Tax Preparer Templates

Documents:

1288

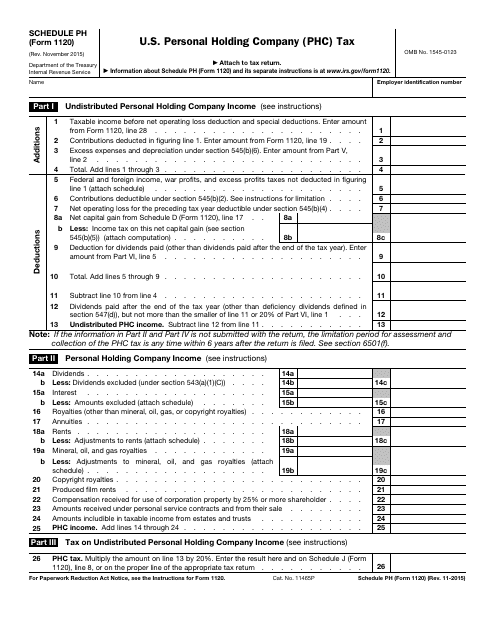

This form is used for reporting and paying U.S. Personal Holding Company (PHC) Tax for companies classified as personal holding companies.

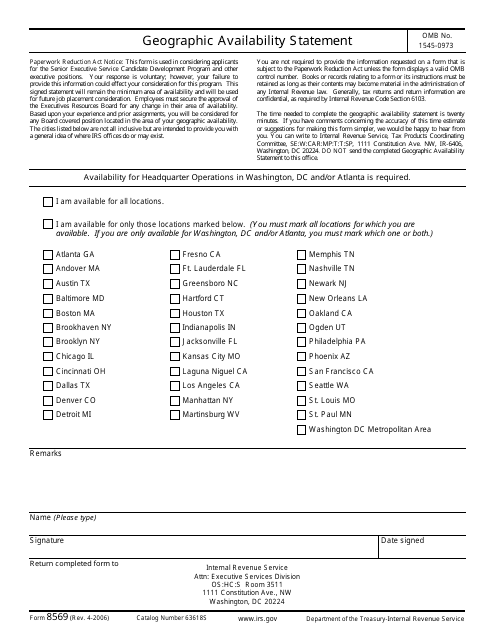

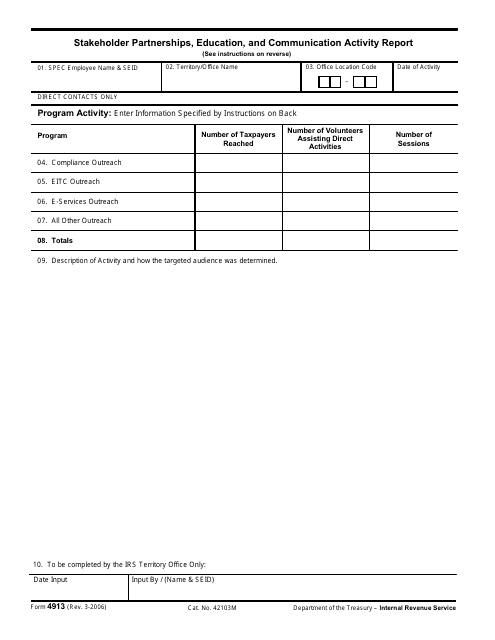

This form is used for providing information about the geographic availability of services provided by an organization to the Internal Revenue Service (IRS).

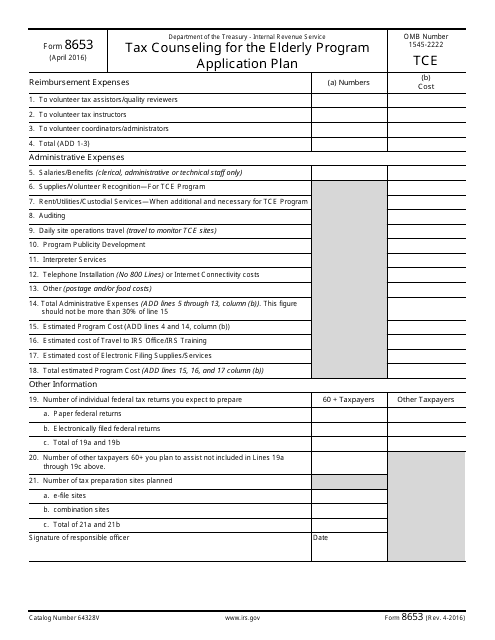

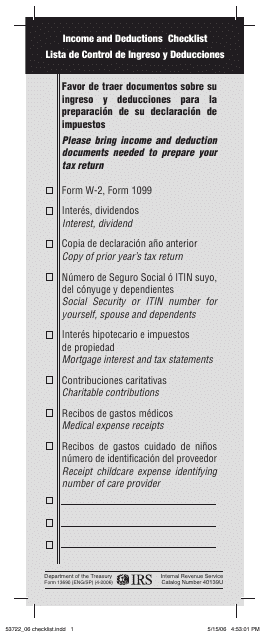

This form is used for checking income and deductions. It is available in both English and Spanish.

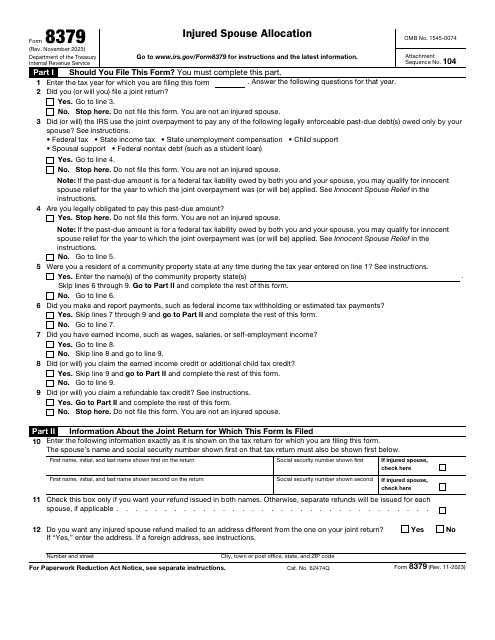

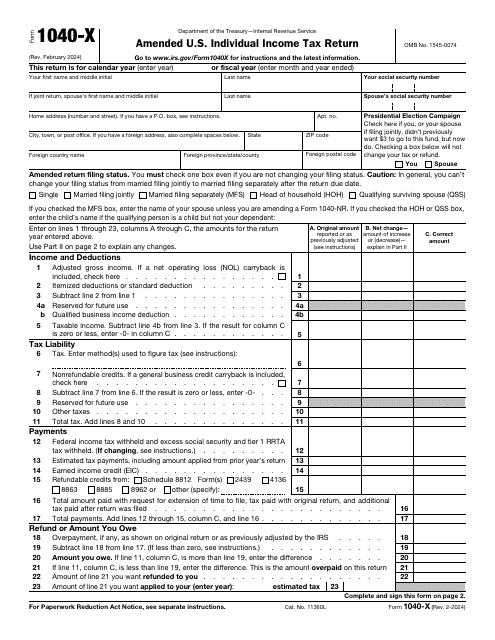

This document is used for correcting records on your tax return form. A separate form is used every year for which information is changed. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid.

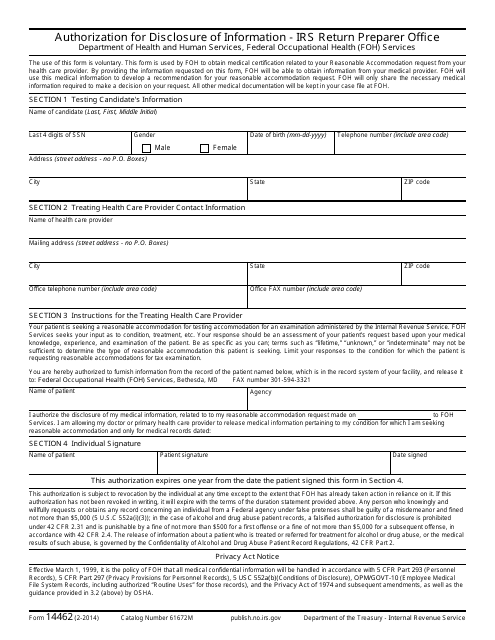

This document for authorizing disclosure of information to the IRS Return Preparer Office.

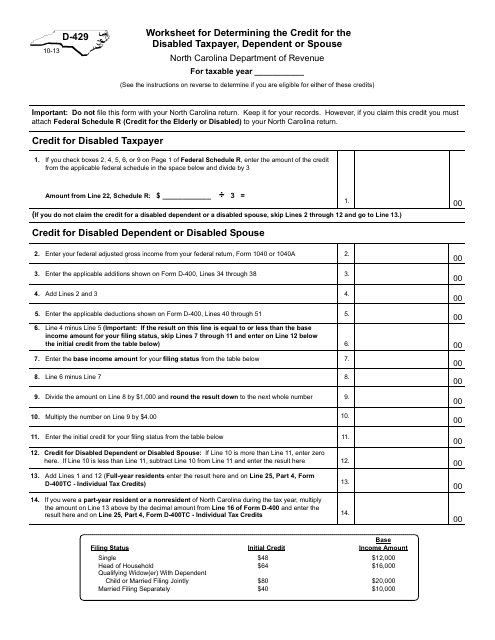

This Form is used for determining the credit for the disabled taxpayer, dependent or spouse in North Carolina.

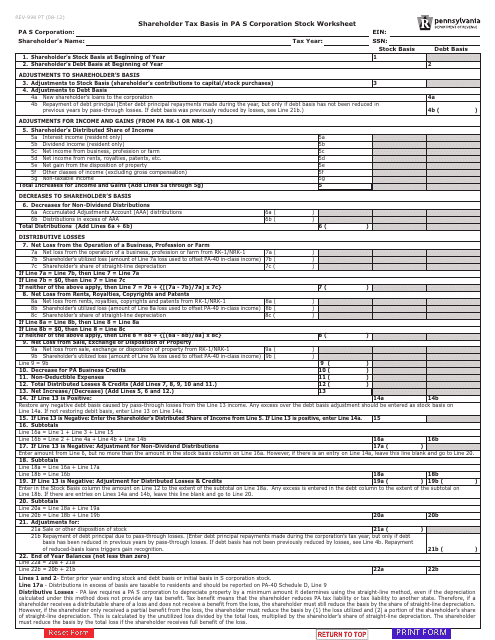

This form is used for calculating the tax basis in Pennsylvania S Corporation stock for shareholders.

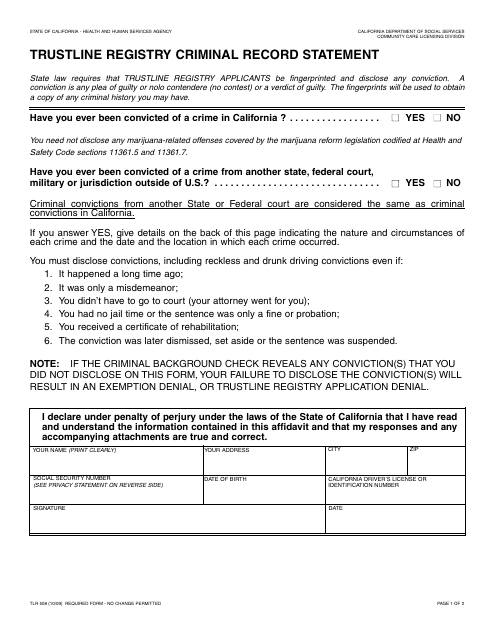

This form is used for providing a criminal record statement when applying for registration with Trustline, a licensed home care agency in California.

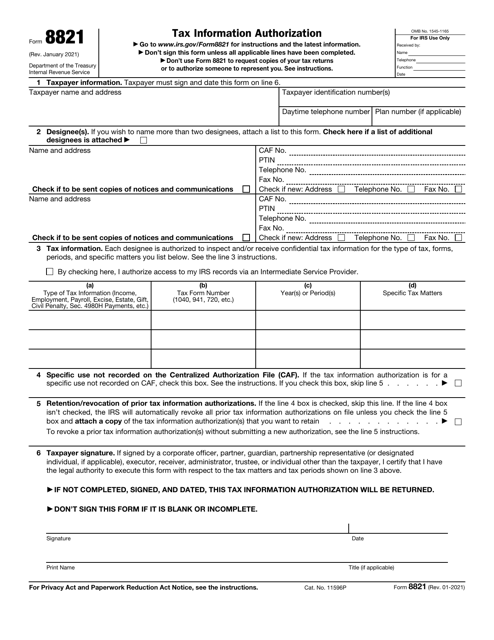

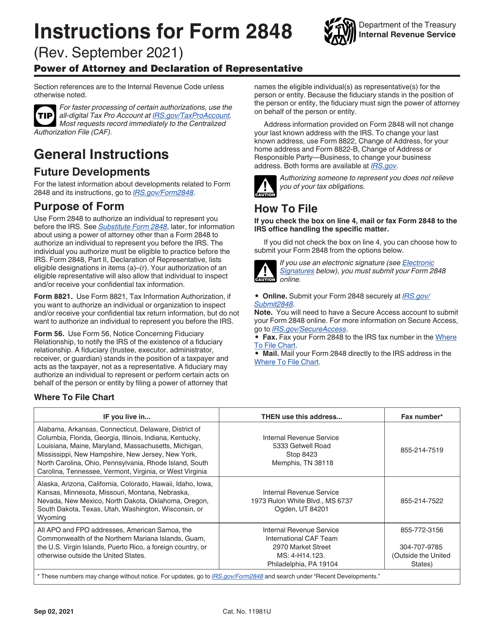

This is a formal document filled out by a taxpayer who wants another individual or company to obtain access to their tax information.

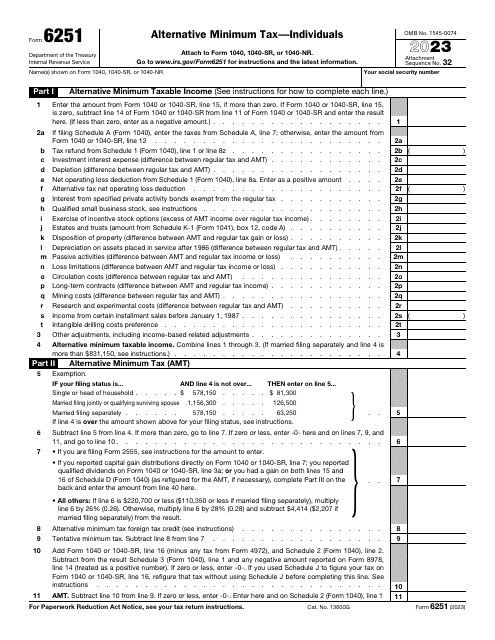

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

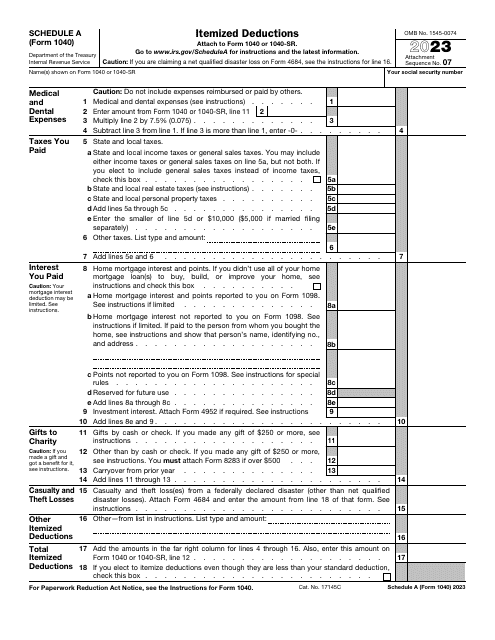

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

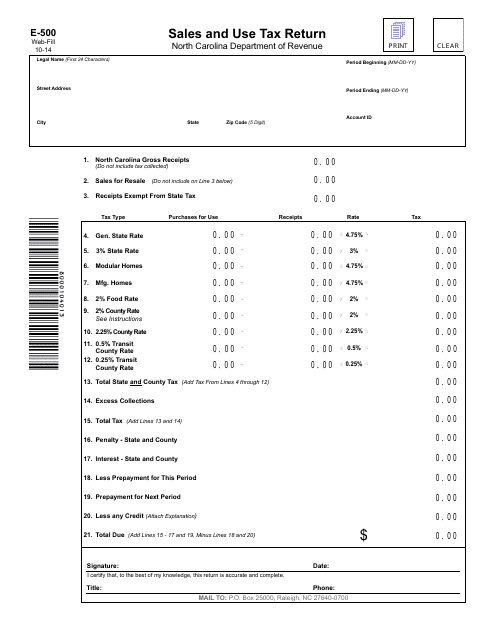

This Form is used for filing sales and use tax returns in the state of North Carolina. It ensures that businesses report and remit the correct amount of sales and use tax owed to the state.

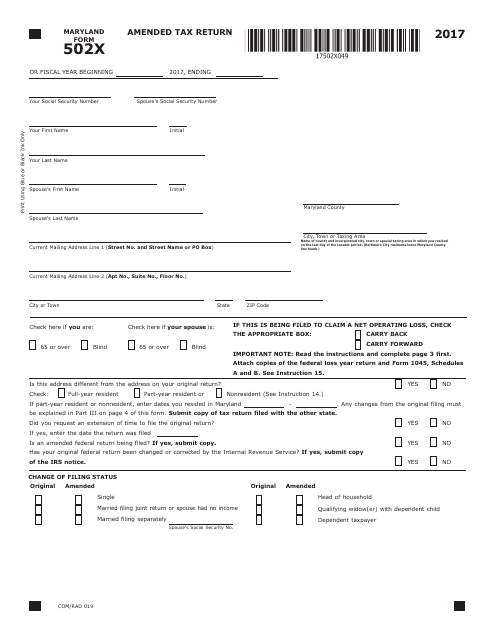

This form is used for filing an amended tax return in the state of Maryland.

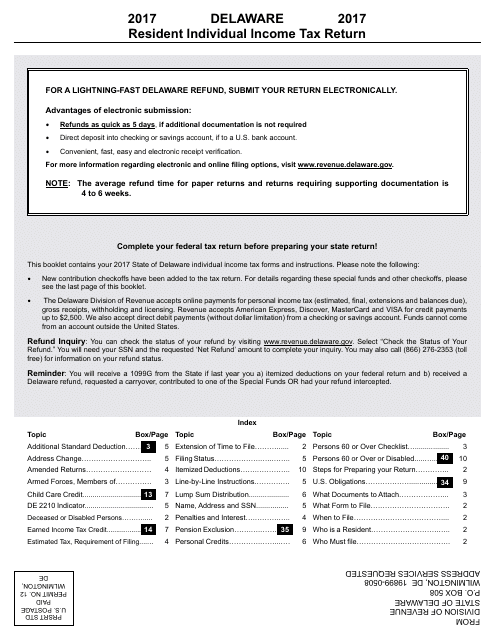

This Form is used for reporting and paying individual income taxes for residents of Delaware.

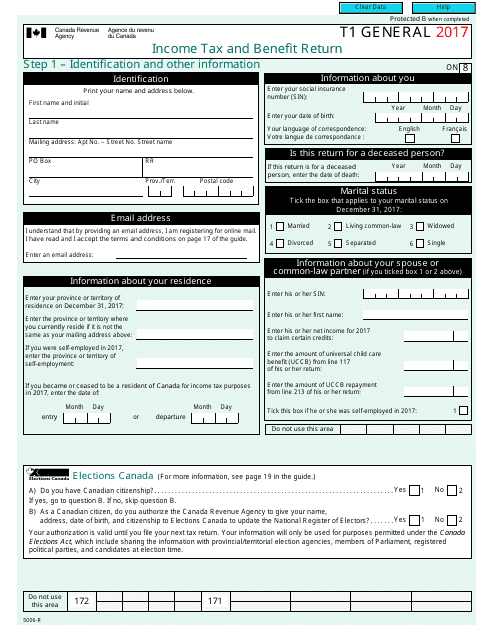

Canadian residents may use this official statement to report their income tax and list all sources of their personal income.

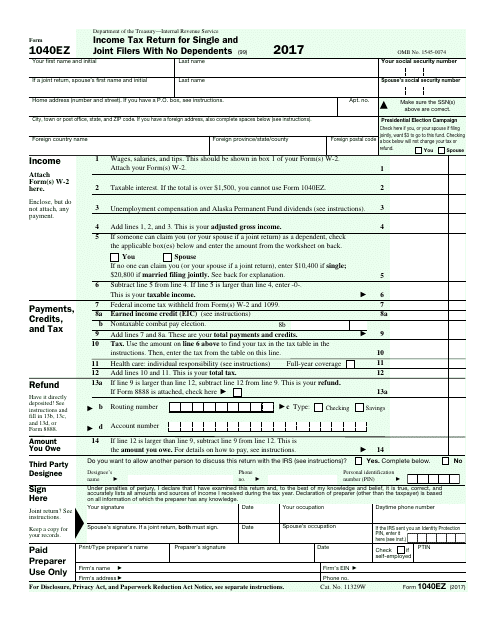

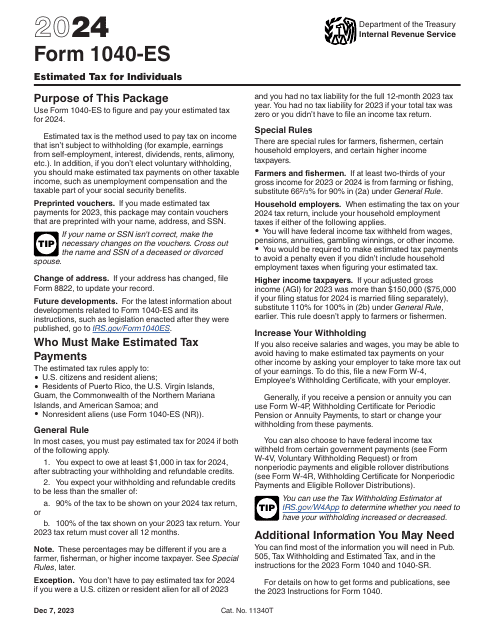

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

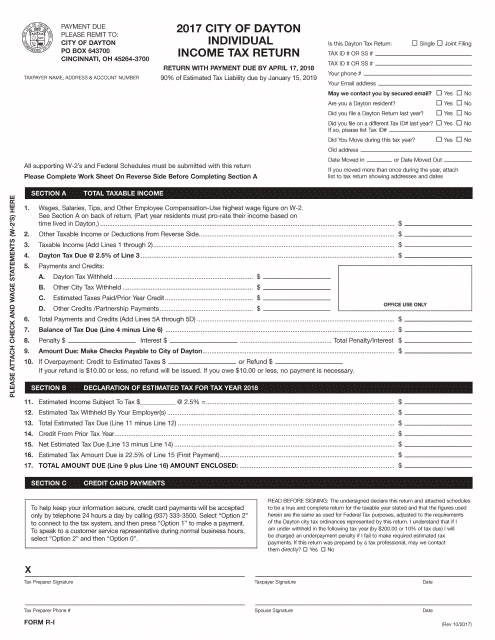

This form is used to report individual income tax return for residents of the City of Dayton, Ohio.

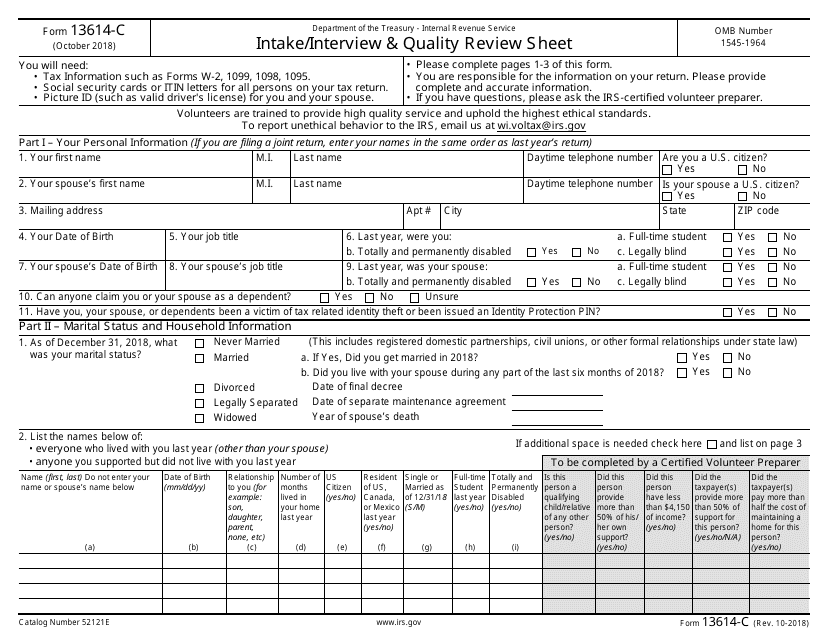

This Form is used for gathering information and conducting interviews with taxpayers to ensure the quality and accuracy of their tax returns.

This Form is used for filing income tax returns specifically for residents of the city of Brunswick, Ohio.

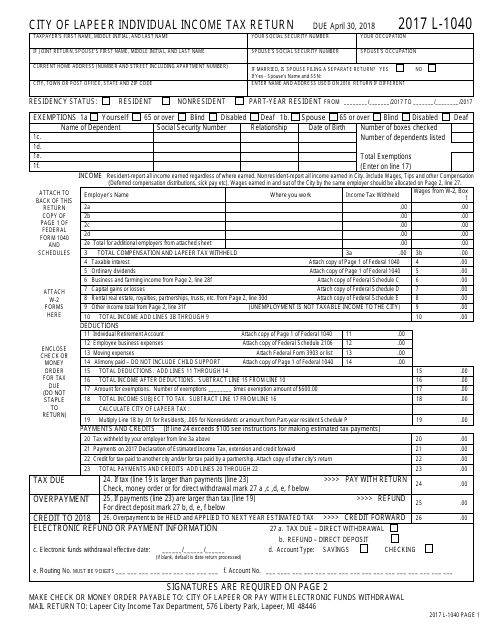

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.

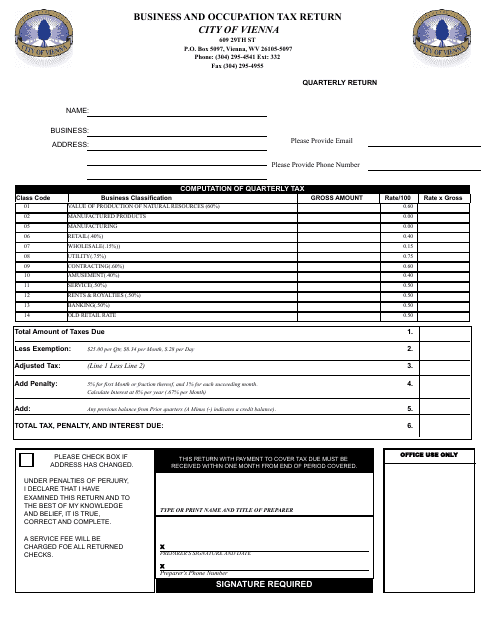

This form is used for filing the Business and Occupation Tax Return with the City of Vienna, West Virginia.

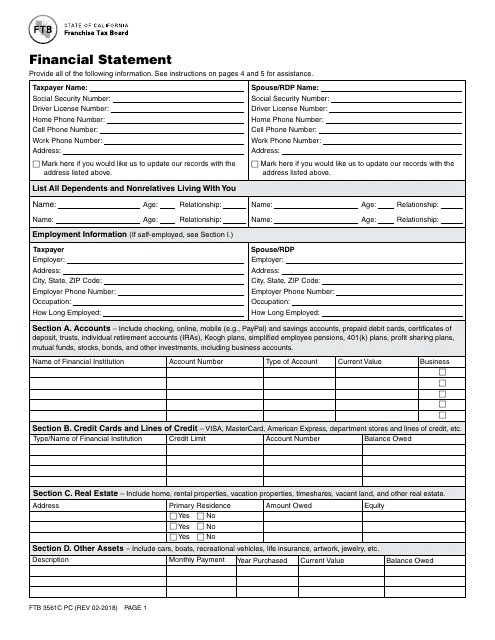

This form is used for filing a financial statement in California.

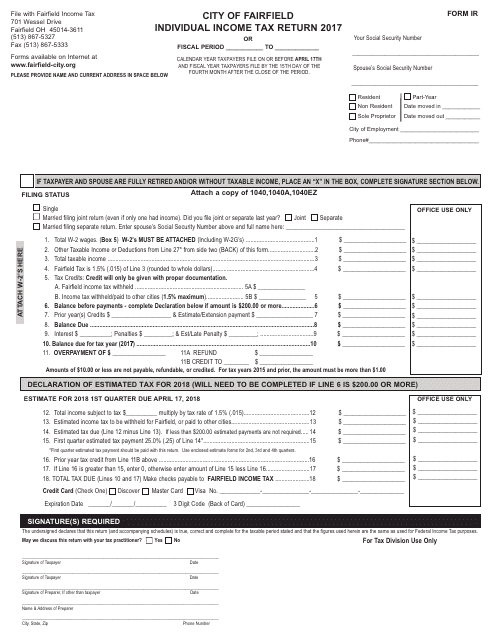

This form is used for filing an individual income tax return in the city of Fairfield, Ohio.

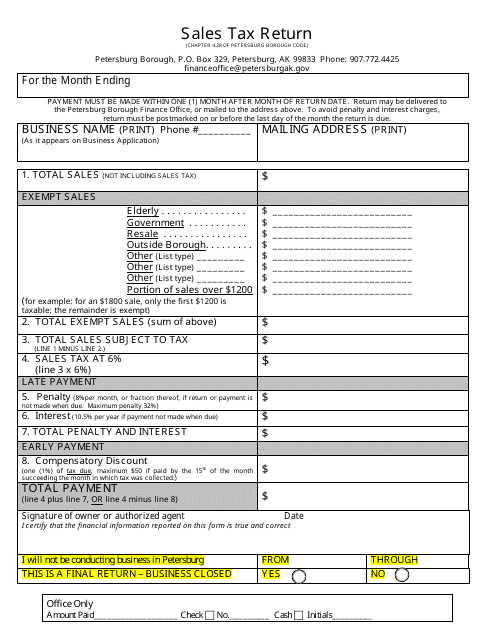

This document is used for reporting and remitting sales tax in Petersburg Borough, Alaska.

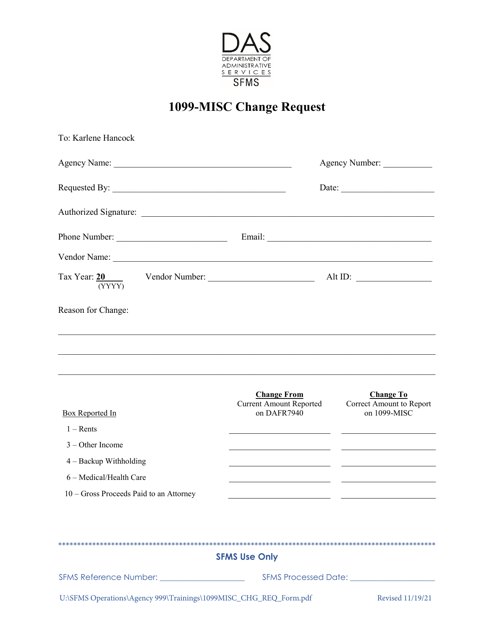

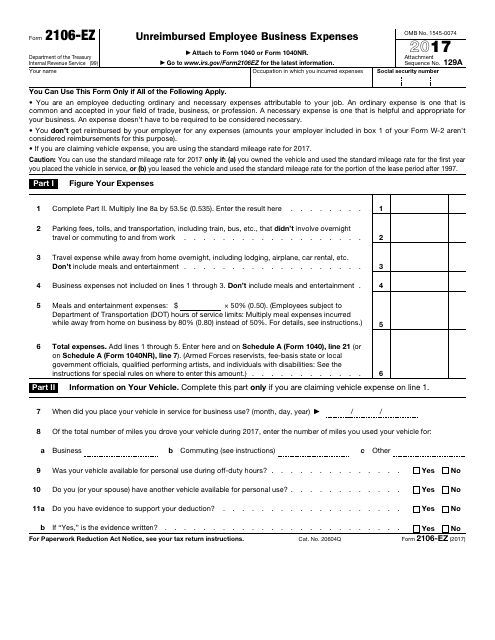

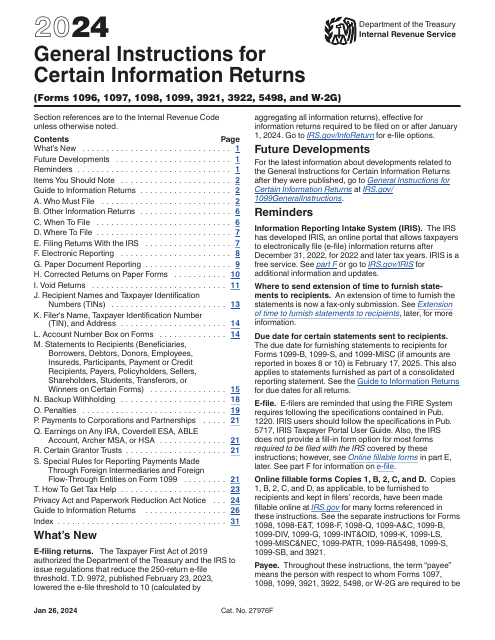

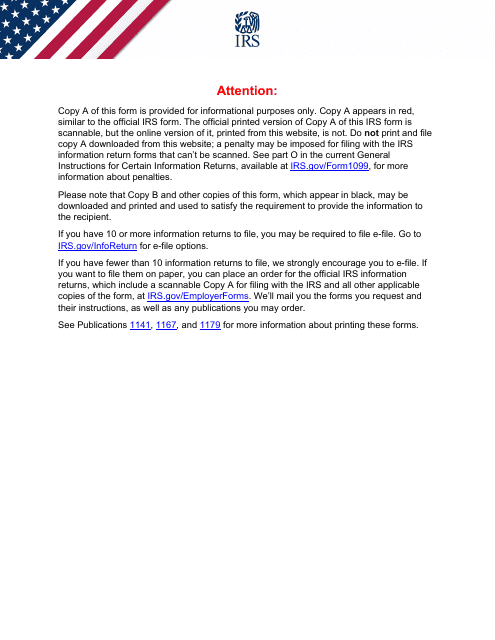

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

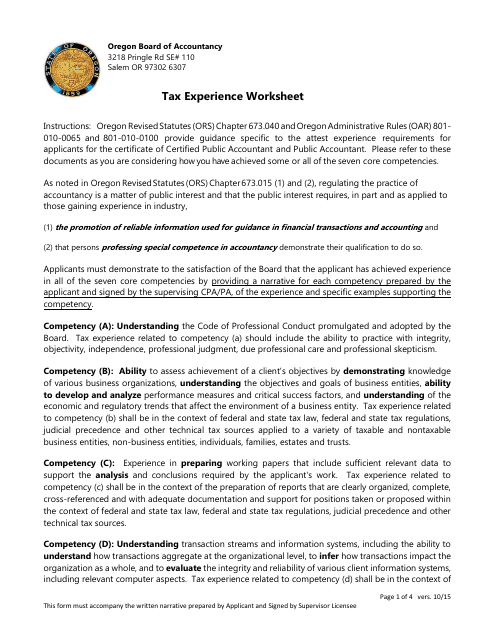

This document is a worksheet specifically for individuals with tax experience in Oregon. It can be used to organize and track relevant information when preparing state taxes in Oregon.

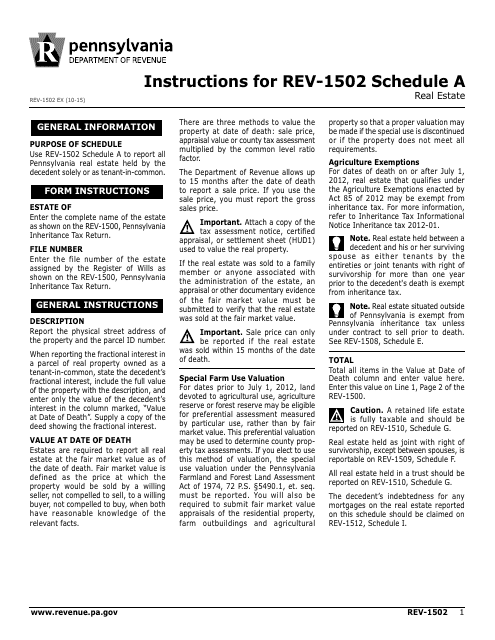

This document provides instructions for completing Form REV-1502 Schedule A, which is a real estate schedule in Pennsylvania. It guides taxpayers on how to report their real estate income and expenses accurately.

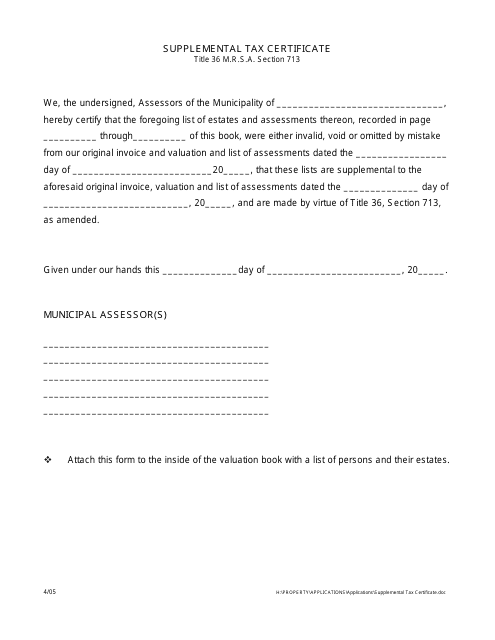

This type of document is used for reporting supplemental taxes in the state of Maine.

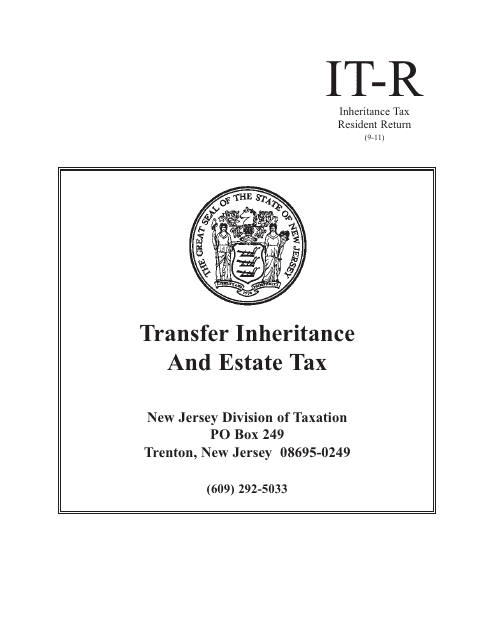

This form is used for reporting and paying inheritance tax for residents of New Jersey.

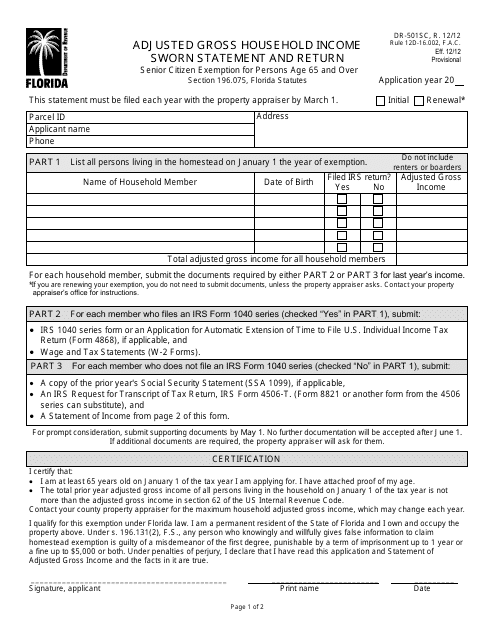

This form is used for reporting the adjusted gross household income in Florida and is required to be accompanied by a sworn statement.