Tax Templates

Documents:

2882

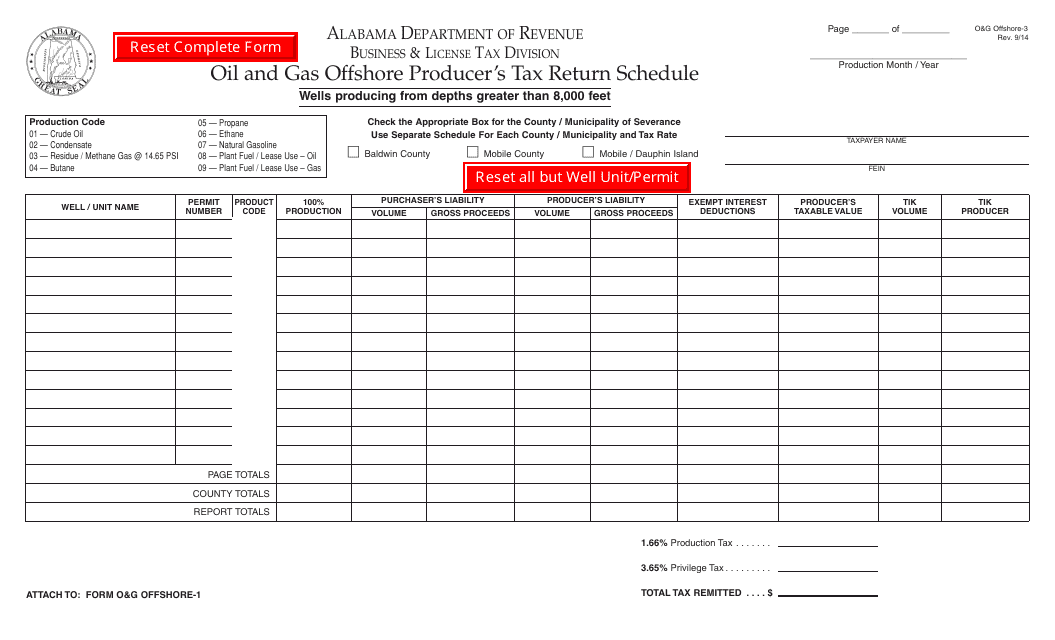

This form is used for reporting and paying taxes by oil and gas producers operating offshore in Alabama. It is specifically for the O&G OFFSHORE-3 schedule of the Oil and Gas Offshore Producer's Tax Return.

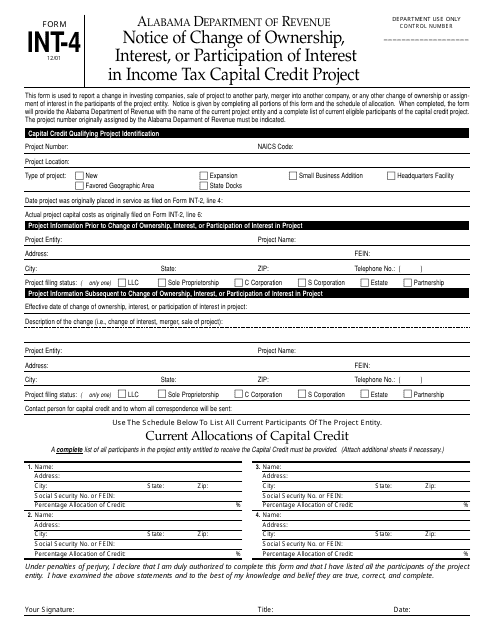

This form is used for informing the Alabama Department of Revenue about any change in ownership, interest, or participation of interest in an income tax capital credit project in Alabama.

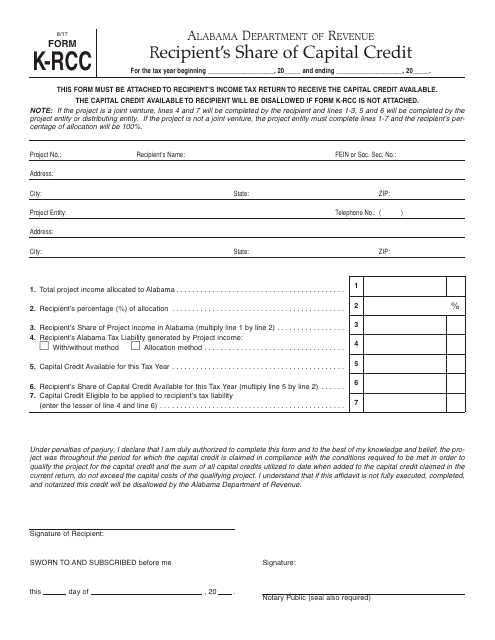

This Form is used for Alabama residents to report their share of capital credit as a recipient.

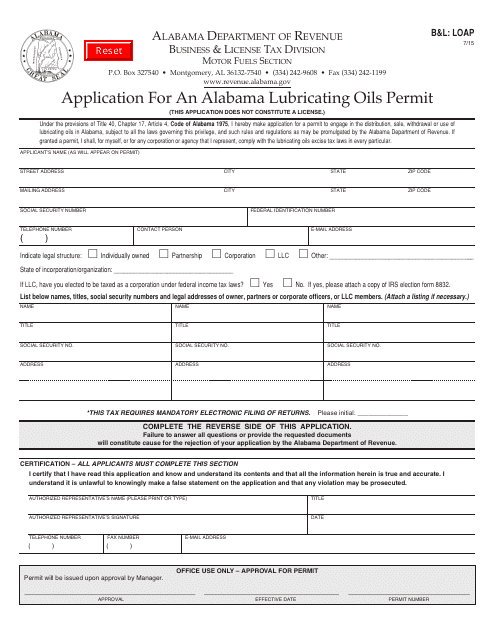

This Form is used for applying for a Lubricating Oils Permit in the state of Alabama.

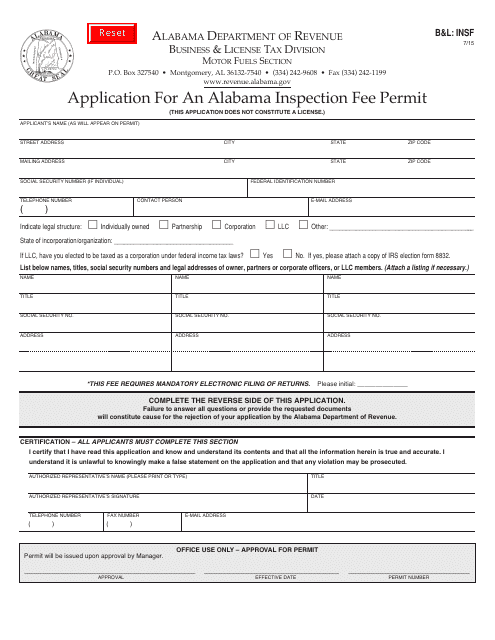

This document is used for applying for an Alabama Inspection Fee Permit in Alabama.

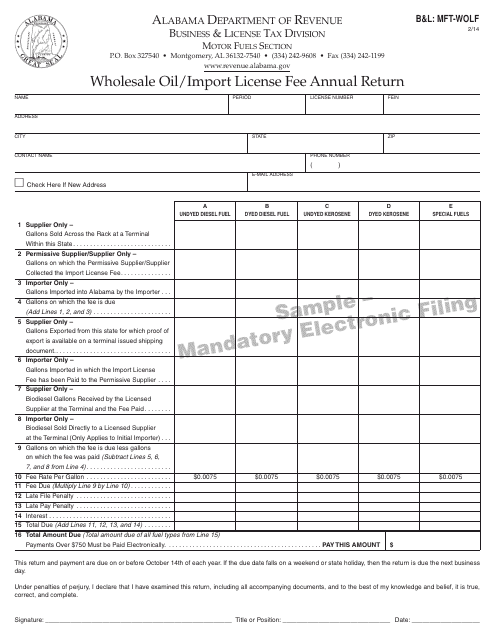

This form is used for filing the annual return and paying the license fee for wholesale oil/import in Alabama.

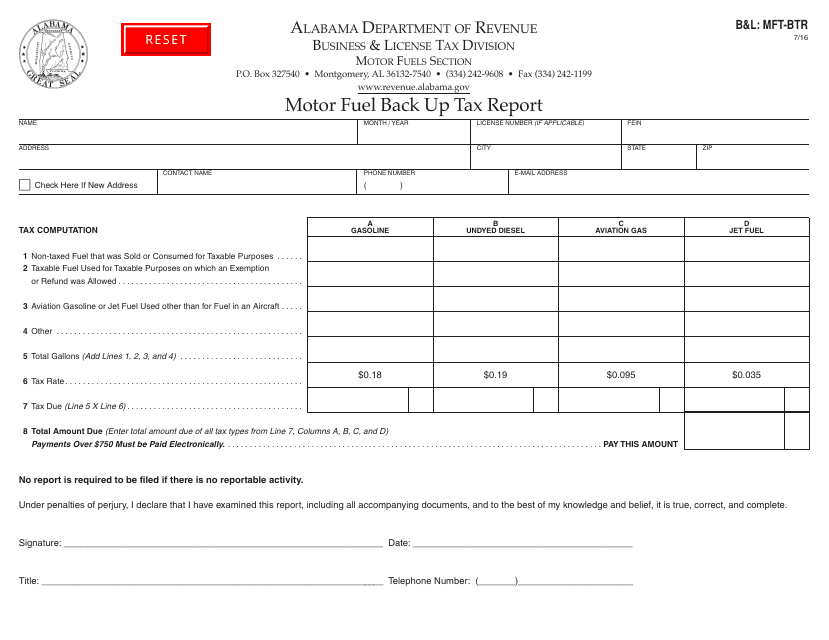

This form is used for reporting and calculating the motor fuel back up tax in Alabama. It is specifically designed for businesses in the motor fuel industry.

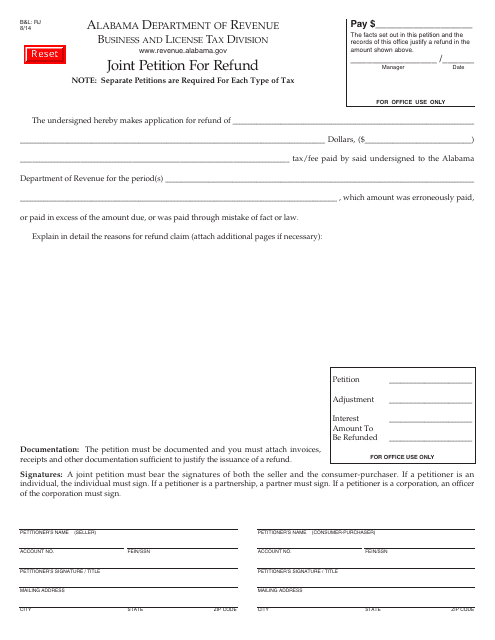

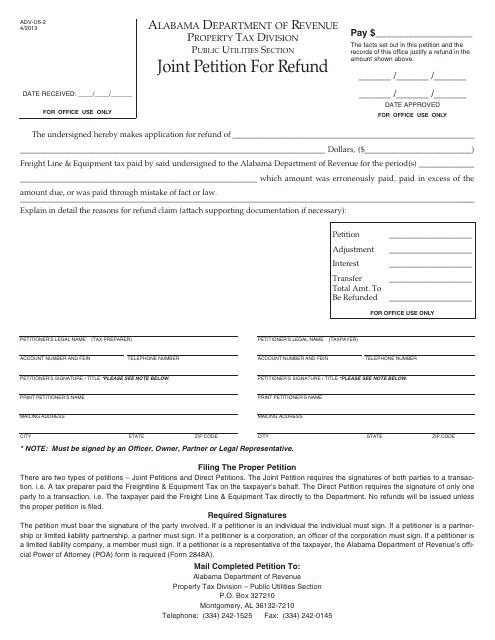

This form is used for submitting a joint petition for a refund in the state of Alabama. It is specific to residents of Alabama who are seeking a refund, and it must be completed and submitted according to the instructions provided.

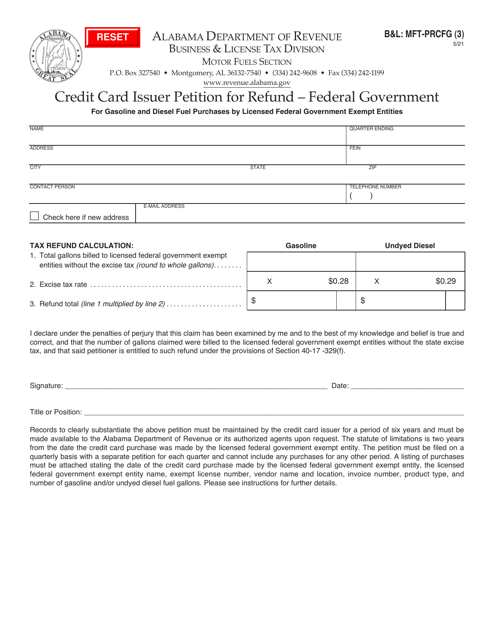

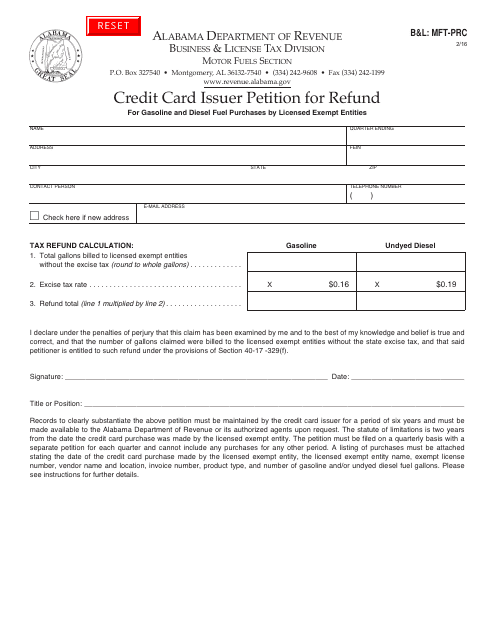

This Form is used for requesting a refund from a credit card issuer in Alabama for a B&L issued card.

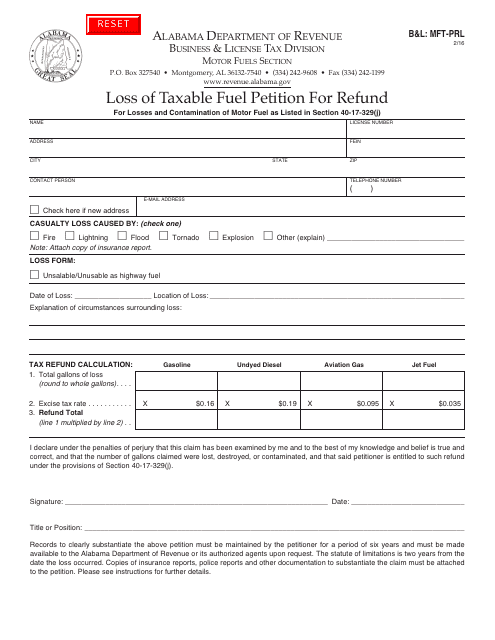

This Form is used for filing a petition for refund of taxable fuel lost in Alabama. It is specifically for taxpayers who have experienced a loss of taxable fuel and are seeking a refund.

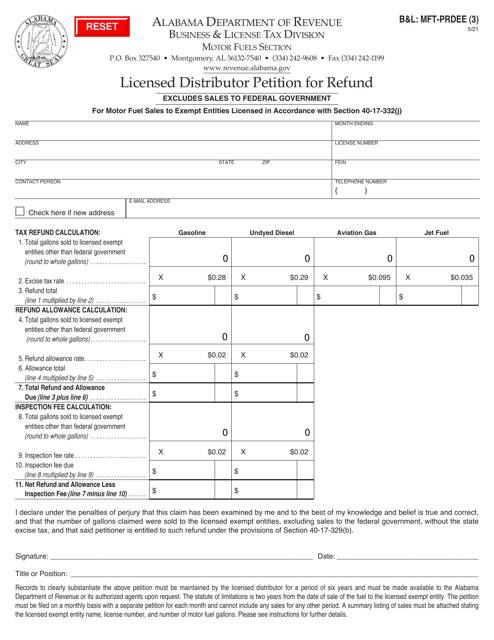

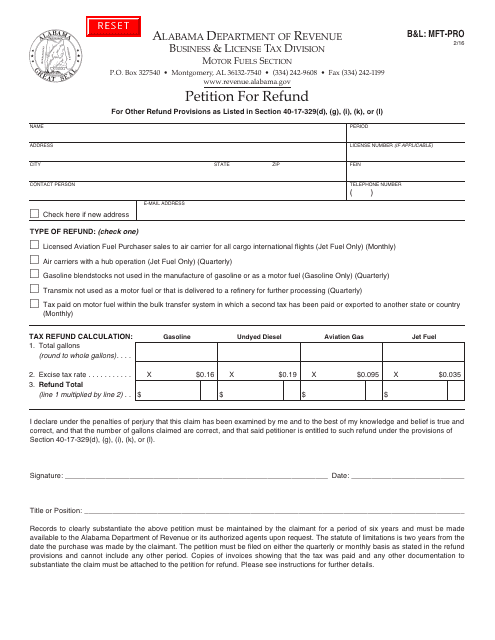

This form is used for filing a petition for refund in Alabama for the MFT-PRO tax.

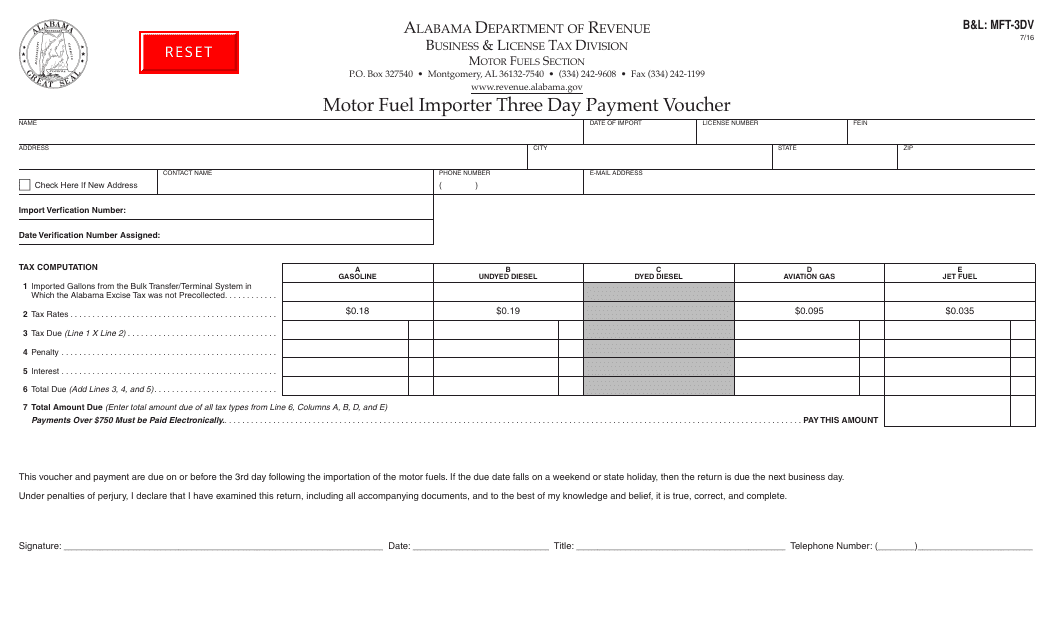

This form is used for motor fuel importers in Alabama to make a three-day payment.

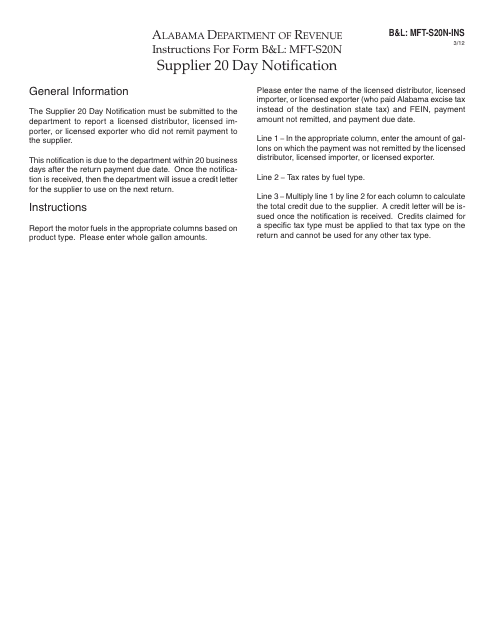

This Form is used for notifying suppliers in Alabama about a 20-day notification requirement.

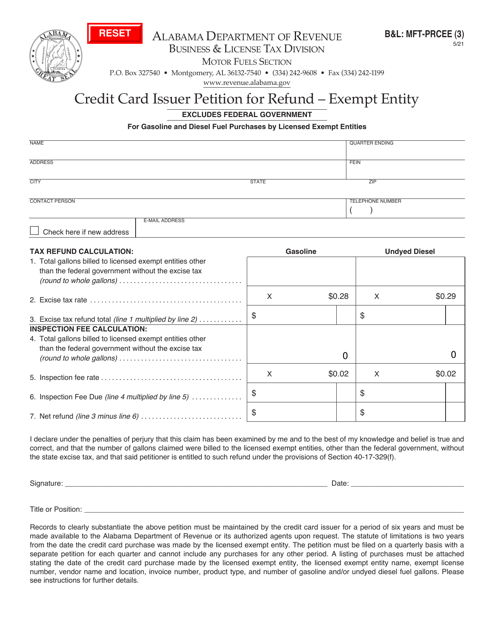

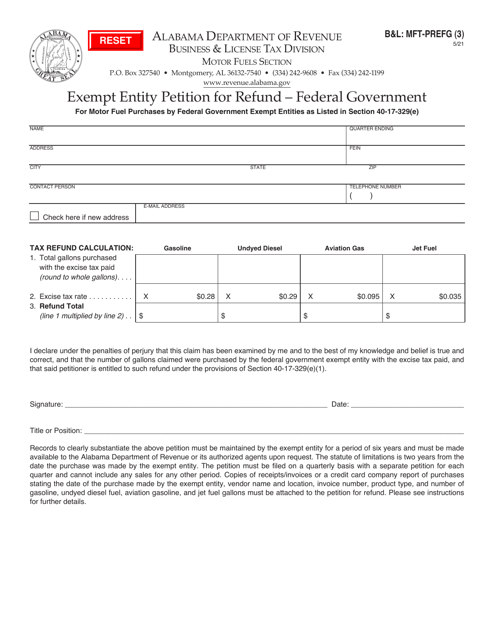

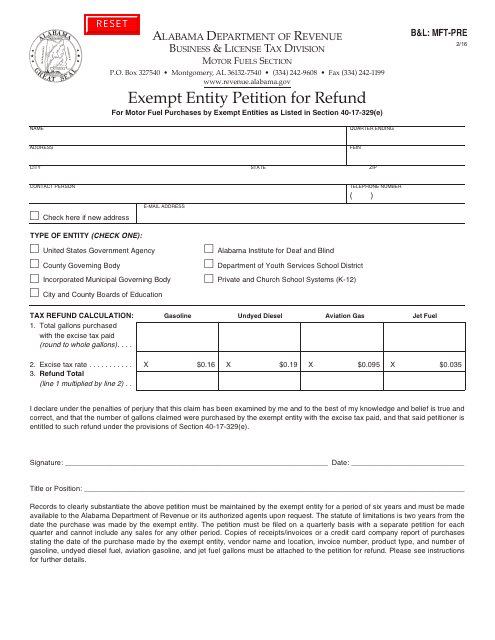

This form is used for exempt entities in Alabama to petition for a refund.

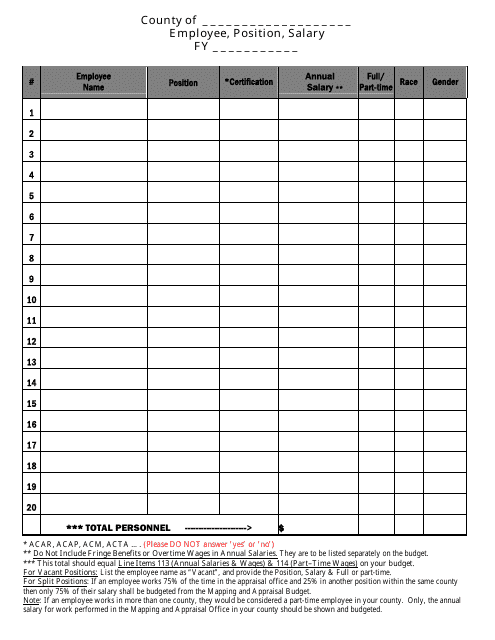

This Form is used for managing personnel budget in the state of Alabama. This document helps organizations in Alabama keep track of their personnel expenses and allocate funds efficiently.

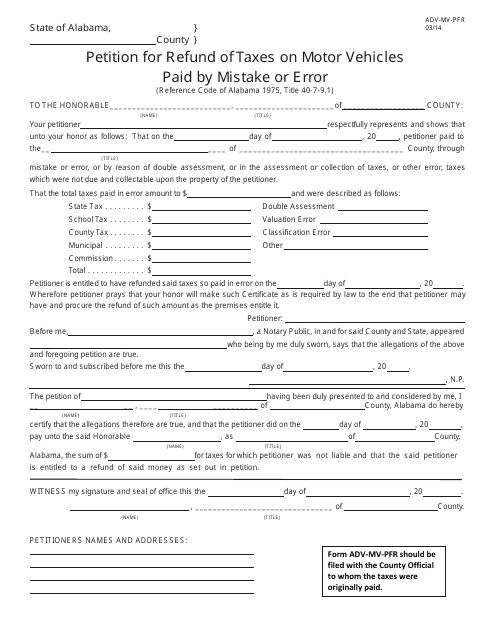

This form is used for requesting a refund of taxes paid by mistake or error on motor vehicles in Alabama.

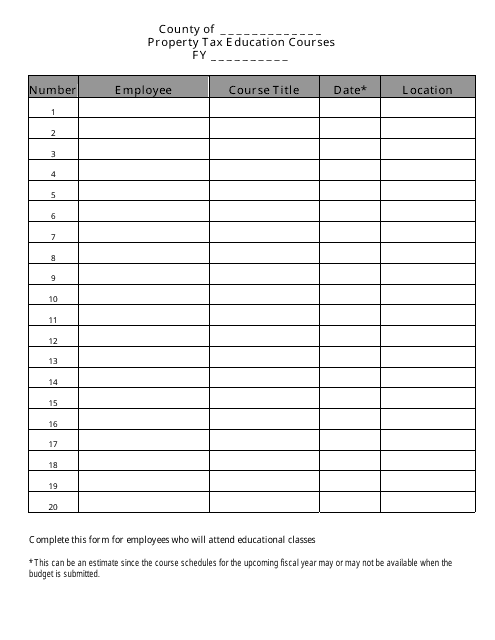

This Form is used for budgeting personnel courses in the state of Alabama. It allows individuals or organizations to request funds for training and development courses related to personnel management.

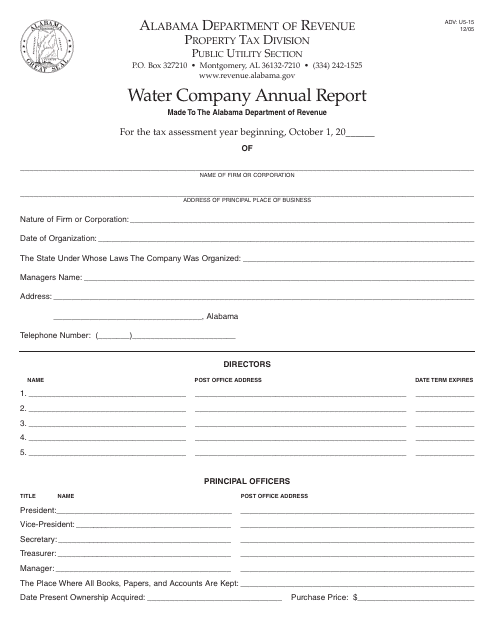

This Form is used for filing the annual report of a water company in Alabama.

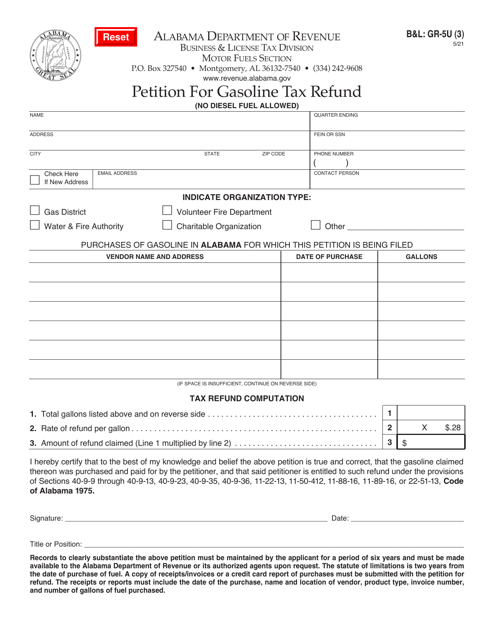

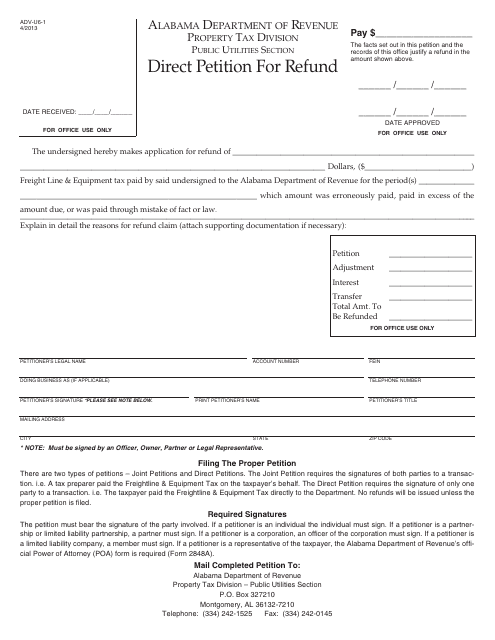

This Form is used for a direct petition for a refund in the state of Alabama.

This Form is used for filing a joint petition for refund in Alabama.

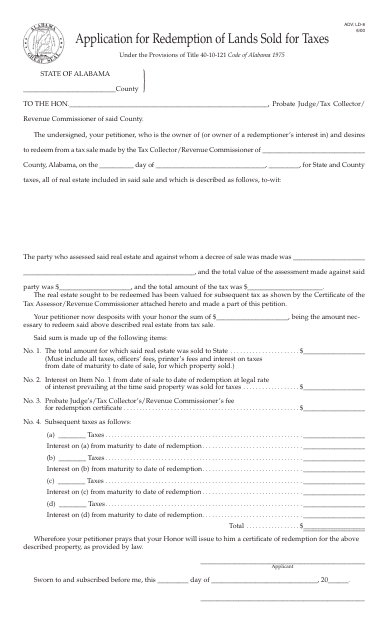

This form is used for redeeming lands that have been sold for taxes in Alabama.

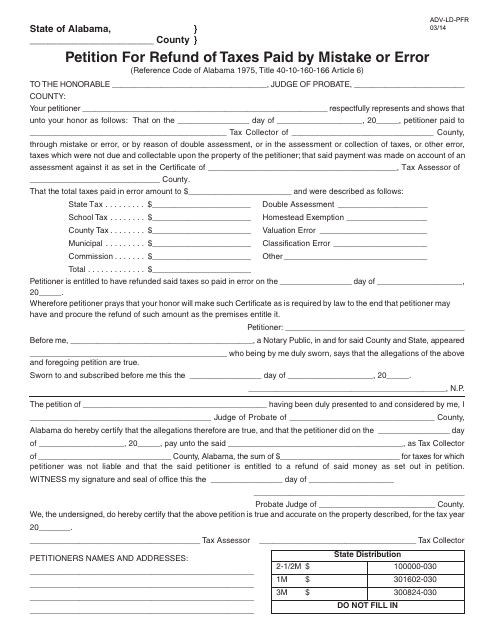

This form is used for petitioning a refund of taxes that were paid by mistake or error in the state of Alabama.

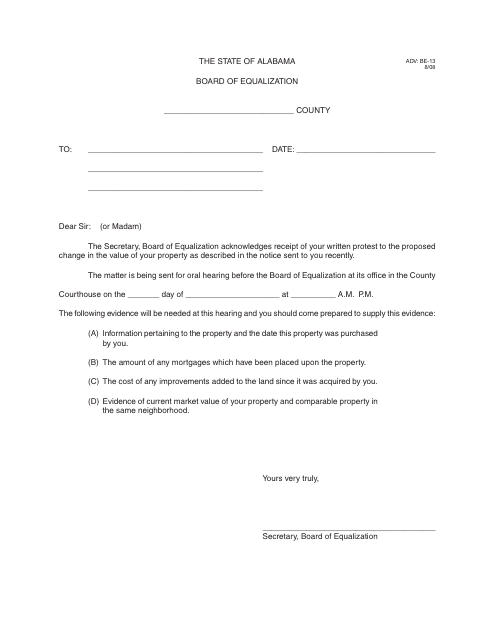

This form is used for the BE-13 Board of Equalization to send a letter to taxpayers in Alabama, providing the date and time of their hearing.

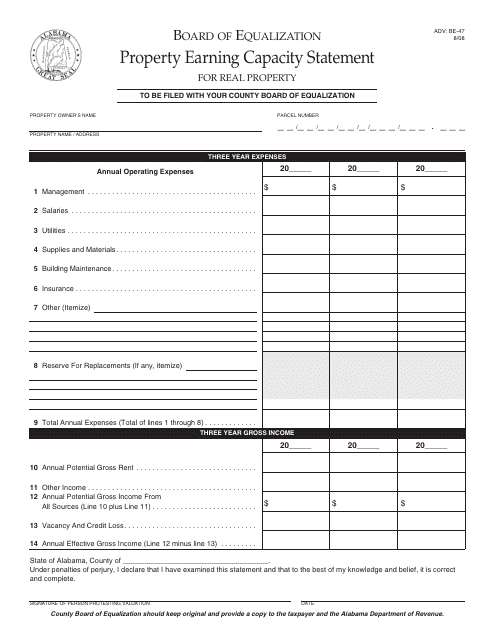

This Form is used for reporting the earning capacity of property in Alabama. It is part of the Form ADV filing process.

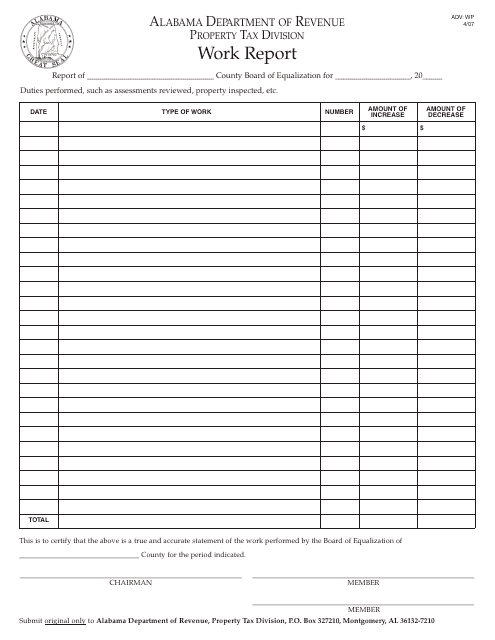

This document is used for submitting a work report related to WP (water pollution) in Alabama.

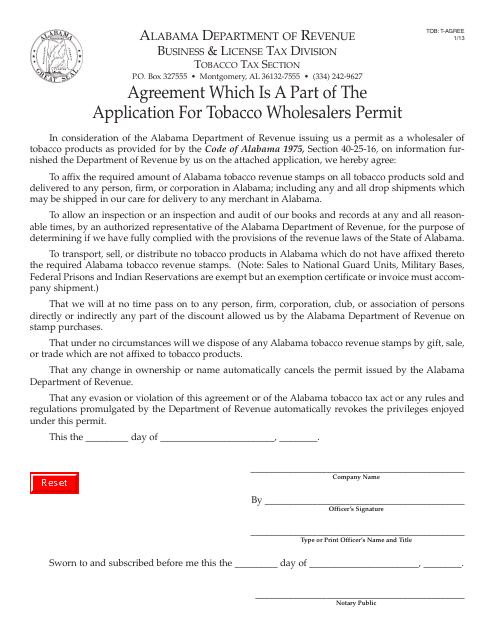

This form is used for agreeing to the terms and conditions of the tobacco wholesalers permit application in Alabama.

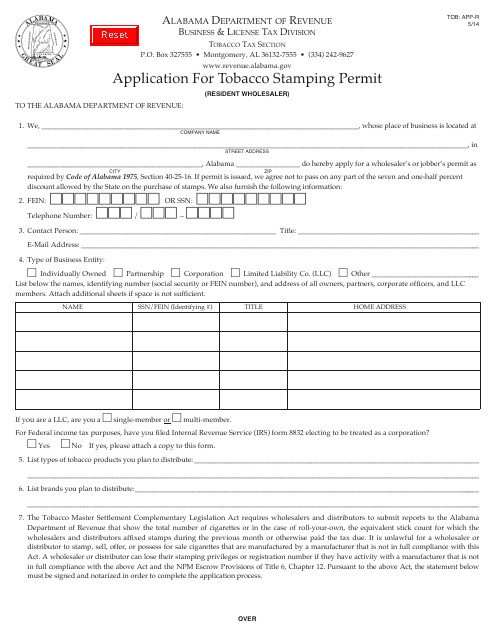

This Form is used for applying for a tobacco stamping permit in Alabama.

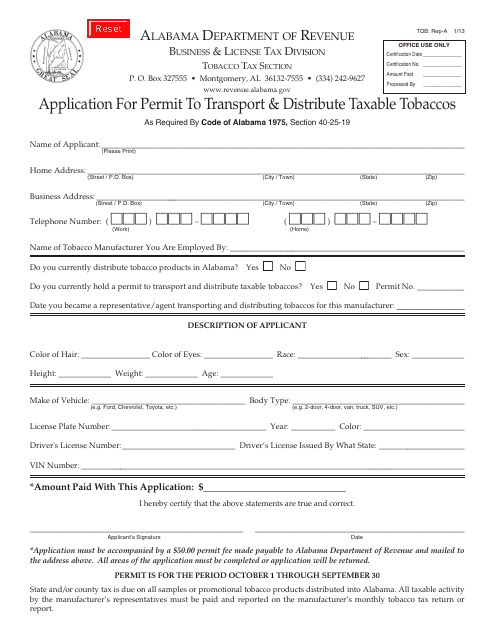

This form is used for applying for a permit to transport and distribute taxable tobaccos in the state of Alabama.

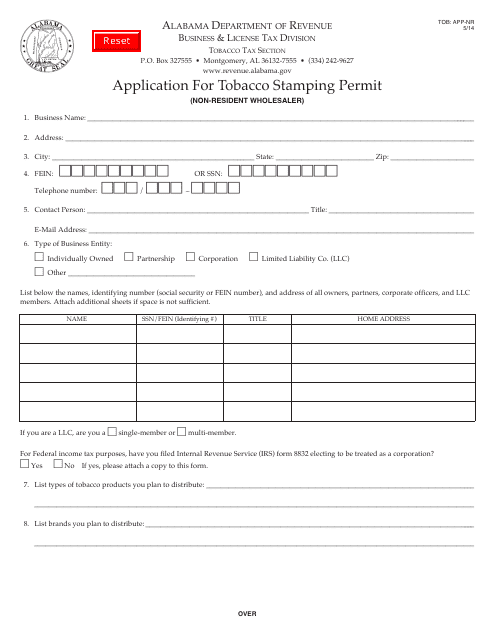

This form is used for applying for a tobacco stamping permit for non-resident wholesalers in the state of Alabama.

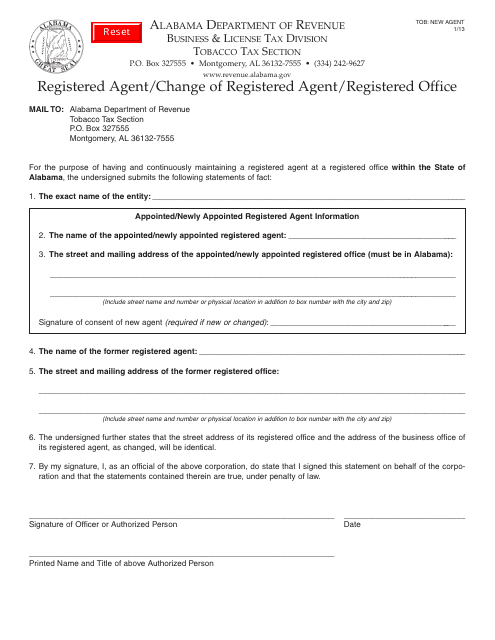

This Form is used for registering a new agent or changing the registered agent or registered office in the state of Alabama.

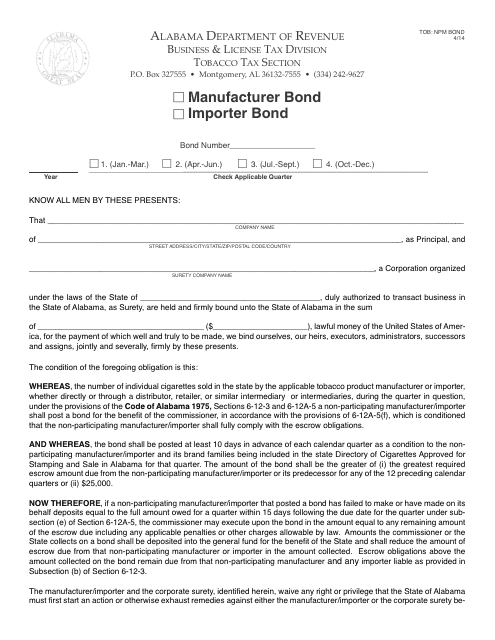

This Form is used for Non-participating tobacco manufacturers or importers to post a bond in Alabama.

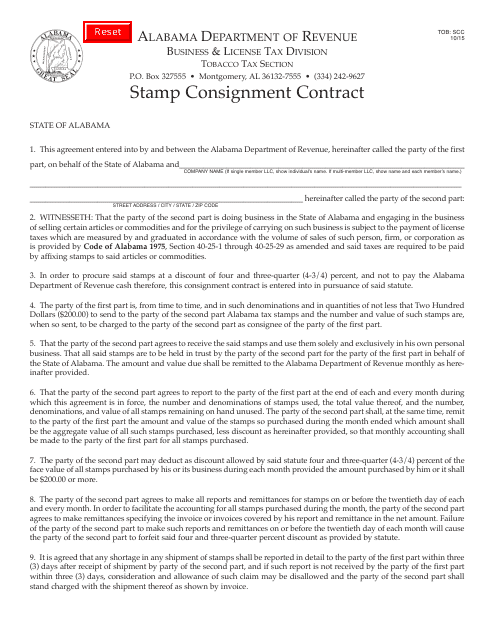

This form is used for the SCC Stamp Consignment Contract in the state of Alabama.