Formulario De Impuestos Templates

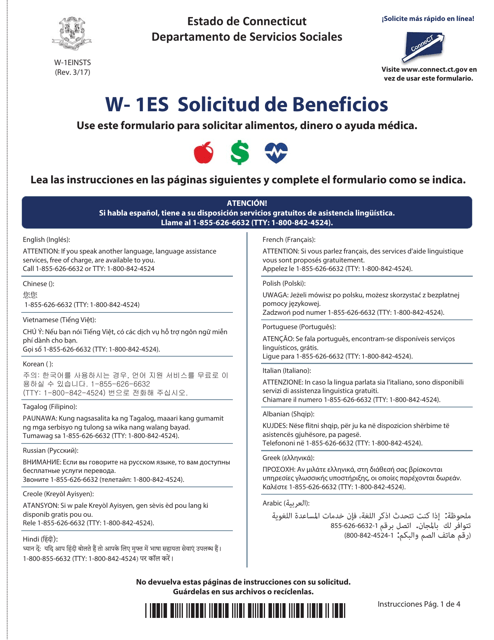

Are you looking for information on tax forms? Our website provides comprehensive resources on various tax forms including the formulario de impuestos, formularios de impuestos, and formulario de impuesto. These documents are essential for individuals and businesses to accurately report their income and claim any applicable deductions or credits.

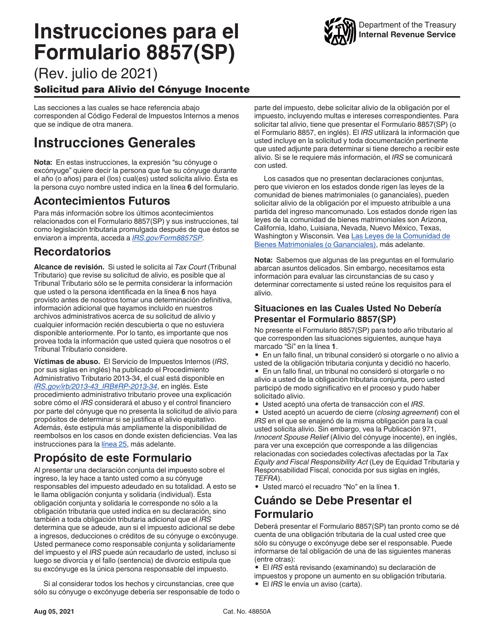

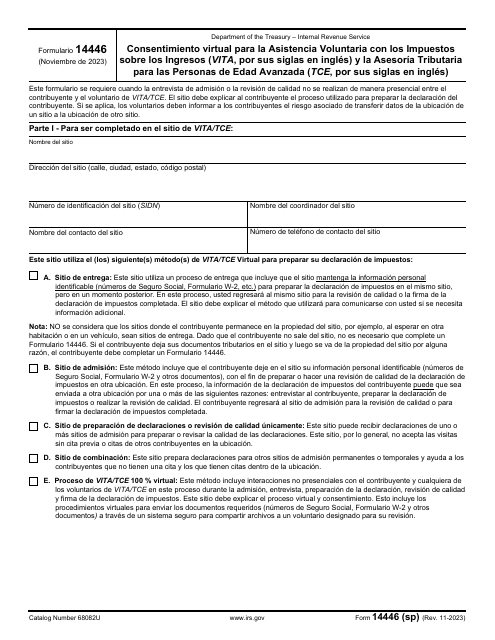

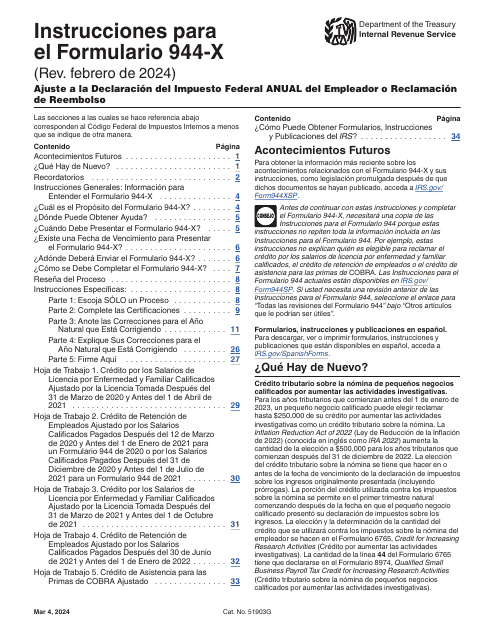

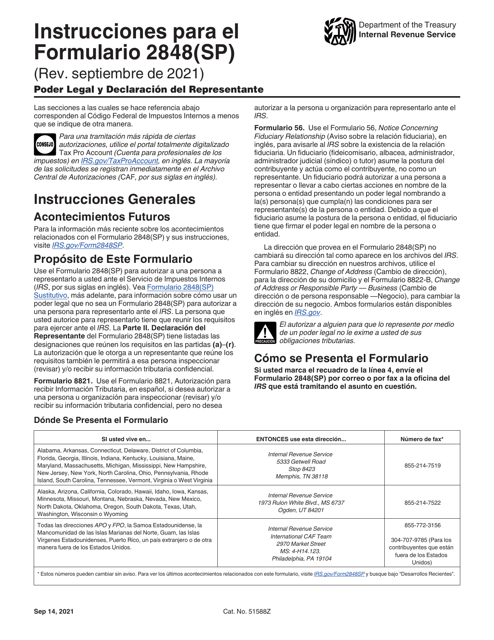

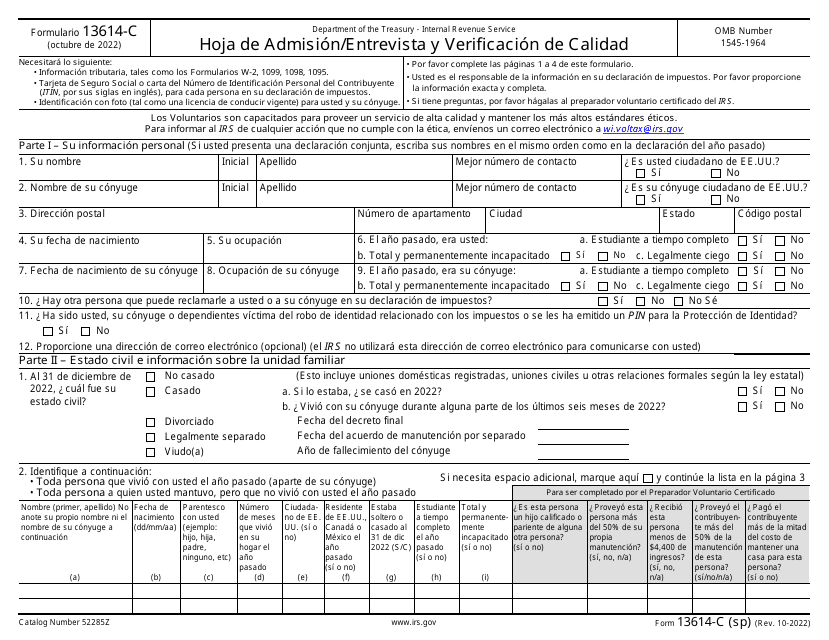

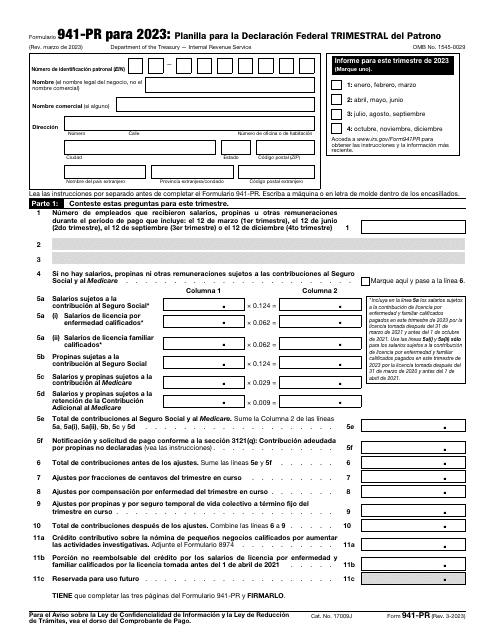

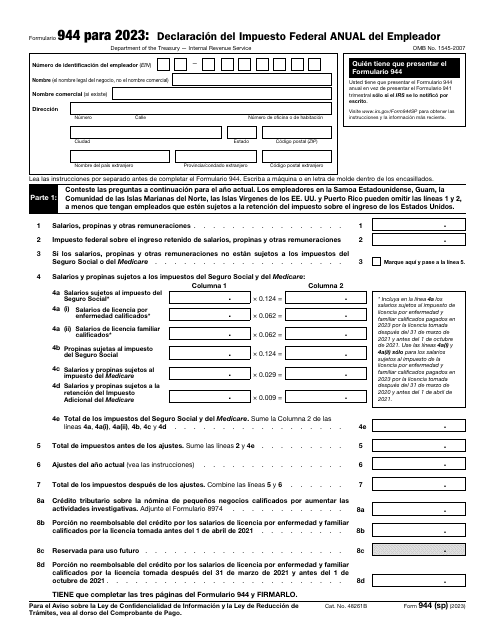

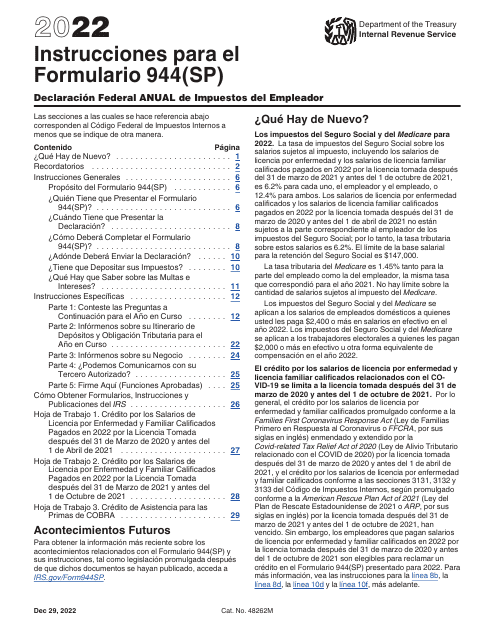

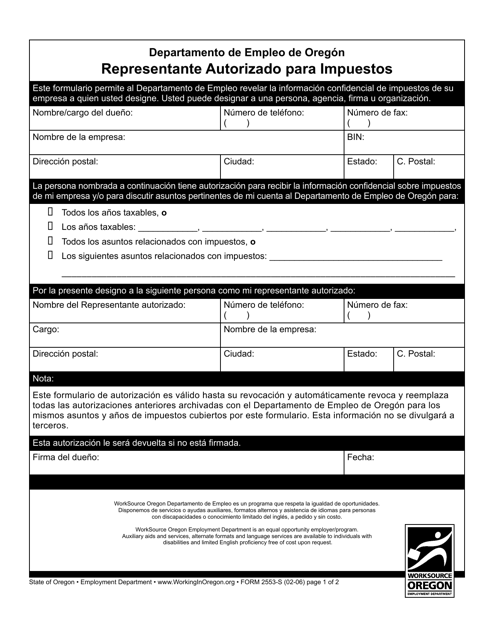

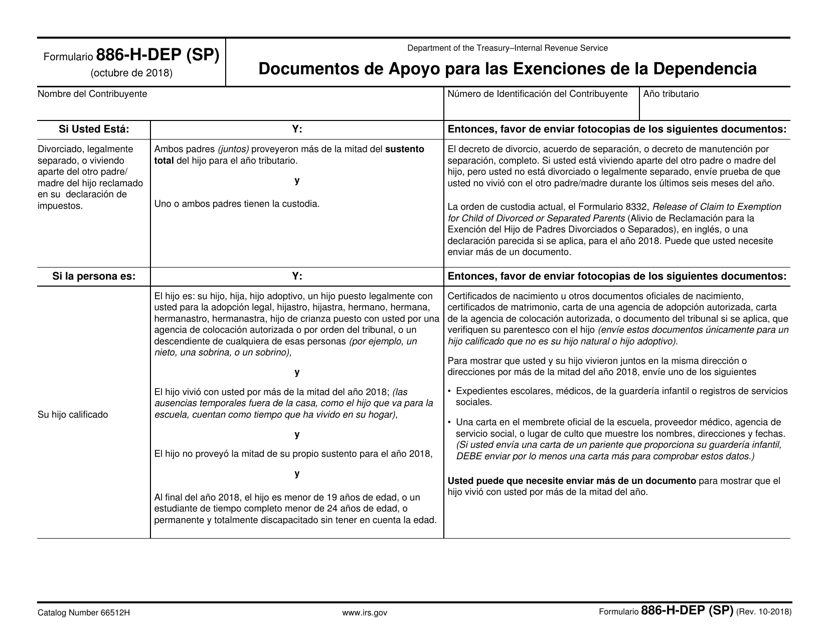

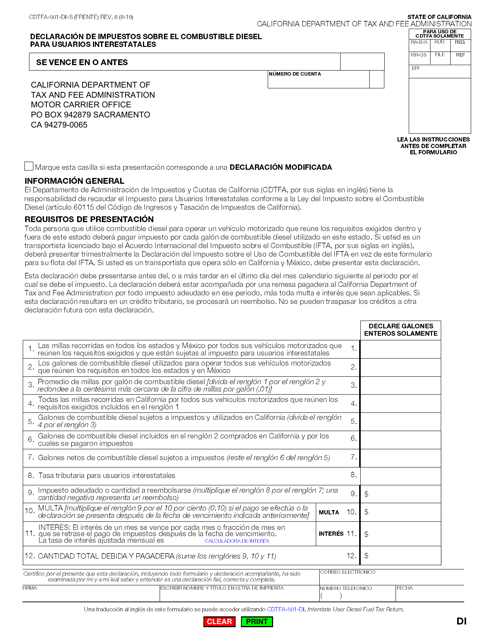

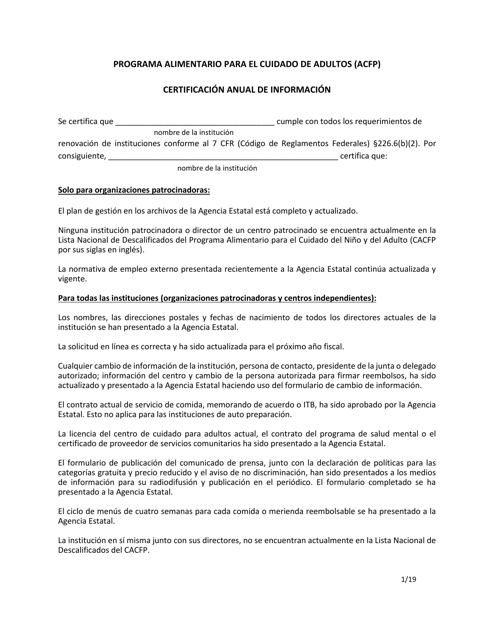

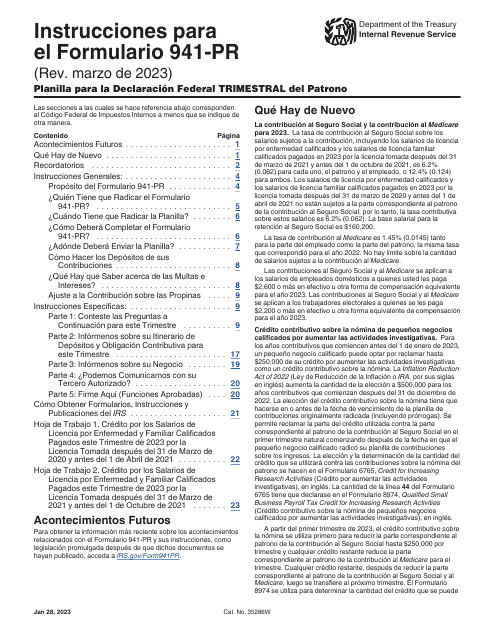

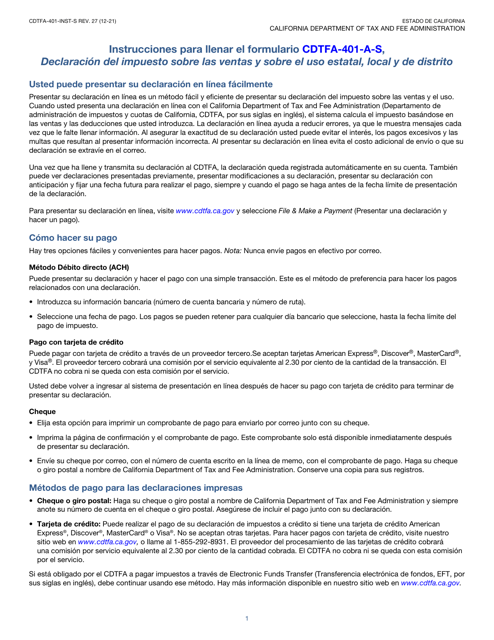

Our website offers a wide range of instructional guides and resources to help you understand and navigate the complexities of preparing and filing tax forms. Whether you need instructions for completing IRS Formulario 944-X (SP) Ajuste a La Declaracion Federal Anual Del Empleador O Reclamacion De Reembolso in Spanish, Formulario 3063-S Ingresos Del Trabajo Por Cuenta Propia - Texas, or instructions for Formulario OR-W-4, 150-101-402-5 Retenciones De Oregon - Oregon, our website has you covered.

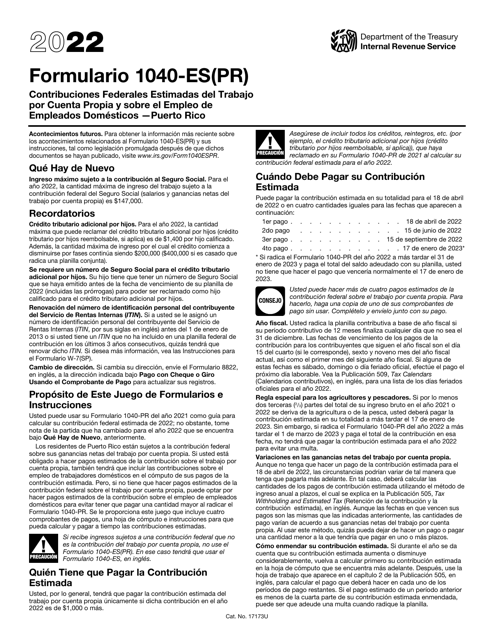

Additionally, if you are in Puerto Rico, our website provides instructions for IRS Formulario 943-PR Planilla Para La Declaracion Anual De La Contribucion Federal Del Patrono De Empleados Agricolas in Puerto Rican Spanish. We also offer resources such as Formulario CCA-1105A-S Encuesta De Reclamante Fiscal - Arizona in Spanish to cater to taxpayers in different states.

Our goal is to simplify the tax filing process by providing you with accurate and up-to-date information and resources on tax forms. Whether you are an individual taxpayer or a business owner, our website is your go-to source for all your formulario de impuestos needs. Browse through our extensive collection of tax forms and instructional guides to find the information you need.

Documents:

118

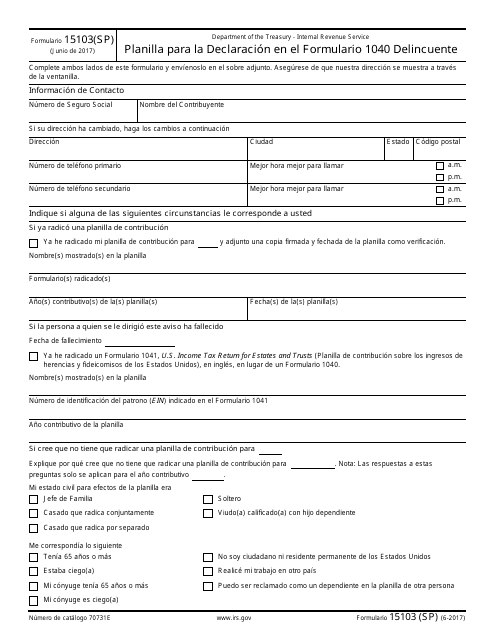

This Form is used for filing a tax return for individuals who have committed a crime and need to declare their income on Form 1040. (Spanish)

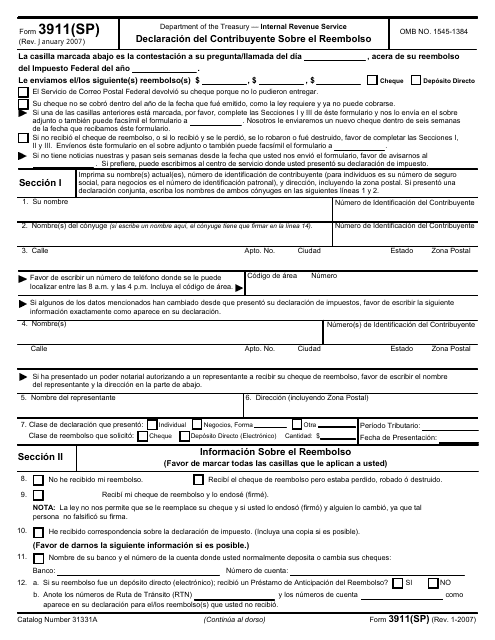

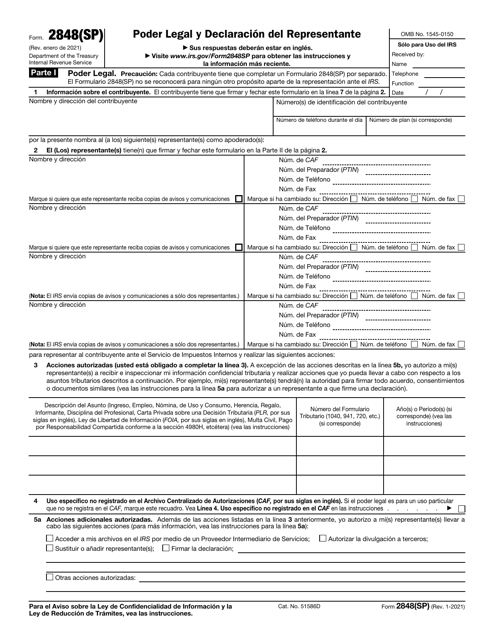

This Form is used for Spanish-speaking taxpayers to declare information about their refund with the IRS.

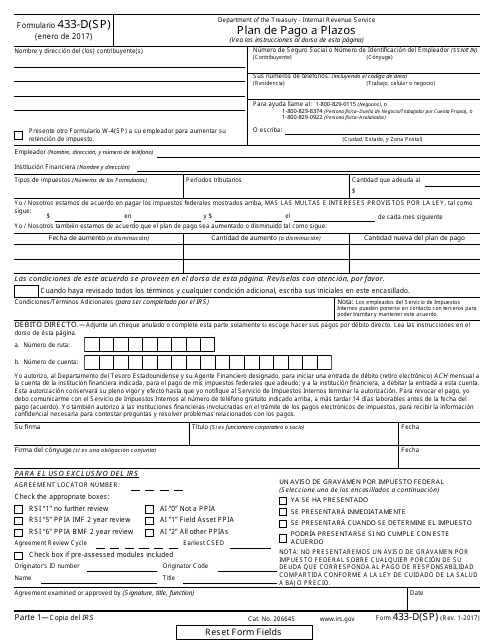

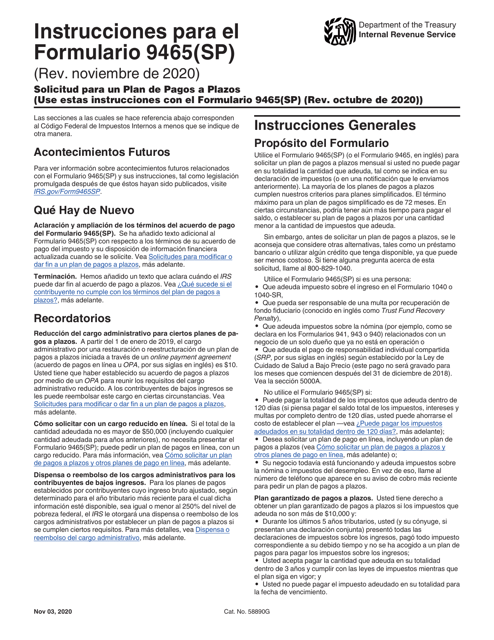

This Form is used for setting up a payment plan with the IRS in Spanish.

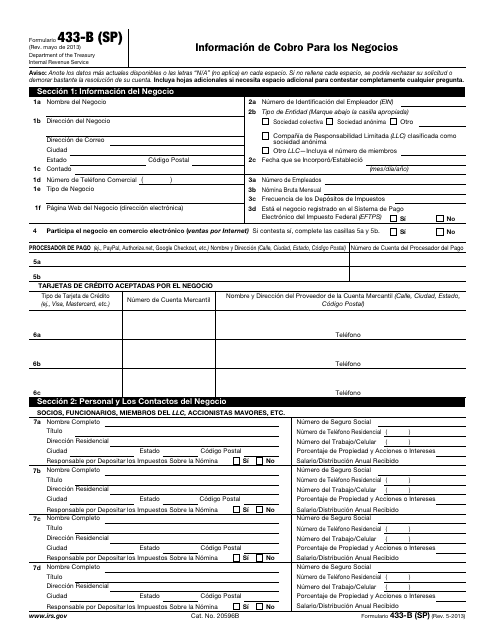

This form is used for businesses to provide information about their collection activity to the IRS. (Note: The description is in Spanish)

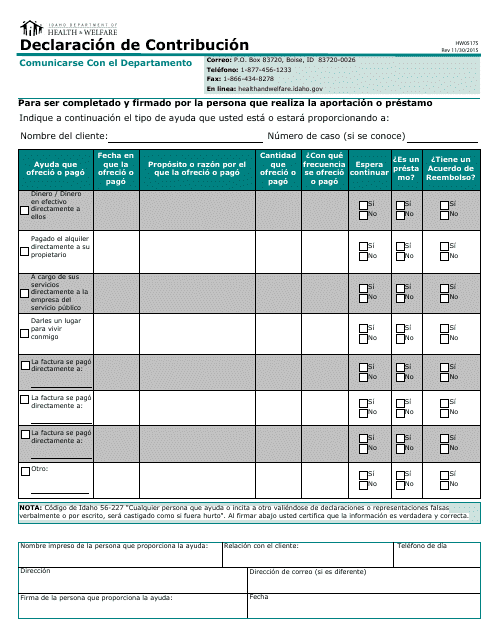

This Form is used for declaring contributions in the state of Idaho.

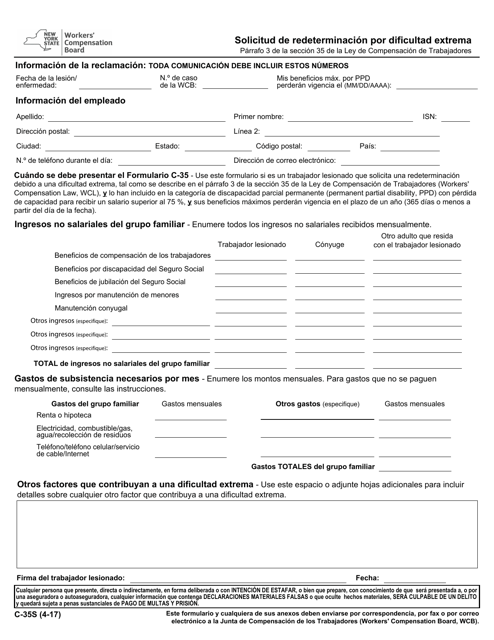

This Form is used for requesting a redetermination due to extreme hardship in the state of New York.

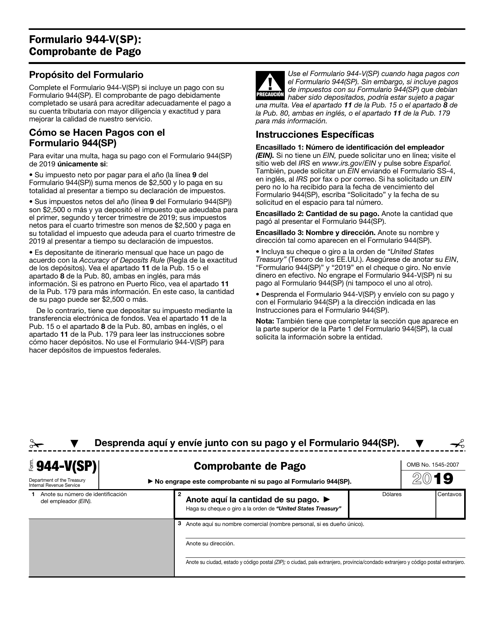

This type of document is a Spanish version of the IRS Form 944-V Payment Voucher. It is used by Spanish-speaking individuals or businesses to make payment arrangements with the IRS.

This form is used for making a sworn statement in Spanish in the state of California.