Tax Benefits Templates

Documents:

418

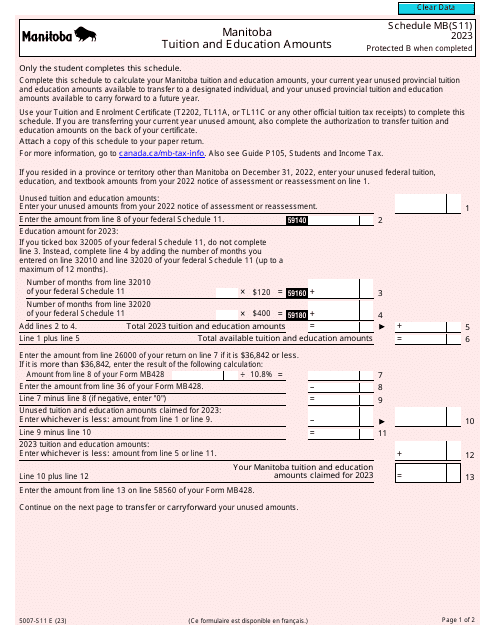

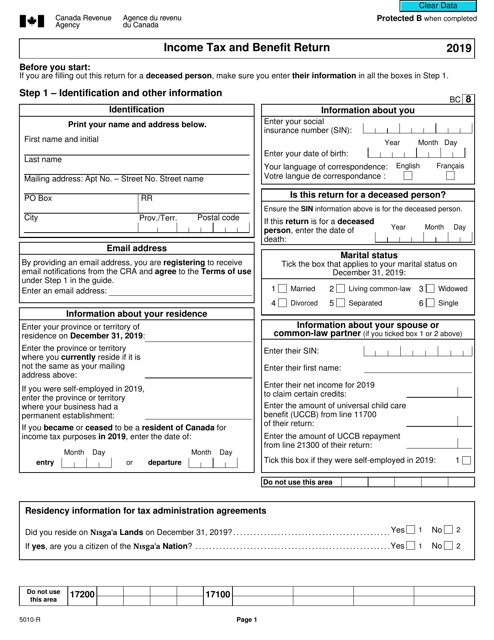

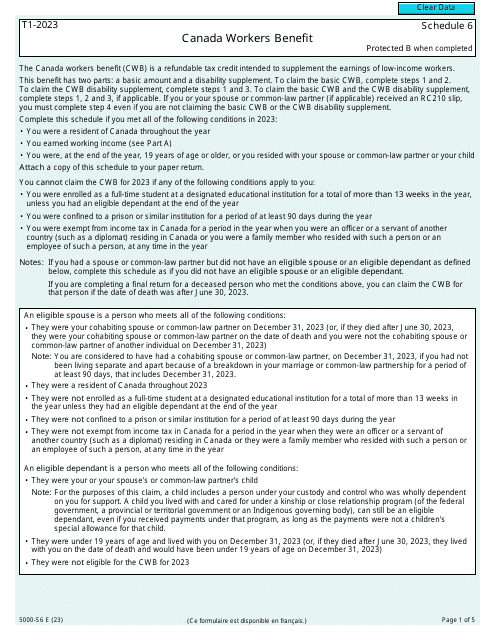

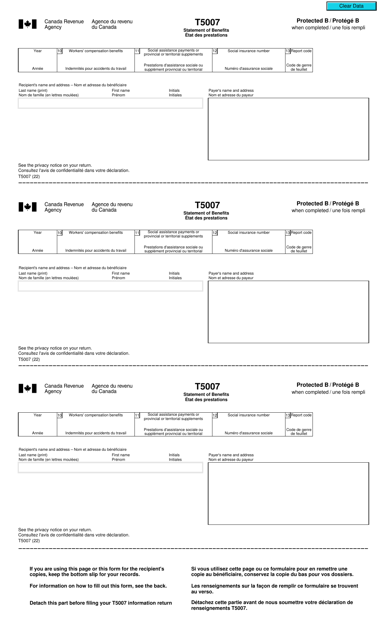

This form is used for filing income tax and benefit returns in Canada. It is available in both English and French languages.

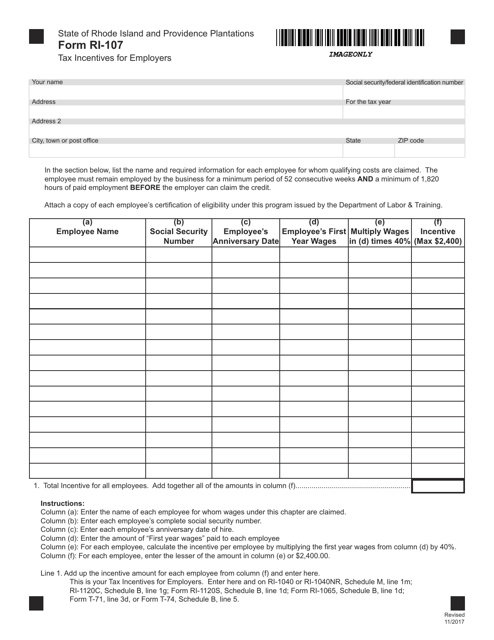

This Form is used for employers in Rhode Island to claim tax incentives and benefits.

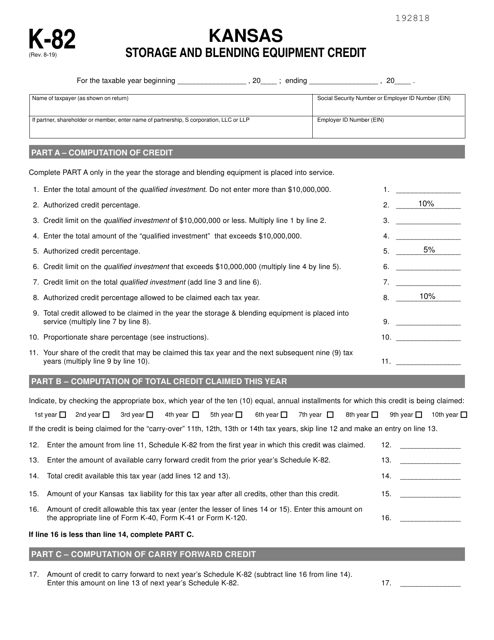

This Form is used to claim the Storage and Blending Equipment Credit in the state of Kansas.

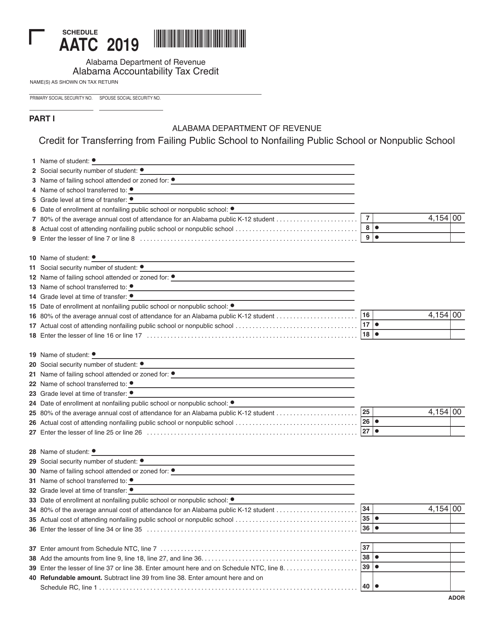

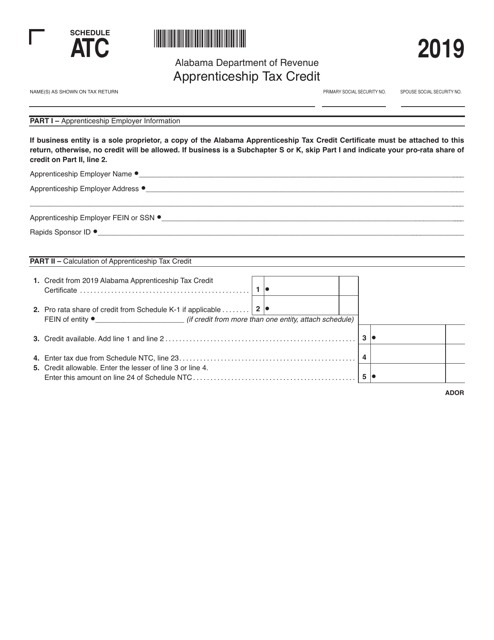

This document is a schedule for claiming the ATC Apprenticeship Tax Credit specific to the state of Alabama. It provides information on how to calculate and claim tax credits related to apprenticeship programs.

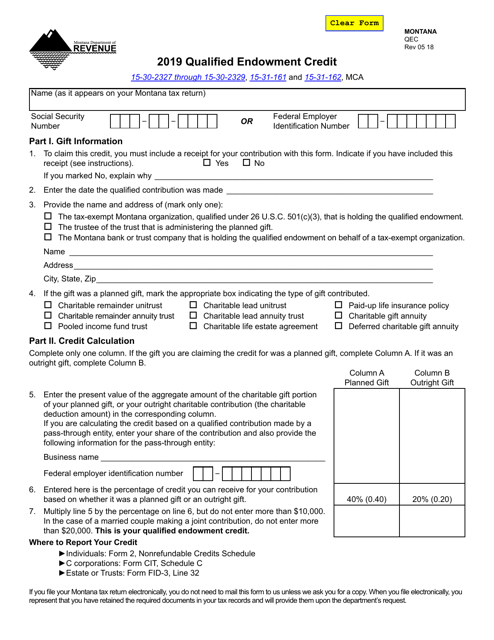

This Form is used for claiming the Qualified Endowment Credit in Montana. The credit is available to individuals and businesses contributing to qualified endowment funds.

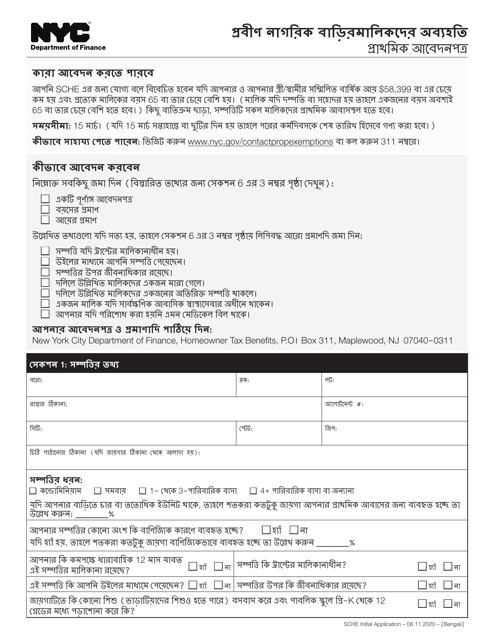

This document is for senior citizens in New York City who want to apply for a property tax exemption. It is available in the Bengali language.

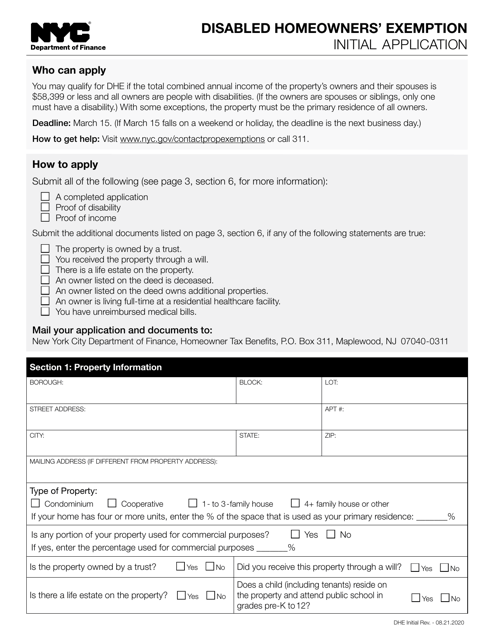

This document is for disabled homeowners in New York City who are applying for the initial exemption.

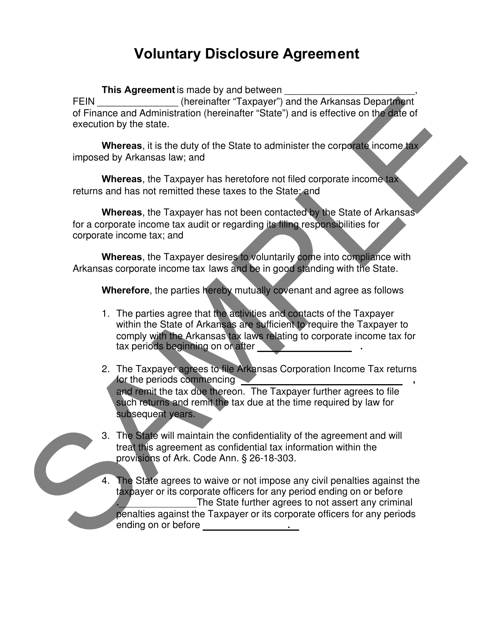

This form is used for corporate taxpayers in Arkansas to voluntarily disclose any errors or omissions in their previous corporate tax returns.

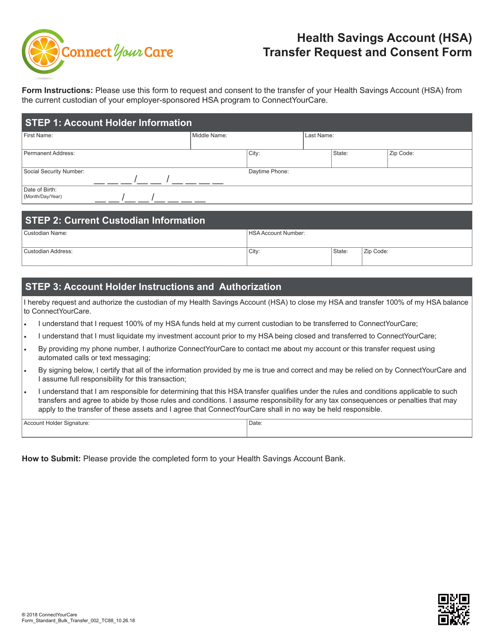

This document allows individuals to request the transfer of their Health Savings Account (HSA) funds and gives consent for the transfer in the state of Arkansas.

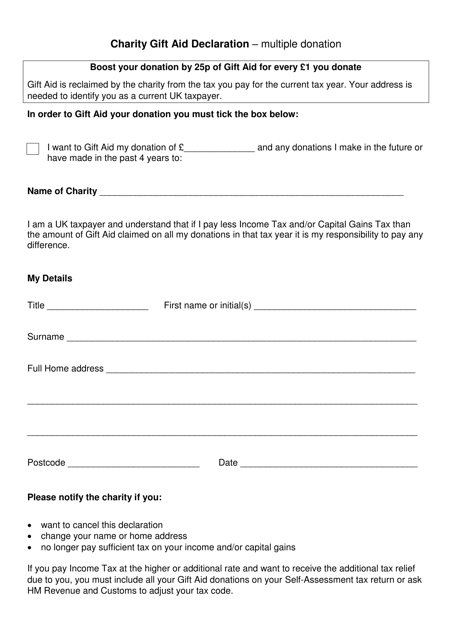

This document is used for multiple donations in the United Kingdom to declare Gift Aid and maximize the value of charitable contributions.

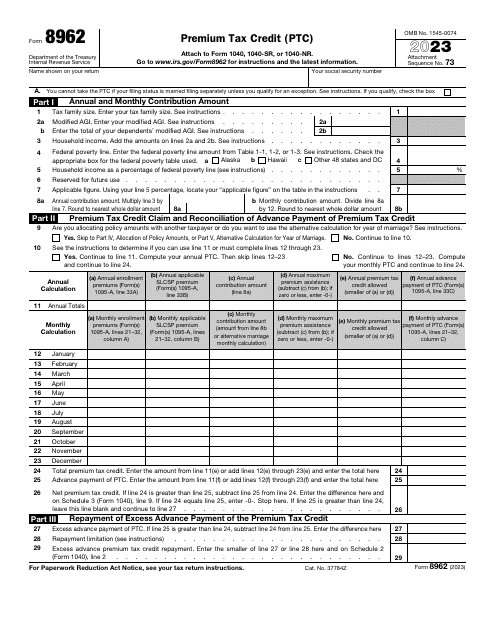

This is an IRS legal document completed by individuals who need to figure out the amount of their Premium Tax Credit and reconcile it with the Advanced Premium Tax Credit (APTC) payments made throughout the reporting year.

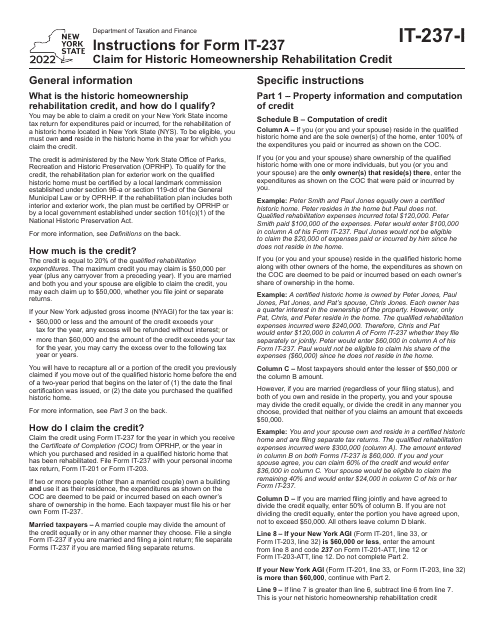

Instructions for Form IT-237 Claim for Historic Homeownership Rehabilitation Credit - New York, 2022