This version of the form is not currently in use and is provided for reference only. Download this version of

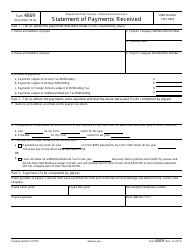

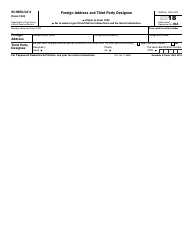

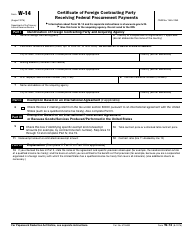

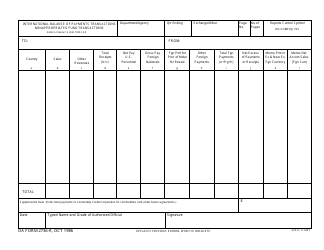

Instructions for IRS Form 1099-K

for the current year.

Instructions for IRS Form 1099-K Payment Card and Third Party Network Transactions

This document contains official instructions for IRS Form 1099-K , Payment Card and Third Party Network Transactions - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-K is available for download through this link.

FAQ

Q: What is IRS Form 1099-K?

A: IRS Form 1099-K is a tax form used to report payment card and third-party network transactions.

Q: Who needs to file IRS Form 1099-K?

A: Merchants or payment settlement entities who process payment card transactions or facilitate third-party network transactions need to file IRS Form 1099-K.

Q: What types of transactions are reported on IRS Form 1099-K?

A: IRS Form 1099-K reports transactions made through payment cards (such as credit cards) or third-party networks (such as PayPal) that exceed a certain threshold.

Q: What is the purpose of filing IRS Form 1099-K?

A: The purpose of filing IRS Form 1099-K is to report income received through payment card and third-party network transactions, helping the IRS ensure compliance with tax laws.

Q: What is the deadline for filing IRS Form 1099-K?

A: The deadline for filing IRS Form 1099-K is January 31st of the year following the reporting year.

Q: Is there a penalty for not filing IRS Form 1099-K?

A: Yes, there can be penalties for not filing or for filing incorrect or incomplete information on IRS Form 1099-K. It's important to ensure accurate and timely filing.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.