Tax Preparer Templates

Documents:

1288

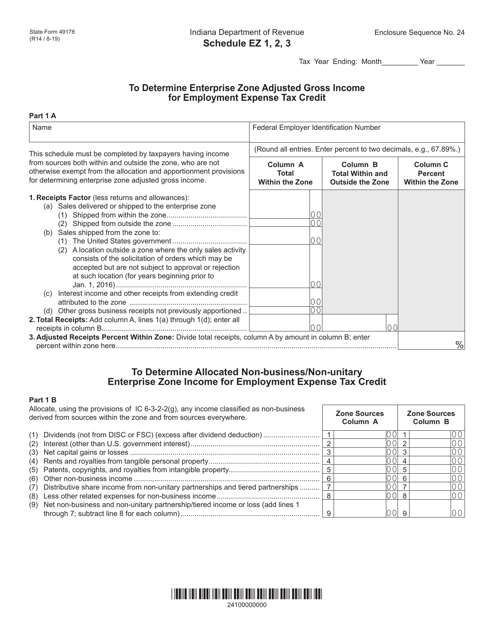

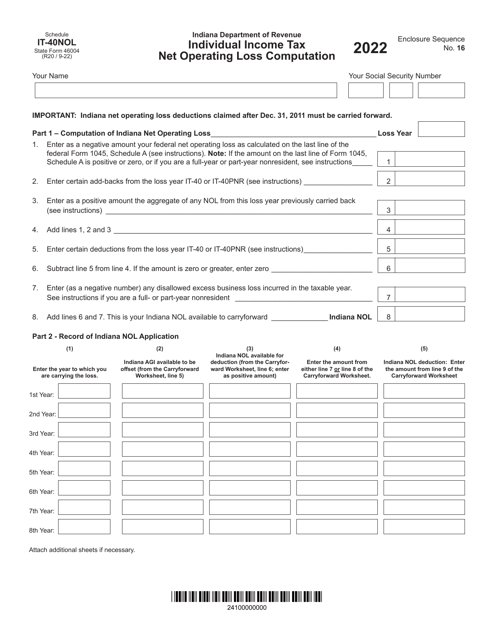

This form is used for filing individual income taxes in the state of Indiana. It includes schedules EZ 1, 2, and 3 for reporting various types of income, deductions, and credits.

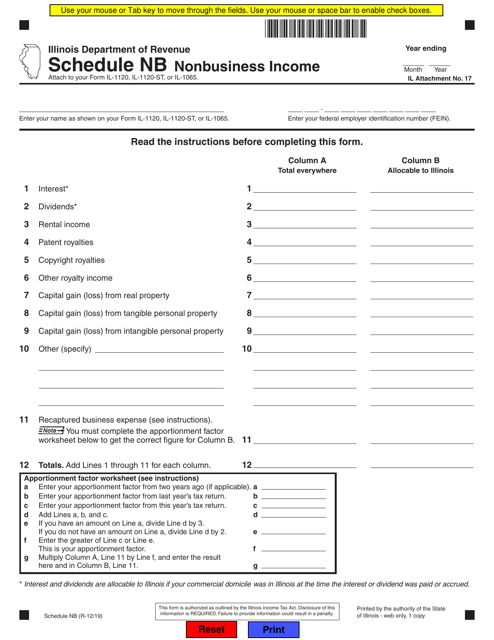

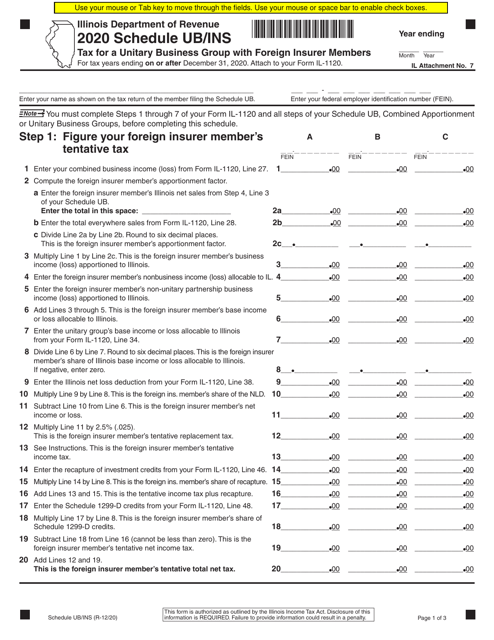

This document is for reporting nonbusiness income in the state of Illinois for individual taxpayers. It is used to schedule the income that is not derived from business activities.

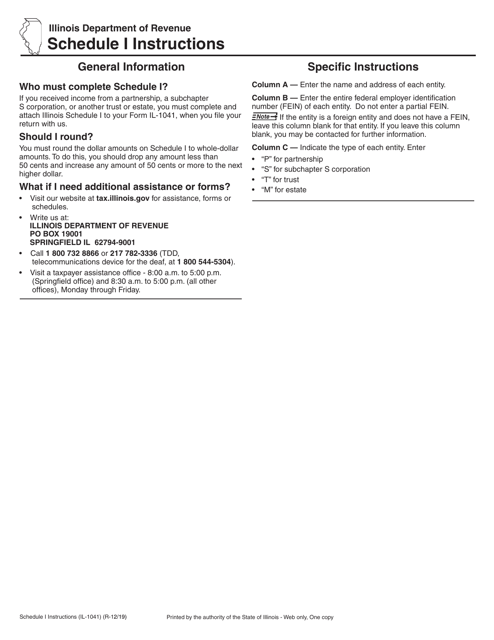

This Form is used for reporting income received in the state of Illinois when filing Form IL-1041. It provides instructions for filling out Schedule I, which is used to report various types of income.

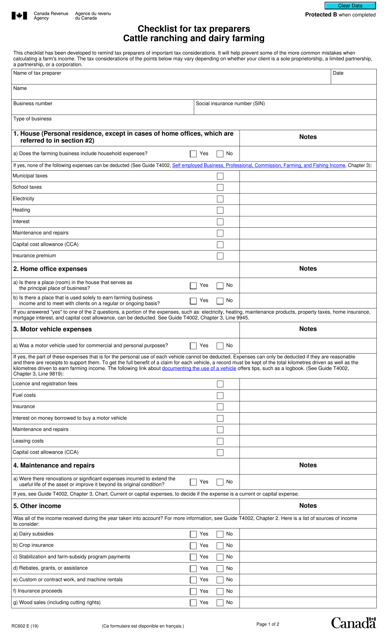

This Form is used for tax preparers in Canada who specialize in cattle ranching and dairy farming. It is a checklist that provides guidance on the specific tax considerations and requirements for these types of agricultural businesses.

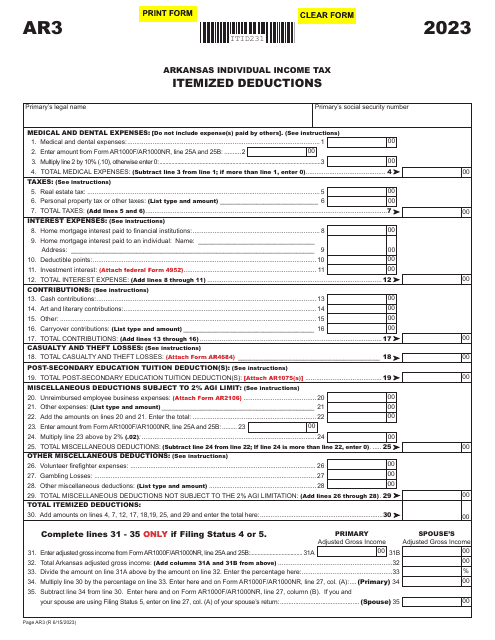

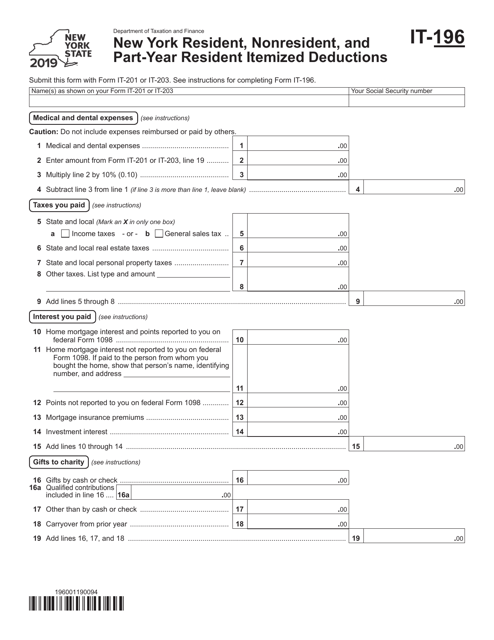

This Form is used for reporting itemized deductions for New York state residents, nonresidents, and part-year residents on their tax return.

This document provides instructions for filling out IRS Form 1040 and 1040-SR. It guides you through the process of reporting your income, deductions, and credits to calculate your tax liability.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.