Claim for Refund Templates

Title: Claim for Refund - Get Your Money Back Now!

Are you looking to get a refund for overpaid taxes, incorrect payments, or any other financial transactions? Look no further - our Claim for Refund service is here to help you retrieve your hard-earned money.

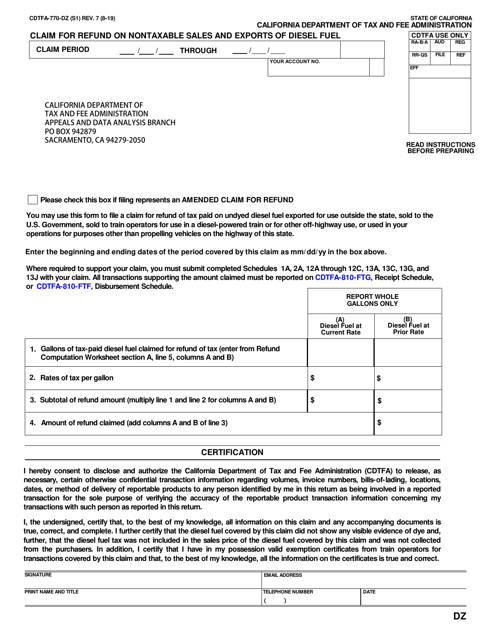

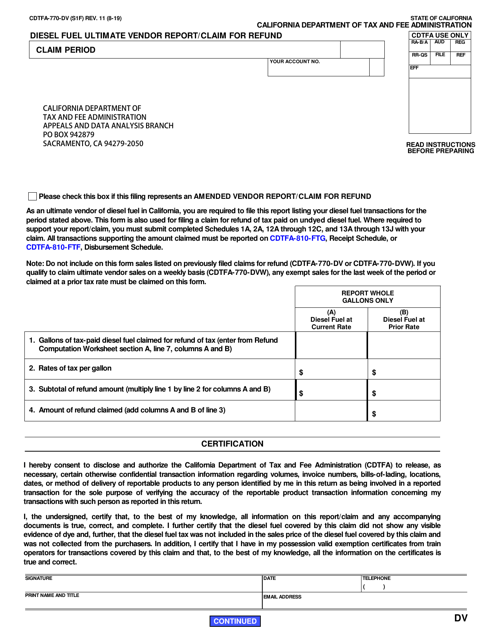

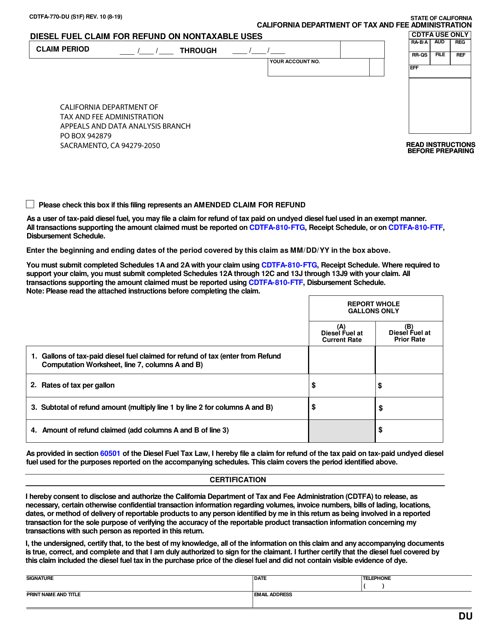

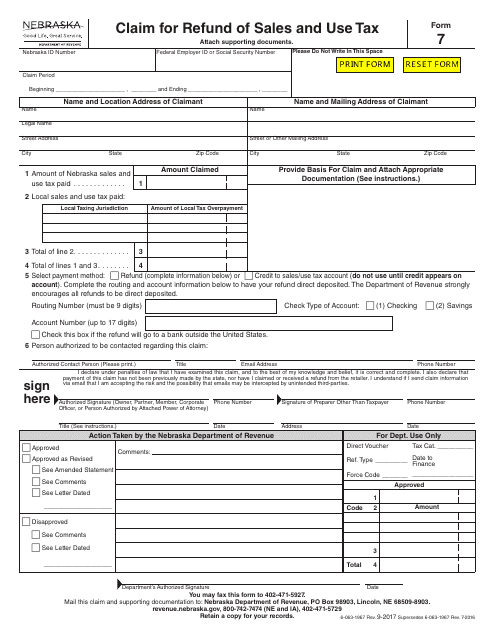

Also known as claim for refund forms or claims for refunds, these documents are the key to getting your money back from various institutions, such as the IRS or state revenue agencies. With our user-friendly platform, we provide guidance and assistance for filling out and submitting claim for refund forms, making the process quick and effortless.

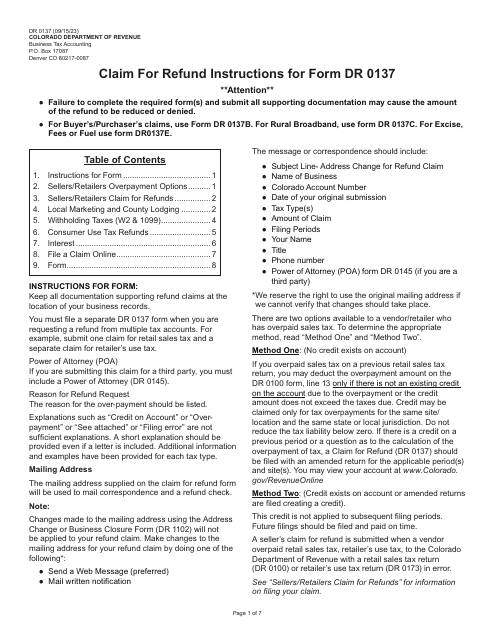

Our extensive collection of claim for refund forms includes those for federal taxes, state taxes, use taxes, and much more. If you're unsure which claim for refund form you need, don't worry - we have detailed instructions for several forms to simplify the process even further.

Don't let your money go to waste! Whether you're a business owner or an individual taxpayer, our claim for refund service can help you recover your funds effortlessly. Start your claim for refund today and ensure that every penny is back where it belongs - in your pocket.

Documents:

163

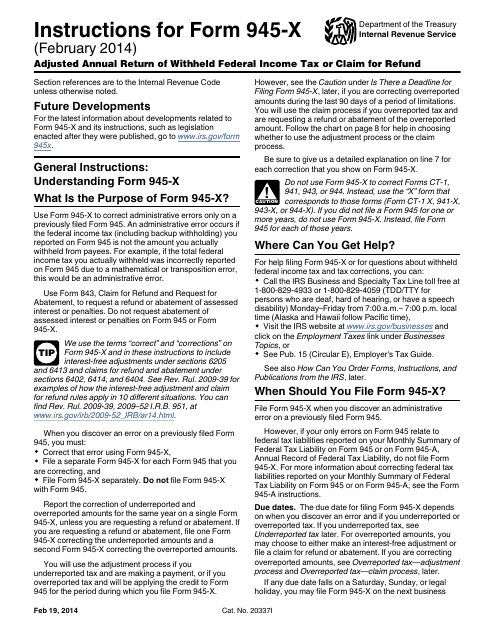

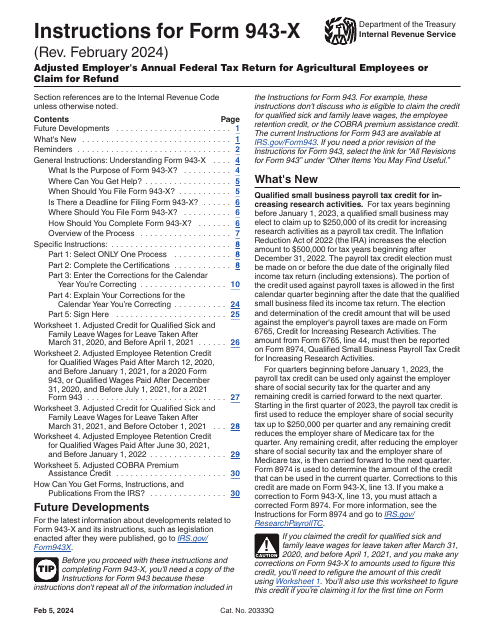

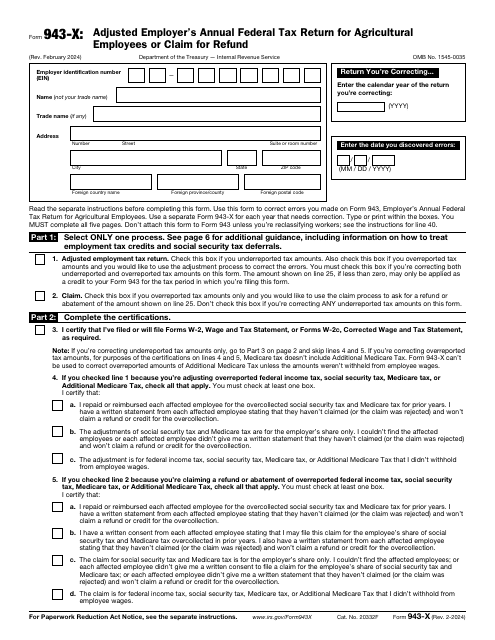

This Form is used for making adjustments to the annual return of withheld federal income tax or claiming a refund. It is specifically designed for the IRS Form 945-X.

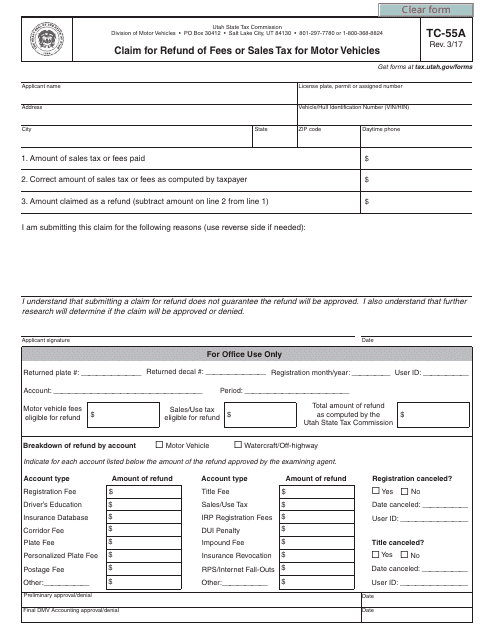

This form is used for claiming a refund of fees or sales tax paid for motor vehicles in Utah.

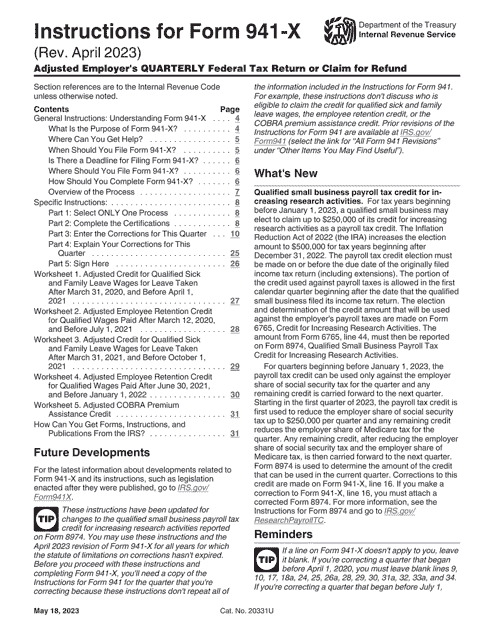

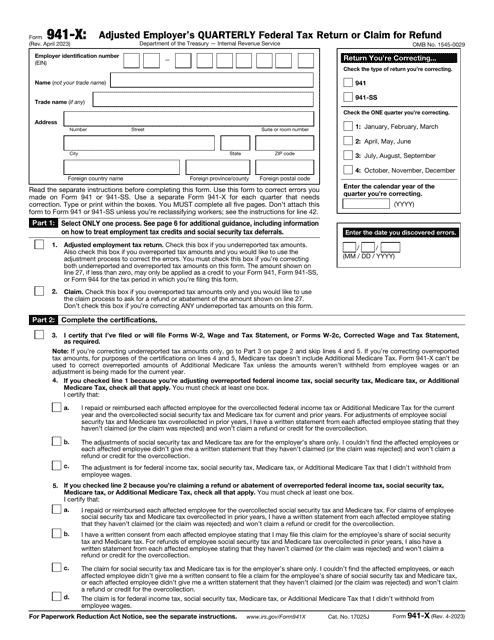

Instructions for IRS Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

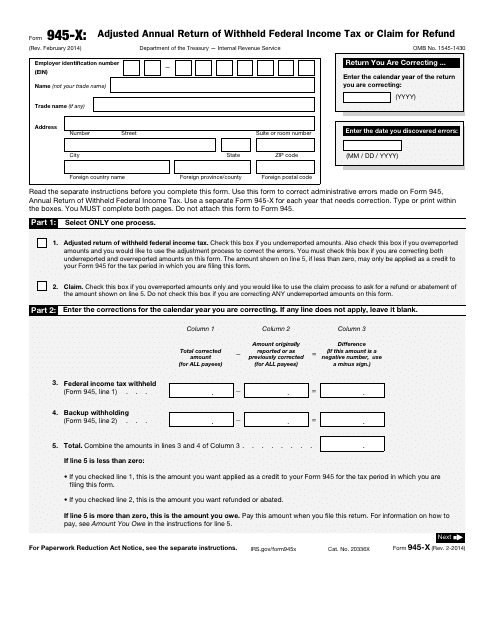

This is a fiscal form used by taxpayers to modify the information they submitted via IRS Form 945, Annual Return of Withheld Federal Income Tax.

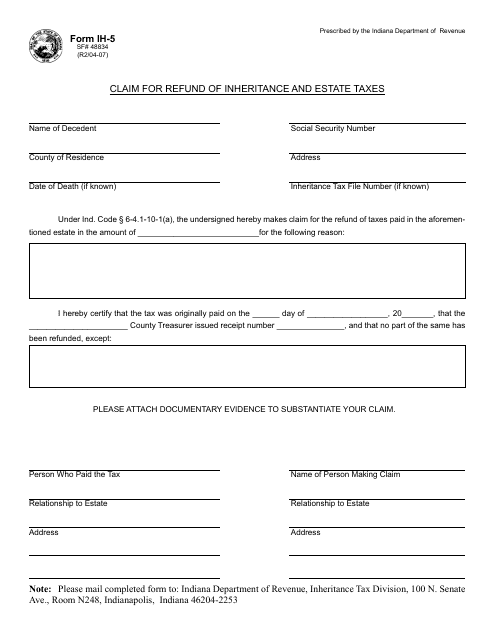

This form is used for claiming a refund of inheritance and estate taxes in the state of Indiana.

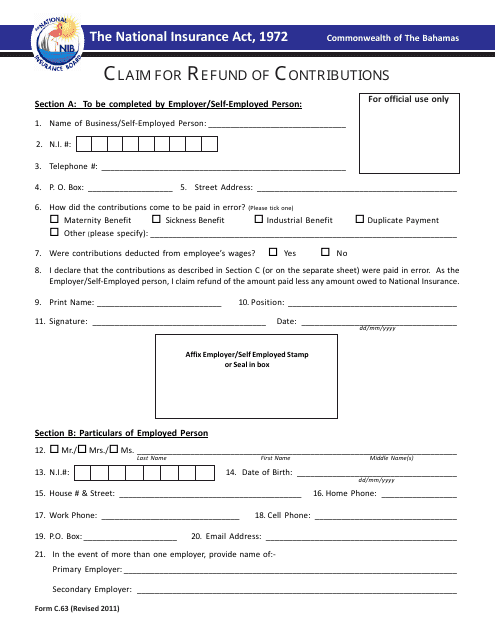

This form is used for claiming a refund of contributions in the Bahamas.

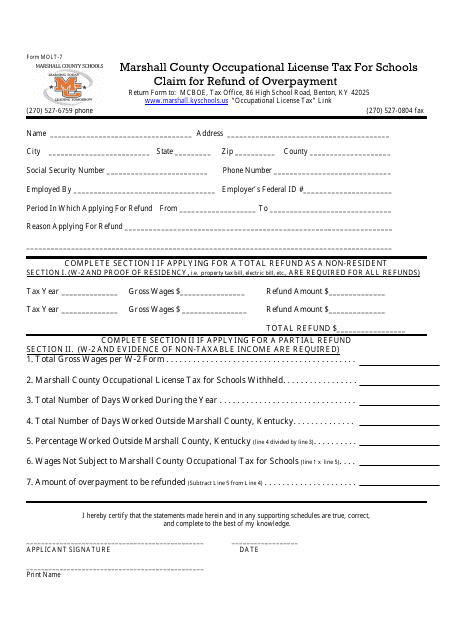

This form is used for residents of Marshall County, Kentucky to claim a refund of overpaid occupational license tax for schools.

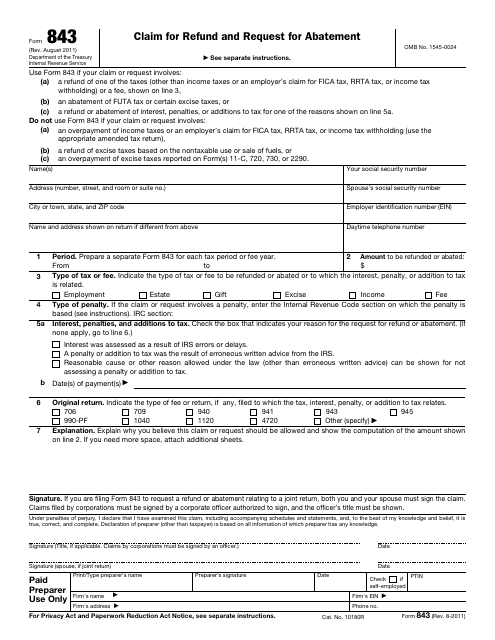

This form is used for claiming a refund and requesting a reduction in penalties or interest from the Internal Revenue Service (IRS).

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

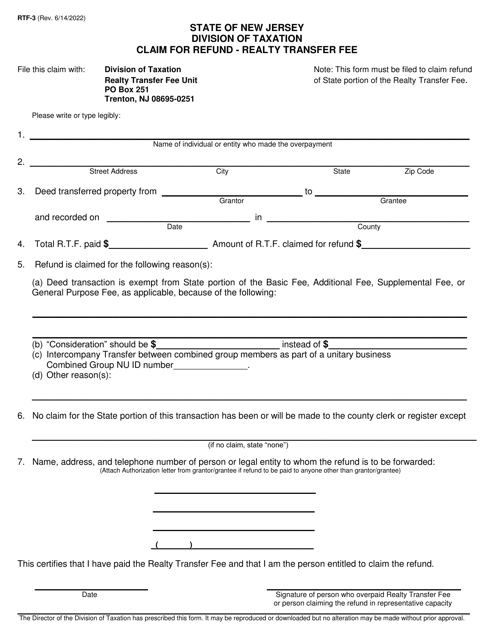

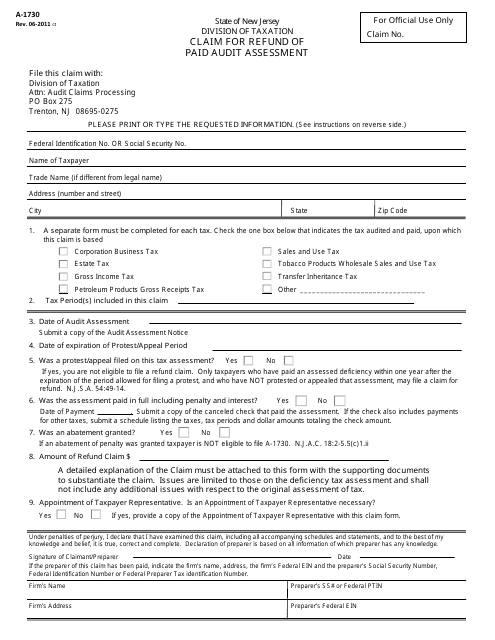

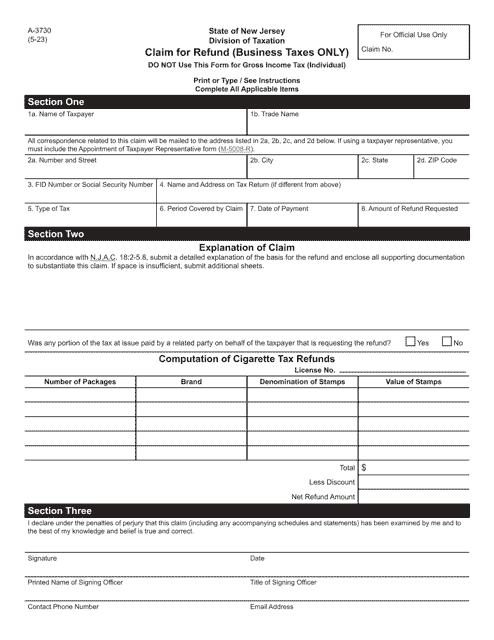

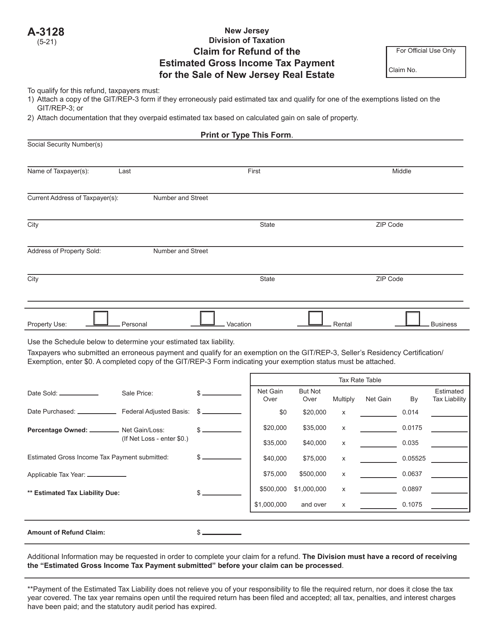

This Form is used for residents of New Jersey to claim a refund for a paid audit assessment.

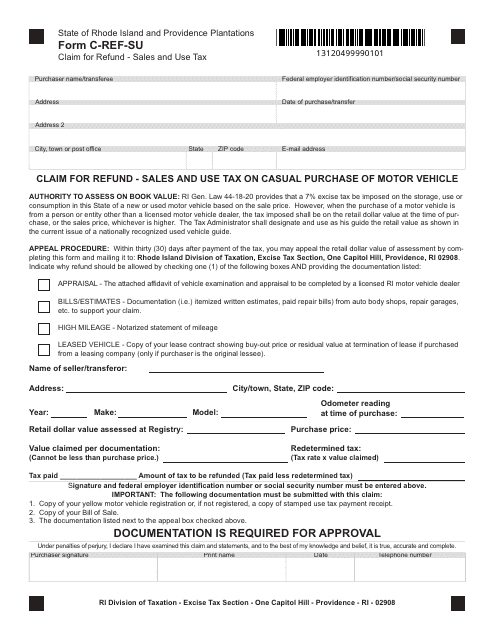

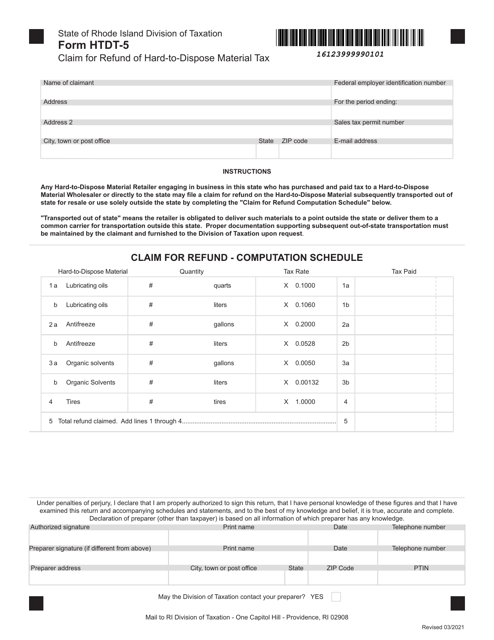

This Form is used for claiming a refund on sales and use tax paid for a casual purchase of a motor vehicle in Rhode Island.

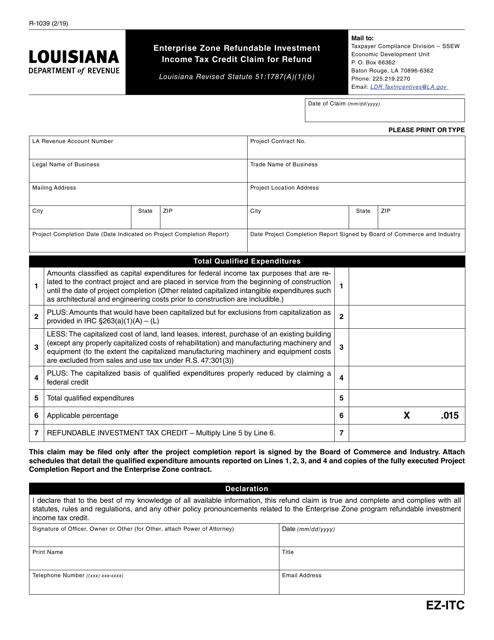

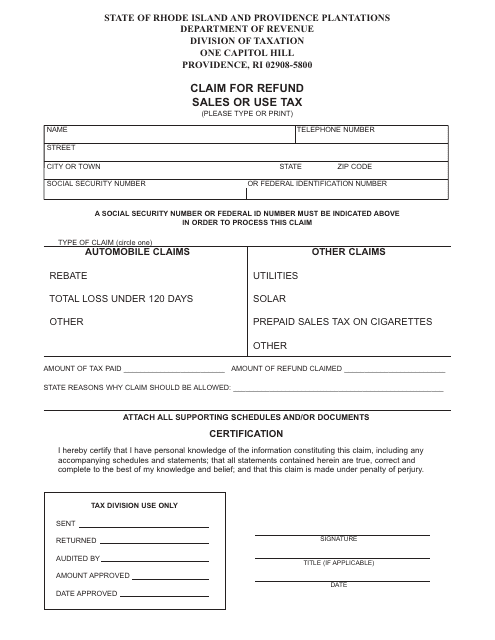

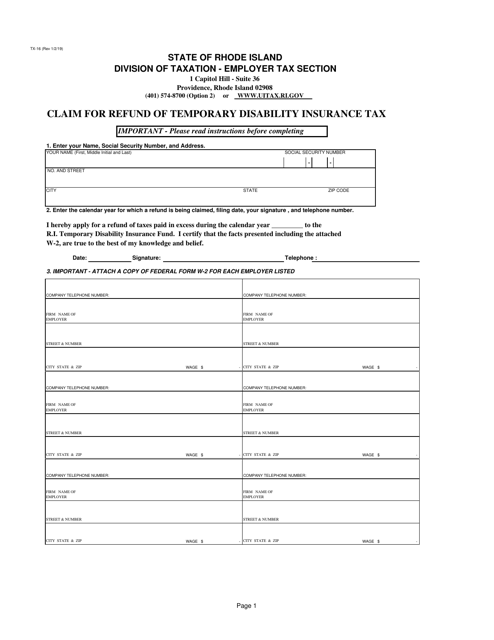

This document is for claiming a refund of sales or use tax paid in Rhode Island. You can use this form to request a refund if you believe you have overpaid or are eligible for a tax exemption.

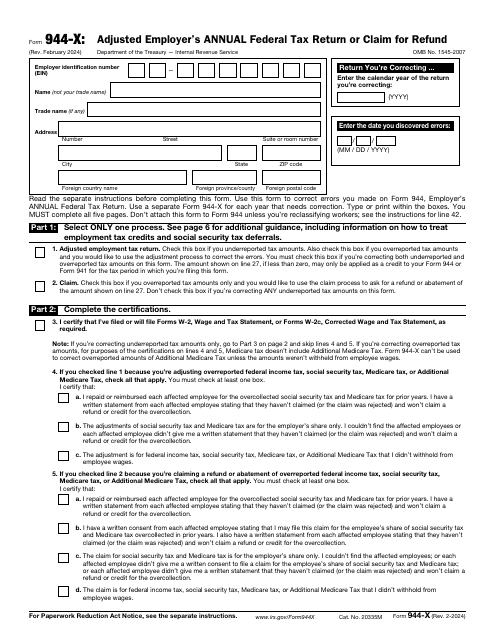

This is an IRS form designed to allow taxpayers to amend the information they previously filed reporting tax deducted from an employee's wages.

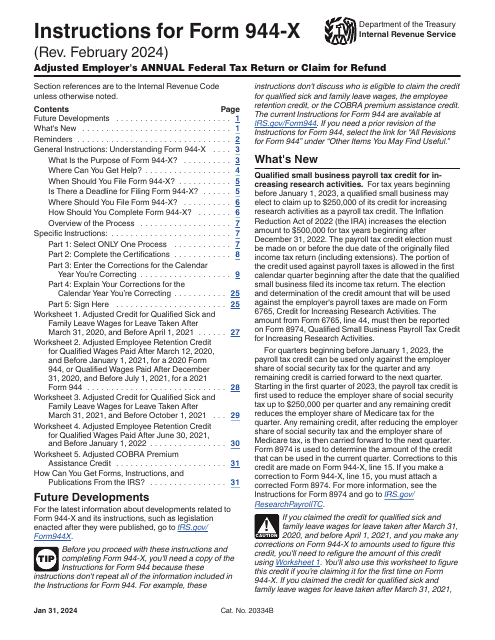

This is a fiscal form used by employers that learned about the need to correct a previously filed IRS Form 944, Employer's Annual Federal Tax Return.

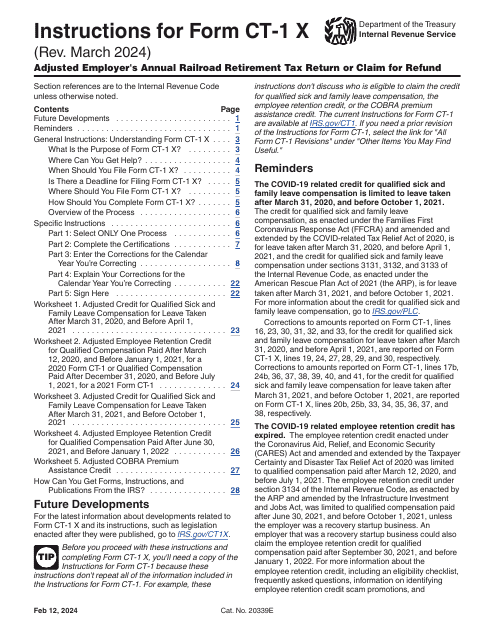

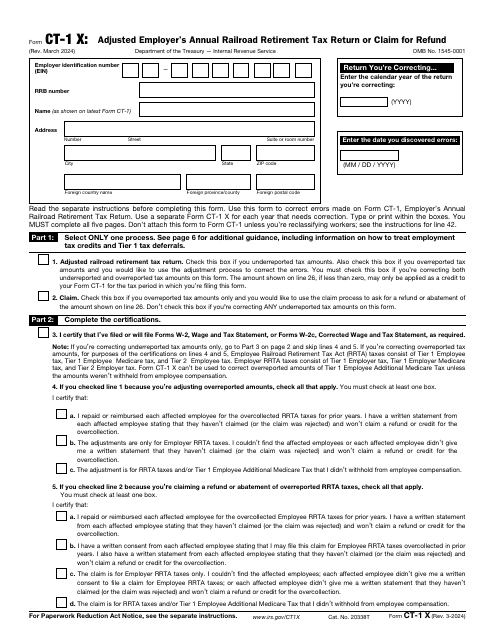

This is a formal document used by railroad industry employers to correct errors they have noticed upon filing IRS Form CT-1, Employer's Annual Railroad Retirement Tax Return.

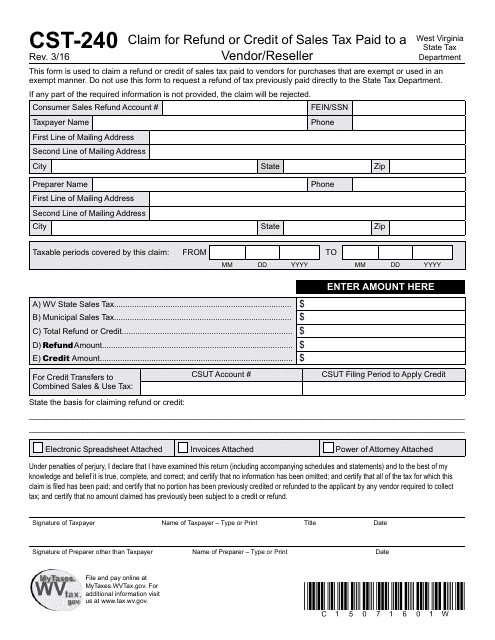

This Form is used for claiming a refund or credit for sales tax paid to a vendor or reseller in West Virginia.

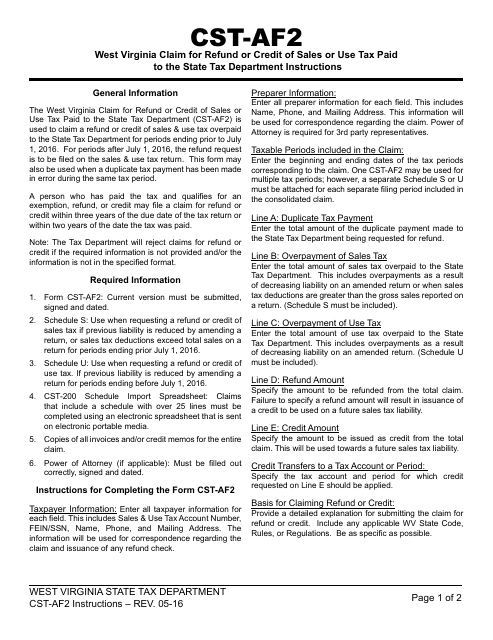

This Form is used for claiming a refund or credit for sales or use tax paid to the West Virginia State Tax Department.

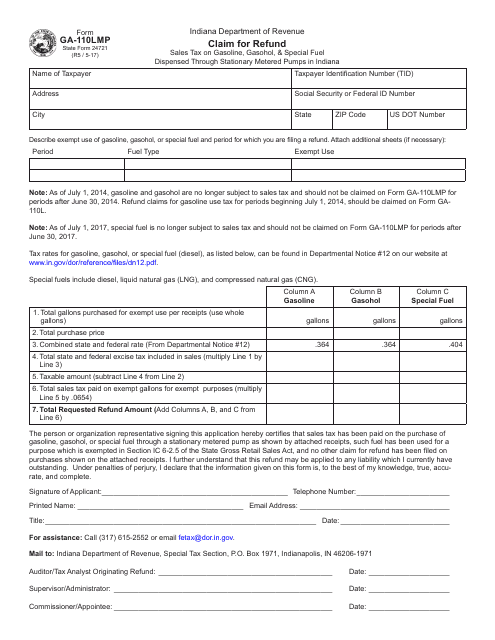

This Form is used for claiming a refund on sales tax paid for gasoline, gasohol, and special fuel dispensed through stationary metered pumps in Indiana.

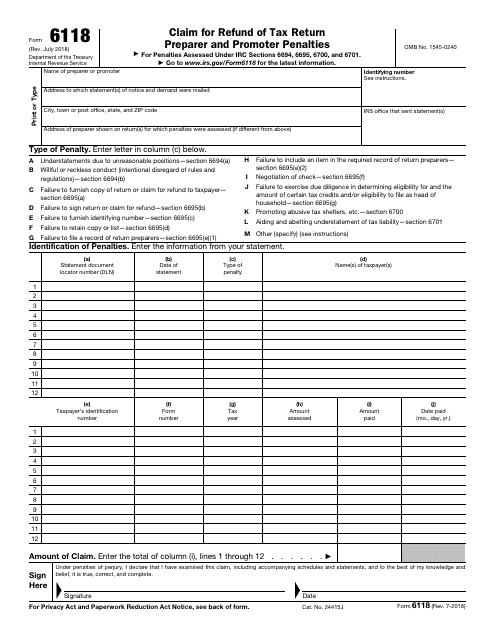

This form is used for claiming a refund of tax return preparer and promoter penalties imposed by the IRS.

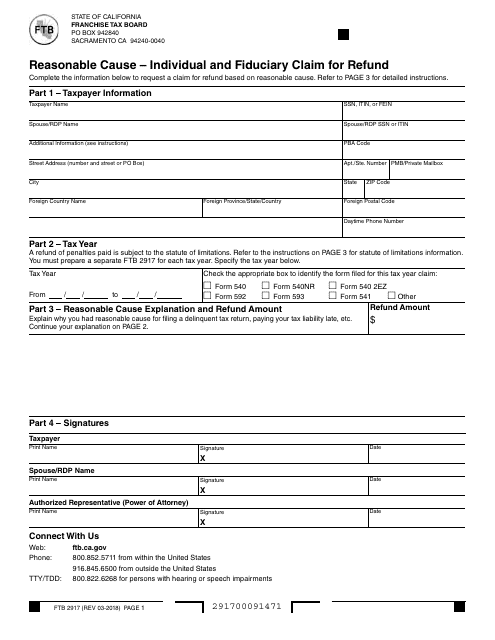

This form is used for individuals and fiduciaries in California to claim a refund and provide a reasonable cause for doing so.

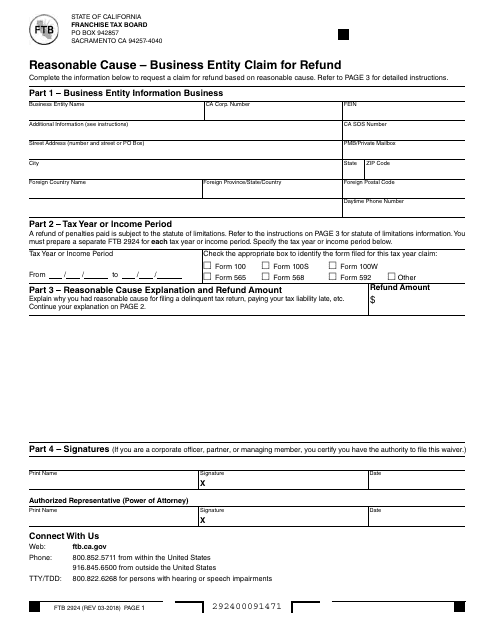

This form is used for claiming a refund for a business entity in California if there is a reasonable cause for the refund.

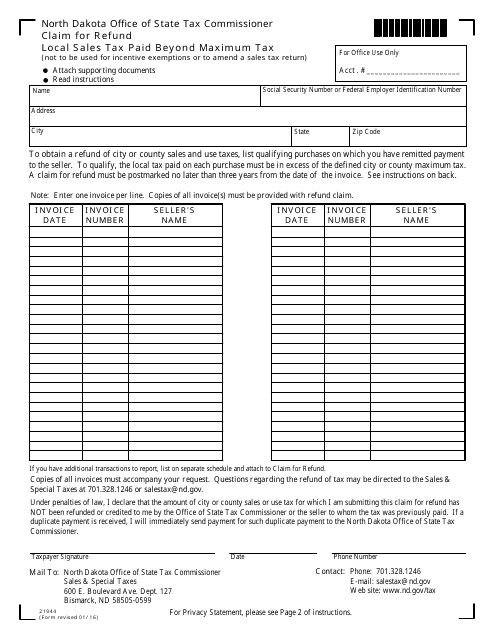

This Form is used for claiming a refund on local sales tax paid beyond the maximum tax amount in North Dakota.

This Form is used for individuals and businesses in Nebraska to claim a refund of sales and use tax that was incorrectly paid or overpaid.