Download this form if you are an educational institution and need information about qualified tuition and related fees paid during the tax year. The information can be used by the paying student to calculate their education-related tax deductions and credits.