Claim for Refund Templates

Documents:

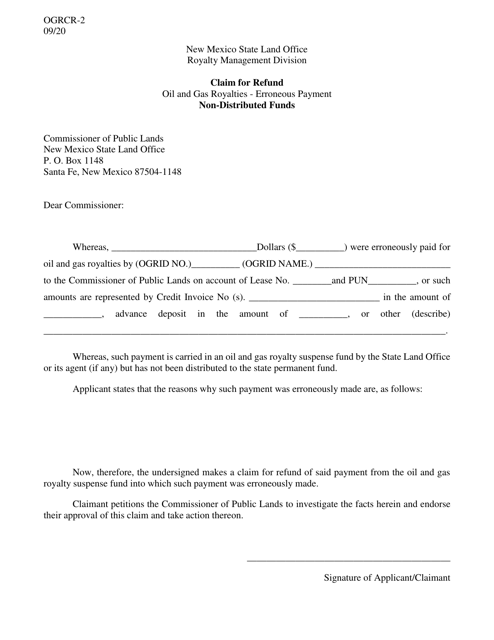

163

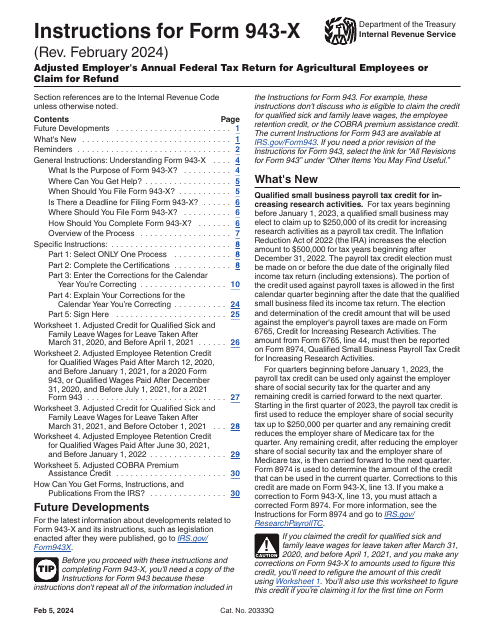

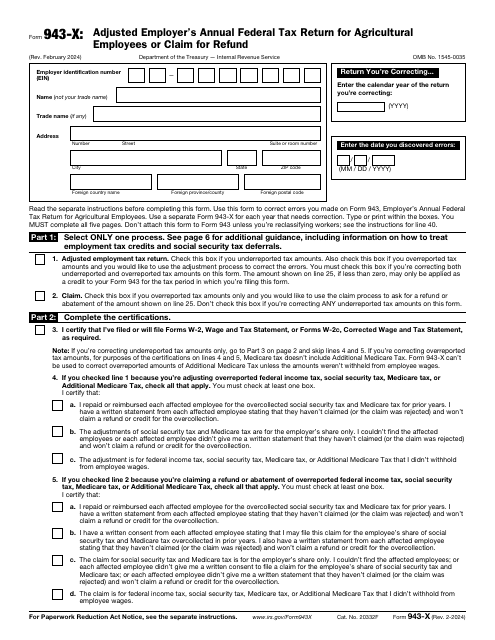

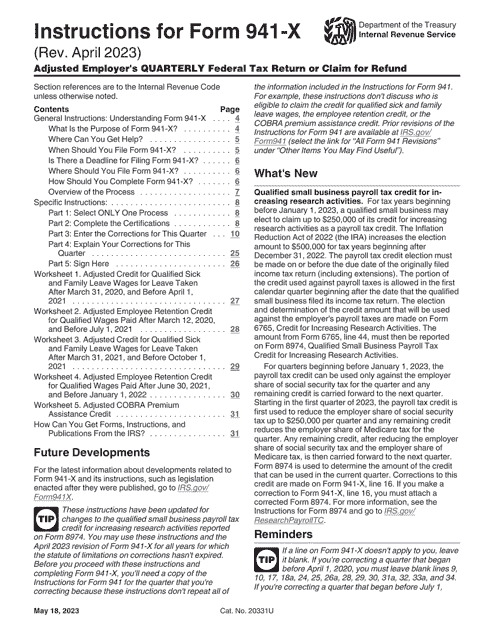

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

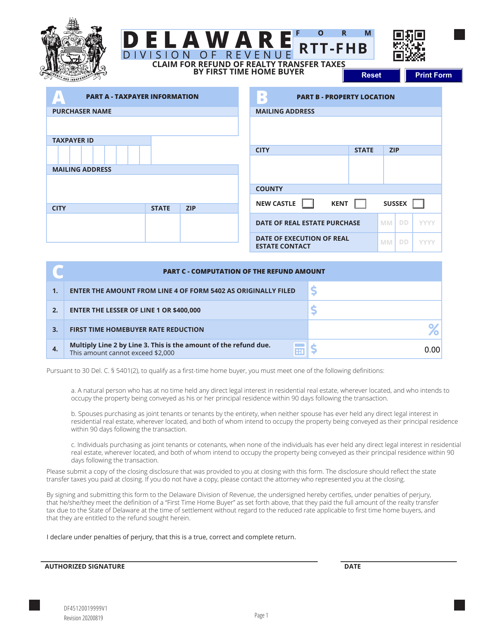

This form is used for first-time home buyers in Delaware who want to claim a refund for realty transfer taxes paid during the purchase of a property.

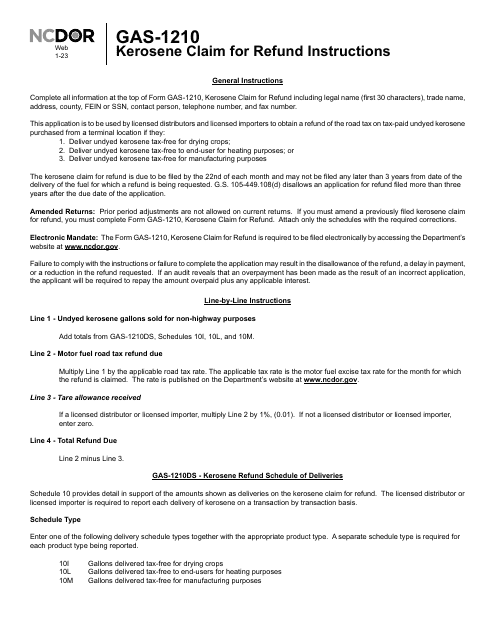

This is a North Carolina legal document used to request semiannual refunds of sales and use taxes paid on direct purchases and leases of tangible property and services from the Department of Revenue.

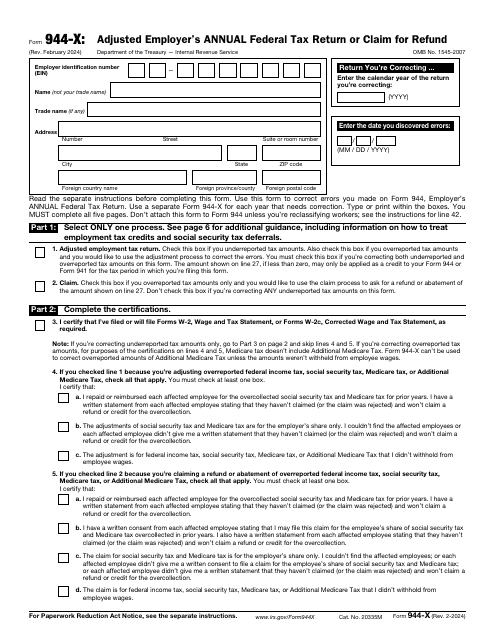

This is a fiscal form used by employers that learned about the need to correct a previously filed IRS Form 944, Employer's Annual Federal Tax Return.

This is an IRS form designed to allow taxpayers to amend the information they previously filed reporting tax deducted from an employee's wages.

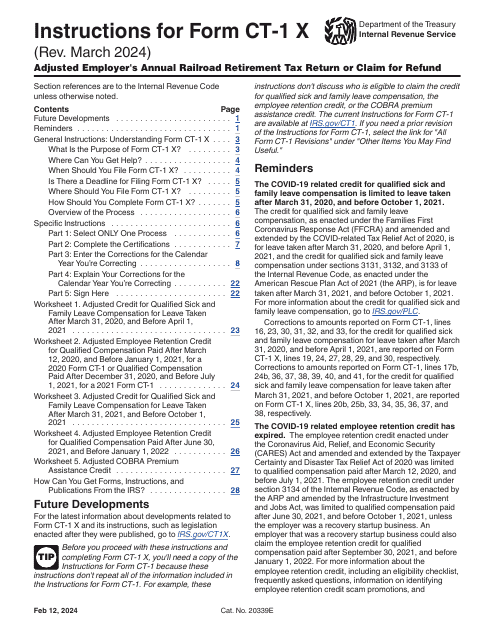

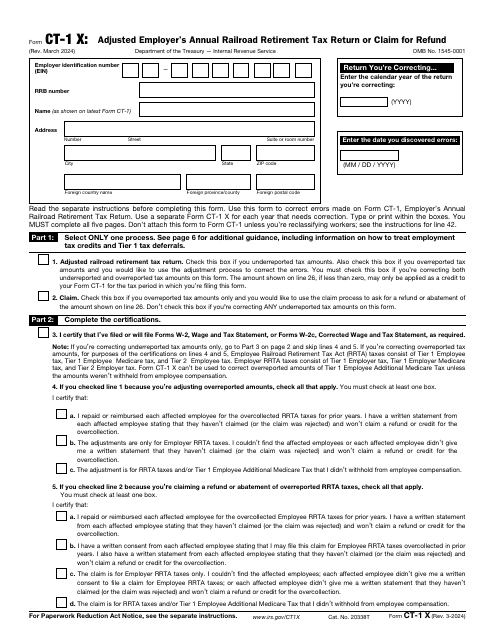

This is a formal document used by railroad industry employers to correct errors they have noticed upon filing IRS Form CT-1, Employer's Annual Railroad Retirement Tax Return.

Instructions for IRS Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

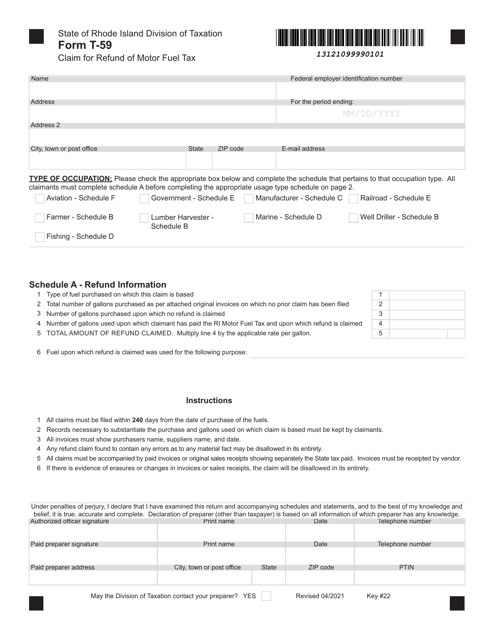

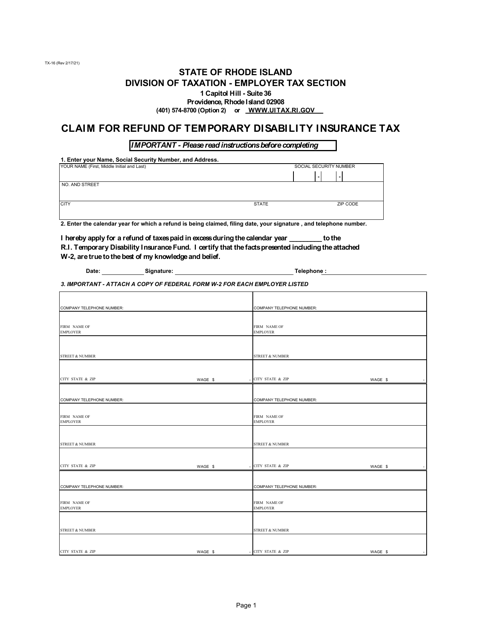

This form is used for claiming a refund of temporary disability insurance tax paid in Rhode Island.

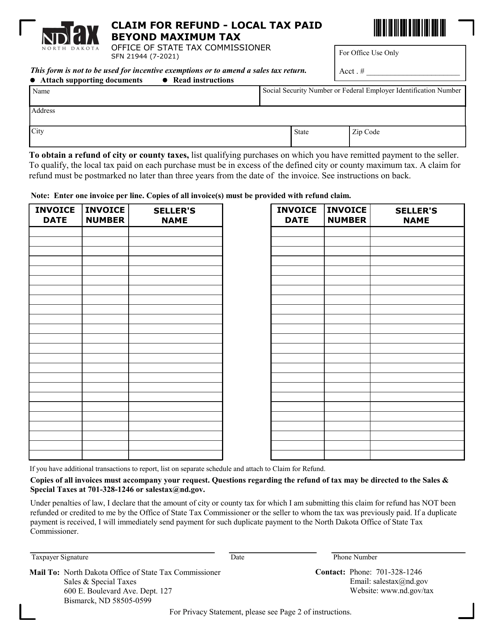

This form is used for filing a claim for a refund of local tax paid in North Dakota, beyond the maximum tax amount allowed.

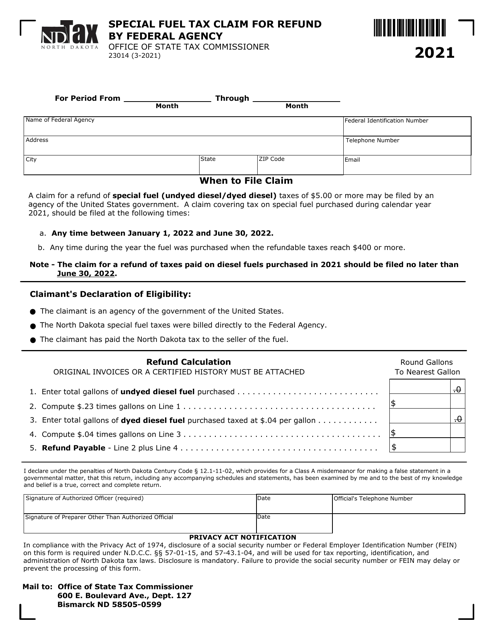

This Form is used for federal agencies in North Dakota to claim a refund for special fuel taxes paid.

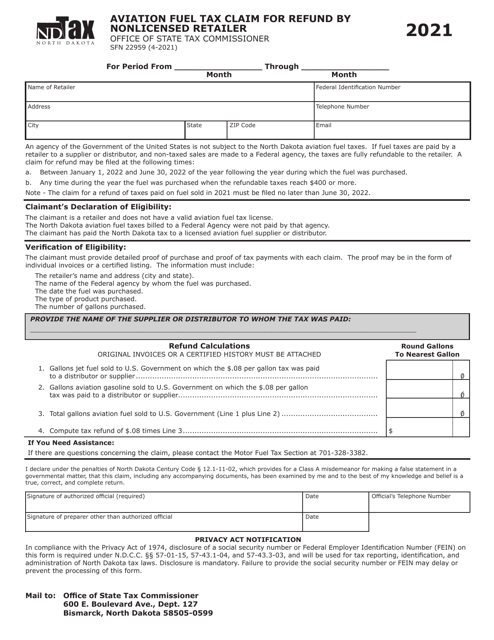

This form is used for nonlicensed retailers in North Dakota to claim a refund for aviation fuel tax paid.

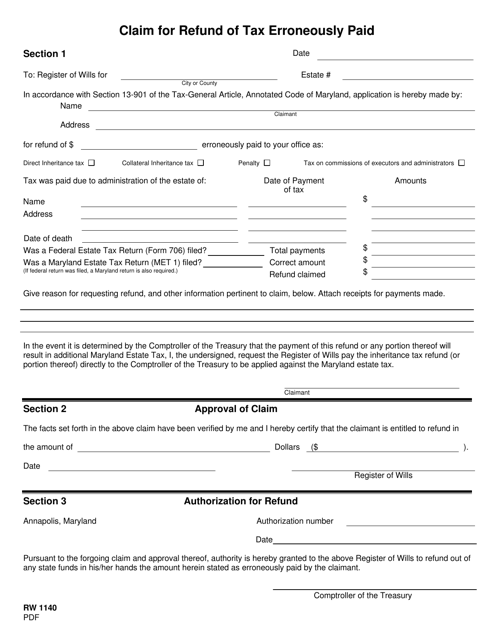

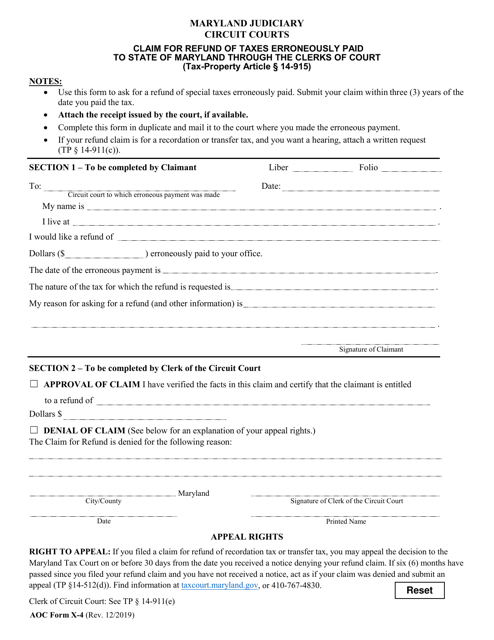

This Form is used for claiming a refund of tax that was paid erroneously to the state of Maryland.

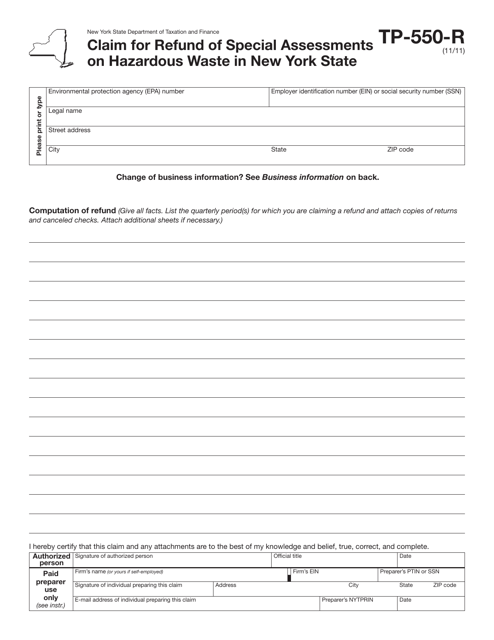

This Form is used for claiming a refund of special assessments on hazardous waste in the state of New York.

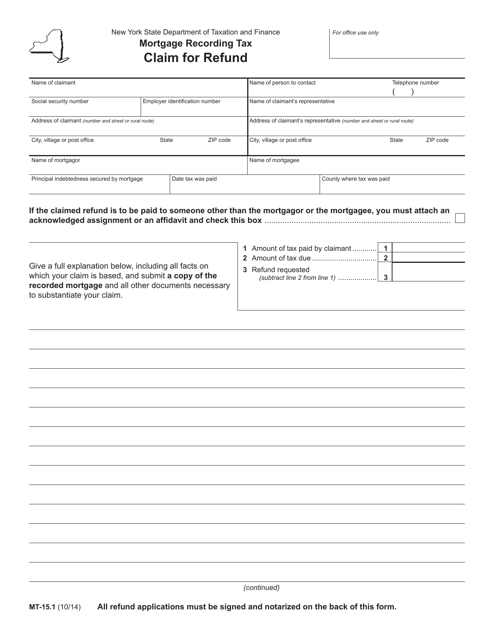

This form is used for claiming a refund on mortgage recording tax in the state of New York.

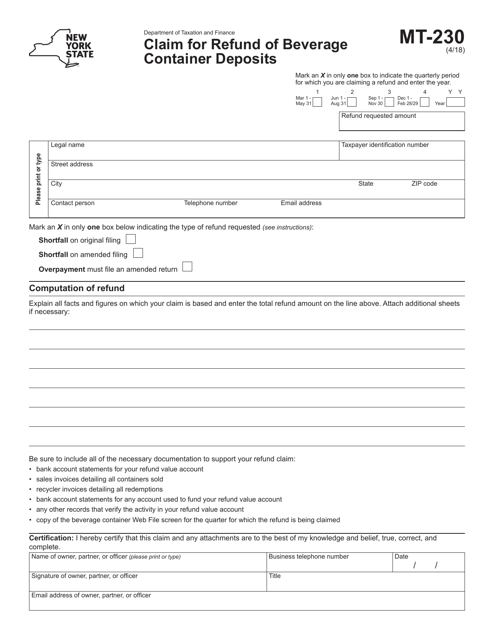

This form is used for claiming a refund of beverage container deposits in New York.

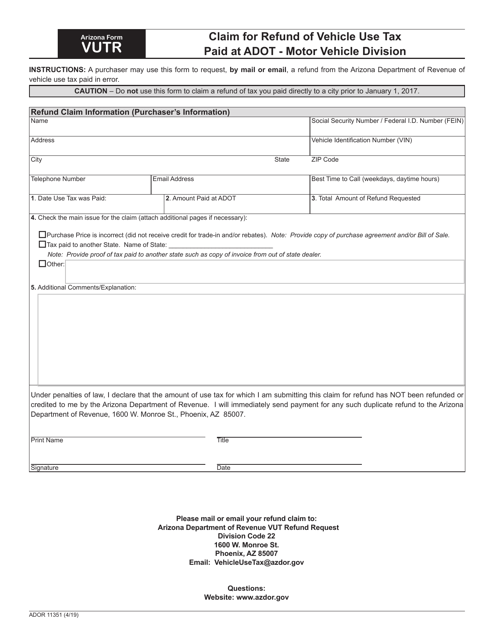

This Form is used for claiming a refund of vehicle use tax paid at the Arizona Department of Transportation's Motor Vehicle Division.

This form is used for claiming a refund of taxes that were mistakenly paid to the State of Maryland through the Clerks of Court.