Tax Templates

Documents:

2882

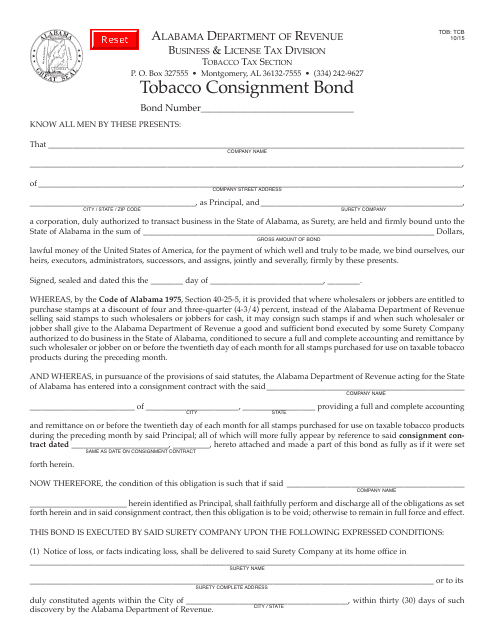

This form is used for the TCB Tobacco Consignment Bond in the state of Alabama.

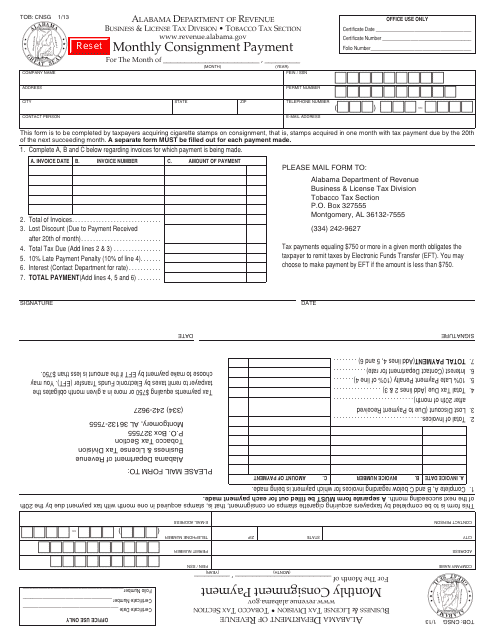

This form is used for making monthly consignment payments in Alabama through the Centralized Sales and Use Tax System.

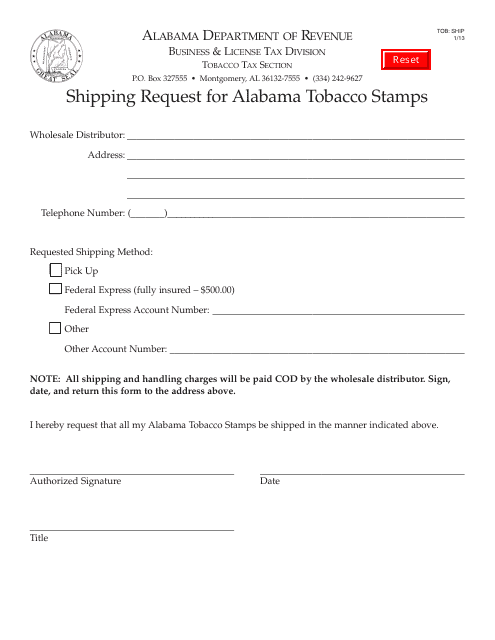

This form is used for requesting shipping of Alabama tobacco stamps.

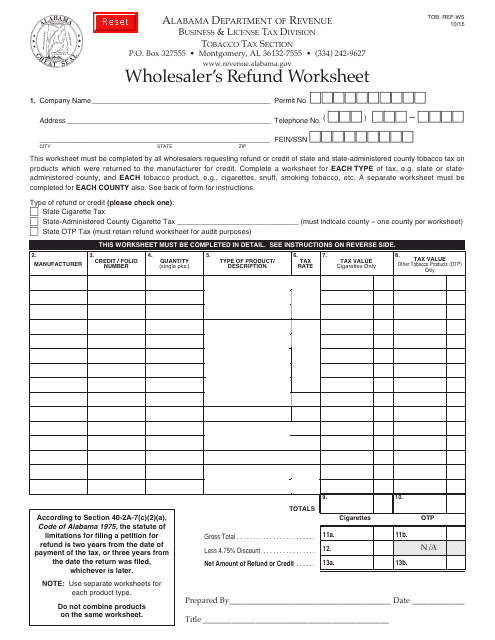

This form is used for wholesalers in Alabama to claim refunds.

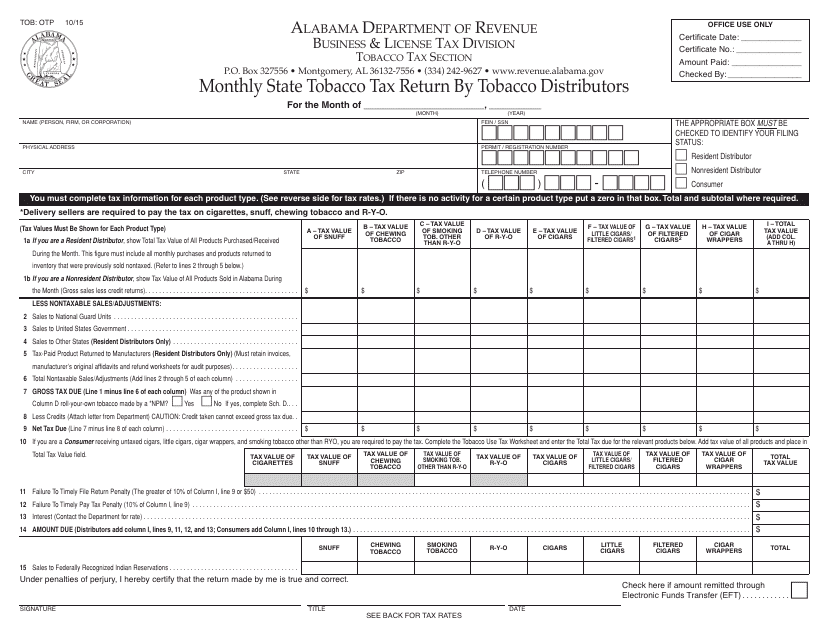

This Form is used for Alabama tobacco distributors to report and pay their monthly state tobacco tax.

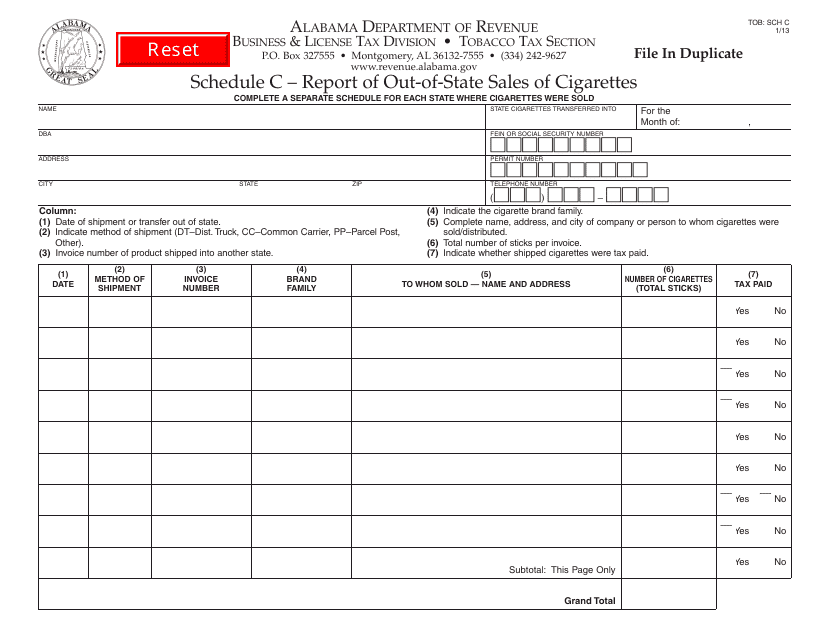

This document is used for reporting out-of-state sales of cigarettes in Alabama.

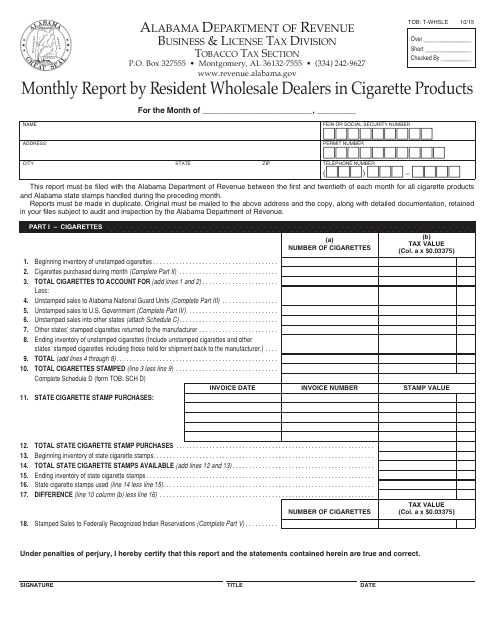

This form is used for resident wholesale dealers in Alabama to report their monthly sales of cigarette products.

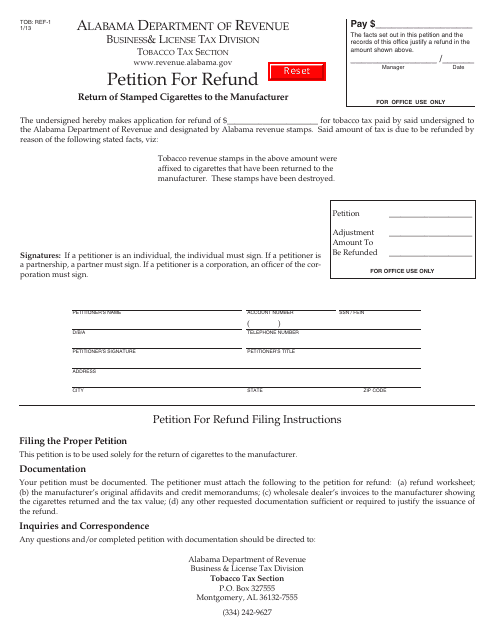

This form is used for filing a petition for a refund of taxes paid in the state of Alabama.

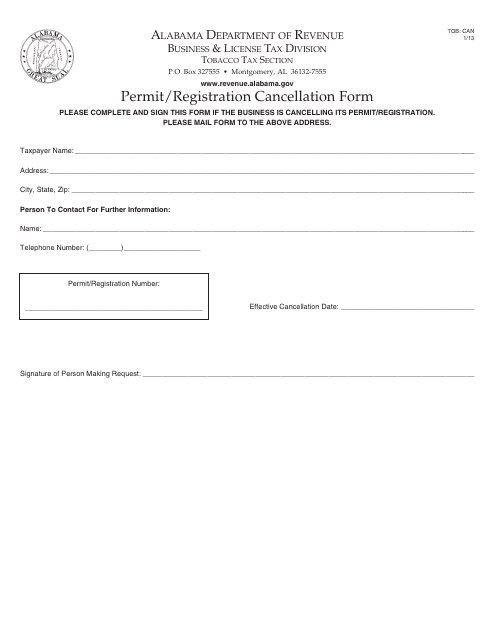

This form is used for canceling a permit or registration in Alabama.

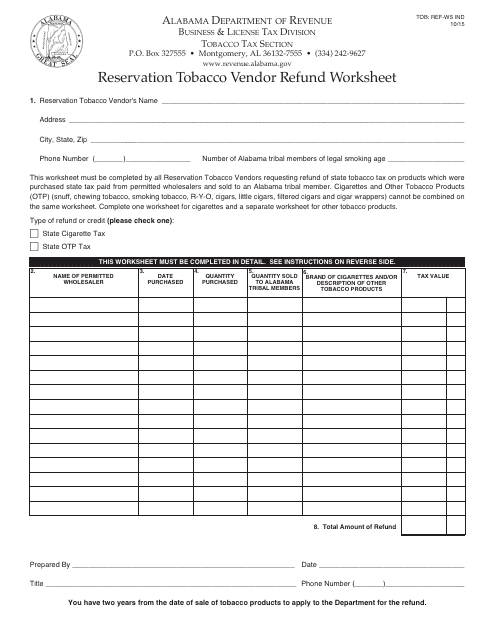

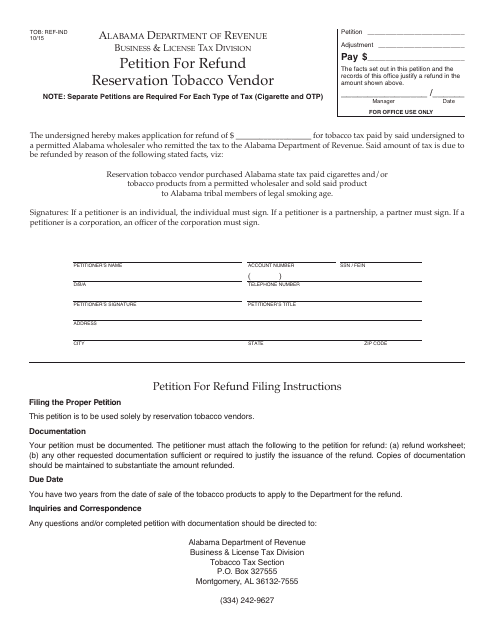

This form is used for requesting a refund for tobacco vendor reservations in Alabama.

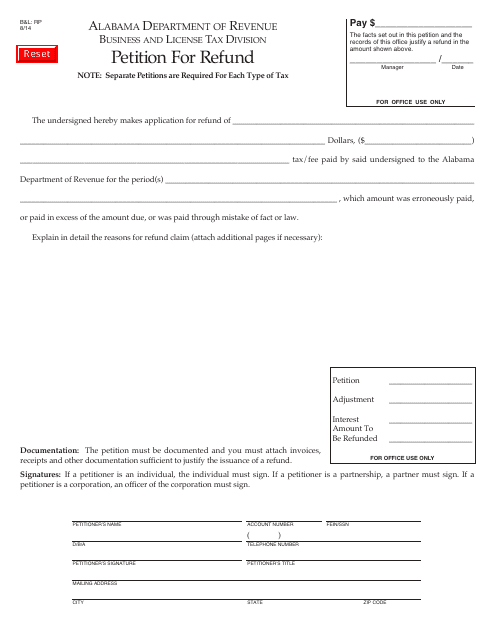

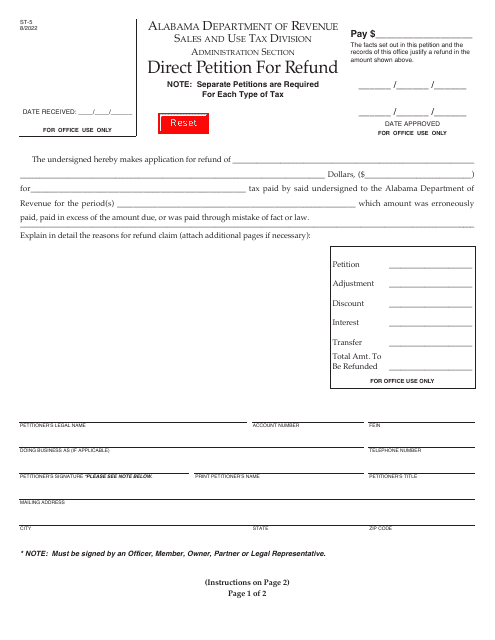

This form is used for filing a petition for a refund in Alabama.

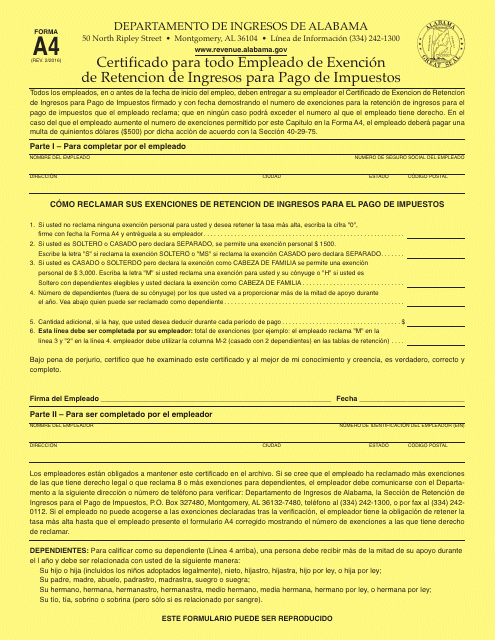

This document is a Form A4 Certification for employees in Alabama to claim exemption from income tax withholding for the payment of taxes.

This form is used for Alabama tobacco vendors to petition for a refund reservation for tobacco sales.

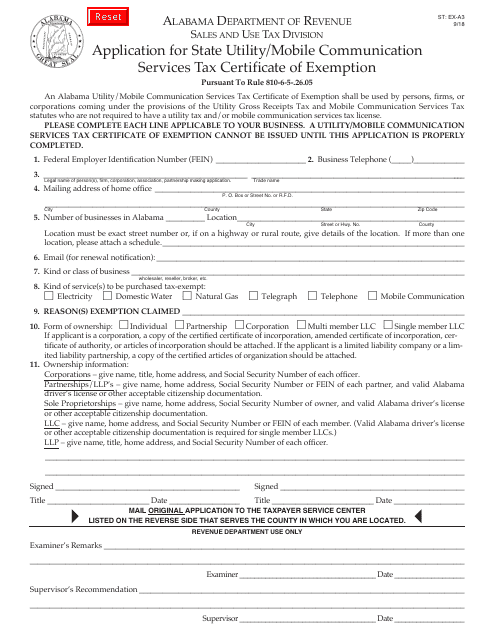

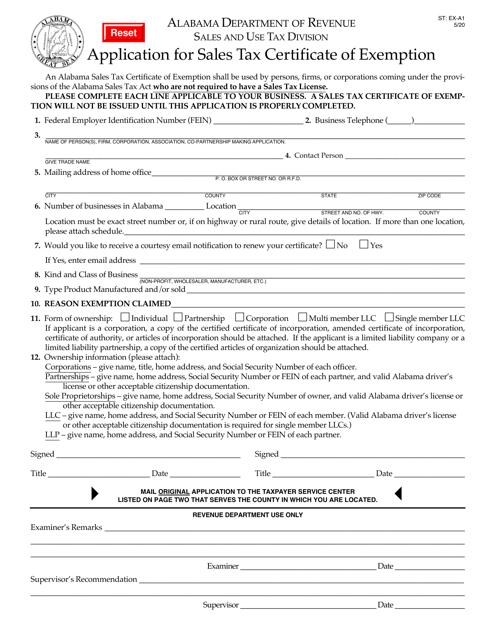

This form is used for applying for a tax certificate of exemption for state utility and mobile communication services in Alabama.

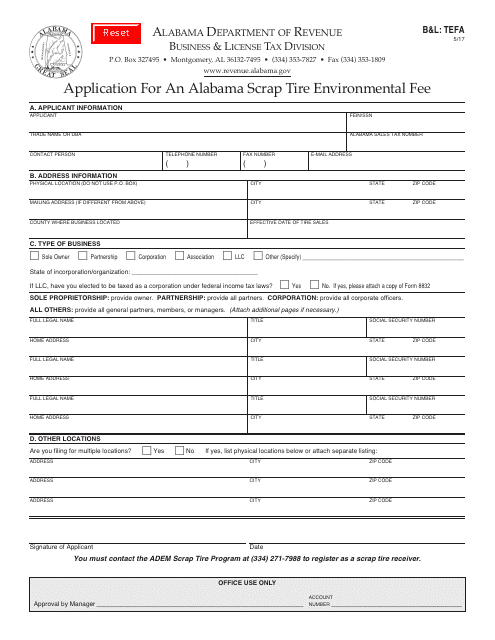

This form is used for submitting an application for the Alabama Scrap Tire Environmental Fee.

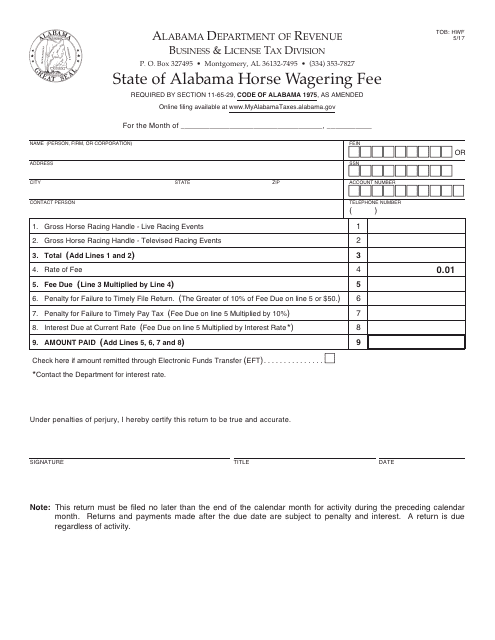

This form is used for paying the Horse Wagering Fee in the state of Alabama.

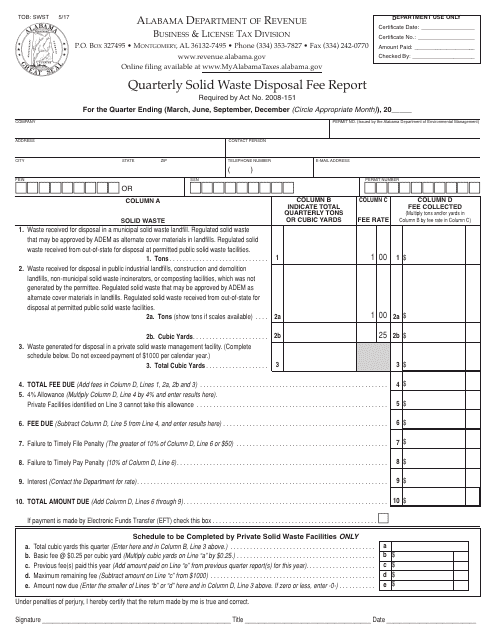

This form is used for quarterly reporting of solid waste disposal fees in Alabama.

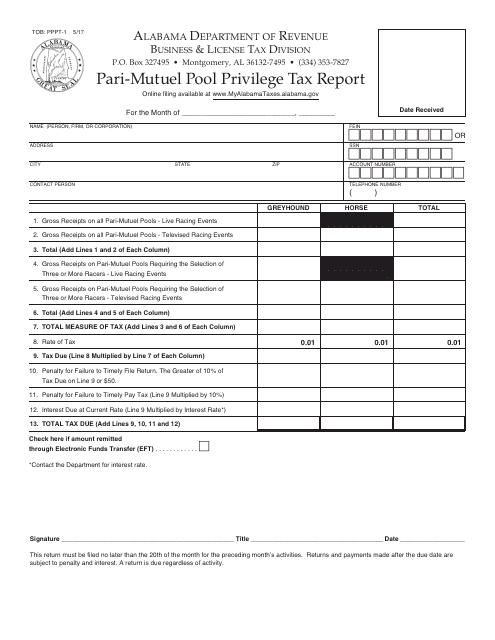

This document is used for reporting the privilege tax on pari-mutuel pool in Alabama.

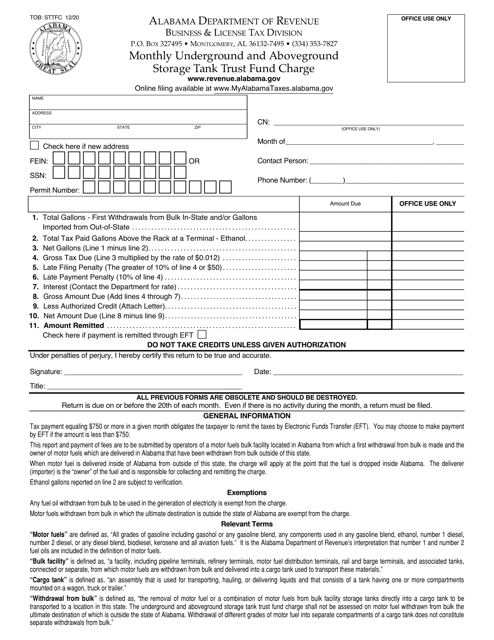

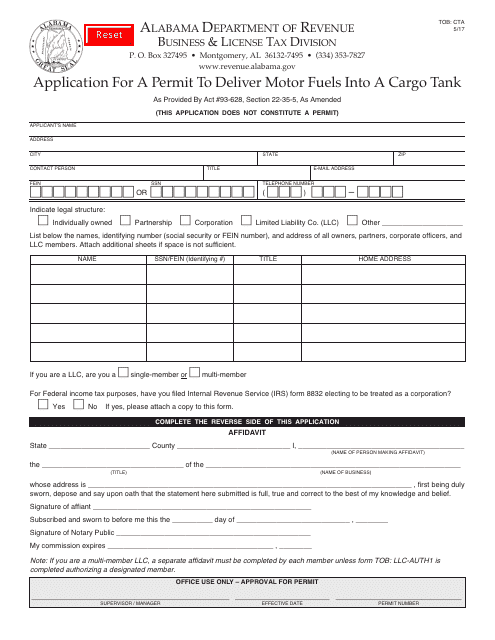

This form is used for applying for a permit to deliver motor fuels into a cargo tank in the state of Alabama.

This form is used to request access to open records in the state of Alabama.

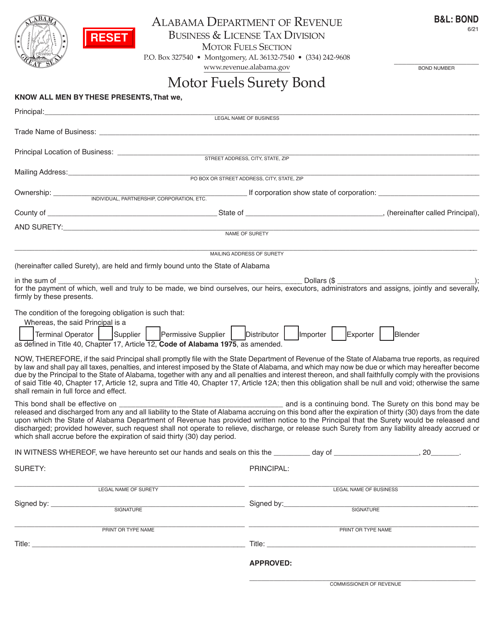

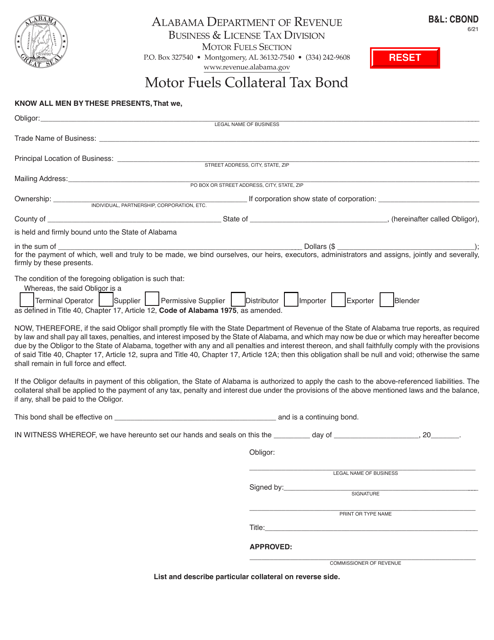

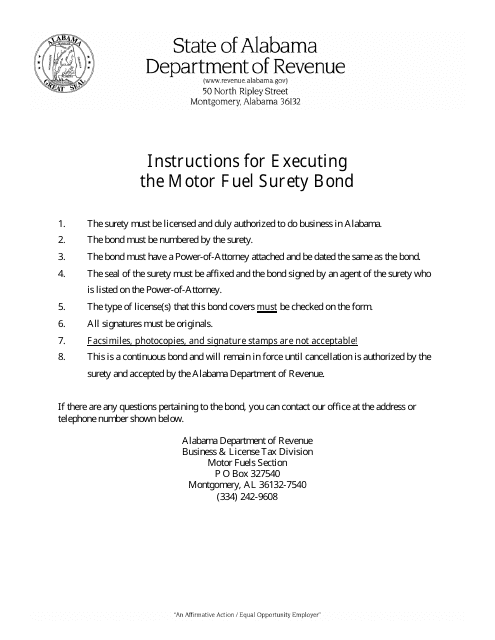

This document is used for obtaining a surety bond for motor fuel in Alabama. It provides instructions for completing Form B&L: BOND Motor Fuel Surety Bond.

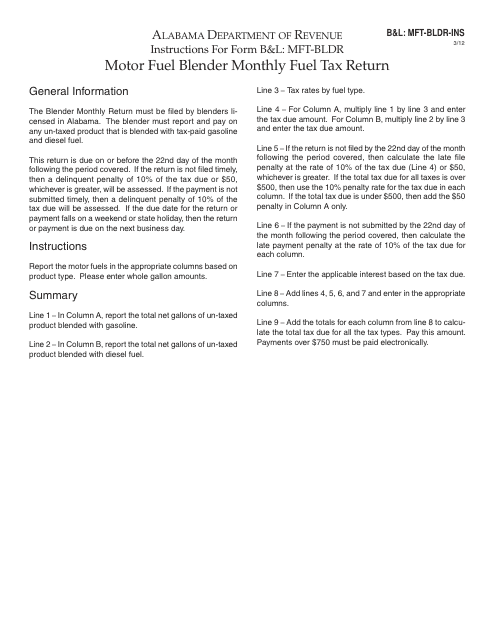

This form is used for submitting the Motor Fuel Blender Monthly Fuel Tax Return in Alabama.

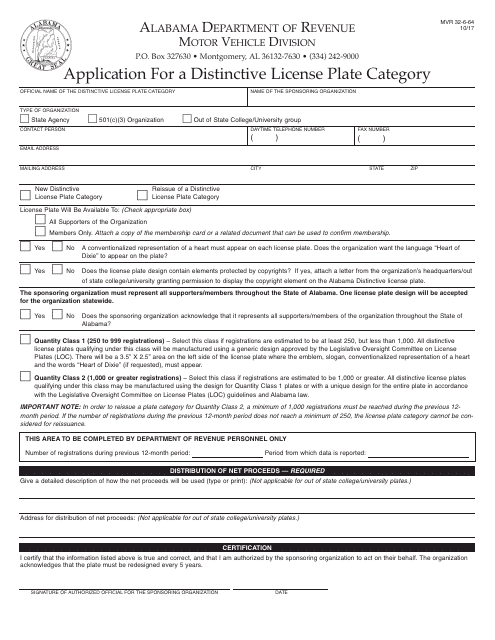

This Form is used for applying for a distinctive license plate category in the state of Alabama.

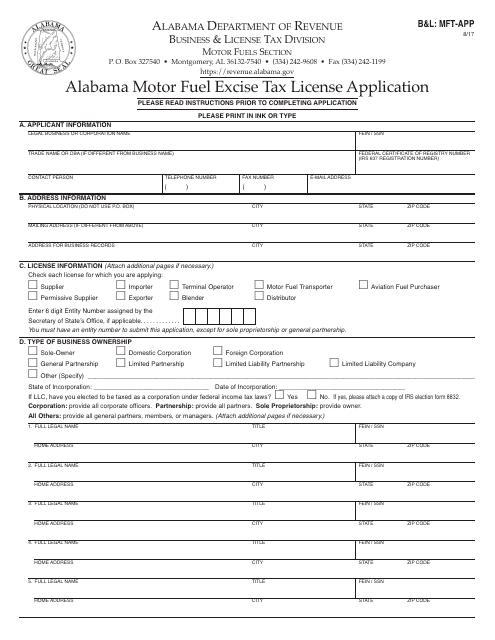

This Form is used for applying for an Alabama Motor Fuel Excise Tax License. It is required for businesses in Alabama that sell or distribute motor fuel.

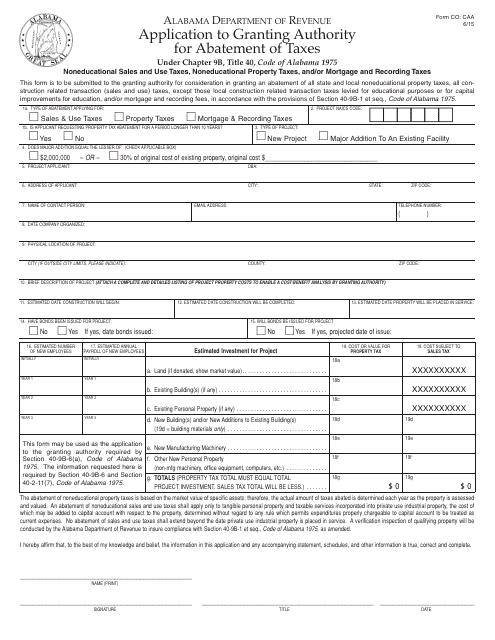

This form is used for applying for authority to grant abatement of taxes in Alabama under Chapter 9g, Title 40, Code of Alabama 1975.

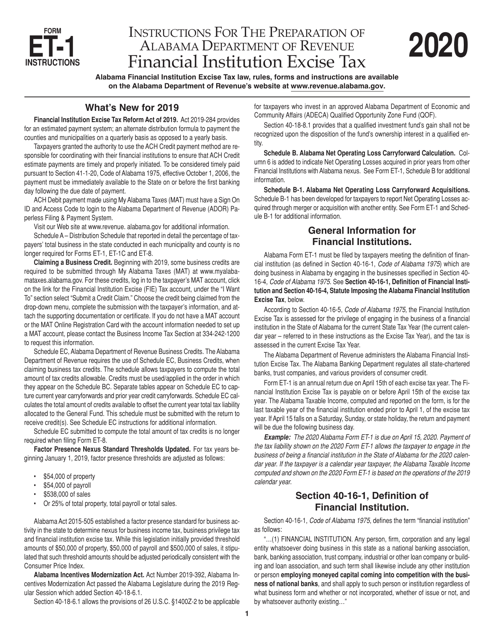

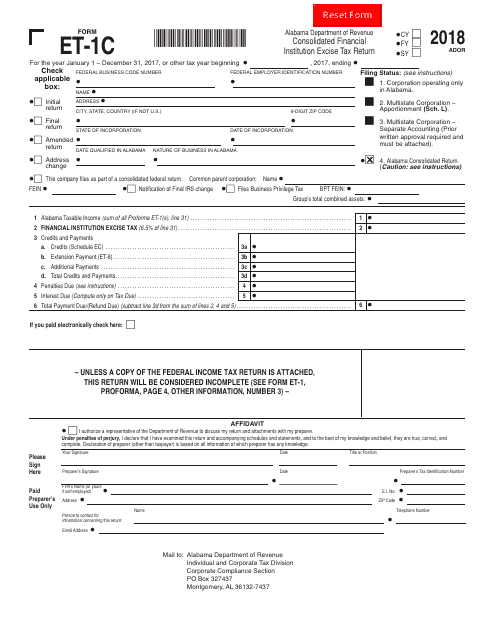

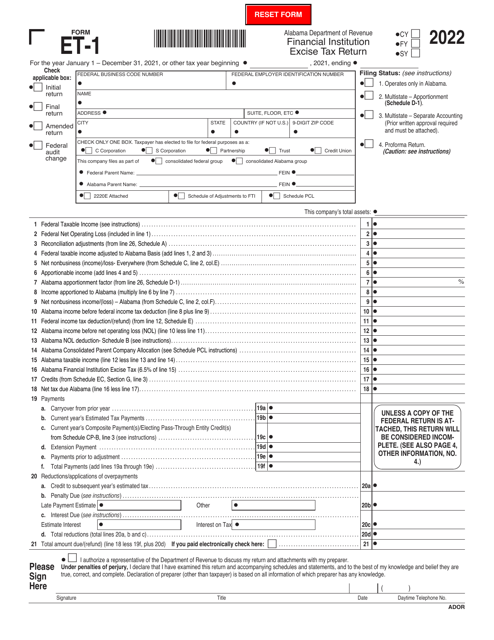

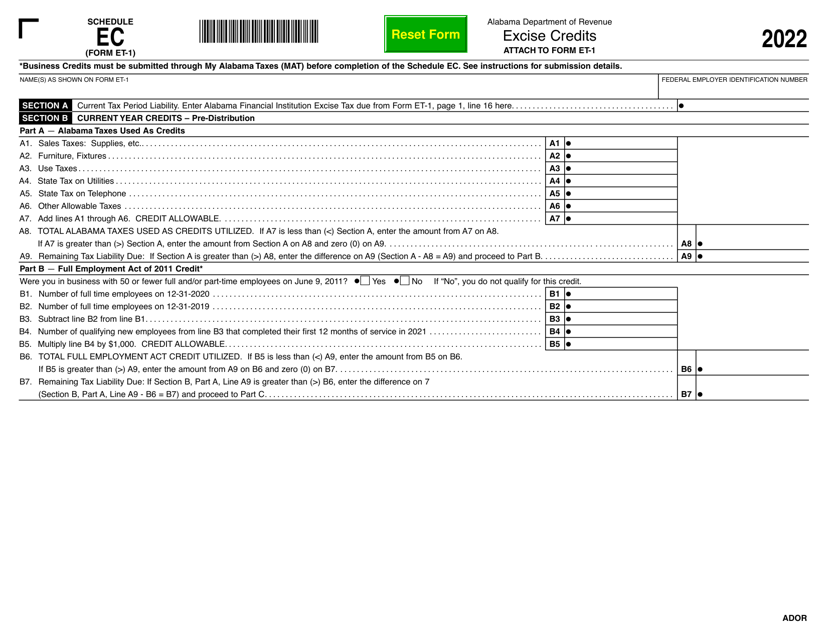

This form is used for filing the Consolidated Financial Institution Excise Tax Return in the state of Alabama.

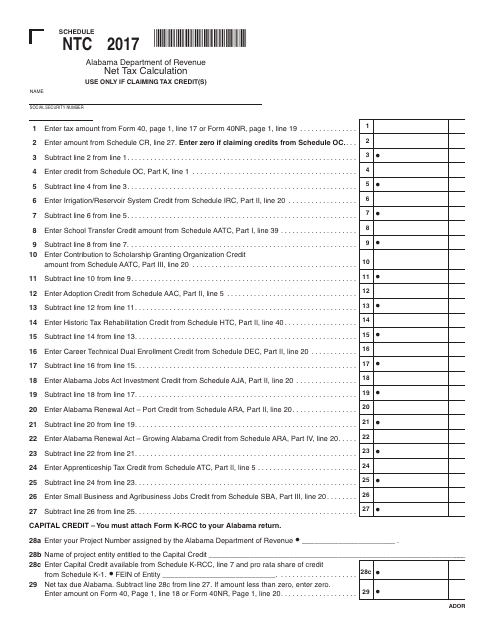

This document is used for calculating the net tax in Alabama using Schedule NTC.