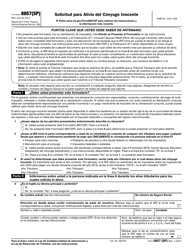

Instructions for IRS Form 8802 Application for United States Residency Certification

IRS Form 8802, Application for United States Residency Certification , is used to request Form 6166, Certification of U.S. Tax Residency (certificate, unavailable online). Private individuals or companies with the use of IRS Form 8802 can claim tax treaty benefits while working in foreign countries. For this purpose, they should prove their U.S. residency with the Tax Residency Certificate (Form 6166) which can be issued by filing Form 8802.

IRS Form 8802 instructions were released by the Department of the Treasury Internal Revenue Service on July 22, 2022 , and a PDF version of the instructions can be downloaded below. The original IRS Form 8802 can be found here.

Instructions for IRS Form 8802

The main instructions for this form may be found in the form but a short summary of the Form 8802 Instructions are the following:

-

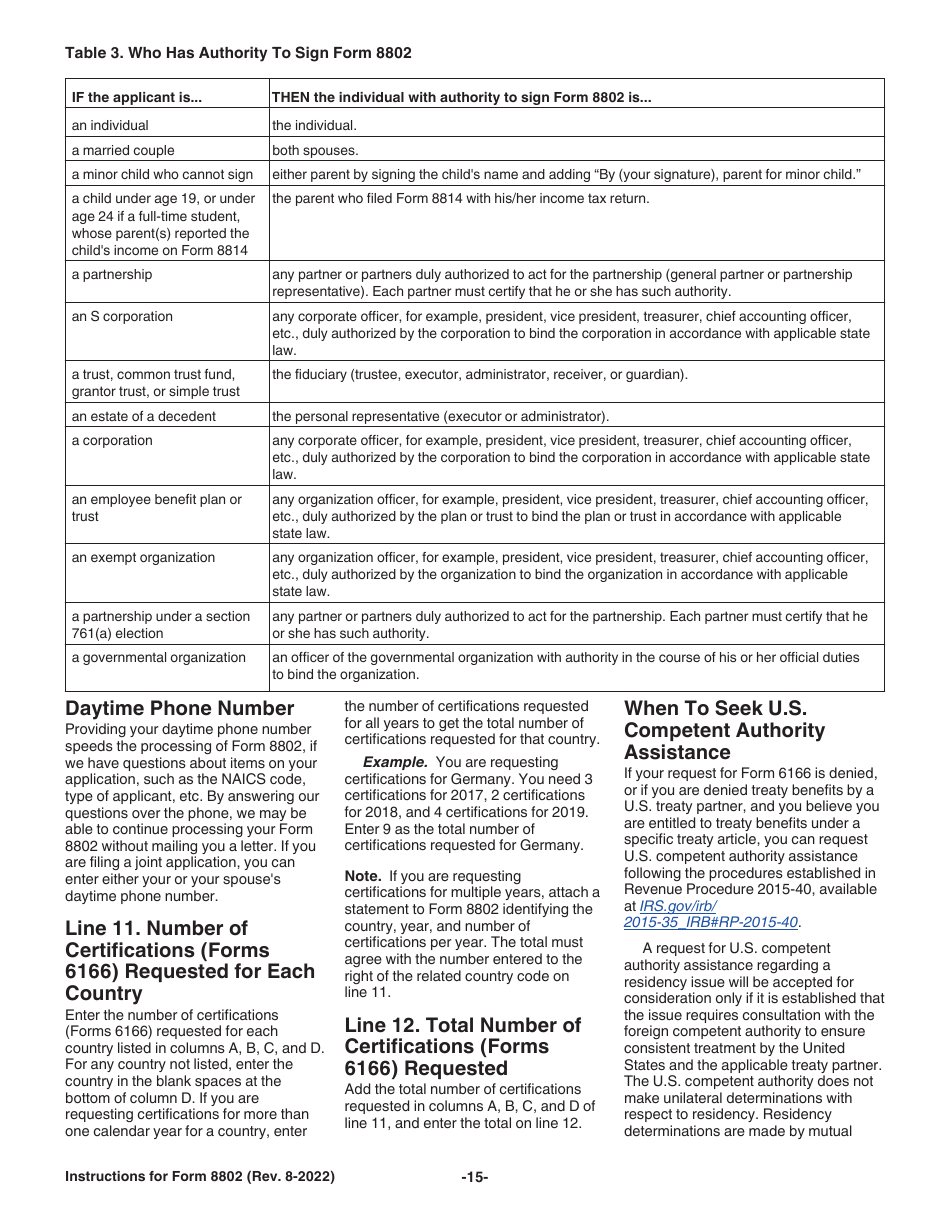

Lines 1-3. The name, taxpayer identification number, address, and email address of the applicant should be indicated. The name of the applicant's third-party appointee should be entered as well. It should be someone the IRS can communicate with, who can respond to any IRS questions regarding the applicant's form.

-

Line 4. The applicant should give an answer relating to their residency status for individuals, or applicant's entity classification if it is an organization.

-

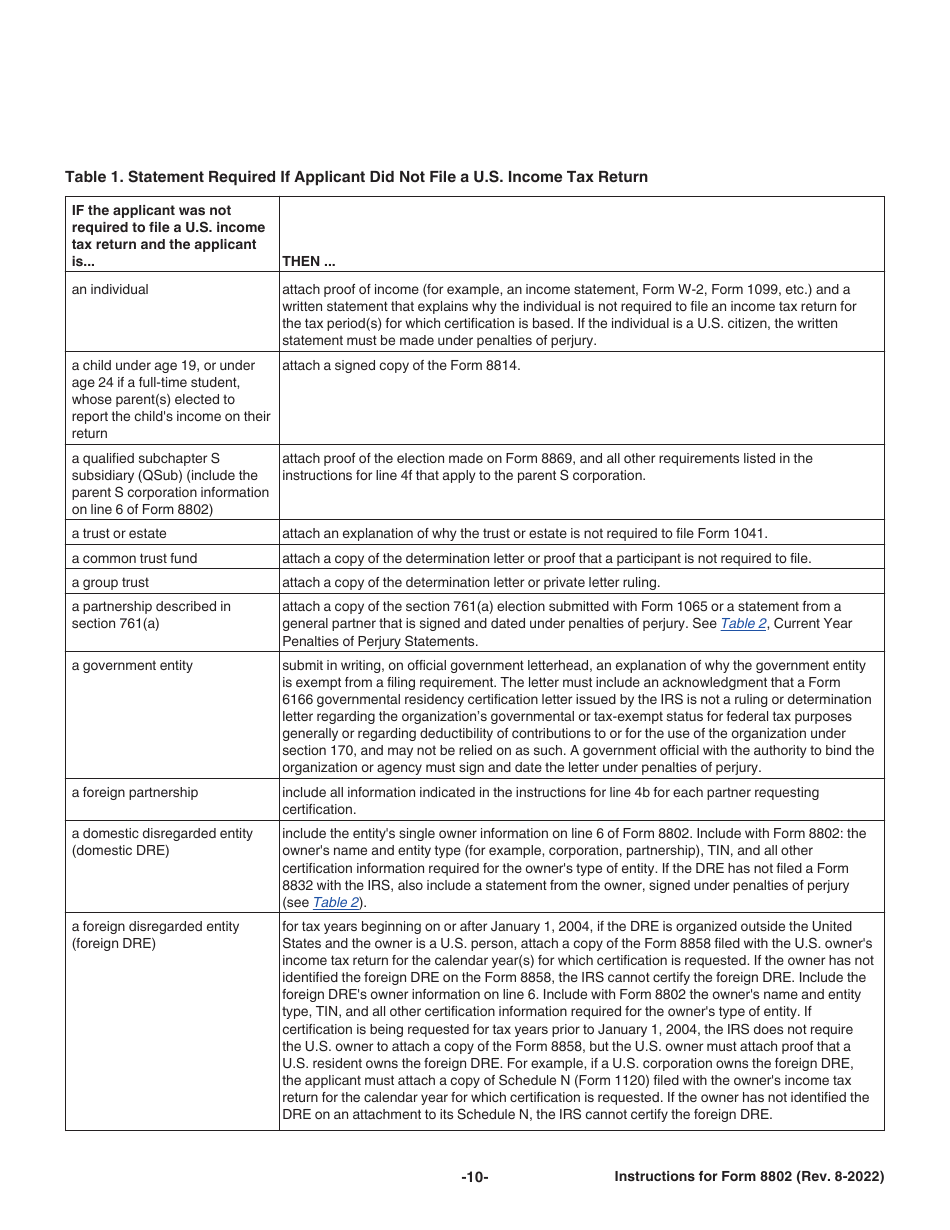

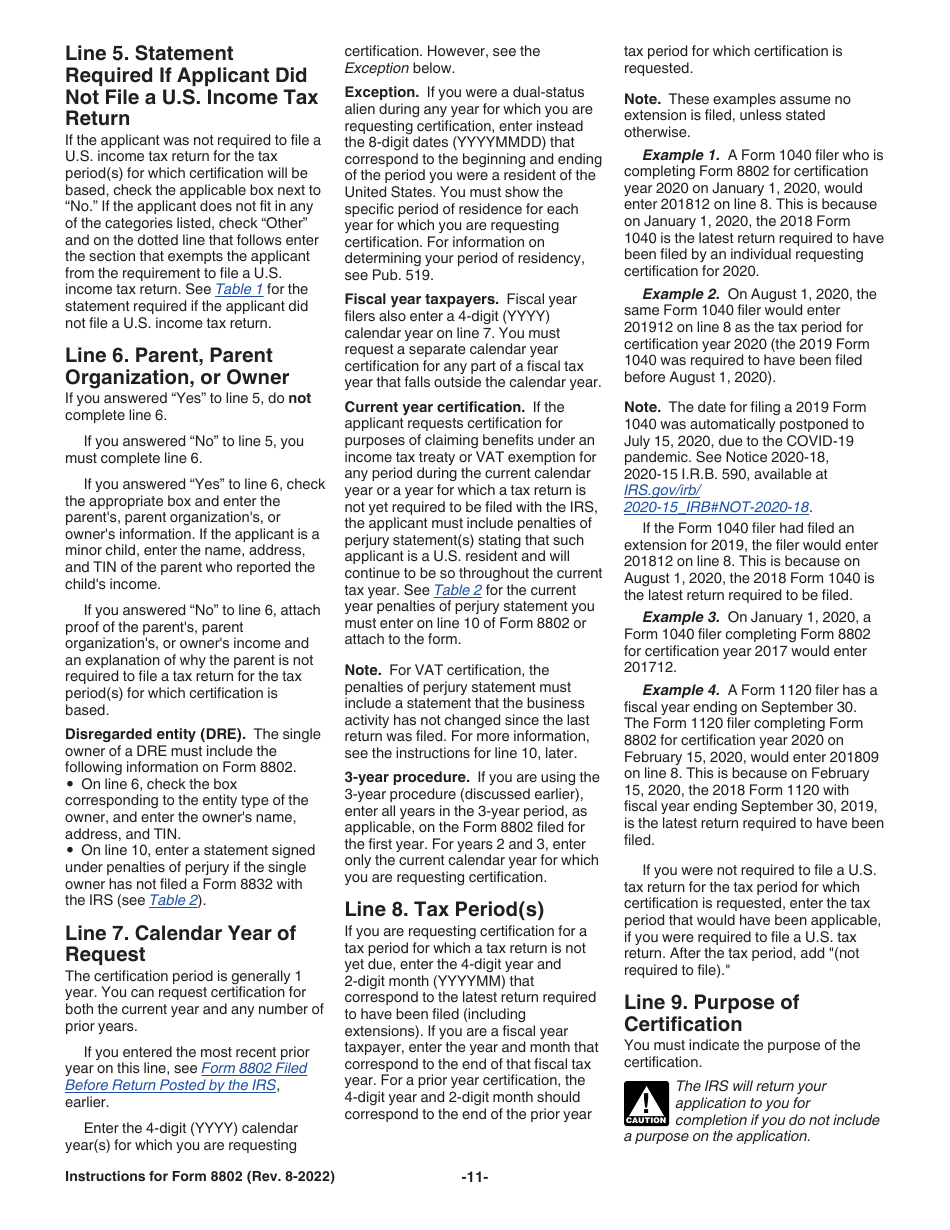

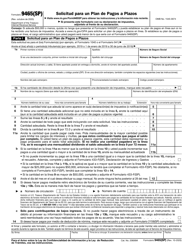

Line 5. The applicant should answer "Yes" or "No" in regards to whether they were required to file a U.S. income tax return for the tax period. If the applicant did not file a U.S. income tax return, they should see Table 1* for the statement required.

-

Line 6. This line should be completed only in case of answering "No" to line 5. It is necessary to answer if a parent of the applicant was required to file a U.S. tax form.

-

Line 7. The calendar year of the request should be indicated here. The certification period is generally 1 year, but certification can be requested for the current year and any number of prior years.

-

Line 8. The tax period should be checked in this line.

-

Line 9. The applicant should indicate the purpose of the certification.

-

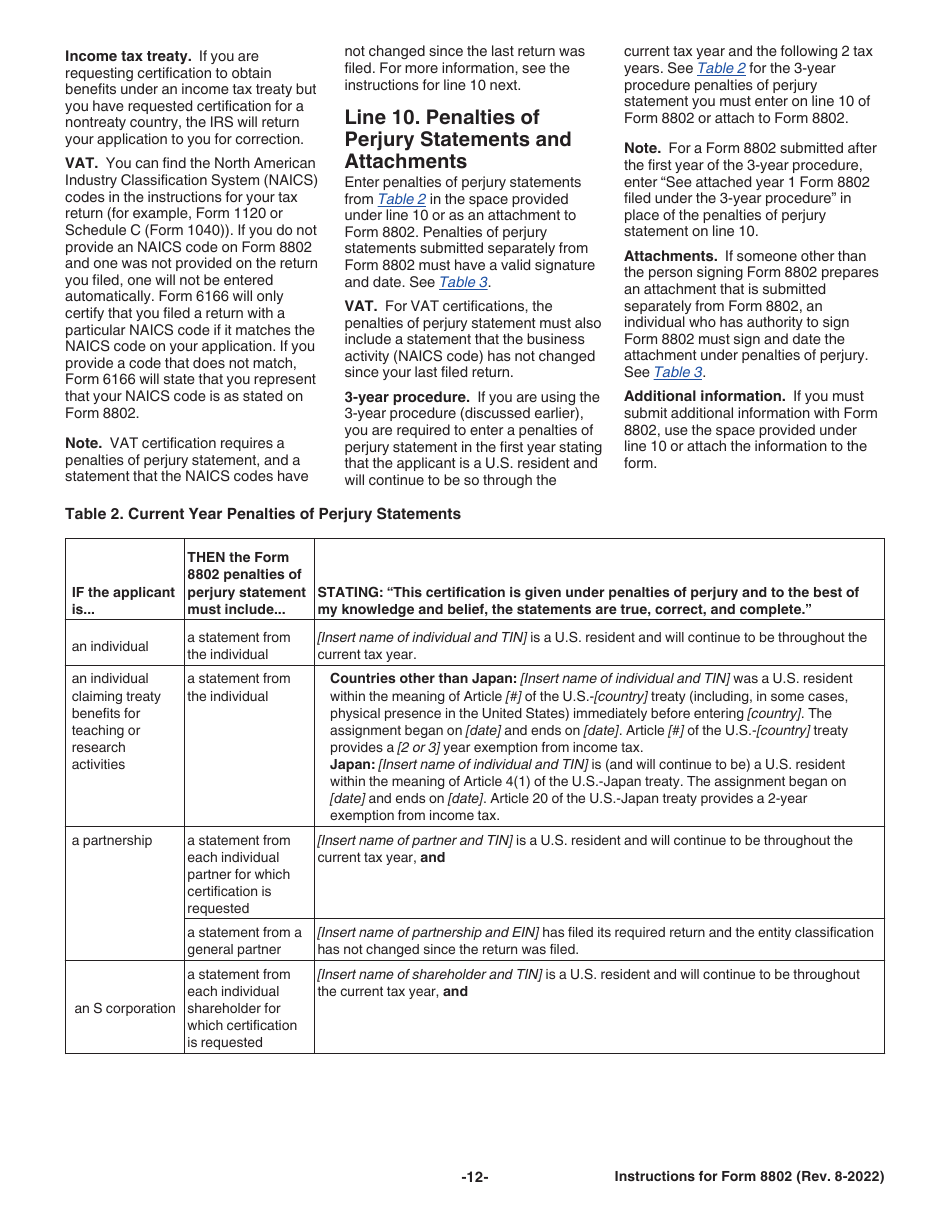

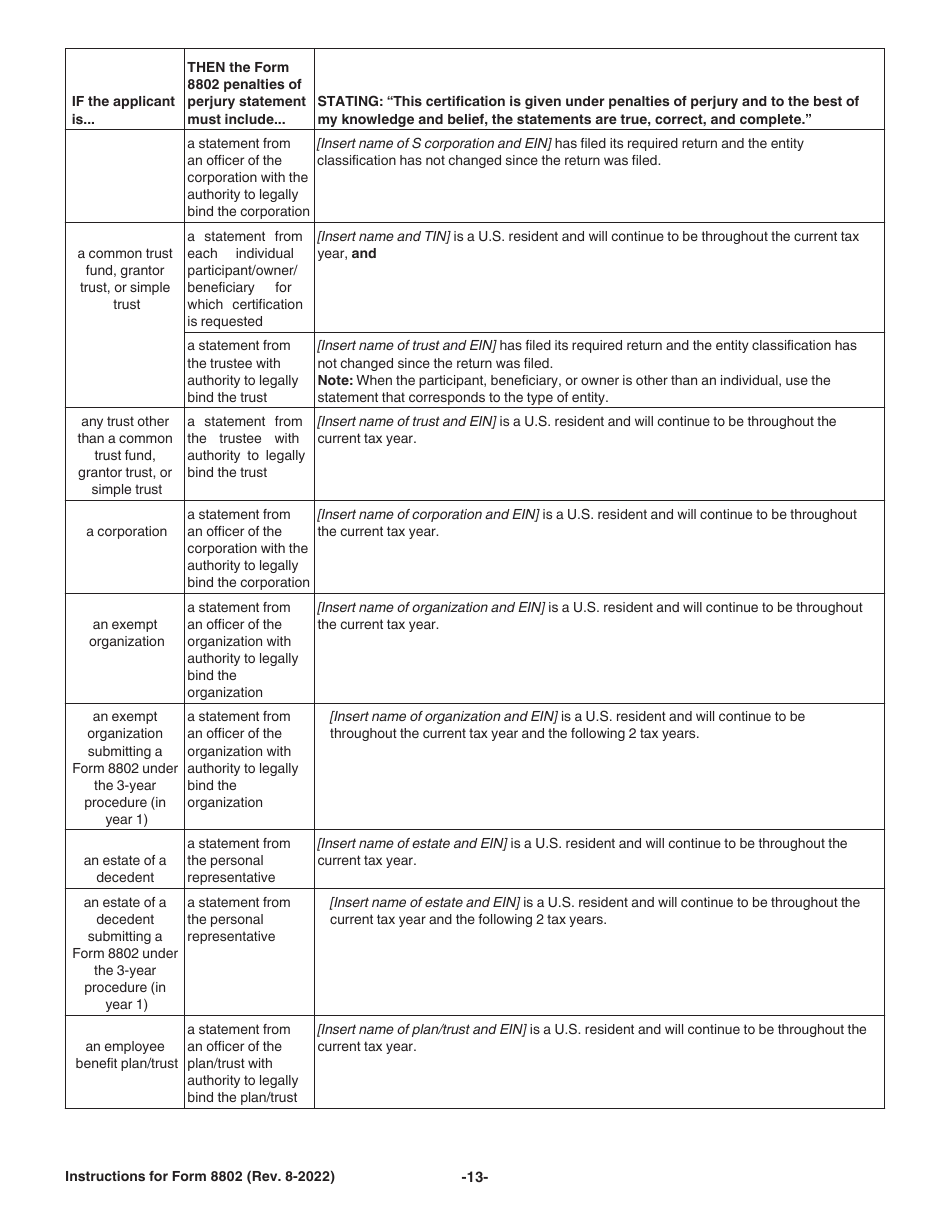

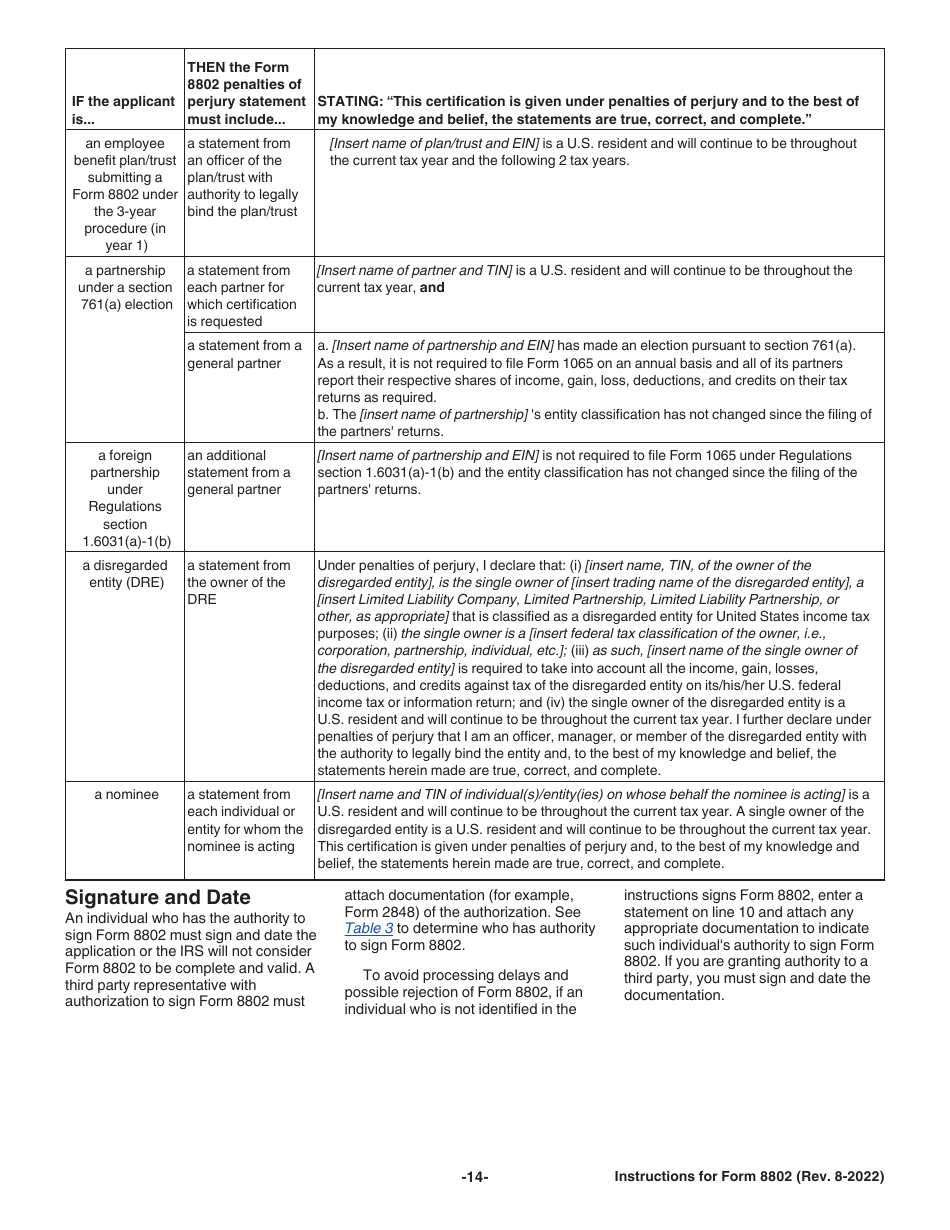

Line 10. The penalties of perjury statements from Table 2* should be entered. Signature and date.

-

Lines 11-12. The number of certifications requested for each country and the total number of certifications requested should be entered.

*Tables 1 and 2 are located in the instructions for Form 8802 released by the Department of the Treasury Internal Revenue Service.