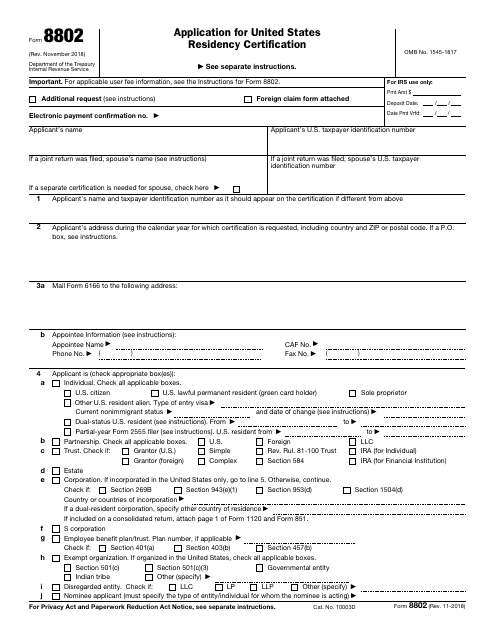

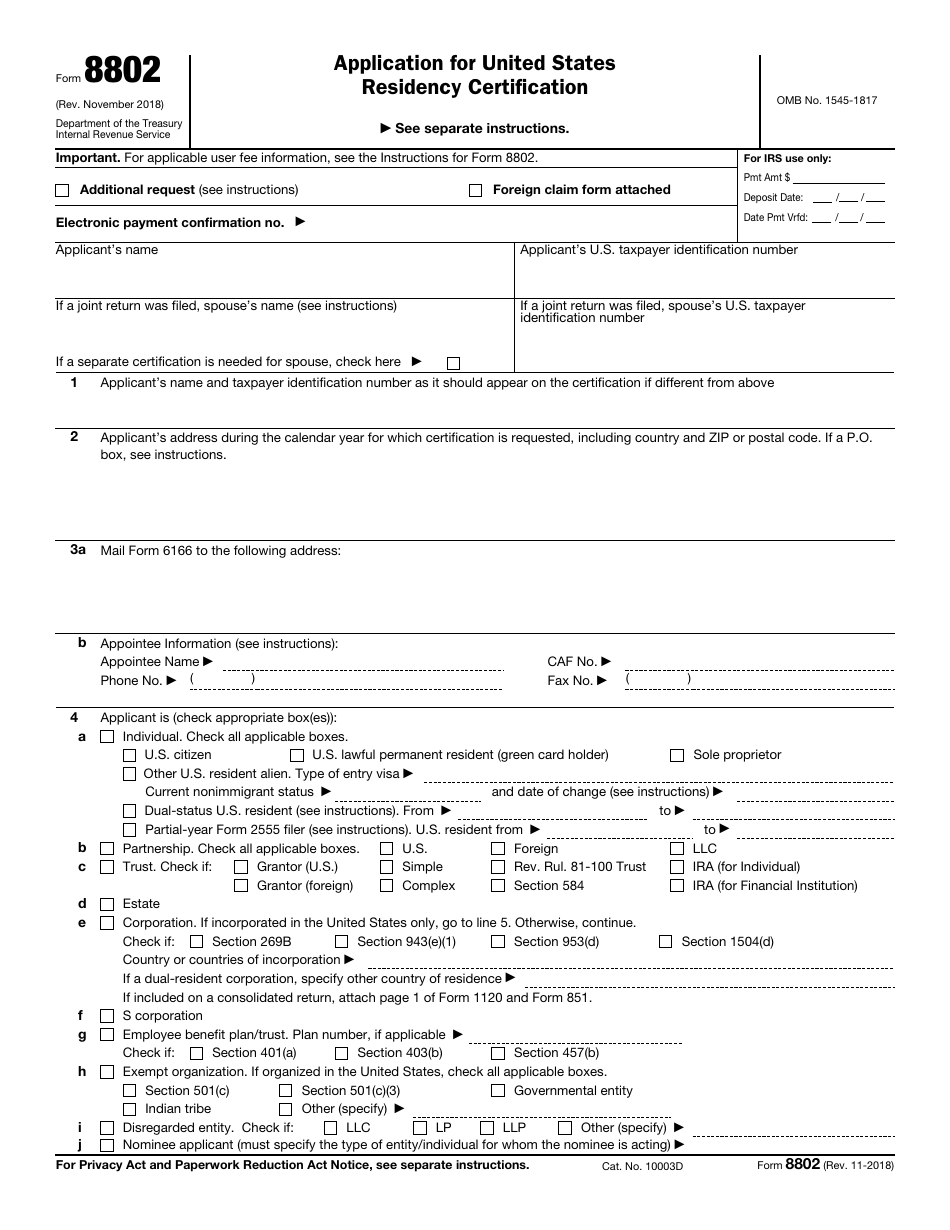

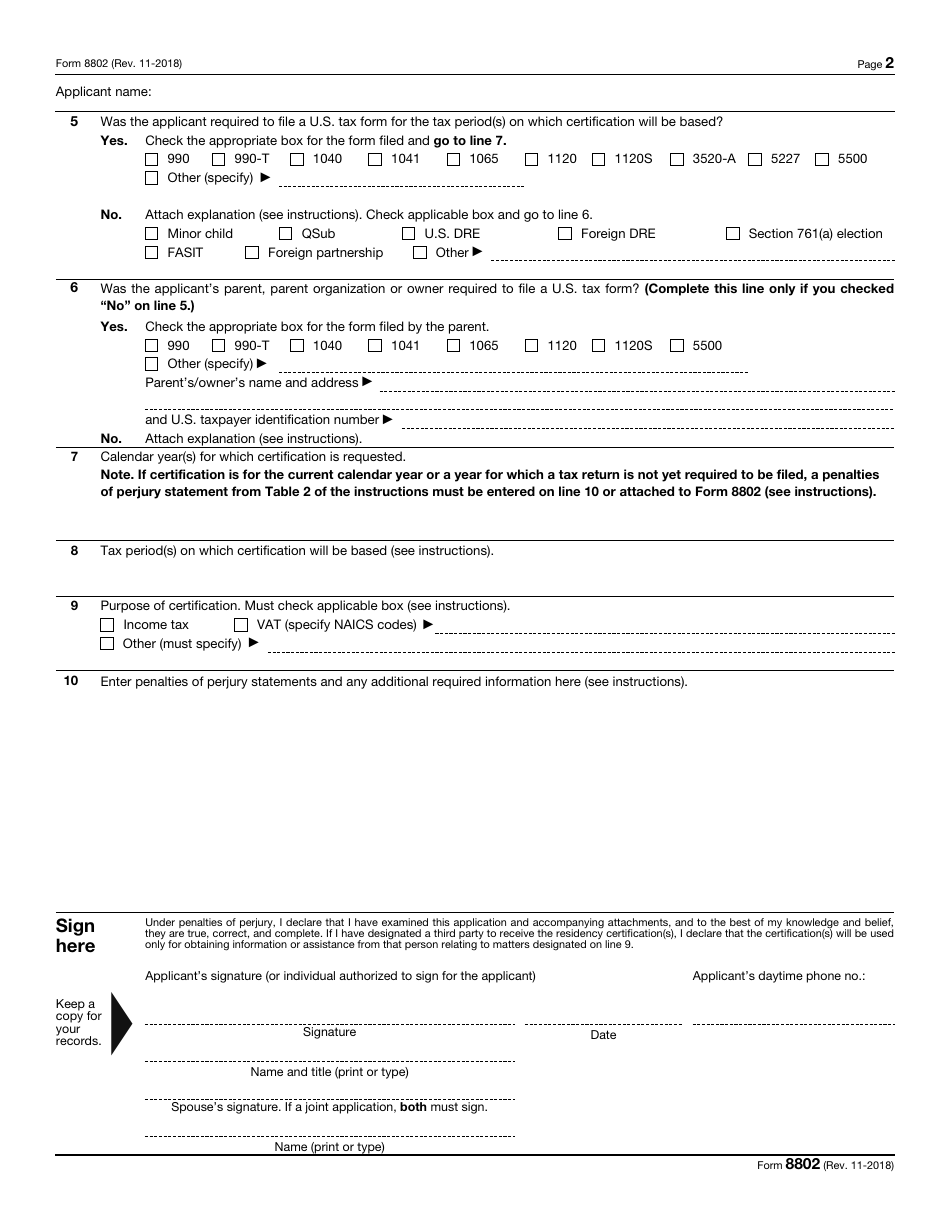

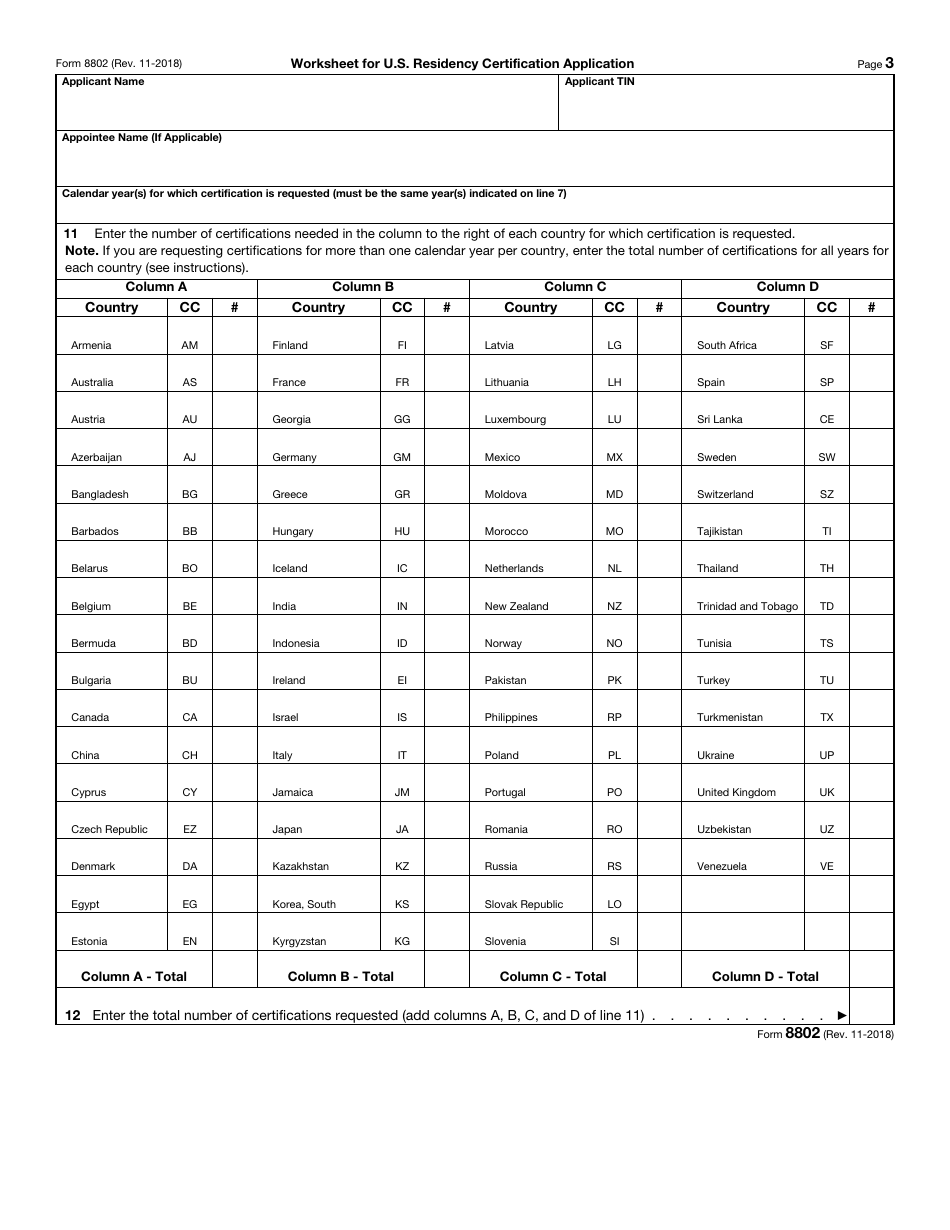

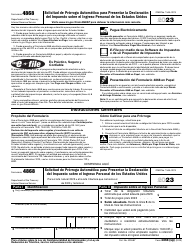

IRS Form 8802 Application for United States Residency Certification

What Is IRS Form 8802?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8802?

A: IRS Form 8802 is the Application for United States Residency Certification.

Q: What is the purpose of IRS Form 8802?

A: The purpose of IRS Form 8802 is to request a certification that you are a U.S. resident for tax purposes.

Q: Who needs to file IRS Form 8802?

A: Individuals or entities who need to prove their U.S. residency for tax purposes may need to file IRS Form 8802.

Q: How do I file IRS Form 8802?

A: You can file IRS Form 8802 by completing the form and submitting it to the IRS.

Q: What is the processing time for IRS Form 8802?

A: The processing time for IRS Form 8802 can vary, but it typically takes around 45 days.

Q: Can I request expedited processing for IRS Form 8802?

A: Yes, you can request expedited processing for IRS Form 8802, but there is an additional fee for this service.

Q: What supporting documents do I need to include with IRS Form 8802?

A: You may need to include supporting documents, such as a copy of your valid passport or other identification, with IRS Form 8802.

Q: Can I e-file IRS Form 8802?

A: No, IRS Form 8802 cannot be e-filed. It must be submitted by mail.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8802 through the link below or browse more documents in our library of IRS Forms.