This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1099-INT, 1099-OID

for the current year.

Instructions for IRS Form 1099-INT, 1099-OID

This document contains official instructions for IRS Form 1099-INT , and IRS Form 1099-OID . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-OID is available for download through this link.

FAQ

Q: What is IRS Form 1099-INT?

A: IRS Form 1099-INT is used to report interest income received during the tax year.

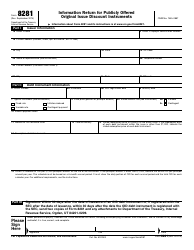

Q: What is IRS Form 1099-OID?

A: IRS Form 1099-OID is used to report the original issue discount on debt instruments.

Q: Who should receive a copy of these forms?

A: Recipients of interest income or original issue discount should receive a copy of the corresponding form.

Q: When should these forms be filed?

A: Both forms need to be filed with the IRS by January 31st of the following year.

Q: What information is required to complete these forms?

A: You will need to provide the recipient's name, address, taxpayer identification number, and the amount of interest income or original issue discount.

Q: What should I do if I make a mistake on these forms?

A: If you make a mistake on the forms, you should correct them and file the corrected forms with the IRS.

Q: Are there any penalties for not filing these forms?

A: Yes, failure to file these forms or filing them late can result in penalties.

Q: Can I e-file these forms?

A: Yes, you can e-file these forms if you have the necessary software or use the services of a tax professional.

Q: Do I need to include a copy of these forms with my tax return?

A: No, you do not need to include a copy of these forms with your tax return, but you should keep them for your records in case of an audit.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.