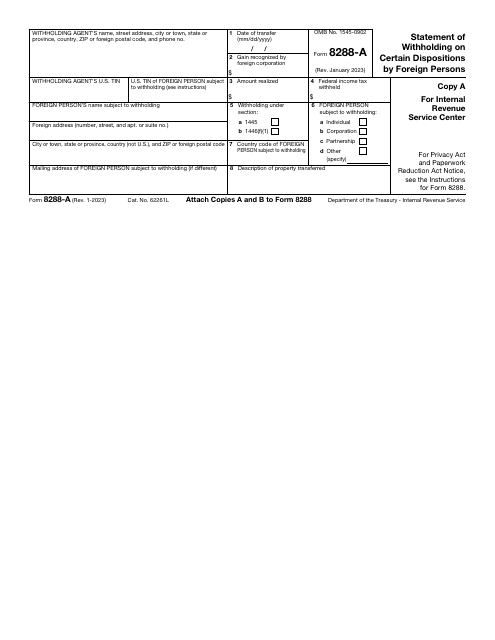

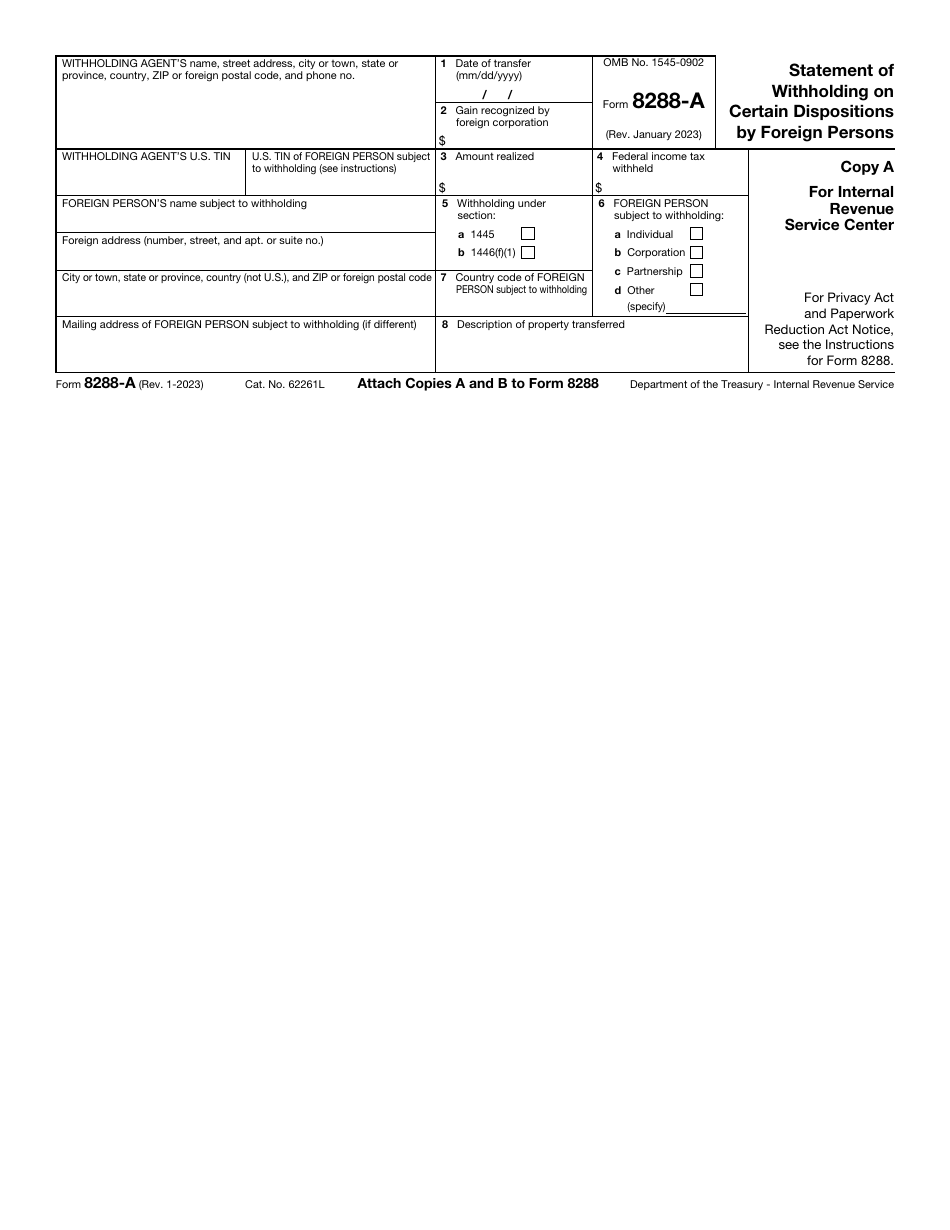

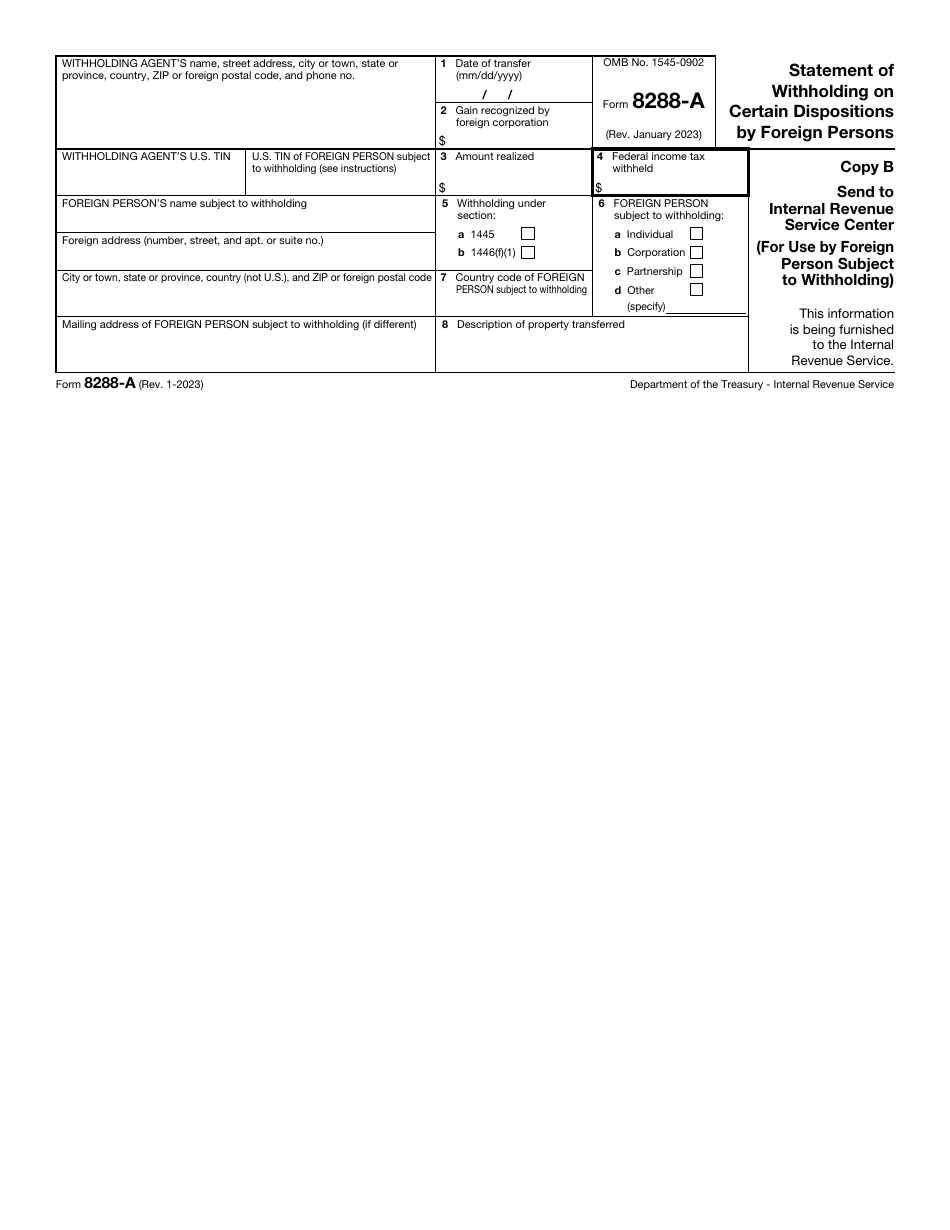

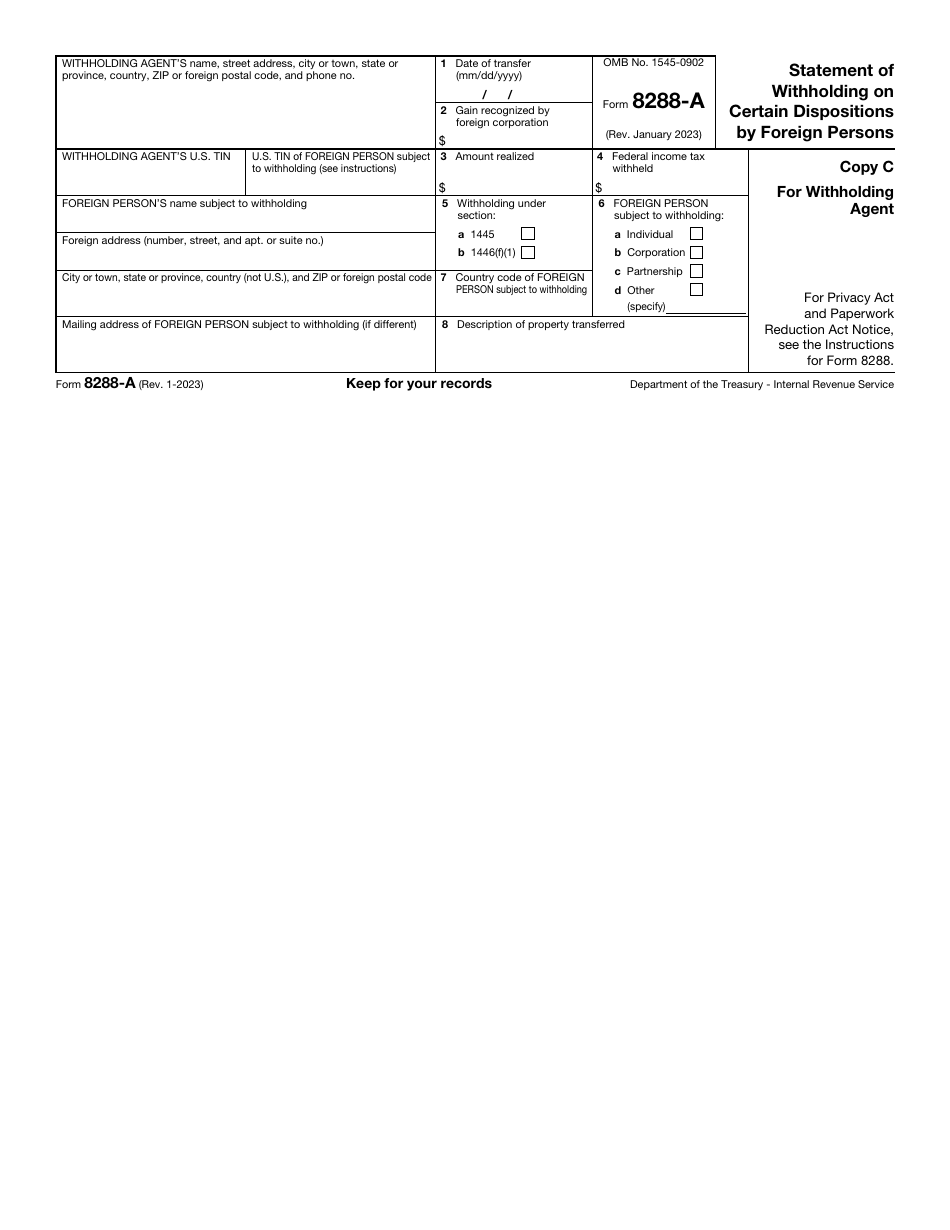

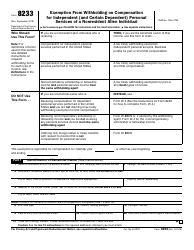

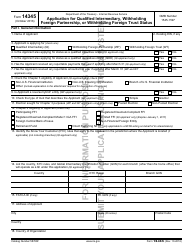

IRS Form 8288-A Statement of Withholding on Certain Dispositions by Foreign Persons

What Is IRS Form 8288-A?

IRS Form 8288-A, Statement of Withholding on Certain Dispositions by Foreign Persons , is a supplementary document used by a withholding agent to describe the disposition of real property and report how much tax was withheld as a result of the transaction.

Alternate Name:

- Tax Form 8288-A.

Additionally, it is required to file this form if the taxpayer wants to claim a refund for the amounts already deducted. Estates, partnerships, trusts, and corporations that have the responsibility to deduct a certain amount of tax upon distribution of U.S. real property have to complete this statement.

This instrument was issued by the Internal Revenue Service (IRS) on January 1, 2023 - older editions of the statement are now outdated. An IRS Form 8288-A fillable version can be downloaded through the link below.

What Is Form 8288-A Used For?

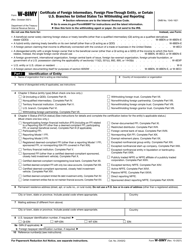

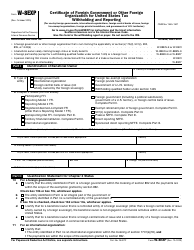

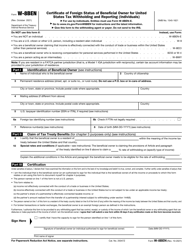

Form 8288-A must be filled out if you are submitting IRS Form 8288, U.S. Withholding Tax Return for Certain Dispositions by Foreign Persons, and withholding certain amounts in line with provisions of the Internal Revenue Code. It is attached to your regular tax return and sent to fiscal authorities before the deadline every year so that the IRS is aware of sales and similar property dispositions in case a foreign person disposes of real estate situated in the United States. The new owner is obliged to withhold 15% of the transaction amount and report the details of the deal to tax organs.

Note that if an interest in a partnership involved in business or trade is transferred, it is the duty of the acquirer to withhold 10% of the total amount instead - this amount includes the market value of the property, liabilities the new owner assumed, cash payment, and a possible reduction of the selling party's share if the property transferred involves partnership liabilities.

Form 8288-A Instructions

IRS Form 8288-A instructions are as follows:

-

Identify the withholding agent - state their full name, mailing address, and taxpayer identification number . Provide information about the foreign person who is subjected to withholding - their name, physical address, correspondence address, and taxpayer identification number.

-

Provide information about the transaction - indicate the date of the deal, specify the amount of gain the foreign corporation recognizes, and the amount the property was realized for . Note that if the distribution is singled out in additional guidelines on the fifth page of the form, you have to indicate the date of distribution instead. State the total amount of federal income tax that was deducted and check the box to point out the section of the tax code that laid down the conditions for the transaction.

-

Clarify the status of the foreign person identified in the form - there are three options listed but you are free to add something different to the statement if necessary . Write down the country code where the foreign person permanently resides or conducts business operations and describe the property that was transferred.

-

Once the paperwork is ready, send two copies of the form to the Ogden Service Center, P.O. Box 409101, Ogden, UT 84409 . Keep one copy in your records - there is no need to prepare a separate document for the foreign person that participated in the transaction, it will be done by the tax authorities when they get the instrument and review the accuracy of the numbers you submitted. The previous owner will have to file a separate statement alongside their tax return to describe the withholding.