This version of the form is not currently in use and is provided for reference only. Download this version of

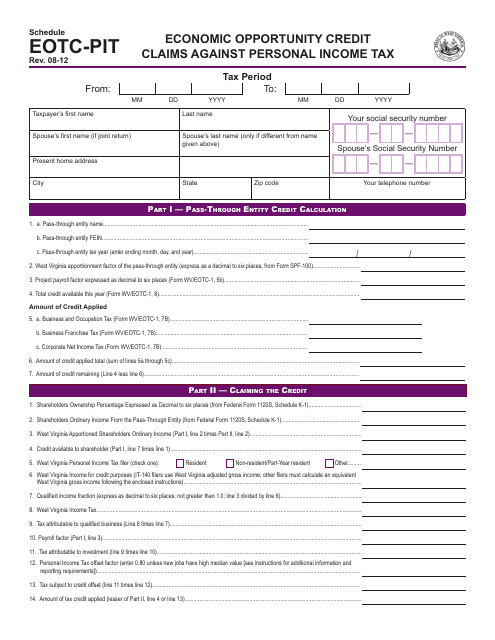

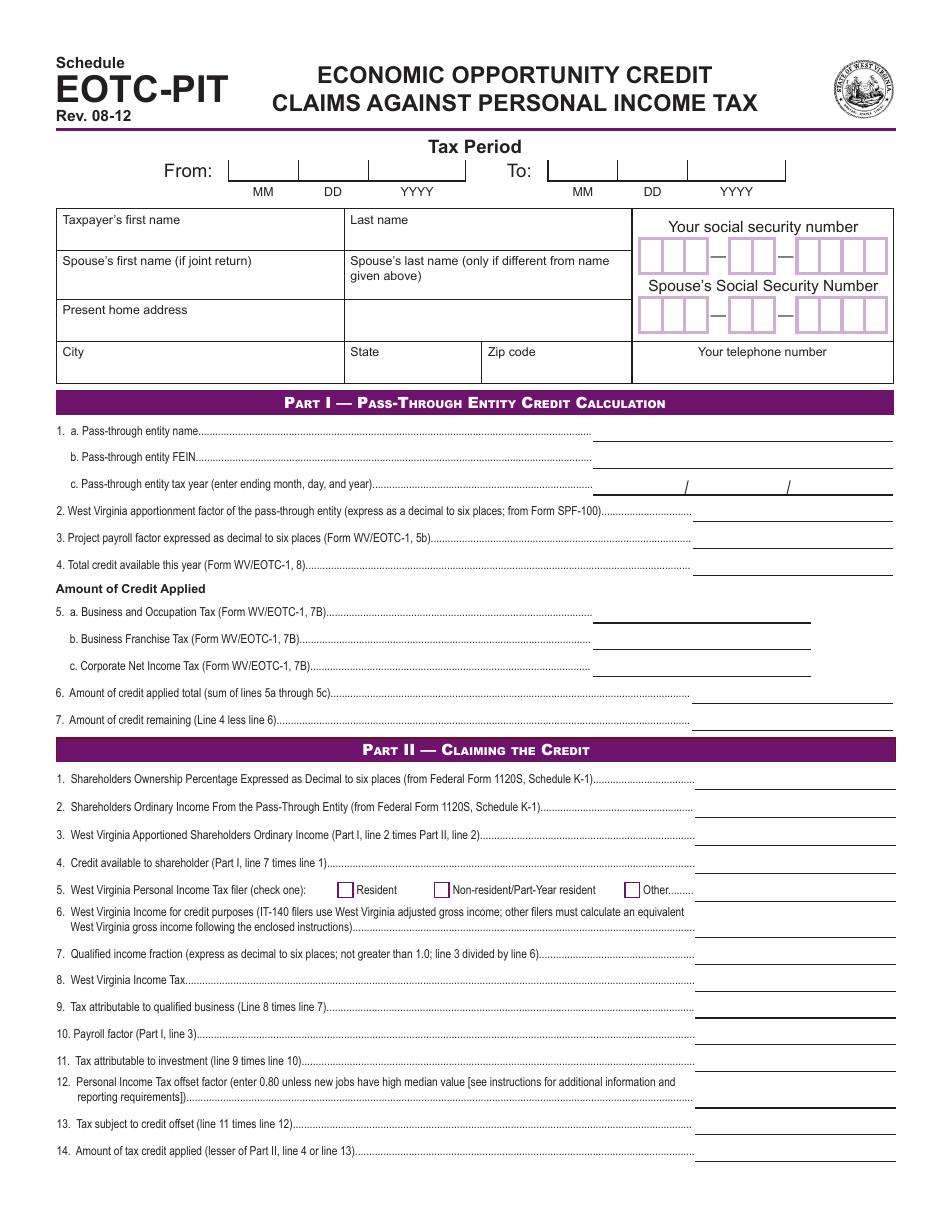

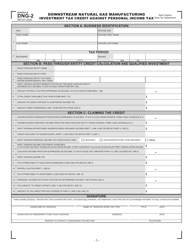

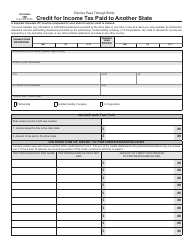

Schedule EOTC-PIT

for the current year.

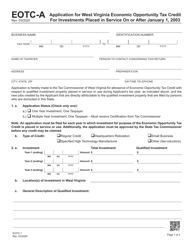

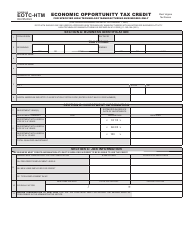

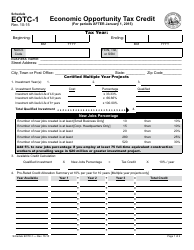

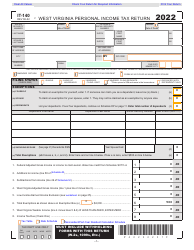

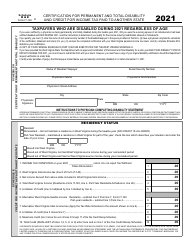

Schedule EOTC-PIT Economic Opportunity Credit Claims Against Personal Income Tax - West Virginia

What Is Schedule EOTC-PIT?

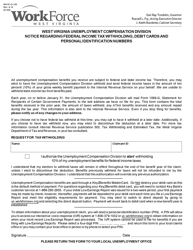

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule EOTC-PIT?

A: Schedule EOTC-PIT is a form used by West Virginia residents to claim the Economic Opportunity Credit against their personal income tax.

Q: What is the Economic Opportunity Credit?

A: The Economic Opportunity Credit is a tax credit provided by West Virginia to individuals who invest in economic opportunity projects.

Q: Who is eligible to claim the Economic Opportunity Credit?

A: West Virginia residents who invest in economic opportunity projects are eligible to claim the credit.

Q: How is the Economic Opportunity Credit calculated?

A: The credit is calculated based on the amount of qualified investment made by the individual in economic opportunity projects.

Q: What are economic opportunity projects?

A: Economic opportunity projects are projects that promote the economic development and growth of West Virginia.

Q: Are there any limitations or restrictions on claiming the Economic Opportunity Credit?

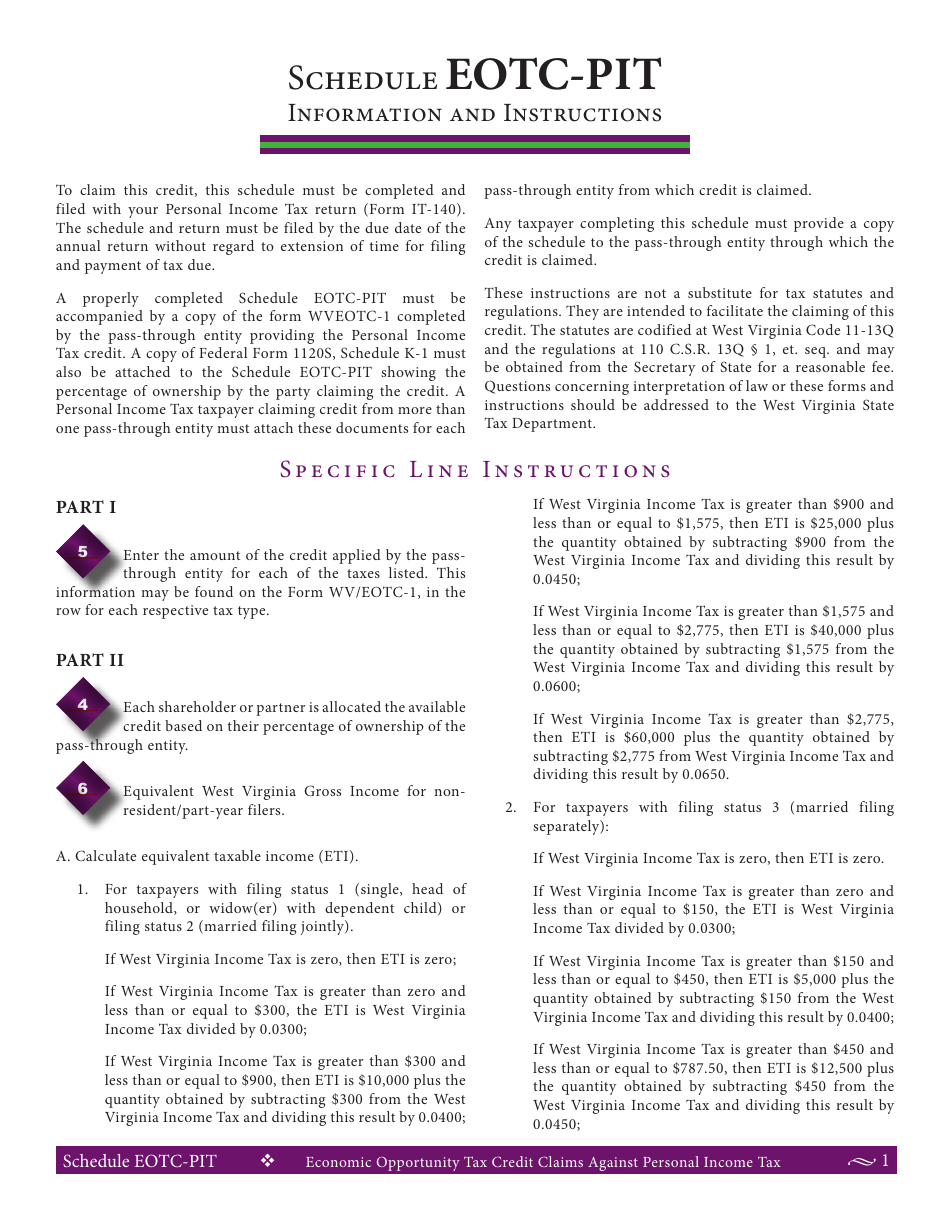

A: Yes, there are limitations and restrictions on claiming the credit. It is recommended to review the instructions provided with Schedule EOTC-PIT for more details.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule EOTC-PIT by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.