Tax Preparer Templates

Documents:

1288

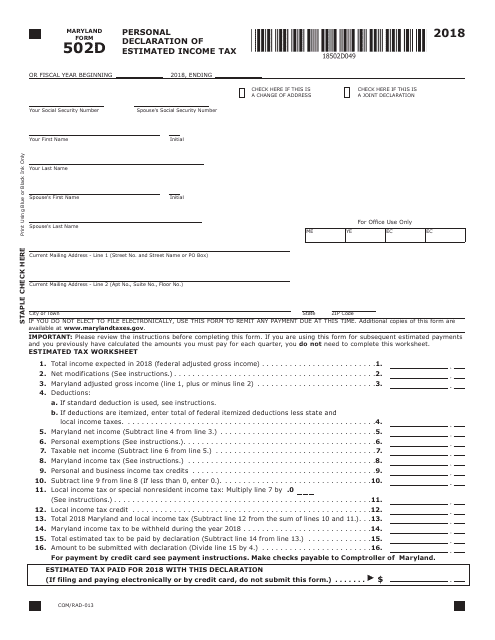

This form is used for residents of Maryland to declare their estimated income tax for the year. It allows individuals to calculate and submit their projected income tax liability to the state.

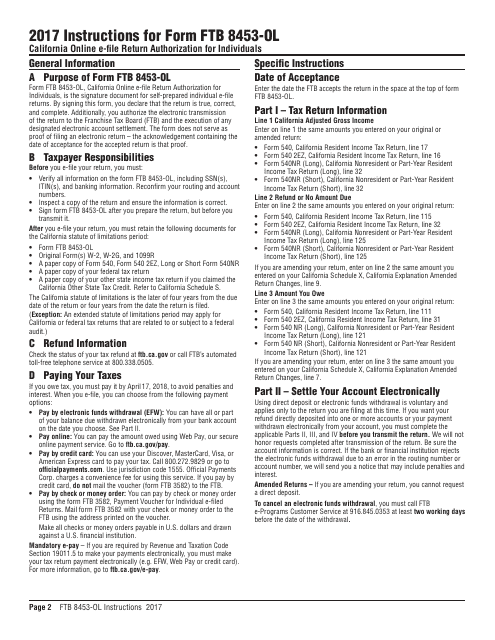

This Form is used for authorizing the electronic filing of individual tax returns in California.

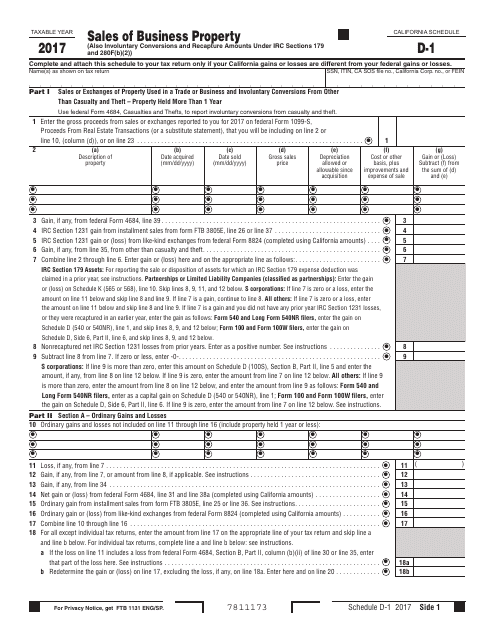

This form is used for reporting sales of business property in California on Form 540 Schedule D-1.

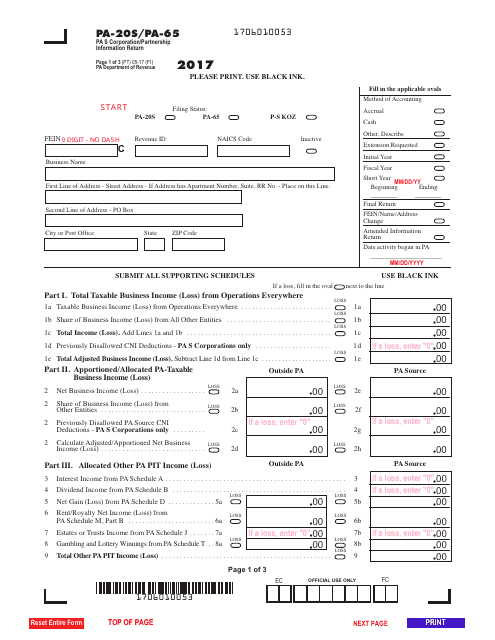

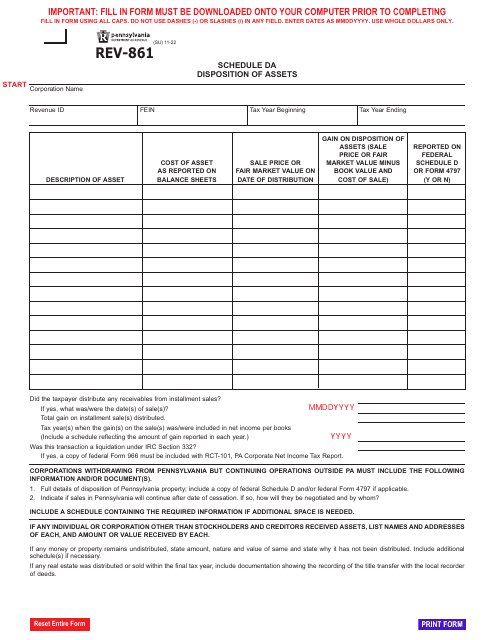

This Form is used for Pennsylvania S corporations and partnerships to file their annual information return.

This Form is used for reporting income and expenses of electing large partnerships in the United States.

This is a document you may use to figure out how to properly complete IRS Form 6765

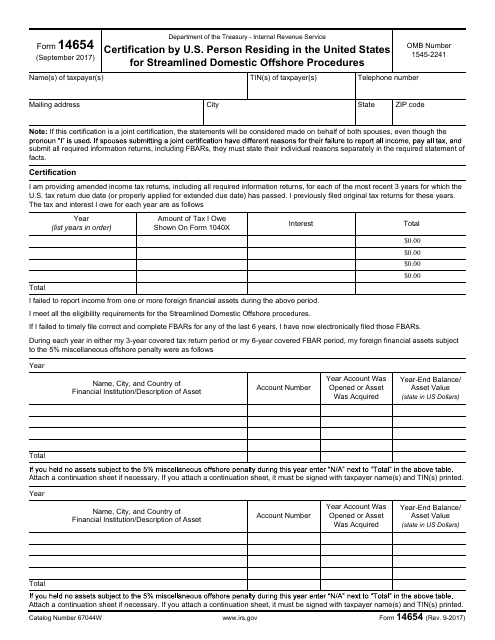

This form is used for U.S. persons who reside in the United States and want to certify their compliance with the streamlined domestic offshore procedures for reporting offshore income and assets to the IRS.

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

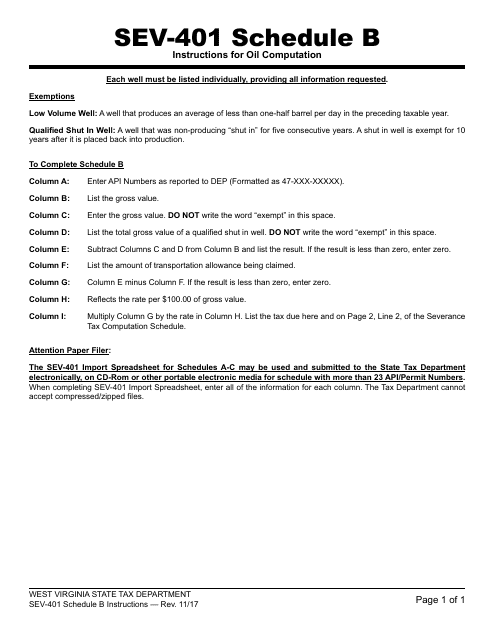

This Form is used for calculating oil production for tax purposes in the state of West Virginia.

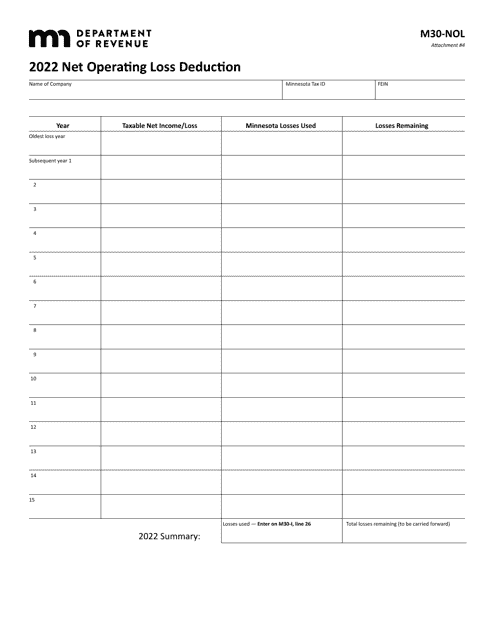

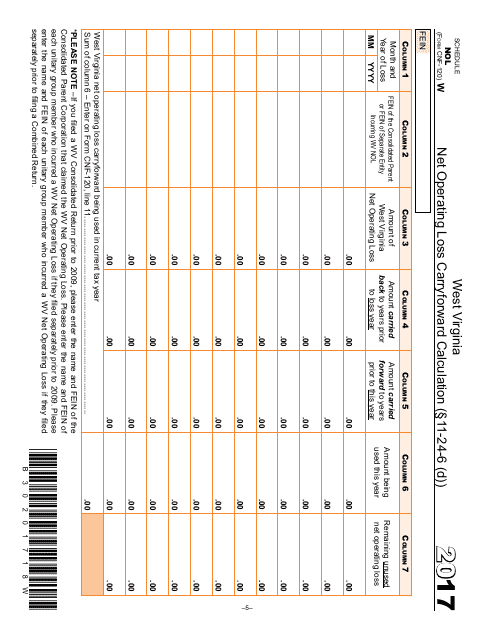

This form is used for calculating the Net Operating Loss (NOL) carryforward for individuals and businesses in West Virginia.

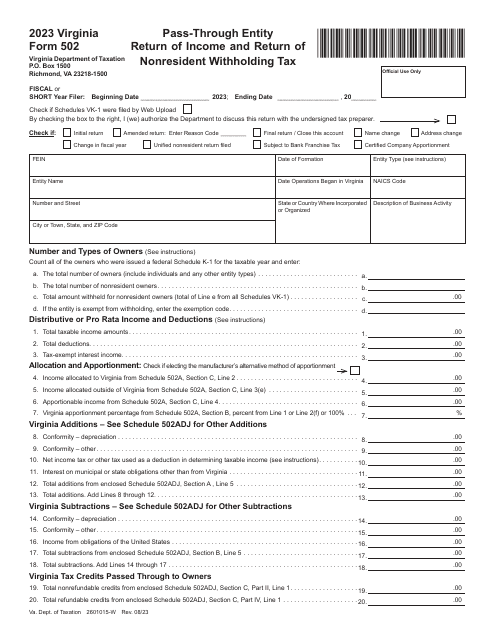

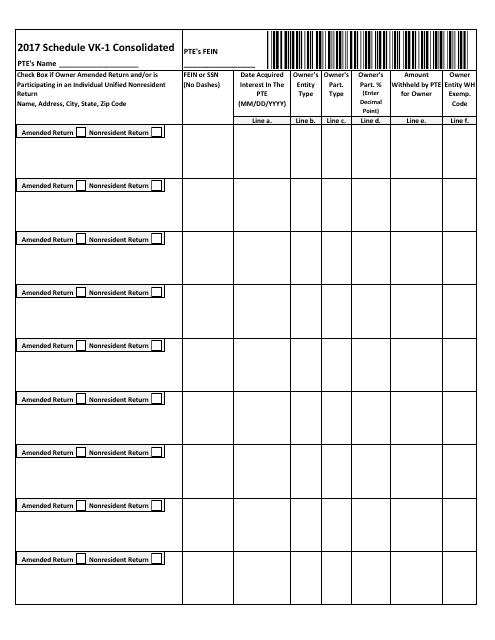

This document is used for reporting consolidated income and expenses in the state of Virginia.

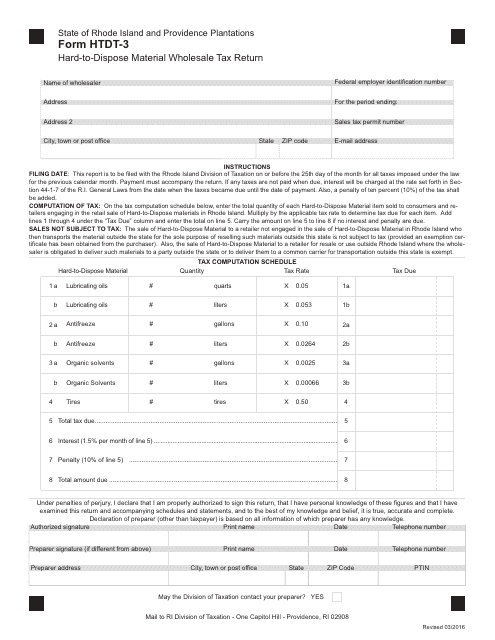

This Form is used for filing the Hard-To-Dispose Material Wholesale Tax Return in Rhode Island.

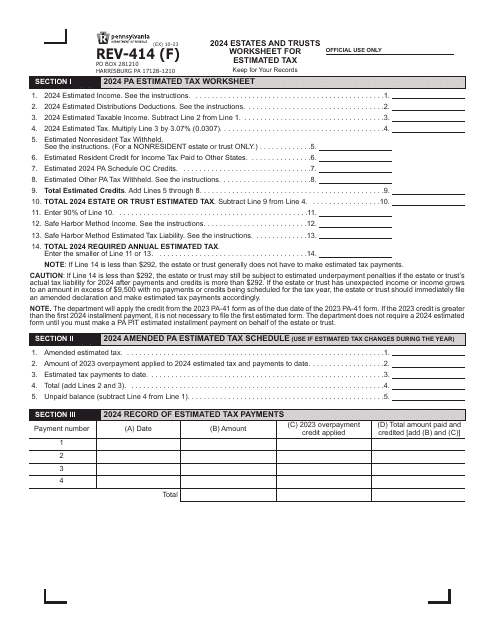

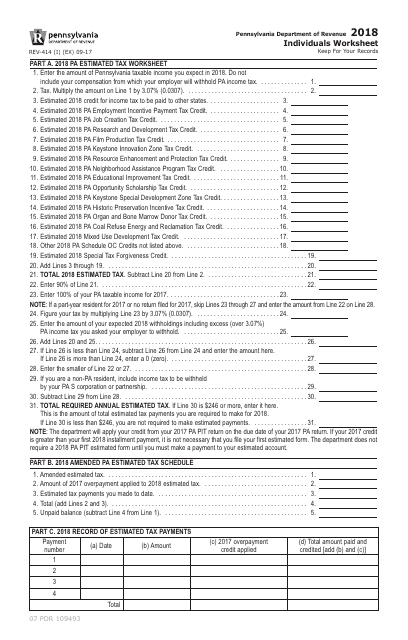

This form is used for individuals in Pennsylvania to complete a worksheet related to their taxes.

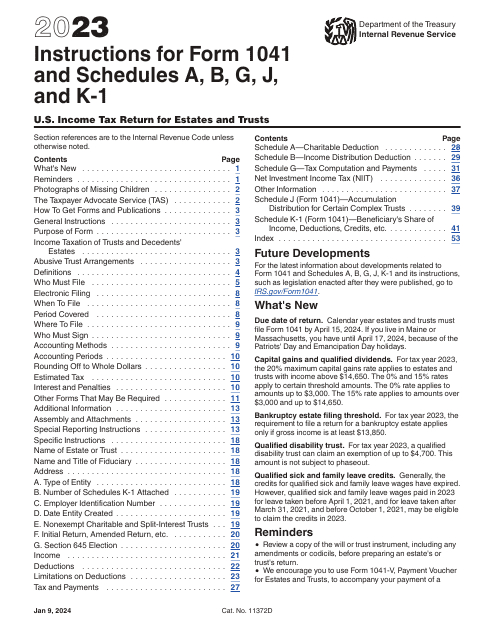

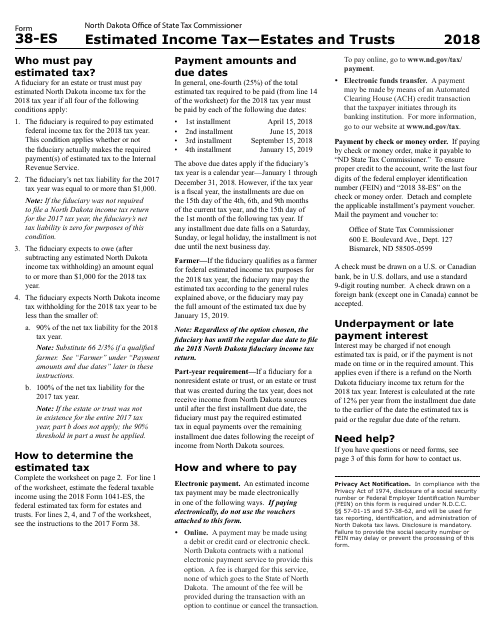

This Form is used for estimating income tax for estates and trusts in North Dakota.