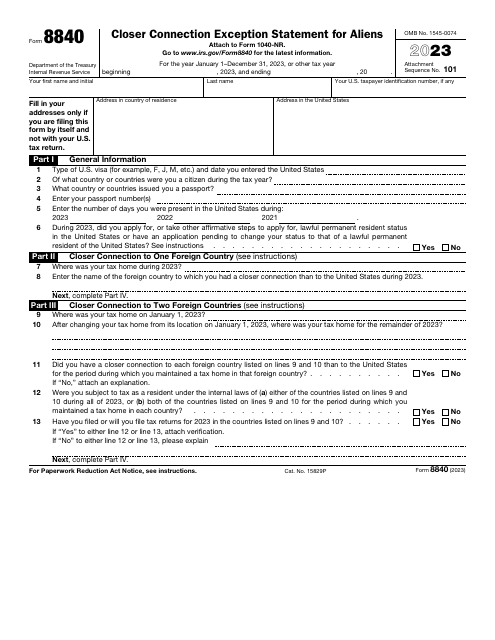

IRS Form 8840 Closer Connection Exception Statement for Aliens

What Is IRS Form 8840?

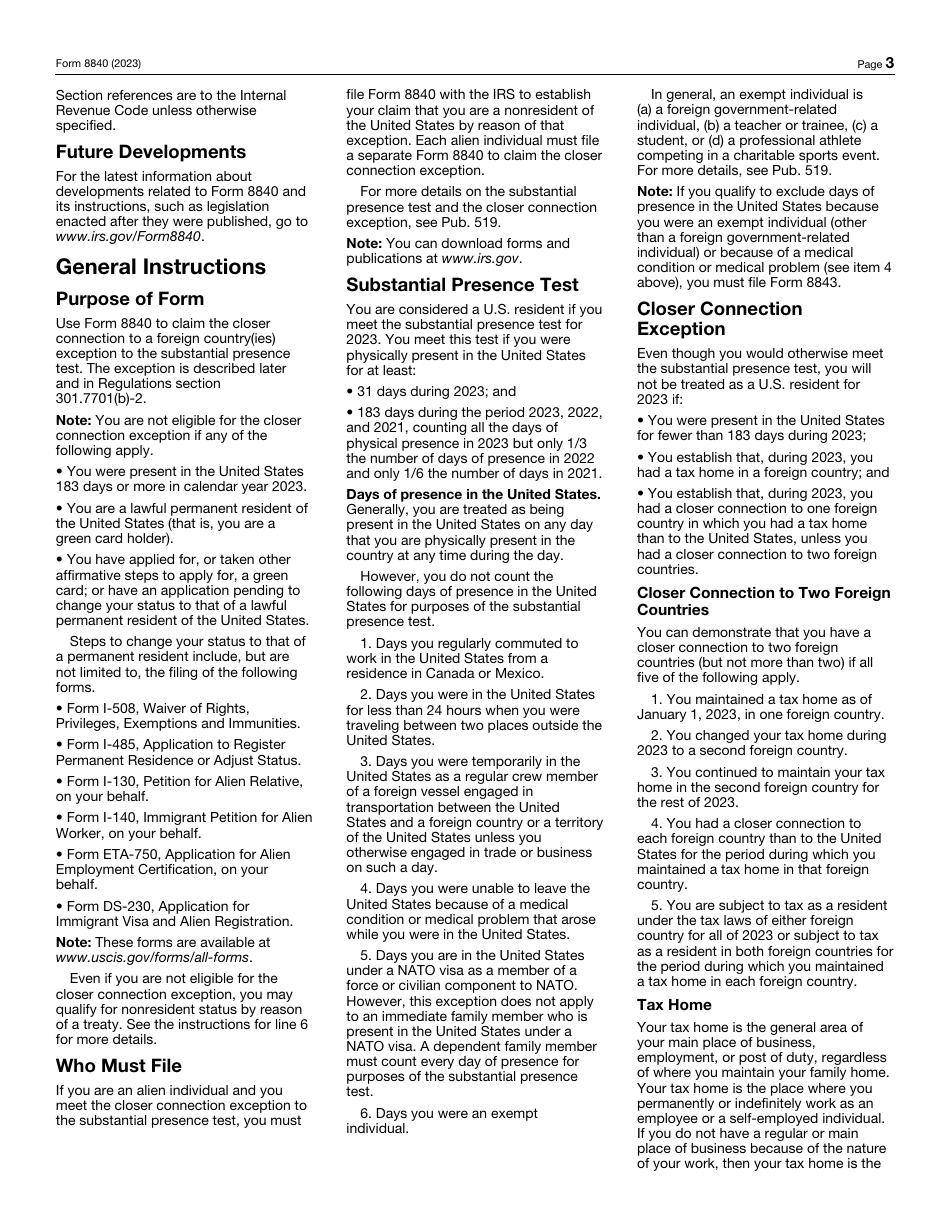

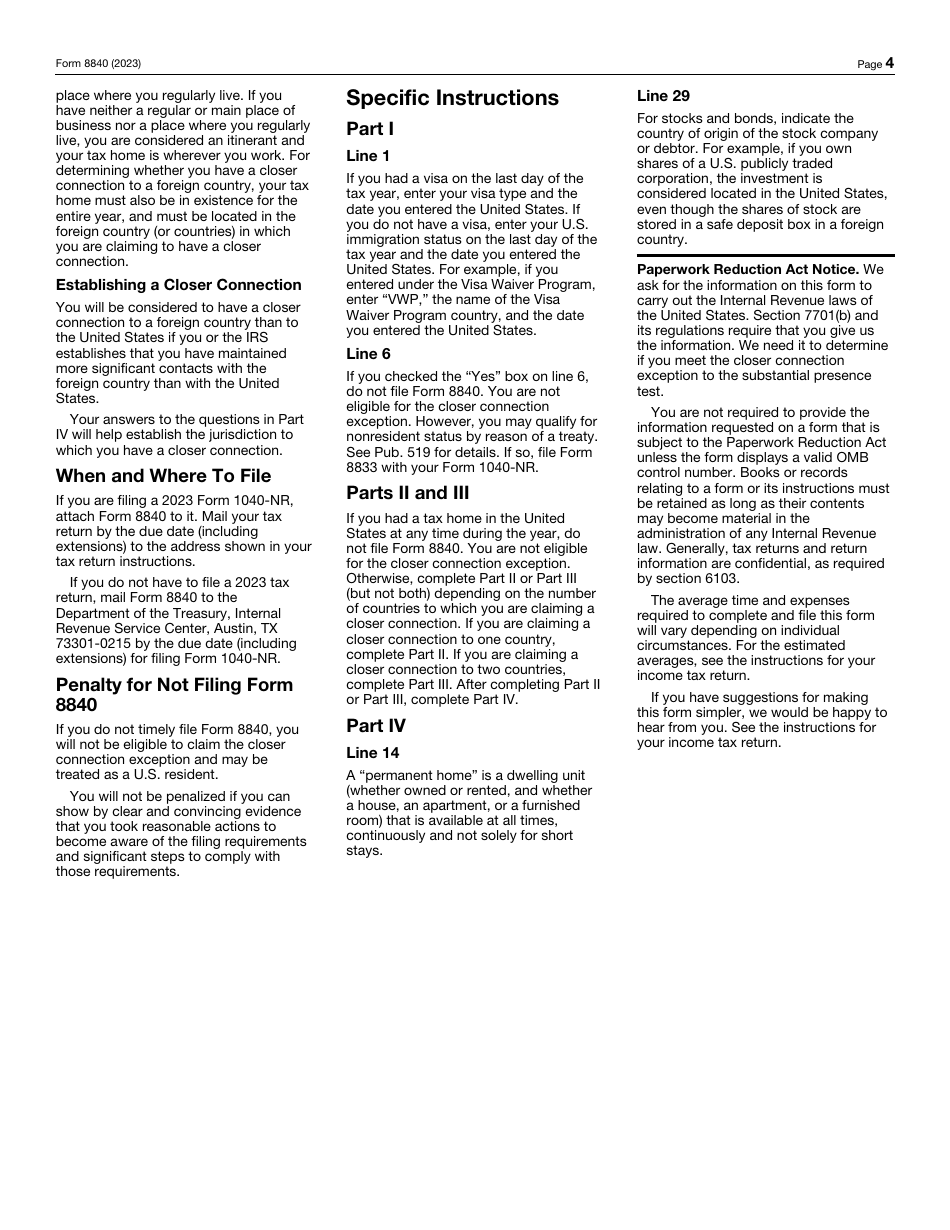

IRS Form 8840, Closer Connection Exception Statement for Aliens , is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim a closer connection to a foreign country exception to the substantial presence test. The document was revised in 2023 . An IRS Form 8840 fillable version is available for download below.

The purpose of the form is to oblige applicants who fulfill the closer connection exception to the substantial presence test, to file Form 8840 with the IRS to establish their claim that they are a non-resident of the U.S. by reason of the exception.

When Does Form 8840 Need to Be Filed?

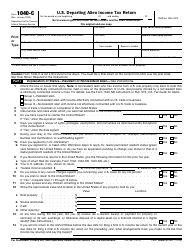

If an applicant is required to submit IRS Form 1040NR, U.S. Nonresident Alien Income Tax Return, or IRS Form 1040NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents, then they attach an 8840 Form to it.

If an applicant does not have to file a tax return, then the form must be mailed to the IRS Center in Austin, Texas 73301-0215. Form 8840 due date is the same as the due date for filing IRS Form 1040-NR or IRS Form 1040-NR-EZ.

How to Fill Out IRS Form 8840?

IRS Form 8840 instructions are as follows:

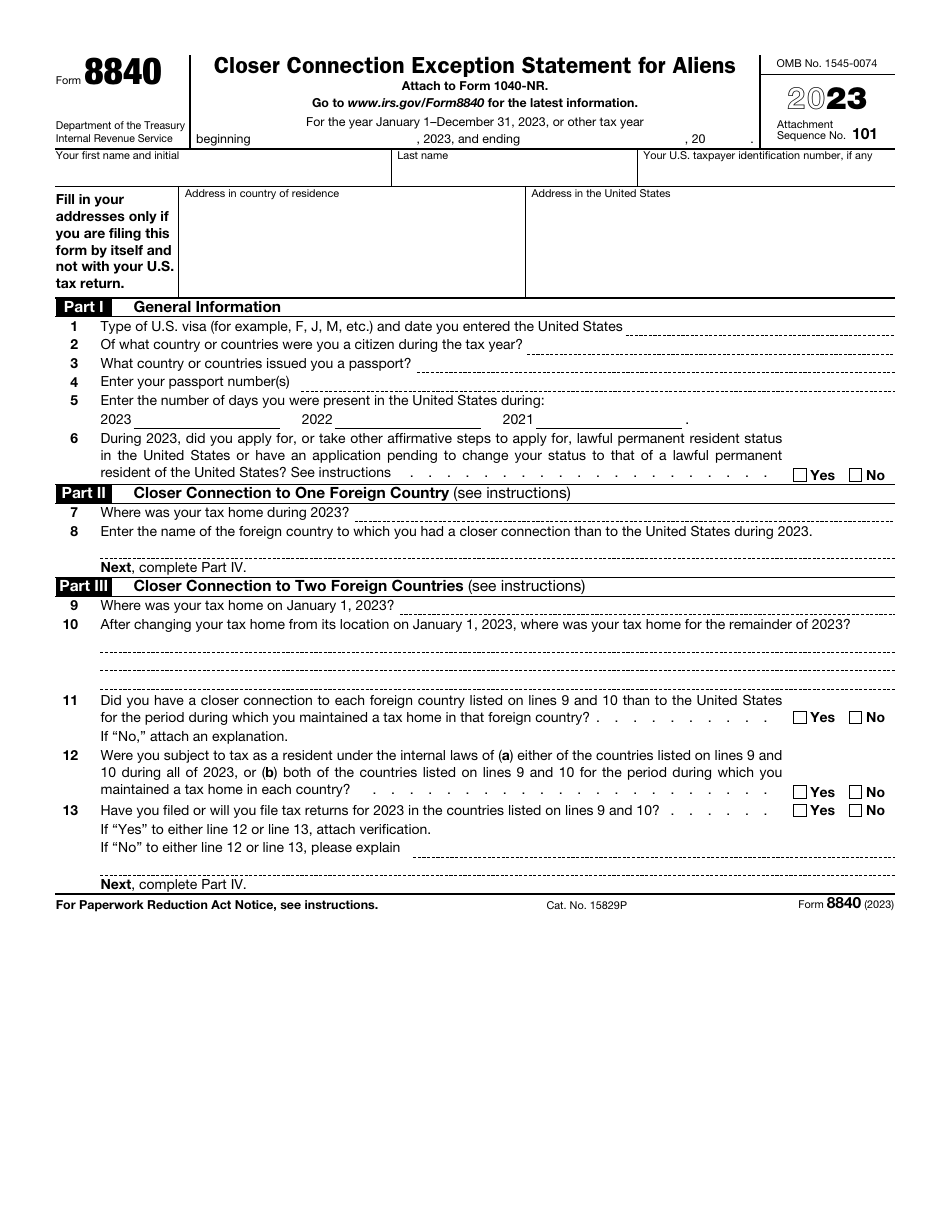

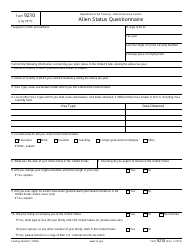

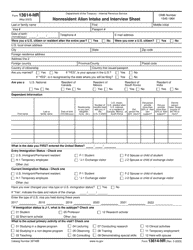

- Part I ("General Information") requires the type of U.S. visa, passport number, country of issuing the passport, etc.

- Part II ("Closer Connection to One Foreign Country") is for reporting information connected to the applicant's tax home and the name of the country to which they had a closer connection than to the U.S. during the previous year.

- Part III ("Closer Connection to Two Foreign Countries") is only supposed to be filled in if an applicant didn't fill in Part II. According to IRS Instructions, if an applicant is reporting a closer connection to two countries, they complete Part III.

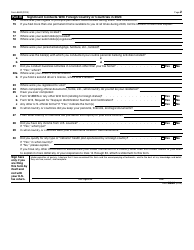

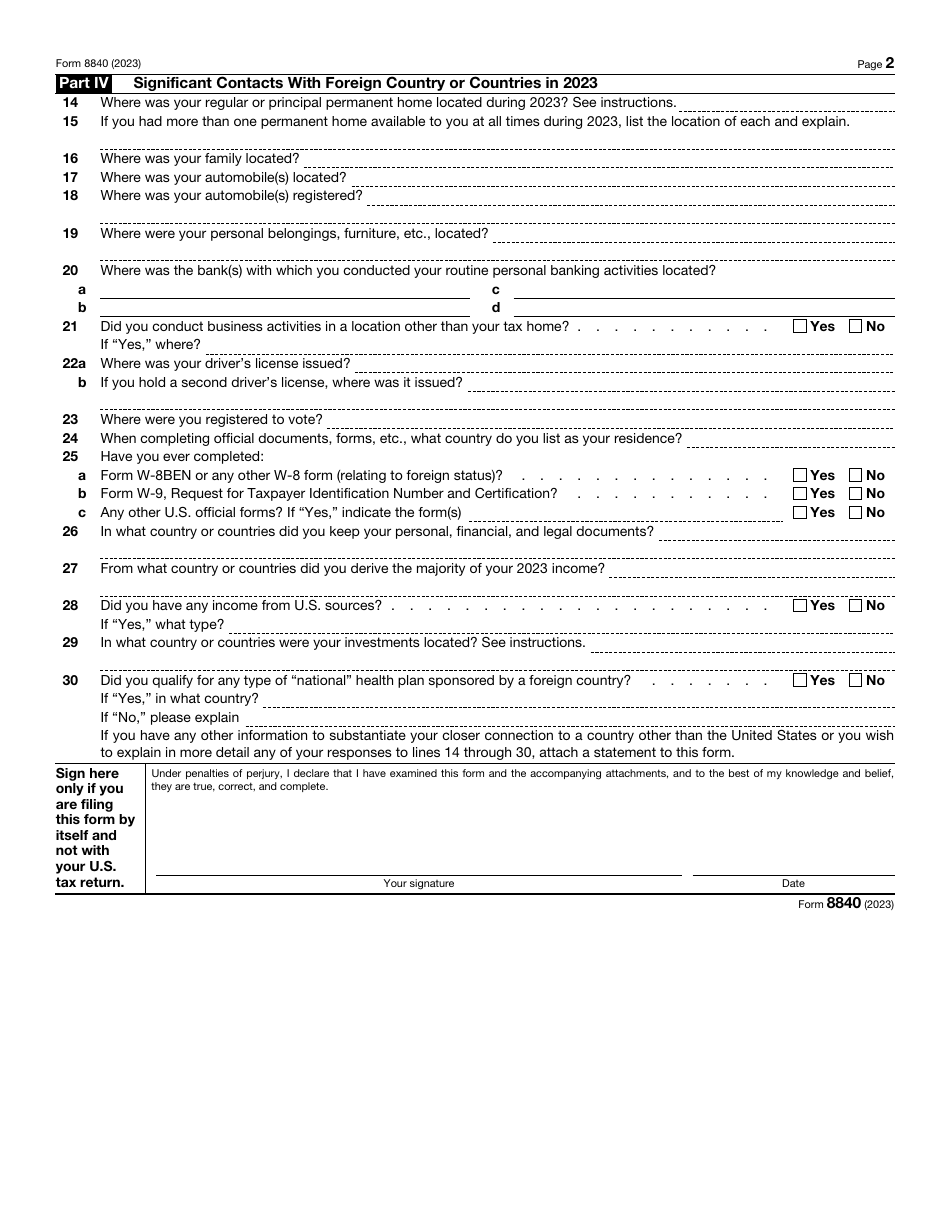

- Part IV ("Significant Contacts With Foreign Country or Countries in the Previous Year") requires the applicant to respond to different questions, their responses will provide the IRS with information, such as where their family is located, where their personal belongings are located, where their automobile is registered, etc.

Where to Mail Form 8840?

When an individual attaches an IRS 8840 Form to Form 1040NR or Form 1040NR-EZ, they must mail their tax return and the attachment to the address shown in their tax return instructions. When an individual submits the form by itself, they mail it to the Department of the Treasury, Internal Revenue Service Center in Austin, Texas 73301-0215.