Tax Benefits Templates

Are you looking to maximize your tax savings? Explore the world of tax benefits and discover how you can reduce your tax liability while potentially putting some extra money back in your pocket. With various tax benefit options available, it's important to understand how they work and how you can take advantage of them legally.

Tax benefits, also known as tax deductions or tax credits, are incentives designed to reduce your overall tax liability by allowing you to deduct certain expenses or claim credits for eligible activities. These benefits can be claimed on your annual tax return, helping you minimize the amount of income taxes you owe.

Whether you're a business owner, a student, or a homeowner, there are tax benefits available to suit your specific circumstances. For instance, if you've made charitable contributions such as donating a motor vehicle, boat, or airplane, there may be a tax benefit for you. Alternatively, if you're a student or have a dependent currently in school, education credits can provide substantial tax savings.

In Canada, there are also various tax benefit programs, such as the Provincial Tuition and Education Amounts benefit, which can help offset the costs of education. Likewise, the Wisconsin Business Development Credit and the Oregon Natural Resource Credit offer tax incentives for businesses operating in those states.

Navigating the world of tax benefits can be complex, but with the right information and guidance, you can make the most of these opportunities. If you're unsure where to start or how to claim tax benefits, consult with a tax professional who can help you understand the requirements and qualifications for each benefit.

Don't leave money on the table - explore the vast array of tax benefits available to you. Take advantage of the resources provided by the IRS, Canada Revenue Agency, or your respective state revenue department to ensure you're taking full advantage of the tax benefits that apply to your situation. Start maximizing your tax savings today!

Documents:

418

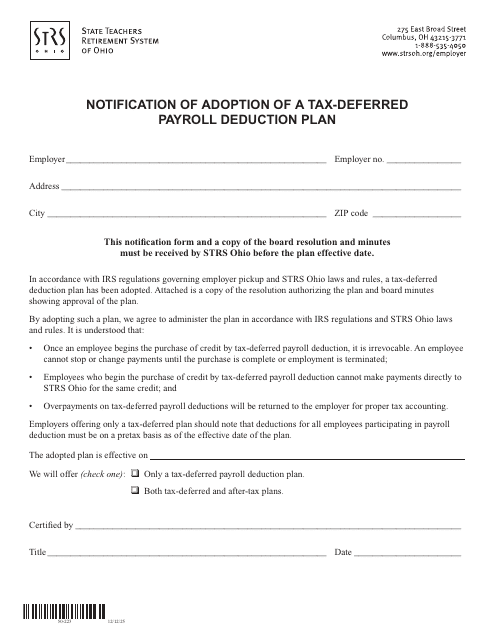

This document is a notification of the adoption of a tax-deferred payroll deduction plan by the State Teachers Retirement System of Ohio. It provides information about the plan and how it will affect Ohio teachers' retirement savings.

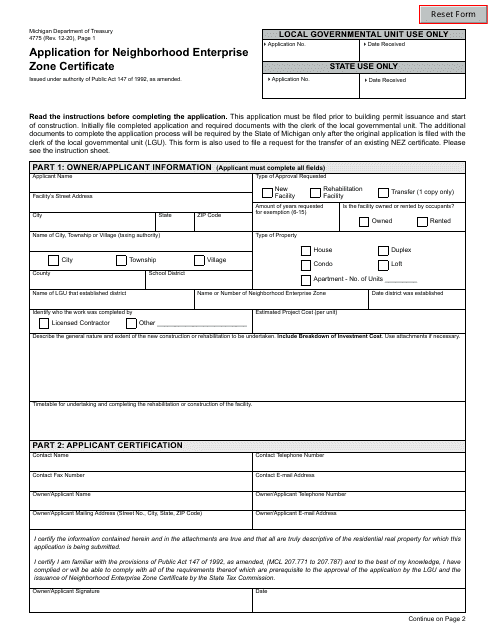

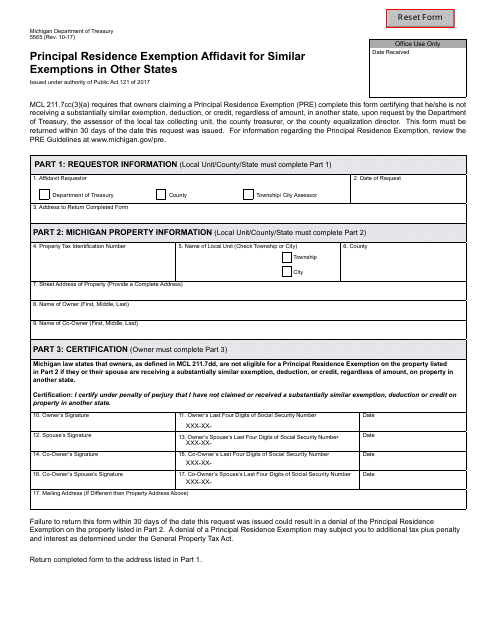

This document is used for claiming principal residence exemption in Michigan and exploring similar exemptions in other states.

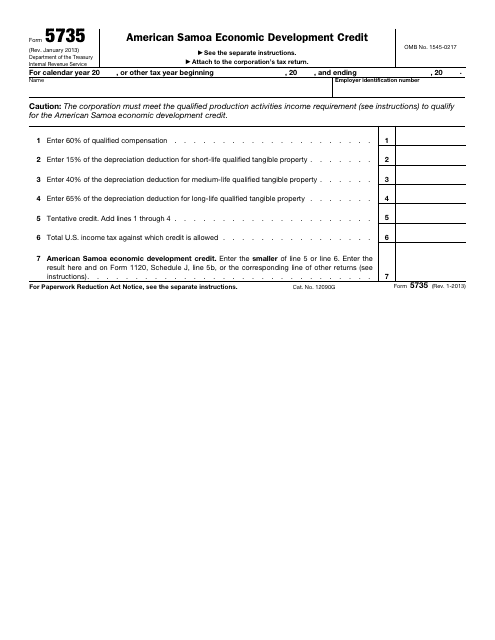

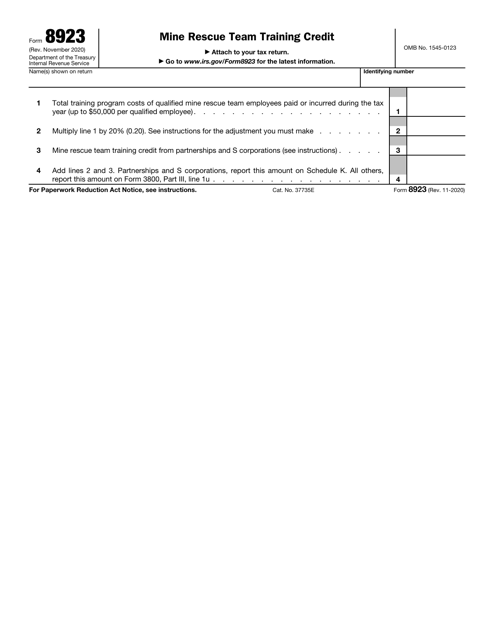

This form is used for claiming the American Samoa Economic Development Credit on your federal taxes.

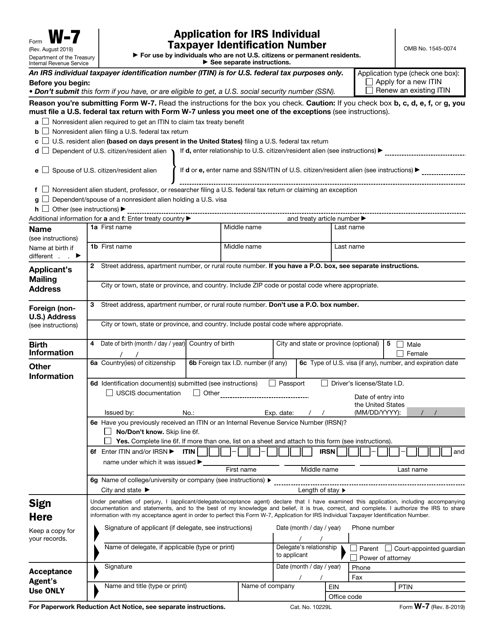

This is a formal statement filled out by individuals that want to obtain an identification number that will confirm their identity to fiscal organizations and let them communicate with the government as taxpayers. Additionally, it may be completed to renew a number they received before.

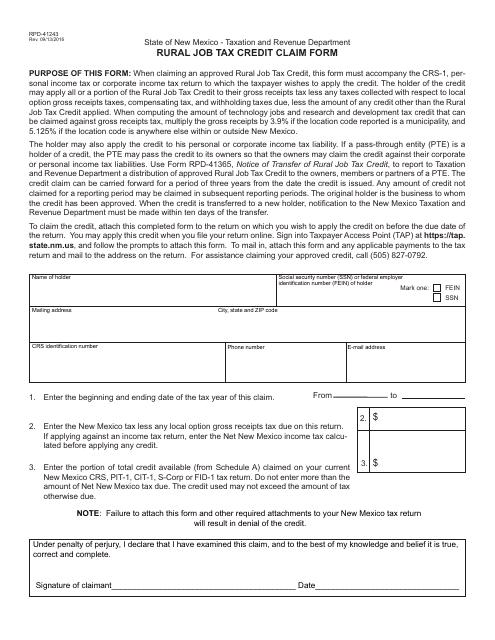

This form is used for claiming the rural job tax credit in the state of New Mexico. It is for businesses that have created jobs in rural areas and are eligible for this tax credit.

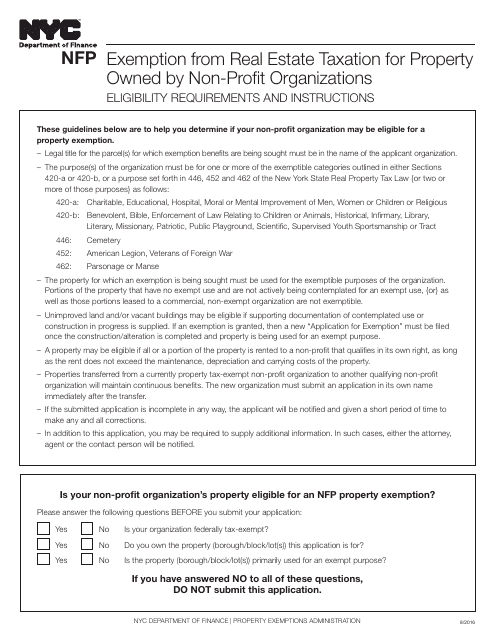

This Form is used for non-profit organizations in New York City to apply for exemption from real estate taxation for their properties.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

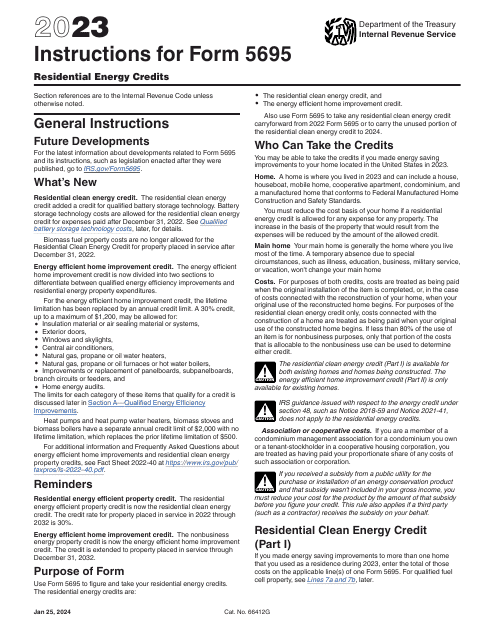

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

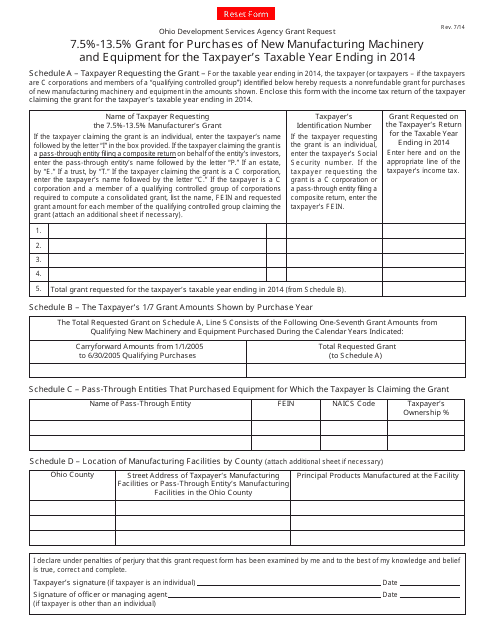

This form is used to apply for a grant of 7.5%-13.5% for the purchase of new manufacturing machinery and equipment in Ohio for the taxpayer's taxable year ending in 2014.

This Form is used for applying for a real property tax exemption under the Residential-Commercial Urban Exemption Program in New York. It provides instructions for completing the application.

This is a document you may use to figure out how to properly complete IRS Form 6765

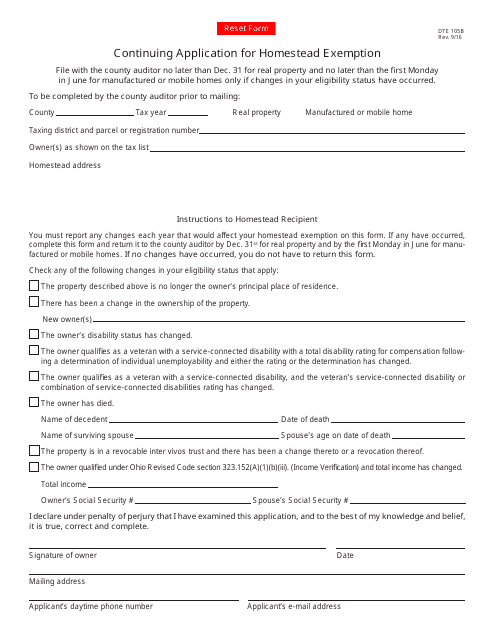

This form is used for applying for a continuing homestead exemption in the state of Ohio. It allows eligible individuals to continue receiving the benefits of the homestead exemption on their property tax.

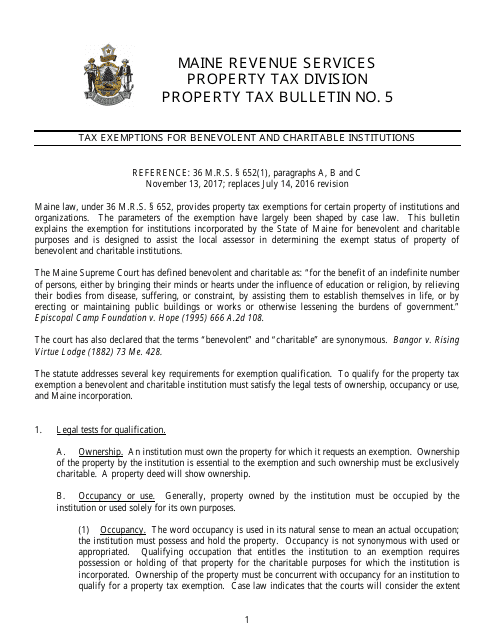

This document provides information about tax exemptions available to benevolent and charitable institutions in the state of Maine. It outlines the eligibility criteria and the process for obtaining these exemptions.

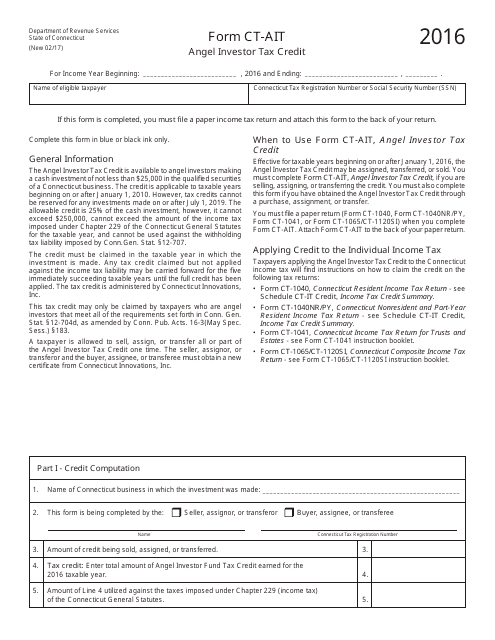

This form is used for claiming the Angel Investor Tax Credit in the state of Connecticut.

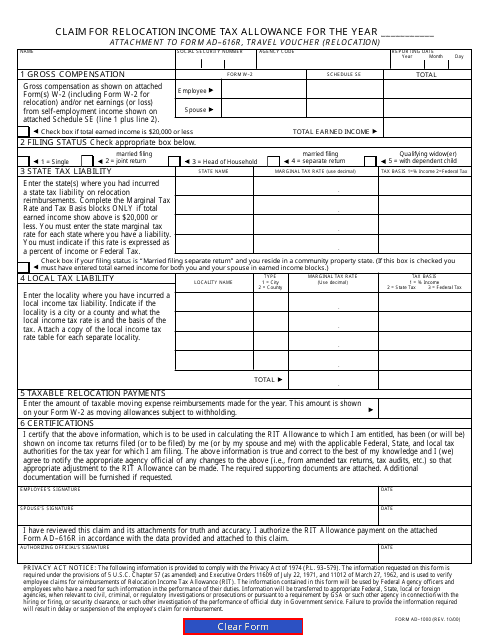

This Form is used for claiming the Relocation Income Tax Allowance for qualified expenses incurred during a relocation.