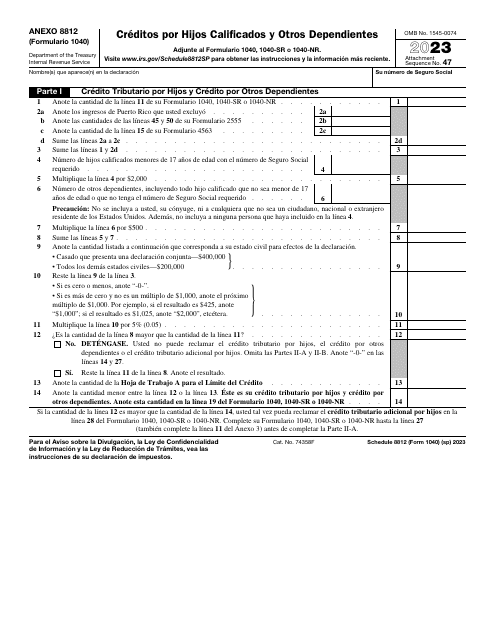

Formulario De Impuestos Templates

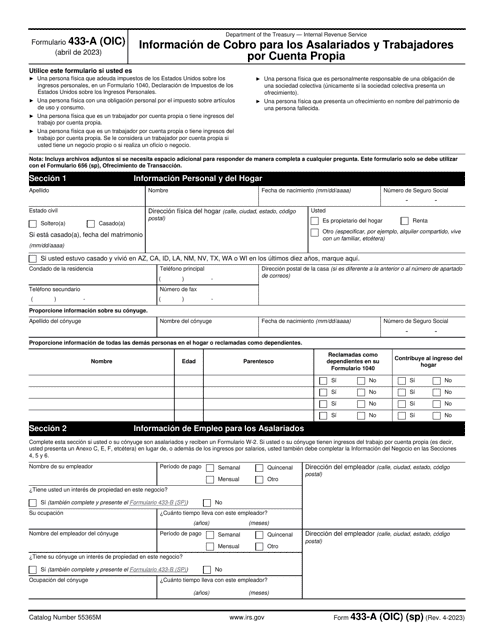

Documents:

118

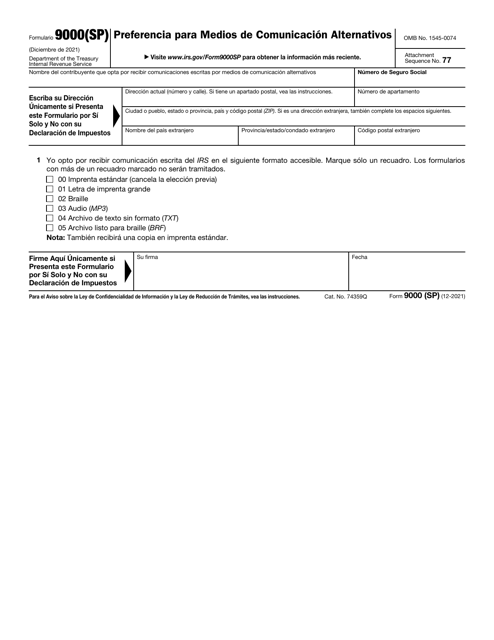

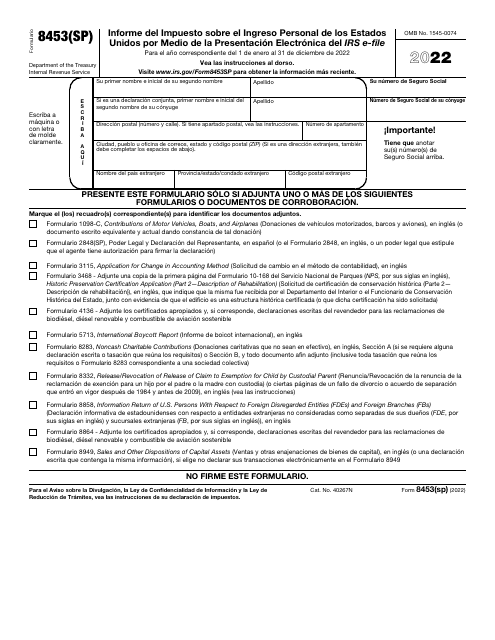

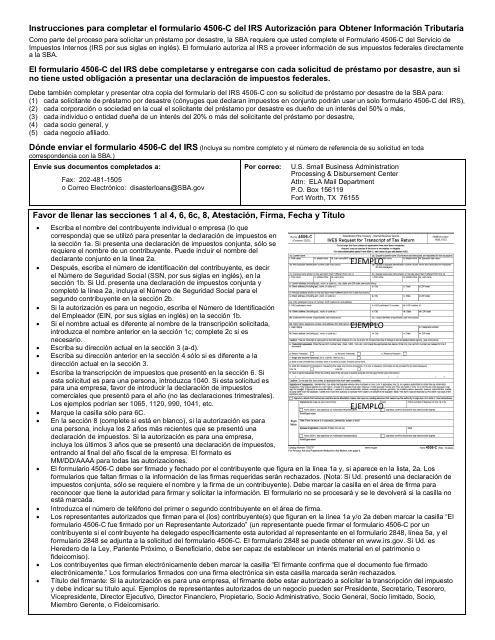

This document is for requesting preference for alternative communication methods with the IRS. (in Spanish)

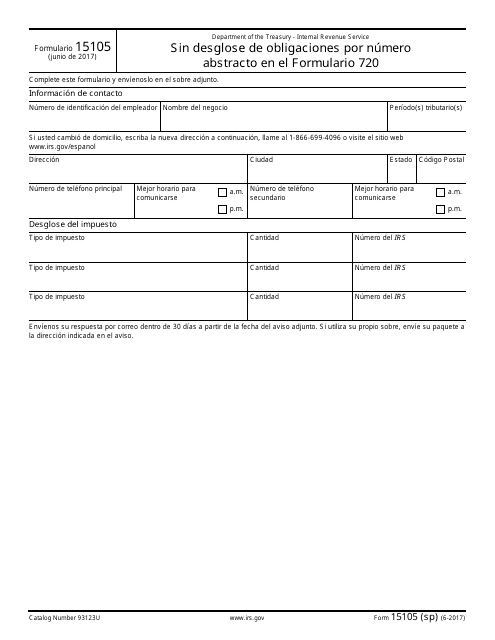

This document is a Spanish version of IRS Form 15105 (SP) used for reporting abstract number obligations on Form 720 without itemizing them.

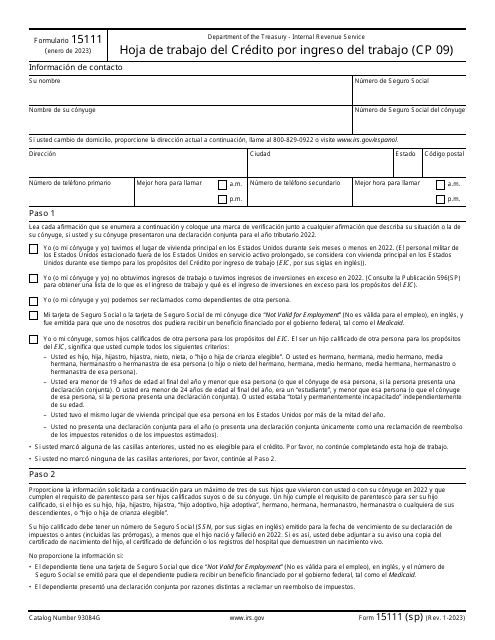

This document is a Spanish version of IRS Form 15111 (SP), which is used for calculating the Earned Income Credit.

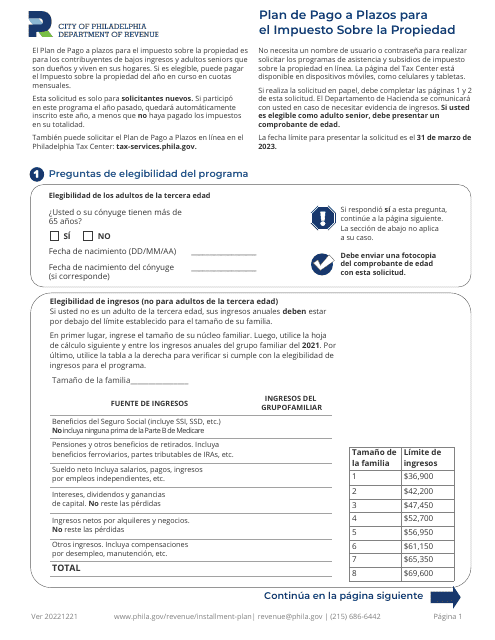

This type of document is a Plan de Pago a Plazos (Installment Payment Plan) for the Impuesto Sobre La Propiedad (Property Tax) in the City of Philadelphia, Pennsylvania.

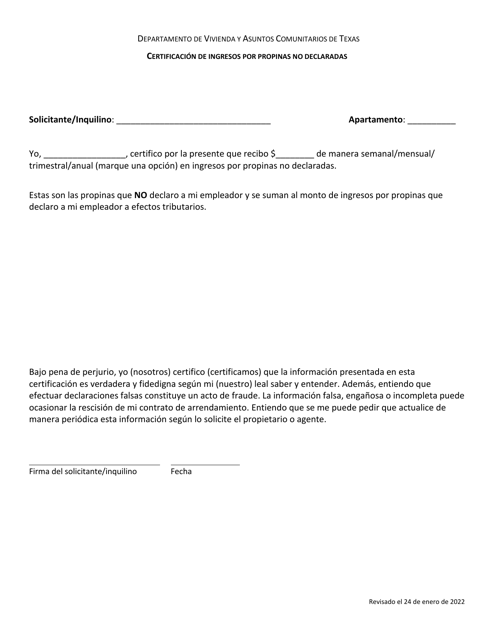

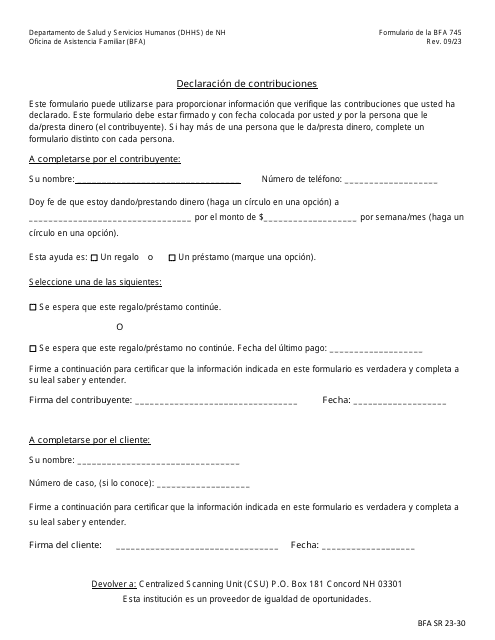

This document certifies income from undeclared tips in Texas.

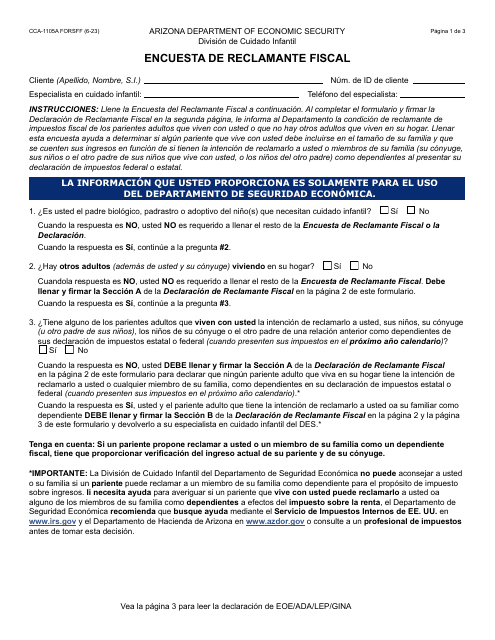

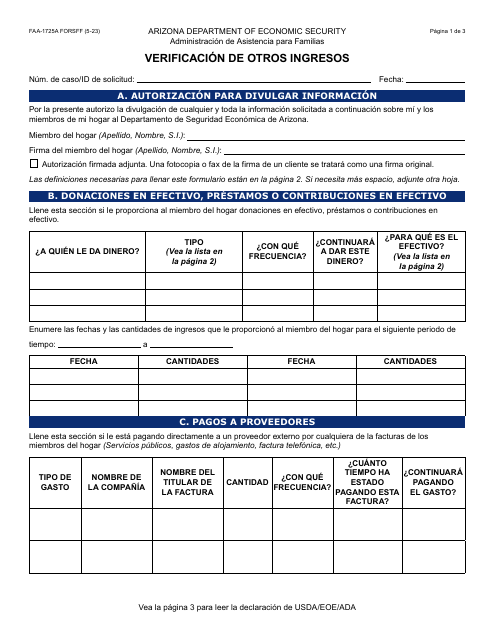

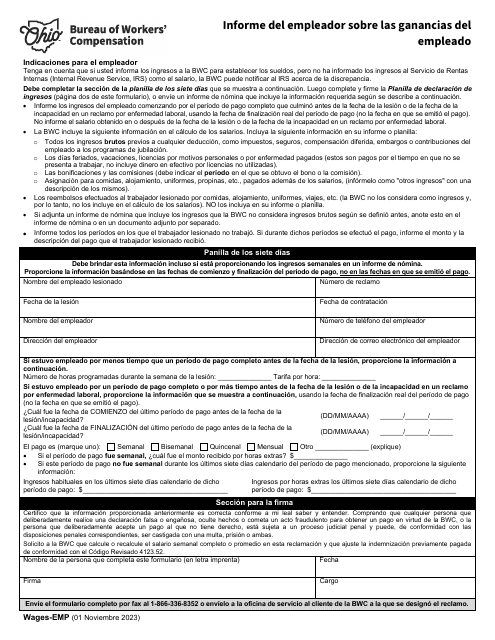

This form is used for verifying other incomes in Arizona.

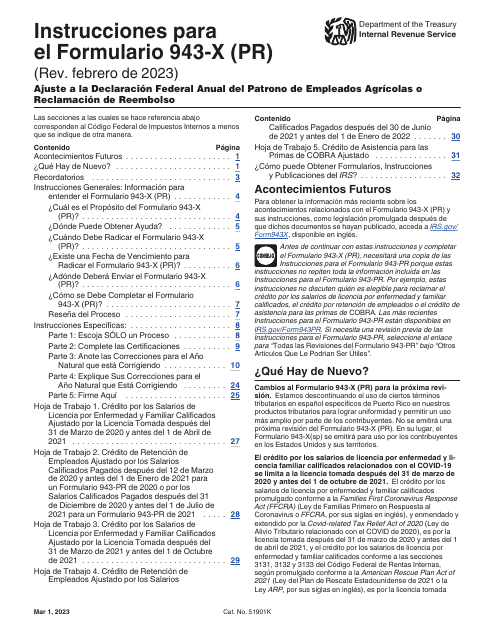

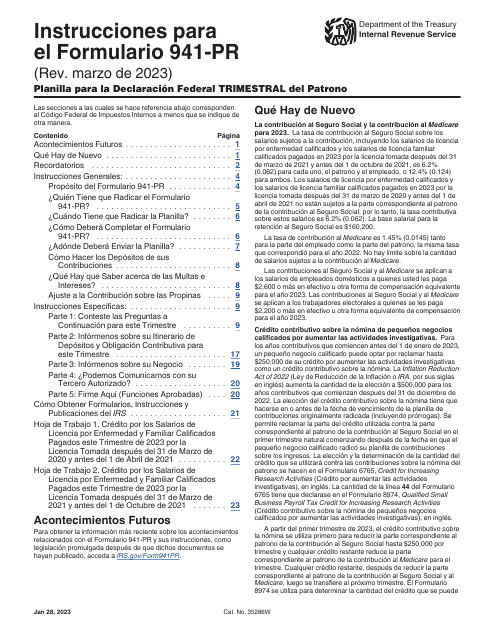

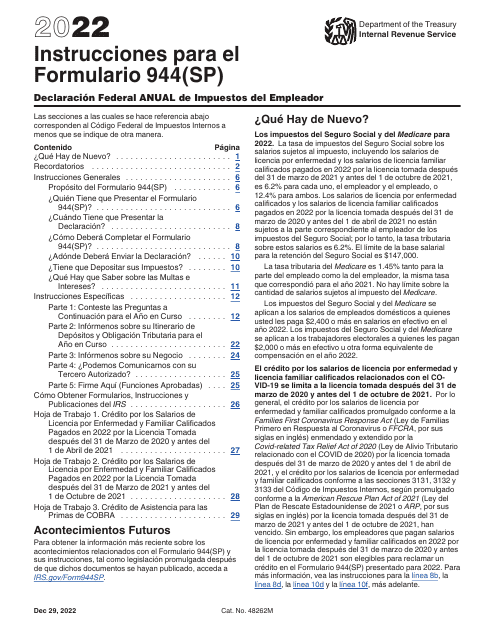

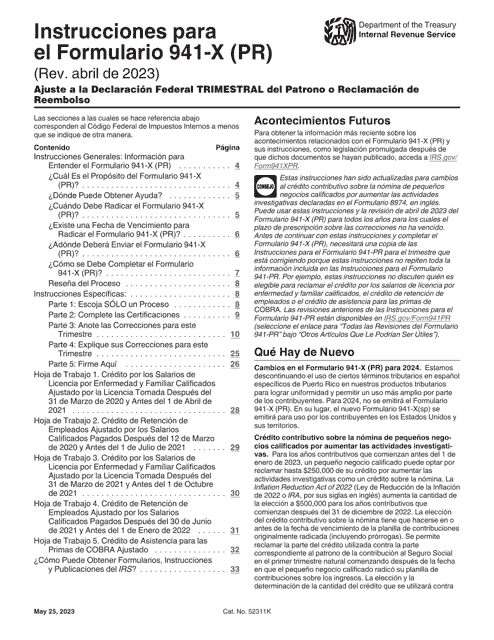

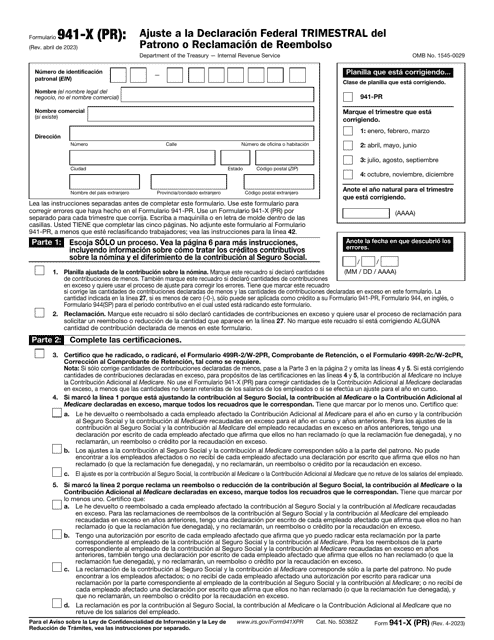

This Form is used for making adjustments or claiming refunds on the quarterly federal employer's declaration.

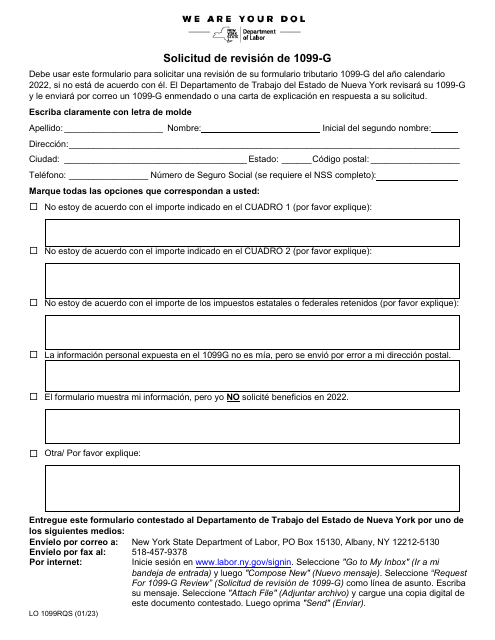

This Form is used for requesting a review of the 1099-G form for residents of New York.

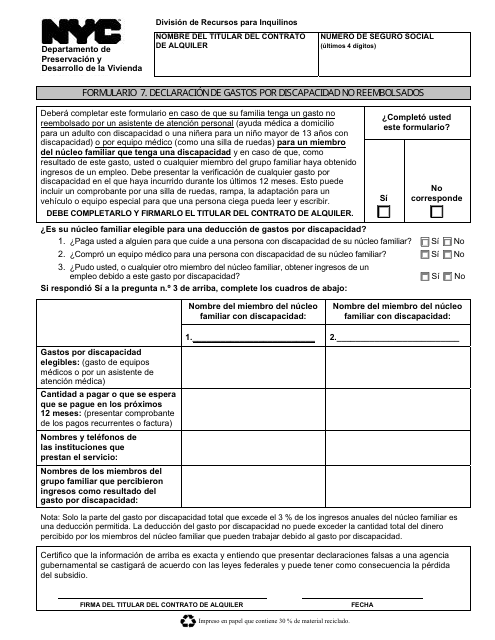

This form is used for declaring unreimbursed disability expenses in New York City.