Formulario De Impuestos Templates

Documents:

118

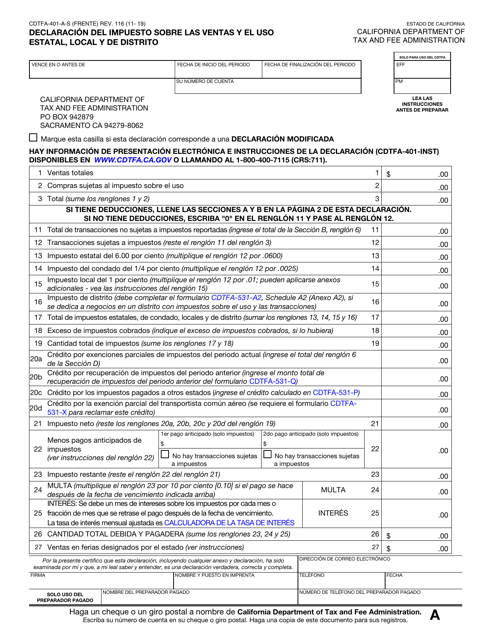

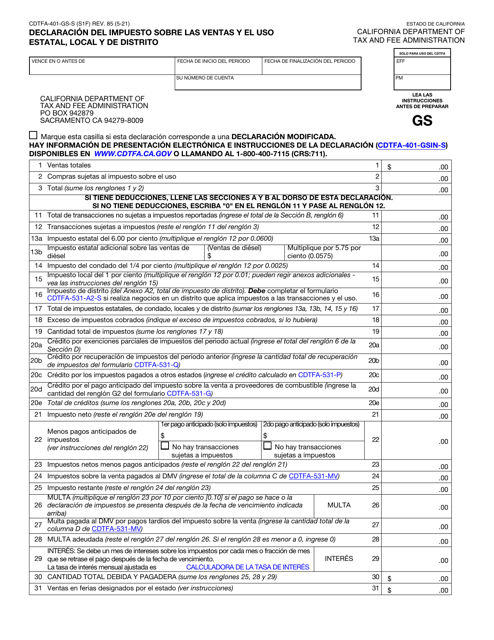

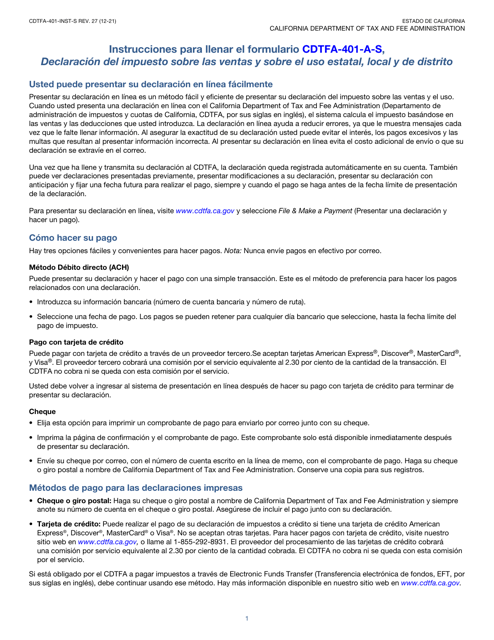

This form is used for individuals and businesses in California to report and pay state, local, and district sales and use taxes.

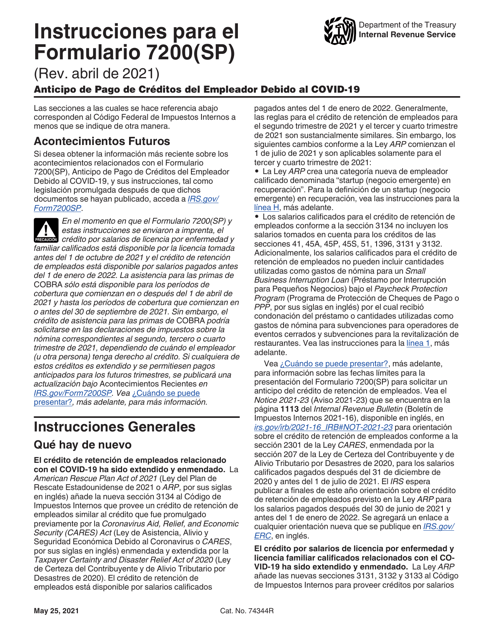

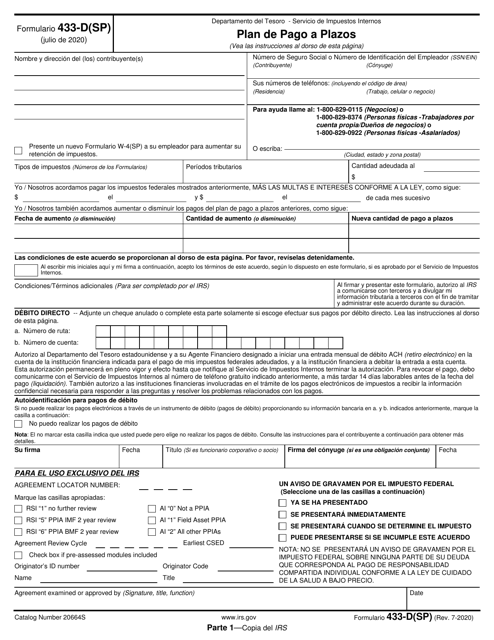

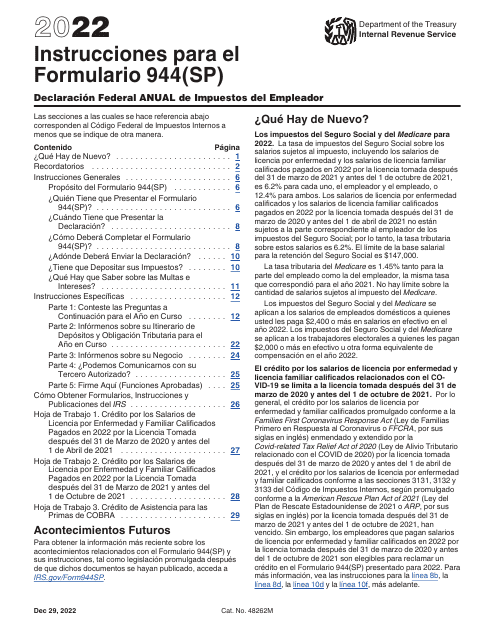

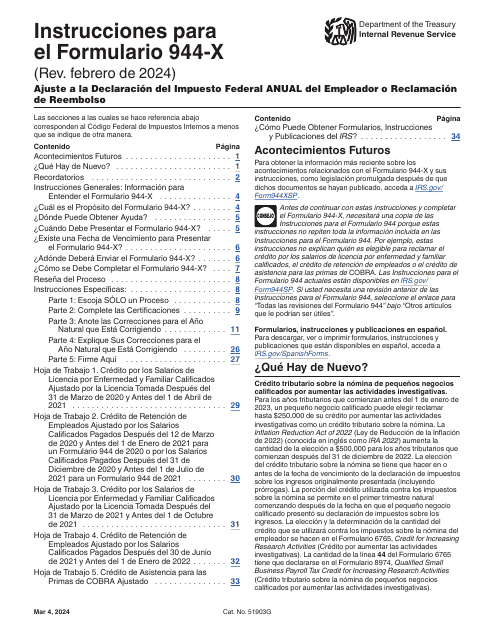

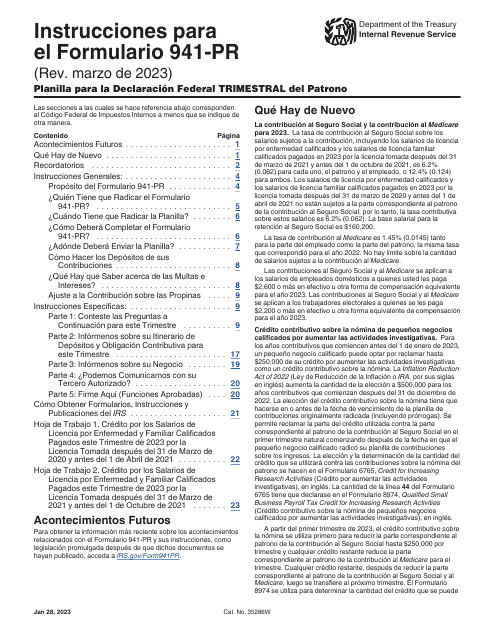

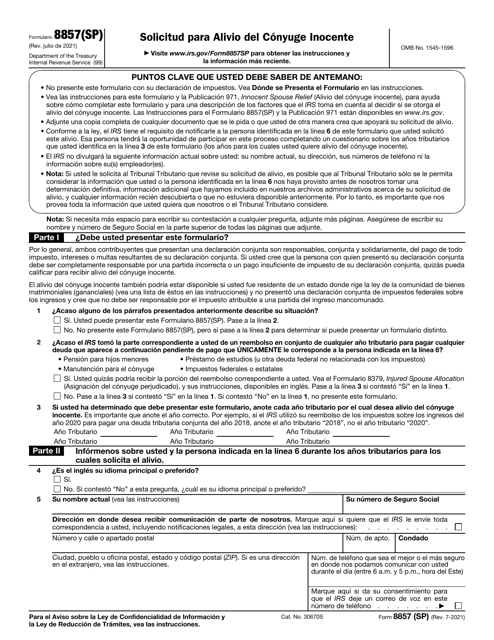

This Form is used for creating a payment plan with the IRS for Spanish-speaking individuals.

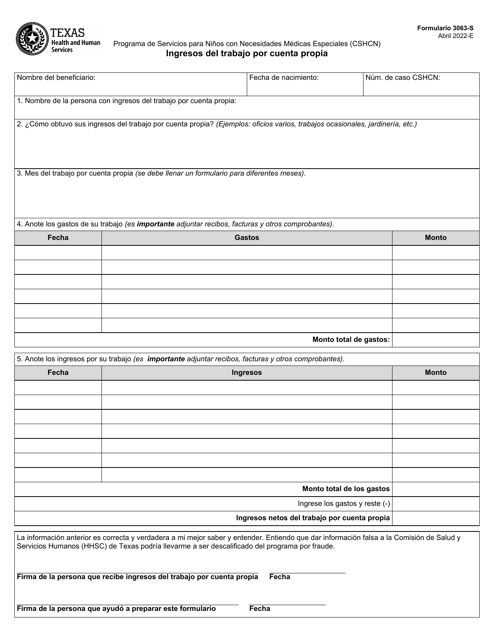

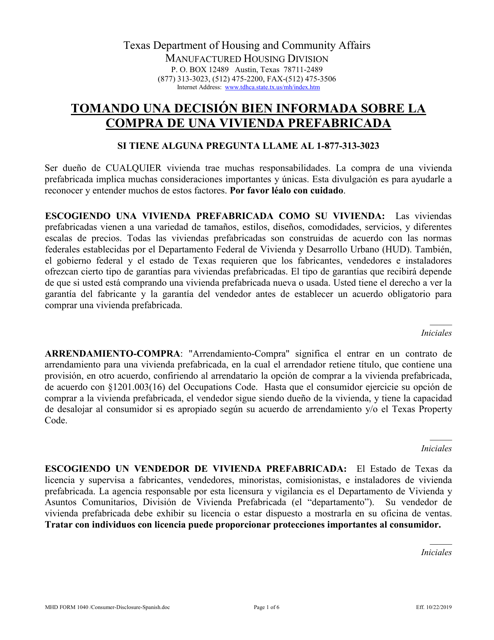

This type of document is a Spanish version of the MHD Form 1040, which is used for consumer disclosure in Texas. It is a form that individuals can use to provide information about their financial activities and disclosure of personal information to comply with consumer protection laws in Texas.

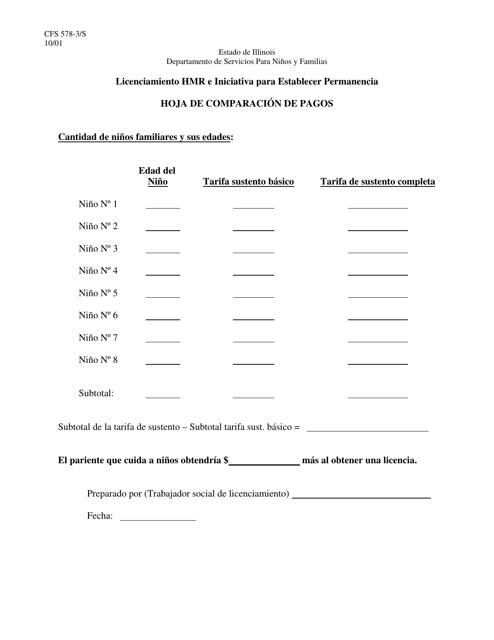

This form is used for comparing payments in Illinois.

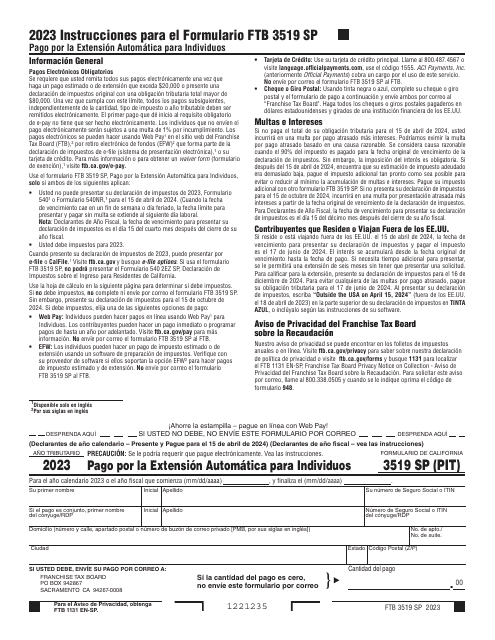

This document is used for submitting a Declaration of Compliance in Spanish.

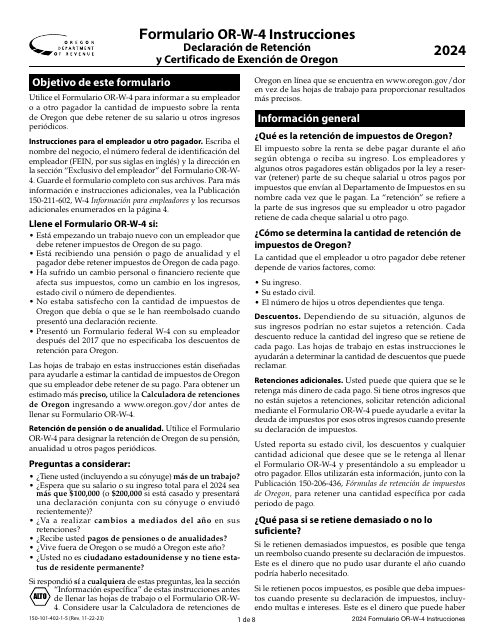

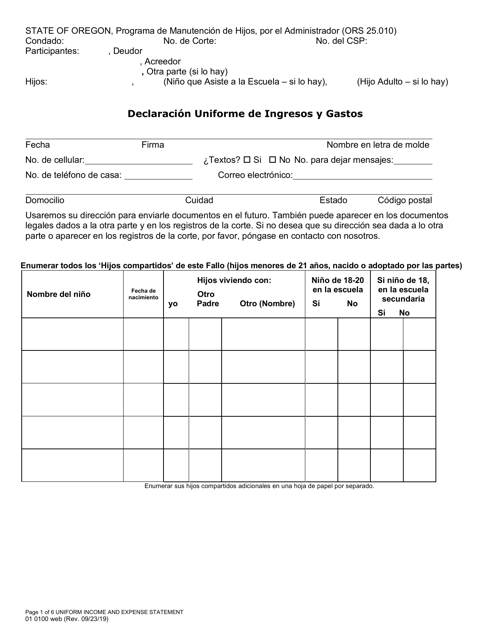

This document is a Spanish version of Form 01 0100, used for reporting income and expenses in the state of Oregon.

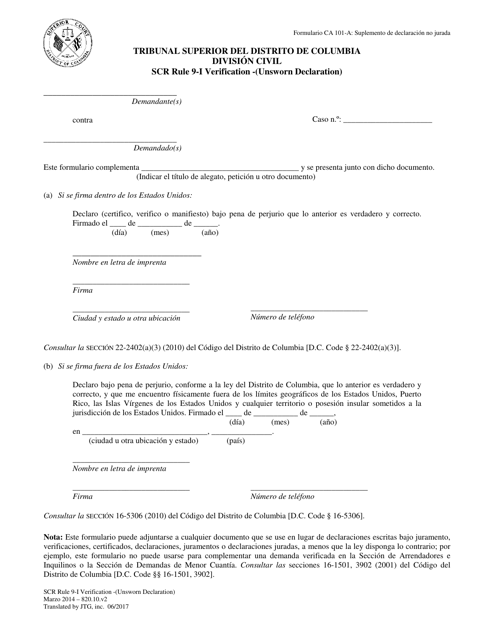

This Form is used for a Supplemental Sworn Statement - Washington, D.C. This document is in Spanish.

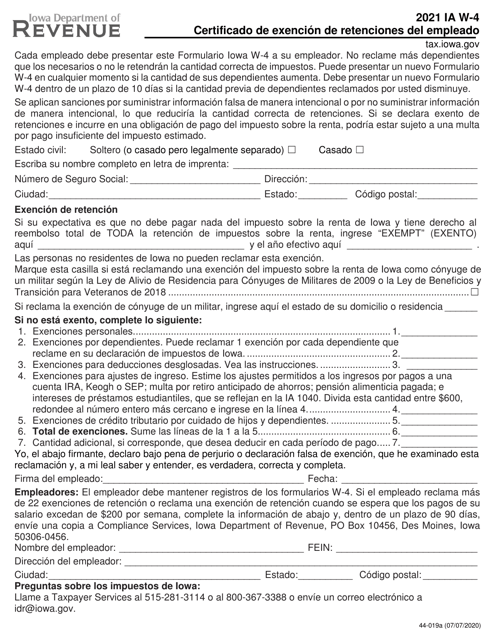

This type of document is used for certifying employee exemptions from withholding taxes and reporting employee information in Iowa. (Spanish version)

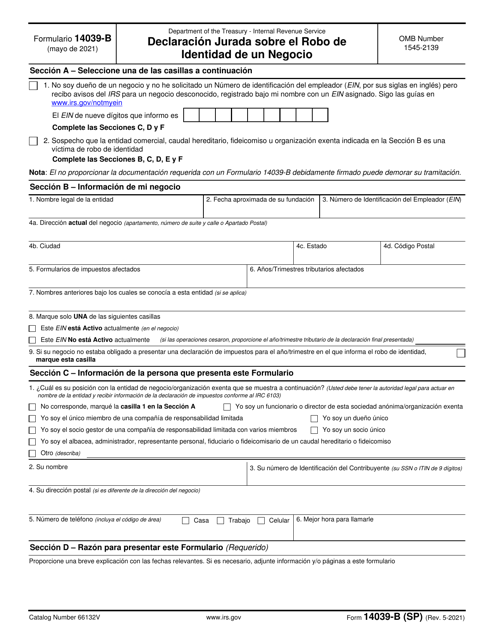

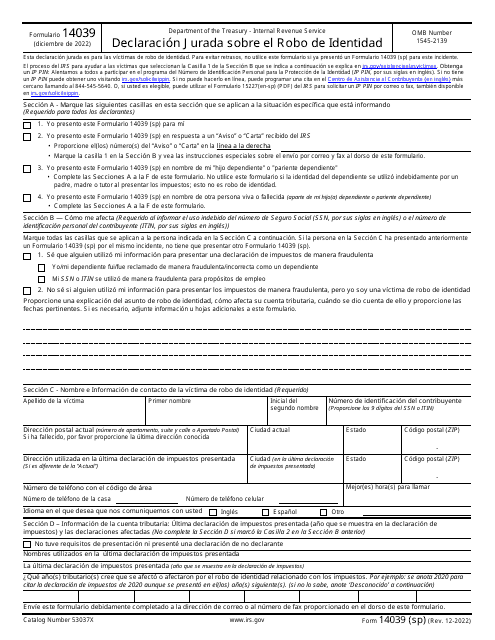

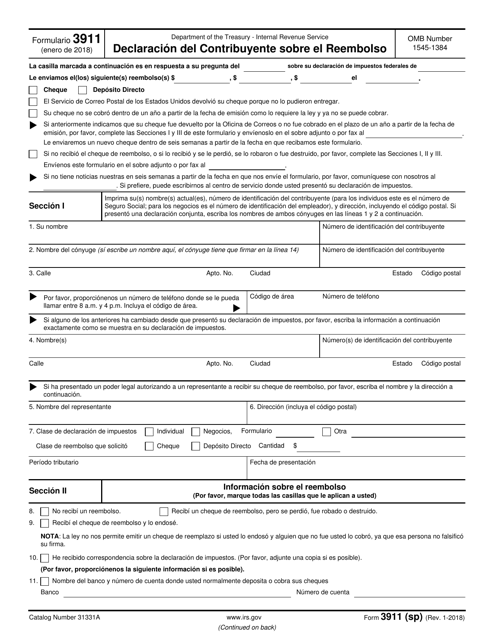

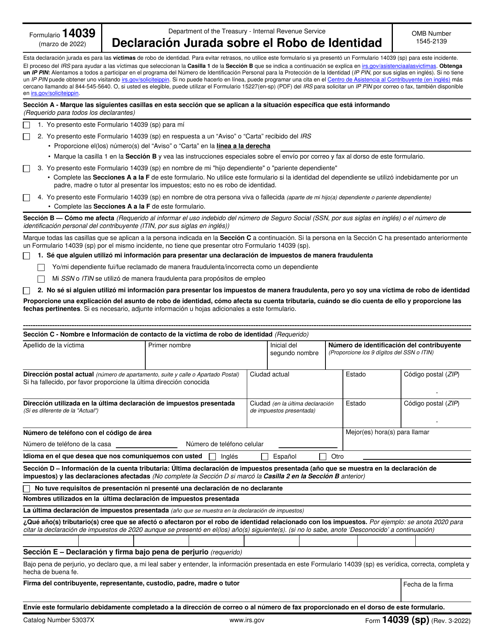

This document is for reporting identity theft to the IRS, and it is in Spanish.