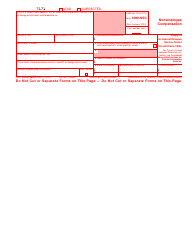

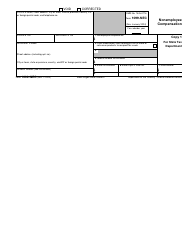

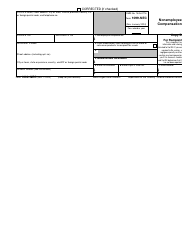

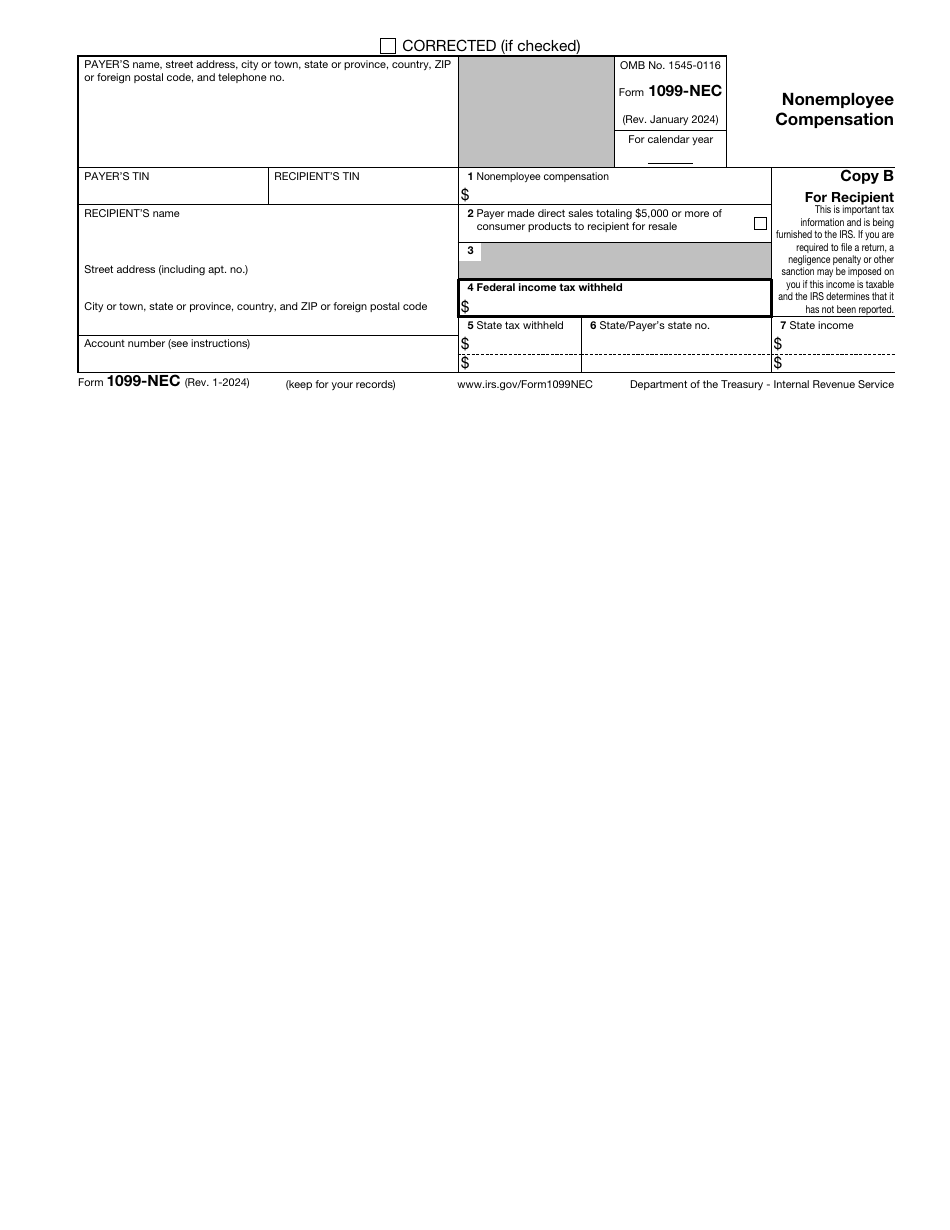

IRS Form 1099-NEC Nonemployee Compensation

What Is IRS Form 1099-NEC?

IRS Form 1099-NEC, Nonemployee Compensation , is a fiscal document business entities have to use to report compensation they have paid to individuals and companies they do not consider their employees.

Alternate Name:

- Tax Form 1099-NEC.

If you hired a freelancer or independent contractor and paid them money for their services - from paying for a writing commission to finding someone willing to help you with social media account design - you are obliged to treat these individuals, estates, partnerships, and corporations are nonemployees, pay them benefits and fees they have earned, inform the government about these payments in a timely manner, and send a copy of the statement to every contractor to enable them to list all their sources of income correctly.

This form was issued by the Internal Revenue Service (IRS) on January 1, 2024 , making older editions obsolete. An IRS Form 1099-NEC fillable version is available for download through the link below.

Check out the 1099 Series of forms to see more IRS documents in this series.

What Is 1099-NEC Used For?

Complete and submit Form 1099-NEC to let fiscal authorities know about the payments you have made to self-employed specialists, freelancers, and independent contractors. These people have to receive a copy of the form as long as their nonemployee compensation was $600 or more throughout a tax year - all individuals you do not treat as your employees will use the information from this instrument to finalize and file their tax returns so that the government is aware of their total income.

There are various types of compensation covered by the Tax Form 1099-NEC - attorney payments, prizes, fees, and commissions. Remember that one of the essential Form 1099-NEC requirements obliges you to use this form only when the payments you describe in writing were made in the course of your business or trade - do not include any of the personal payments in your calculations. If the self-employed individual has not received the papers from the entity that paid them by the end of January, they are advised to reach out to the business and request a copy of the document to avoid getting into trouble with the IRS.

1099-MISC Vs 1099-NEC

Many taxpayers confuse IRS Form 1099-NEC with a similar document - IRS Form 1099-MISC, Miscellaneous Information. The main difference between 1099-MISC and 1099-NEC is that the former is prepared if the payer reports awards, prizes, rents, and royalties third parties receive while the latter is required to outline nonemployee compensation.

You also cannot use Form 1099-NEC to notify tax authorities about gross proceeds - 1099-MISC is going to help you with that. This document will also be sent to people that did a one-off job for the payer - for instance, a speaker invited to make a presentation at a specific event can expect to receive Form 1099-MISC to assist with their tax return. It is also required to file this form in March - there are two deadlines for taxpayers that depend on the filing method they choose. If you are submitting paperwork via mail, you can do it by March 1 while electronic filing is permitted until March 31 which makes the latter option preferable for many individuals and companies.

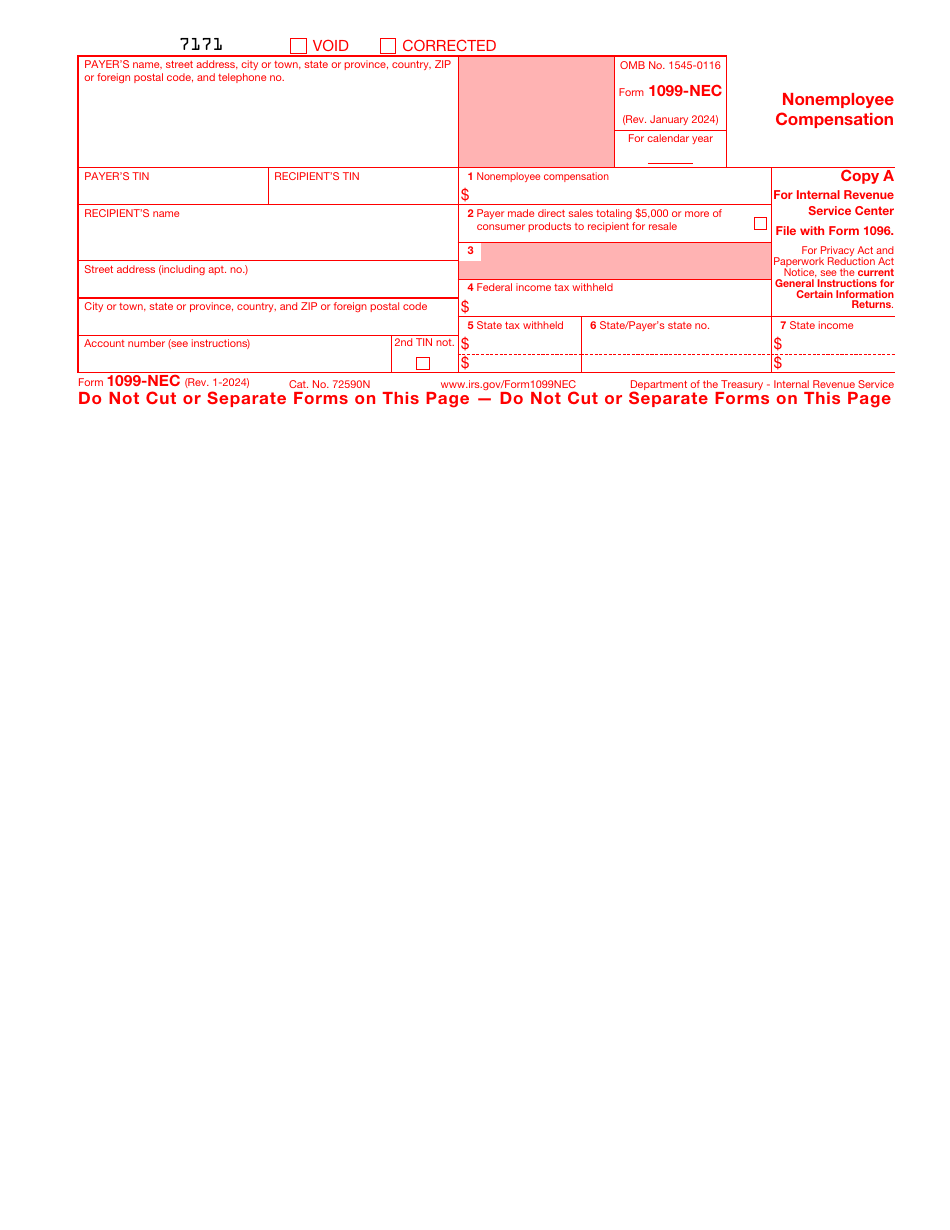

Form 1099-NEC Instructions

The Form 1099-NEC Instructions are as follows:

-

Write down the details of the payer - the name, mailing address, and taxpayer identification number . Identify the recipient of the form by their name, address, and taxpayer identification number as well. In case the recipient has multiple accounts, enter the account number you refer to in the paperwork to avoid confusion. Check the box if the IRS informed you two times over the last three years about the payee submitting a taxpayer identification number with an error and enter the tax year you describe in the form.

-

Record the total amount of nonemployee compensation - do not forget that you are obliged to report it if it equals or exceeds $600 . Check the box in case you need to confirm direct sales of the payer reached the amount of $5.000 or more - there is no need to specify the amount in dollars. Add the amount of federal income tax you deducted from the compensation and provide information about the state where you are carrying out your business operations - write down how much state tax you have deducted, indicate the abbreviation of the state, and include the state payment amount.

-

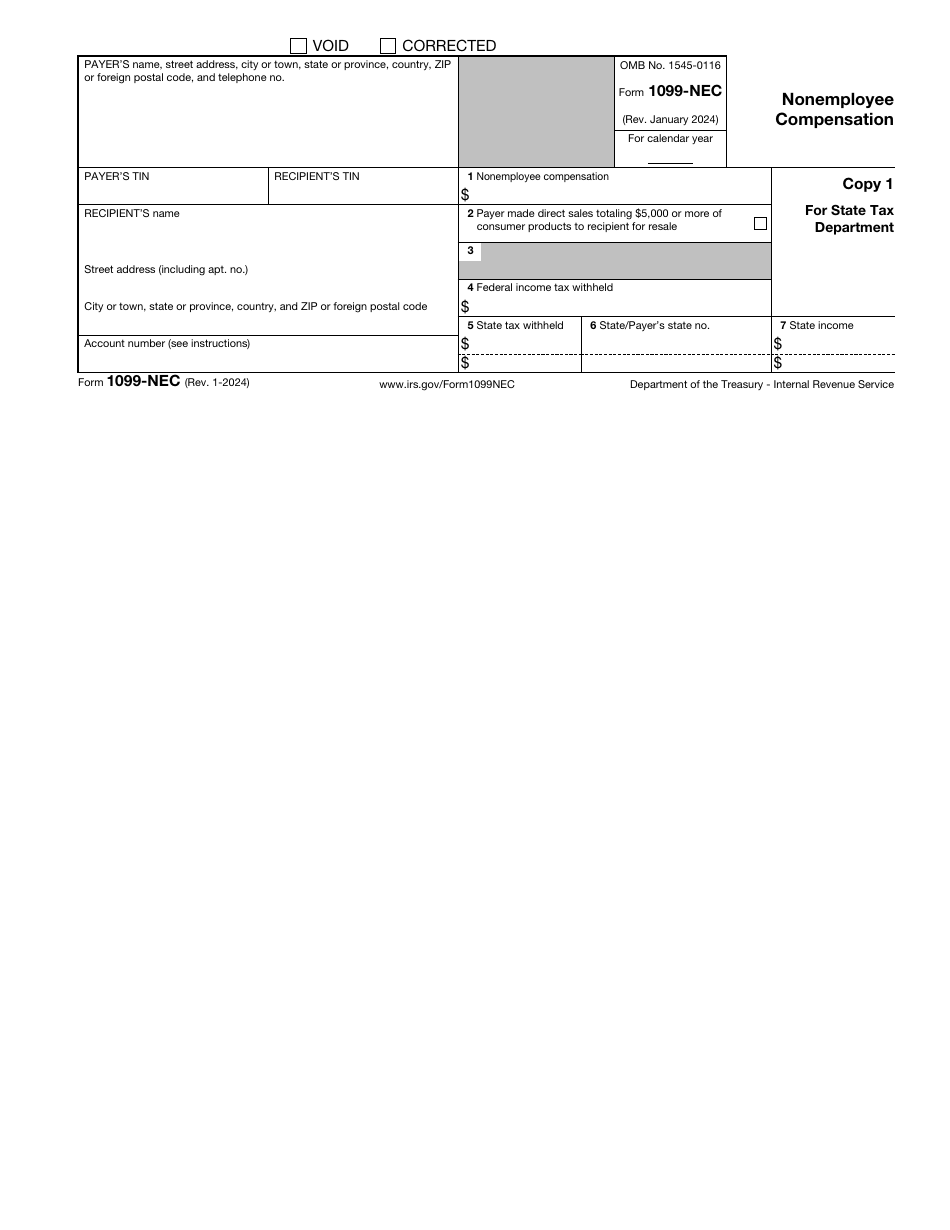

Prepare several copies of the document - for the state tax department, the payer, and the recipient . Make sure you submit the papers on time - Form 1099-NEC deadline is January 31; if you fail to comply with this condition, you will be subject to a penalty. It is also a smart idea to keep a copy of the form for your records in case you will be subject to an audit from the tax authorities. Nevertheless, nonemployees that did not get the form on time must report the compensation they received even if there is no formal document to do it with.

Where to Mail Form 1099-NEC?

There are two ways to submit Form 1099-NEC - online and via mail. The former method is preferable since you do not have to fill out any paperwork with a pen; however, many taxpayers still opt for a traditional way of filing 1099-NEC Form. Use one of the three addresses below to file Tax Form 1099-NEC:

-

I nternal Revenue Service, Austin Submission Processing Center, P.O. Box 149213, Austin, TX 78714 , if you reside in Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, or Virginia.

-

Department of the Treasury, IRS Submission Processing Center, P.O. Box 219256, Kansas City, MO 64121-9256 , if you are located in Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, or Wyoming.

-

Department of the Treasury, IRS Submission Processing Center, 1973 North Rulon White Blvd., Ogden, UT 84201 , is the address for taxpayers from California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, and West Virginia.