Claim for Refund Templates

Documents:

163

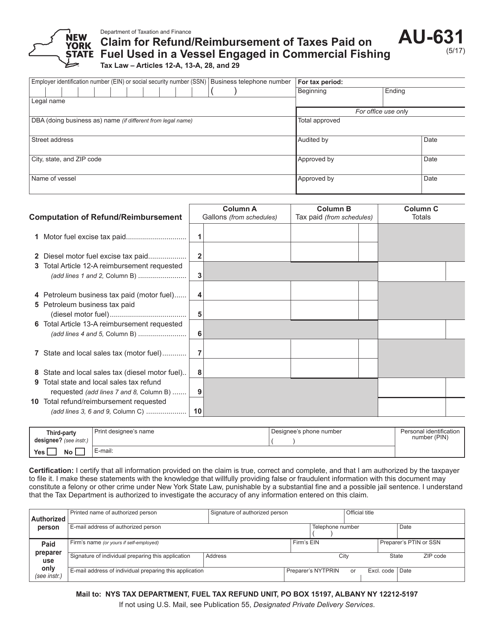

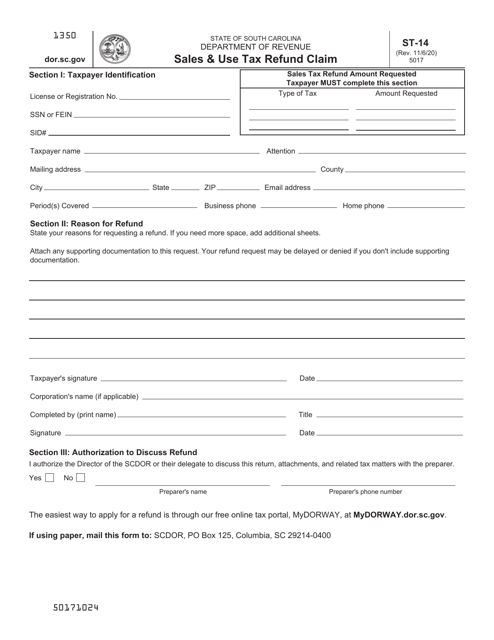

This form is used for claiming a refund or reimbursement of taxes paid on fuel used in a commercial fishing vessel in New York.

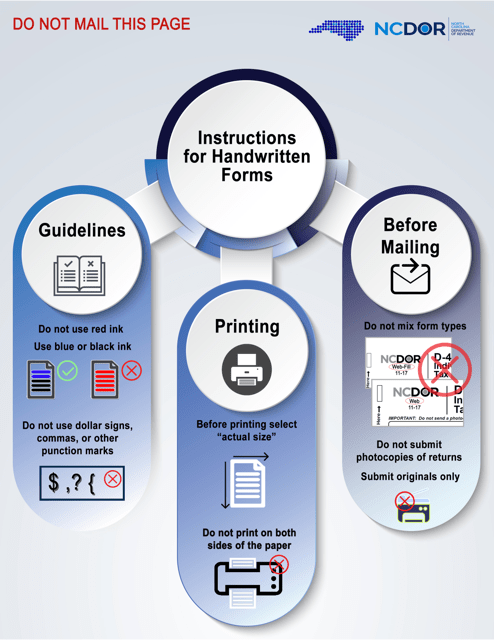

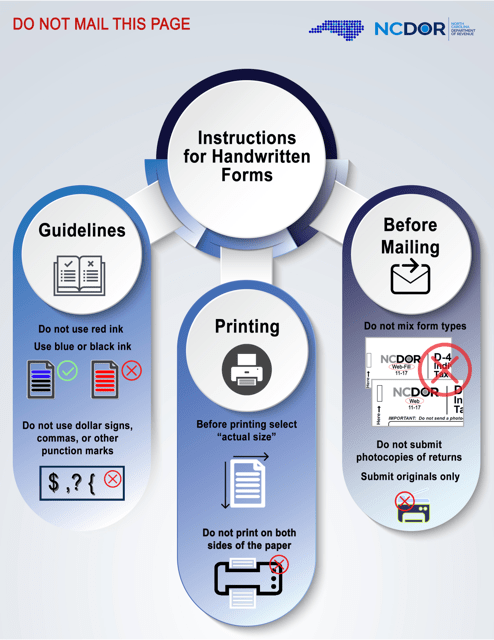

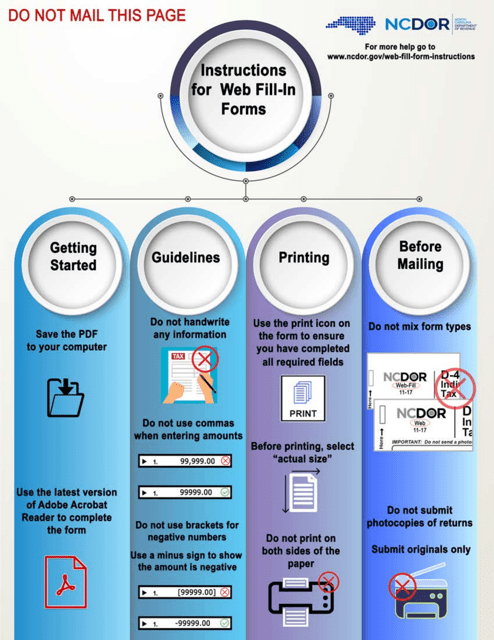

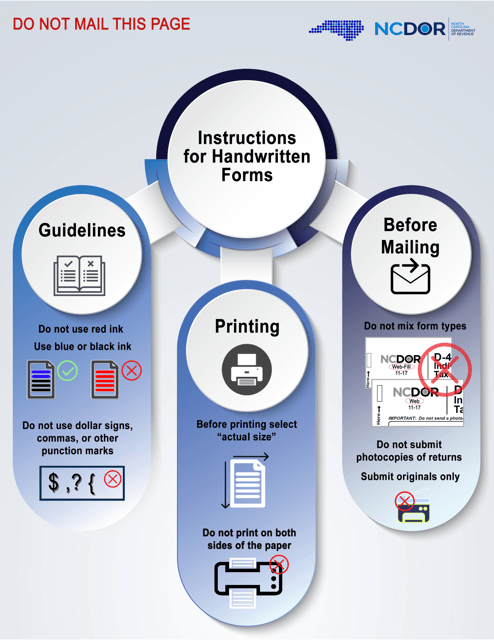

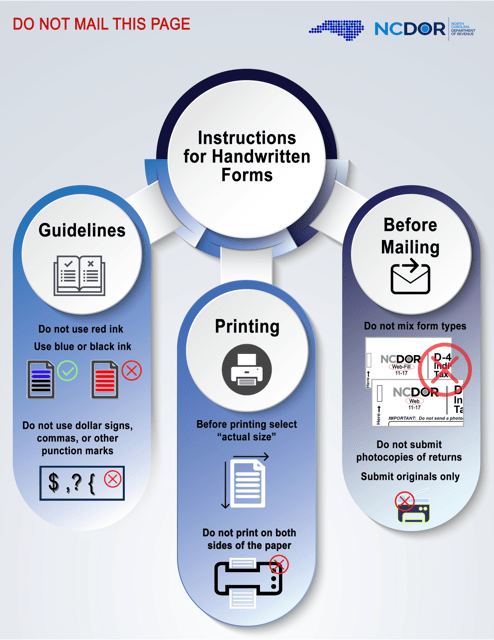

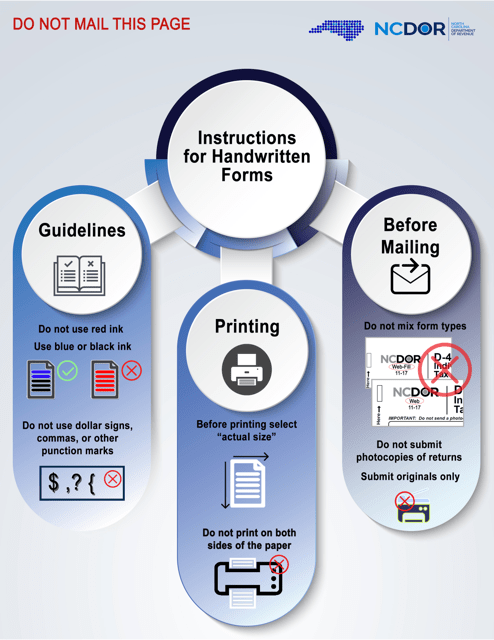

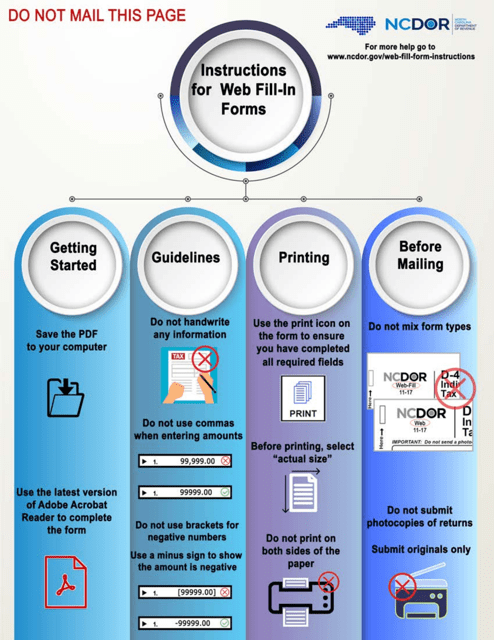

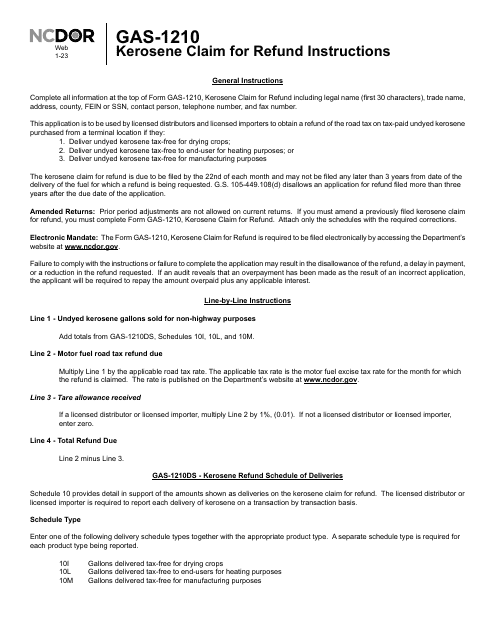

This Form is used for claiming a refund of taxes paid in the state of North Carolina.

This form is used for claiming a refund of the White Goods Disposal Tax in North Carolina.

This is a North Carolina legal document used to request semiannual refunds of sales and use taxes paid on direct purchases and leases of tangible property and services from the Department of Revenue.

This form is used for interstate carriers to claim a refund of combined general rate sales and use taxes in North Carolina.

This Form is used for utility companies in North Carolina to claim a refund for state, county, and transit sales and use taxes.

This Form is used for claiming a refund for the combined general rate of tax on utility, liquor, gas, and other items in North Carolina.

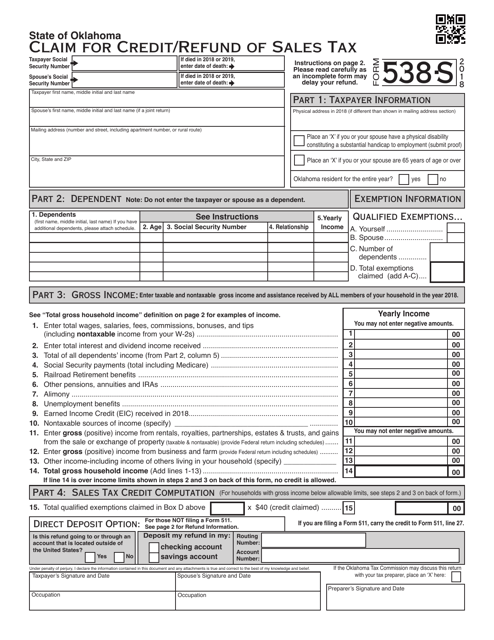

This form is used for claiming a credit or refund of sales tax paid in Oklahoma.

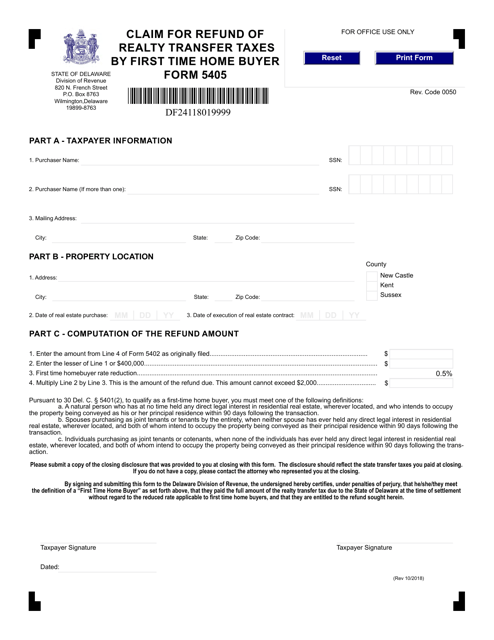

This Form is used for claiming a refund of realty transfer taxes by first-time home buyers in Delaware.

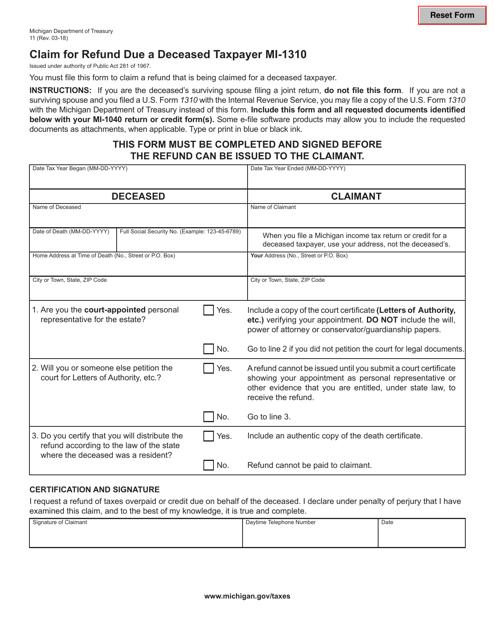

This form is used for claiming a refund on behalf of a deceased taxpayer in the state of Michigan.

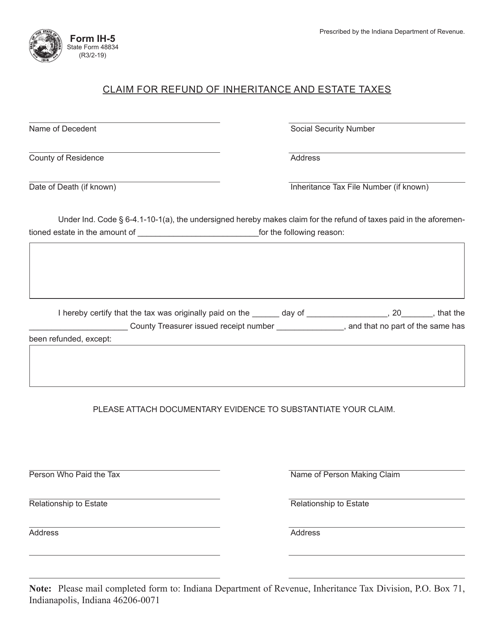

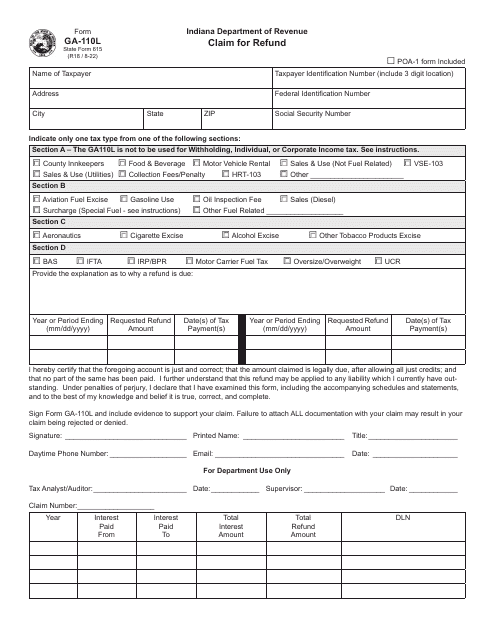

This form is used for claiming a refund of inheritance and estate taxes in the state of Indiana.

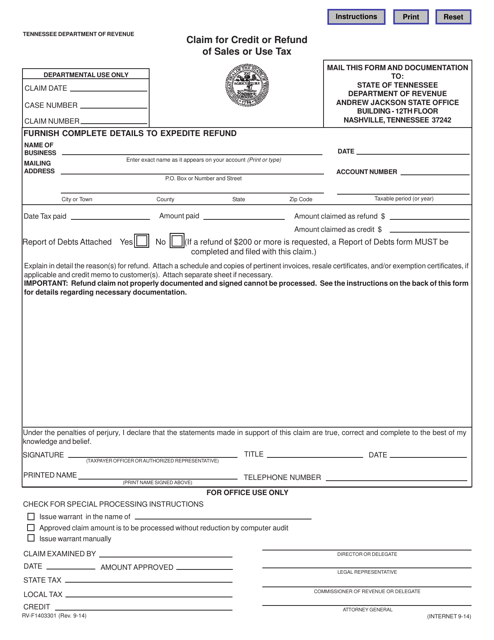

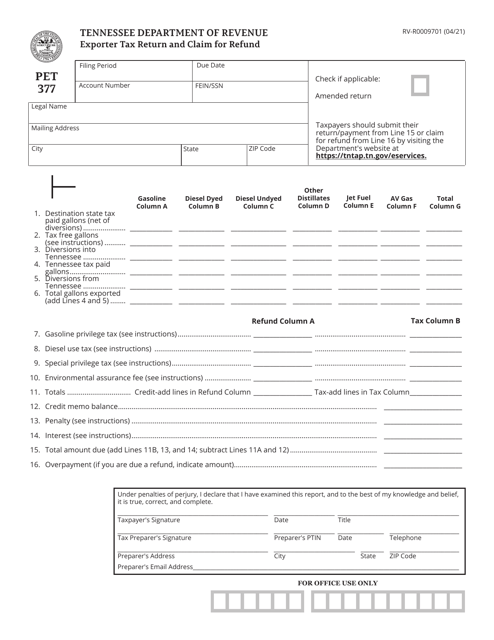

This form is used for claiming a credit or refund for sales or use tax paid in Tennessee.

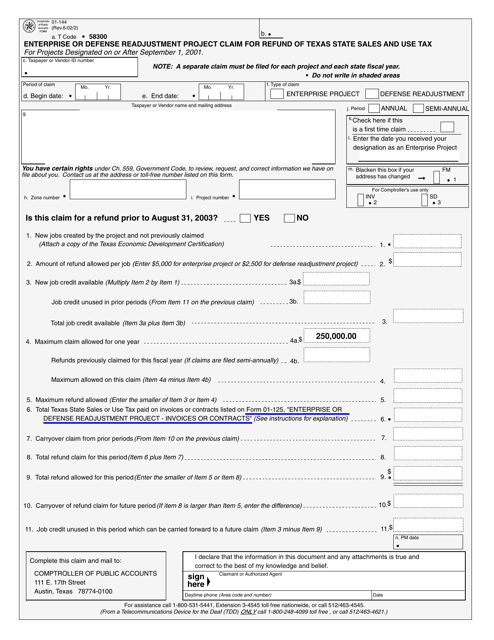

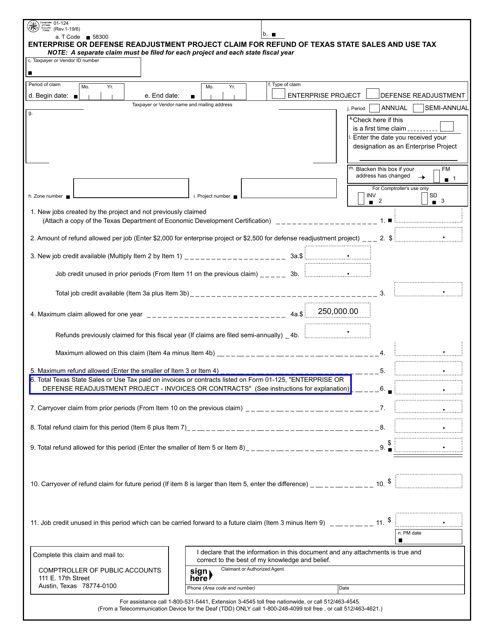

This Form is used for claiming a refund of Texas State Sales and Use Tax for enterprise or defense readjustment projects in Texas.

This form is used for claiming a refund of Texas State Sales and Use Tax for enterprise or defense readjustment projects in Texas.

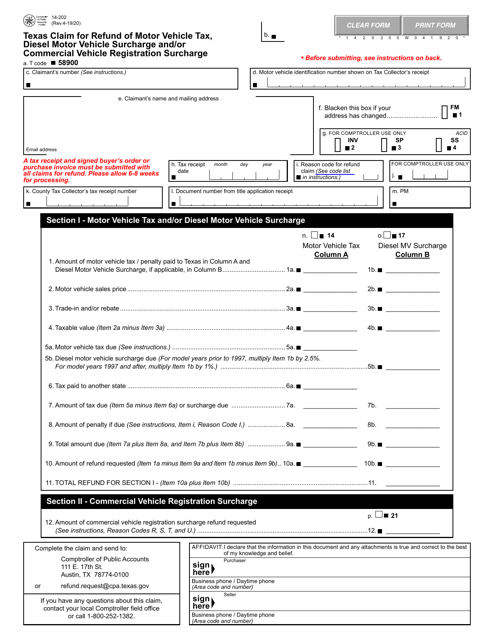

This Form is used for claiming a refund of motor vehicle tax, diesel motor vehicle surcharge and/or commercial vehicle registration surcharge in the state of Texas.

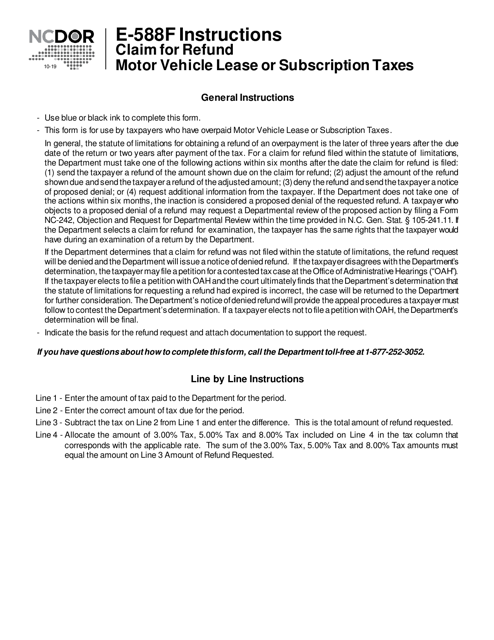

This form is used for claiming a refund of motor vehicle lease or subscription taxes in the state of North Carolina.

This Form is used for claiming a refund of motor vehicle lease or subscription taxes paid in North Carolina.