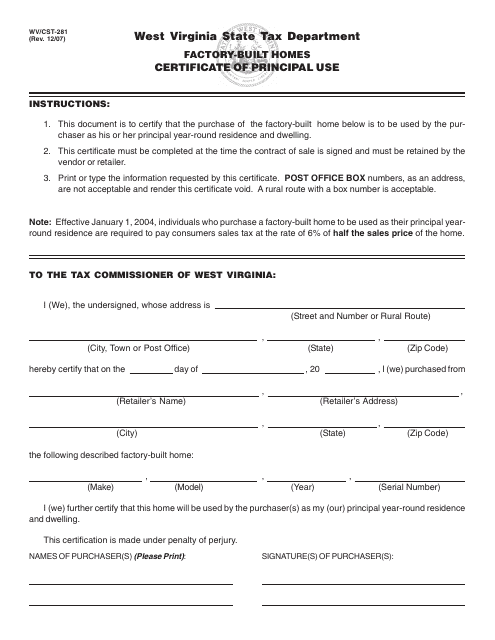

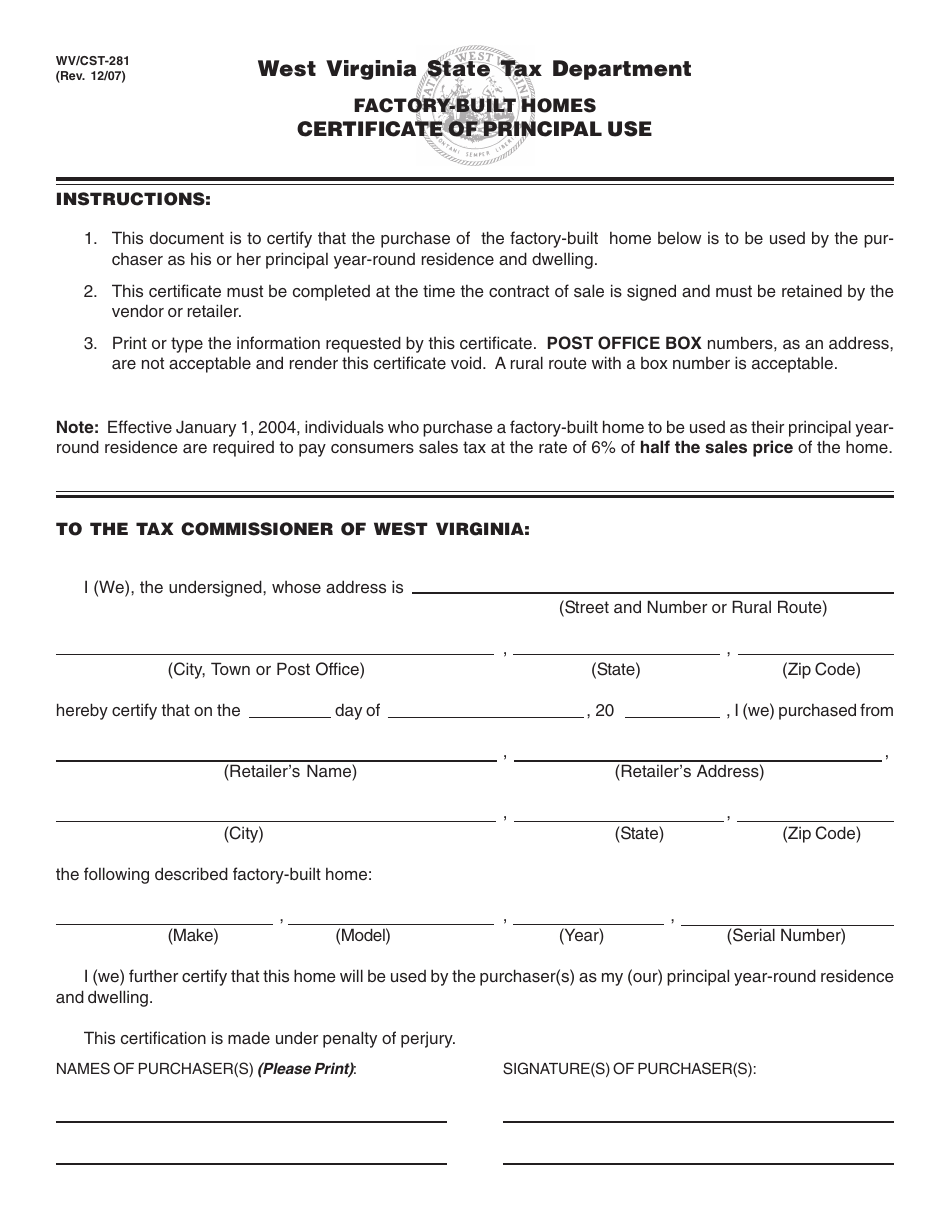

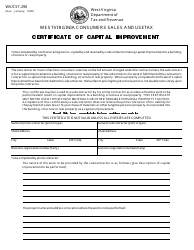

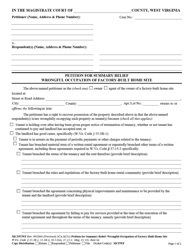

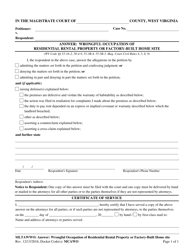

Form WV / CST-281 Factory-Built Homes Certificate of Principal Use - West Virginia

What Is Form WV/CST-281?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is WV/CST-281?

A: WV/CST-281 is the abbreviation for the Factory-Built Homes Certificate of Principal Use form in West Virginia.

Q: What is the purpose of WV/CST-281?

A: The purpose of WV/CST-281 is to certify the principal use of factory-built homes in West Virginia.

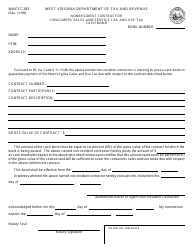

Q: Who needs to complete WV/CST-281?

A: Any person or business that owns or operates a factory-built home in West Virginia and wishes to certify its principal use.

Q: What information is required on WV/CST-281?

A: Some of the information required on WV/CST-281 includes the owner's name, contact information, factory-built home specifics, and details about the principal use.

Q: Is there a fee for submitting WV/CST-281?

A: Yes, there is a fee associated with submitting WV/CST-281. The fee amount may vary and should be confirmed with the West Virginia State Tax Department.

Q: What do I do with the completed WV/CST-281 form?

A: Once completed, you should submit the WV/CST-281 form along with any required fees to the West Virginia State Tax Department.

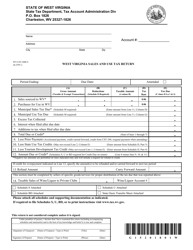

Q: Are there any penalties for not completing WV/CST-281?

A: Failure to complete WV/CST-281 may result in penalties, such as fines or legal consequences. It is important to comply with the requirements.

Q: How long does it take to process WV/CST-281?

A: The processing time for WV/CST-281 may vary. It is advisable to allow sufficient time for the West Virginia State Tax Department to review and process the form.

Form Details:

- Released on December 1, 2007;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/CST-281 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.