Tax Templates

Documents:

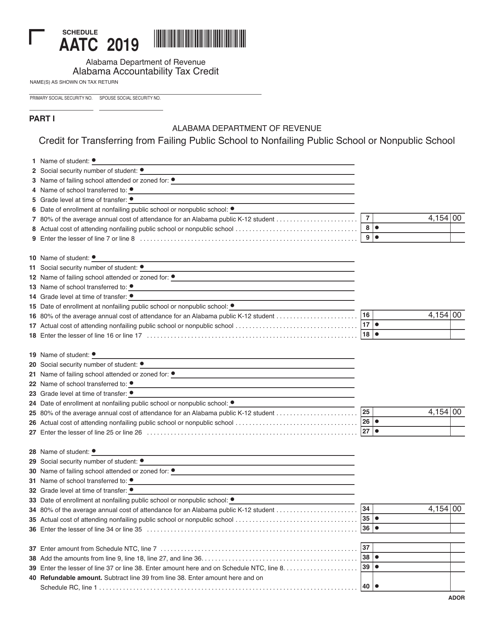

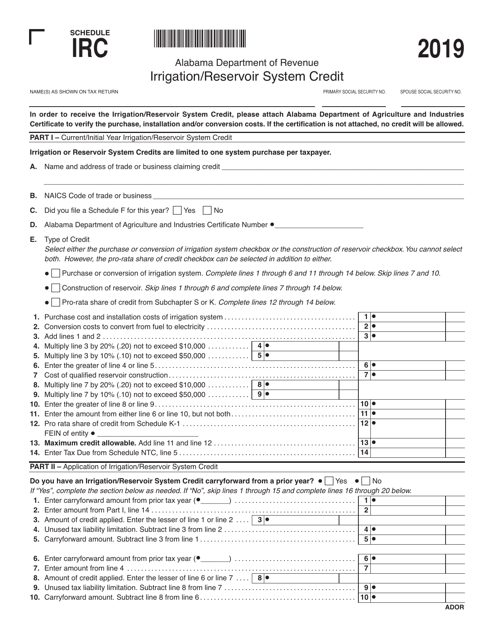

2882

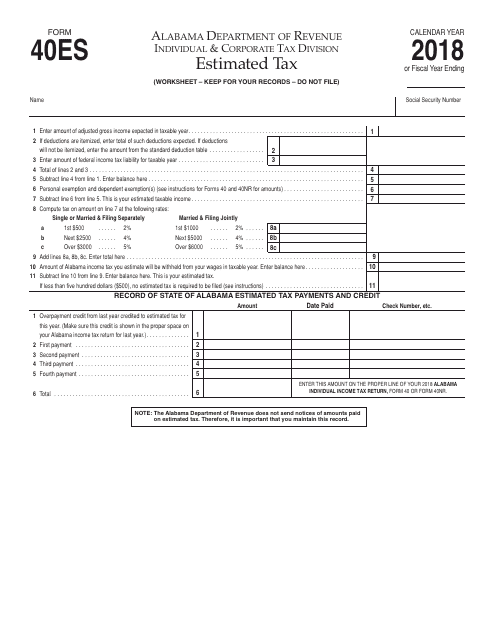

This form is used for individuals in Alabama to report and pay estimated taxes.

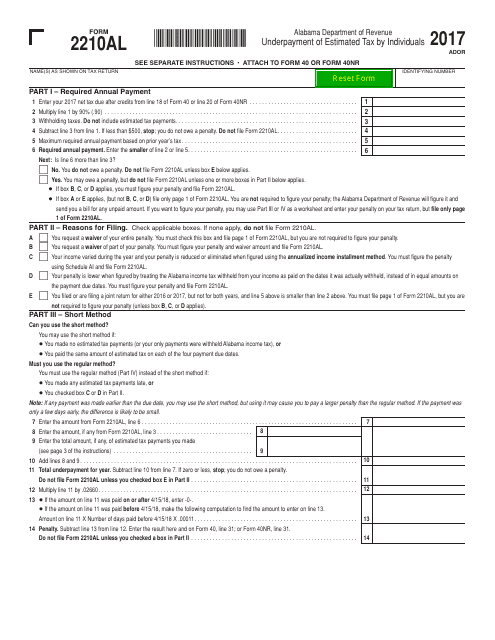

This form is used for reporting underpayment of estimated tax by individuals in Alabama.

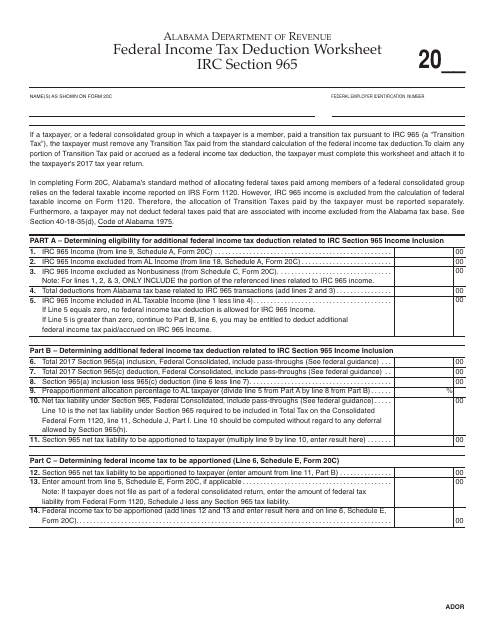

This document provides a worksheet to calculate the federal income tax deduction under IRC Section 965 for residents of Alabama.

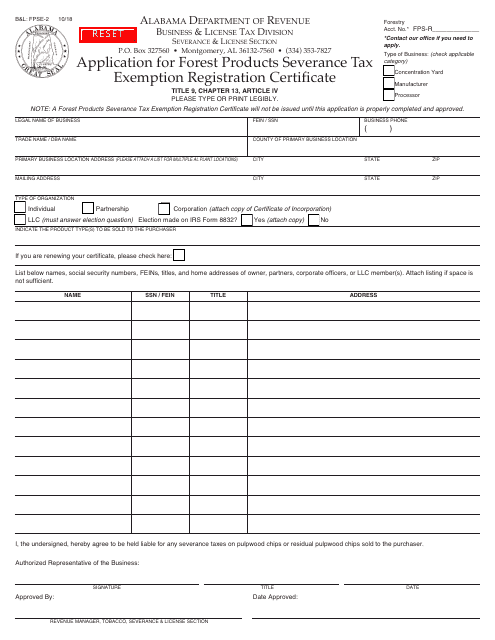

This Form is used for applying for a Forest Products Severance Tax Exemption Registration Certificate in the state of Alabama.

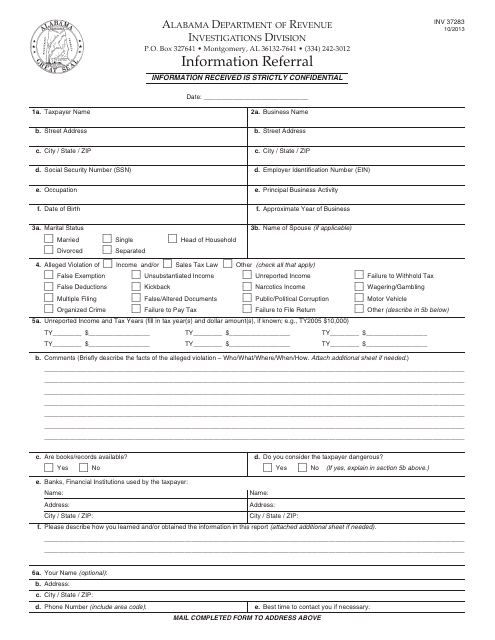

This form is used for submitting information referrals in the state of Alabama.

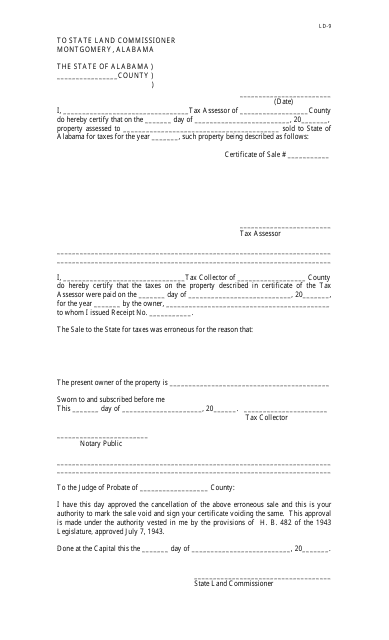

This form is used for requesting the cancellation of certain county-specific documents in Alabama.

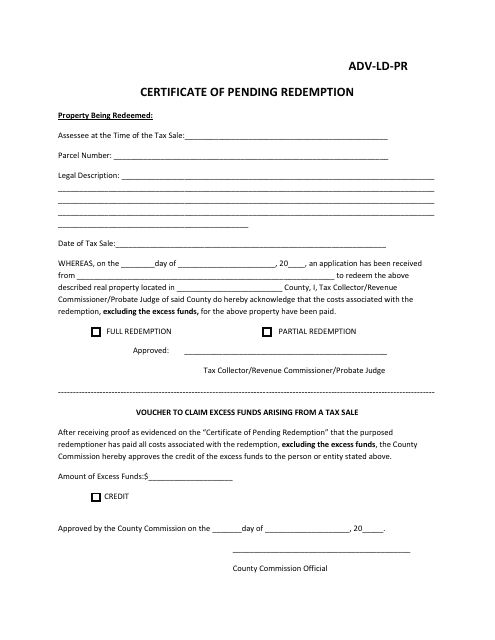

This type of document, the Form ADV-LD-PR Certificate of Pending Redemption, is used for redeeming securities in the state of Alabama. It certifies that a redemption of securities is pending and provides necessary information for the redemption process.

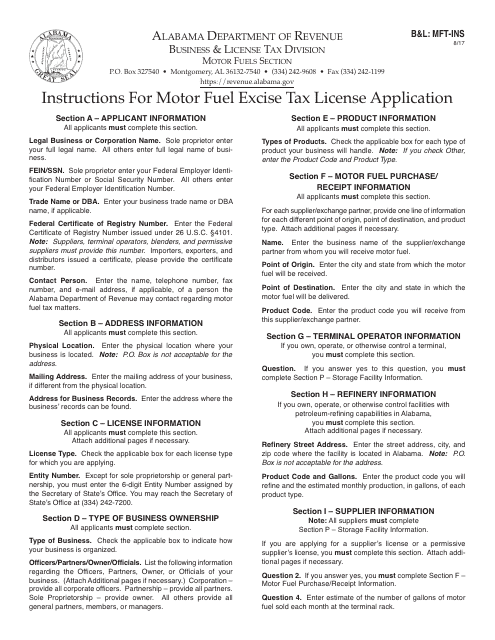

This Form is used for applying for a Motor Fuel Excise Tax License in Alabama. It is also referred to as Form B&L: MFT-INS or B&L:MFT-APP. Follow the instructions provided to complete the application accurately.

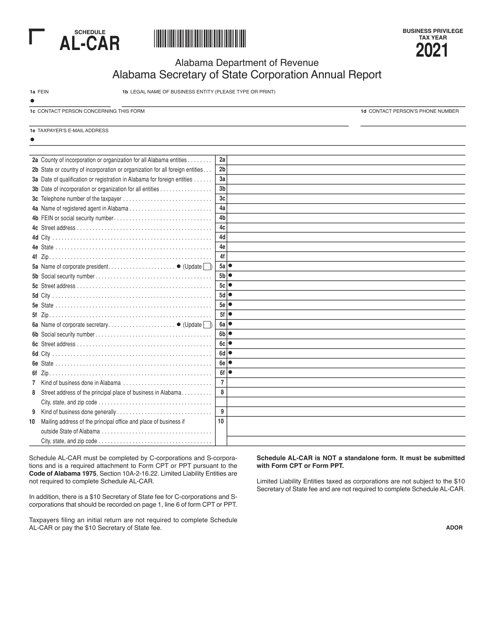

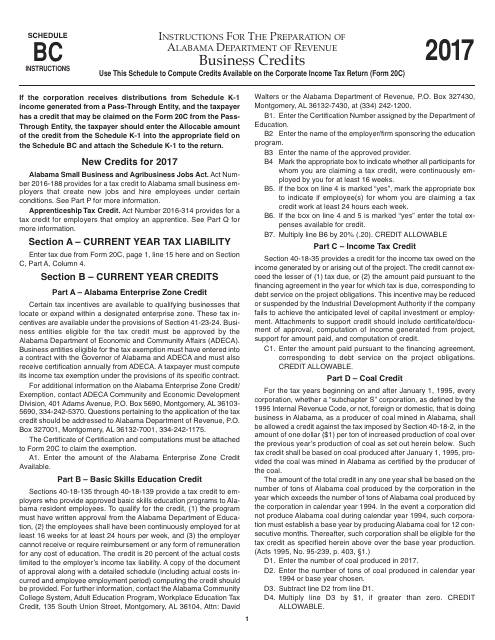

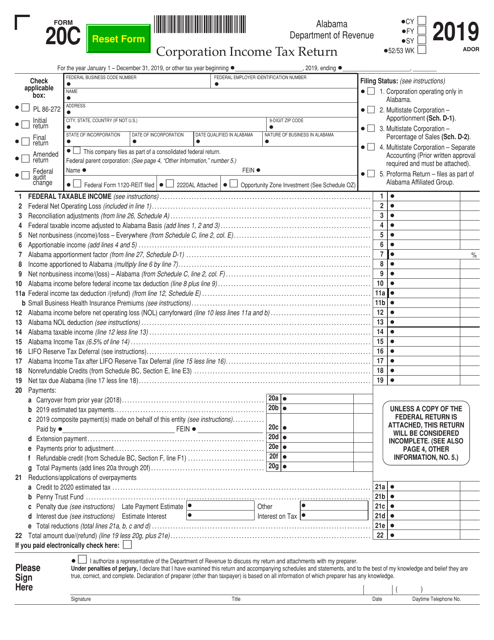

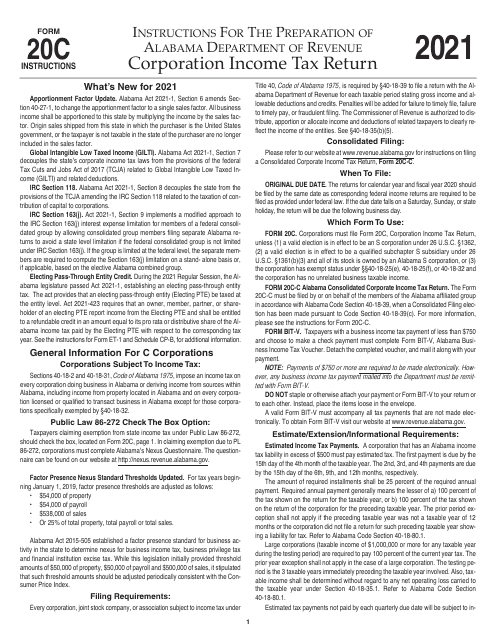

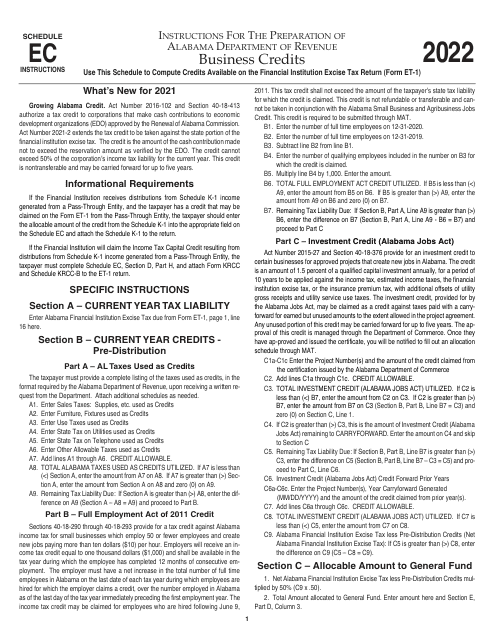

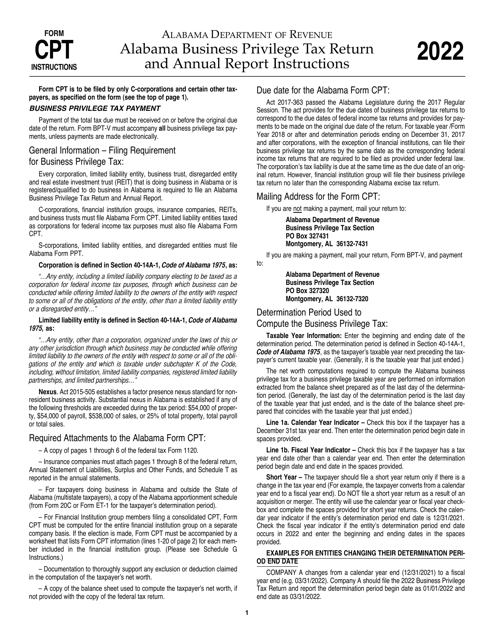

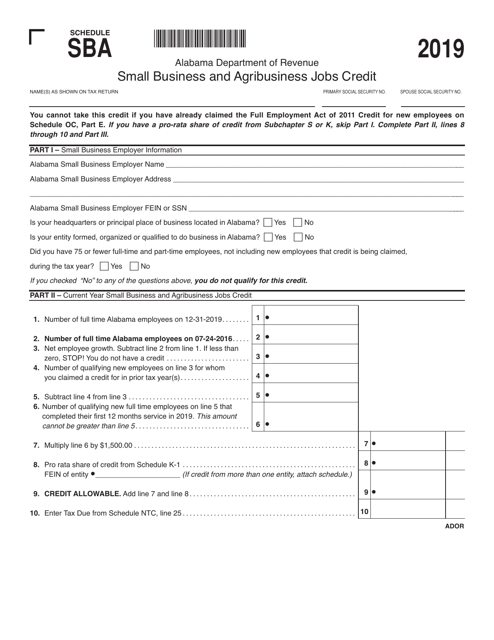

This Form is used for reporting business credits in Alabama. It provides instructions on how to fill out Schedule BC for Form 20C.

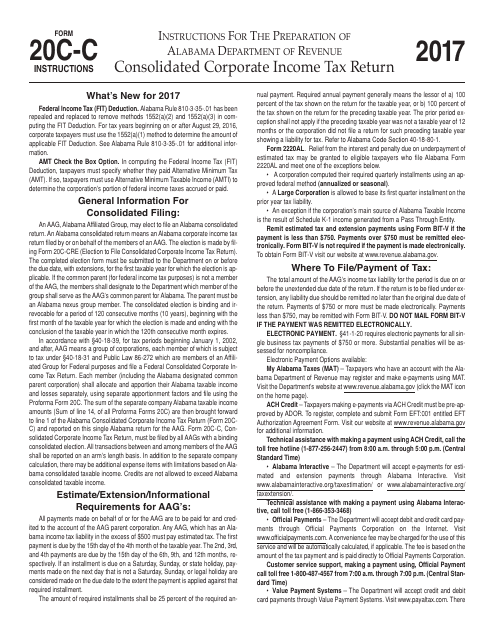

This Form is used for filing consolidated corporate income tax returns in the state of Alabama. It provides instructions for completing and submitting Form 20C-C.

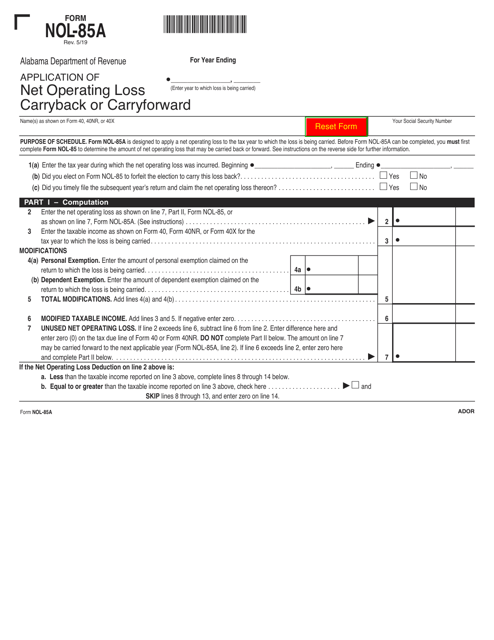

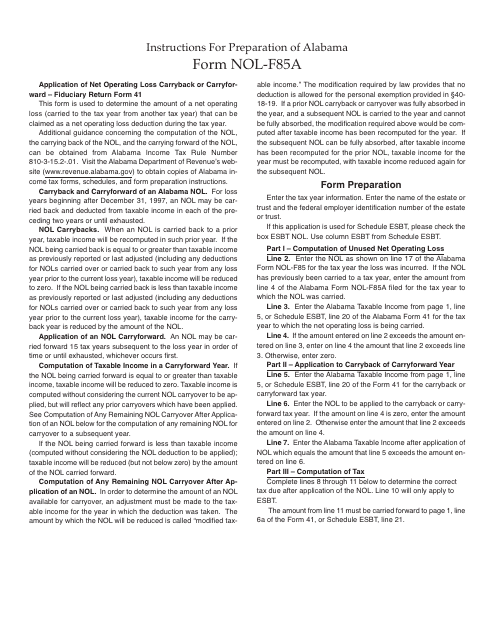

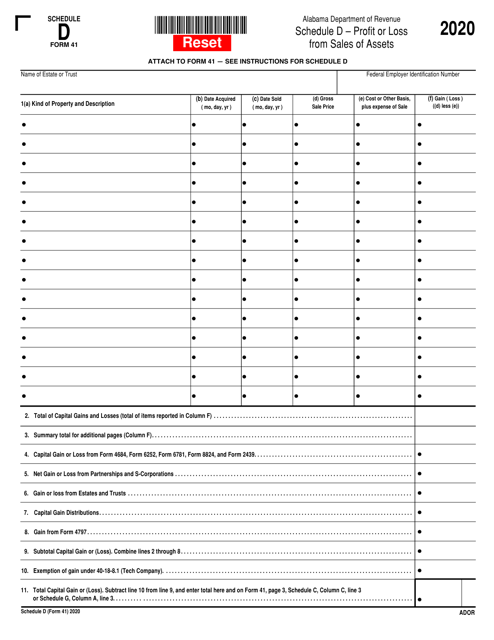

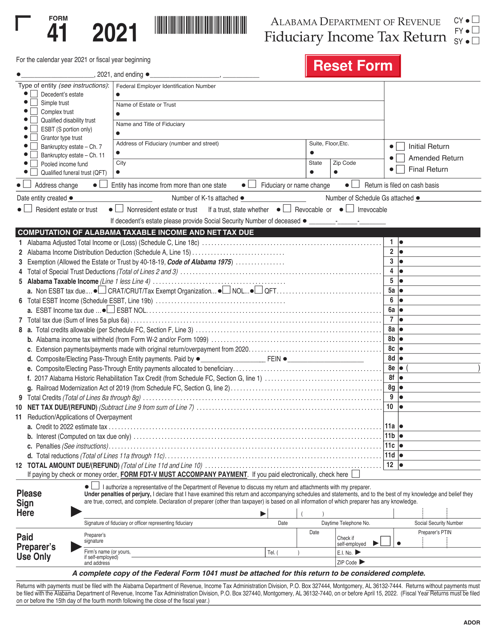

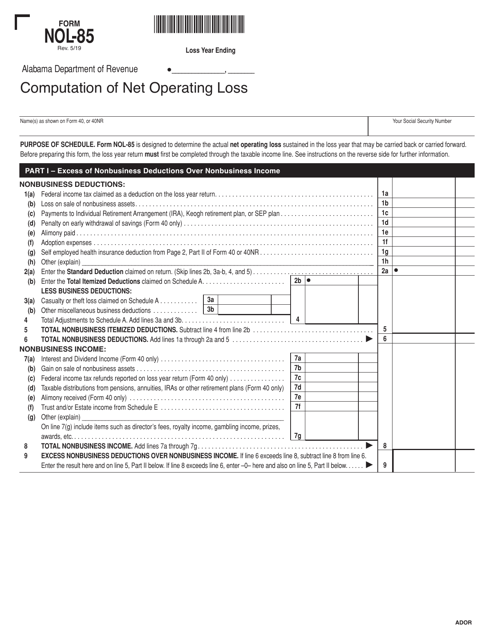

This document provides instructions for completing Form NOL-F85A, which is used to apply for a net operating loss carryback or carryforward on a Fiduciary Return Form 41 in the state of Alabama.

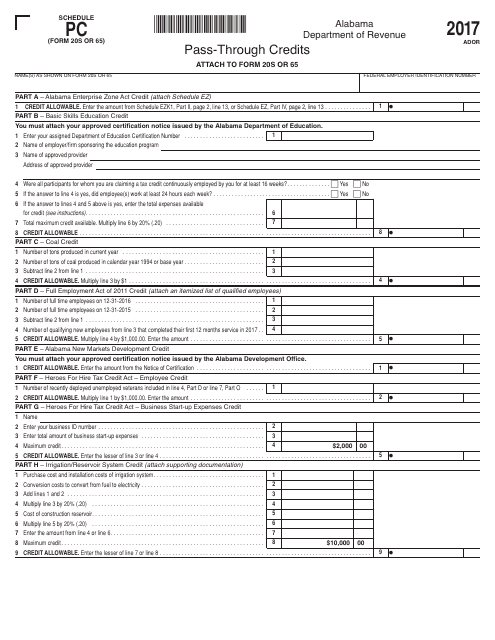

This form is used for reporting pass-through credits on Alabama Schedule PC for partnerships and S corporations.

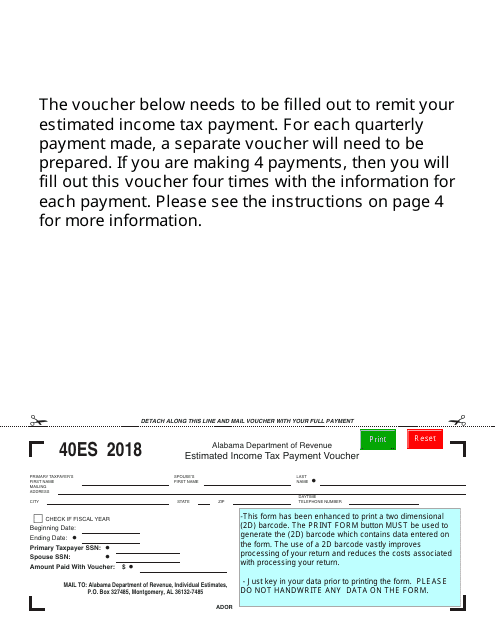

This form is used for making estimated income tax payments in Alabama.

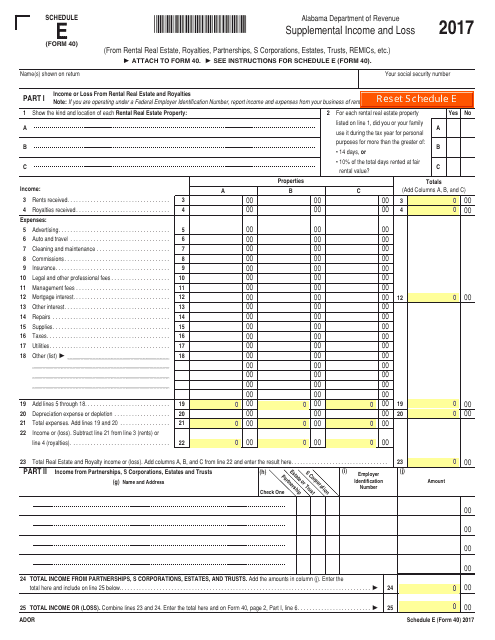

This Form is used for reporting supplemental income and loss in the state of Alabama.

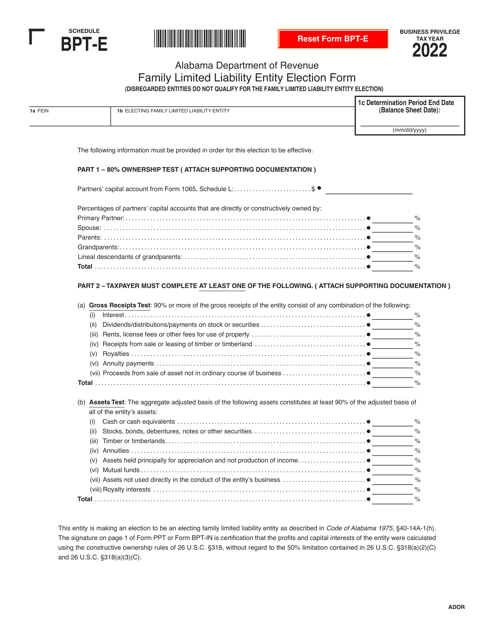

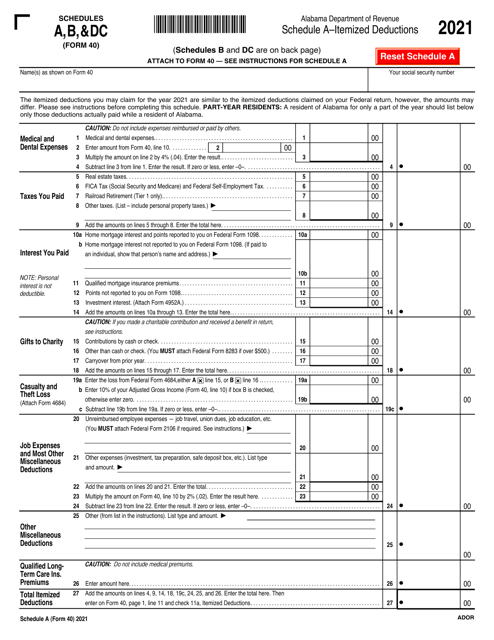

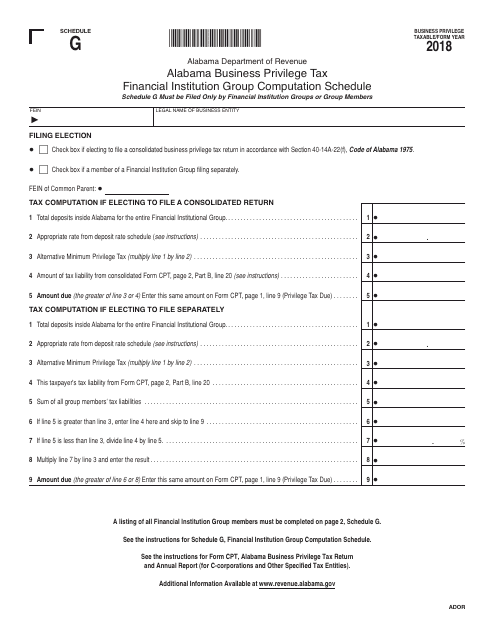

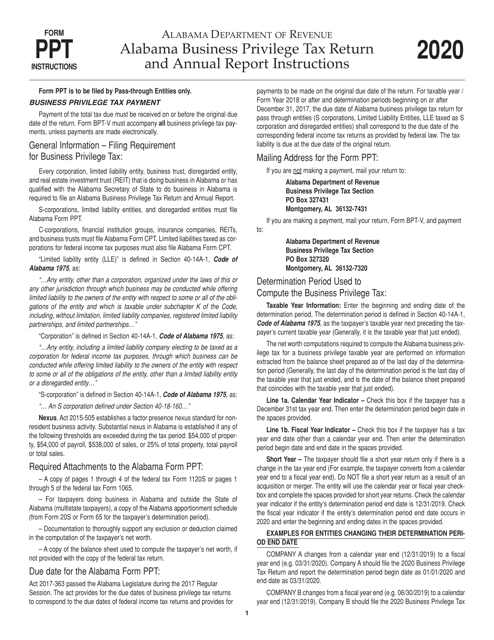

This document is used for calculating the Alabama Business Privilege Tax for financial institutions. It is a schedule specifically for the computation of the tax for the Financial Institution Group in Alabama.

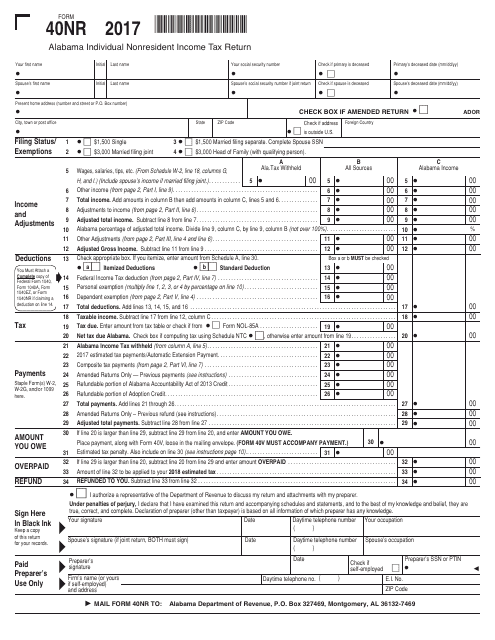

This Form is used for filing Alabama individual nonresident income tax return for taxpayers who earned income in Alabama but are not residents of the state.

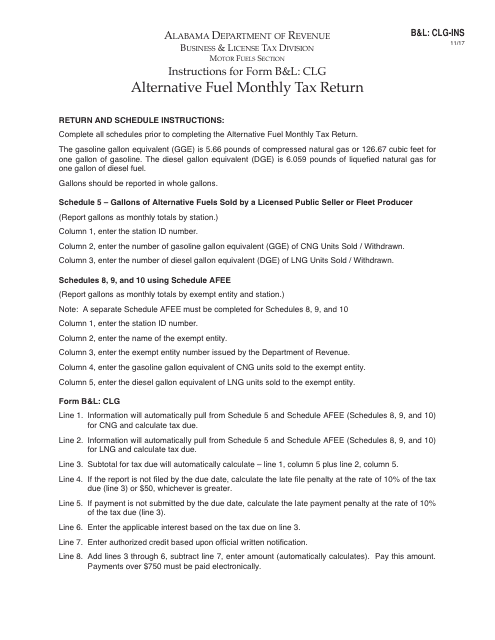

This Form is used for reporting and paying monthly taxes on alternative fuel usage in Alabama.

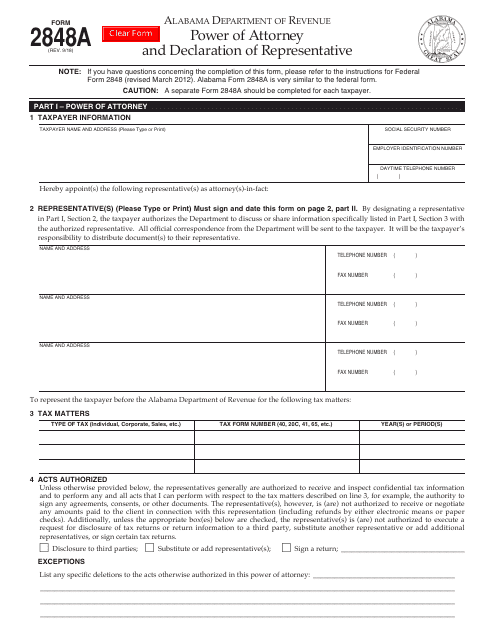

This form is used for granting power of attorney and designating a representative in Alabama.

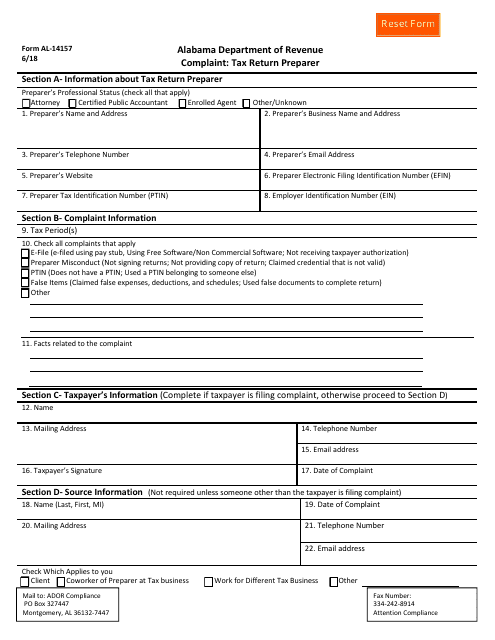

This form is used for filing a complaint against a tax return preparer in the state of Alabama.

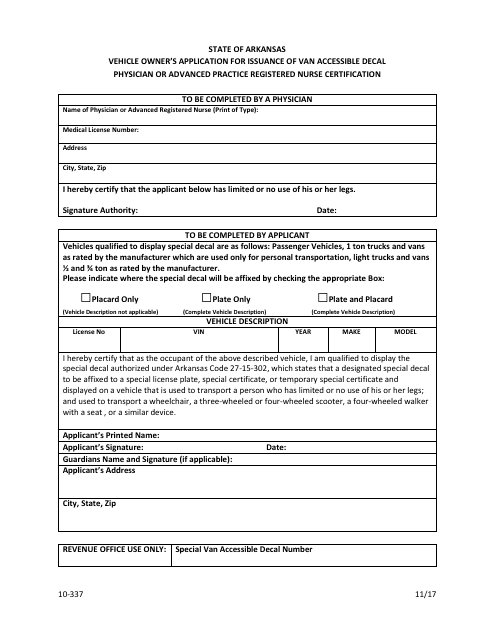

This form is used for Arkansas vehicle owners to apply for the issuance of a van accessible decal. It requires a certification from a physician or advanced practice registered nurse.

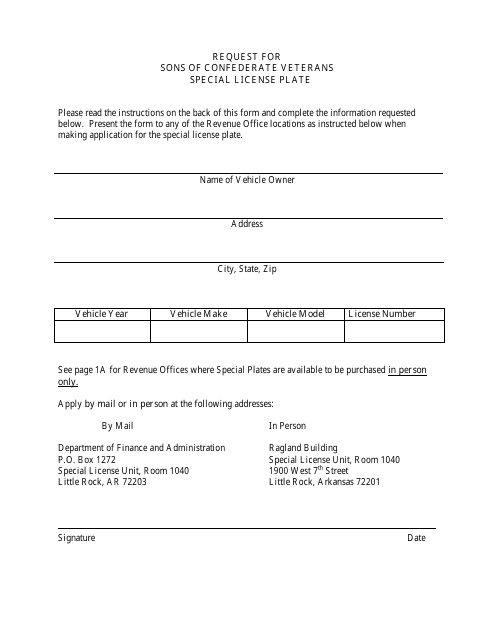

This form is used for requesting a special license plate for Sons of Confederate Veterans in Arkansas.