This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1099-MISC, 1099-NEC

for the current year.

Instructions for IRS Form 1099-MISC, 1099-NEC

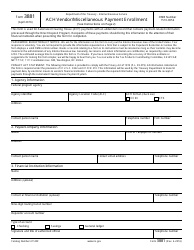

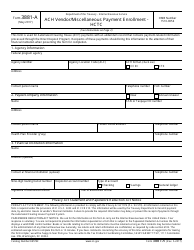

This document contains official instructions for IRS Form 1099-MISC , and IRS Form 1099-NEC . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-MISC is available for download through this link. The latest available IRS Form 1099-NEC can be downloaded through this link.

FAQ

Q: What is IRS Form 1099-MISC?

A: IRS Form 1099-MISC is used to report miscellaneous income received by individuals or businesses.

Q: When do I need to file Form 1099-MISC?

A: You need to file Form 1099-MISC if you made payments of $600 or more for services performed by someone who is not your employee.

Q: When do I need to file Form 1099-NEC?

A: You need to file Form 1099-NEC if you made payments of $600 or more for services performed by someone who is not your employee.

Q: How do I fill out Form 1099-MISC?

A: You need to provide the recipient's information, your information, and the amount of miscellaneous income paid.

Q: Do I need to send a copy of Form 1099-MISC to the IRS?

A: Yes, you need to send a copy of Form 1099-MISC to the IRS.

Q: Do I need to send a copy of Form 1099-NEC to the IRS?

A: Yes, you need to send a copy of Form 1099-NEC to the IRS.

Instruction Details:

- This 12-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.