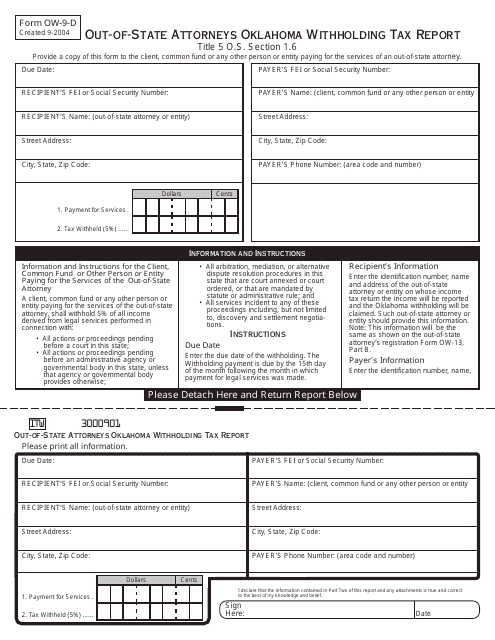

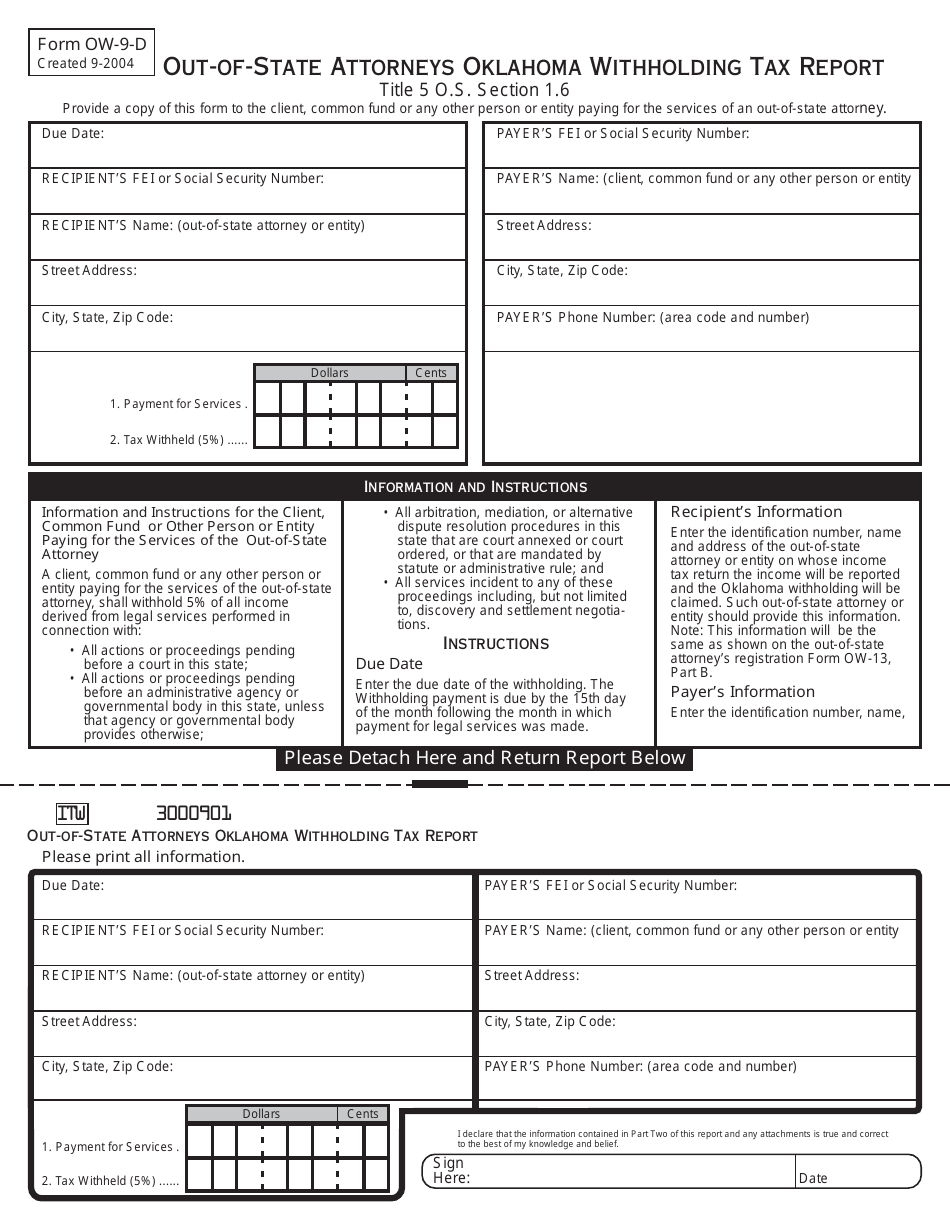

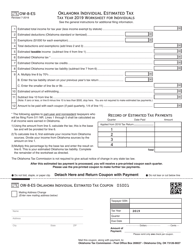

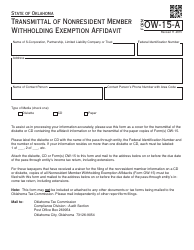

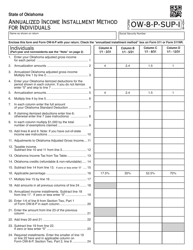

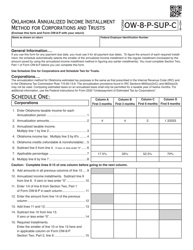

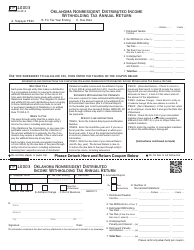

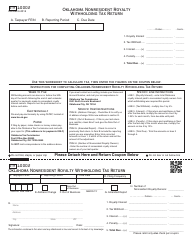

OTC Form OW-9-D Out-of-State Attorneys Oklahoma Withholding Tax Report - Oklahoma

What Is OTC Form OW-9-D?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form OW-9-D?

A: OTC Form OW-9-D is the Oklahoma Withholding Tax Report specifically for Out-of-State Attorneys.

Q: Who needs to file OTC Form OW-9-D?

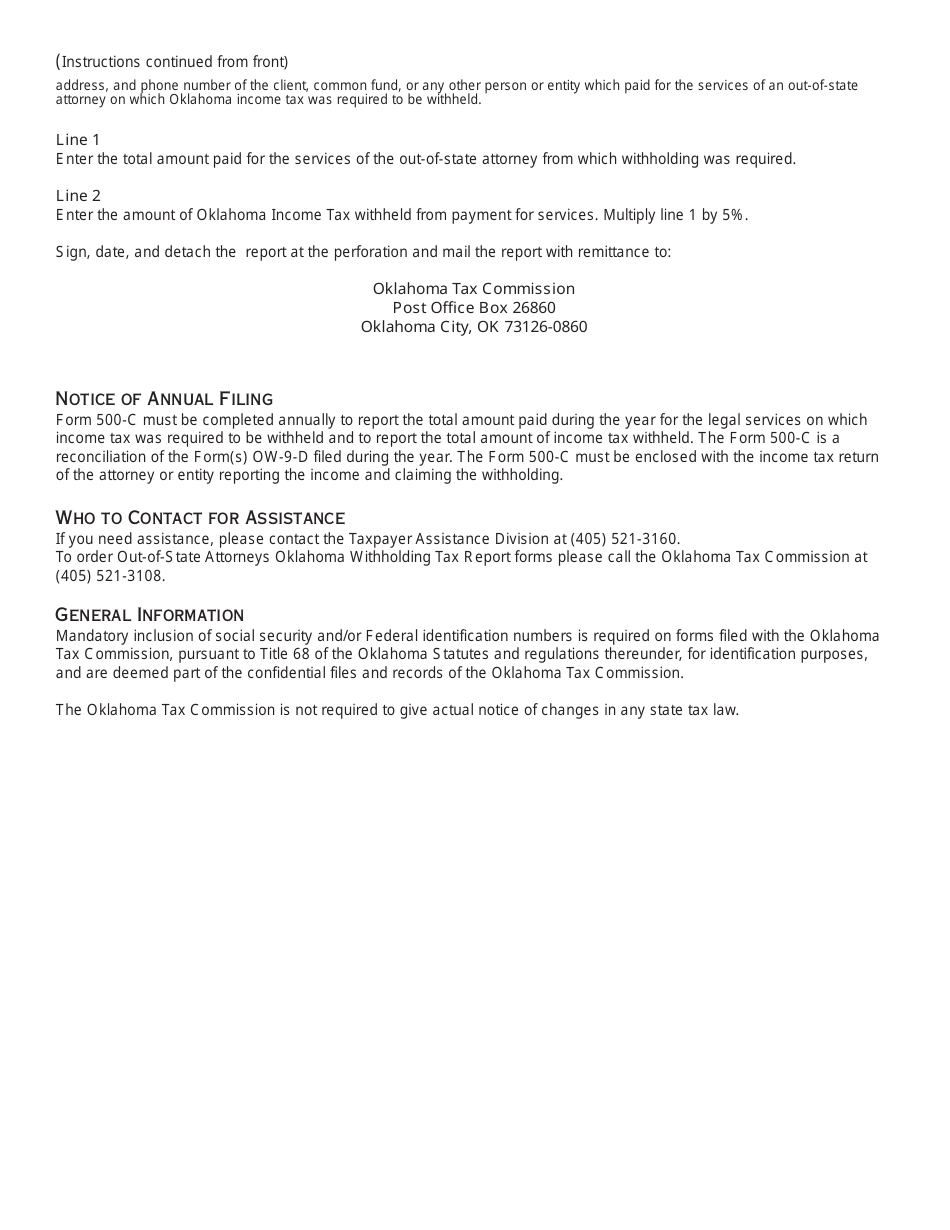

A: Out-of-State Attorneys who have performed legal services in Oklahoma and are subject to withholding tax must file OTC Form OW-9-D.

Q: What is the purpose of OTC Form OW-9-D?

A: The purpose of OTC Form OW-9-D is to report and remit withholding tax on legal services performed by Out-of-State Attorneys in Oklahoma.

Q: When is OTC Form OW-9-D due?

A: OTC Form OW-9-D is due on or before the 20th day of the month following the calendar quarter in which the legal services were performed.

Q: Is OTC Form OW-9-D only for attorneys?

A: Yes, OTC Form OW-9-D is specifically for Out-of-State Attorneys who have performed legal services in Oklahoma.

Q: Are there any penalties for not filing OTC Form OW-9-D?

A: Yes, failure to file OTC Form OW-9-D or remit the withholding tax may result in penalties, interest, and other enforcement actions.

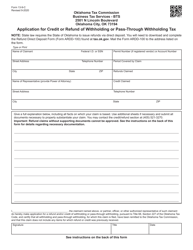

Q: What information do I need to complete OTC Form OW-9-D?

A: To complete OTC Form OW-9-D, you will need information such as the attorney's name, address, tax identification number, and details of the legal services performed in Oklahoma.

Q: Can I amend OTC Form OW-9-D if I made a mistake?

A: Yes, you can file an amended OTC Form OW-9-D to correct any mistakes or omissions.

Form Details:

- Released on September 1, 2004;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of OTC Form OW-9-D by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.