Tax Preparer Templates

Are you looking for professional tax preparers to handle your tax documents? Look no further! Our expert team specializes in tax preparation and can assist you with all your tax needs. Whether you are an individual taxpayer or a business owner, we have the knowledge and experience to ensure that your tax returns are prepared accurately and efficiently.

Our tax preparation services cover a wide range of forms and documents, including IRS Form 1120-S Schedule K-1, Form D-403 Partnership Income Tax Return, Form 765 Schedule L Unified Nonresident Individual Income Tax Return List of Participants, IRS Form 1120-F Schedule M-3, and the Commercial Business Tax Receipt Fee Worksheet.

At Templateroller.com, we understand that tax preparation can be a complex and time-consuming task. That's why we are here to simplify the process for you. Our team stays up-to-date with the latest tax laws and regulations to ensure that your taxes are prepared in compliance with all applicable rules. We will help you identify all eligible deductions, credits, and exemptions to minimize your tax liability and maximize your refund.

When it comes to tax preparation, accuracy is key. Our skilled tax preparers are meticulous in their work, reviewing each document thoroughly to avoid any errors or omissions. We take the time to understand your unique financial situation and tailor our services to meet your specific needs.

Don't let the stress of tax preparation overwhelm you. Let our team of tax experts handle the paperwork while you focus on what matters most to you. With our help, you can have peace of mind knowing that your taxes are in capable hands.

Contact Templateroller.com today to schedule a consultation with one of our tax preparers. Let us take the burden of tax preparation off your shoulders and ensure that your tax documents are completed accurately and efficiently. Trust us to handle your tax preparation needs with professionalism and expertise.

Documents:

1288

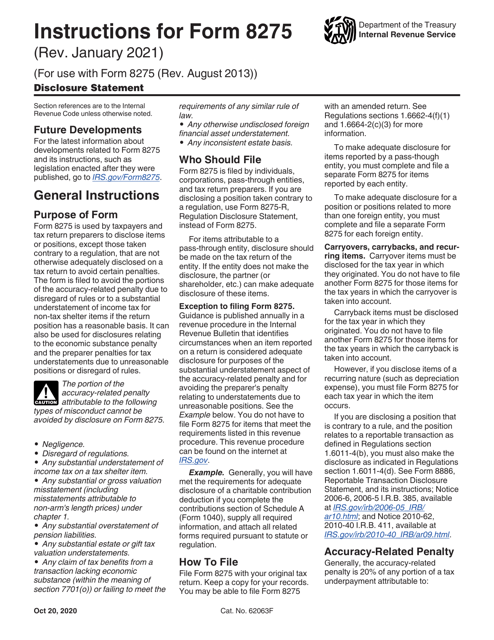

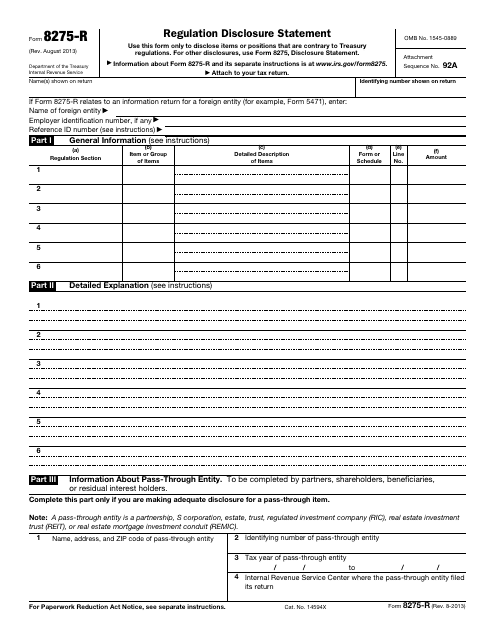

This document is used to disclose information about the regulations that apply to a tax return.

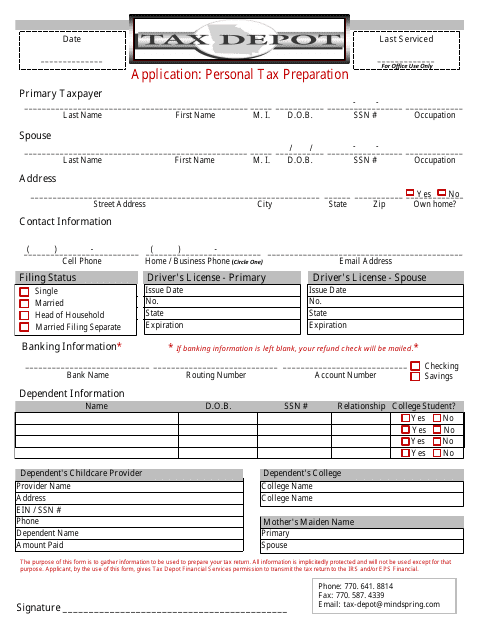

This Form is used for applying for a personal tax preparation application through Tax Depot.

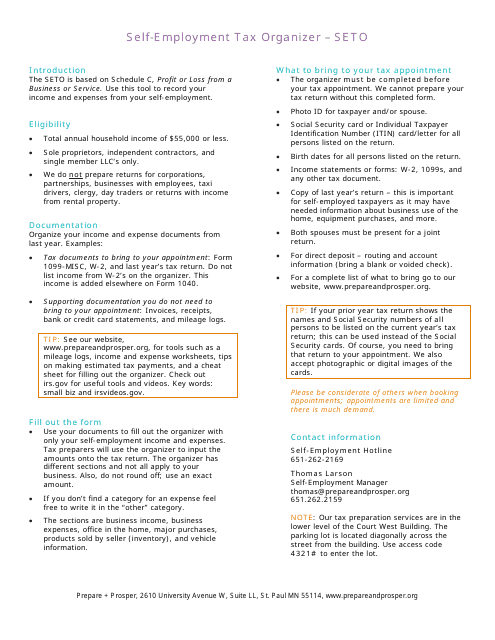

This document is a template used for organizing self-employment taxes. It helps self-employed individuals keep track of their income, expenses, and deductions for tax reporting purposes.

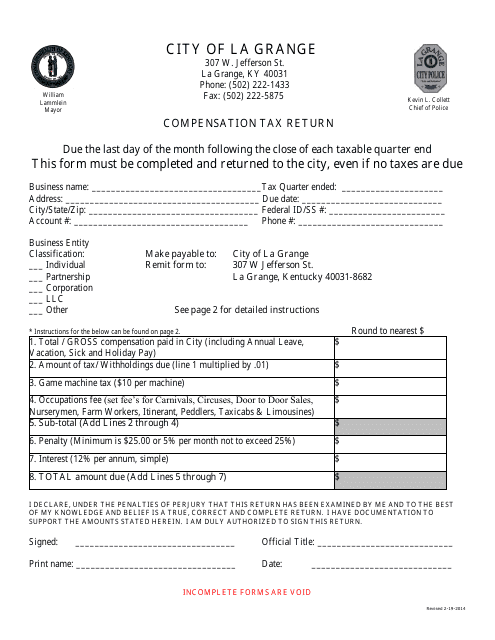

This document is used for reporting compensation tax returns to the City of La Grange, Kentucky.

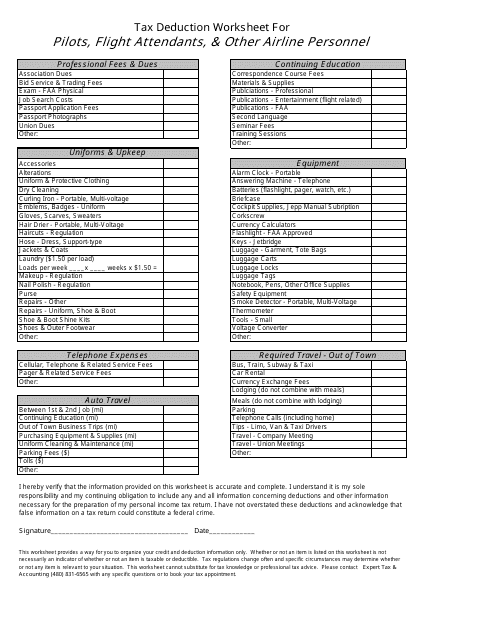

This form is used for calculating tax deductions specific to pilots, flight attendants, and other airline personnel. It helps ensure that eligible expenses related to work in the aviation industry are properly accounted for.

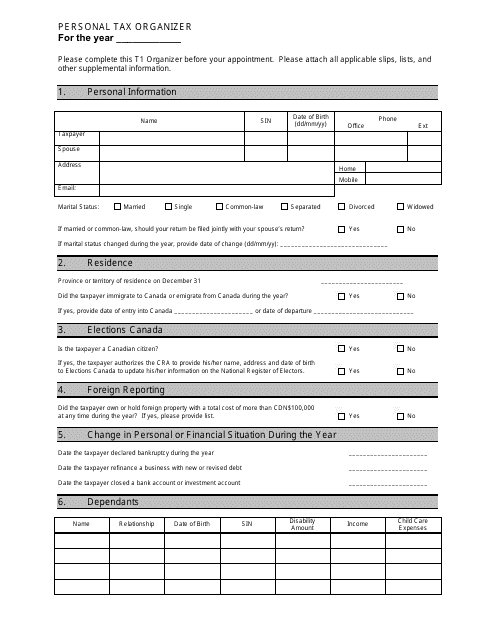

This document is a template that helps individuals organize their personal tax information for filing taxes. It provides sections to record income, expenses, deductions, and other relevant details. Using this template can help simplify the tax filing process.

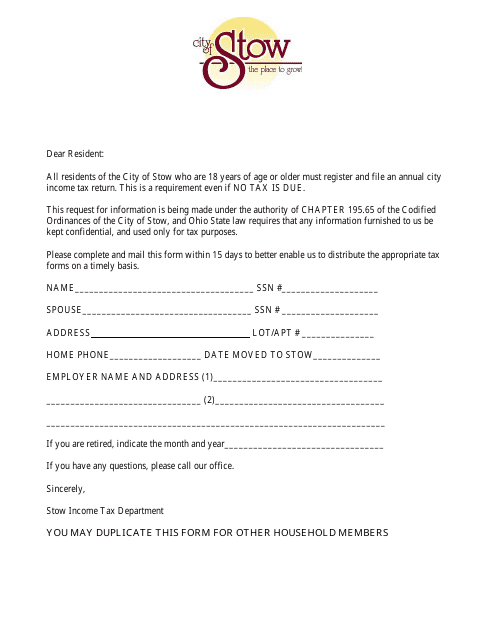

This Form is used for filing your income tax return in the City of Stow, Ohio.

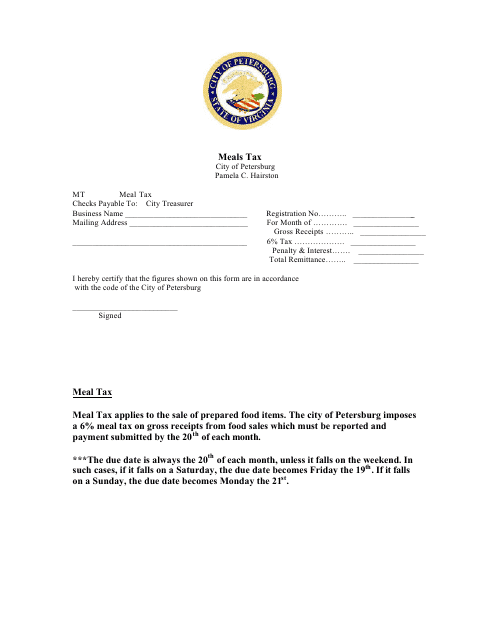

This form is used for reporting and paying the meals tax in Petersburg, Virginia. Businesses in the city that sell prepared meals are required to complete and submit this form to the local tax authority.

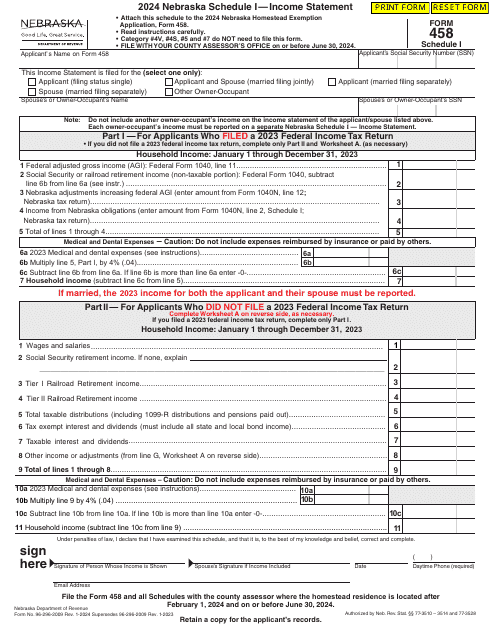

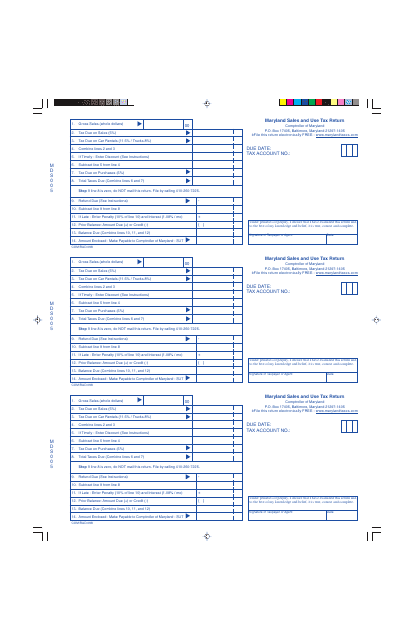

This document is used to report and remit sales and use tax in the state of Maryland. Businesses must submit this return to the Maryland Comptroller's Office to report the sales they have made and the corresponding sales tax collected.

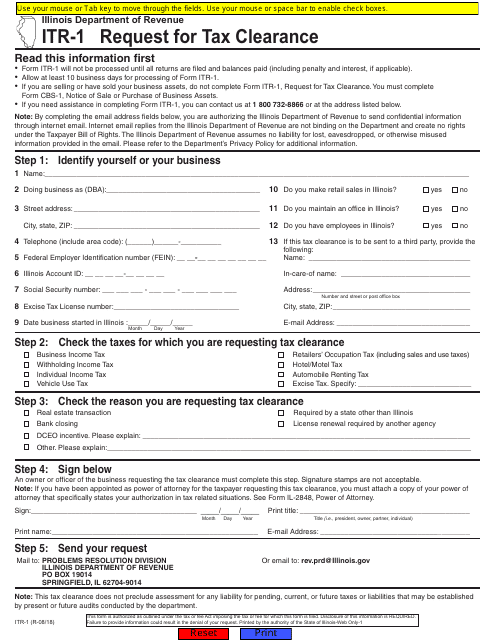

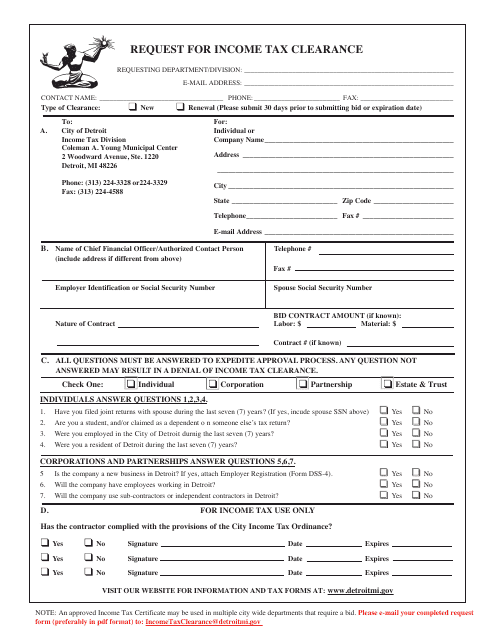

This form is used for requesting an income tax clearance in Detroit, Michigan. It is required to ensure all income taxes have been paid before certain transactions or activities can take place.

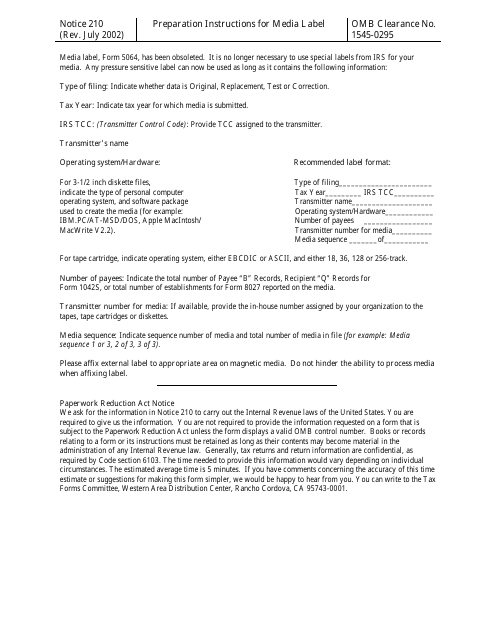

This document provides instructions for preparing media labels as required by the IRS for tax-related purposes.

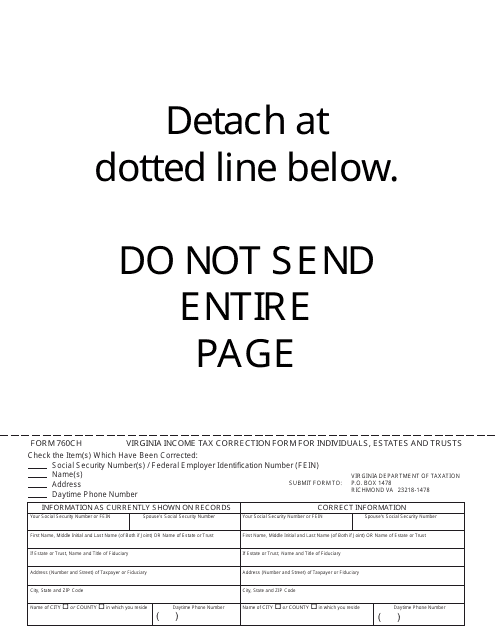

This form is used for correcting Virginia income tax filings for individuals, estates, and trusts in the state of Virginia. It is used to amend any errors or omissions made on previous tax returns.

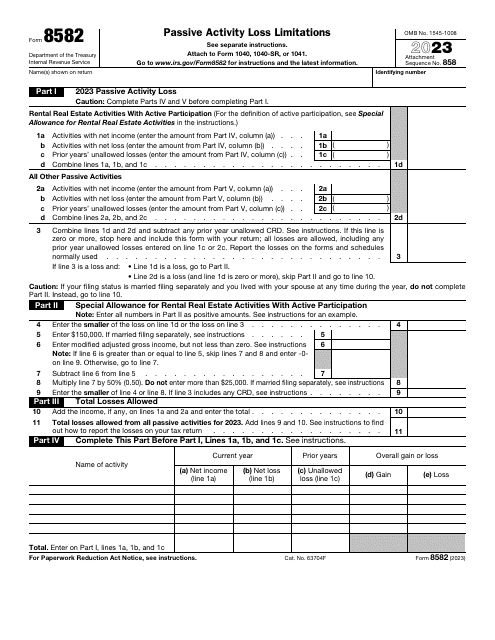

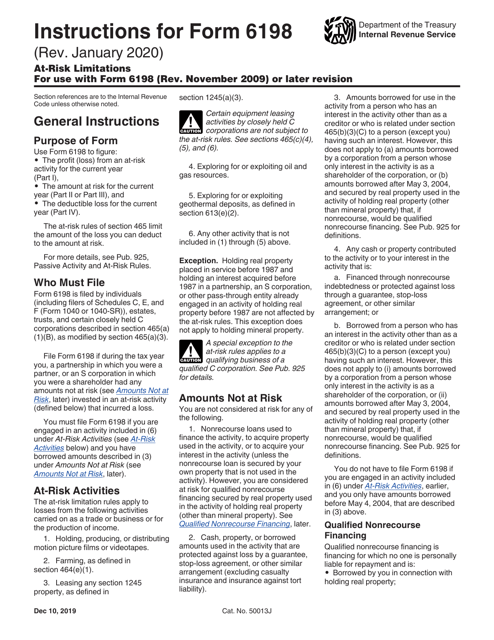

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

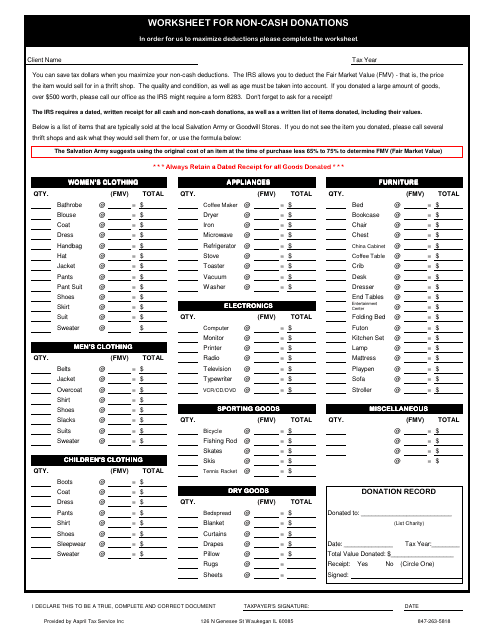

This document is a non-cash donations worksheet template provided by Aapril Tax Service Inc. It helps individuals track their non-cash donations for tax purposes.

This is a fiscal form used by taxpayers that need to inform the tax organs about the financial profit they generated through transactions with real estate.

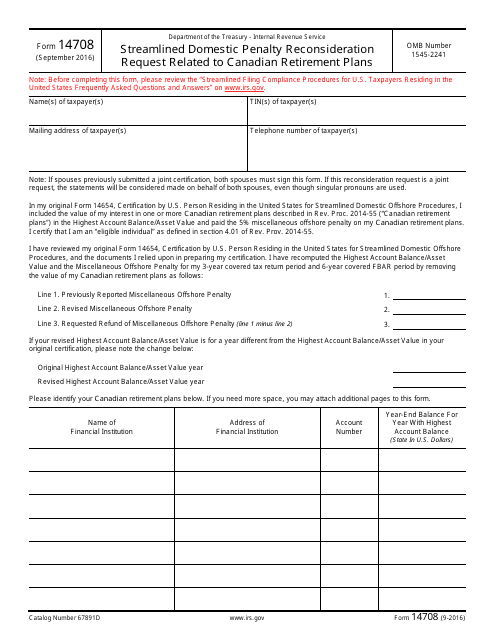

This document is used for requesting a reconsideration of penalties related to Canadian retirement plans under the Streamlined Domestic Offshore Procedures.

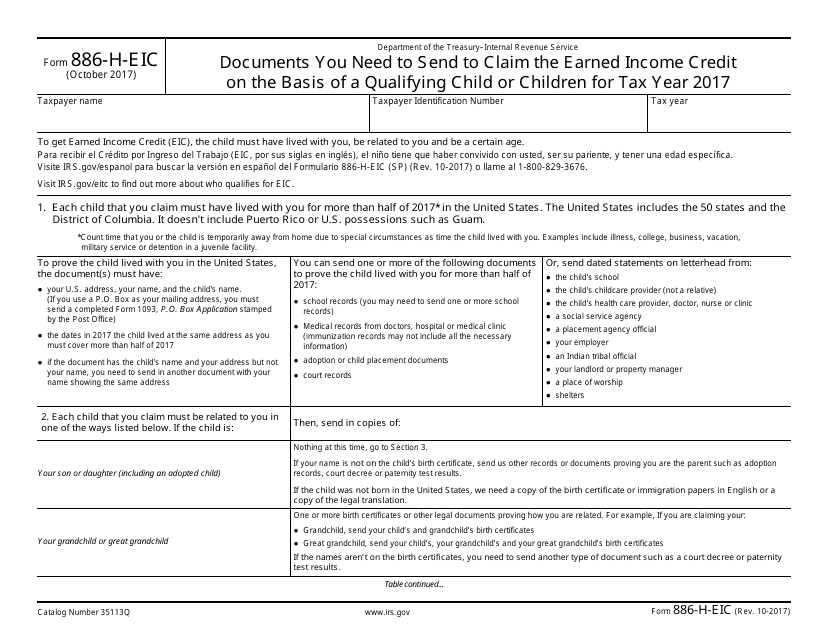

This form is used to provide the necessary documentation required to claim the Earned Income Credit (EIC) based on having a qualifying child or children. It outlines the specific documents that need to be submitted to the IRS in order to support your claim.

This is a formal IRS document used by entities that charge their customers a commission or fee for handling buy and sell orders to report how much capital gain or loss every client has got.

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

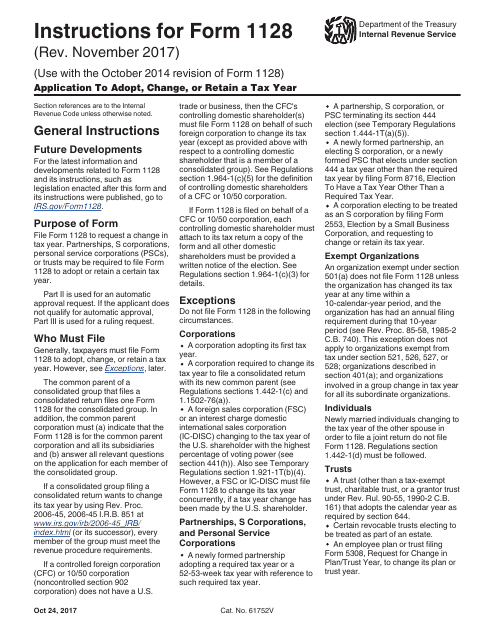

These are instructions for IRS Form 1128, Application to Adopt, Change, or Retain a Tax Year.

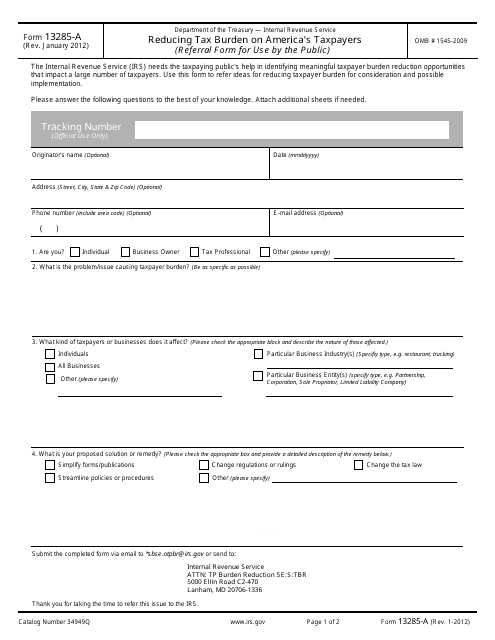

This Form is used for reducing the tax burden on American taxpayers. It provides eligible taxpayers with options to reduce their overall tax liability.