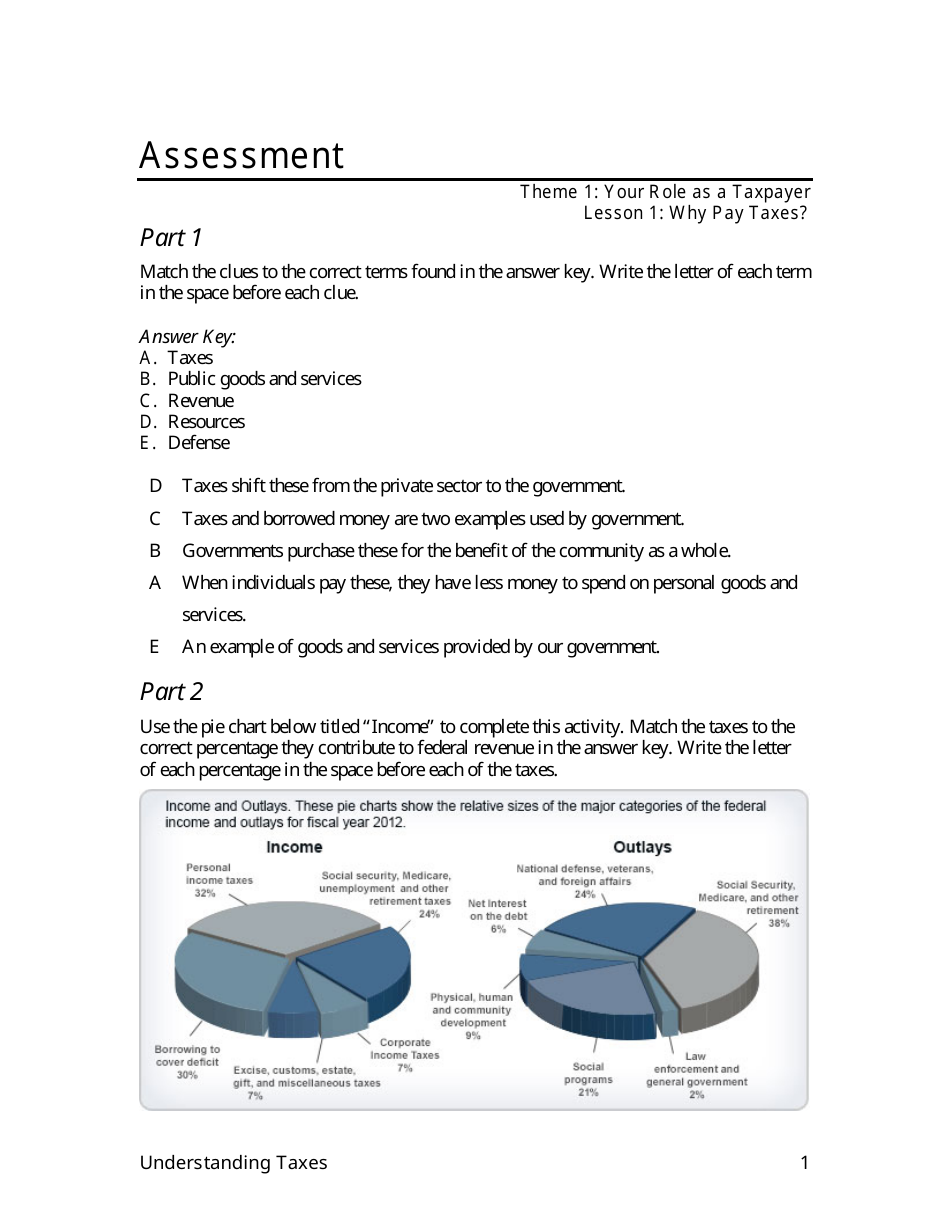

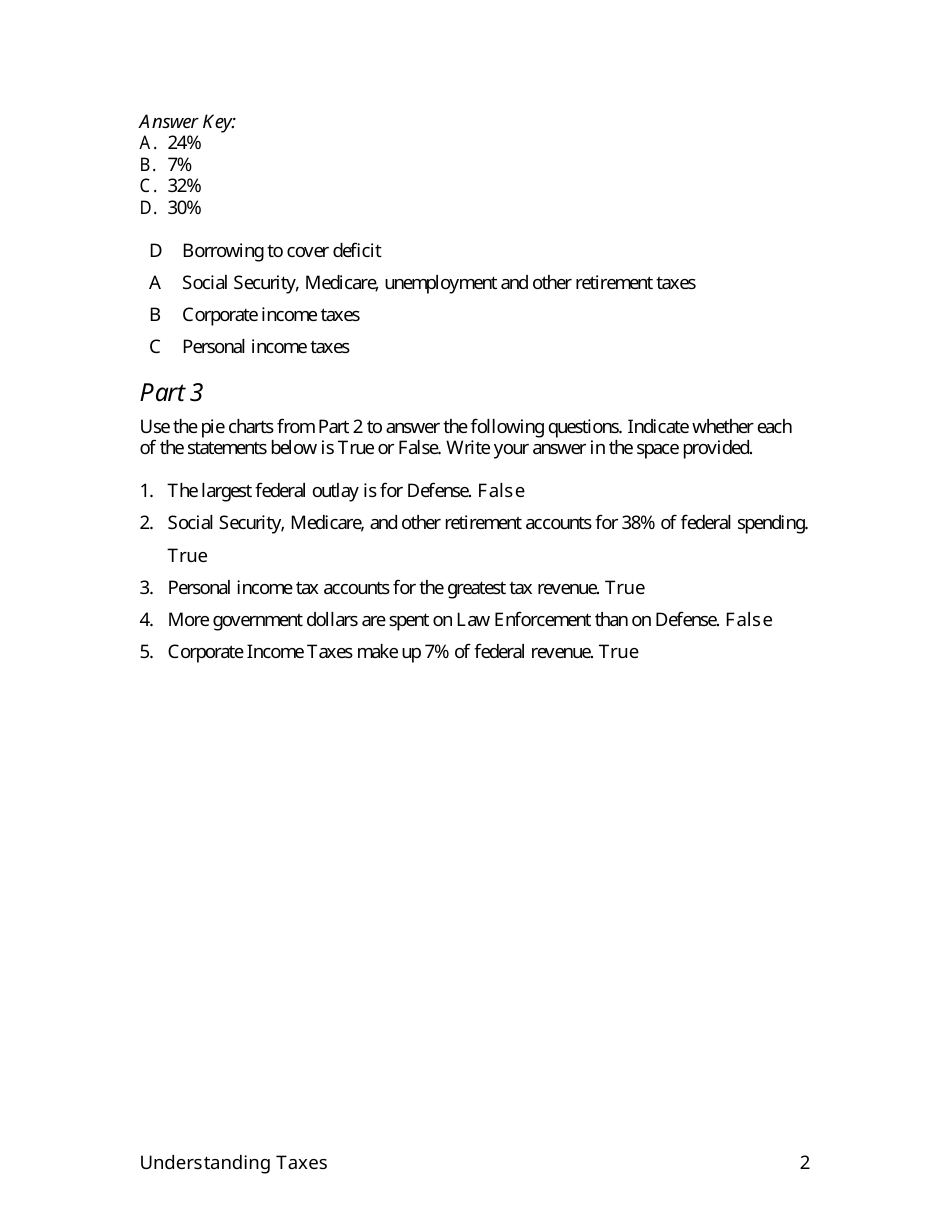

Your Role as a Taxpayer Assessment Answer Sheet - IRS, Understanding Taxes

As the Taxpayer Assessment Answer Sheet - IRS, Understanding Taxes, my role is to help individuals assess their knowledge and understanding of taxes. It is designed to provide self-assessment and educational resources for taxpayers to improve their understanding of the tax system.

The Your Role as a Taxpayer Assessment Answer Sheet is filed by the individual taxpayer, not the IRS or Understanding Taxes.

FAQ

Q: What is the IRS?

A: The IRS is the Internal Revenue Service, the agency responsible for collecting taxes in the United States.

Q: What is the purpose of the Understanding Taxes program?

A: The Understanding Taxes program aims to help individuals gain knowledge about taxes and the role of taxpayers.

Q: Why is it important to understand taxes as a taxpayer?

A: Understanding taxes is important as a taxpayer because it allows you to fulfill your tax obligations and make informed financial decisions.

Q: What resources are available through the Understanding Taxes program?

A: The Understanding Taxes program provides interactive lessons, simulations, and educational materials to enhance taxpayer knowledge.

Q: Can the Understanding Taxes program help me with filing my tax returns?

A: Yes, the Understanding Taxes program provides resources and guidance on tax filing, deductions, and credits.

Q: Is the Understanding Taxes program only for individuals?

A: No, the Understanding Taxes program is also useful for educators and provides teaching materials for schools.

Q: Can the Understanding Taxes program help me with specific tax questions or issues?

A: While the Understanding Taxes program provides general tax knowledge, it may be best to consult a tax professional for personalized advice regarding specific tax questions or issues.