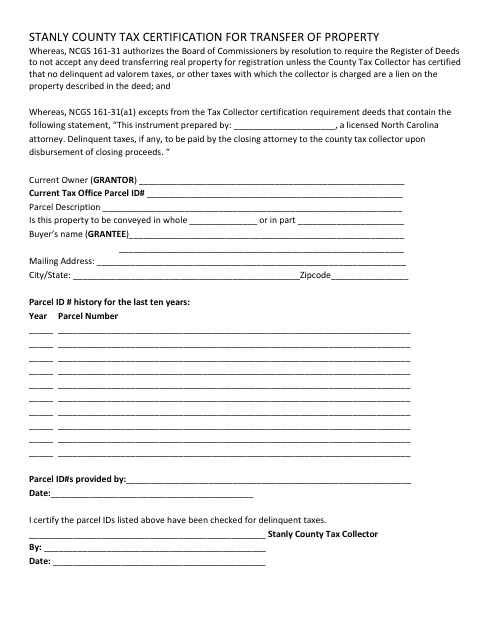

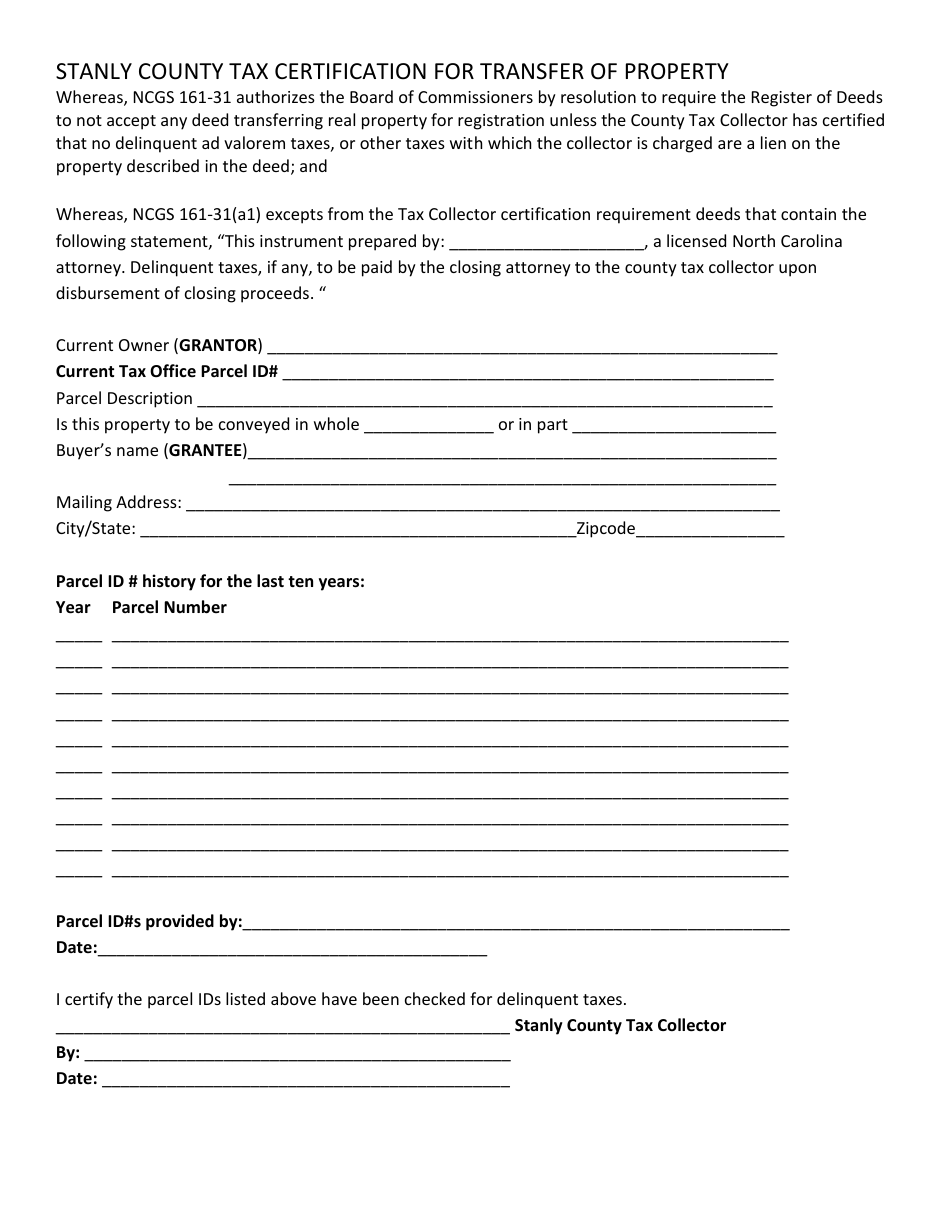

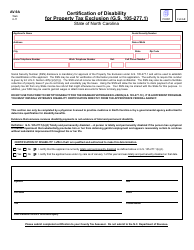

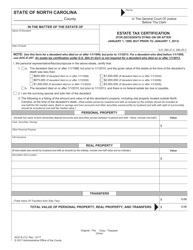

Tax Certification for Transfer of Property - Stanly County, North Carolina

Tax Certification for Transfer of Property is a legal document that was released by the Tax Administration Department - Stanly County, North Carolina - a government authority operating within North Carolina. The form may be used strictly within Stanly County.

FAQ

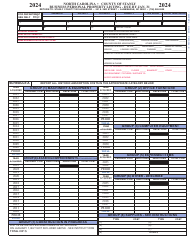

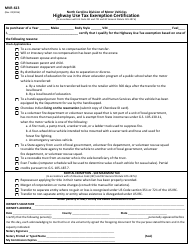

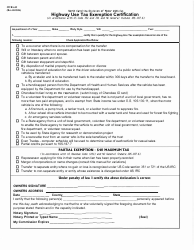

Q: What is tax certification?

A: Tax certification is a document that verifies the tax status of a property.

Q: Why is tax certification needed for the transfer of property?

A: Tax certification is needed to ensure that all property taxes are paid and up to date before the transfer of ownership.

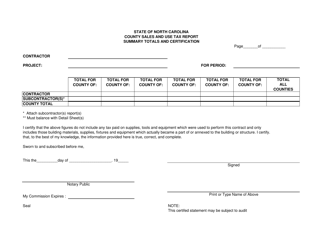

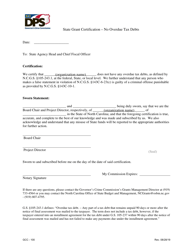

Q: Who provides tax certification for property transfers in Stanly County, North Carolina?

A: The Stanly County Tax Collector provides tax certification for property transfers.

Q: How can I obtain tax certification for a property transfer?

A: You can obtain tax certification for a property transfer by contacting the Stanly County Tax Collector's office.

Q: Is tax certification required for all property transfers?

A: Yes, tax certification is required for all property transfers in Stanly County, North Carolina.

Q: What happens if there are unpaid taxes on the property?

A: If there are unpaid taxes on the property, they must be paid in full before the property transfer can take place.

Q: Are there any fees associated with obtaining tax certification for a property transfer?

A: Yes, there may be fees associated with obtaining tax certification for a property transfer. Contact the Stanly County Tax Collector's office for more information.

Form Details:

- The latest edition currently provided by the Tax Administration Department - Stanly County, North Carolina;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tax Administration Department - Stanly County, North Carolina.