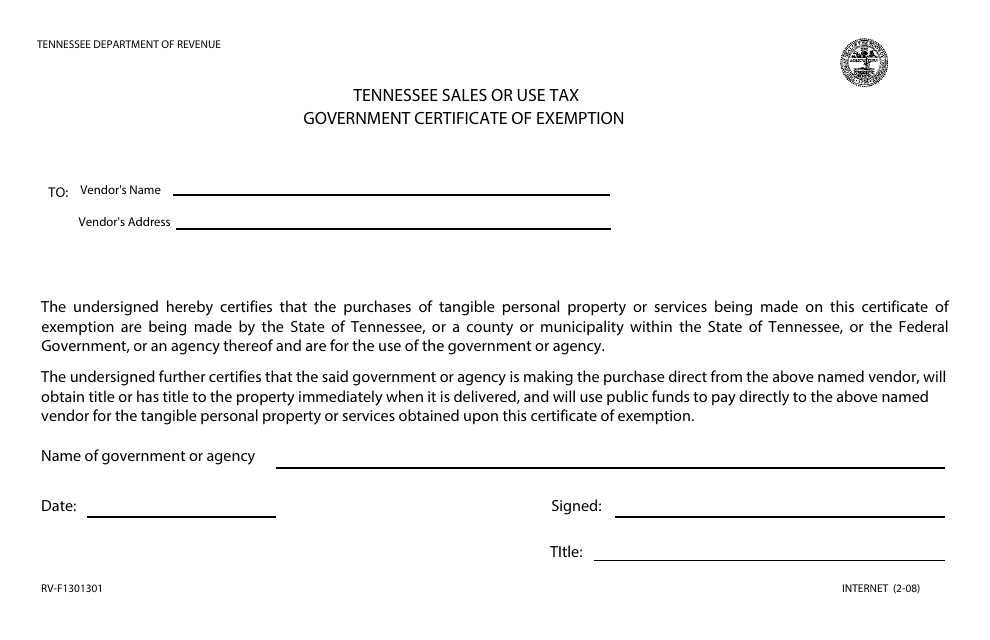

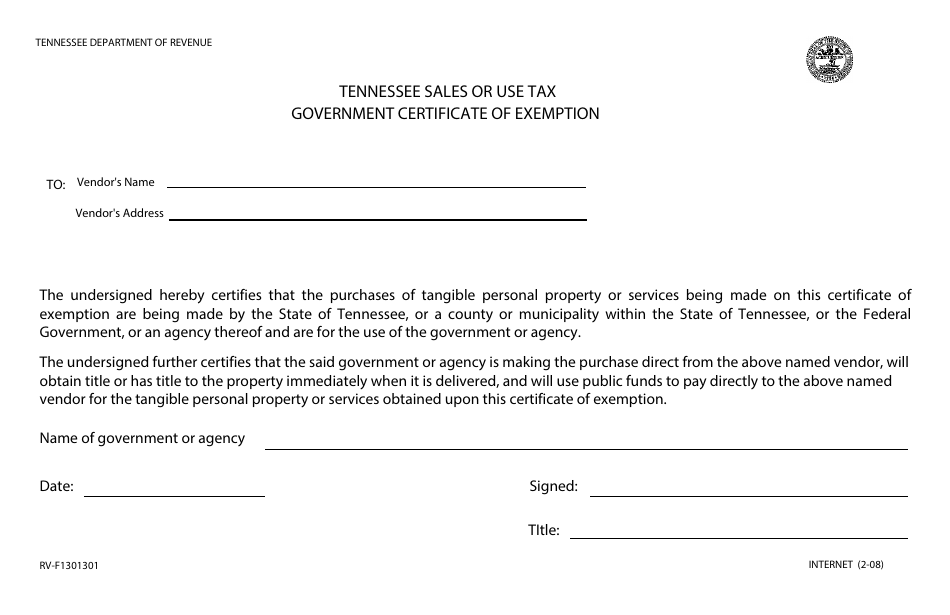

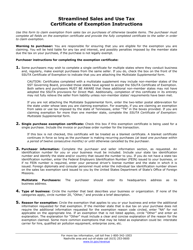

This version of the form is not currently in use and is provided for reference only. Download this version of

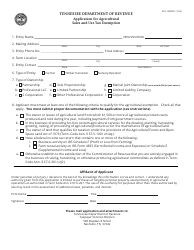

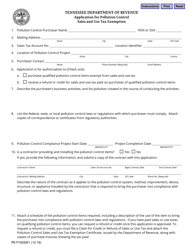

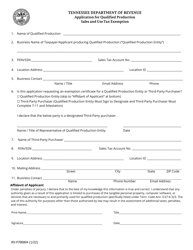

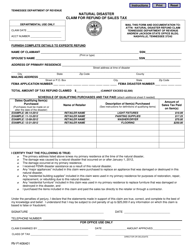

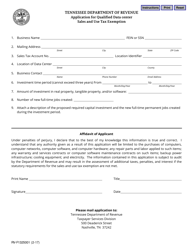

Form RV-F1301301

for the current year.

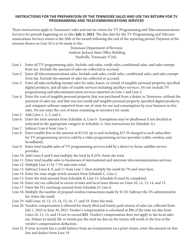

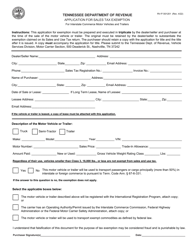

Form RV-F1301301 Tennessee Sales or Use Tax Government Certificate of Exemption - Tennessee

What Is Form RV-F1301301?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

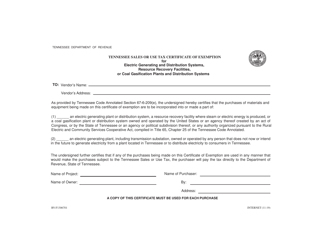

Q: What is the Form RV-F1301301?

A: Form RV-F1301301 is the Tennessee Sales or Use Tax Government Certificate of Exemption.

Q: What is the purpose of Form RV-F1301301?

A: The purpose of Form RV-F1301301 is to claim exemption from sales or use tax in Tennessee for government entities.

Q: Who can use Form RV-F1301301?

A: Government entities in Tennessee can use Form RV-F1301301 to claim exemption from sales or use tax.

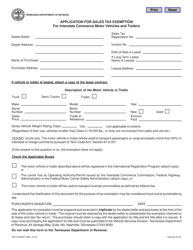

Q: What is sales tax?

A: Sales tax is a tax imposed on the sale of goods and services.

Q: What is use tax?

A: Use tax is a tax imposed on the use, consumption, or storage of goods and services that were purchased without paying sales tax.

Form Details:

- Released on February 1, 2008;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F1301301 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.