Tax Benefits Templates

Documents:

418

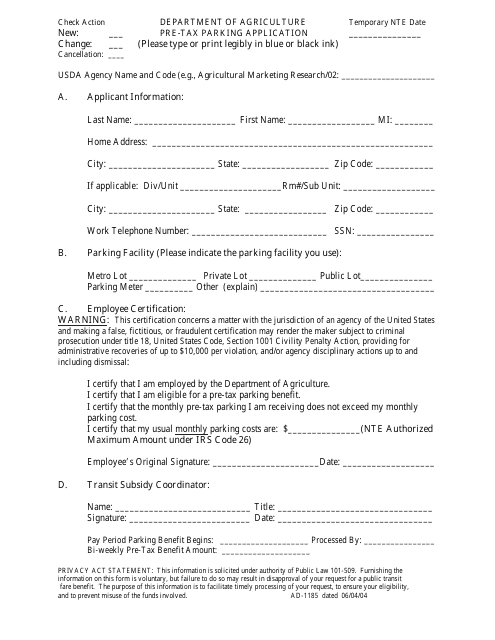

This Form is used for applying for pre-tax parking benefits. Fill out this form to request pre-tax deductions for parking expenses at work.

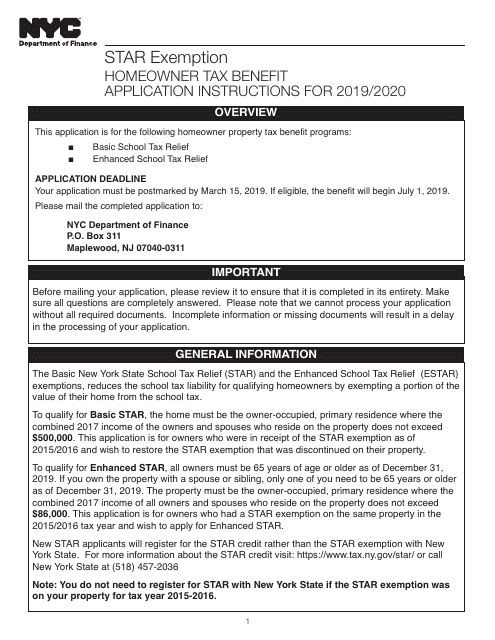

This form is used for applying for the Star Exemption Homeowner Tax Benefit in New York City for the year 2019/2020.

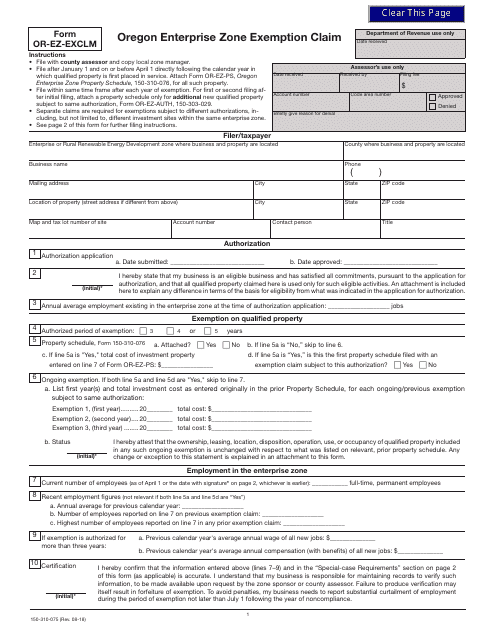

This form is used for claiming an enterprise zone exemption in Oregon. It is specifically for use by businesses to apply for tax incentives and benefits offered by the Oregon Enterprise Zone Program.

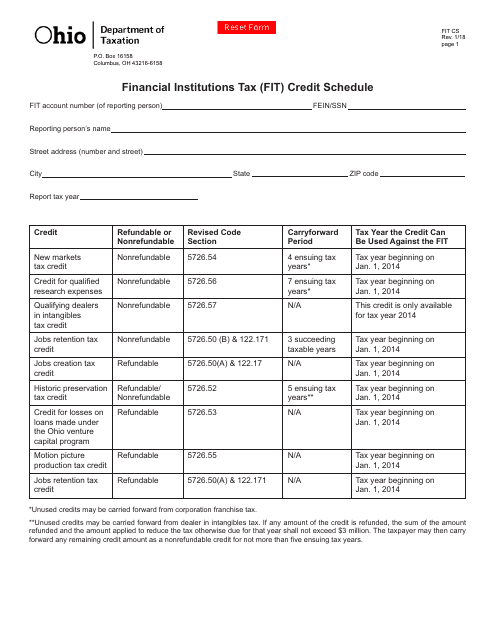

This Form is used for reporting and claiming the Financial Institutions Tax (FIT) Credit in Ohio.

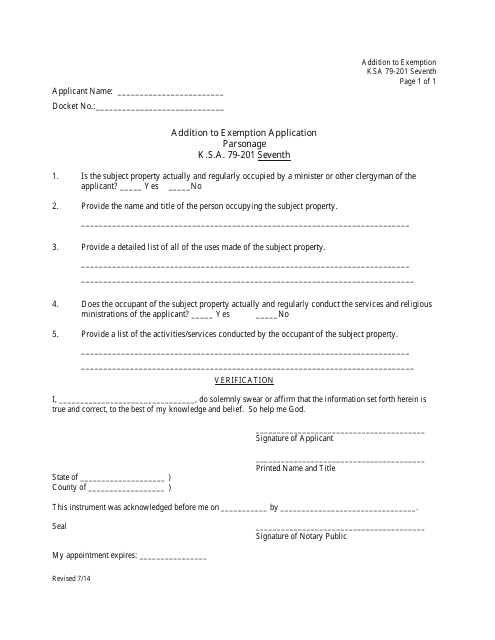

This document is an addition to the exemption application for parsonage in the state of Kansas. It is used to provide additional information or updates to an existing application.

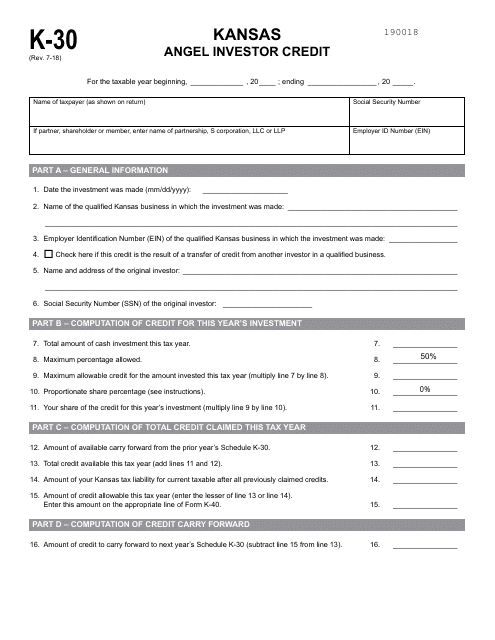

This form is used for claiming the Angel Investor Credit in Kansas. It helps individuals and businesses who invest in qualified Kansas businesses to claim a tax credit.

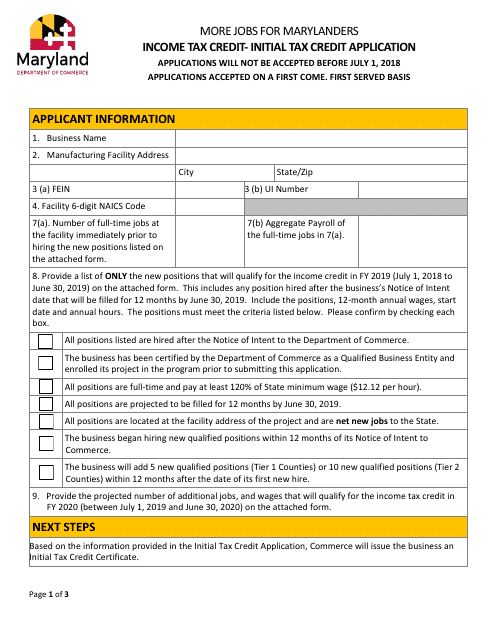

This Form is used for applying for the Initial Tax Credit in Maryland.

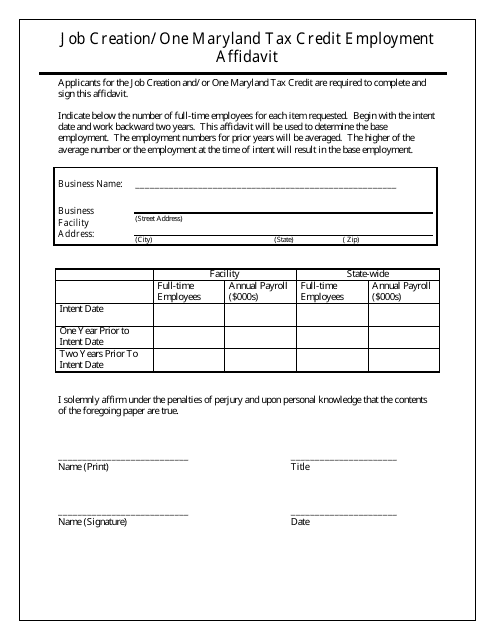

This Form is used for claiming the One Maryland Tax Credit Employment Affidavit, which encourages job creation in Maryland by providing tax credits to businesses that meet certain eligibility criteria.

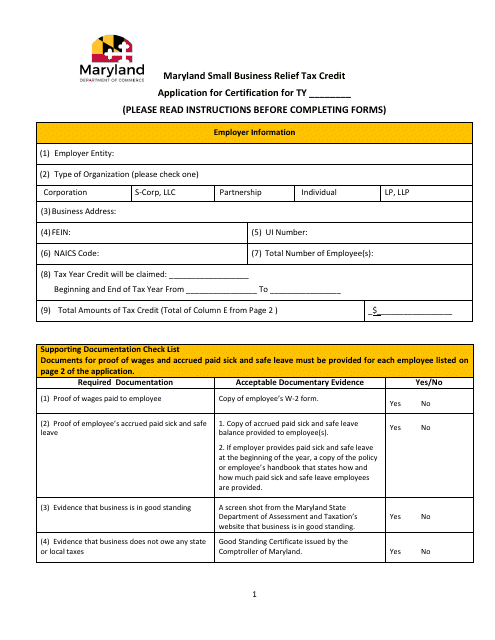

This document is an application for the Maryland Small Business Relief Tax Credit in the state of Maryland. It is used by small businesses to apply for certification and eligibility for the tax credit.

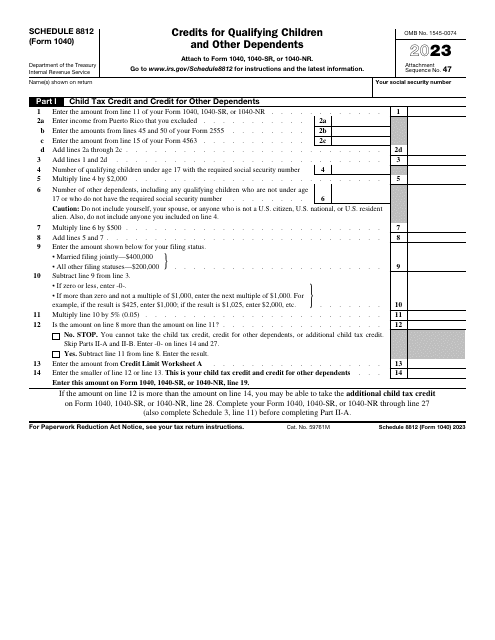

This is a fiscal statement created to let taxpayers with children make the most of the tax benefits they qualify for via extra tax credit.

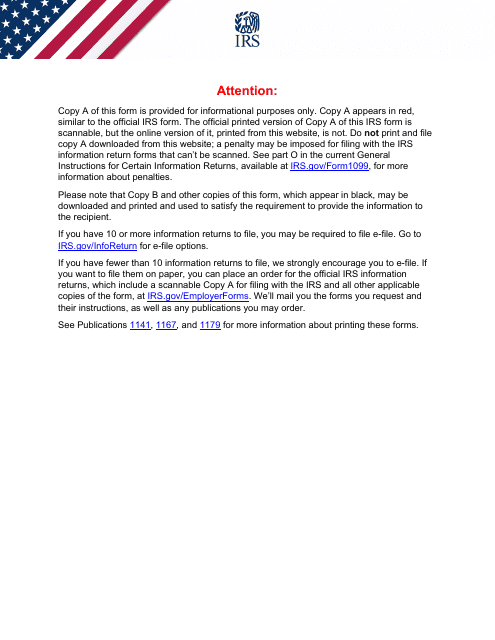

Download this form to report the interest amount paid on a qualified student loan during the past calendar year in cases when the amount exceeded $600.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

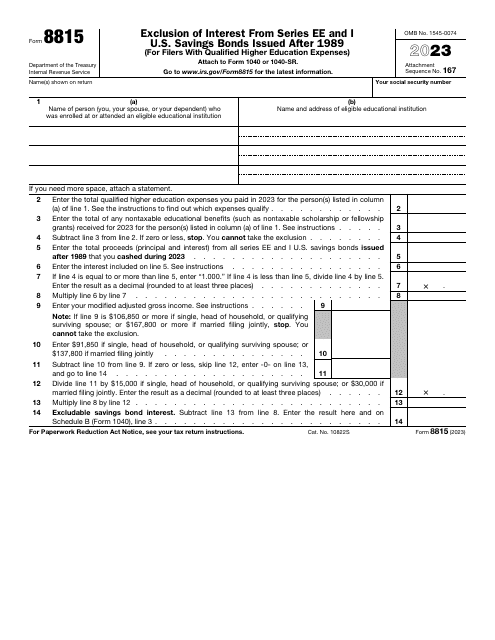

This is a fiscal document used by individual taxpayers to exclude the specific bond interest from their income.

This document is used for reporting contributions of motor vehicles, boats, and airplanes to qualifying organizations.

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

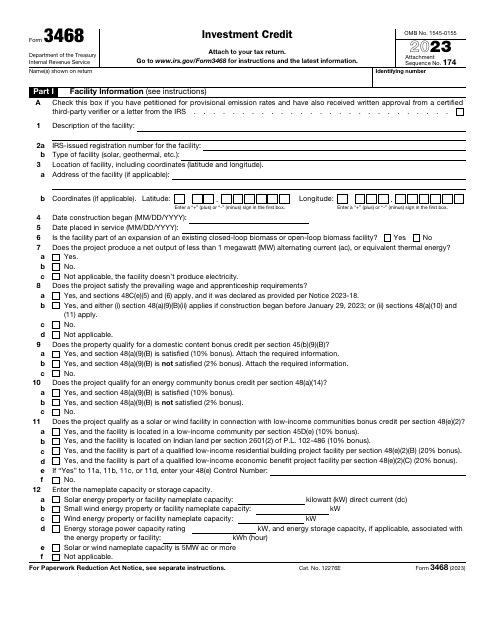

This document provides information on the tax incentives available for businesses that provide accessibility accommodations for individuals with disabilities. It outlines the potential tax benefits and requirements for businesses to qualify for these incentives.

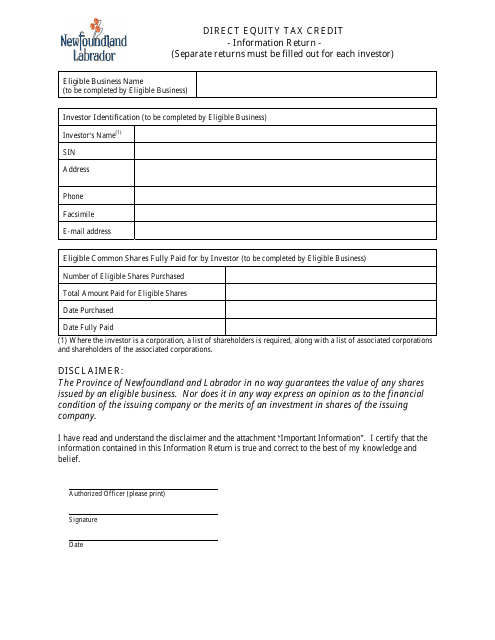

This document provides information on the Direct Equity Tax Credit Program in Newfoundland and Labrador, Canada. The program offers tax credits for investments in eligible businesses.

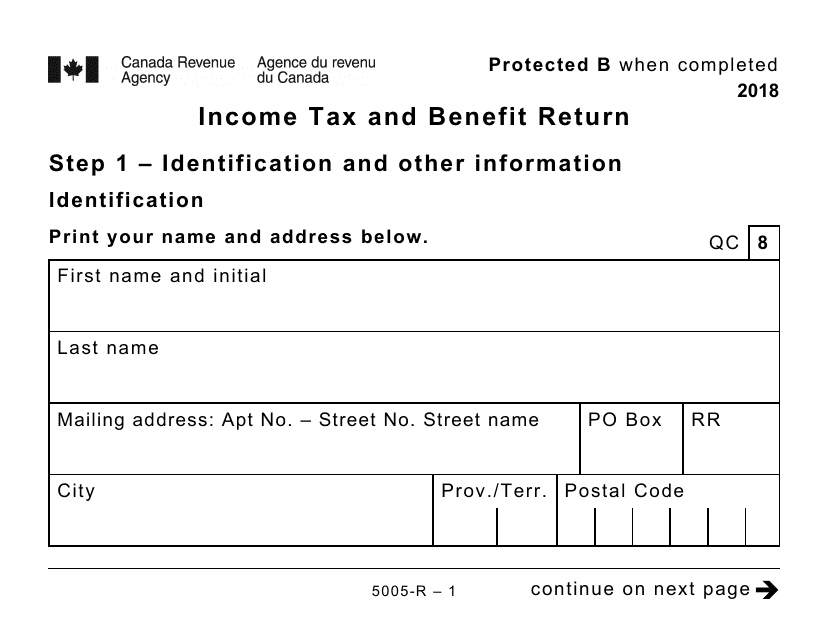

This form is used for filing income tax and benefit returns in Canada. It is specifically designed and formatted for individuals who require a larger print size for easier readability.